Executive summary

The integration of the European retail payments markets has been going on for almost two decades. The Single Euro Payments Area (SEPA) is now a reality for over 500 million citizens using uniform credit transfers and direct debits. In contrast, card payments still lack the same degree of market integration and harmonisation of business practices and rules, as well as technical standards. Although cards have been the fastest growing means of payment in Europe for some time, some users (cardholders and merchants) have not benefited as much as they could have if a SEPA for cards had been achieved.

The card industry has made significant efforts to achieve the objectives outlined in the 2014 report Card payments in Europe – a renewed focus on SEPA for cards, which presented the Eurosystem’s views, policies and objectives. Since the publication of this report, new legislation and substantial technological progress have reshaped the environment for card payments. However, so far this has not led to a harmonised, competitive and innovative European cards payment area. Overall, a SEPA for cards has not yet been achieved.

The Eurosystem therefore decided to analyse the current state of card payments in Europe and review its policies. This report includes the views of cards market participants from the supply side, obtained during a market consultation conducted in late 2017. It enumerates measures by cards market participants that are conducive to a SEPA for cards. In a SEPA for cards, a number of impediments would be abolished, including: (i) a lack of interoperability between cards and terminals, (ii) limitations on merchants accepting certain cards, and (iii) cardholders being confused by different payment experiences across Europe.

To achieve the above objectives, coordination among cards market players is of the utmost importance, in particular in the area of cards standardisation. However, multiple players actively promote their own services based on proprietary standards, thereby hindering progress in this area. Players from the supply side of the cards market believe the migration towards harmonised standard needs to be market-driven and justified by business case considerations. The Eurosystem takes note of this reasoning and acknowledges that most existing national card schemes actually operate on a relatively low cost basis, which has benefited users in the past. However, to some extent, this has constrained investment in the modernisation of their services and prevented efforts towards achieving a pan-European approach. Taking this into account, the SEPA for cards objectives could be better served by supply-side stakeholders investing in current, or possibly new, processing infrastructure. In addition, such developments could facilitate technical interoperability, provided they are based on common standards and incorporate state-of-the-art technology and innovations.

The Eurosystem acknowledges that, in general, European cardholders are able to pay with one card all over Europe. However, at present the pan-European acceptance of cards issued under a national card scheme is entirely reliant on co-badging with an international card scheme. Increasingly, payment service providers only issue cards from international card schemes. Such an arrangement calls into question market efficiency in terms of costs, competition and governance, as European payment service providers have little or no influence on the market’s development. In the past, all attempts to establish a common European card payment scheme have failed, as national card schemes and banks did not see a viable business case in the short term.

The implementation of a European instant payments scheme and the development of common or interoperable instant payments infrastructure to process such payments may create new momentum to interconnect existing national card schemes. The use of this newly installed instant payments infrastructure could be a way to support the interlinking and interoperability of national card schemes and, if full pan-European coverage is ensured, would provide a possible alternative to establishing a European card scheme. To promote the use of such cards, it would be helpful to have a common European logo indicating the possibility of using the cards of national card schemes at EU level.

Furthermore, innovative technologies will bring more competition to the cards market and boost the range of choices for consumers. They are also expected to affect the evolution of card-based products, including changes in merchants’ payment acceptance technologies. However, innovations may be capital intensive and thus smaller market participants might experience difficulties in keeping up with technological progress. There is therefore a risk of innovations not being introduced in some markets in Europe, while others may already benefit from them. The Eurosystem welcomes innovative solutions that enable efficient, convenient and secure card payments. In principle, these should be designed (i) to enable pan-European reach, even if at first they target national environments, and (ii) to not perpetuate fragmentation of the cards market. Thus, deeper cooperation and dialogue among relevant market players, in particular incumbents and newcomers, is highly supported.

Finally, it should be borne in mind that the European cards industry has already implemented or is currently implementing two important pieces of EU legislation aimed at supporting a harmonised, competitive and innovative cards market. These are the Interchange Fee Regulation (IFR) and the revised Payment Services Directive (PSD2). The Eurosystem welcomes both legal acts, as they provide the legal foundation for an integrated cards market aimed at increasing efficiency, competitiveness and safety. While market players from the supply side generally welcome the objectives of the acts and the rules stipulated therein, they also call for the rules to be implemented in a harmonised fashion by Member States and caution against further regulation of the market. In their view, any amendments to the current legislation should take into account the results of a thorough and comprehensive impact assessment of the entire applicable legal and regulatory framework as well as market concerns and business requirements. To ensure that the interests of the card industry are represented, the Eurosystem encourages all relevant stakeholders to actively take part in public consultations on reviews of existing regulation and drafts of potential new legal acts.

For almost two decades various market players have striven for payments harmonisation in Europe. This goal was achieved for credit transfers and direct debits, while harmonisation for card payments is still lagging behind. Although numerous important objectives for card payments have been achieved, a SEPA for cards has not yet been achieved. Therefore, further action by various players to address outstanding issues hampering a SEPA for cards is much needed. The implementation of instant payments may help to achieve this goal sooner, as it can be instrumental in interconnecting national card schemes, thereby creating pan-European reach and a stronger basis for innovation. Thus interconnectivity and interoperability of existing national card schemes, based on common and open standards and taking advantage of standards and solutions used in SEPA, would facilitate card payments at EU level. The Eurosystem is committed to supporting the activities still needed to achieve a SEPA for cards as soon as possible and to facilitating dialogue amongst market players.

1 Introduction

Over the last few years, an evolution towards a more integrated retail payments market has taken place in Europe. In the context of the Single Euro Payments Area (SEPA), the European Payments Council (EPC) has developed schemes setting rules and standards that allow harmonised credit transfers and direct debits at pan-European level. By means of the SEPA End-Date Regulation[1], payment service users have been able to make such payments under the same conditions everywhere in SEPA since August 2014.[2]

Despite being seen as a third pillar of the SEPA project, a SEPA for cards, aimed at creating a harmonised, competitive and innovative card payment area, has not been fully achieved. Under the auspices of the EPC, and now the European Cards Stakeholders Group (ECSG), cards market players have made substantial efforts to set common rules and standards. As migration to these is voluntary, harmonisation in the field of cards is continuing to lag behind credit transfers and direct debits. Consequently, national cards markets have to some extent remained fragmented, not allowing European cardholders to use their national cards elsewhere in Europe. The European-wide acceptance of cards issued under national card schemes is only possible due to prevalent co-badging with international card payment schemes.

Although technically feasible, a number of efforts and initiatives undertaken in the last few years to establish a European card scheme or to achieve European-wide cross-border coverage of national card schemes have so far not been successful. The absence of a European card scheme, combined with the well-established presence of international card schemes, has accelerated the extensive practice of co-badging. In addition, the number of national card schemes has also been diminishing.

Card usage, however, is growing significantly in Europe. With nearly 70 billion payments in 2017, payment cards are the most widely used electronic payment instrument in the European Union, already totalling more than half (52%) of all non-cash transactions, with credit transfers accounting for 24% and direct debits for 19%. Furthermore, payment cards are also the fastest growing cashless payment instrument, with the number of transactions more than doubling in the last decade. This rapid growth has also been fuelled by the introduction of contactless cards in recent years. Due to its convenience for payment service users, contactless payment can provide an even stronger incentive to use electronic payments at the point of sale and has the potential to replace a substantial number of low-value cash transactions.

