The challenge of low real interest rates for monetary policy

Lecture by Vítor Constâncio, Vice-President of the ECB, Macroeconomics Symposium at Utrecht School of Economics, 15 June 2016

Ladies and gentlemen,

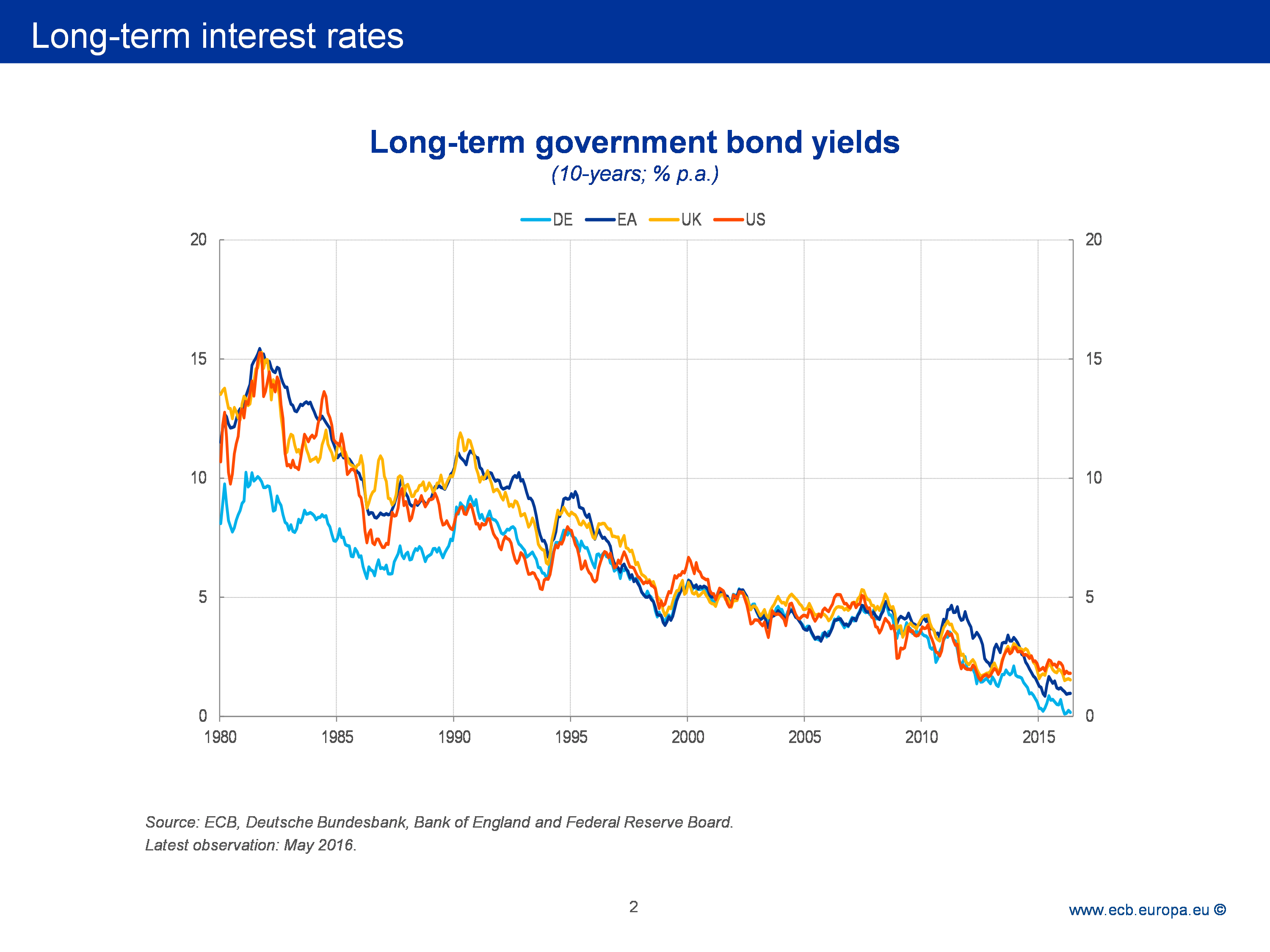

I warmly thank the organisers for inviting me to the Utrecht University Macroeconomics Symposium, a prestigious event dedicated this year to the low interest rate environment. Low interest rates are prevailing in advanced economies where a third of public debt is in negative territory and deposit facility policy rates are negative in several of them. Over the past decades, across major advanced economies both short- and long-term interest rates have experienced a significant decline and are currently at historical lows (see chart below on Long-term interest rates).

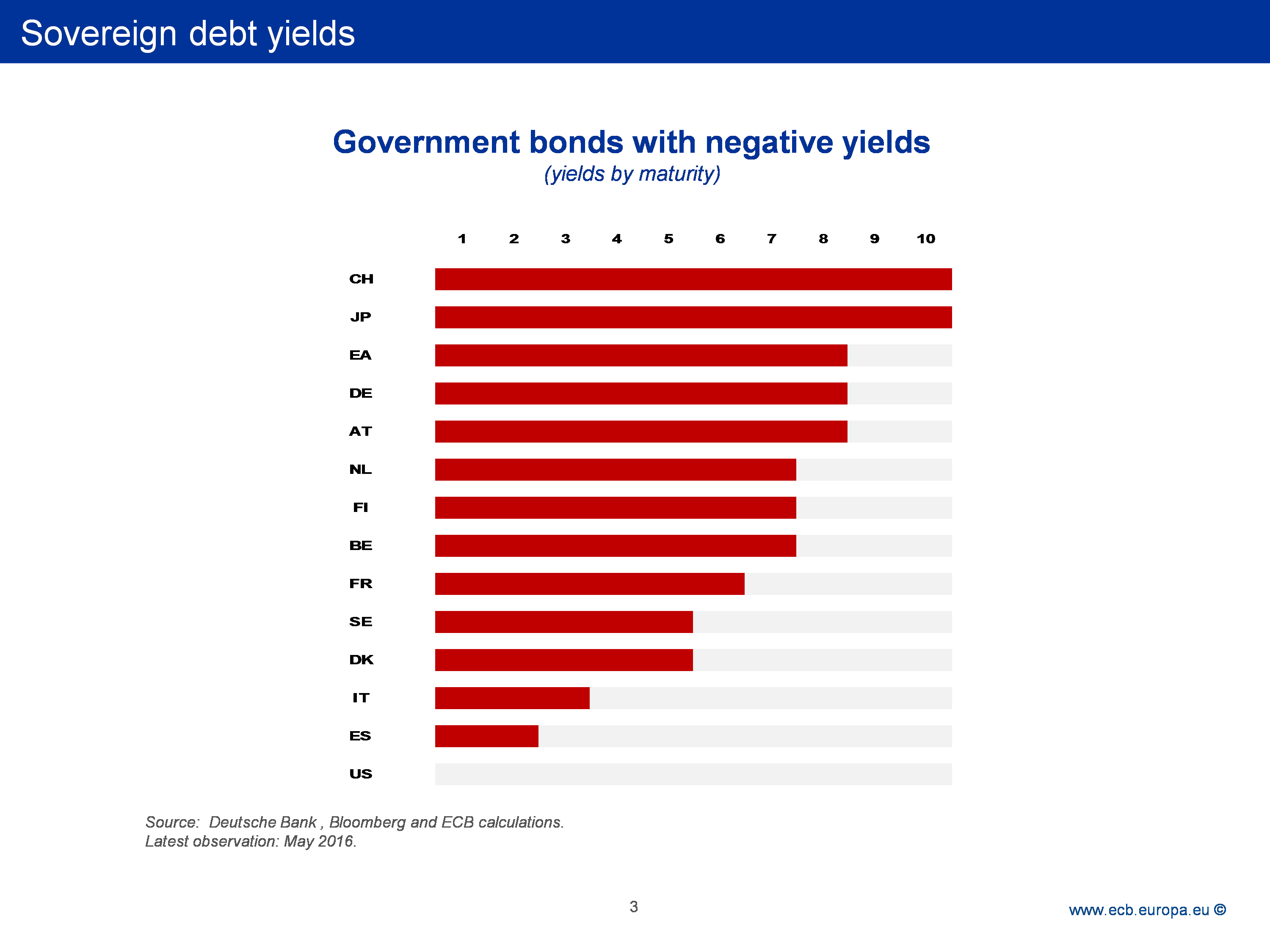

In 1980, long-term interest rates stood at 11.4% in the U.S. and 8.5% in Germany. On average, over 2016 they have been about 1.9% and 0.3%, respectively and at about 0.3% for the euro area as a whole. Short-term interest rates have witnessed an equally dramatic fall: in 1980 the interest rate on three-month Treasury securities stood at 11.4% in the U.S. and 6.4% in Germany; this year it has averaged about 0.3% in the U.S. and minus 0.5% in Germany. In the euro area, the overnight interest rate has been minus 0.3%. A striking feature of the current environment is the extent to which interest rates are in negative territory at different maturities across so many advanced countries (see chart below on Sovereign debt yields). For example, yields in Japan up to ten years are negative, and in the case of Switzerland this extends to 15 years.

