Lecture on “Activism and alertness in monetary policy”

by Jean-Claude TrichetPresident of the European Central Bankat the conference on Central Banks in the 21st Century organised by the Banco de Espana, Madrid, 8 June 2006

Ladies and gentlemen,

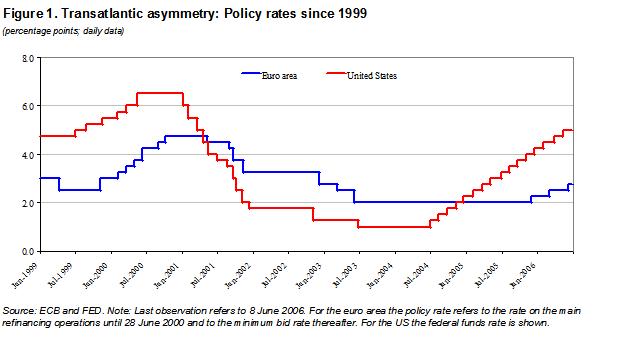

Since 1 January 1999, the day on which it officially became the monetary authority of the euro area, the ECB has changed its policy rate, the rate on its main refinancing operations, 18 times. Over the same period, the Federal Reserve System has made 35 changes. The easing cycle that started on both sides of the Atlantic – and of the Channel – in 2001 saw a cumulative reduction in the policy rate of 275 basis points in the euro area, accomplished in a sequence of seven moves. The ECB started to reverse that cycle in December last year and has since changed its policy in a sequence of three steps. In the United States, the same easing phase saw 13 reductions, with a total loosening of 550 basis points, and was first reversed in June 2004. Since then, the Federal Reserve has hiked its target rate 16 times in continuous steps.

I thought I would take advantage of the opportunity afforded by this impressive programme to revisit a theme on which I have reflected in the past: “activism” in monetary policy. Is there a univocal definition of this notion? Can “activism” be quantified by simple statistics such as the frequency and size of policy moves? Can a central bank be “active” while moving its policy rate in a measured and observationally cautious way? Was the ECB active enough in responding to the evolving state of the euro area economy? The few facts that I have recounted seem to suggest otherwise. I will try to convince you that the contrary is true.

I will offer some provisional answers on the basis of what I believe I have learned thus far. I suspect, though, that the passing of time and further analysis of the euro area economy will be needed to deepen our understanding of this issue.

My definition of activism in monetary policy is, I believe, conventional: activism is the strategic attitude of a central bank that is constantly endeavouring to be faithful to its objective. In the case of the ECB, it is the constant striving to keep inflation close to its arithmetic objective, and to take all the steps needed to check nascent inflationary pressures while at the same time trying to minimise unnecessary macroeconomic disruptions in the process. “Activist” is an attribute that applies to a strategy, not to a policy path.

My answer to the question of whether or not activism can be measured by simple statistics is negative. Strategic activism in monetary policy cannot be quantified in simple terms, not in abstraction from knowledge of the key structural forces and economic relationships that govern the functioning of our systems at any point in time. When evaluating the appropriateness of their action, central banks do not have the luxury of linking policy to a handful of summary statistics. They engage in a complicated process of signal extraction from a wealth of diffuse data and events. They calibrate decisions to the key structural parameters of the economy in which monetary policy has to function, to the nature of the shocks to which the economy is typically prone. The path of policy is adjusted accordingly.

The ECB’s strategy is as active as it needs to be to fulfil our mandate. I would claim that clarity about the objective of our policy afforded considerable latitude for action in the early years of the decade, and a remarkable leverage over market conditions more recently. This has happened despite repeated unfavourable shocks in the former period and apparent policy inaction in the latter. Always, our strategy and the information coming from the real economy, as well as from the sphere of monetary aggregates, much more than our words, have shaped market expectations beyond the very near term, a sign that the complex analysis required to predict our judgement has not materially impeded market participants in responding meaningfully to incoming data.

Policy activism and economic dynamism

To frame the issue, let us consider a stereotypical monetary policy reaction function that has a short-term interest rate on the left and a number of observable reaction variables on the right. Think, for example, of any kind of reaction functions that econometricians and expert observers often use – and sometimes abuse – to compare monetary policy strategies. In essence, they all encapsulate a simple rule of thumb: raise the policy rate if anticipated inflation is higher than the objective and there are signs that the economy is operating above capacity. An additional condition for ensuring macroeconomic stability that applies to these rules is that the reaction in the nominal rate must be strong enough for the real rate to be varied pro-cyclically: when inflation expectations rise, and the economy expands above potential, real monetary conditions have to be tightened.