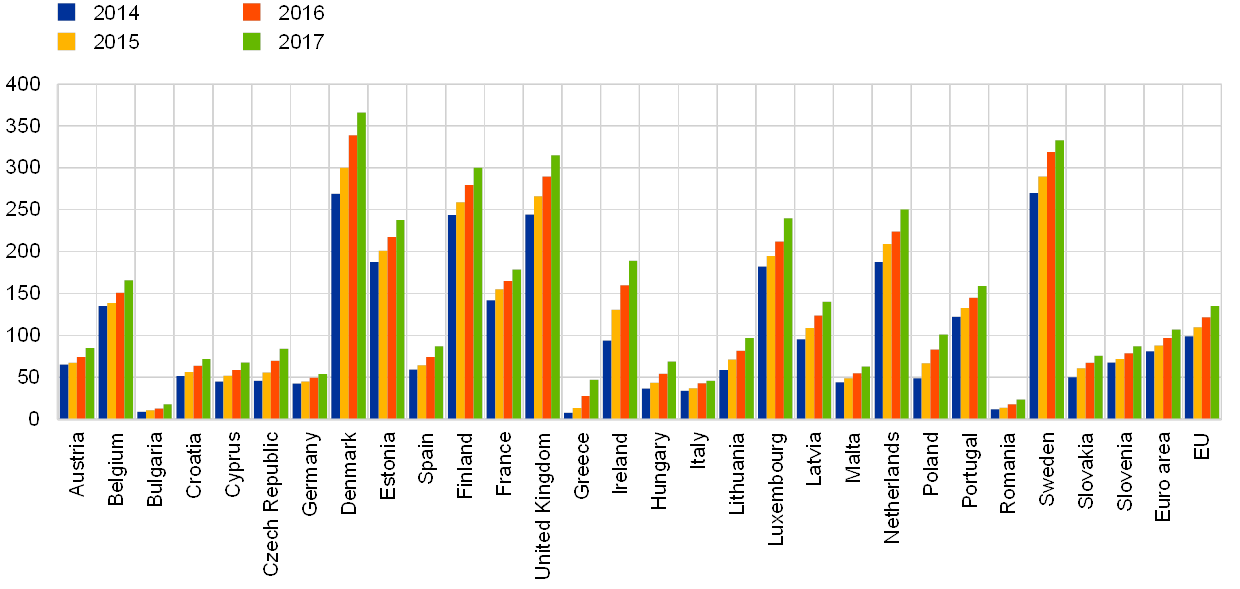

As shown in Chart 1, although large variations can be identified among European countries with respect to the level of card usage, solid annual growth rates can be observed in all of them. In 2017, there were 135 card payments per capita on average in the European Union, ranging from a low of 18 in Bulgaria to a high of 366 in Denmark.

Number of card payments per inhabitant (2014‑2017)

Source: ECB Statistical Data Warehouse.Note: The chart shows card payments with cards issued by EU-resident payment service providers, except cards with an e-money function only.

Growth, albeit marginal, can also be observed for cross-border card payments at the EU level, as shown in Chart 2, with the EU average increasing from 6.8% in 2014 to 8.3% in 2017. It is considered to be one of the signs that a SEPA for cards is incomplete when users are not yet fully comfortable using their cards abroad. Increasing cross-border acceptance of national scheme cards could potentially contribute to further growth in cross-border card transactions and the completion of a SEPA for cards.

Cross-border card payments as a percentage of total card payments at point-of-sale (POS) terminals (2014‑2017)

Source: ECB Statistical Data Warehouse.Notes: The chart shows card payments with cards issued by EU-resident payment service providers, except cards with an e-money function only. Sweden and the United Kingdom are excluded, as data on cross-border card transactions for these two countries are not available.

Cards play a major role for European citizens and businesses conducting their daily payment transactions. Thus, the Eurosystem continues to strongly support the creation of a SEPA for cards. Despite some positive steps in recent years, the Eurosystem has observed that a SEPA for cards has not been achieved yet and progress towards establishing it has been slower than hoped. In addition, recent developments in the payments market have the potential to substantially affect the cards business.

In the light of the above, the Eurosystem has in the present report reviewed the progress towards a SEPA for cards and identified barriers hampering its establishment by market players. On this basis, the Eurosystem has re-evaluated its policies and objectives to facilitate the activities of market players and help promote the development of a SEPA for cards. As a SEPA for cards can best be achieved in a co-operative manner, all market players are invited to intensify their efforts.

This report is structured as follows: Chapter 2 addresses the fundamental topic of the reachability of national card schemes. Chapter 3 reviews the legal and regulatory framework. Chapter 4 provides a description of initiatives recently taken on cards standardisation. Chapter 5 looks at the way current innovations in payments could impact the card business.

To produce the present report, a market consultation was launched in the third quarter of 2017. To take stock of the progress since 2014, and in view of additional efforts still needed to achieve a SEPA for cards, the Eurosystem reached out to cards market participants from the supply side, namely card payment schemes, issuers, processors and acquirers. Over 40 replies were obtained, both from individual respondents and from industry groups. These provided substantial information crucial for the work on the report, for assessing the current market situation in different domains and for analysing the way forward.

2 Reachability of European card schemes

Today, cross-border card payments in Europe are mainly made through two international card payment schemes: Visa and MasterCard. In order to guarantee cross-border acceptance, national card schemes are reliant on co-badging with international card schemes.

An alternative solution to co-badging lies in cross acceptance of national card schemes, which are still active in ten European countries. Despite their number declining from 22 in 2013 to 17 in 2018, as shown in Chart 3, some still have a significant share of their national markets. To achieve cross acceptance the respective card schemes need to agree on a strategy for cross-border acceptance of their brands.

Number of national card schemes active in individual Member States in 2013 and 2018

Source: ECB.Note: Member States with no national schemes in 2013 or 2018 are not included in the chart.

Market players have been hesitant so far in pursuing this path, mainly because of the initial investments required for a relatively small number of cross-border transactions. These figures are, however, steadily increasing. Up until today, short-term business viability was a major roadblock to the implementation of various initiatives in this area. However, if European cardholders were offered the possibility of using their cards abroad, national schemes would have the chance to expand their business.

Furthermore, new technical solutions and regulatory and market developments are paving the way for changes in market arrangements by providing coexistence and increasing competition between different payment solutions. The launch of the SEPA Instant Credit Transfer (SCT Inst) scheme in November 2017 and the introduction of the revised Payment Services Directive (PSD2)[3] may give European payment service providers new options to accept and offer new payment solutions in competition to cards.

2.1 National and cross-border card payments

The European cards market is characterised by two separate and markedly different markets: the market for national payments and the market for cross-border payments. In national markets both national and international card schemes may compete for transactions through co-badged and single-branded cards. The cross-border payments market, conversely, is dominated by international card schemes, which capitalise on the lack of European-wide acceptance of national card schemes and guarantee cross-border acceptance of their brand.

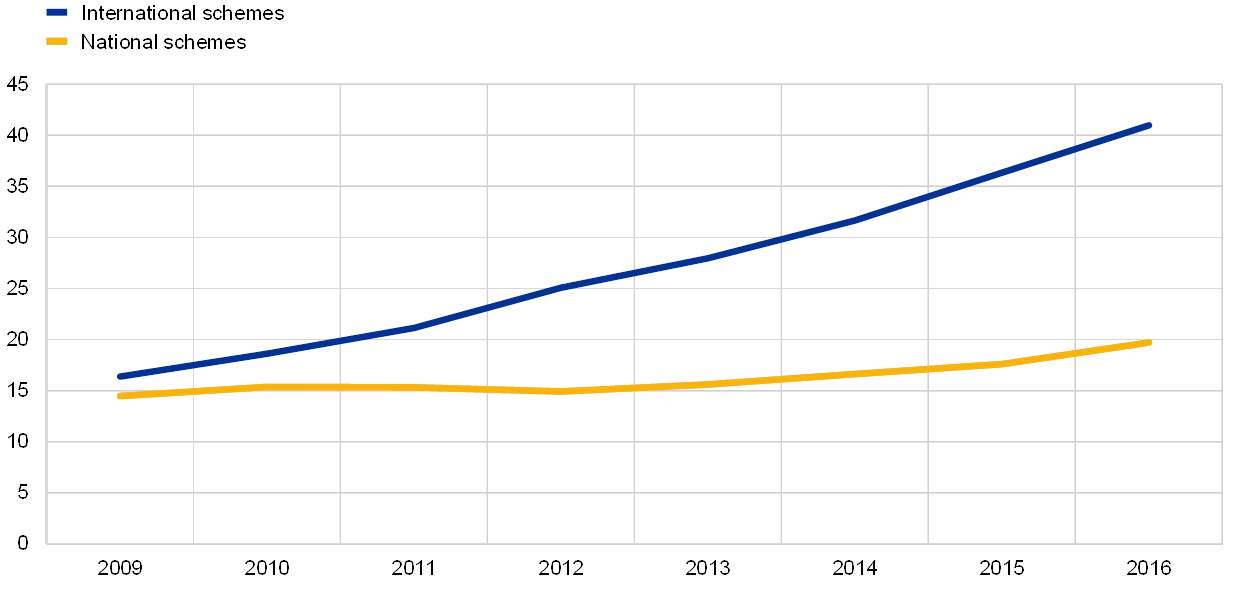

Today, international card schemes are present in all Member States with respect to issuance and acceptance. Whilst they were once mostly confined to the relatively small cross-border market, international card schemes have now also gained traction in national markets and are steadily increasing their share of the cards market at EU level (see Chart 4). At the end of 2016, the share of transactions made with international card schemes on payment cards issued in the EU was 67.5%. A number of factors contributed to this. First, co-badging and choice of brand provided a user-friendly solution to the demand for a single payment instrument for national and cross-border payments. Second, the early implementation of online and contactless payments by international card schemes provided users with new payment opportunities. Third, with the aim of achieving cross-border acceptance, new banks opted to issue cards with only an international card scheme, even in countries where a national card scheme was available. Finally, the introduction of interchange fee caps in 2015 reduced national card schemes’ price advantage on the acquiring side (previously, the interchange fee of national schemes was lower than that of international schemes). As a consequence of these four developments, the profitability of maintaining separate infrastructures was reduced and some national card schemes merged or ceased to exist.