Why are interest rates so low? Is monetary policy responsible?

Answering these questions is of crucial importance. Understandingly, low interest rates are generating a degree of apprehension in some quarters about the potential negative implications for savers and for the financial industry, due to the compression of interest income.

A superficial, impulsive answer is that rates are low because monetary policy keeps them low. However, in reality, low rates are the result of real economy developments and global factors, some of which are of a secular nature and others relate to the financial crisis.

The concept of a real equilibrium interest rate

To fully understand the present situation, it is useful to invoke the concept, controversial as it may be, of an equilibrium (or neutral) real interest rate, determined by long-term real economic factors and independent from monetary causes. It is based on the idea that there are real economic forces that lead the economy to long-term equilibrium at full employment with stable inflation. The role of monetary policy should therefore be to steer policy and market rates to that equilibrium rate. The concept assumes therefore that money, as well as finance, are neutral in the long run, and only act as devices that facilitate contemporaneous and intertemporal transactions. Many general equilibrium models operate reflecting this vision, which may be difficult to square with economies at present, on the back of the staggering permanent loss of output resulting by the recent financial crisis.

The importance of the concept of a real equilibrium interest rate is that it provides a sort of anchor to a monetary economy. In reality, the concept defines an optimum to which the economy would move spontaneously in the long run if wrong policies would not disturb it. The concept was introduced in 1898 by Knut Wicksell as he became aware that in a credit-dominated economy, where banks create money, the traditional quantity theory of money could not explain inflation. He therefore introduced the theory of a natural real rate of interest, linked to the marginal productivity of capital that, in combination with market interest rates, would determine price dynamics. Prices would increase if market rates were below the natural rate, and would decrease should the opposite be the case. As market rates are influenced by monetary policy and somehow related to monetary aggregates, he presented his theory as a reformulation of the quantity theory of money adapted to a credit/money economy. As he wrote in his book “Interest and prices”: “There is a certain rate of interest on loans which is neutral in respect to commodity prices, and tends neither to raise or lower them. This is necessarily the same as the rate of interest which would be determined by supply and demand if no use were made of money and all lending were effected in the form of capital goods. It comes to much the same thing to describe it as the current value of the natural rate of interest on capital.”[1]

The connection with the productivity of capital in production in physical terms was kept in the loanable funds theory of the interest rate when it refers the forces of “productivity and thrift”. Keynes, in his 1930 Treatise on Money, uses the concept of the natural rate but abandons it in the “General Theory” as he introduces the concept of equilibrium at different levels of employment rejecting the idea of real self-equilibrating forces and underlining the importance of monetary factors (the liquidity preference theory) in determining the interest rates even in the long term. As a result, some Keynesians and especially all post-Keynesians reject the notion of the natural real equilibrium interest rate.[2] The link with the real productivity of capital also contributed to that rejection after the famous controversy between the two Cambridge Universities (U.K. and U.S.) in the 1960s and 70s about the possibility of aggregating different capital goods in a capital variable with prices that need an interest rate to be calculated, when, at the same time, the interest rate was supposed to depend on the real productivity of capital.[3]

The idea of the real equilibrium or natural rate disappeared from monetary theory and policy during the time of the controversy between monetarists and Keynesians as also Milton Friedman did not believe in the concept. In his 1968 paper Friedman wrote: “What if the monetary authority chose the "natural" rate – either of interest or unemployment – as its target? One problem is that it cannot know what the "natural" rate is. Unfortunately, we have as yet devised no method to estimate accurately and readily the natural rate of either interest or unemployment. And the "natural" rate will itself change from time to time. But the basic problem is that even if the monetary authority knew the "natural" rate, and attempted to peg the market rate at that level, it would not be led to a determinate policy. The "market" rate will vary from the natural rate for all sorts of reasons other than monetary policy.”[4] As the empirical instability of money demand functions contributed to the demise of Friedman’s monetarism based on monetary aggregates, the concept of the real equilibrium rate in a Wicksellian sense re-emerged by the hand of Michael Woodford and Lars Svensson, when both created the theory of inflation targeting monetary regimes. Woodford even titled his 2003 book as “Interest and Prices” to underline the relation to Wicksell.[5] Monetary aggregates were substituted by interest rates as the monetary instrument of choice, with monetary policy subject to a quantitative inflation target. As the real equilibrium rate is unobservable, as in the case of Wicksell, evidence that the policy and market rates were deviating from the natural rate would be given by the change in inflation. The policy response was then to increase or decrease policy rates accordingly, to address the problem. This Wicksellian approach, at the centre of the inflation targeting theory, can also be found in optimal rules extracted from new-Keynesian macro models as well as in the Taylor-type monetary policy rule in which the intercept is set at the real equilibrium interest rate level.

The importance of this background is that monetary policy needs to shadow the equilibrium rate in order to meet its stability mandate. If the real equilibrium rate is decreasing then failure to accompany it would leave the economy with too high borrowing costs with respect to the return on investment. This would discourage investment and consumption and generate recessionary and deflationary pressures.

Monetary policy is therefore part of the solution and not part of the problem. By ensuring low interest rates, monetary policy is supporting and accelerating the recovery and with this, the return to a normalisation of inflation and subsequent normalisation of interest rates. This starts to be visible in the U.S. where interest rates have started to increase.

To demonstrate that monetary policy did not create per se the environment of low interest rates but is rather responding to a declining real rate of equilibrium, we need to have some empirical idea about a concept that is unobservable. There exist, however, many different methods to try to estimate this unobservable rate. One approach can be based on the existing medium- to long-term market interest rates, assuming that the markets are influenced by the concept of a long-term equilibrium real rate. Methodologies can then try to extract that wisdom of markets by using filters or models to decompose the actual interest rates. Other methods are more theoretical and model-based, building on the possible determinants of a real equilibrium interest rate. I will present some estimates using both types of approaches.

Determinants behind the decline of market interest rates

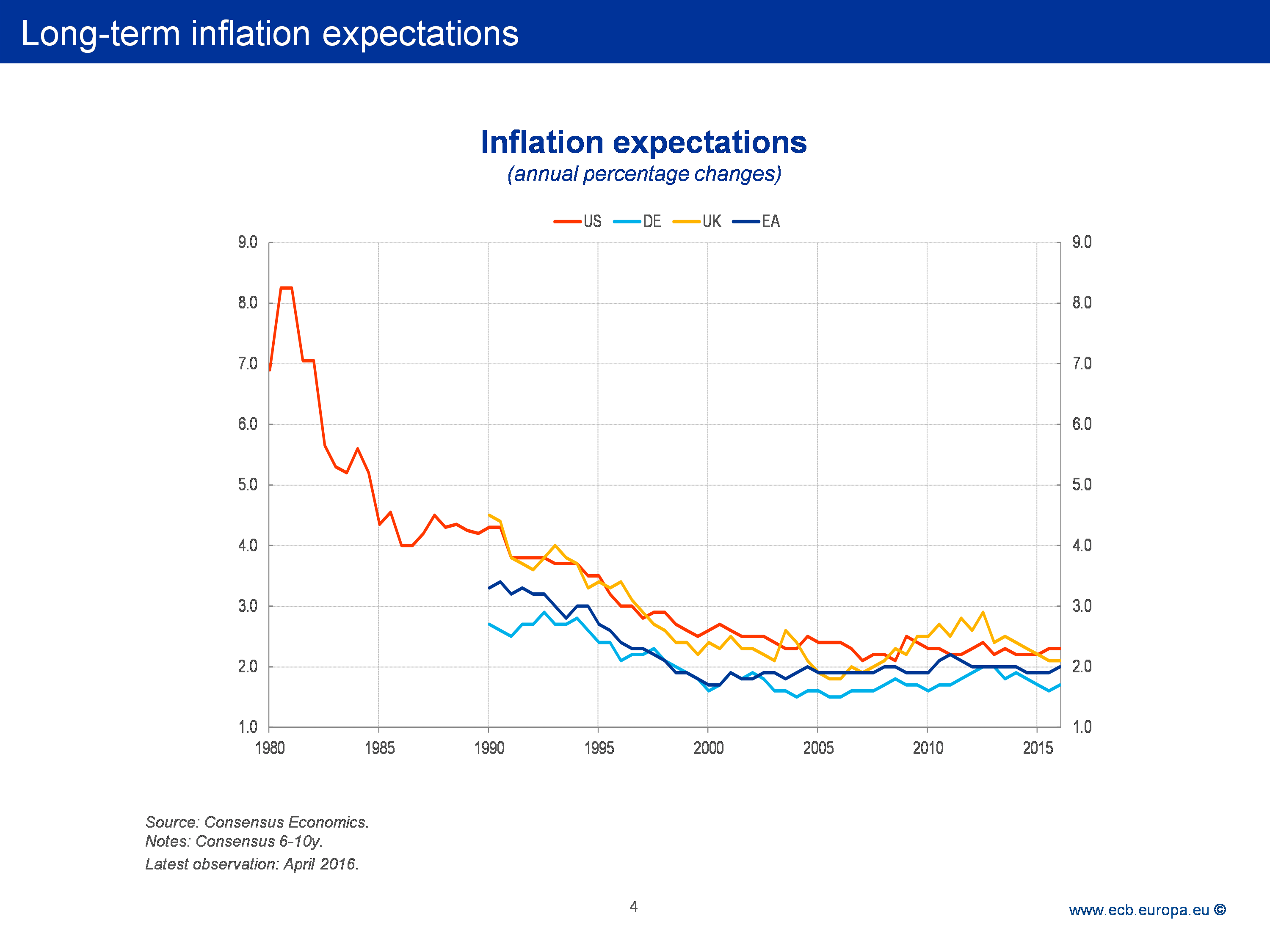

A useful starting point to understand the decline in nominal risk-free long-term interest rates over the last thirty years is to decompose their evolution into four components: expected inflation over the lifespan of the asset, inflation and real term premia, which are the compensation investors require for holding onto a long-term asset and finally, the expected path of the short-term real interest rate.[6] Although data limitations make it hard to derive empirical estimates of each element of this decomposition going far back in the past, available estimates suggest that all components have contributed to the decline in nominal interest rates.[7]

