Model-based risk analysis during the pandemic: introducing ECB-BASIR

Published as part of the ECB Economic Bulletin, Issue 1/2021.

The interplay between epidemiological fundamentals of the coronavirus (COVID-19) pandemic, containment policies and the macroeconomy can be assessed by combining a macroeconomic model with an epidemiological model. ECB‑BASIR[1] is an extension of the ECB-BASE[2] model which addresses specific features of the COVID-19 crisis by combining a standard pandemic susceptible-infected-recovered (SIR) model with a semi-structural large-scale macroeconomic model. An SIR model – a compartmental model introduced by Kermack and McKendrick[3] – divides the population into groups and, using differential equations, predicts how a disease will spread on the basis of the number of susceptible, infected, recovered or deceased individuals. We extend that model by incorporating two additional categories: (i) quarantined individuals, and (ii) people who have been vaccinated (who are assumed to be immune to the virus). We postulate that economic behaviour will affect the transmission of the disease (with declines in consumption and work activity reducing the probability of people getting infected, for example), establishing a channel from the macroeconomic model to the epidemiological model through the sensitivity of transmission to economic interaction between people. The channel running in the opposite direction, from the epidemiological model to macroeconomic behaviour, is established by assuming that different groups of agents modelled in the epidemiological component have differing ability to work, consume and invest. For example, agents that are constrained by lockdowns can only consume part of what unconstrained agents consume, with those differences between the consumption of constrained and unconstrained agents being estimated on the basis of data for the first and second quarters of 2020. Those effects then propagate through the macroeconomic linkages in the model.

In this environment, interaction between the severity of infection rates and the lockdowns that are imposed to curb the pandemic becomes the main driver of macroeconomic dynamics. The infection rate in the model is based on several factors, one of which is the containment measures that are implemented (including lockdowns). Lockdowns[4] are based on a decision-making rule for containment measures which assumes that policymakers seek to ensure that infection rates do not result in hospital admissions[5] exceeding hospital capacity, while minimising economic costs.

The unique nature of the COVID-19 shock makes it difficult to use standard econometric analysis to characterise uncertainty, requiring the use of dedicated scenario analysis.[6] ECB-BASIR is designed to serve that very purpose. In the analysis below, for example, it is used to consider a favourable scenario in which a medical solution to the pandemic (i.e. a vaccine) is implemented more quickly than expected. In that scenario (which is established as a deviation from a baseline scenario approximate to the baseline in the Eurosystem’s December 2020 staff macroeconomic projections), a medical solution is assumed to be effective as of 1 January 2021, rather than the second quarter of the year, thus being closer to the mild scenario in the December 2020 staff macroeconomic projections. In the model, that earlier implementation of a vaccine leads to lower levels of uncertainty for economic agents[7] and the weakening of lockdown restrictions on spending behaviour and productive capacity.