I choose this way of framing the issue primarily because it is widely used by our observers, and because it is sufficiently concise to be easily understood. But, before launching into the analysis, I should add that, precisely because it is simple and pedagogical, this framework is also a very incomplete description of our policy behaviour. Overall, because it does not capture the very essence of the two-pillar strategy, based on an economic assessment of medium-term risks to price stability, on the one hand, and a cross-checking based on medium to longer-term risks assessed though our monetary analysis, on the other. Also, because such representations of our policy are not sufficiently state-contingent, whereas my colleagues and I are far from being exclusively guided by mechanical configurations of indicators, but are very interested in the contingencies, and finally take our decisions on the basis of synthetic judgement enlightened by multiple experiences. As I often say, collegial wisdom is of the essence in central banking. This underscores the tension between describing policy simply and implementing policy simply: simple descriptions of policy need not – and indeed never do – mean simple policy behaviour.

Assuming that the parameters attached to the various indicator variables in the reaction function indeed capture the deep strategic preferences of the central bank, empirical estimates of these coefficients are often used to quantify the strength with which the central bank intends to respond to the state of the economy. In other words, these estimated parameters are sometimes viewed as objective measures of strategic “activism” in monetary policy.

A central bank would qualify as strategically more passive – or less active – than another central bank if the estimated coefficient attached to inflation expectations in deviation from the central bank’s objective, and the estimated coefficient penalising the indicator of macroeconomic slack, turned out to be smaller. Why would this central bank qualify as more “passive”? Because, for given variances of inflation and real activity, this central bank would indeed be inclined to take more moderate action in response to changes in the outlook. It would move its policy rate by narrower margins – and perhaps more infrequently – than its more “activist” counterpart. Moreover, as analysts typically append a partial adjustment mechanism to the representation of how the central bank interest rate responds to the economic state, there is an additional source of “activism” – or “passivity” – that would emerge from these simple empirics. This is the inertia coefficient attached to the lagged interest rate dependent variable, which in these rules moderates the pace of reaction of the policy rate to its fundamental determinants.

In any case, in the naive theory of this world, plain comparison of the frequencies of policy moves and the size of interest rate adjustments would suffice to tell the strategies of these two central banks apart. A smoother policy path would signal a “more passive” strategy.

But of course the world is not that simple, and in fact there are serious pitfalls lurking behind strategic inferences drawn on the basis of comparisons of variances in policy rates. It is not too difficult to portray situations in which such inferences could be highly misleading. I will give three examples, all relaxing one important qualification upon which my earlier example was predicated: the assumption that our two central banks are confronted with the same economic environment.

First, imagine two central banks which are equally responsive to economic conditions: in the reaction-rule jargon that I am using here, these are two central banks that share exactly the same reaction parameters. But one central bank now faces a less dynamic economy than its counterpart. By “less dynamic” I mean an economy that – as a matter of regularity – is hit by shocks of smaller magnitude which tend to fade away more gradually. Here, reaction parameters are the same – by hypothesis – but the reaction variables fluctuate at different speeds. All other things being equal, the patterns of adjustment of the policy rate that the same rule would induce in the two economies would be likely to look very different. The central bank operating in the less dynamic economy would in all likelihood be observed to adjust interest rates along a more moderate path. The other central bank would appear more reactive. But any strategic implications drawn from the variance in the two policy paths would be purely illusionary. The smoother course of policy would not reveal any deep-seated strategic inertia: it would only reflect the same response to shocks with quite different dynamic properties. Monetary policy would appear “passive” because the economy itself was evolving slowly.[1]

A second example again considers two identical central banks, now facing shocks of a different nature. One central bank predominantly faces demand shocks, which result in persistent departures from trend growth. This statistical pattern has symmetric and durable effects on output and inflation and thus presents a relatively straightforward monetary policy problem under the rule that I am postulating here for simplicity. As both reaction variables – forecasted inflation and output – would frequently move in tandem, the policy rate of this central bank would have to be changed frequently and forcefully in the same direction to offset the shock. But what would happen in the other economy, if it – unlike the first – were more prone to supply shocks? Experience suggests that supply shocks yield sharp transitory increases in inflation, possibly followed by smaller, more permanent “second-round” effects, though the longer-run impact on inflation is obviously significantly determined by the response of monetary policy. Given the transitory nature of the initial inflation bursts, the simple hypothetical rule – which incorporates the reaction to expected inflation – would advise the central bank to “look through” the immediate disturbance and change policy only to the extent needed to offset the anticipated more permanent effects of the shock on inflation in subsequent quarters. Its policy rate, again, would be observed to be less variable. What is important to note is that the same rule – equally active strategies – would support two different patterns of observed policy behaviour in different economic environments.

