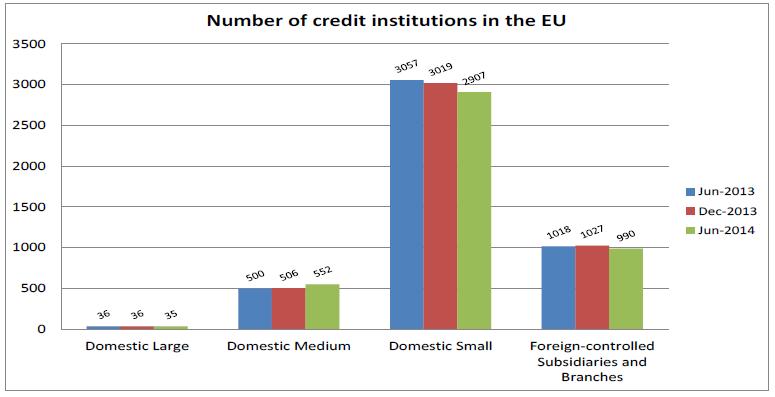

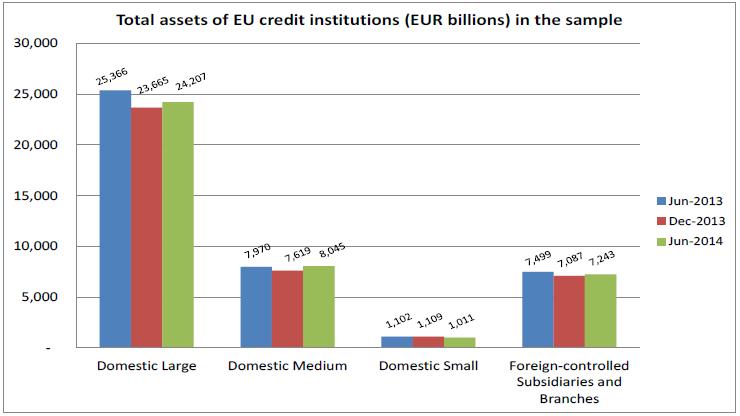

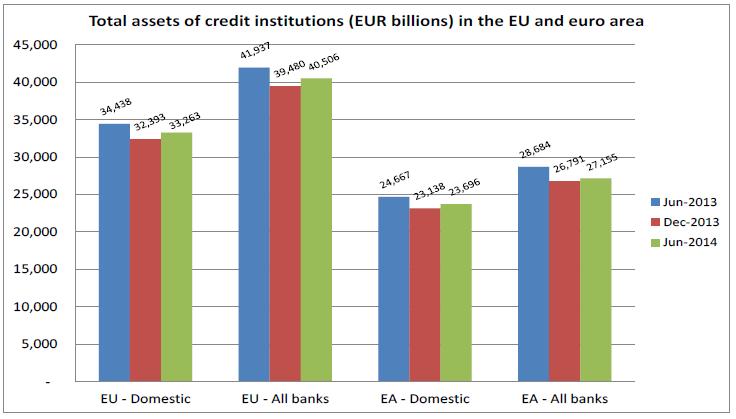

Today the European Central Bank (ECB) is publishing the June 2014 Consolidated Banking Data (CBD), a data set that provides statistics and indicators on the banking system of the European Union (EU) on a consolidated basis. It includes statistics on individual EU Member States as well as for the EU and Euro Area as a whole. Data for June 2014 refer to 396 banking groups together with 4088 stand-alone credit institutions, including 990 foreign-controlled branches and subsidiaries operating in the EU. This data set includes profitability and efficiency indicators, balance sheet indicators, non-performing loans developments as well as solvency ratios.

This semi-annual dataset comprises selected data points taken from the more comprehensive annual data collection published on http://sdw.ecb.europa.eu/browse.do?node=71390 (reference data) and http://www.ecb.europa.eu/press/pr/date/2013/html/pr130628.en.html (press release).

The CBD are separately reported for domestic stand-alone credit institutions and banking groups (broken down into small, medium-sized and large). The series are available for banks on a cross-border and cross-sector basis, where “cross-border” refers to branches and subsidiaries located outside the domestic market and “cross-sector” to branches and subsidiaries of banks that can be classified as other financial institutions. Insurance companies are not included in the consolidation perimeter.

The CBD are also available in the ECB Statistical Data Warehouse. The data and more information about the methodology behind the data compilation are available on the ECB’s website: http://www.ecb.int/stats/money/consolidated/html/index.en.html.

For media enquiries, please call Nicos Keranis on +49 69 172 758 7237.