Published as part of the Financial Stability Review, May 2022.

Since the middle of last year, global investors have stepped up their scrutiny of risks emanating from China as it experiences rising defaults and a slowing economy.[1] In the past, spillovers from China to other financial markets were typically judged to be small,[2] reflecting China’s less developed financial markets, a largely closed capital account regime, a managed exchange rate and a relatively small share of foreign investors in the domestic market. Yet China’s footprint in the global economy has grown rapidly over recent years, while domestic financial markets have deepened and integrated more with global capital markets.[3] This box looks at how Chinese macro risk shocks identified from movements in Chinese and US asset prices can affect global and European financial markets.

This box takes a two-step approach to quantify the importance of China-specific shocks for global financial markets. The first step involves applying a structural Bayesian vector autoregression (BVAR) model using daily financial market data from 2017 to 2021 to disentangle the drivers of movements in US and Chinese financial markets.[4] The five structural shocks – Chinese macro risk and monetary policy shocks, US macro risk and monetary policy shocks, and global risk shocks – are identified using sign restrictions[5] and relative magnitude restrictions in the spirit of the recent literature.[6] The second step entails assessing the effects of shocks originating in China on global financial markets using panel local projections[7] in a sample of advanced and emerging economies.

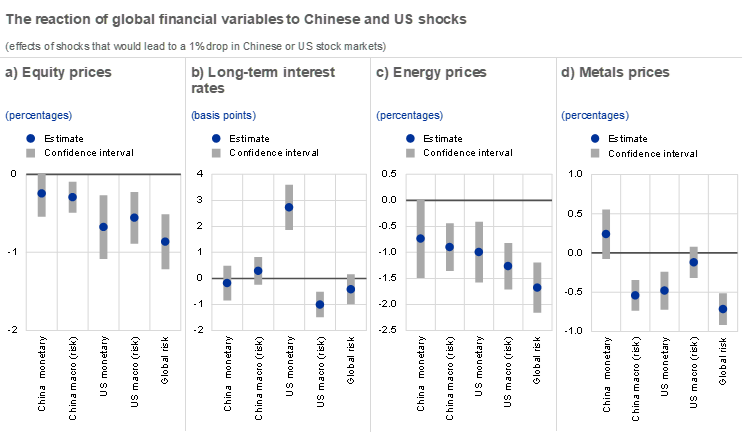

Chart A

Shocks originating in China have a modest impact on core financial markets, but a larger impact on commodity markets

Sources: Haver Analytics, Bloomberg Finance L.P., Refinitiv and ECB calculations.

Notes: Panels a) and b) show the (same-day) impact of structural shocks on financial market prices in a sample of 30 advanced and emerging economies. Panels c) and d) show the impact on commodity price indices. To make it easier to compare results, the impulse response function to Chinese shocks is scaled to represent the effect of a shock that would lead to a decline of 1% of China’s stock market capitalisation. Similarly, the responses to US and global risk shocks are scaled to represent the effect of a shock that would lead to a decline of 1% of the S&P500 equity price index. For all countries in our sample, equity prices refer to the spot domestic stock market indices, while long-term interest rates refer to long-term yields on government bonds with five- or ten-year maturity, depending on data availability. Energy prices and metals prices refer to the S&P GSCI Energy Index and Industrial Metals Index. The S&P GSCI Spot Index is calculated using the most recent prices for liquid commodity futures contracts and world production weights.

The empirical evidence suggests that shocks emanating from China have a noticeable effect on global financial markets, although the impact is smaller than in case of shocks originating in the United States or global risk shocks. Global equity prices respond significantly to Chinese macro risk shocks. However, the impact is roughly half of the effect of shocks stemming from the United States and a third as large as after global risks shocks (Chart A). At the same time, shocks in China are associated with a much more modest impact on global bond markets.

By contrast, shocks originating in China have larger spillover effects on commodity markets, which in some cases are even larger than those of shocks originating in the United States. This is consistent with the major role played by China in the demand for global energy and non-energy commodities. For example, China consumes a similar amount of energy goods to the United States and yet a significantly higher share of global non-energy commodities (such as metals).[8] This suggests that a shift in the outlook for the Chinese economy could expose firms in commodity-related industries to increasing financing costs, making it harder for them to secure or roll over debt.