The third case is perhaps the most interesting of all. Here exogenous shocks are identical, but economic structures differ. Different transmission mechanisms therefore propagate the same shocks with lags that vary between the two economies. The first economy has more rigid adjustment mechanisms: price-setters and wage-negotiators are more sluggish than those in the other economy in processing economic news – including changes in the stance of monetary policy – and bringing them to bear on their decisions. What is the source of those rigidities in the first economy? There can be many reasons for rigidity. Perhaps labour practices and contractual institutions – dating from the early post-war decades when the economy was heavily regulated – induce distortions in large segments of the labour market. This stands in the way of an efficient matching of skills and productive capabilities. Perhaps tight regulatory restraint on business and statutory inhibitions discourage innovation and impede a faster response to new shocks and new opportunities. Whatever the source of rigidity, the observational result is that prices and wages in the first economy reflect changes in fundamentals with considerable lags.

How should monetary policy respond to shocks in these conditions? Note that I am moving away from the naive world of simple policy rules and am taking a step further into the – admittedly no less conjectural – realm of optimal policy design. The answer to my question depends critically on the inflation process that we postulate. We know that when inflation expectations are well-anchored around the inflation objective of the central bank, the evolution of inflation over time is influenced by the numerical objective of policy more than by the history of inflation itself. We can state this differently, saying that when the economy internalises the central bank’s objective firmly, the inflation process becomes less persistent and more forward-looking. If inflation expectations are well-anchored, a shock to inflation in the recent past is likely to have a lesser impact on inflation in the future. One reason for this is that the shock will not encourage workers to bargain for commensurate rises in nominal wages to protect the real value of earnings. Equally, firms would certainly resist such potential bargaining. All such parties and other price-setters will anticipate that the central bank will ultimately drive inflation back to its pre-shock level. Hence, they will tend to treat past inflationary shocks as transitory and inconsequential for the future outlook.

In the first economy in this example, where prices are sticky and inflation expectations are well-anchored, monetary policy can be more patient and focused on the medium term when confronting a cost-push shock. Again, as in the other two examples, it is likely to be observed to change policy less aggressively in the face of an unexpected shock to headline inflation. But this seeming “patience”, once again, does not signal inertia, “passivity” or neglect for macroeconomic conditions. It reflects a careful calibration of the policy course to the structural peculiarities of the underlying economy. First and foremost, the policy response to the inflationary shock will be less persistent because the inflationary consequences of the shock will be more promptly reabsorbed in the first place. Second, with stickier prices, a change in the nominal policy rate of a given size will have a stronger impact on the real rate, which is all that matters when it comes to measuring the stance of policy. In these conditions, a more moderate policy path is not a cause of instability. In fact, it is the very precondition for avoiding the dangers of over-steering, of accidentally destabilising the economy.

Of course, the thought experiments that I have been sharing with you so far are only as useful as the rules or the optimality benchmarks with which real-world behaviour has been compared. And I am certainly not the only one here who believes that simple reaction rules – or monetary policy optimality exercises, for that matter – cannot serve as the ultimate test for actual policy behaviour. But I hope I have conveyed one notion. Even in the over-simplified world of my canonical examples, where the macroeconomic state can be adequately described by a handful of facts, where these facts are reliably condensed in summary indicators – which, too, are immune from sampling errors and statistical revisions[2] – and where policy algorithms are an acceptable description of policy choices, even in that conjectural world the variability of the policy instrument would not be a sufficient statistic with which to judge monetary policy strategies. In particular, even in that world, a slower-moving, structurally more rigid economy would support an observationally more moderate policy course.

In the real world, as I will try to explain next, that observationally moderate path for policy receives an even stronger justification.

Facts and policy in the euro area

My emphasis on a structurally more rigid and less dynamic economy periodically facing adverse supply shocks is, of course, deliberate. That laboratory case resembles the euro area that I know. I will organise my interpretation of stylised facts about the euro area in the recent past into three broad categories: shocks, structures and monetary policy.

Shocks

One reason the euro area resembles my third example is that, compared with the United States, it seems to be subject to demand shocks of smaller magnitude but to be more frequently hit by supply shocks.[3] In the last ten years this shock pattern seems to have grown even more pronounced, despite globalisation and a generalised shift towards closer international economic integration.[4] This is nowhere more evident than in the anatomy of the boom-bust cycle that spanned the decade starting in 1995 in the two economies. In the United States, the run-up phase was significantly propelled – as we know with hindsight – by overly optimistic views about long-run earnings growth and, notably, exaggerated beliefs in the profitability of emerging technologies. But the strength in business investment that the boom brought with it also had important implications for the supply side of the US economy, through its influence on the rate of increase in labour productivity and thus the economy’s sustainable level of potential output. ECB staff calculations estimate that the contribution to the growth of output per hour worked coming from capital deepening doubled in the United States in the course of the 1990s. Subsequently – and despite the sharp reappraisal of those expectations and the unprecedented drop in business investment that followed the market collapse in 2000 – it stabilised at the elevated levels that it had reached at the turn of the millennium. Since then, remarkably, capital deepening has been replaced, as the main engine of output per hour growth, by extraordinary advancements in total factor productivity (TFP). Arguably, US firms have been able to meet expanding demand with a more efficient organisation of the production processes.