Number of transactions made with national and international card schemes on payment cards issued in the EU

(billions of transactions)

Source: Reporting by card schemes for oversight purposes to the ECB.

There are both market efficiency and governance arguments in favour of increasing cross-border reachability of national card schemes. From a market efficiency perspective, reachability would increase national card schemes’ volumes and help support competition on the acquiring side; the extent to which volumes could increase would be contingent on whether gaining cross-border reachability would also enhance national card schemes’ competitiveness in other national markets. Bringing national card schemes into cross-border acquiring might also increase the number of competitive players in an inherently oligopolistic market. Increasing cross-border reachability could further increase competition in processing and acquiring services, which tend to be fragmented along national lines. Finally, increased competition and market consolidation could help the market along the path of product and process standardisation and support investment in innovation.

From a governance perspective, European banks and institutions currently have little control over the cross-border payments market, or even the national market if relying on an international card scheme, and cross-border reachability of national schemes would provide an alternative payment route subject to European governance. The Eurosystem has previously promoted the creation of a European card scheme, which would offer its services at pan-European level in competition with international card schemes. The 2014 card report provided an overview of four initiatives, namely Euro Alliance of Payment Schemes (EAPS), PayFair, EUFISERV and Monnet. However, these projects failed, and banks’ commercial interests prevailed over a pan-European solution. Visa Europe, the only card scheme that broadly met the definition of a European card scheme, was acquired by Visa Inc. in June 2016.

The market players that responded to the consultation do not perceive cross-border acceptance for national schemes as a core factor for their continued success. However, they acknowledge that cross-border acceptance could provide an alternative to international card schemes and enhance the European position in the global payment landscape. Furthermore, respondents highlighted two possible ways of achieving direct cross-border reachability: (i) interlinking or co-badging national schemes, and/or (ii) establishing a SEPA card scheme.

2.2 Interlinking or co-badging of national schemes

Interlinking national schemes and creating EU-wide acceptance for these schemes, is a topic that emerges cyclically in the European card payments market. Indeed, as mentioned above, there have been some unsuccessful attempts to achieve this.

Some respondents report that interlinking would preserve competitiveness due to the lower card scheme fees. They also argue that it would help control the (increasing) fees charged by international card schemes and, as such, give European stakeholders more influence over the functioning of the European cards market.

The main concern of the market is whether the costs associated with interlinking are justified by a business case. Cross acceptance involves arrangements such as technical and operational interlinking of participants in national schemes and implementing legal and financial requirements (see the Annex for further details on interoperability necessary for national schemes’ cards to be accepted on a cross-border level). Processors and acquirers generally confirm that technical difficulties can be resolved. As far as the business case is concerned, they claim that demand for cross-border acceptance is still low and the low proportion of cross-border card transactions (cross-border card transactions account for around 8.3% of the total in the European Union)[4] has not yet justified the significant investments. However, if European cardholders were offered the possibility of using their national cards abroad, new business opportunities would open up for national networks and cross-border transactions might increase. A common European logo, indicating pan-European interoperability of national card schemes and the possibility of using cards of respective national schemes at EU level, might be helpful in promoting the use of such cards. This would provide transparency and clarity to European cardholders on the possibility of also using national cards in other Member States and could promote the use of “national” cards abroad. Furthermore, recent developments in the payments market, namely the introduction of the SCT Inst scheme and the development of the related clearing and settlement infrastructure, may limit the investments needed to interconnect national card schemes (see section 2.4). Given the fact that not every European country has a national card scheme, those countries should also be taken into consideration by the initiatives for interlinking national card schemes. In this respect, the payment industries in those countries may consider liaising with existing European national schemes. By doing so, they could lower the national banking communities’ operational costs in view of lower card scheme fees and enable card transactions in the whole EU to be made using European payment solutions.

The market responses indicate that co-badging among national card schemes does not appear to be a workable alternative to interlinking. On the one hand, it would provide limited economies of scale, while acquirers and processors prefer to concentrate their services on a few card brands with high volumes than to accept many brands with a low volume of transactions. On the other hand, co-badging would imply a sizable investment in getting co-badged national cards accepted on national terminals.

2.3 Establishing a SEPA card scheme

Another option contemplated by market consultation respondents would be the possibility of creating a SEPA card scheme. This could be a fresh scheme, in partnership with an internationally accepted card scheme, in order to get international acceptance, or an interlinking of national card schemes into a single internationally accepted card scheme.[5]

If such a SEPA scheme could achieve acceptance in the countries where national card schemes are present, and even at some point expand to cover the whole of Europe, it might prove to be a business case. Entering a two-sided market could, however, be challenging as co-badging with international schemes already guarantees issuers pan-European and global acceptance.

Regardless of the way in which a SEPA scheme is formed, start-up, organisational and marketing costs would be large and cost recovery uncertain. In the view of market participants, reduced interchange fees, as mandated by the Interchange Fee Regulation (IFR)[6], can make cost recovery even more difficult. While competition from international card schemes in national markets might eventually squeeze national card schemes’ margins to the point where they consider an international merger (when it is already too late), building a SEPA card scheme is likely to remain a political construct rather than a sound business case in the short term, similar to the fate of past approaches to such a potential scenario. However, in view of the gradual phasing out of several national card schemes, in the long-run the lack of a pan-European card solution may lead to the phasing out of European national card schemes and the loss of European stakeholders’ strategic influence over the European cards market.

2.4 Market initiative on interconnecting national card schemes

There are a number of market initiatives that aim to promote the interoperability of national card schemes. In addition to the initiatives trying to achieve interoperability through standardisation (described in more detail in Chapter 4), the European Card Payment Association (ECPA) is looking into the possibility of interconnecting card processing in Europe.

A decade after the Eurosystem first called for the development of the SEPA card processing framework and two years after the IFR provision on technical interoperability came into force, progress in the area of card processing interoperability still appears to be limited. In this regard, the ECPA presented a European card payment interconnection (ECPI) initiative to connect national card schemes using existing card infrastructures for authorisation (using standards ISO 8583 and ISO 20022) and the new SCT Inst infrastructure for clearing and settlement, allowing for synergies by making the operation and maintenance of a separate infrastructure for inter-scheme card transactions superfluous.

The ECPI initiative concerned the possibility of using SCT Inst infrastructure to clear and settle card-based transactions between issuers and acquirers. Investments in the infrastructure for transaction processing could thus be limited only to achieving an authorisation service at European level by providing gateway services between national schemes’ switches based on ISO 20022 message exchange.

The ECPI project could potentially provide an alternative to international card schemes, allowing European national card schemes to extend their offer beyond national borders and introduce competition in the market for cross-border transactions. The inclusion of all national card schemes in the ECPI initiative can thus provide the same functionalities as a European card scheme, e.g. cross-border reachability, and ensure European independence for all internal market transactions, bringing such transactions fully under EU jurisdiction in terms of data protection, confidentiality and security.

It is, however, of the utmost importance that clarity is provided on the business model used to execute the payment transaction (card payments, credit transfers or direct debits) in order to ascertain the set of applicable rules for all actors involved and make users aware of which payment service they are using so that they can refer to the relevant rights, obligations and transparency provisions. As a next step, the initiative would need to set up a separate legal entity responsible for managing the scheme’s rules (e.g. acceptance rules, payment scheme branding and fee structures), inter-scheme specifications, certification, operational management of disputes and arbitrage and financial settlement arrangements between different members.

