PRESS RELEASE

13 June 2019

International use of the euro increases

- Euro’s share in global foreign exchange reserves rose by 1.2 percentage points in 2018

- Role of euro also strengthened in debt issuance and remained stable as invoicing currency

- Policies for deeper economic and monetary union are key to supporting a further rise in international role of the euro

The euro’s international role strengthened in 2018 and early 2019 reversing a declining trend in recent years. This was one of the principal findings in the latest annual report on The international role of the euro, published today by the European Central Bank (ECB).

Adjusting for exchange rate valuation effects, the share of the euro as a global exchange reserve currency was 1.2 percentage points higher at the end of 2018 than at the end of 2017 (20.7% compared with 19.5%). The euro’s share in international debt issuance and international deposits also increased, together with its share in the value of outstanding international loans. Its use as an invoicing currency remained broadly stable, as did shipments of euro banknotes to destinations outside the euro area.

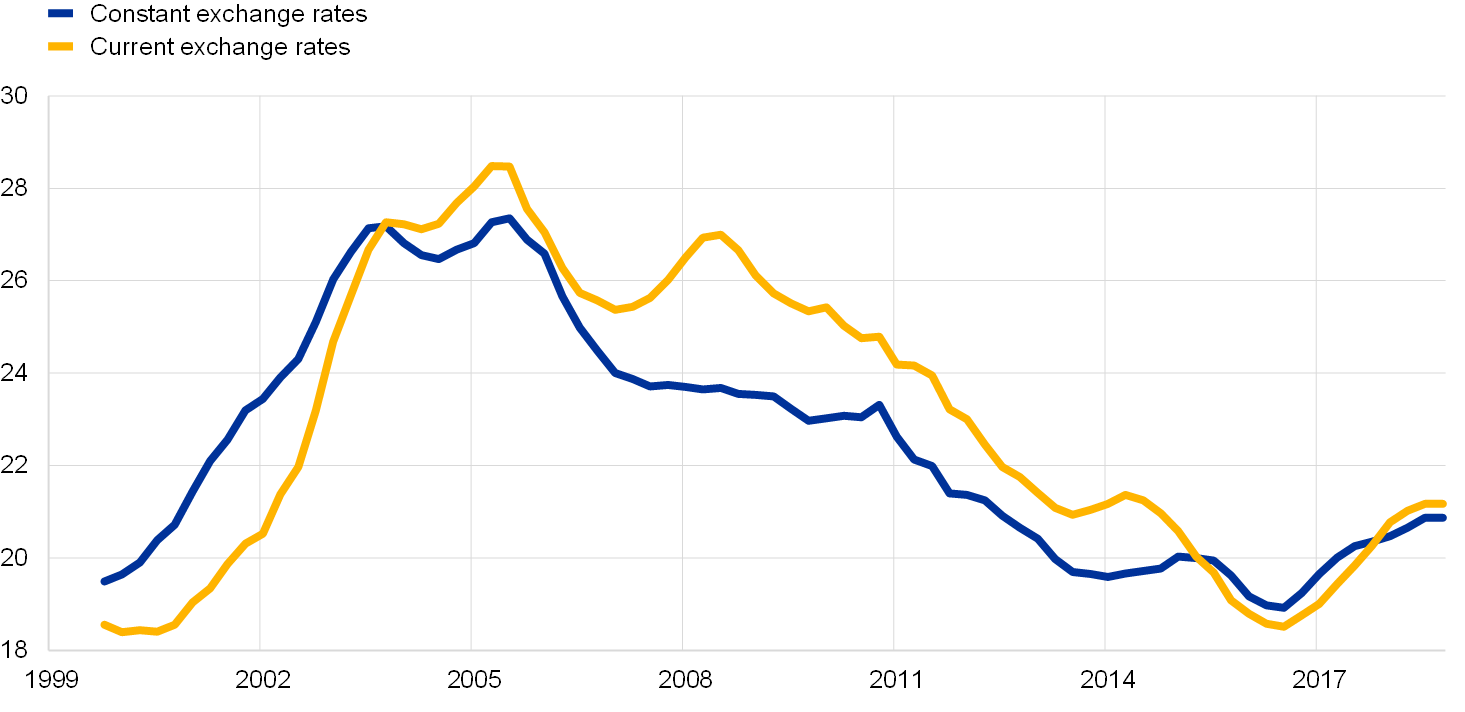

Since its introduction 20 years ago, the euro has remained unchallenged as second most used currency globally after the US dollar, but its usage declined after the global financial crisis. After bottoming out in 2016, the international use of the euro has recently slightly strengthened again (see chart).

Composite index of the international role of the euro

(percentages; at current and Q4 2018 exchange rates; four-quarter moving averages)

The report provides background to the initiative launched by the European Commission in December 2018 to strengthen the international role of the euro. Like the Commission, the Eurosystem stresses that the international role of the euro is primarily supported by a deeper and more complete Economic and Monetary Union (EMU), including advancing the capital markets union, in the context of the pursuit of sound economic policies in the euro area.

“The Eurosystem supports these policies and emphasises the need for further efforts to complete EMU,” said Mario Draghi, the ECB’s President. “Sound economic policies and a deeper and more complete EMU can be expected to ultimately boost the global role of the euro and also help facilitate the smooth transmission of monetary policy across euro area financial markets”, said Benoît Cœuré, member of the ECB’s Executive Board. “In particular, because capital markets in Europe are still fragmented along national lines, there is a need to further strengthen the ability of the financial sector to contribute to economic stabilisation and resilience in the euro area.”

Strengthening the credit quality of outstanding debt, notably by pursuing sound and sustainable fiscal policies, would contribute to increasing the supply of safe euro area debt and raising the euro’s global appeal. In the longer term, the creation of a common euro area safe asset, if so decided by Member States, in a way that does not undermine incentives for sound national fiscal policies, could also contribute to this objective.

The report also contains four special features. The first assesses whether and how the economic costs and benefits of the international use of the euro have evolved over time. The second special feature describes the economic importance of the “exorbitant privilege” enjoyed by the euro as one of the major global currencies. The third special feature assesses the role of trade invoicing for the global transmission of monetary policy, while the fourth weighs the relative importance of the euro and the US dollar as denomination currencies for cross-border bank positions.

For media queries, please contact Peter Ehrlich, tel.: +49 69 1344 8320.

Banc Ceannais Eorpach

Stiúrthóireacht Cumarsáide

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, an Ghearmáin

- +49 69 1344 7455

- media@ecb.europa.eu

Ceadaítear atáirgeadh ar choinníoll go n-admhaítear an fhoinse.

An Oifig Preasa