The same ten-year episode had a distinctly different face in the euro area. The stock market appreciation – comparable in size to that seen in the United States – went hand in hand with a decline, not a rise, in the contribution of capital to measured productivity. And a contemporaneous steady decline in TFP throughout the decade has reinforced, rather than offset, the diminishing contribution of capital.[5] The euro area seems to have had its fair share of stock market turbulence, without enjoying the side benefit of improved supply conditions.

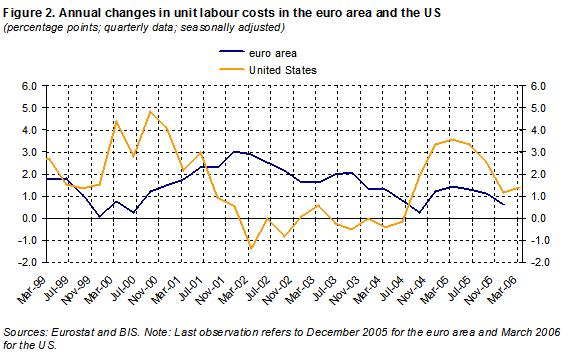

The slowdown in trend productivity has been a primary determinant of the weak economic performance of the euro area. By depressing income growth prospects and by reducing the prospective return on capital, it has held back consumption spending and business investment, which has been further curtailed to some extent by the ongoing demographic shift towards a more elderly population.[6] Rapidly decelerating productivity was one force behind the counter-cyclical rebound in unit labour costs that we observed during the early part of the new millennium. [See Figure 2].

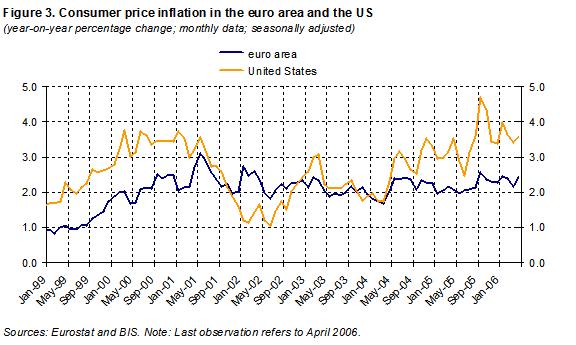

This surge in unit labour costs was atypical, if contrasted with the way in which unit labour costs in the United States elastically responded to the downturn with a sharp decline, and it represented an ongoing source of inflationary pressures. Adverse underlying developments in productivity have made it more difficult for our firms to smooth through the volatility of the many non-wage cost disturbances that they have encountered since 1999. This lesser degree of resilience has kept the evolution of inflation – and real activity as well – constantly vulnerable to unexpected shocks, such as the increases in the prices of energy and beef – to name only two – which have been brought about by adverse changes in supply conditions.[7] Note that inflation [Figure 3] edged higher in the downturn phase and remained at elevated levels thereafter, at a time when the accumulating margin of slack in labour and product markets could in fact have been expected to reduce price pressures. Again, compare these developments with the sharp disinflation which occurred, during the same period, in the United States.

Of course, we cannot directly observe full capacity of either labour or other production factors. Consequently, we can never be certain about the level of activity that would represent the full utilisation of available resources, and even less so about the strength of the relationship that links utilisation and inflation. However, I hope that I have demonstrated that this connection is seemingly weak in the euro area, probably weaker than across the Atlantic.

Structures

This structural feature brings me to the second category of my remarks: the structure of the economy on this side of the Atlantic. I will concentrate on two factors that critically affect the relationship between inflation and the fundamental shocks that drive the economy and determine its state: price flexibility and the anchoring of price-setting.

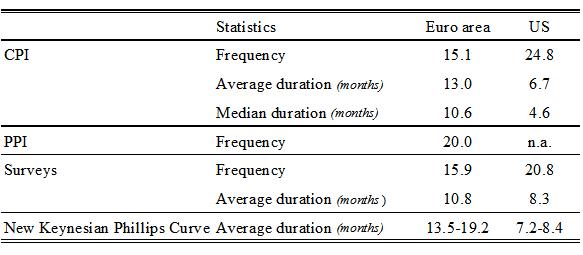

Extensive empirical research on price flexibility and inflation persistence in the euro area has recently been produced in a concerted effort that has occupied staff of the ECB and of the entire European System of Central Banks.[8] It comes to two main conclusions. First, in the euro area, prices are distinctly less flexible than, say, in the United States. Prices change infrequently: the average duration of a consumer price spell – a measure of the time that it takes for retailers to reprice their products – is 13 months [Table 1]. According to surveys, it is 11 months for producers. In the United States, comparable figures indicate durations of less than 7 months and slightly more than 8 months respectively.[9]

