MFI statistics 2010: number of financial institutions in the euro area and in the EU decreases

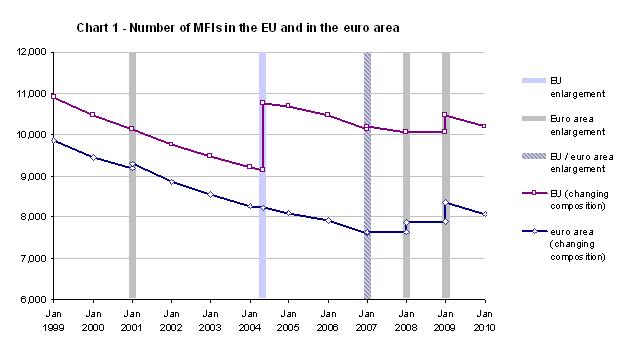

On 1 January 2010, the total number of monetary financial institutions (MFIs) [1] in the euro area stood at 8,076. This comes down to a net decrease of 274 units (3.3%) in comparison with the situation one year ago. The decline was spread across the whole euro area. On 1 January 2010, there were 10,192 MFIs in the European Union (EU), a net decrease of 284 units as compared with the year before.

Number of MFIs

- On 1 January 2010, there were 8,076 MFIs resident in the euro area, compared with 8,350 MFIs on 1 January 2009. With a decrease of 10.5%, or 50 MFIs, Spain accounted for most of the net decrease of 274 units in the whole euro area.

- Despite the enlargement of the euro area through the accession of Greece (2001), Slovenia (2007), Cyprus and Malta (both 2008) as well as Slovakia (2009), the number of MFIs in the euro area has decreased by 18.1% or 1,780 institutions since 1 January 1999. On 1 January 2010, Germany and France accounted for 41.1% of all euro area MFIs, a share broadly unchanged from that recorded on 1 January 2009.

- On 8 July 2009, the European Investment Bank (EIB) became an eligible counterparty for the Eurosystem’s monetary policy operations. In that context, the EIB is considered a euro area credit institution that is not formally deemed resident in any particular country, as holds true of the ECB (see Table 1). [2]

- On 1 January 2010, there were 10,192 MFIs resident in the EU, which implies a net decrease of 284 units (-2.7%) since 1 January 2009. Compared with the situation on 1 January 1999 (10,909 MFIs in the EU), there has been a net decrease of 717 units (-6.6%), despite the addition of 1,608 MFIs on 1 May 2004, when ten new Member States acceded, and despite the addition of 72 MFIs on 1 January 2007, when Bulgaria and Romania joined the EU.

Structure of the MFI population

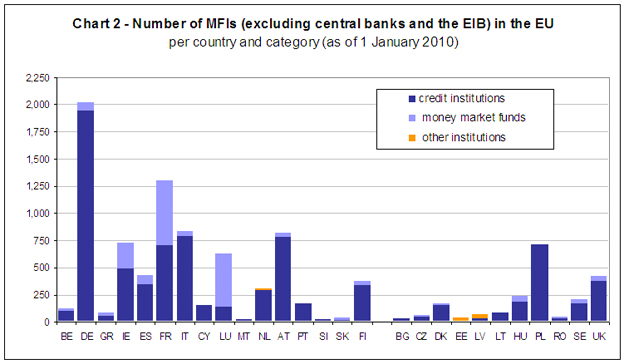

- The vast majority of euro area MFIs are credit institutions (i.e. commercial banks, savings banks, post banks, credit unions, etc.), accounting for 80.0% of such institutions (6,458 units) on 1 January 2010, while money market funds contributed 19.8% (1,599 units). Central banks (17 units including the ECB) and other institutions (2 units) together only accounted for 0.2% of all euro area MFIs.

- In the EU as a whole, credit institutions accounted for 82.0% of all MFIs on 1 January 2010, while money market funds represented 17.2% of the total (see Chart 2 below).

Country breakdown on 1 January 2010

- In the euro area, two countries accounted for 41.1% of all MFIs, namely Germany (25.0%) and France (16.1%). Italy, Austria and Ireland accounted for a further 29.5%. Over the past 11 years (1999-2010), noteworthy developments in national MFI sectors included a significant increase of 631 units in Ireland (mainly as a consequence of the reclassification of 419 credit unions as credit institutions on 1 January 2009) and, conversely, relatively large decreases of 54.3%, 38.5% and 33.0% in the Netherlands, Germany and France respectively and lesser declines of 29.8%, 25.9% and 20.9% in Spain, Portugal and Belgium respectively). Since joining the EU on 1 May 2004, Malta and Slovakia have seen a notable increase in the number of MFIs, by 70.6% and 42.9% respectively. The number of MFIs in Cyprus, by contrast, has decreased by 61.9% over the same period (see Table 1 below).

- Among the non-euro area EU Member States, Poland had by far the largest number of MFIs (714), representing 7.0% of the MFI sector in the EU. Since their accession to the EU, there have been substantial increases in the MFI sectors of Latvia (42.3%) and Estonia (52.0%). Sweden saw an increase of 42.5% in the number of MFIs from 1999 to 2004, after which the number decreased. In the United Kingdom and Denmark, the MFI populations contracted by 24.1% and 22.7% respectively from the beginning of 1999 to 1 January 2010.

Foreign branches

- On 1 January 2010, 620 branches of non-domestic credit institutions were resident in the euro area. These branches accounted for 9.6% of all euro area credit institutions. The largest share of these branches was located in Germany (17.4%), while Belgium had the largest proportion of foreign branches in relation to the total number of credit institutions (53.8%). For the majority of the foreign branches in euro area countries, the head offices were located either in another euro area country (66.3%) or in the United Kingdom (14.4%).