Progress on creating a solution that would enable cross-border payments with cards issued under European schemes has been considerably slower than hoped. Several national card schemes have been replaced by international card schemes and more schemes may face the risk of extinction. Thus, competition in the European cards market (not only cross-border but also national) might be reduced and, in an extreme scenario, end up in a duopoly of international card schemes. The current status of the cards market is already hampering its efficiency and calls for further action. The Eurosystem encourages cards market players to take a more ambitious approach to a SEPA for cards, allowing them to maintain their strategic influence over the European cards market, and supports market initiatives working towards it.

As a result, the Eurosystem:

- acknowledges that national card payment schemes working towards pan-European reachability could result in increased competition and efficiency in the European cards market;

- welcomes market initiatives to interlink national card payment schemes, including through processing arrangements, provided that full pan-European reach is achieved, and notes that a common European logo indicating the possibility of using the cards of national card schemes at EU level might be helpful in promoting the use of such cards;

- notes that the already interoperable European SCT Inst infrastructure for the settlement and/or clearing of card transactions may be a possible way to support interlinking of national card payment schemes, provided that clarity concerning the operating business model used to execute the payment transaction (i.e. the underlying payment instrument) is provided to all parties involved.

3 The current legal and regulatory framework

Since the publication of the 2014 card report, the legal and regulatory framework has been extensively enhanced to support the establishment of a SEPA for cards. As shown in Chart 5, the European Commission proposed the IFR and PSD2, which were adopted by the Council and the European Parliament. The Commission has also adopted the relevant regulatory technical standards (RTS) developed by the European Banking Authority (EBA), which is also establishing guidelines to support the implementation of the new rules. Market players have implemented a large share of this new legal and regulatory framework already or are currently in the course of doing so.

Selected changes in the European legal and regulatory framework impacting cards

Source: ECB.

In addition, a number of recent legislative initiatives, including delegated legislation, also have an impact on the card payments market. These include:

- the Payment Accounts Directive (PAD)[7];

- the Second Wire Transfer Regulation (WTR2)[8];

- the General Data Protection Regulation (GDPR)[9];

- the Fifth Anti-Money Laundering Directive (AML5)[10];

- the eIDAS‑Regulation[11].

These legal acts aim to increase safety, efficiency and competition, though it is acknowledged that they may also increase complexity in the legal and regulatory environment for the European cards market. In line with the questionnaire, this section focuses mainly on the perception of the IFR and PSD2 among cards market players from the supply side. In general, any assessment of the framework that has emerged so far would suffer from the fact that it is not yet being fully implemented. This cautionary note is also made by a majority of the consultation respondents.

Overall, most market participants welcome the overarching objectives of the rules stipulated in the new legal and regulatory framework. They consider the existing framework as adequate and/or sufficient to achieve the SEPA objectives. However, some are of the opinion that, given the status of cards in SEPA, little justification is left to impose further requirements on market players. Consequently, about half of market participants believe that no further legislation is needed. Some even state that the extensive regulation has led to a situation where national schemes are disappearing. Moreover, the rules are regarded as stifling innovation and hampering the ability of national schemes to compete with big tech players and international card schemes.

According to market players, the main difficulties experienced with the new rules are as follows: (i) the implementation across Member States is inconsistent, (ii) the supervisory approach chosen by the national competent authorities seems to differ to some extent, and (iii) the time gaps and deviations between the implementation deadlines of the primary legislation compared to the associated delegated acts are confusing and create unnecessary uncertainty. Hence, the priority should be consistent implementation as well as gaining experience with the rules while closely studying their impact.

Most respondents strongly advocate a market-driven approach to more harmonisation and integration based on business reasoning and accounting for the resources required for implementation. If further legislation is considered, market participants advocate that this needs to: (i) be strictly balanced with business requirements, (ii) respect the views of all card market players, and (iii) be implemented in a harmonised fashion across Member States.

Besides these more general remarks, some specific areas of potential improvements were outlined by providers in the cards market with respect to the IFR and PSD2.

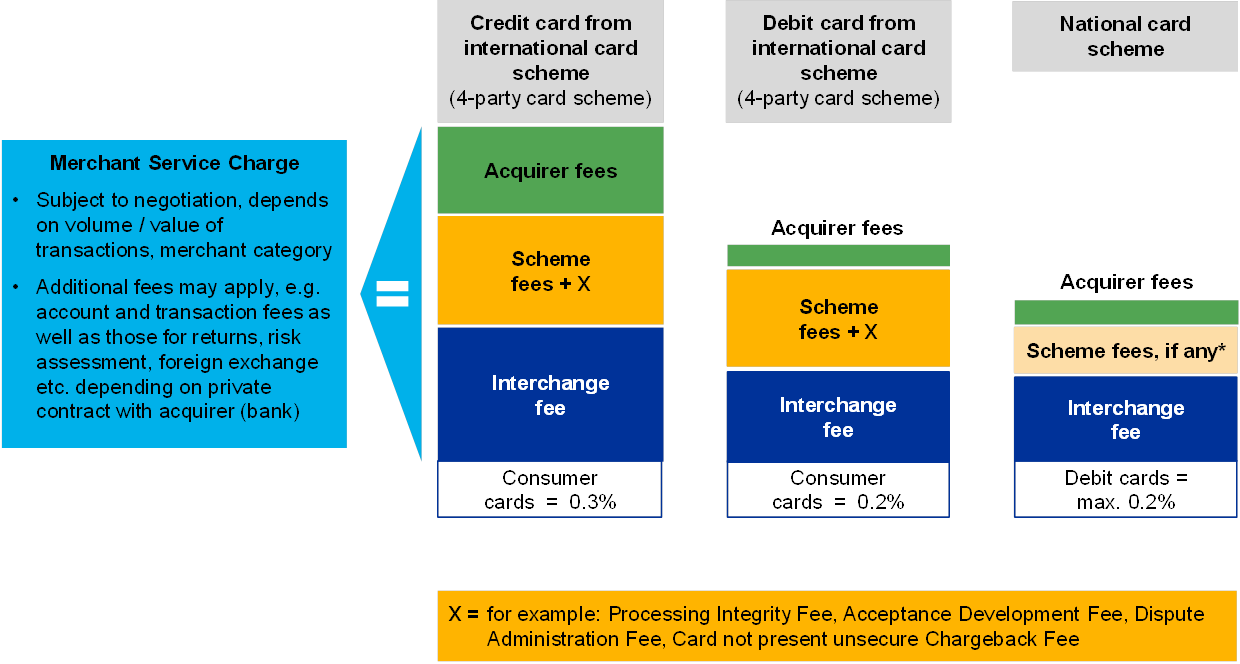

Based on the market consultation, it remains to be seen whether the objectives of the IFR have been successfully addressed. A number of answers relate to the separation of scheme and processing, which is described as not being fully implemented by international schemes. This is stated as being the case for innovation, such as tokenisation, but also for regular card transactions in a national environment. In addition, some respondents pointed out that issuing banks had changed their pricing models by raising cardholder fees, while merchant prices did not decrease in the course of the IFR. This is partly explained by the fact that the interchange fees are only one component of merchant service charges, the other ones being the fees charged by card schemes to acquirers and the fees stemming from the acquirers themselves (see Chart 6). In particular, some respondents report increasing scheme fees charged by international card schemes largely offsetting the forced decrease in interchange fees. Moreover, smaller and medium-sized merchants may also not be able to negotiate lower merchant service charges proportionate to the interchange fee reduction, as they lack sufficient bargaining power compared to merchants processing more transactions of an overall higher value.

Stylised overview of components of merchant service charges

* Not all national card schemes charge scheme fees.Source: ECB.

Overall, perception of the IFR adoption appears rather mixed based on the replies from the market consultation. Hence, the review study planned by the European Commission for 2020[12] is of the utmost importance to provide more insight into market dynamics.

With respect to the PSD2, the respondents address in particular the RTS on Strong Customer Authentication (SCA) and Common and Secure Communication. A number of market consultation respondents view the RTS as hampering e-commerce and not being technologically neutral, as for instance: (i) exemptions from SCA are very complex and not easy to comprehend from a consumer’s perspective, (ii) the same low-value transactions are treated differently when initiated with different payment instruments (such as contactless vs. contact card payments), and (iii) merchant liability is diminished, which could lead to higher fraud rates. The European Commission will review the PSD2 by 13 January 2021. Also reviews of its delegated acts are foreseen.