Table 1: Measures of price stickiness for the euro area and the United States

Sources: For the CPI in the euro area, Dhyne et al. (2005), Bils and Klenow (2004) in the US. For the PPI, Vermeulen et al. (2005). Surveys: Fabiani et al. (2005) for the euro area, Blinder et al. (1998) for the US. New Keynesian Phillips Curve: Estimates in Galí et al. (2001, 2003) refer to the GDP deflator and are converted from original quarterly figures.

More infrequent price revisions make the setting of prices less responsive to economic news, including, as I already pointed out, changes in monetary conditions. In general, sticky price revision processes reduce the odds that the imbalances created by economic shocks can be rectified by adjustments in prices. Conversely, they make the burden of adjustment to a shock fall disproportionately on changes in output, incomes and employment. Also, stickier prices tend – all other things being equal – to increase the persistence of inflation. This is because the impact of a shock that today modifies firms’ real cost conditions tends to be spread out over an extended future, as staggered price adjustments catch up only slowly with the changed underlying circumstances.

Despite sluggish price-setting mechanisms, however, inflation persistence in the euro area is low by international standards. This is the second important finding of the new body of evidence that I mentioned: an inflationary shock dissipates quickly in the euro area despite rigidities, and inflation has a tendency to return to its long-run norm reasonably quickly. The half-life of the effect of a shock to inflation is considerably less than one year, which is close to the figure that one obtains, for example, for the United States, again notwithstanding vastly different patterns of price-updating practices across the two areas.

What explains this apparently inconsistent evidence? Another ECB study, estimating a structural model on euro area and US data, goes some way towards reconciling empirical stickiness in prices and low persistence in inflation on the basis of a model of inflation determination that features real costs and expectations.[10] As I said before, even if price sluggishness introduces persistence into the inflation process – which in itself tends to perpetuate past inflation pressures into the future – some of that persistence can be undone if the expectations of price and wage-setters are focused on the objective of the central bank. Indeed, this study finds that the influence of the ECB’s inflation objective on the evolution over time of inflation outweighs the influence of past shocks, and thus at least partly compensates for the added inertia resulting from a more rigid economic structure. We are pleased to observe that analysis of survey-based measures of inflation expectations suggests that central bank leverage on expectations has become much stronger since the establishment of the euro.[11]

Monetary policy

Having reviewed structures and shocks, I now move on to the third aspect of my discussion of the euro area: monetary policy. Did considerations pertaining to the nature of the shocks that occurred in the recent past and to the structural peculiarities of the euro area play any role in positioning the stance of monetary policy? Can they go some way towards explaining the observationally moderate path that the policy rate has followed in the euro area? Did the smoother path of our policy rate impede a smooth adjustment of the euro area to the shocks that have hit the global economy in the recent past? Finally, does low inflation persistence provide reason for complacency?

When the ECB in early 2001 initiated the easing cycle that we started to reverse in December last year, this was done on the heels of significant adverse supply shocks, relatively strong wage dynamics, and headline inflation rates at levels unseen in Europe since the late phases of convergence to the new currency. Yet the Governing Council judged that our commitment to attaining price stability, in line with our official definition, through our monetary policy strategy was sufficiently credible for us to take that easing decision without running the risk of destabilising inflation expectations. That conviction was reinforced by a rapidly deteriorating outlook and by reassuring signs that inflation expectations discounted a scenario in which inflation would settle in the zone of price stability in the medium term. The rapid softening of activity that we saw coming and the increasing odds that the recovery would not materialise soon – we believed – would validate ex post the inflation expectations and make the threat of renewed inflation considerably weaker. Information extracted from monetary trends supported our prediction of subdued inflation looking into the more distant future.

Monetary accommodation was quicker and, in retrospect, far more persistent than could have been predicted on the basis of the policy regularities on record. In the end, monetary action amounted to an interest rate reduction of 275 basis points, bringing the policy rate to a level which was below the lowest intervention rate of the central banks of an overwhelming majority of member countries, including Germany, during the last 50 years. It is all the more remarkable that we were able to follow such a historically unseen trajectory for our vast continental economy, the euro area, given that the individual countries had very diverse and mixed legacies as regards past monetary credibility.

It is difficult to work out a convincing counterfactual: what would have happened if the reaction of the ECB had been more in line with the patterns of policy behaviour established in the past, rather than the more forceful action we took. However, structural – if model-specific – analysis of the mix of the macroeconomic shocks that have hit the euro area since 2001 reveals with hindsight that the extra monetary policy stimulus that we introduced has been critical in avoiding a deeper and more enduring recession here and on a global scale.