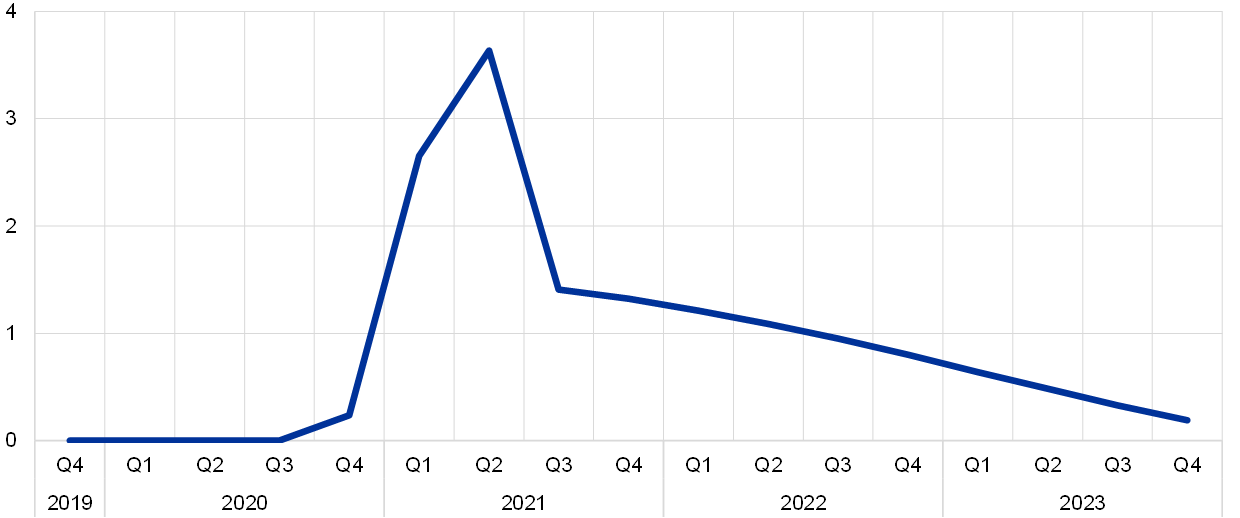

As Chart A shows, the relaxation of containment measures as a result of early implementation of a vaccine produces an inverted V-shaped boost to economic activity. The macroeconomic impact of this scenario peaks at 3.5% of GDP in the second quarter of 2021, while the overall impact on inflation is fairly limited (peaking at just under 0.25 percentage points in 2022). The economic stimulus declines quickly in the third quarter of 2021, and the expansionary effects then recede further in 2022 and 2023 (albeit remaining fairly persistent). On the nominal side, the inflation response gradually declines over the simulation horizon, but inflation remains 0.1 percentage points higher than in the baseline scenario at the end of 2023. Overall, the inflationary impact appears to be fairly limited when compared with the magnitude of the rebound in economic activity. This is a key feature of the macroeconomic dynamics stemming from COVID-related containment measures, which inflict V-shaped adjustment patterns on the real economy and act on both the demand and supply sides of goods and labour markets.[8]

Chart A

Macroeconomic and financial implications of early implementation of a vaccine

a) Euro area GDP

(levels; deviation from baseline scenario in percentages)

b) Annual HICP inflation

(levels; deviation from baseline scenario in percentage points)

Source: ECB calculations.

In addition to scenario analysis looking at a discrete event, ECB-BASIR can also indicate the distribution of risk, spanning all relevant sources of uncertainty. In particular, the model can be used to assess a combination of economic and pandemic-related risk factors. Chart B, for example, shows a composite measure of risk density combining (i) the standard historical uncertainty captured in the residuals of the model, (ii) uncertainty about the timing and efficiency of the vaccine’s implementation[9] and (iii) uncertainty about the fundamentals of the pandemic (estimated epidemiological parameters).

The percentage of the population that will be vaccinated and the potential for a third wave are key pandemic-related risk factors. In the bottom right panel of Chart B, we can see that differences in the timing and efficiency of implementation result in differences in the percentage of the population that is vaccinated. In the short term, a successful vaccination programme allows policymakers to ease lockdowns, as can be seen in the top left panel of Chart B. In the medium term, however, that increases the likelihood of a third wave, resulting in greater medium‑term risks in respect of the potential severity of containment measures.

Chart B

Uncertainty surrounding pandemic-related developments

(y-axis: percentages; x-axis: number of days after 31 December 2019)

Source: ECB calculations.

Note: The daily infection rate indicates the percentage of the population that has the virus on a given day.

