Economic, financial and monetary developments

Overview

On 15 December 2022 the Governing Council decided to raise the three key ECB interest rates by 50 basis points and, based on the substantial upward revision to the inflation outlook, expects to raise them further. In particular, the Governing Council judges that interest rates will still have to rise significantly at a steady pace to reach levels that are sufficiently restrictive to ensure a timely return of inflation to the 2% medium-term target. Keeping interest rates at restrictive levels will over time reduce inflation by dampening demand and will also guard against the risk of a persistent upward shift in inflation expectations. The Governing Council’s future policy rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach.

The key ECB interest rates are the Governing Council’s primary tool for setting the monetary policy stance. At its December meeting, the Governing Council also discussed principles for normalising the Eurosystem’s monetary policy securities holdings. From the beginning of March 2023 onwards, the asset purchase programme (APP) portfolio will decline at a measured and predictable pace, as the Eurosystem will not reinvest all of the principal payments from maturing securities. The decline will amount to €15 billion per month on average until the end of the second quarter of 2023 and its subsequent pace will be determined over time.

At its meeting in February 2023 the Governing Council will announce the detailed parameters for reducing the APP holdings. The Governing Council will regularly reassess the pace of the APP portfolio reduction to ensure it remains consistent with the overall monetary policy strategy and stance, to preserve market functioning, and to maintain firm control over short-term money market conditions. By the end of 2023, the Governing Council will also review its operational framework for steering short-term interest rates, which will provide information regarding the endpoint of the balance sheet normalisation process.

At its December 2022 meeting, the Governing Council decided to raise interest rates, and expects to raise them significantly further, because inflation remains far too high and is projected to stay above the target for too long. According to Eurostat’s flash estimate, inflation was 10.0% in November, slightly lower than the 10.6% recorded in October. The decline resulted mainly from lower energy price inflation. Food price inflation and underlying price pressures across the economy have strengthened and will persist for some time. Amid exceptional uncertainty, Eurosystem staff have significantly revised up their inflation projections. They now see average inflation reaching 8.4% in 2022 before decreasing to 6.3% in 2023, with inflation expected to decline markedly over the course of the year. Inflation is then projected to average 3.4% in 2024 and 2.3% in 2025. Inflation excluding energy and food is projected to be 3.9% on average in 2022 and to rise to 4.2% in 2023, before falling to 2.8% in 2024 and 2.4% in 2025.

The euro area economy may contract in the fourth quarter of 2022 and the first quarter of 2023, owing to the energy crisis, high uncertainty, weakening global economic activity and tighter financing conditions. According to the December 2022 Eurosystem staff macroeconomic projections for the euro area, a recession would be relatively short-lived and shallow. Growth is nonetheless expected to be subdued in 2023 and has been revised down significantly compared with the September 2022 ECB staff projections for the euro area. Beyond the near term, growth is projected to recover as the current headwinds fade. Overall, the December 2022 projections now see the economy growing by 3.4% in 2022, 0.5% in 2023, 1.9% in 2024 and 1.8% in 2025.

Economic activity

The global economic outlook has deteriorated in the face of elevated geopolitical uncertainty, high and rising inflation and tight financial conditions. According to the December 2022 projections, the global real GDP growth rate (excluding the euro area) is projected to slow to 2.6% in 2023, below its long-term average, before gradually recovering to 3.1% and 3.3% in 2024 and 2025 respectively. This outlook is weaker than that described in the September 2022 projections. The outlook for global trade and euro area foreign demand has also deteriorated compared with the September 2022 projections. Global price pressures remain broad-based and elevated amid still relatively robust demand, tight labour markets and high food prices, but are expected to decline as commodity markets stabilise and growth weakens. In an environment of high uncertainty, the balance of risks around the baseline projections is tilted to the downside for global growth and to the upside for global price pressures.

Economic growth in the euro area slowed to 0.3% in the third quarter of the year. High inflation and tighter financing conditions are dampening spending and production by reducing real household incomes and pushing up costs for firms. The world economy is also slowing, in a context of continued geopolitical uncertainty, especially owing to Russia’s unjustified war against Ukraine and its people, and tighter financing conditions worldwide. The past deterioration in the terms of trade, reflecting the faster rise in import prices than in export prices, continues to weigh on purchasing power in the euro area.

On the positive side, employment increased by 0.3% in the third quarter, and unemployment hit a new historical low of 6.5% in October. Rising wages are set to restore some lost purchasing power, supporting consumption. As the economy weakens, however, job creation is likely to slow, and unemployment could rise over the coming quarters.