- On 1 January 2010, there were 220 branches of foreign credit institutions resident in non-euro area EU Member States. Of these, the largest percentage (39.1%) was located in the United Kingdom. Estonia had the largest proportion of foreign branches in relation to the total number of credit institutions (61.1%). The head offices of the majority of the foreign branches in non-euro area EU Member States were located either in euro area countries (67.3%) or in other non-euro area EU Member States (23.6%).

| Country | Number of MFIs | Percentage changes | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 Jan. 1999 | 1 Jan. 2001 | 1 May 2004 | 1 Jan. 2008 | 1 Jan. 2009 | 1 Jan. 2010 | 1 Jan. 1999 to 1 Jan. 2010 | 1 May 2004 to 1 Jan. 2010 | 1 Jan 2009 to 1 Jan. 2010 | |

| ECB | 1 | 1 | 1 | 1 | 1 | 1 | - | - | - |

| EIB | - | - | - | - | - | 1 | - | - | - |

| BE | 153 | 142 | 126 | 126 | 121 | 121 | -20.9 | -4.0 | 0.0 |

| DE | 3,280 | 2,782 | 2,268 | 2,097 | 2,061 | 2,018 | -38.5 | -11.0 | -2.1 |

| GR | 102 | 105 | 100 | 91 | 93 | 89 | -12.7 | -11.0 | -4.3 |

| IE | 96 | 211 | 294 | 332 | 781 | 727 | 657.3 | 147.3 | -6.9 |

| ES | 608 | 571 | 512 | 358 | 477 | 427 | -29.8 | -16.6 | -10.5 |

| FR | 1,938 | 1,764 | 1,577 | 1,386 | 1,354 | 1,298 | -33.0 | -17.7 | -4.1 |

| IT | 944 | 884 | 854 | 863 | 853 | 833 | -11.8 | -2.5 | -2.3 |

| CY | - | - | 409 | 216 | 164 | 156 | - | -61.9 | -4.9 |

| LU | 676 | 662 | 586 | 613 | 644 | 630 | -6.8 | 7.5 | -2.2 |

| MT | - | - | 17 | 28 | 29 | 29 | - | 70.6 | 0.0 |

| NL | 668 | 620 | 484 | 351 | 312 | 305 | -54.3 | -37.0 | -2.2 |

| AT | 910 | 866 | 827 | 822 | 824 | 821 | -9.8 | -0.7 | -0.4 |

| PT | 228 | 223 | 205 | 180 | 178 | 169 | -25.9 | -17.6 | -5.1 |

| SI | - | - | 27 | 30 | 28 | 28 | - | 3.7 | 0.0 |

| SK | - | - | 28 | 38 | 40 | 40 | - | 42.9 | 0.0 |

| FI | 354 | 362 | 396 | 393 | 390 | 383 | 8.2 | -3.3 | -1.8 |

| Euro area * | 9,856 | 9,193 | 8,230 | 7,887 | 8,350 | 8,076 | -18.1 | -1.9 | -3.3 |

| BG | - | - | - | 33 | 35 | 36 | - | - | 2.9 |

| CZ | - | - | 79 | 67 | 66 | 68 | - | -13.9 | 3.0 |

| DK | 216 | 213 | 206 | 192 | 174 | 167 | -22.7 | -18.9 | -4.0 |

| EE | - | - | 25 | 29 | 34 | 38 | - | 52.0 | 11.8 |

| LV | - | - | 52 | 69 | 73 | 74 | - | 42.3 | 1.4 |

| LT | - | - | 74 | 83 | 87 | 88 | - | 18.9 | 1.1 |

| HU | - | - | 238 | 241 | 243 | 246 | - | 3.4 | 1.2 |

| PL | - | - | 659 | 722 | 716 | 714 | - | 8.3 | -0.3 |

| RO | - | - | - | 49 | 52 | 51 | - | - | -1.9 |

| SE | 179 | 177 | 255 | 235 | 217 | 212 | 18.4 | -16.9 | -2.3 |

| UK | 556 | 541 | 457 | 423 | 429 | 422 | -24.1 | -7.7 | -1.6 |

| EU * | 10,909 | 10,124 | 10,756 | 10,068 | 10,476 | 10,192 | -6.6 | -5.2 | -2.7 |

| * Changing composition. | |||||||||

The number of MFIs has been derived from the ECB’s “List of monetary financial institutions”, which is updated daily on the ECB’s website and is compiled in a way to ensure its completeness, accuracy and homogeneity across countries. Its objectives are twofold, namely (i) to serve as the reference reporting population for the compilation of comprehensive and consistent monetary statistics for the euro area and (ii) to serve as a register and a reliable sampling frame for other data collections and for statistical and economic analyses.

Information on MFIs and other financial institutions, including the list of monetary financial institutions and institutions subject to minimum reserves, can be found on the ECB’s website.

-

[1]"Monetary financial institutions" (MFIs) are central banks, resident credit institutions as defined in Community law, and other resident financial institutions whose business is to receive deposits and/or close substitutes for deposits from entities other than MFIs and, for their own account (at least in economic terms), to grant credits and/or make investments in securities. Money market funds are also classified as MFIs.

[2]For the ECB's monetary and other euro area statistics, the EIB continues to be treated as an institution that is resident outside the euro area.

Europäische Zentralbank

Generaldirektion Kommunikation

- Sonnemannstraße 20

- 60314 Frankfurt am Main, Deutschland

- +49 69 1344 7455

- media@ecb.europa.eu

Nachdruck nur mit Quellenangabe gestattet.

Ansprechpartner für Medienvertreter