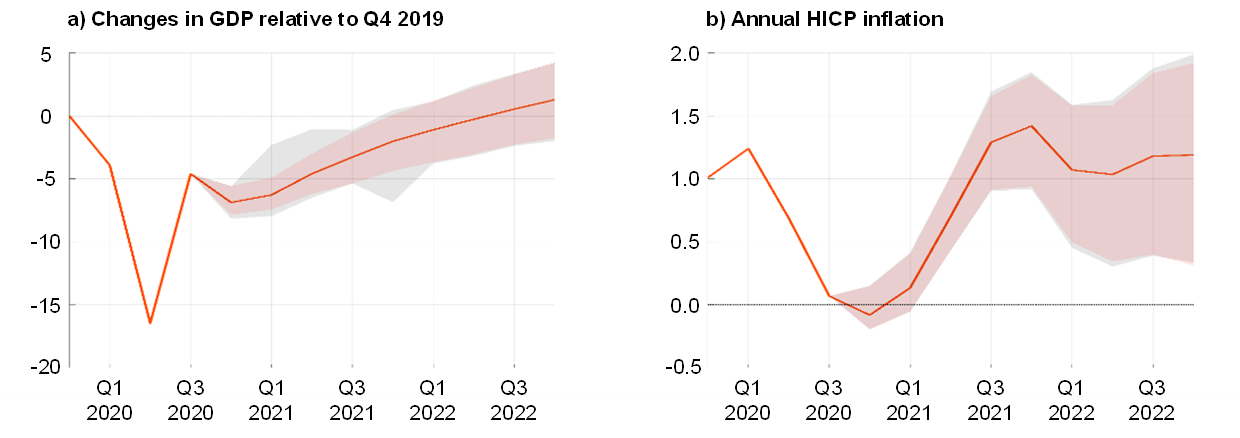

Turning to the distribution of risk, the pandemic-related risk factors which are considered above are such that uncertainty surrounding the short-term outlook for growth is significantly higher than standard economic risk factors would suggest. For the purposes of this analysis, we have assumed that the median pandemic-related developments in Chart B are consistent with the baseline scenario in the December 2020 staff macroeconomic projections. Chart C presents the resulting risk distributions around the projection baseline, drawing on either (i) a combination of pandemic-related and economic risk factors or (ii) economic risk factors alone. Given the uncertainty surrounding the severity of containment measures, efficient and timely vaccination has the potential to increase GDP by almost 5% in the first half of 2021 and raise inflation at end-2021 by around 0.5 percentage points. At the same time, however, the recovery may be hampered considerably if the pandemic worsens and a third wave is seen. At longer horizons, the dominant factor is the standard model-based uncertainty resulting from historical residuals, rather than pandemic‑related developments.

Chart C

Uncertainty surrounding macroeconomic developments

(percentages)

Source: ECB calculations.

Notes: Red shading denotes economic risk factors alone; grey shading denotes economic and pandemic-related risk factors combined. All shading indicates 90% confidence intervals.

- See Angelini, E., Damjanović, M., Darracq Pariès, M. and Zimic, S., “ECB-BASIR: a primer on the macroeconomic implications of the Covid-19 pandemic”, Working Paper Series, No 2431, ECB, June 2020.

- See Angelini, E., Bokan, N., Christoffel, K., Ciccarelli, M. and Zimic, S., “Introducing ECB-BASE: The blueprint of the new ECB semi-structural model for the euro area”, Working Paper Series, No 2315, ECB, September 2019.

- See Kermack, W.O. and McKendrick, A.G., “A Contribution to the Mathematical Theory of Epidemics”, Proceedings of the Royal Society, Series A, Vol. 115, No 772, August 1927, pp. 700-721.

- The severity of lockdowns is estimated using information from Google’s COVID-19 Community Mobility Reports.

- In the model, admissions exceed hospital capacity if they surpass 88% of the admissions seen in the first wave in spring 2020.

- Indeed, since June 2020 the Eurosystem’s staff macroeconomic projections for the euro area have featured alternative scenarios alongside the baseline projection.

- In the ECB-BASIR model, the effect of pandemic-related uncertainty is estimated via local projection methods for the period from the second quarter of 2020 to the fourth quarter of 2022. It is assumed that those effects disappear one quarter before the vaccine starts to be implemented efficiently.

- As a sensitivity analysis, the same scenario can be run using anticipation channels. If households and firms fully anticipate the earlier medical solution, the macroeconomic outcomes are frontloaded (notably on the nominal side), but are also short-lived, with inflation actually returning to the baseline scenario by end-2023.

- Within the confines of the theoretical model, uncertainty around the deployment of the vaccination strategy is captured by the start date for the vaccination process, assuming that vaccinated people have immediate immunity. In practice, it may take some time for vaccines to be rolled out, so the percentage of the population that is immune in the median model-based scenario is roughly consistent with a vaccination campaign starting in the first quarter of 2021.