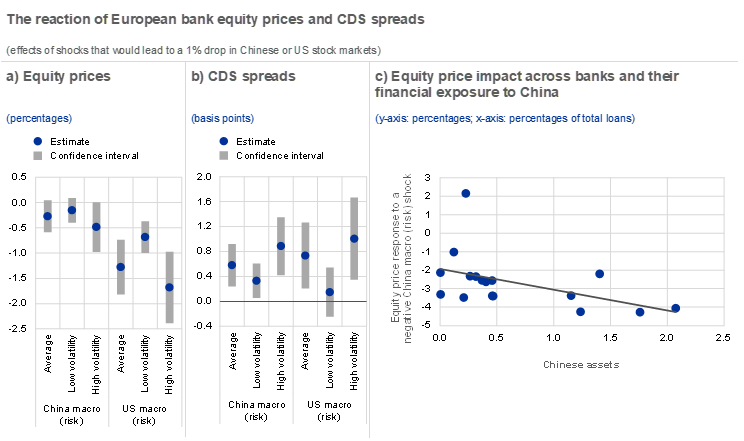

Shocks from China also affect European bank valuations, with a greater impact when general market conditions are more volatile. While, on average, the effects on European banks from Chinese macro risk shocks appear modest (Chart B, panel a and panel b), the impact is more pronounced during periods of high market stress. Moreover, there is some evidence to suggest that banks with higher exposure to China are likely to see their equity prices react more heavily to negative Chinese macro risk shocks (Chart B, panel c).

Chart B

Shocks from China also affect European bank valuations, with larger effects during periods of heightened market volatility

Sources: Bloomberg Finance L.P., Refinitiv and ECB calculations.

Notes: Panels a) and b) show the (same-day) impact response of equity prices and five-year CDS spreads of EU banks to structural shocks from local projections. The responses are scaled to represent the impact of Chinese (US and global shocks) shocks that would knock 1% off Chinese (US) equity prices. The grey bars indicate the 95% confidence intervals based on corrected Driscoll-Kraay standard errors. Panel c) shows the individual response of a bank’s equity price to a positive Chinese macro (risk) shock that would knock 1% off Chinese stock market capitalisation relative to the bank’s exposure to China as a share of total assets.

All in all, the analysis suggests that macro risk shocks originating in China can have a material impact on global financial markets in specific asset classes such as equities and commodities. This is particularly true when such shocks hit in a time of heightened global volatility. China’s policy paradigm has shifted from a tightly controlled system towards a more market-based mechanism with ongoing efforts to allow market forces to play a greater role in the functioning of credit and forex markets. Consequently, its impact on global financial markets will continue to catch up with its role in the global economy[9], increasing the country’s importance for euro area financial stability. This calls for close monitoring of developments in China from the perspective of both financial market liberalisation and economic growth.

See Box 4 entitled “Downside Risks from Property Developer Stress”, Staff Report, International Monetary Fund, January 2022.

See Arslanalp, S. et al., “China’s Growing Influence on Asian Financial Markets”, IMF Working Papers, No 2016/173, International Monetary Fund, 2016, which documents how spillovers from China to Asian equity markets have increased during the period since the global financial crisis, though they remain lower than those from the United States.

However, the foreign ownership of the Chinese onshore bond market remains relatively low, accounting for around 4% of the total market.

The sample starts in 2017 in order to focus the analysis on a period when China’s policy paradigm shifted closer to a market system after interest rates were broadly liberalised by 2015. Since then, efforts have been made to increase the flexibility of the renminbi.

The estimations are made using the BEAR toolbox – see Dieppe et al., “The BEAR toolbox”, Working Paper Series, No 1934, ECB, 2016. For China and the United States, accommodative monetary policy shocks are assumed to lower domestic yields and boost equities, while a favourable macro outlook is assumed to boost both yields and equities. Chinese shocks are separated from US shocks based on assumptions that shocks in both countries have a larger impact on domestic yields than foreign yields. In addition, the safe-haven role of the US dollar is used to identify a global risk shock, similar to Brandt et al., “What drives euro area financial market developments? The role of US spillovers and global risk”, Working Paper Series, No 2560, ECB, 2021.

See Brandt et al., op. cit.

The panel local projections regress changes in financial market prices on the estimated shocks, lags of the dependent variable, a series of controls (the VIX and the US and Global Citigroup Economic Surprise Index) and country fixed effects. Regressions for commodity prices use a similar specification, but in a time-series context.

According to the OECD Trade in Value Added database, in 2015 final demand for energy goods as a share of world value added stood at around 17% in China and 18% in the United States, while the final demand for non-energy goods as a share of world value added was 24% in China compared with only 12% in the United States.

In 2021 China accounted for 19% of global output, whereas the share of the renminbi in various measures of international use remains low.