The Eurosystem acknowledges that the IFR and PSD2 have addressed some of the outstanding issues identified as obstacles to achieving a SEPA for cards. The objectives of the IFR are to enhance competition and increase the efficiency of the European cards market. A harmonised implementation of these rules would pave the way for a more efficient cards market.

As a result, the Eurosystem:

- underlines the need for consistent and harmonised application of EU legislation as well as alignment of supervisory activities of national competent authorities in Member States in order to allow payment service providers to consider, in their strategy, adapting business processes and developing efficient, convenient and secure card payment solutions, which would allow payment service users to take advantage of the new legal and regulatory framework;

- welcomes the initiative of cards market players to participate more actively in public consultations on forthcoming regulatory reviews as well as on draft legal acts, thereby ensuring that their interests are taken into account.

4 European stakeholder involvement initiatives for cards

The involvement of various stakeholders and industry groups in the payments market is of the utmost importance. All achievements, whether attained as a consequence of adopted legislation or market-driven initiatives, demand the involvement and cooperation of different stakeholders. This especially holds true for the cards market, where a large number of different market players with different and sometimes conflicting positions and interests are present. Therefore, these players need to cooperate when establishing standards and environments to help them achieve interoperability and consequently enable acceptance of cards all over Europe, regardless of the issuing country.

In its 7th SEPA progress report[13] and the 2014 card report, the Eurosystem emphasised the importance of cards standardisation in the development of a SEPA for cards and identified standardisation activities as a prerequisite to ensuring that any card can be used at any terminal in Europe. The 2014 card report pointed out that the slow progress is mainly due to the lack of decision-making on future SEPA standards and the absence of a concrete migration plan. It further stated that a decision on the standards to be used and their implementation is both urgent and sensitive, as it may help to open up the market and foster a level playing field across Europe. In its 2014 card report the Eurosystem also mentioned different cooperation initiatives, some of which have already terminated due to an inability to deliver results, while others are still running and successfully continuing their work to ensure the steps needed towards a harmonised cards market in Europe. In general, the Eurosystem has seen an improvement in cooperation between stakeholders in the area of standardisation compared to 2014, especially within the European Cards Stakeholders Group.[14]

4.1 The European Cards Stakeholders Group

The European Cards Stakeholders Group (ECSG), which replaced the Cards Stakeholders Group in 2016 as a multi-stakeholder association dedicated to harmonising card payments in Europe, comprises organisations from multiple industries and sectors, including processors, retailers, vendors, schemes and payment service providers. The European Commission and the European Central Bank have an observer role.

The main aim of the ECSG is to develop and maintain the SEPA Cards Standardisation Volume[15] (the “Volume”). The requirements and implementation guidelines in the Volume aim to harmonise data elements, functional aspects of card payment products/services and security requirements. If taken up, which is a voluntary exercise based on self-commitment, the Volume’s requirements may provide a basis for interoperability.

The Euro Retail Payments Board (ERPB) acknowledged[16] the ECSG’s work on formulating harmonised requirements for cards standardisation as being very important and invited the group to keep the ERPB informed of its progress on a regular basis. Therefore, the ECSG tracks progress indicators in its annual progress report[17] to the ERPB. Additionally, in December 2014, the ERPB invited the ECSG to implement the relevant procedures and start monitoring the conformance of implementation specifications for payment card products and services to the Volume.

A Volume Conformance Management Committee (VCMC) has been set up within the ECSG to monitor the market adoption of Volume-conformant specifications. A procedure to verify compliance with the standardisation requirements in the Volume has been set out by the ECSG. This consists of a labelling process for the specifications to comply with the requirements. To date[18] Volume standards have been adopted for seven sets of specifications by three organisations[19] and more are likely to follow. The certification process to verify that a solution (e.g. point of interaction (POI) or card) complies with a set of specifications is conducted by certification bodies from outside the ECSG.

It is important to note that the labelling process is based on a self-assessment by the implementation specification providers. The Eurosystem sees the labelling process as a step towards further harmonisation in the area of standardisation. However, if this was based on the assessment by an independent third party, a more impartial judgement could be achieved. Conformance with the Volume is a voluntary decision by each stakeholder, but would become meaningful if the relevant stakeholders align services and products with the Volume.

The Eurosystem also notes that the ECSG has taken the initiative to work on subjects that go beyond the strict domain of traditional card payments (e.g. wallets, tokenisation and person-to-person (P2P) card payments). It welcomes initiatives working on harmonised and competitive implementation specifications with the aim of avoiding further fragmentation of the market. In this respect, the active involvement of cards market players in the work of relevant standardisation bodies, regardless of their scale or organisational status, and in decision-making processes is welcomed. Only a balanced representation of all relevant stakeholders in the field of cards standardisation can ensure that the cards industry pursues the objectives for a fully integrated and harmonised retail payments market in the field of card payments.

As a result, the Eurosystem:

- welcomes initiatives that have been taken within the ECSG to foster and ensure harmonisation, such as the setting up of a Volume Conformance Management Committee (VCMC) to monitor the market development of Volume-conformant specifications;

- welcomes the performance of a self-assessment by relevant stakeholders to verify the compliance of their specifications with the standardisation requirements set out in the ECSG Volume;

- is of the opinion that this “labelling” process could be improved by ensuring that an independent entity conducts a more impartial assessment of whether Volume requirements are being fully met by institutions, which would increase transparency in the market;

- welcomes the ECSG activities aimed at standardising derivative card services (e.g. P2P card-based payments, digital wallets, tokenisation) while maintaining the level of card payment security;

- welcomes the activities of smaller card stakeholders in relevant standardisation bodies, e.g. joining forces with other stakeholders to promote common interests and achieve common objectives.

4.2 Initiatives and achievements in the area of standardisation

Processing of card payments consists of two distinct steps: the authorisation of payments and the handling of the financial flows (clearing and settlement). These processes involve different stakeholders, namely merchants/retailers, acquirers, processors, issuers and card schemes. Common standards for communication between stakeholders facilitate the processing of card payments. The current situation regarding standardisation of communication between stakeholders in the relevant domains is set out below.

4.2.1 Card-to-terminal domain

The payment instrument industry is constantly exploring new solutions to attract new customers and to make the act of purchasing easier. Contactless card payments, as well as mobile-based card transactions, are the best known examples. For some years now, cards market players have been seeking solutions to ensure their technological independence, which is essential for them to survive.

In the card-to-terminal domain, the European Card Payment Cooperation[20] (ECPC), which is composed of the main national schemes in Europe, has been established to develop a generic card and mobile payment application specification, the CPA contactless extension (CPACE), which can be used in different environments (contact and contactless cards, mobile near field communication (NFC), remote transactions). CPACE adds card and mobile extensions for both contactless and remote payments to the EMVCo CPA standard specification and enables national schemes to develop interoperable extensions for contactless transactions with EMV-based cards. It also allows European card issuers and schemes to become independent from proprietary contactless applications currently available. This European contactless payment application goes together with the provision of a European kernel (core software for POS terminals) for payment acceptance (see 4.3).

At the same time, other private stakeholders’ specifications (e.g. PURE[21]) and related products and services offer white label solutions to national schemes or local labels. The suite includes a scheme-agnostic EMV payment application adopted by many actors for various white label payment offers involving contact/contactless mobile/cards devices and wearables. The core specifications address both issuance (cloud-based and secure element) and acceptance (POS kernel) fields.

4.2.2 Terminal-to-acquirer domain

The terminal-to-acquirer domain (T2A) applies to the communication between a terminal at the point of sale and a payee’s payment service provider (i.e. the acquirer). In this domain, the aim of standardisation is to ensure the possibility for merchants to change an acquirer without any transition costs and as such reduce the business lock-in.

A major initiative has been undertaken by the Nexo organisation[22] which bases its specification on ISO 20022 CAPE (card payments exchanges) messages. Nexo proposes a series of standards for many practical applications. Standards have already been implemented by an increasing number of retailers to set up international payment processing platforms.

4.2.3 Acquirer-to-issuer domain

The acquirer-to-issuer domain (A2I) applies to the communication between a payee’s payment service provider (i.e. the acquirer) and a payer’s payment service provider (i.e. the issuer). In its 2016 Acquirer to Issuer Processing Study[23], the ECSG, responding to the invitation of the ERPB to assess the opportunity of migrating to a single standard in the acquirer-to-issuer domain, reports that today most of the protocols used in the market are variants of the ISO 8583 standard (e.g. messages are based on various versions of the ISO 8583 standard).

