Published as part of the ECB Economic Bulletin, Issue 2/2023.

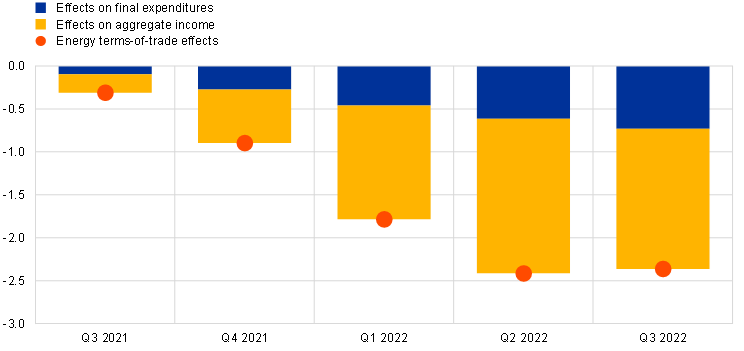

The recent surge in euro area energy prices led to a significant deterioration in the energy terms of trade. This deterioration (defined as the ratio of export to import prices) induced a cumulative loss of 2.4 percentage points of GDP between the third quarter of 2021 and the third quarter of 2022, the largest five-quarter loss on record since the launch of the euro (Chart A, red dot).[1] So how did this loss spread across households and firms? To assess the uneven impact of the recent rise in the price of imported energy in the euro area, this box takes a two-step approach. First, it uses disaggregated data to disentangle the effects of the recent energy terms-of-trade deterioration on final expenditures and aggregate income, allocating the implied purchasing power losses across the household income distribution. Second, the box uses structural models to identify the energy price shock underlying the recent terms-of-trade deterioration and to gauge its direct, indirect and second-round effects on the overall economy.[2] Throughout the box, variables are expressed in nominal terms.

Chart A

Energy terms-of-trade effects on GDP

(cumulative changes, percentage points of GDP)

Sources: Eurostat and ECB calculations.

Notes: The energy terms-of-trade effects are calculated by weighting export and import energy price changes by the share of exports and imports of energy in GDP (all in nominal terms). The effects on final expenditures and aggregate income are further separated using disaggregated information from annual input-output tables on the import content of expenditures. Specifically, the import contribution of the energy terms of trade is first decomposed based on the share of energy imports for private consumption, government consumption, total investment, inventories and intermediate inputs out of total energy imports. The effects on final expenditures are the negative of the sum of import contribution of private consumption, government consumption, total investment and inventories. The effects on aggregate income are the difference between the export contribution and the import contribution of intermediate inputs. The latest observations are for the third quarter of 2022.

The energy terms-of-trade effects reflected a loss in aggregate income and, to a lesser extent, a surge in final expenditures for private consumption. The effects of rising energy prices and subsequent changes in the terms of trade on GDP are calculated as the difference between the impact on exports of domestic energy and the impact on imports of foreign energy for intermediate inputs and final expenditures. As higher final expenditures for energy also raise GDP, the effects of rising energy prices on GDP through final expenditures cancel out in net terms. Hence, the net impact on exports and imports through intermediate inputs measures the remaining effect on aggregate income. Owing to the lack of granular quarterly data, these effects through expenditures and income can be disentangled only with disaggregated information from annual input-output tables that show the energy import content of expenditures.[3] On this basis, the energy terms-of-trade loss from the third quarter of 2021 to the third quarter of 2022 was reflected in lower aggregate income by 1.7 percentage points of GDP and in higher final expenditures by 0.7 percentage points of GDP (Chart A, bars), almost entirely due to private consumption.[4]