I judge that the policy course was carefully calibrated to the structural characteristics of the euro area transmission mechanism, some features of which I tried to outline earlier. We were guided, in particular, by the understanding that a central bank operating in a relatively rigid economy is able to deliver the same quantum of monetary accommodation by adjusting its policy instrument in more moderate steps than in a relatively more flexible economy. Under the structural conditions that prevail in our economy, a more aggressive easing would have introduced unwelcome volatility in both inflation and output that would have necessitated corrective, countervailing action further down the road.[12] Certainly, as I will argue shortly, the ECB would not have maintained the nominal and real policy rate at the low levels at which they were held for more than two years without consistent signs that expectations were well-anchored and inflationary shocks were being quickly reabsorbed.

Alertness and active communication

No central bank represented in this room, or elsewhere, can reasonably spell out in advance its reaction to every conceivable contingency. This means that surprises in our behaviour can never be ruled out, notably in the face of potent shocks. In particular, we might be confronted with new occurrences of risks which could force us to take bold steps that our observers could not have predicted by extrapolating from our past history of policy conduct. To some extent, this is what occurred over the earlier phase of the international economic downturn: we took sizeable risks in the direction of “activism”.

What were those risks? First, in an economy as rigid as the euro area, it might well be true that temporary imbalances between demand and potential supply are slow to show through convincingly to inflation. But if and when they finally do, they would be more costly to correct.[13] So, monetary policy should be sufficiently alert to any threats to the outlook for price stability, so that it does not find itself reacting belatedly – and with less chance of success – to trends that have long been underway.

Second, it is true that the expectation that inflation will not come loose from its anchor affords some short-term flexibility to respond to economic disturbances – with a view to ensuring more balanced macroeconomic conditions in the longer term. But that flexibility only lasts as long as economic agents and the public are confident that the opportunity will not be misused. And we just do not know enough about the way policy actions influence expectations and how sensitive central banks’ credibility is to short-run departures from low inflation to warrant experimenting. Occasional monetary policy activism, as circumstances require, is not the same as fine-tuning. Fine-tuning – if I may twist a phrase borrowed from Alan Blinder and Ricardo Reis – cannot be resurrected.[14] Building and maintaining a reputation for prudent policy involves commitment to a systematic strategy: that is, following a recurrent pattern of behaviour, so that stable expectations are consistently validated ex post.

During the extended period of policy accommodation, we were able to steer expectations effectively without explicit action, proof that markets accept as true the ultimate motives of policy that we profess. In those instances in which expectations displayed signs of overreaction to current events – such as surging oil prices – our renewed emphasis in communication on our objective, on the vigilance and determination that we would apply to enforce it, on our steady alertness, provided effective resistance to inordinate developments. Importantly, signalling vigilance proved instrumental in reaching a common understanding with the markets: the ECB, though observationally inactive, was at any time ready to start action. Our policy course was rightly seen as always contingent on the arrival of new information. Given the information available each time the Governing Council meets, the standing assumption in the markets should always be that the policy decision is aimed at positioning the stance of policy appropriately. No history of past monetary policy decisions could ever be taken as an indication of a commitment, on our side, to enact a sequence of interest rate moves in the future. Unconditional – or “quasi-unconditional” – talk about future policy would have impaired the difficult balance that we maintained between supportive credit conditions and persistently anchored inflation expectations. Active emphasis in communication upon “alertness” required keeping all options open to a – possibly quick – change in policy. Pre-commitment to a policy path would certainly have made that reversal of policy difficult to execute and/or to justify, and therefore non-credible.

The markets seem to have internalised these strategic principles with an increasing degree of precision. Incoming data which, since the autumn of 2005, have indicated more persuasive signs of a recovery in an environment of abundant liquidity and elevated commodity prices were correctly mapped into expectations that the stance then prevailing would not be consistent with controlling inflation over the medium term. Markets anticipated in good time that the ECB would soon begin reversing the extra easing that had been put in place.