Indeed, the processing of transactions (e.g. message standards and processing practices) is often specific to each card scheme, due to their legacy evolution. In addition, acquirers and issuers have developed proprietary solutions for cross-scheme communication, such as bilateral or multilateral architectures, intra-processor processing and gateway services, leading to a plethora of different types of messages.

Some initiatives aim to harmonise the usage of message standards and eliminate the lack of standardisation in this domain.

The acquirer-to-issuer cards messages (ATICA) initiative was set up to design a standard that captures business processes currently addressed by ISO 8583, but by using ISO 20022 methodologies. This simplifies the conversion process between message standards. ATICA produced an initial version of the standard in December 2014. While this early version of the standard is still a proof of concept, ATICA is working towards a second version of its standard where schemes have to ensure technical compatibility, but not necessarily functional compatibility, leading to a situation where a set of specific messages could be different among the different schemes. Standardisation remains the result of a business decision to use the same specifications and increase interoperability.

The Berlin Group, on the other hand, has defined a card clearing model based on using SEPA direct debit infrastructure, known as SEPA Cards Clearing (SCC). In many payment systems in Europe, the clearing of card transactions is carried out analogously to the clearing of credit transfers and direct debits. The Berlin Group has developed an SCC framework that offers a simple message extension to the SEPA direct debit definition to include the additional card originated data in ISO 20022 payment messages. The framework has been adopted in Germany, where banks decided to migrate from domestic legacy clearing systems for Girocard transactions to the SCC services by February 2016.

In the absence of a common message set for all card transactions, and given the difficulty of providing one that suits all industry players, the ECSG is developing a message translation guide between different standards, such as different versions of ISO 8583 and ISO 20022. While this initiative will not solve the issues of interoperability, it could help overcome divergence in standards and improve harmonisation.

A majority of the market consultation respondents were of the opinion that standards like ISO 20022 are beneficial for interoperability, but most parties indicated that these standards should be implemented in a market-driven manner only and will probably only be used for new projects. Respondents claimed that this is particularly true for large incumbents who are looking at the cost of migration and do not see clear business benefits, such as new functionalities. Indeed, according to the ECSG study, even in the case of a global mandate for all card schemes to migrate to a common standard, the payback period is estimated at a decade in the best case scenario. As indicated previously for ISO 20022 ATICA messages, the adoption of the standard by most of the actors helps, but does not guarantee, business interoperability between systems.

An alternative solution to address issues of standardisation in the acquirer-to-issuer domain might be the use of interoperable SCT Inst clearing and settlement infrastructure. This may strengthen the foundation of the European payments market by fostering efficiency and European independence in the field of payments. It represents an opportunity to achieve the unification of the A2I domain based on European players and solutions. As mentioned in Chapter 2, this is the solution that has been proposed by the ECPI initiative to connect national card schemes. For such a solution to be viable, the pan-European reach of SCT Inst clearing and settlement infrastructure is required.

In the area of card payments processing, an emerging trend towards integration of a growing number of market players can be observed. In particular, merchants, technical service providers and financial technology entities (fintechs), aiming to become more competitive, are extending the scope of their activities by providing additional services (e.g. merchants are implementing payment platforms and offering payment solutions). This movement has resulted in a concentration of larger European players, while smaller national players are being challenged by competition from larger ones. In addition, international players are benefiting from the ongoing standardisation in Europe, enabling them to enter a previously fragmented market and compete with incumbents.

4.2.4 Terminal security domain

As the entry point to the financial system, payment cards and card payment terminals have always needed attention from a security perspective. Whereas payment cards were already subject to harmonised and adequate security standards, terminals did not have a common set of requirements or a harmonised process for their evaluation and certification. The ECSG has worked to further standardise this domain.

The Payment Card Industry Security Standards Council (PCI SSC), originally formed by the main international card schemes, is mainly responsible for managing the Payment Card Industry Data Security Standard (PCI DSS) and sub-standards, against which businesses may measure their own payment card security policies, procedures and guidelines. In the field of terminal security, the PCI PIN Transaction Security/Point of Interaction requirements (PCI PTS POI) are intended to reduce the likelihood of, and limit the consequences of, fraud involving POI devices. Over recent years, terminal manufacturers have gradually been led towards adopting standards to comply with security requirements set by the PCI SSC.

Common Criteria (CC) is an internationally recognised set of standards (ISO 15408) whose objective is to impartially assess the security of computer systems and software. This framework has been born out of a partnership between Canada, the United States and Europe. A certificate issued by the common certification body responsible for certifying that an evaluated product meets the Common Criteria ensures that the evaluated product fulfils particular security criteria. Some features of the Common Criteria standard prevented it from being adopted for payment terminals by the majority of card industry stakeholders; the evaluation process appeared to be costly and cumbersome, in opposition to a “time-to-market” principle.

The Volume now provides a harmonised set of requirements for terminal security and ensures a single process for the evaluation and certification of new types of payment terminals. The Common Criteria standard has been adopted in the United Kingdom and Germany, whereas other countries have opted for the PCI standard. However, for the PCI standard, the security requirements against which a new product or a new technical solution are evaluated in order to obtain approval, should be more inclusive and take more account of the expertise of all PCI SCC members, especially in the field of security.

The Eurosystem acknowledges that work in the area of standardisation is complex, mainly due to the existence of many and sometimes conflicting interests, and that it is a time-consuming process. Progress towards harmonised standards has been observed, and deploying common standards that are able to provide interoperable solutions for the European cards market will be a key factor in achieving a SEPA for cards. To ensure the interoperability of European solutions and that the European payment industry has adequate influence over SEPA card standards, non-proprietary standards are seen as the basis for current and future activities in the area of cards standardisation. However, recent developments, like implementation of the SCT Inst scheme, also deserve special attention, as they may be seen as an opportunity to address standardisation issues using the SCT Inst infrastructure to clear and settle card-based payments.

As a result, the Eurosystem:

- welcomes the implementation of specifications which have been developed through industry-driven standardisation initiatives based on open standards such as ISO 20022 and which are able to provide interoperable solutions in the European cards market;

- supports the work on the potential use of European SCT Inst infrastructure to clear and settle card-based payments in the acquirer-to-issuer domain to foster efficiency and interoperability in the European cards market;

- notes that it is important for stakeholders to remain vigilant as regards terminal security and to continue to work towards common terminal security, evaluation and certification requirements that are in the interest of European stakeholders.

4.3 Latest technologies as a potential factor for further market fragmentation

Until a few years ago, national card schemes benefited from the technological contributions of international card schemes under different types of agreement, such as “grandfathering” (contracts under which the parties agree to share services, such as the provision of technical expertise in return for access to a national network).

More recently, relationships have become more competitive and pressures on national schemes have increased with the development of mobile payment solutions and their different sorts of wallets by international card schemes and other providers, which are then adopted by European issuers. This started with EMV specifications, whose implementation varies significantly according to the scheme’s special features. Indeed, these schemes had different technical approaches from the beginning to overcome production issues, resulting in the development of different kernels that can hardly reach the full range of hardware platforms (processors, operating systems, etc.), thus hindering interoperability.

Although the development of strong customer authentication solutions based on the 3D‑Secure protocol has provided an example of technology transfer from international card schemes to different stakeholders, the market could become very competitive in terms of the diversity of the platforms that will implement the second version of the protocol.

More recently, proprietary payment solutions like Original Credit Transaction (OCT), based on the “push” payment capabilities (credit accounting messages from an issuing bank to an acquiring bank through card infrastructures) relying on existing card payment systems, allow senders to make near real-time payments to beneficiaries for person-to-person (P2P) or business-to-person (B2P) usages. These solutions allow cross-border and cross-payment-instrument transactions (cards, bank accounts, mobile wallet, cash payout) for intra- and, theoretically, inter-scheme transactions or for payments initiated via social networks. Each scheme is developing its own solution with different market players (banks, merchants, social networks, etc.) without considering interoperability issues. Consideration should be given to whether this type of transaction is to be seen as a credit transfer in a legal sense, even if it is made under the rules of a card payment scheme. As previously mentioned, it is of the utmost importance for the business model adopted to be clear to all players involved, including end-users.