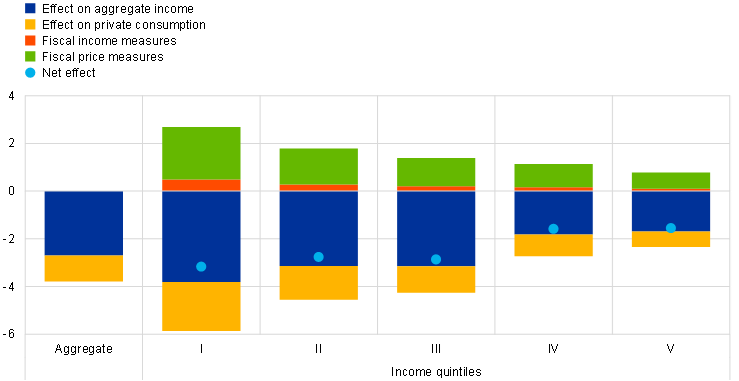

Households’ different exposures to fluctuations in energy costs and aggregate income imply a relatively larger impact of the energy price surge on lower-income households. Energy exposures vary significantly across income groups, as households in the bottom quintile spend 12% of their disposable income on electricity, gas and heating, while households in the top quintile spend only 4%. Income elasticity also differs significantly across households, as labour income is less cyclical and represents the main source of income for lower-income households, while non-labour income is more cyclical and mainly affects higher-income households.[5] Combined with the effects on private consumption and aggregate income from the analysis above, these energy exposures and income elasticities indicate that, as a share of their income, households in the bottom quintile experienced purchasing power losses twice the size of those in the top quintile between the third quarter of 2021 and the third quarter of 2022 (Chart B). Together with the relatively thin liquidity buffers of lower-income households,[6] this points to the conclusion that these households bore the brunt – relative to their income – of the energy price surge, despite fiscal measures providing some relief.[7]

Chart B

Household net effects of the change in energy terms of trade resulting from the recent energy price shock

(cumulative change between third quarter of 2021 and third quarter of 2022, percentage points of disposable income)

Sources: Eurostat and ECB calculations.

Notes: The energy terms-of-trade effects on household consumption and aggregate income were calculated on the basis of Eurostat’s latest FIGARO input-output tables. The expenditure effects and the fiscal measures are allocated by using the share of disposable income spent on imported energy, based on information from the experimental statistics on income, consumption and wealth. The aggregate income effects reflect the exposure of households across the income distribution to labour income (wages) and non-labour income (profits, property income and self-employed income), based on information from the experimental statistics on income and consumption from social surveys and national accounts. Net effects refer to the overall impact on aggregate income and private consumption, net of the effects of (income and price) fiscal measures.

Structural models can be used to assess the overall impact of the energy price shock, going beyond the observed effects through the energy terms of trade. The energy terms of trade are only a first gauge of the impact of energy price shocks for two reasons: first, they react to many other shocks, and second, they are only one of several channels through which energy price shocks propagate. In what follows, structural economic models are used to assess the direct, indirect and second-round economic effects of the recent energy price shock on the overall economy. First, a production network model is used to disentangle the direct and indirect effects of the shock through global supply chains in the presence of a limited input elasticity of substitution.[8] Structural vector autoregression (SVAR) models then estimate the overall impact of the shock based on historical regularities, taking into account second-round effects arising from changes in agents’ behaviour, price and wage formation and policy actions.[9]

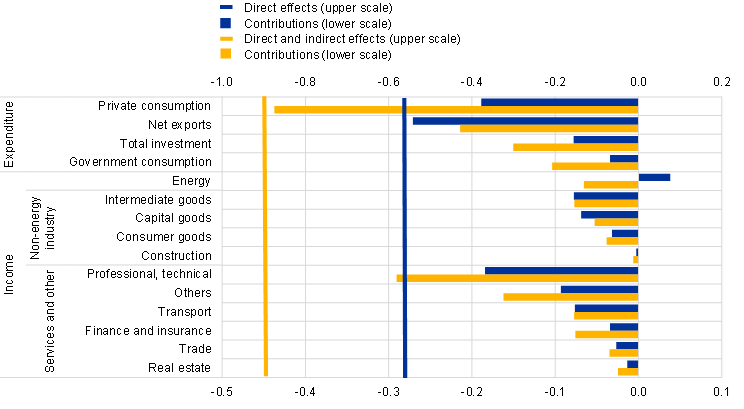

The production network model shows that the direct and indirect effects mainly impacted private consumption on the expenditure side and non-energy sectors on the income side. The direct effects – reflecting the impact on prices and quantities induced by the sectoral exposures to non-euro area energy – weighed on net exports through higher energy imports on the expenditure side and favoured the energy sector through higher sales on the income side (Chart C). However, the indirect effects – including the full pass-through of energy prices and substitution away from expensive energy goods – especially hit private consumption on the expenditure side. Furthermore, these indirect effects induced losses, particularly for non-energy companies on the income side, notably energy-intensive sectors, such as intermediate goods and transport services, and central sectors, such as professional and technical activities. Overall, the production network model shows that indirect effects amplified the direct effects by about half, from -0.6 to -0.9 percentage points of GDP (Chart C, solid lines), between the third quarter of 2021 and the third quarter of 2022.[10]

Chart C

Direct and indirect effects of the recent energy price shock on the overall economy

(cumulative change between third quarter of 2021 and third quarter of 2022, percentage points of GDP)

Sources: Eurostat and ECB calculations.