The outlook for the euro area has deteriorated somewhat, with weaker growth and higher and more persistent inflation than envisaged in the September 2022 projections. Staff now expects a short-lived and shallow recession in the euro area at the turn of the year. As the economic consequences of the war in Ukraine unfold and fuel the strong inflationary pressures, consumer and business confidence have remained subdued, while real disposable incomes are being eroded and soaring cost pressures are curtailing production, especially in energy-intensive industries. The negative economic repercussions are expected to be partially mitigated by fiscal policy measures. In addition, high levels of natural gas inventories and ongoing efforts to reduce demand and replace Russian gas with alternative sources imply that the euro area is expected to avoid the need for mandated energy-related production cuts over the projection horizon, although risks of energy supply disruptions remain elevated, in particular for the winter of 2023-24. Over the medium term, as the energy market rebalances, it is expected that uncertainty will decline, and real incomes will improve. As a result, economic growth is expected to rebound, also supported by strengthening foreign demand and the resolution of remaining supply bottlenecks, despite less favourable financing conditions. The labour market is expected to remain relatively resilient to the coming mild recession, reflecting labour hoarding amid still significant labour shortages. Overall, annual average real GDP growth is expected to slow down markedly, from 3.4% in 2022 to 0.5% in 2023, and then to rebound to 1.9% in 2024 and 1.8% in 2025. Compared with the September 2022 projections, the outlook for GDP growth has been revised up by 0.3 percentage points for 2022, owing to positive surprises over the summer, and revised down by 0.4 percentage points for 2023, while it is unchanged for 2024.

According to the December 2022 projections, the euro area budget balance is projected to worsen in 2023 before improving thereafter, while government debt is projected to decline over the full projection horizon. After an estimated improvement for 2022 (from -5.1% of GDP in 2021 to -3.5% in 2022), the budget balance is projected to decline to -3.7% in 2023. Further improvements are expected in 2024 and, to a lesser extent, in 2025, when the budget balance is projected to be -2.6% of GDP. Nonetheless, this is still well below the pre-pandemic level (-0.6%). After the sharp increase in 2020, euro area aggregate government debt is expected to decline over the projection horizon, reaching 88% of GDP in 2025, which is still above its pre-pandemic level (84%). This expected decline is mainly due to favourable interest rate-growth differentials on account of the nominal GDP growth, which more than offsets the persisting, albeit decreasing, primary deficits.

Fiscal support measures to shield the economy from the impact of high energy prices should be temporary, targeted and tailored to preserving incentives to consume less energy. Fiscal measures falling short of these principles are likely to exacerbate inflationary pressures, which would necessitate a stronger monetary policy response. Moreover, in line with the EU’s economic governance framework, fiscal policies should be oriented towards making the euro area economy more productive and gradually bringing down high public debt. Policies to enhance the euro area’s supply capacity, especially in the energy sector, can help reduce price pressures in the medium term. To that end, governments should swiftly implement their investment and structural reform plans under the Next Generation EU programme. The reform of the EU’s economic governance framework should be concluded rapidly.

Inflation

Inflation declined to 10.0% in November, mainly on the back of lower energy price inflation, while services inflation also edged down. Food price inflation rose further to 13.6%, however, as high input costs in food production were passed through to consumer prices. Price pressures remain strong across sectors, partly as a result of the impact of high energy costs throughout the economy. Inflation excluding energy and food was unchanged in November, at 5.0%, and other measures of underlying inflation are also high.

Fiscal measures to compensate households for high energy prices and inflation are set to dampen inflation over 2023 but will raise it once they are withdrawn. Supply bottlenecks are gradually easing, although their effects are still contributing to inflation, pushing up goods prices in particular. The same holds true for the lifting of pandemic-related restrictions: while weakening, the effect of pent-up demand is still driving up prices, especially in the services sector. The depreciation of the euro in 2022 is also continuing to feed through to consumer prices.

Wage growth is strengthening, supported by robust labour markets and some catch-up in wages to compensate workers for high inflation. As these factors are set to remain in place, the December 2022 projections see wages growing at rates well above historical averages and pushing up inflation throughout the projection period. Most measures of longer-term inflation expectations currently stand at around 2%, although further above-target revisions to some indicators warrant continued monitoring.