Regarding contactless payments, in its latest report[24] the ECSG records the growing use of contactless card payments and raises concerns regarding the multiplicity of kernels[25]. In order to reduce the complexity of contactless acceptance, the ECSG analysed the possibility of converging either to one single existing kernel (out of over seven kernels available on the market) or to the EMV 2nd Gen, which is likely to require large investments and an implementation period of several years. Regarding migration to one of the existing single kernels as an interim solution, the disadvantages would largely outweigh any benefits. Therefore, the ECSG recommended pushing the industry to proceed with a joint plan for the EMV 2nd Gen in the long term.

On the contactless issuing specification side, the two initiatives, namely CPACE and PURE, are making specifications available to the market (in one case subject to a licensing agreement), showing that open initiatives are possible. According to the ECSG, after agreement between the card/mobile application owner and the kernel owner, any existing EMVCo kernel can now be configured to ensure the acceptance of the card/mobile application.

Tokenisation is another example of technology that may allow players to indirectly impose their proprietary solution. This is a new technology that raises the security of card-based payments by replacing the primary account number (PAN) with a value which can only be used in a controlled way (the token). This enables the safe storage of payment card details in mobile wallets, wearables, merchant checkout systems and Internet of Things payment solutions. A tokenised PAN cannot be used outside its original context, such as a specific mobile wallet or specific merchant. However, in order to enable financial transactions to be processed in the interbank domain, the tokenised card details have to be translated back to the PAN. At the moment, this service is mainly offered by international card schemes, while it should be provided by several scheme-independent token service providers in order to maintain competitiveness. However, further analysis is needed to better understand tokenisation practices in the cards market.

The payments market is becoming more competitive and innovative, with players wishing to develop efficient and appealing solutions to attract users and reduce costs. In this context, it can be expected that initiatives for technology sharing will come up against the economic interests of the various players. It seems that, although market players show a willingness to collaborate, competition is increasing, especially for the latest innovations. The Eurosystem acknowledges that innovation which improves the efficiency of the cards market and leads to convenient and secure solutions is, after integration, the second major driver of change, provided that common and open standards are used by payment service providers when setting up new solutions. This will enable interoperability with other solutions and ensure pan-European reachability, while the use of the core SEPA schemes will allow the achievement of European independence.

As a result, the Eurosystem:

- welcomes the activities of payment service providers aimed at delivering innovations to increase the efficiency, convenience and security of card payments for payment service users;

- notes that it is important that all card schemes support tokenisation, including by third party processors;

- notes that, to avoid further fragmentation in the cards market, innovations need to be based on common standards and preferably also on European (instant) credit transfer schemes;

- welcomes the further activities of European stakeholders aimed at providing innovative payment solutions in a harmonised way (e.g. in terms of standards and security) to achieve European independence.

5 Direction of innovations

5.1 Agents of innovation

Considering the rapid development of the payments landscape and other financial innovations in recent years, innovation seems to be key to maintaining or improving the competitiveness of cards within the broader payments market. In recent years, innovation relating to cards has been mainly headed by card schemes. However, this trend seems to be about to shift in the coming years, as new players have emerged in the payments market, spurred by financial innovation and the new regulatory environment driven by the PSD2. In the near future, innovation will contribute to broader acceptance of cards involving issuers and acquirers, but innovation might also spur alternatives to the existing card schemes.

All participants in the payment chain, both new and traditional players, may incorporate innovation through new services and products, and foster it within the EU payments market. Using rapid progress in technology, market players ultimately drive payment innovations, which need to meet customer expectations in order to be adopted. For example, the ubiquity of the smartphone and other mobile devices created strong demand for payment systems that could integrate with these. The majority of use cases so far have involved the application of new technologies to traditional products or services, as opposed to using those technologies to create entirely new products.

However, when dealing with innovations, the security implications must always be taken into account. Even though some initiatives may enable additional acceptance for card payments, a downgrade in the level of security must be avoided. Innovation must not hamper current security and guarantees of current payments.

5.2 Main drivers of innovation in the European cards market

In the market consultation, five key factors were identified as either fostering or hampering innovation in the European cards market.

- Business priorities: As previously stated, different stakeholders located along the card payments value chain will certainly participate in the innovation process that is currently affecting the whole financial sector and, more specifically, the payments market. Their ability to innovate might be affected by their physical location, the category they belong to (e.g. payment service providers, technological companies, merchants, etc.) and their size, due to the substantial resources needed to make investments.

- Security and fraud risk management: Most new features that have been launched in recent years seek to add security and fraud risk management measures. Successful cases of innovation relating to security and fraud issues include EMV chip cards, which provide strong two-factor authentication and counterfeit protection, and 3D Secure, which increases transaction security for e-commerce. One of the elements of strong customer authentication under PSD2 is the verification of a customer using biometric features (e.g. fingerprints, iris and facial recognition).

- Efficiency and customer convenience: Customer convenience and the need to improve customer experience at the point of interaction becomes a driver for any market player, as providing a better service (customer experience) could reduce payment friction, generate greater customer loyalty and attract new customers.

- Increasing competition from non-card payment instruments (e.g. instant payments): Financial innovation has developed technical solutions which enable new payment methods, such as those started from a smartphone through a digital wallet or based on an instant payment. Such competition is also being assisted by legislation (i.e. the PSD2), which is opening up the market by including under the regulatory framework new actors, such as payment initiation service providers (PISP) and account information service providers (AISP). Both new payment methods and new entrants impact the card payments market directly, as they could potentially take market share from traditional cards. Moreover, new market infrastructures for processing SCT Inst, such as the launch of the TARGET instant payment settlement (TIPS) service, might also affect this scenario.

- Mobile wallets using cards as the underlying instrument: The use of smartphones to perform payment transactions using card-based mobile wallets as the underlying instrument is spreading rapidly. However, the overall usage is still low, as it is limited by the necessary technological deployment of devices capable of accepting this type of proximity payment. There is the potential that the market will progressively move from plastic to mobile-based solutions in the coming years, which could allow cards to maintain a significant role in the payments market or even boost card-based payments using new form factors.

5.3 Implications of innovation trends for card payments

There are at least two general considerations that should be made when trying to analyse the future implications of current innovation trends for card payments. The first is the risk in terms of further fragmentation arising from technological developments and the second is the opportunities emerging from such innovation.

Considering that innovation is driven by various stakeholders involved in the payments ecosystem through individual or joint initiatives, when it comes to a SEPA for cards, innovation could become a challenge for interoperability. There are plenty of innovations which are usually deployed first at the local or regional level, potentially causing a high degree of fragmentation in each market and at European level before, eventually, consolidated solutions emerge. Making such fragmented innovations interoperable adds complexity, which must be taken into account in order to achieve a harmonised European market. Some respondents to the market consultation also pointed out that solutions developed by global players could discourage local and European initiatives.

Fragmentation could also arise from technological developments that are not homogenously spread throughout SEPA. It has already been noted in Chapter 4 that efforts are being made to increase standardisation in the market. These collaborative efforts are constantly challenged by innovative solutions and by competition itself. This issue was already addressed in the 2014 card report and is an important objective of the ECSG. Promotion of the smooth operation of payment systems is one of the Treaty tasks of the European System of Central Banks (ESCB) to be carried out via the Eurosystem. In carrying out this task, the Eurosystem aims to ensure pan-European reach or, at least, interoperability of card payment solutions. Although this might not be an initial priority for start-ups that develop in national environments, any new solutions should be designed with the potential for pan-European reach in mind.

Despite the aforementioned fragmentation risks, innovation is often considered to be one of the most competitive factors in open markets. Innovations which share a common interest, like security features providing confidence in the payments market, have in the past been driven by cooperative projects involving payment market players (such as EMV) and have been a major driver of card payments growth and ubiquity. Other payment solutions, such as instant payments at the point of sale, may also increase competition, encouraging the payments market to become more efficient and interoperable. However, current card payments in the EU are clearly dominated by international schemes that also lead innovation in this sector. Although this might mean improvements in payment efficiency and security, it must be closely monitored by policymakers to prevent a lock-out effect for smaller players or newcomers, which might be forced into co-badging to access the market, and to ensure that the interests of European market players are adequately reflected.

Proportionate regulation is key when it comes to fostering competition between traditional and new actors, so as to guarantee a level playing field. Competition in an environment based on novelty and technology depends heavily on capital. It can be difficult for small players starting in national markets to achieve a critical size in order to survive.