Notes: The direct and the indirect elasticity of the different components to imported energy supply shocks is based on a production network model with data between the third quarter of 2021 and the third quarter of 2022. The sector aggregation reflects Eurostat's end-use categories (Main Industrial Groupings, MIGs), based on the NACE2 classification, with adjustments depending on the sector breakdown available in FIGARO industry-by-industry world input-output tables. In particular, “Energy” refers to sectors B, C19, D35, E36, “Consumer goods” to C10-C12, C13-C15, C18, C21, C31-C32, “Intermediate goods” to C16, C17, C20, C22, C23, C24, C27, “Capital goods” to C25, C26, C28, C29, C30, C33, “Construction” to F, “Trade” to G45, G46, G47, “Transport” to H49, H50, H51, H52, H53, “Finance and insurance” to K, “Real estate” to L, “Professional, technical” to M69-M70, M71, M72, M73, M74-M75, N77, N78, N79, N80-N82, “Others” to the remaining sectors.

The econometric models suggest that the overall impact was widely spread across expenditure components and mainly felt through profits on the income side, while the government partially shielded private sector disposable income. Looking at the income breakdown of GDP, the shock inflicted substantial losses on profits and, to a lesser extent, labour income from the third quarter of 2021 to the third quarter of 2022 (Chart D). Labour income losses were mainly driven by changes in employment, suggesting a more buoyant increase in employment in the absence of the energy price shock over the same period. The results also suggest that public sector intervention played a significant role in cushioning the negative impact on the private sector. This is reflected in the substantial loss in the disposable income of governments relative to that of households and firms. On the expenditure side, the overall loss of GDP was attributable to all expenditure components, and in particular to private consumption, followed by business investment. Compared with the direct and indirect effects above (Chart C), these results suggest that second-round effects significantly altered the distributional consequences of the energy price shock on the expenditure side, spreading the effects more evenly across private consumption and investment. The SVAR models point to the recent price energy shock having an overall impact of ‑1.5 percentage points of GDP from the third quarter of 2021 to the third quarter of 2022 (Chart D, solid line).

Chart D

Overall effects of the recent energy price shock on the general economy

(cumulative change between third quarter of 2021 and third quarter of 2022, percentage points of GDP)

Sources: Eurostat, Baumeister et al., Wu and Xia, ECB and ECB calculations.

Notes: The chart shows SVAR model-based results of the effects of the recent energy price shock for three different decompositions of nominal GDP. Specifically, for each breakdown, the models estimate the impact of the recent energy price shock on GDP and its components. The impact on the components is then rescaled by their average share of GDP over the sample period. The contribution of indirect taxes, the rest of the world (the global economy outside the euro area) and net exports is calculated as the residuals between the total GDP effects and the sum of the estimated contributions of the modelled components. For the sake of exposition, the GDP effects are averaged across the models, with the contribution of components scaled accordingly. The models identify an energy price shock by assuming that the shock leads to an increase in the energy import-related income losses for the euro area and a decline in real GDP as well as an increase in the GDP and private consumption deflators, with the latter increasing more than the former. Since the variables from the expenditure or income side of GDP and sectoral disposable income are not constrained in the estimations, the direction and magnitude of these responses are determined by the data. For details on the model variables, see footnote 9. “Profits” refers to gross operating surplus and mixed income, while “Business investment” refers to non-construction investment.

Overall, this box finds that the recent energy price shock weighed especially on lower-income households and non-energy companies, despite support from governments. The box highlights the key role of disaggregated data for assessing and quantifying the effects of the change in the energy terms of trade on final expenditures and aggregate income. Moreover, the analysis indicates that indirect and second-round effects largely shaped the distributional implications of the recent energy price shock. Despite a moderation of energy price pressures in recent months, the effects of the recent energy price shock may continue to unfold in the near term as the economy gradually adjusts.

For details on the calculation of the terms of trade, see the box entitled “Implications of the terms-of-trade deterioration for real income and the current account”, Economic Bulletin, Issue 3, ECB, 2022.

The direct effects are the result of an immediate link between the specific expenditure/income components and imported energy, while the indirect effects capture the transmission of the energy price shock via the production and distribution chain. Second-round effects occur when agents change their consumption or investment behaviour in response to the shock or pass on the energy price effects to wage and price setting, depending on broader economic, institutional or policy features. The taxonomy of the different effects on the overall economy mirrors the taxonomy of the different effects of energy price hikes on inflation. See, for example, the box entitled “Wage share dynamics and second-round effects on inflation after energy price surges in the 1970s and today”, Economic Bulletin, Issue 5, ECB, 2022.