Taking a historical perspective, the first component, long-term inflation expectations have declined steadily since the beginning of the 1980s to stabilise at levels around 2% in the late 1990s (see chart above on Long-term inflation expectations). The trend decline and subsequent stabilisation are a manifestation of the success of central banks’ monetary policy in regaining control of inflation and in establishing strong credibility. In the last two years, these benign developments have been overshadowed by the small decline in long-term inflation expectations, with the decline in short- and medium-term inflation expectations reflecting oil price developments and the degree of slack in the economy. From a central bank’s perspective, this was very concerning and motivated the ECB’s substantial and comprehensive policy response. I will return later to the issue to elaborate on the ECB’s policy measures.

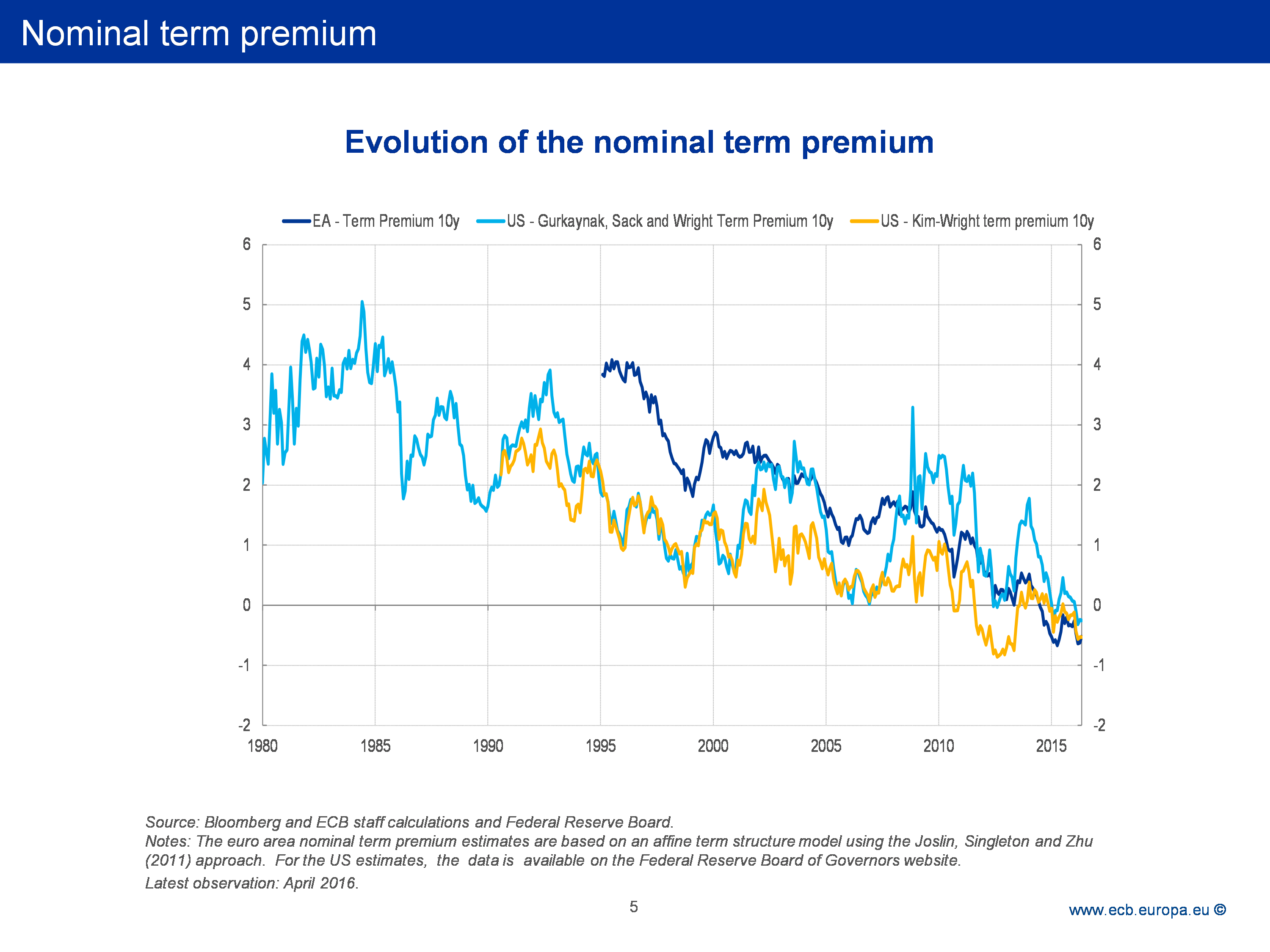

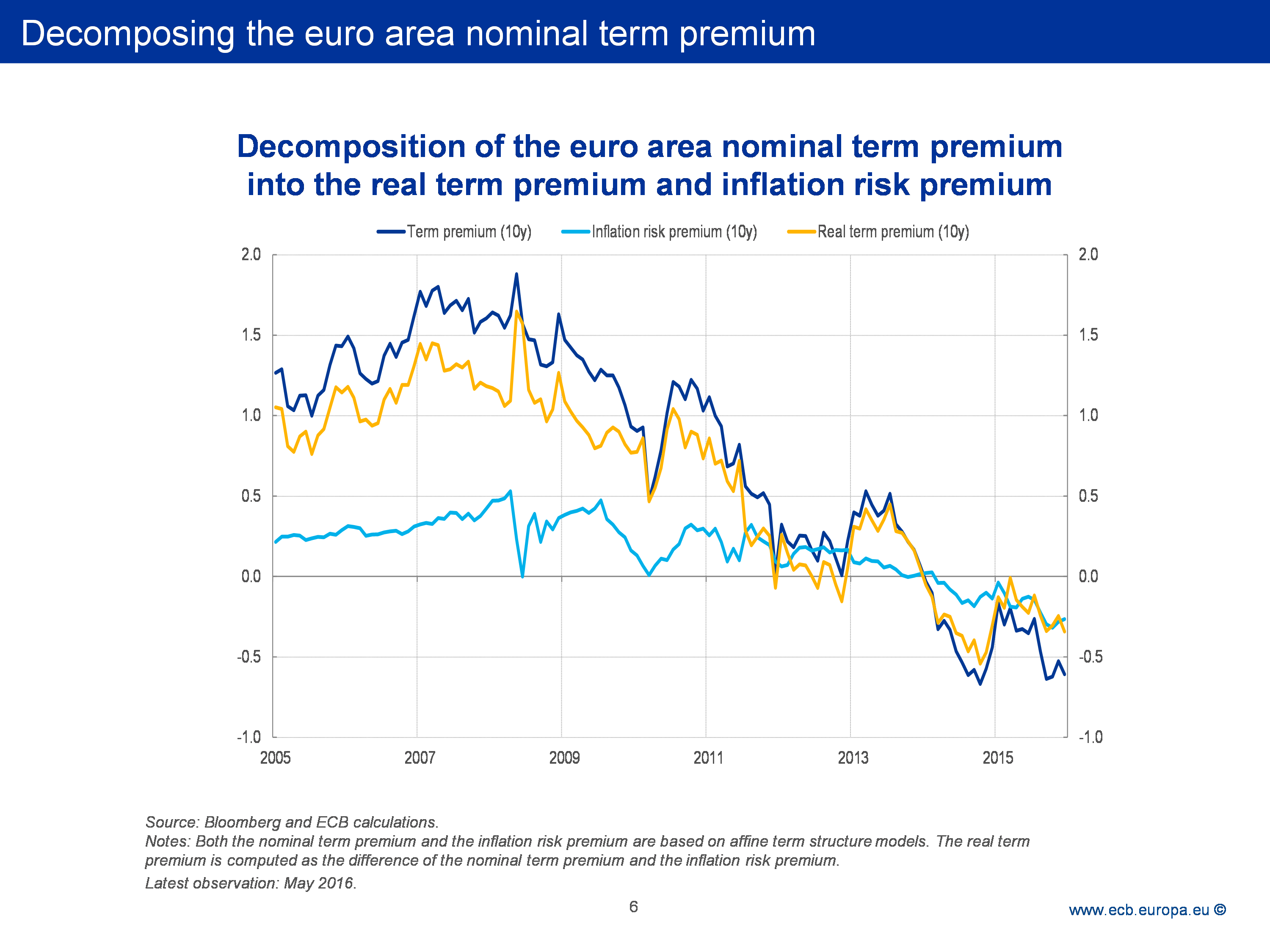

The second element of the decomposition is the nominal term premium that corresponds to the additional return that investors demand to hold a long-term bond as opposed to rolling over a short-term bond. It can be decomposed in the inflation premium and the real term premium. But it is imperative to first look at the nominal term premium as a whole, as it is available over a longer sample. Some caution is needed when interpreting the results, as premia cannot be directly observed, and deriving estimates requires a model-based analysis.