In retrospect, market expectations have aligned well with our intentions. Since December, consistent with our remit to be alert and pre-emptive, the monetary policy of the ECB has been perceived to be in a mode of progressive withdrawal of monetary accommodation. Indeed, this withdrawal has been and remains conditional on the evolution of our analysis with respect to our objective of price stability, but it has not been predicated on any single short-term indicator of the macroeconomic state. In the last few months, the ECB has not measured the state of the economy by the strength or weakness of any particular piece of incoming news. It has continued to extract the macroeconomic trend from the wealth of cumulative evidence accruing – from month to month – from the economic and the monetary side. In both cases, the medium-term orientation of its monitoring activity has been preserved. Two examples: as regards our economic analysis, when looking at the underlying trend of growth of the European economy, we judged in the second half of last year that we were experiencing a recovery with the trend progressively approaching potential. We judged that the short-term volatility observed in important indicators, including the quarterly growth figure for the fourth quarter of 2005, did not call into question the medium-term growth prospects and therefore the associated gradual increase of risks to price stability. Another example can be extracted from our monetary analysis: consistent indications that broad money growth was increasingly due to its most liquid components has contributed in recent months to a gradual tilt of the balance of risks perceived to be signalled by our monetary analysis. It was not the behaviour of aggregate M3 per se which altered the outlook for price stability. It was the realisation that the structural force at work behind persistently abundant liquidity was becoming increasingly connected with final spending and pricing decisions.

As I said at the start, the complexity of the analysis required to predict our moves has not materially impeded market participants in responding meaningfully to incoming data. The understanding of our strategy and the information coming from the real economy, as well as from the sphere of monetary aggregates, have shaped market expectations beyond the very near term. I attribute this satisfactory result to our policy framework, which features a primary, sharply-defined objective and a systematic reaction to events whenever the objective is perceived to be at risk.

Concluding remarks

I am sometimes asked the following question: “You are in the process of increasing rates. Is your judgement that your rates today are significantly lower than they should be? What then is the level of the “neutral rate” that you would judge it appropriate to reach (as rapidly as possible)?”

My response to such questions would be the following. First, we are not in a position that we would judge “abnormal”, in the sense that we would have to increase as rapidly as possible our interest rates up to the “normal” level. We are in a process of progressively withdrawing the present degree of monetary accommodation commensurate with the risks to price stability that we perceive, associated in particular with the present development of the economic recovery. To the extent that we never previously pre-committed to unconditional moves and we have always adhered to the posture of steady alertness which is at the heart of our strategy, our monetary policy stance should and does – to the best of our own comprehensive, deep and candid assessment of the situation – at any time makes it possible to cope with the risks we see for price stability in a medium-term perspective. Then, in a dynamic perspective, our refusal of unconditional pre-commitments, our position of permanent, steady alertness and our strategy help focus our policy upon being permanently at the “correct level” in terms of attaining our primary goal in a medium-term perspective.

Second, from a central bank’s perspective, the Wicksellian concept of a “neutral rate” is more particularly useful in the event that the central bank has – for whatever reason – moved its rates far away from the policy stance that it would judge appropriate ici et maintenant, here and now. As you can see, in my view, this cannot be the case for the Governing Council of the ECB.

Third, one can be sure that we will continue to analyse the situation very carefully on an ongoing basis. It is clear that if our main scenario is confirmed over time, a further withdrawal of monetary accommodation will be appropriate. We do not specify ex ante a sequence of policy actions, as I have said clearly since last December. The appropriate policy stance will always depend on information on the economic and monetary side and on the source and dynamic properties of the underlying shocks that will hit the economy and we will always remain alert. It is the combination of events and data, some expected, others unexpected, that will be analysed and will permit us to define our future trajectory.

Thank you for your attention.

-

[1] A similar interpretation of “interest rate inertia” – the tendency of central banks to adjust rates in the same direction and in small steps – can be found in G. Rudebusch, “Term structure evidence on interest rate smoothing and monetary policy inertia”, Journal of Monetary Economics, Vol. 49 (pp. 1161-1187), 2002.

-

[2] Of course, in the actual practice of monetary policy, uncertainty about the data is extremely pervasive. We are even uncertain about the current economic situation as economic data are received with a lag, are typically subject to multiple revisions, and in any case can only roughly and partially depict the underlying economic reality.

-

[3] See, for example, the structural comparative analysis in F. Smets and R. Wouters, “Comparing shocks and frictions in US and euro area business cycles: a Bayesian DSGE approach”, Journal of Applied Econometrics, 20(1), January 2005.

-

[4] This is a well-known, if certainly surprising, fact. See, for example, J. Stock and M. Watson, “Has the business cycle changed? Evidence and explanations”, paper presented at the Federal Reserve Bank of Kansas City Symposium “Monetary Policy and Uncertainty,” Jackson Hole, Wyoming, August 28-30 2003.