The energy import content is calculated based on Eurostat’s FIGARO world input-output (sector-by-sector) tables between 2010 and 2020. Import and export data for the euro area account for intra- and extra-euro area flows, in line with the national accounts concept. The expenditure breakdown is composed of private (including households and non-profit institutions) consumption, government consumption, total investment (including inventories), exports and imports. The quarterly time series are obtained via linear interpolation (up to 2020) and constant extrapolation (before 2010 and after 2020) of the annual time series.

The relative composition of domestic expenditures on imported energy between final expenditures and intermediate inputs is consistent with findings reported for oil in the box entitled “Oil prices, the terms of trade and private consumption”, Economic Bulletin, Issue 6, ECB, 2018.

The quintile-specific income elasticities are obtained by multiplying the elasticity of wages (employee income) and profits (operating surplus, property income and self-employed income) to aggregate income by the quintile-specific share of wages and profits out of total income, respectively. Wage elasticities reflect the worker betas estimate by Lenza, M. and Slacalek, J., “How does monetary policy affect income and wealth inequality? Evidence from quantitative easing in the euro area”, Working Paper Series, No 2190, ECB, October 2018, and are also in line with the measures in the box entitled “Household income risk over the business cycle”, Economic Bulletin, Issue 6, ECB, 2019. Profit elasticities are assumed to be equal to unity. The shares of wages and profits out of total income are obtained from experimental statistics produced by Lamarche, P., Oehler, F. and Riobóo, I., “European household’s income, consumption and wealth”, Statistical Journal of the IAOS, Vol. 36, No 4, November 2020, pp. 1175-1188.

The median saving rate as a percentage of household disposable income is higher in higher-income quintiles. While low-income households dissave, with a median saving rate of around -5.8% of disposable income at the bottom income quintile, those in the top income quintile save around 40% of their disposable income (according to Eurostat's experimental statistics on income, consumption and wealth).

For more details on the impact of the energy/inflation compensatory fiscal measures on households’ income, see Box 2 in the article entitled “Fiscal policy and high inflation” in this issue of the Economic Bulletin. In this box, income measures only relate to the energy compensatory fiscal measures. They are simply redistributed using households’ direct exposure to energy consumption and they account for the imported energy content of household consumption (10%). Price measures are redistributed across income quintiles based on energy exposures, similar to the approach in Box 2 of the above-mentioned article.

The production network model assumes that shocks propagate forward to prices and backward to sales, accounting for cross-input complementarity along supply chains. The shock is assumed to be a negative technology shock, hitting non-euro area energy sectors in proportion to their share of global output. Since the shock is proxied by the quarter-on-quarter percentage change in euro area energy import prices (consistent with the econometric model below), the model elasticity of the shock is standardised to produce a 1 percentage point increase in euro area energy import prices. The elasticity of substitution is assumed to be 0.7, within the range of estimates from 0.5 to 0.9 documented in the literature. The specification and calibration of the production network model corresponds to the case of the roundabout economy without inefficiencies as described by Baqaee, D.R. and Farhi, E., “Networks, Barriers, and Trade”, Econometrica, forthcoming, 2023. For an application of the model to the global economic effects of trade fragmentation, see the box entitled “Friend-shoring GVCs: a model-based assessment [ADD LINK]”, in this issue of the Economic Bulletin.

The models considered contain the same set of core variables, supplemented by variables from the expenditure or income side of GDP and sectoral disposable income. The core variables include the energy import-related income losses for the euro area, a global economic conditions index, the euro area effective exchange rate, euro area real GDP, the GDP deflator, the private consumption deflator and a short-term interest rate. The models are estimated with data from the first quarter of 1999 to the fourth quarter of 2019 to avoid the extraordinary macroeconomic fluctuations of the coronavirus (COVID-19) pandemic having an impact on the estimated model parameters. All data except interest rates are expressed as percentage changes compared with the previous quarter. For the global conditions index, see Baumeister C., Korobilis, D. and Lee, T.K., “Energy Markets and Global Economic Conditions”, The Review of Economics and Statistics, Vol. 104, No 4, 2022, pp. 828-844. The short-term interest rate is proxied by the shadow short rate estimated by Wu, J.C. and Xia, F.D., “Time-Varying Lower Bound of Interest Rates in Europe”, Chicago Booth Research Paper No 17-06, 2017.

In the range of alternative calibrations reported in the literature for the elasticity of substitution from 0.5 to 0.9, the direct and indirect effects vary from -1.5 to -0.3 percentage points of GDP respectively, without significantly affecting the distribution across expenditure, income and sectoral components.