The term premium is found to display a trend decline over the last decades (see chart below on the Nominal term premium). This feature is robust across measures derived from alternative models, whereas there are noticeable differences about the precise level of the premium in specific episodes.

Breaking down the nominal term premium into its components, the real term premium and the inflation risk premium, is subject to data limitations as estimates are based on inflation-linked bonds or swaps which have only recently become more widespread. As a result, this prevents a detailed assessment of the relative importance of the drivers behind the decline in the nominal term premium from a long-term perspective. But it has to be expected that the inflation premium has significantly declined in the 1980s and 1990s alongside the decline in inflation expectations, with investors accepting lower compensation for bearing inflation risk.[8] Focusing on more recent years, available estimates suggest that the inflation premium has remained rather stable at low levels in the 2000s, and has declined in the last couple of years probably reflecting investors’ reduced concern about inflation. This may be worrisome and we monitor these developments closely.

However, the main driving force behind the large decline in the nominal term premium observed in 2003-2004, as well as during the global financial crisis, has been the real term premium, as shown by Abrahams and co-authors (2015) for the U.S. and ECB staff estimates for the euro area – available since 2005 when inflation swaps have been introduced in the euro area (see chart below on the Decomposition of the euro area nominal term premium). [9]

One important factor exerting downward pressure on the real term premium has been the imbalance between the reduction in the supply of and the increased demand for safe assets at the global level, which has been exacerbated by the global financial crisis. Investors’ preference for the moneyness of safe assets – that is a preferred habitat demand for safe assets – has in effect bid up the price of those assets and correspondingly compressed the yield. Prior to the crisis, this was explained by the large appetite among certain emerging economies to hold their rising savings, the so called “savings glut” (Bernanke, 2005) – reflecting factors such as demographics and the desire to build international reserves for precautionary reasons after the Asian crisis of the late 1990s – in U.S. safe assets. This desire for safe assets led also to inflows into U.S. securitised assets – as well as increasing the incentives for the financial sector to boost supply – which were perceived to be safe in the years preceding the global financial crisis. However, by the start of the crisis these asset-backed securities quickly lost their safe status. The subsequent emergence of the euro area sovereign debt crisis also led to government bonds in certain jurisdictions being no longer characterised as safe. According to Caballero and Farhi (2014), the global supply of safe assets has fallen from about $20trn in 2007 to just over $12trn USD in 2011. Additional factors that have boosted the demand for safe assets are the new liquidity regulation for banks and the increased need of safe and liquid assets to be posted in collateralised transactions. Central banks have, of course, contributed to the compression of premia via their quantitative easing programmes, and I will come back to this.

The final component affecting the long-term nominal interest rate is the expected path of the short-term real rate over the life of the asset. Although the real rate has declined at all horizons, it is helpful to partition this path in terms of the front and intermediate segment, and the long-term in order to better understand the drivers of these developments.

First, over the short and medium run, the balance between savings and investment, and therefore the real interest rate, is also affected by many factors of more cyclical nature. Since the global financial crisis in 2008, these factors have predominantly exerted downward pressure on the real interest rate. In the case of the euro area, it has still not emerged from its “balance sheet recession”, where a severe debt overhang and tightening of credit standards have required a substantial amount of deleveraging of both private and public sector balance sheets, thus reducing investment and prolonging the downturn. Furthermore, it takes time to reabsorb the over accumulation of capital and capacity that occurred prior to the crisis. Overall, that growth remains weak in the years after a banking crisis is certainly not atypical and has been well documented (Reinhart and Rogoff, 2009).

Second, in the long-term, market expectations about future monetary policy rates are being very much influenced by the difficulty in normalising inflation and by the pessimistic views about the long run growth prospects of the advanced economies which I will address later.[10]

Another way to operationalise the longer-term notion of the real interest rate is to take real forward rates and remove the real forward premium. An advantage of using market-based measures to derive an estimate of the equilibrium real rate is that they are forward-looking and available on a daily basis (Bomfim, 2001). That being said, this measure is also subject to significant shortcomings. First, removing premia rests on a model and results are usually very sensitive to model specifications. Second, whereas the focus is on the expected real rate in the distant future, this is the part of the model exercise that may be particularly uncertain. [11]Third, market expectations cannot measure the equilibrium real rate per se, but only the market perception of it, which can be exposed to bouts of excessive optimism or pessimism.

Estimates of the real equilibrium interest rate

Beyond what can be observed in the markets, it is thus important for monetary policy to estimate a long-term real equilibrium rate. This real rate should reflect an economy at full employment, with stable inflation close to the monetary authority’s target. As I mentioned before, that rate should be the one used as the intercept in a traditional Taylor rule.

One way of thinking about the equilibrium rate that has inspired some of the methods used, is to connect it with the growth rate of potential output. Current estimates are clearly affected by the fact that potential growth has been decelerating markedly in the advanced economies.

The determinants of the real interest rate in the long run are parsimoniously summarised by the Solow growth model. Within this framework, the long-term real interest rate boils down to productivity and population growth as well as savings behaviour. The intuition is that these forces determine investment and therefore the demand for loanable funds, which have to be matched by savings. Studies show that total factor productivity and population growth have been slowing in the euro area as well as in other advanced economies for decades (Gordon, 2016, Goodhart, Pardeshi and Pradhan, 2015).

Growth models with a richer demographic structure, while supporting this basic insight, allow for more elaborated predictions. In particular, according to overlapping generations (OLG) models which allow for life-cycle effects of consumption and savings decisions, variations in the real rate in the long run can be linked to additional fundamental forces, like an increase in the longevity of agents. Moreover, in comparison with the Solow model, a number of additional general equilibrium effects matter, in such settings. For example, income inequality and the distribution of private sector debt can matter because of deviations from the assumption of a single representative agent. Likewise, the design of pension systems and, more broadly, fiscal developments can matter in view of non-Ricardian model features.[12] Virtually all of these factors shaping the real rate in the long run have been steadily exerting a drag on the real rate.

This type of OLG models open a possible response to the risks of secular stagnation of growth that has been mentioned by Ben Bernanke, Narayana Kocherlakota and many others: in such low interest rate environment, if the private sector does not increase investment, the public sector could do it by increasing expenditures in infrastructure. In a non-Ricardian model more public debt issuance would also contribute to increase interest rates.[13]

There are also additional factors of a secular nature which have altered the balance between savings and investment and as a result, weighed on the real interest rate. This relates, for example, to the shift towards human capital-intensive industries, such as software and finance, and away from physical capital-intensive industries, such as manufacturing (Bean, Broda, Ito and Kroszner, 2015). In addition, the fall in the relative price of capital goods is another factor limiting investment and deteriorating the balance with savings, and thereby the real interest rate. And since capital markets operate on a global scale, downward pressure on returns propagates globally.

