- PRESS RELEASE

Monetary developments in the euro area: July 2022

26 August 2022

- Annual growth rate of broad monetary aggregate M3 decreased to 5.5% in July 2022 from 5.7% in June

- Annual growth rate of narrower monetary aggregate M1, comprising currency in circulation and overnight deposits, decreased to 6.7% in July from 7.2% in June

- Annual growth rate of adjusted loans to households stood at 4.5% in July, compared with 4.6% in June

- Annual growth rate of adjusted loans to non-financial corporations increased to 7.7% in July from 6.9% in June

Components of the broad monetary aggregate M3

The annual growth rate of the broad monetary aggregate M3 decreased to 5.5% in July 2022 from 5.7% in June, averaging 5.7% in the three months up to July. The components of M3 showed the following developments. The annual growth rate of the narrower aggregate M1, which comprises currency in circulation and overnight deposits, decreased to 6.7% in July from 7.2% in June. The annual growth rate of short-term deposits other than overnight deposits (M2-M1) increased to 3.3% in July from 2.0% in June. The annual growth rate of marketable instruments (M3-M2) decreased to -1.4% in July from 2.0% in June.

Chart 1

Monetary aggregates

(annual growth rates)

Looking at the components' contributions to the annual growth rate of M3, the narrower aggregate M1 contributed 4.8 percentage points (down from 5.2 percentage points in June), short-term deposits other than overnight deposits (M2-M1) contributed 0.7 percentage points (up from 0.5 percentage points) and marketable instruments (M3-M2) contributed -0.1 percentage points (down from 0.1 percentage points).

From the perspective of the holding sectors of deposits in M3, the annual growth rate of deposits placed by households stood at 4.2% in July, compared with 4.1% in June, while the annual growth rate of deposits placed by non-financial corporations increased to 6.1% in July from 5.8% in June. Finally, the annual growth rate of deposits placed by non-monetary financial corporations (excluding insurance corporations and pension funds) decreased to 11.7% in July from 12.0% in June.

Counterparts of the broad monetary aggregate M3

As a reflection of changes in the items on the monetary financial institution (MFI) consolidated balance sheet other than M3 (counterparts of M3), the annual growth rate of M3 in July 2022 can be broken down as follows: credit to the private sector contributed 5.0 percentage points (down from 5.1 percentage points in June), credit to general government contributed 2.9 percentage points (down from 3.5 percentage points), longer-term financial liabilities contributed 0.1 percentage points (up from 0.0 percentage points), net external assets contributed -1.5 percentage points (down from -1.4 percentage points), and the remaining counterparts of M3 contributed -1.0 percentage points (up from -1.4 percentage points).

Chart 2

Contribution of the M3 counterparts to the annual growth rate of M3

(percentage points)

Data for contribution of the M3 counterparts to the annual growth rate of M3

Credit to euro area residents

As regards the dynamics of credit, the annual growth rate of total credit to euro area residents decreased to 5.8% in July 2022 from 6.2% in the previous month. The annual growth rate of credit to general government decreased to 7.0% in July from 8.5% in June, while the annual growth rate of credit to the private sector stood at 5.2% in July, unchanged from the previous month.

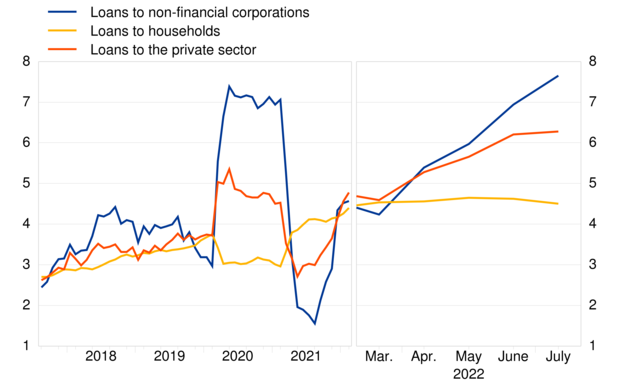

The annual growth rate of adjusted loans to the private sector (i.e. adjusted for loan sales, securitisation and notional cash pooling) stood at 6.3% in July, compared with 6.2% in June. Among the borrowing sectors, the annual growth rate of adjusted loans to households stood at 4.5% in July, compared with 4.6% in June, while the annual growth rate of adjusted loans to non-financial corporations increased to 7.7% in July from 6.9% in June.

Chart 3

Adjusted loans to the private sector

(annual growth rates)

Data for adjusted loans to the private sector

Notes:

- New reporting requirements under Regulation (EU) 2021/379 of the European Central Bank of 22 January 2021 on the balance sheet items of credit institutions and of the monetary financial institutions sector (ECB/2021/2) came into force with effect from the January 2022 reference period. The implementation of the new Regulation, together with other changes to the statistical reporting framework and practices in euro area countries, may result in revisions to preliminary data in subsequent press releases.

- Data in this press release are adjusted for seasonal and end-of-month calendar effects, unless stated otherwise.

- "Private sector" refers to euro area non-MFIs excluding general government.

- Hyperlinks in the main body of the press release and in annex tables lead to data that may change with subsequent releases as a result of revisions. Figures shown in annex tables are a snapshot of the data as at the time of the current release.

Banc Ceannais Eorpach

Stiúrthóireacht Cumarsáide

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, an Ghearmáin

- +49 69 1344 7455

- media@ecb.europa.eu

Ceadaítear atáirgeadh ar choinníoll go n-admhaítear an fhoinse.

An Oifig Preasa-

26 August 2022