Amid exceptional uncertainty, Eurosystem staff have significantly revised up their inflation projections. Inflation is expected to decline from an average of 8.4% in 2022 to 6.3% in 2023, with inflation declining from 10% in the last quarter of 2022 to 3.6% in the last quarter of 2023. Inflation is then expected to decline to an average of 3.4% in 2024 and of 2.3% in 2025. The decline in inflation over the projection horizon reflects strong energy-related downward base effects throughout the course of 2023, the gradual impact of the normalisation of the ECB’s monetary policy which started in December 2021, the weaker growth outlook and the assumed decline in energy and food commodity prices, in line with futures prices, as well as the assumption that longer-term inflation expectations will remain anchored. Headline inflation is expected to fall to the ECB’s medium-term inflation target of 2% in the second half of 2025, while HICP inflation excluding energy and food will remain above 2% throughout the horizon. This persistence is driven by lagged indirect effects from high energy prices and from the past sharp depreciation of the euro (despite the recent slight appreciation), as well as by robust labour markets and inflation compensation effects on wages, which are expected to grow at rates well above historical averages in nominal terms (although in real terms remaining below the levels seen before the war in Ukraine over the full projection horizon). Compared with the September 2022 projections, headline inflation has been revised up substantially for 2022 (by 0.3 percentage points), 2023 (by 0.8 percentage points) and 2024 (by 1.1 percentage points), reflecting recent data surprises, a reassessment of the strength and persistence of pipeline price pressures and their pass-through, stronger wage growth and higher food commodity prices. These upward effects more than offset the downward impact of lower oil, gas and electricity price assumptions, a faster easing of supply bottlenecks, the recent appreciation of the euro and the weaker growth outlook. Importantly, new fiscal measures decided since the September 2022 projections, most of which aim at reducing energy price increases in 2023, dampen the upward revision to inflation in 2023, but contribute significantly to the upward revision in 2024 as many of the measures are assumed to expire.

Risk assessment

Risks to the economic growth outlook are on the downside, especially in the near term. The war against Ukraine remains a significant downside risk to the economy. Energy and food costs could also remain persistently higher than expected. There could be an additional drag on growth in the euro area if the world economy were to weaken more sharply than expected.

The risks to the inflation outlook are primarily on the upside. In the near term, existing pipeline pressures could lead to stronger than expected rises in retail prices for energy and food. Over the medium term, risks stem primarily from domestic factors such as a persistent rise in inflation expectations above the ECB’s 2% target or higher than anticipated wage rises. By contrast, a decline in energy costs or a further weakening of demand would lower price pressures.

Financial and monetary conditions

As the ECB tightens monetary policy, borrowing is becoming more expensive for firms and households. Bank lending to firms remains robust, as firms replace bonds with bank loans and use credit to finance the higher costs of production and investment. Households are borrowing less, because of tighter credit standards, rising interest rates, worsening prospects for the housing market and lower consumer confidence.

In line with the monetary policy strategy, twice a year the Governing Council assesses in depth the interrelation between monetary policy and financial stability. The financial stability environment has deteriorated since the last review in June 2022 owing to a weaker economy and rising credit risk. In addition, sovereign vulnerabilities have risen amid the weaker economic outlook and weaker fiscal positions. Tighter financing conditions would mitigate the build-up of financial vulnerabilities and lower tail risks to inflation over the medium term, at the cost of a higher risk of systemic stress and greater downside risks to growth in the short term. Moreover, the liquidity needs of non-bank financial institutions may amplify market volatility. At the same time, euro area banks have comfortable levels of capital, which helps to reduce the side effects of tighter monetary policy on financial stability. Macroprudential policy remains the first line of defence in preserving financial stability and addressing medium-term vulnerabilities.

Monetary policy decisions

At its December meeting, the Governing Council decided to raise the three key ECB interest rates by 50 basis points and, based on the substantial upward revision to the inflation outlook, expects to raise them further. Accordingly, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility were increased to 2.50%, 2.75% and 2.00% respectively, with effect from 21 December 2022. The Governing Council judges that interest rates will still have to rise significantly at a steady pace to reach levels that are sufficiently restrictive to ensure a timely return of inflation to the 2% medium-term target. Keeping interest rates at restrictive levels will over time reduce inflation by dampening demand and will also guard against the risk of a persistent upward shift in inflation expectations. The Governing Council’s future policy rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach.

The Governing Council intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP until the end of February 2023. Subsequently, the APP portfolio will decline at a measured and predictable pace, as the Eurosystem will not reinvest all of the principal payments from maturing securities. The decline will amount to €15 billion per month on average until the end of the second quarter of 2023 and its subsequent pace will be determined over time. As concerns the pandemic emergency purchase programme (PEPP), the Governing Council intends to reinvest the principal payments from maturing securities purchased under the programme until at least the end of 2024. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance. The Governing Council will continue applying flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to countering risks to the monetary policy transmission mechanism related to the pandemic.

As banks are repaying the amounts borrowed under the targeted longer-term refinancing operations, the Governing Council will regularly assess how targeted lending operations are contributing to its monetary policy stance.

The Governing Council stands ready to adjust all of its instruments within its mandate to ensure that inflation returns to its 2% target over the medium term. The Transmission Protection Instrument is available to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across all euro area countries, thus allowing the Governing Council to more effectively deliver on its price stability mandate.