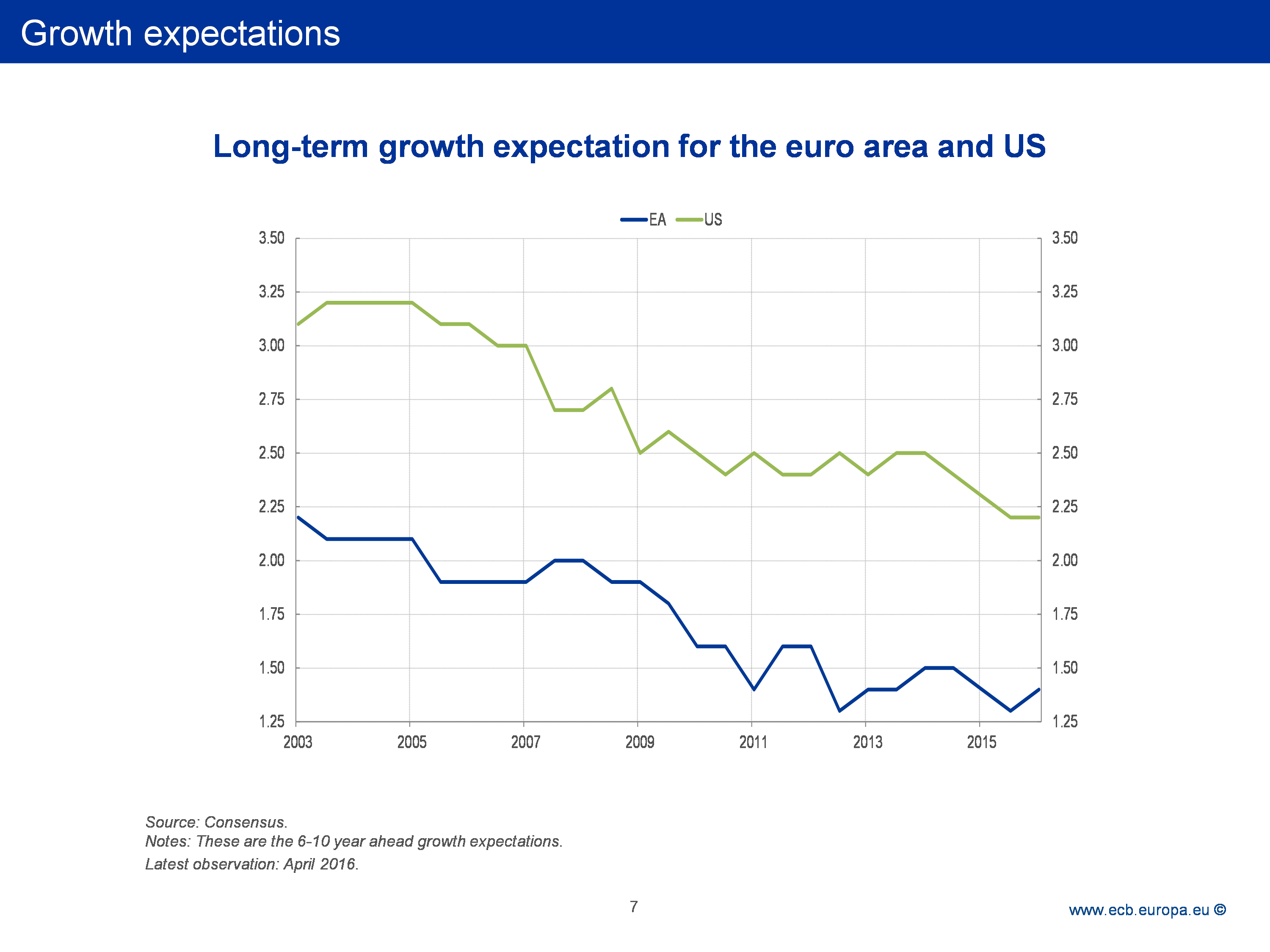

The decline in the real interest rate in the long run is also consistent with the repeated downward revisions in the long run growth potential of the economy that we have witnessed. Indeed, potential growth shares some of the drivers of the real interest rate in the long run, such as productivity and population growth. For instance, in the early part of 2003, the Consensus estimate for U.S. long run real potential output growth was 3.1%, with recent estimates revised down to 2.2%. In the euro area, survey expectations for long-term economic growth have moved down from 2.2% in April 2003 to 1.4% in the latest estimates (see chart below on Growth expectations).

This decline in economic growth in advanced economies has led some scholars to bring back the concept of secular stagnation which was first introduced by Alvin Hansen in 1938 to portray the decline in U.S. economic growth he envisaged on account of the decline in innovation, population growth and investment opportunities. More recently, Robert Gordon (2016) and Larry Summers (2016) have reignited the debate on secular stagnation, with the former emphasising the role of supply-side factors and the latter on the chronic weakness of demand. Both frameworks are not mutually exclusive as both supply and demand factors can interact and reinforce each other. For example, weak demand leads to unemployment and if this becomes prolonged, workers’ human capital can diminish, which in turn reduces the potential output of the economy (Blanchard and Summers, 1986 and Blanchard, Cerrutti and Summers, 2015).

The connection between the long-term real equilibrium rate and the potential growth rate of the economy is therefore widely used in methodologies to estimate the real equilibrium rate, such as the one developed by Williams and Laubach (2003). This connection is even accentuated in a normative sense as in a simple OLG growth model with growing productivity, the so-called golden rule that ensures the dynamic efficiency of the economy, (i.e. that the economy does not over-invest or under-invest and maximizes consumption equally across generations), implies that the real rate of interest has to be equal to the economy’s growth rate.

Let me now turn to the description of some available model-based methods to estimate the real equilibrium rate.

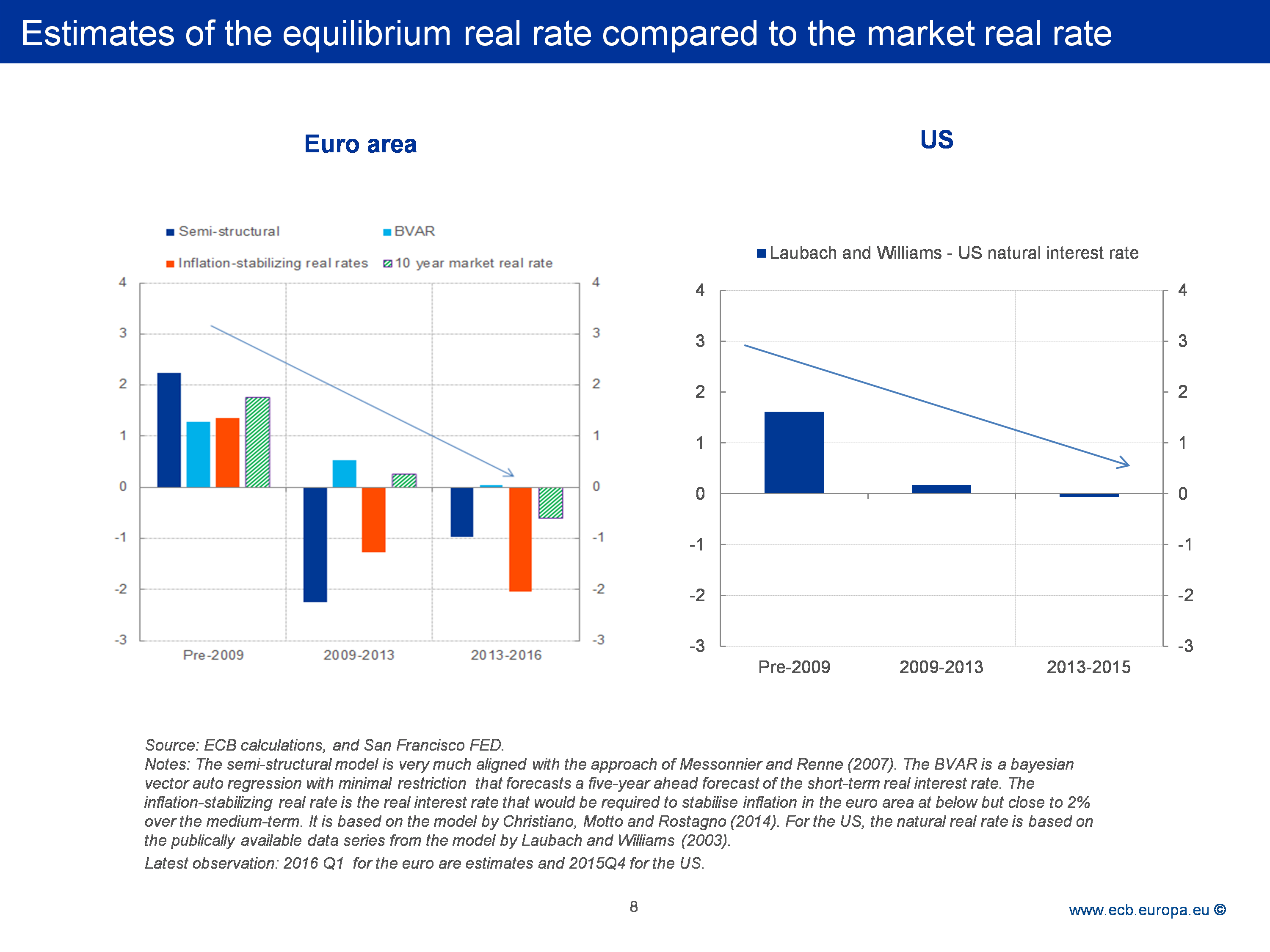

One approach to conduct the estimate, placing emphasis on the medium- to long-term, is to use a time series approach based on a Bayesian vector auto regression (BVAR) with minimal restrictions. For instance, a 5-year ahead forecast of the short-term real interest rate could provide a proxy for the equilibrium real rate. This is based on the assumption that at such a horizon, the effect of most shocks should have dissipated and as a result the forecast mainly reflects persistent developments in the real interest rate.[14]

A more elaborated approach is to use a semi-structural model, emphasising a medium-run concept of the equilibrium rate. In this approach, initiated by Williams and Laubach (2003) that I just mentioned, the equilibrium rate depends on the trend growth of the potential output and on a time-varying unobserved component that represents all the other drivers of the equilibrium rate. This latent component and the trend growth rate are unobserved in a model with an IS and an inverted Philips curve. In this approach, a statistical technique known as Kalman filtering is used to estimate several unobserved variables including a time-varying equilibrium real rate. This algorithm partially adjusts the estimates of the unobserved components based on the distance between the model’s forecasts of inflation and real GDP and the actual values of these variables until these statistically converge.[15]

Still, an alternative approach to operationalise the equilibrium real rate – taking directly into account the mandate of central banks to stabilise inflation over a not-too-distant horizon – is to compute the real interest rate that, if maintained for some time, would stabilise inflation. For the euro area, this corresponds to a level below but close to 2% over the medium-term and, for this approach, the model by Christiano, Motto, Rostagno (2014) can be used.[16]

When applying these approaches to the euro area, it emerges that, in comparison to the years prior to the crisis, estimates of the equilibrium real rate have sharply declined during the crisis and have kept declining or remain in deep negative territory over the recent periods (see chart above on Estimates of the equilibrium real rate). The estimates also show the degree of model uncertainty surrounding the measurement of the equilibrium real rate, which of course compound to the parameter uncertainty.[17] For comparison, the observed market real rate discussed in the previous section is depicted in the green bar. It is apparent that the sharp decline of the equilibrium real rate and the recent negative value is not unique to the euro area, but it is also found by in the U.S.