Innovations have been transforming the cards market and payments market in general. The Eurosystem welcomes innovative solutions that enable efficient, convenient and secure card payments. The Eurosystem stresses the importance for innovative payment products and services not to reintroduce fragmentation into the European cards market. While it is comprehensible for innovative solutions to appear and focus on regional markets initially, the Eurosystem emphasises the need for solutions to have the potential to extend their acceptance to the pan-European level or to become interoperable with other solutions, using commonly accepted, international standards. The emergence of fragmented national solutions needs to be avoided.

As a result, the Eurosystem:

- invites cards market participants, such as payment service providers and card schemes, to develop new products and strategies based on common and open standards with a pan-European perspective, focusing on an interoperable-by-design attitude that should benefit from faster access to economies of scale, and would welcome all relevant stakeholders becoming familiar with and actively involved in the work of standardisation bodies when developing new solutions;

- welcomes the development of innovative solutions that offer EU-wide capabilities/acceptance or interoperate with existing local initiatives, even if they are not specifically card-related solutions;

- stresses the importance that innovations in card payments should not lead to fragmentation in the cards market or the broader payments market.

6 Conclusion

Payment cards are perceived as an efficient and convenient way of making retail payments. Therefore, it comes as no surprise that they are the most widely used and the fastest-growing electronic payment instrument in Europe. However, the differences between cards usage in the various European countries is strikingly high and the percentage of cross-border card payment transactions is still relatively low in volume terms. This observation indicates that there is still vast potential for cards usage growth, both within many individual countries and across European borders. The cross-border acceptance of cards issued under national card payment schemes could contribute to achieving the SEPA for cards “any card at any terminal” objective, and foster a further take-off of card payments in Europe. So far, despite significant efforts by the industry in recent years, this aim has not been achieved and cross-border acceptance relies on co-badging with international card payment schemes.

Technological innovations, combined with new legislation that spurs competition among stakeholders, have influenced and will continue to influence the landscape of card payments in Europe. These developments have large-scale effects in the fields of (i) security, with the appearance of not yet mature solutions on the market that may impose a security risk for users; (ii) sovereignty, with the increasing adoption of payment solutions from non-European market players; and (iii) market integration, with the risk of fragmentation of the European market due to the emergence of proprietary local solutions that do not allow pan-European reach. European innovations improve the efficiency of the market and lead to new, more versatile and secure services for users. Therefore, the use of European SCT Inst infrastructure for the clearing and settlement of card payments could be, amongst other possibilities, a solution to ensure the pan-European reach of national schemes at a potentially low cost and to increase efficiency in the European cards market. At the very least, using interoperable or common clearing and settlement SCT Inst infrastructure for card payments and interlinking national card schemes and processing entities has the potential to increase efficiency and competition.

New entrants and new payment services may considerably affect the traditional card payments business model. In particular, new payment services and instant payment solutions, combined with innovative channels such as mobile phones and wearables, might diminish cards’ share of the payments market. In this increasingly competitive market, only payment solutions providing efficient services at competitive prices for customers and merchants will manage to attract new users.

Therefore, cooperation between incumbents and new market entrants is key to developing the missing elements of a SEPA for cards and for preventing fragmentation of the European single market. Innovative and standardised industry-driven solutions based on open standards could enable pan-European reach of (card) payment products and services and ensure European technological independence.

Over recent years, the Eurosystem has monitored developments in different areas of the cards market and facilitated the activities of relevant stakeholders, while promoting and extending cooperation where possible. In order to address the issues identified and help the market to achieve a harmonised, competitive and innovative European card payments area, as envisaged in a SEPA for cards, the Eurosystem will continue to pursue its activities to facilitate dialogue among market players and will continue to provide support for their activities in line with the aforementioned objectives. Nonetheless, SEPA for cards is market-driven, so only the ambition and determination of relevant market players will bring about a harmonised, competitive and innovative European cards market in which they will be able to maintain their strategic influence.

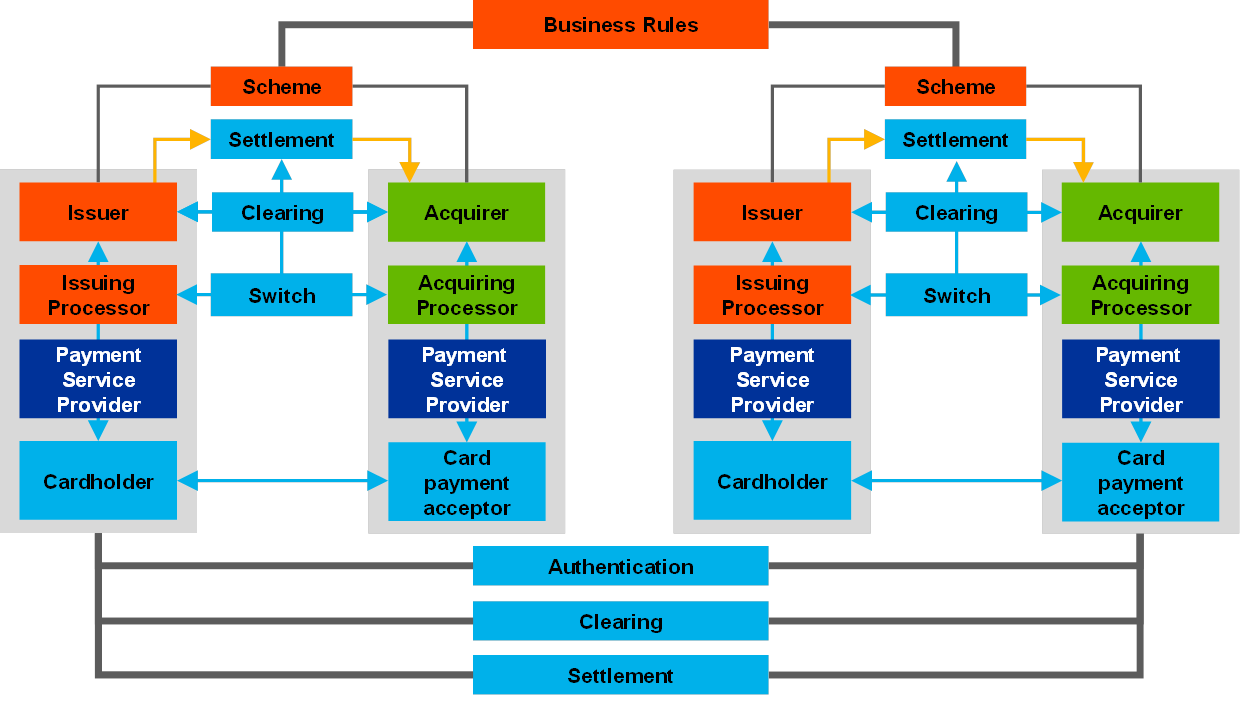

Annex: Interoperability of card payment schemes

Interoperability can be defined from a technical and a business perspective. Both types of interoperability are necessary for national scheme cards to be accepted on a cross-border level.

Technical interoperability refers to reachability in enabling transactions to be exchanged from a payment terminal through an acquirer via one or more switches to the issuer of the payment card (or wallet, mobile, etc.) in order to authorise the transaction. Additionally, interoperability must be arranged for the processing of clearing messages and the execution of financial settlement between the parties.

Business interoperability defines the arrangements to be made between different stakeholders in processing transactions. These arrangements are implemented both within international and national payment schemes and between schemes or between participants within different schemes when these are interlinked. This could be seen as interlinking arrangements between schemes (as shown in Chart A.1), possibly through a separate legal entity that arranges the operational, financial and legal issues between national schemes and their participants. This has proven to be complex to arrange, requiring common message formats, operational exchange of messages, exception handling and financial settlement.

Interlinking arrangements

Source: ECB.

Important elements that have to be put in place to achieve business interoperability include:

- inter-scheme rules that determine liability for transactions in cases of disputes or fraud. These rules relate to the application of strong customer authentication and transaction risk analysis and possible further rules on transaction acceptance. Arbitration should be available when individual participants (issuers, acquirers) are not able to agree;

- a clearing model that defines how transactions can be cleared between acquirers and issuers in different formats. As an alternative, card-based transactions can be cleared via the SEPA direct debit (SDD) infrastructure, as specified in the SEPA Cards Clearing model of the Berlin Group,[26] or using SEPA credit transfer (SCT) infrastructure or SCT Inst infrastructure;