-

[5] See G. Gomez-Salvador, A. Musso, M. Stocker and J. Turunen, “Labour productivity developments in the euro area”, forthcoming as an ECB Occasional Paper. They report that the average contribution of capital to measured productivity growth in the United States was 0.6 percentage point in the first half of the 1990s, increasing to 1.1 percentage points in the second half of the decade and stabilising at 1.0 percentage point on average between 2000 and 2004. In the euro area, the trend was reversed: a contribution of 1 percentage point in the first half of the 1990s became 0.4 percentage point and 0.6 percentage point, respectively, in the second half of the 1990s and in the first five years of this century. The TFP contribution, calculated on the basis of the Solow residual, tripled in the United States from the early 1990s to 1.6 percent on average in 2000-2004, but halved in the euro area from 1.3 to 0.6 percent in the same period. Correcting the euro area TFP measures mentioned above for variable capital utilisation does not change the picture. In fact, such correction would shift the start of the slowdown in productivity to the mid-1990s.

-

[6] As the share of the population that is of working age declines, the rise in the capital stock needed to equip the labour force decreases. Lower rates of investment in some member countries may also reflect some relocation of production to China and other newly industrialised countries (where investment rates have been quite high in recent years).

-

[7] The cluster of large unanticipated supply shocks that have implications for the Harmonised Index of Consumer Prices that is the focus of the ECB’s inflation analysis includes a strong and persistent increase in the price of oil and natural gas in 2000 and again after 2004; increases in unprocessed food prices associated with the outbreak of BSE and foot-and-mouth disease in 2001; and rises in administered prices and tobacco taxes announced in late 2004.

-

[8] See E. Dhyne, L. Alvarez, H. Le Bihan, G. Veronese, D. Dias, J. Hoffmann, N. Jonker, P. Lünnemann, F. Rumler and J. Vilmunen, “Price-setting in the euro area: some stylised facts from individual consumer price data”, ECB Working Paper No 524, 2005. The paper reports that the average duration of CPI price spells in the euro area is 4.3 quarters. By comparison, M. Bils and P. Klenow, in “Some evidence on the importance of sticky prices”, Journal of Political Economy 112, 2005, calculate that the average duration of CPI prices in the United States is 2.2 quarters. Other Phillips curve-based analyses broadly confirm these results. For the euro area, see J. Gali, M. Gertler and D. Lopez-Salido, “European inflation dynamics”, European Economic Review 45(7), 2001, and J. Gali, M. Gertler and D. Lopez-Salido, “Erratum”, European Economic Review 47(4), 2003.

-

[9] Abstracting from methodological differences in price-collecting procedures across statistical institutes, differences in the frequency of price adjustments can be due to various causes. Differences in the degree of competition, especially in the services sector, may be a factor, particularly given evidence that the divergence of such frequencies is most pronounced in that sector. Another factor that is often cited is the fact that small corner shops, which change their prices less frequently than supermarkets, have a higher market share in euro area countries than in the United States.

-

[10] See L. Christiano, R. Motto and M. Rostagno, “Financial factors in business cycles”, presented at the IMF-IRF Conference on DSGE Modelling at Policymaking Institutions: Progress and Prospects hosted by the Federal Reserve Board of Governors (Washington, 2-3 December 2005).

-

[11] The consumer survey on inflation expectations compiled by the European Commission is a good barometer of the sensitivity of short-term inflation expectations to recent inflation dynamics. Results are presented in terms of the difference between the percentage of respondents who believe prices will increase and the percentage of respondents who believe that they will decrease or stabilise. Prior to the euro cash changeover there was a tight relationship between this qualitative indicator and actual inflation developments, with a correlation coefficient close to 1. However, since the cash changeover, the correlation between the two series has dropped to 0.4.

-

[12] Counterfactual simulations based on a large-scale estimated dynamic general equilibrium model of the euro area have quantified the implications of alternative policy scenarios. This analysis reaches two conclusions. First, the loss in GDP that would have been associated with a situation in which the ECB did not deviate from the estimated reaction rule embedded in the model – and thus monetary policy in the euro area followed a tighter course – would have come close to 1% per annum on average since 2001. Second, had the ECB followed a more aggressive policy easing, one resembling the sharp rate reduction engineered by the Federal Reserve in the United States, the standard deviation of inflation would have tripled and the standard deviation of output doubled since 2001. The model used is documented in Christiano et al cited above.

-

[13] Another way to state this notion is that in an economy such as the euro area, where prices and wages are as rigid as they prove to be, the “sacrifice ratio” is probably large. This means that the action required to counter inflation – when inflationary pressures actually emerge – would be more forceful.

-

[14] See A. Blinder and R. Reis, “Understanding the Greenspan Standard”, paper presented at the Federal Reserve Bank of Kansas City Symposium “The Greenspan Era: Lessons for the Future”, Jackson Hole, Wyoming, August 25-27 2005.

Europäische Zentralbank

Generaldirektion Kommunikation

- Sonnemannstraße 20

- 60314 Frankfurt am Main, Deutschland

- +49 69 1344 7455

- media@ecb.europa.eu

Nachdruck nur mit Quellenangabe gestattet.

Ansprechpartner für Medienvertreter