These measures of the equilibrium real rate contrast with the shorter-term notion of the equilibrium real rate typically adopted in the DSGE literature, namely, the short-term real interest rate which at each point in time would stabilise the economy to its equilibrium level in the absence of nominal rigidities. Evidently, this approach has the advantage that it is directly linked to the nature of frictions in the economy. However, this measure turns out to be highly model-dependent and volatile, limiting its practical relevance for monetary policy setting (Barsky, Justiniano and Melosi (2014).

Overall, available measures indicate that the euro area’s equilibrium real rate appears to have turned negative and is significantly lower than it was in the past, irrespective of the specific notion and approach used to measure it, even if its precise level is uncertain.

The use that the central bank should make of the equilibrium real interest rate is straightforward if one follows the textbook prescription: the central bank takes the equilibrium interest rate as being driven by structural factors which are largely beyond its control, and steers the policy rate relative to the level of the equilibrium rate. By doing this, the central bank alters the relative attractiveness of saving versus spending, which facilitates aggregate demand to match aggregate supply so that the output gap is closed and price stability is ensured.

In practice, however, there are many challenges, and not only limited to the conceptual and measurement issues I have just described. One challenge is that, in reality, there is not just one interest rate affecting saving and investment in the economy, but there is an array of market and bank lending rates which apply to different contracts and are linked by spreads that vary over time. This makes the use of the concept of the equilibrium rate less straightforward. Another challenge is the presence of the zero lower bound on nominal interest rates. In the event of being confronted by large adverse shocks, the zero lower bound can prevent the central bank from bringing the policy rate to the sufficiently low level that it is called for by the declining equilibrium interest rate.

But recent experience has shown that we can look at these challenges in a less negative manner. First, the presence of an array of interest rates can actually provide a way for the central bank to inject additional accommodation by lowering such rates even when the policy rate is at the zero lower bound; and, second, the lower bound may not be actually at zero but in negative territory.

Negative interest rates and central bank’s asset purchases

In effect, this has been the ECB’s response to being confronted with a weak economy, malfunctioning banks’ credit intermediation and severe and persistent disinflationary forces.

Since mid-2014, our monetary measures can be categorised into three elements: first, we have reduced the policy rates and brought the deposit facility rate into negative territory – currently it stands at minus 40 basis points; second, we have fostered an overall easing of euro area financial conditions via central bank’s asset purchases – we have progressively expanded the scope and size of our purchases as well as the horizon, which is intended to run until the end of March 2017, or beyond, if necessary, and in any case until there is a sustained adjustment in the path of inflation; third, we have re-habilitated the bank lending channel via providing targeted long-term lending to banks at favourable conditions to support lending to the real economy. And these policy measures have been flanked by our reinforced forward guidance which we have provided pertaining to our future policy actions so as to clarify our policy reaction function and reduce uncertainty and volatility and thereby, strengthen the control over the yield curve.

Moreover, these measures are designed to work in combination, positively interacting with each other through different channels so that the overall easing effect on financing conditions is greater than the sum of the individual effects. In doing so, the cost of capital is reduced and this provides the incentive for firms to undertake investment in the euro area, which is a crucial element for absorbing the considerable amount of economic slack which exists, reducing the high level of unemployment and boosting potential output.

Let me briefly provide some salient features of each of these policy measures.

The adoption of negative policy rates has allowed money market interest rates and the longer end of the yield curve to decline further. While this shares some of the mechanisms of a standard reduction of policy rates when they remain in positive territory, the adoption of negative rates provides additional accommodation by effectively relaxing the non-negative constraint on expectations of future short-term interest rates, thus helping to reduce long-term yields. In the absence of negative rates, when central banks bring short-term interest rates to zero, forward-looking investors start to think that the long-term interest they can earn by investing in a long-term security is too low to compensate for a potential backup in yields. Therefore, they start fearing a reversal of the low interest rate policy and prefer to invest and lend for a very short term. In sum, a zero lower bound suggests to investors that short-term rates can only rise and cannot fall further. This scenario was described by John Hicks in his 1937 Econometrica paper: “In an extreme case, the shortest short-term rate may perhaps be nearly zero. But if so, the long-term rate must lie above it, for the long rate has to allow for the risk that the short rate may rise during the currency of the loan, and it should be observed that the short rate can only rise, it cannot fall.”[18] To this end, we have reiterated in our last Governing Council communication on 2 June that policy rates would remain at current levels or lower for an extended period of time.

With our asset purchase programme (APP) – launched in January 2015 and successively recalibrated in December 2015 and March 2016 – we have been able to provide substantial additional accommodation over and above the easing via policy rates. And the fact that the scope of our purchase programmes has been calibrated to include a variety of investment-grade financial assets has meant that our purchases have allowed the compression of several premia across a wide range of markets in which we intervene. Via portfolio rebalancing effects, these effects propagate across the whole array of rates, delivering broad-based accommodation.

Asset purchases interact with the negative deposit facility rate (DFR), which acts through what amounts to an effective tax on liquidity held by banks. Indeed, the portfolio rebalancing effect is empowered by the negative DFR, as banks with high amounts of excess liquidity holdings have a strong incentive to reduce these holdings and put their reserves to work.

Another effect of negative rates is to increase the velocity of circulation of excess reserves in the interbank market towards the banks that need liquidity to sustain or expand their credit portfolio. The banks with excess liquidity have an incentive to pass it on to other institutions to reduce the cost of paying for the excess reserves. This is directly related with another effect which results from the banks having also the incentive to expand their portfolio of credit or to buy securities with longer maturities, thus increasing revenues and reducing their amount of excess reserves. This turns out to be an additional element of portfolio rebalancing that that is pursued by our policy. We have had some success on both scores and the stimulus to demand has benefited the European and global economies.

Many market commentators link negative DFR with exchange rate policy. However, recent experience clearly demonstrates that it does not work in a simple or reliable way. The recent ECB and Bank of Japan’s decision to implement negative DFRs, resulted in the euro and the yen appreciation against the U.S. dollar. There is no inexorable link between the levels of deposit facility rates and exchange rates, as even the possibility of some form of carry trades depends on the general situation of risk aversion. Therefore, negative policy rates are not a reliable policy to make the exchange rate more favourable to domestic exporters. In addition, negative DFRs should not be seen as a zero sum game as the boost to growth which they provide benefits all jurisdictions via trade spill-overs.

ECB staff finds supportive empirical evidence for the empowering complementarities of our measures. For instance, banks in less-vulnerable euro area countries have been granting more loans to the real economy than would have been the case without a negative DFR. In addition, banks with large holdings of excess liquidity, in particular in less-vulnerable member States, were found to have rebalanced significantly more towards non-domestic euro area government bonds than they would have done in the absence of a negative DFR. Overall, the portfolio rebalancing effects, triggered by large-scale asset purchases have been strengthened in the euro area by the negative DFR.

Furthermore, in March 2016 we decided that banks could borrow from the ECB in the context of the new targeted long-term refinancing operations (TLTROs II) ex-post at rates as low as the negative DFR which strengthens the transmission of our conventional policy to the real economy. Moreover, this builds on the successful targeted long-term refinancing operations (TLTROs) which were introduced in September 2014 and have greatly helped in bolstering the bank lending channel.

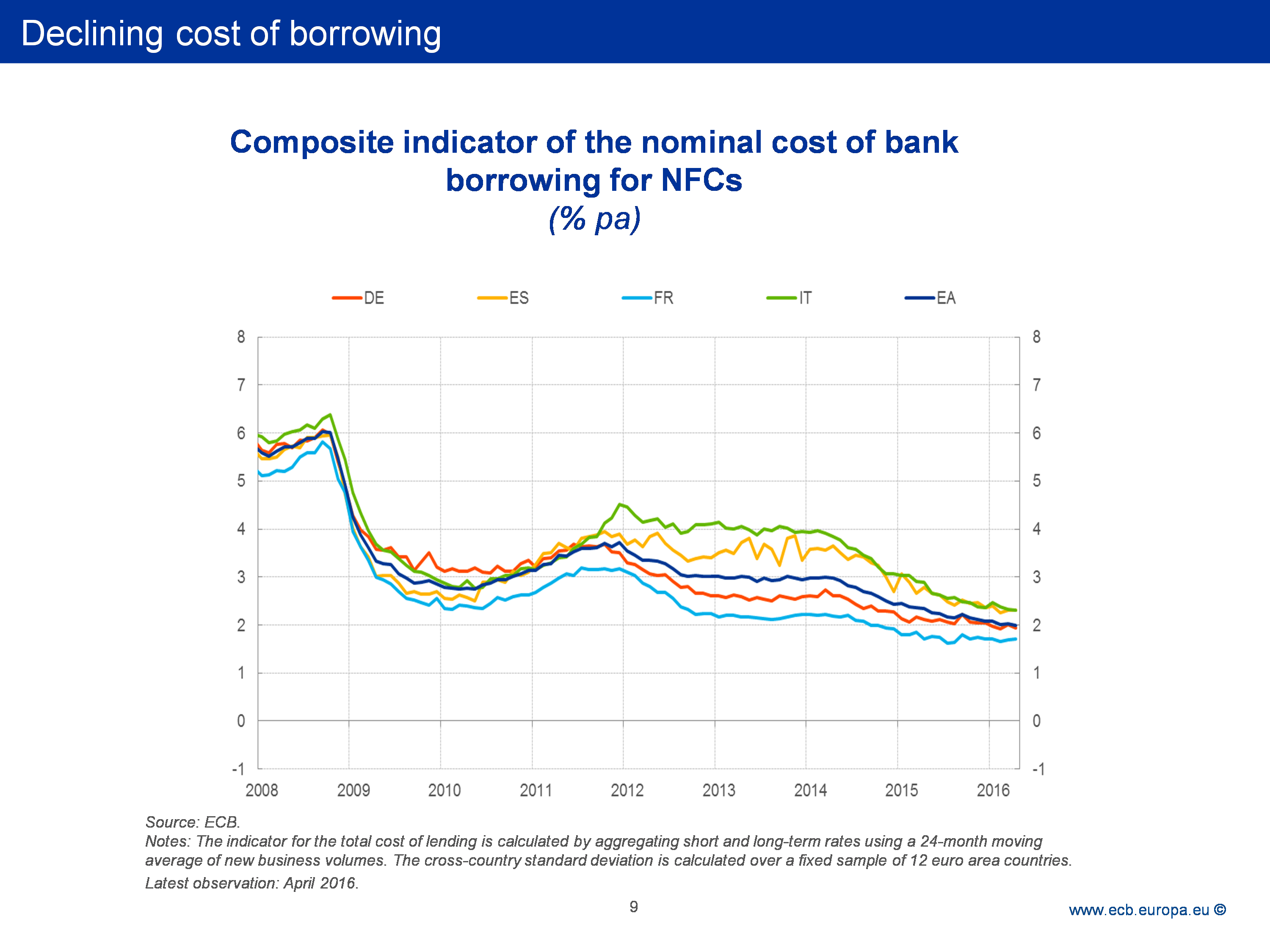

The expectations which we held when we first designed the measures introduced in summer 2014 are being validated by the incoming data. Borrowing costs for NFCs and households have significantly declined and cross-country heterogeneity continues to recede (see chart below on Cost of borrowing). Loan growth to the euro area non-financial private sector has been recovering and according to the latest Bank Lending Survey (BLS), there has been a continued net easing of banks’ overall terms and conditions for loans to enterprises and increases in loan demand across all categories.

Notwithstanding the impact in improving financial conditions faced by the real economy, the instrument of negative DFR has clear limits and we need to monitor the possible occurrence of undesirable side-effects. The first limitation is the risk that, after a certain point, the policy could trigger an increase of preference for cash which would be disturbing. Nevertheless, at present levels, the risk is not in the horizon as negative rates are not being passed on by the banks to depositors.

Negative interest rates can also be a source of concern for their impact on banks’ profitability. In examining this issue, it is important that our measures are viewed in their entirety. Therefore, the impact of the overall effects of our purchase programmes and our credit easing measures on bank profitability go far beyond the negative DFR. Our policy stance leads to capital gains on the securities held by banks and to lower funding costs. Furthermore, the positive macroeconomic effects support the demand for credit. This in turn increases intermediation volumes, contributes to increase credit quality and decreased banks’ costs associated with loan losses. As a result, these effects can offset the negative impact on banks’ net interest margin brought about by lower interest rates on banks’ assets. In 2015, the first full year of negative DFRs, net interest income increased and we estimated that, on average, the cumulative effect of our policies until 2017 will continue to be overall positive for banks’ profitability. Nevertheless, there are limits to the use of negative rates, if maintained over a protracted period of time. For example, at some stage, banks may be passing on the cost of the negative rates by increasing lending rates to boost their margins which would be detrimental to our final objectives.

Another potential cost of the policy instrument, concerns financial stability if signs of overvaluation emerge in asset markets as a result of the low credit rates and the search for yield. Financial stability considerations are taken very seriously at the ECB and a considerable amount of resources are devoted to closely monitor this issue. At present, no broad signs of instability or excesses in asset price developments have been detected in euro area countries. Moreover, together with national authorities, we are prepared to intervene with supervisory and regulatory tools should this be needed. Nonetheless, the proposition that the ECB should pre-emptively resolve financial stability issues with monetary policy tools at the expense of delivering on the mandate of price stability is both wrong and very hazardous.

More generally, two prominent arguments against the low policy rate environment have been raised from several quarters. The first is that it is hurting savers and in particular retirees who rely heavily on their savings as well as citizens building up their savings for retirement. The second is that it is self-defeating because it distorts incentives to clean-up the private and public sectors’ balance sheets as well as inhibiting the exit of unproductive firms and thereby, the creative destruction process which drives economic growth. In doing so – it is argued – the expansionary policies perpetuate financial instability from one cycle to the next.

While I understand why the first argument is made, it fails to recognise that today’s low interest rates are greatly assisting the economy to recover and inflation to move to levels below, but close to 2% and with this, a return to a normalisation of interest rates in the future. Furthermore, the flow-of-funds statistics show that the earnings of households with interest revenues are higher than their total interest payments.

The second argument, which can be characterised as the “liquidationist view” deserves assessment as well. It should be noted however, that in recent years, monetary policy has actually been very effective in improving overall financial conditions, which has been an instrumental factor in the balance sheet repair of households and firms and consequently, the improving health of the financial sector. Furthermore, debt reduction is facilitated by a growing economy, with the latter benefiting directly from our policy response. The alternative policy that the “liquidationist view” seems to suggest is that we should ignore the recessionary forces that are driving down inflation and allow for more recession, destruction of capital and higher unemployment.

Naturally, what ultimately matters in determining the need to maintain policy accommodation is our price stability objective. According to the latest Eurosystem projections, euro area real GDP growth is expected to grow by 1.6%, 1.7% and 1.7% in 2016-18, respectively, and annual HICP inflation is projected to be 0.2%, 1.3% and 1.6% in 2016-18. Personally, I believe that without upheavals in the world economy we can reach a slightly higher level of inflation in 2018. The full implementation of our policy package adopted last March is still going to produce effects in the forthcoming months and will contribute to achieve our mandate of delivering inflation below but close to 2%, over the medium-term.

Conclusion

Let me conclude. What I have outlined today is that the low interest rates, which currently prevail, are a reflection of adverse long-term forces which have combined with the adverse implications of the global financial crisis and the sovereign debt crisis. The consequence of this has been a decline in the equilibrium real interest rate. I have also tried to portray the uncertainty around the concept and measurement of the equilibrium interest rate. Indeed, the decline in market interest rates at the global level in a context of low inflation and low – or at most moderate – economic growth with no signs of overheating, suggests that the equilibrium real rate has significantly declined and turned negative.

Our monetary policy has provided significant accommodation to limit the negative effects of the global and euro-area-specific shocks on the economy and forestall their deflationary impact. To put it simply, we have shadowed a declining equilibrium interest rate; and we will continue to do so with the full implementation of our measures. Absent of this, would have the dire consequences that the saving-invest imbalance would find the solution via a fall in nominal income levels as a means to compress savings.

By mitigating a prolongation of the recession, monetary policy can help prevent hysteresis from gaining a foothold in the labour market, which in itself weighs on an economy’s economic potential. And by boosting the productive capacity of the economy by supporting investment and capital formation, a link is established between the supply-side and the long-term.

Other policy actors, however, need to actively pursue structural policies which will ensure both a sustainable recovery and an increase in the potential economic growth of the euro area. These, in turn, will make investment more attractive, raise the equilibrium interest rate and expedite the normalisation of interest rates. Only then can we envisage a stronger recovery and can the European policy-makers deliver on their hopes of an improved prosperity for the citizens of Europe.

Thank you for your attention.

I would like to thank ECB staff, J. Hutchinson and R. Motto, for important contributions to this speech – including estimates of the equilibrium real rate for the Euro Area to which also contributed other colleagues using different methodologies (M. Lenza, M. Jarocinski, W. Lemke and L. von Thadden).

This is the full text of a speech delivered in abridged form at the Macroeconomics Symposium at Utrecht School of Economics on 15 June 2016.

References:

Abrahams, M., T. Adrian, R. K. Cump and E. Moench (2015), “Decomposing Real and Nominal Yield Curves”, Federal Reserve Bank of New York Staff Reports, No. 570.

Barsky, R., A. Justiniano and L. Melosi (2014), “The Natural Rate of Interest and Its Usefulness for Monetary Policy,” American Economic Review: Papers & Proceedings, 104(5): 37–43.

Bean, C., C. Broda, T. Ito and R. Kroszner (2015), “Low for long? Causes and consequences of persistently low interest rates”, Geneva Reports on the World Economy 17, Geneva, ICMB and London, CEPR Press.

Bernanke, B. (2005), “The Global Saving Glut and the U.S. Current Account Deficit”, Sandridge Lecture, Virginia Association of Economics, Richmond, Virginia, Federal Reserve Board, March.

Blanchard, O. and L. Summers (1986), “Hysteresis and the European Unemployment Problem”, NBER Macroeconomics Annual, Vol. 1.

Blanchard, O., E. Cerutti and L. Summers (2015), “Inflation and Activity: Two Explorations, and Their Monetary Policy Implications”, presented at the 2015 ECB Forum on Central Banking.

Bomfim, A. (2001), “Measuring Equilibrium Real Interest Rates: What can we learn from yields on indexed bonds?”, Finance and Economics Discussion Series, 2001-53, Board of Governors of the Federal Reserve System.

Caballero, R. J. and E. Farhi (2014), “The Safety Trap,” NBER Working Paper No. 19927.

Christiano, L. J., R. Motto, and M. Rostagno (2014), “Risk shocks”, American Economic Review, 104(1):27-65.

Eggertsson, G. and N. Mehrotra (2015), “A model of secular stagnation”, NBER Working Paper No. 20574.

Friedman, M. (1968) "The role of monetary policy ", American Eonomic Review, volume 58, number 1.

Goodhart C., P. Pardeshi and M. Pradhan (2015), “Workers vs pensioners: the battle of our time”, Prospect Magazine, December.

Gordon, R.J. (2016), “The Rise and Fall of American Growth: The U.S. Standard of Living since the Civil War”, Princeton U.P.

Gürkaynak, S., P.B. Sack and J. H. Wright (2006), "The U.S. Treasury yield curve: 1961 to the present," Finance and Economics Discussion Series 2006-28, Board of Governors of the Federal Reserve System.

Harcourt, G, (1972) “Some Cambridge controversies in the theory of capital”, Cambridge U. P

Joslin, J., Scott, K. Singleton and H. Zhu (2011), “A New Perspective on Gaussian Dynamic Term Structure Models”, The Review of Financial Studies, Vol 24 No.3.

Kara, E. and L. von Thadden (2016), "Interest Rate Effects of Demographic Changes in a New Keynesian Life-Cycle Framework," Macroeconomic Dynamics, Cambridge University Press, Vol. 20(01), pp. 120-164, January.

Kim, D, and J. Wright (2005), “An Arbitrage-Free Three-Factor Term Structure Model and the Recent Behavior of Long-Term Yields and Distant-Horizon Forward Rates”, Finance and Economics Discussion Series 2005-33, Board of Governors of the Federal Reserve System.

Kocherlakota, N. (2015) “Public Debt and the Long-Run Neutral Real Interest Rate” speech at South Korea Central Bank, in https://www.minneapolisfed.org/news-and-events/presidents-speeches/public-debt-and-the-long-run-neutral-real-interest-rate-20150908

Laubach, T. and J. Williams (2003), “Measuring the Natural Rate of Interest”, Review of Economics and Statistics 85, No. 4,, pp. 1063–70, November.

Laubach, T. and J. Williams, (2015), “Measuring the real natural interest rate redux” Federal Reserve Bank of San Francisco Working Paper No. 2015-16, October.

Mésonnier, J.S. and J.P. Renne (2007), "A time-varying "natural" rate of interest for the euro area," European Economic Review, Elsevier, Vol. 51(7), pp. 1768-1784, October.

Pilkington, P. (2014) “ Endogenous money and the natural rate of interest: the re-emergence of liquidity preference and animal spirits in the post-Kenesian theory of capital” markets”, Levy Economics Institute Working Paper No. 817.

Reinhart, C. and K. Rogoff (2009), “This Time Is Different: Eight Centuries of Financial Folly”, Princeton University Press.

Summers, L. (2016), “The age of secular stagnation: what it is and what to do about it”, in Foreign Affairs March/April 2016.

Taylor, J.B, and V. Wieland (2016), "Finding the Equilibrium Real Interest Rate in a Fog of Policy Deviations", Economics Working Papers 16109, Hoover Institution, Stanford University.

Wicksell, K. (1936), “Interest and Prices”, translation of 1898 edition by R.F. Kahn, London: Macmillan.

Woodford, M. (2003), “Interest and prices”, Princeton University Press, Princeton.

Wright, J. (2011), “Term Premia and Inflation Uncertainty: Empirical Evidence from an International Panel Dataset”, American Economic Review, Vol 101 No.4.

Wu, J.C. and F. D. Xia (2016), “"Measuring the Macroeconomic Impact of Monetary Policy at the Zero Lower Bound", Journal of Money, Credit, and Banking, 2016, 48(2-3), 253-291.

[1]Wicksell, K. (1898) “Interest and Prices”, edition of 1936 in English published by Macmillan, London, p 102.

[2]See a characteristic post-Keynesian view in Pilkington, P. (2014) “Endogenous money and the natural rate of interest: the re-emergence of liquidity preference and animal spirits in the post-Keynesian theory of capital markets”, Levy Economics Institute Working Paper No. 817.

[3]See Harcourt, G, (1972) “Some Cambridge controversies in the theory of capital”, Cambridge U. P.

[4]See Friedman, M. (1968) "The role of monetary policy ", American Economic Review, volume 58, number 1.

[5]Woodford, M. (2003) “Interest and Prices: foundations of a theory of monetary policy”, Princeton U.P.

[6]An alternative taxonomy would separate out also additional premia, such as the safety premium and the liquidity premium. Furthermore, while the focus of the speech is predominantly on risk-free rates, many assets bear credit risk. In addition, in the context of the euro area sovereign debt crisis in 2012 there was a surge in certain euro area countries’ re-denomination risk.

[7]See Box 2 “Why are interest rates so low?” in the ECB’s 2015 Annual Report.

[8]Jonathan Wright (2011), using a cross-country study, shows that a likely explanation for the decline in the nominal term premium is the reduction in inflation uncertainty associated with increased credibility of monetary policy.

[9]It should be noted that this approach does not take into account the zero lower bound, for approaches that do, see Wu and Xia (2016).

[10]See speech by V. Constâncio, “International headwinds and the effectiveness of Monetary Policy” delivered at the 25th Annual Hyman P. Minsky Conference on the State of the U.S. and World Economies at the Levy Economics Institute of Bard College, Blithewood, Annandale-on-Hudson, New York, 13 April 2016.

[11]As interest rate processes are usually showing very high persistence, it is difficult to econometrically pin down far-ahead expectations. Either the interest rate process is taken as stationary, in which case the unconditional mean parameter (that becomes more and more relevant for computing conditional expectations the longer the desired horizon) can usually be estimated with high uncertainty only. Or the rate process is assumed to have a unit root, in which the far-ahead expectations are driven to a large extent by current conditions, which may be unreasonable.

[12]For examples see Kara, E.and L. von Thadden (2016), “Interest rate effects of demographic changes in a New-Keynesian life-cycle framework”, Macroeconomic Dynamics Vol. 20, No. 1; Eggertsson, G. and Mehrotra, N. (2015), “A model of secular stagnation”, NBER Working Paper N. 20574

[13]See Kocherlakota, N. (2015) “Public Debt and the Long-Run Neutral Real Interest Rate”, speech at South Korea Central Bank, in https://www.minneapolisfed.org/news-and-events/presidents-speeches/public-debt-and-the-long-run-neutral-real-interest-rate-20150908

[14]As an illustration, this approach is applied to the euro area using a VAR containing real GDP growth, the GDP deflator growth, the Eonia rate and a suite of other interest rates, and measuring the short-term real rate as the difference between the Eonia and inflation over the subsequent year.

[15]The estimates in the chart follow a slightly different approach aligned with that of Mésonnier and Renne (2007), which extended the seminal work of Laubach and Williams (2003).

[16]In the exercise the real interest rate that stabilises inflation (defined in the model in terms of the GDP deflator) at the target over the medium term – which for illustrative purposes is set between two and two-and-half years – is computed with the additional requirement to limit volatility. The chart displays the average rate over the two –and-half period. The exercise is carried out with the CMR model, see Christiano, L. J., R. Motto, and M. Rostagno (2014).

[17]For a recent discussion on uncertainty surrounding the estimation of the equilibrium rate, see for example Taylor and Wieland (2016).

[18]See Hicks, J. R. "Mr. Keynes and the "Classics"; A Suggested Interpretation." Econometrica 5, No. 2 (1937): 147-59.

Banc Ceannais Eorpach

Stiúrthóireacht Cumarsáide

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, an Ghearmáin

- +49 69 1344 7455

- media@ecb.europa.eu

Ceadaítear atáirgeadh ar choinníoll go n-admhaítear an fhoinse.

An Oifig Preasa