1 External environment

The global economic outlook has deteriorated in the face of elevated geopolitical uncertainty, high and rising inflation and tight financial conditions. According to the December 2022 Eurosystem staff macroeconomic projections for the euro area, global real GDP (excluding the euro area) growth is projected to slow to 2.6% in 2023, below its long-term average, before gradually recovering to 3.1% and 3.3% in 2024 and 2025 respectively. This outlook is weaker than that described in the September 2022 ECB staff macroeconomic projections for the euro area. The outlook for global trade and euro area foreign demand has also deteriorated compared with the September projections. Global price pressures remain broad-based and elevated amid still relatively robust demand, tight labour markets and high food prices, but are expected to decline as commodity markets stabilise and growth weakens. In an environment of high uncertainty, the balance of risks around the baseline projections is tilted to the downside for global growth and to the upside for global price pressures.

In the course of 2022, the world economy has been buffeted by several shocks which have dampened the pace of growth and which will continue to weigh on the global outlook. The Russian war against Ukraine continues to unsettle energy and food commodity markets and energy prices remain volatile despite having declined since the September 2022 ECB staff macroeconomic projections. In addition, the war is fuelling uncertainty about food security, especially across emerging market economies. In China, the zero-COVID policy implemented so far, at least by the time the December 2022 Eurosystem staff macroeconomic projections were finalised, and the recession in the residential sector are further weighing on activity. Across major advanced economies, the deceleration in economic activity during 2022 has been driven by slowing demand and the start of a tightening cycle in early 2022.The easing of pandemic-related restrictions and supply-chain bottlenecks since spring, together with falling energy prices, supported activity up to the third quarter.

Survey data continue to point to a broad-based moderation in economic activity at the turn of the year, especially across advanced economies. The global (excluding the euro area) composite PMI indices peaked in June and have been on a downward trajectory ever since. In November the PMI indices declined further below the neutral threshold in both advanced economies (excluding the euro area) and emerging markets and across the manufacturing and services sectors (Chart 1). For the fourth quarter of 2022 global real GDP growth (excluding the euro area) is estimated to slow to 0.3% quarter on quarter from 1.1% in the third quarter, reflecting still high and persistent inflationary pressures and tight financial conditions which continue to take a toll on household disposable income and savings accumulated during the pandemic. Compared with the September projections, growth in the fourth quarter has been revised down by 0.5 percentage points, reflecting weaker projected growth across both advanced and emerging economies.

Chart 1

PMI output by sector across advanced and emerging market economies

a) Advanced economies (excluding the euro area)

(diffusion indices)

b) Emerging market economies

(diffusion indices)

Sources: S&P Global and ECB staff calculations.

Note: The latest observations are for November 2022.

Global real GDP (excluding the euro area) growth is projected to decline in 2023 before gradually recovering in 2024 and 2025. In 2022 global GDP growth decreased to 3.3%. It is projected to slow further to 2.6% in 2023, reflecting a significant decline in growth in advanced economies, including the United States and the United Kingdom. Some emerging market economies (EMEs) are projected to better withstand the current headwinds in view of lower macro-financial vulnerabilities compared with previous tightening cycles, particularly in terms of lower inflation, lower US dollar-denominated debt exposures and reduced exchange rate misalignments. Nonetheless, there is still significant heterogeneity even within this group and the outlook remains fragile for some countries, such as China, owing to its difficulties in the residential sector and the recent resurgence of coronavirus (COVID-19) infections. A slower pace of growth in Latin American countries and a deepening recession in Russia, despite another significant upward growth revision, especially for 2022, are dampening the growth outlook for EMEs. Compared with the September 2022 ECB staff macroeconomic projections, global real GDP growth (excluding the euro area) has been revised upwards for 2022 (+0.4 percentage points) but downwards for 2023 (-0.4 percentage points) and 2024 (-0.3 percentage points).

Weakening manufacturing activity is expected to weigh on global trade at the turn of the year. Global trade remained relatively resilient in the first half of 2022 as the headwinds from the Russian war in Ukraine and lingering supply bottlenecks were partially offset by the recovery in travel and transportation services following the lifting of COVID-19 containment measures. The momentum for global merchandise trade (excluding the euro area; measured by three month-on-three month changes) has been deteriorating since July owing to weak growth in advanced economies. Global PMI new export orders (excluding the euro area), which are a timelier indicator of world trade, also remained in negative territory. Supply chain pressures continue to ease gradually, although developments related to COVID-19 in China represent a potential downside risk, particularly in the near term. In November global PMI supplier delivery times (excluding the euro area) improved further to 47.3 and surged above the expansionary threshold (+50) in the United States, while in China these fell from 48.7 to 45.4 (Chart 2) owing largely to the renewed tightening of containment measures in November in the face of a flare-up in new COVID-19 infections. The situation nevertheless remains highly uncertain as the authorities started to ease containment measures at the beginning of December and are considering the introduction of a new phase of measures to fight the virus.

Chart 2

PMI suppliers’ delivery times

(index)

Sources: S&P Global and ECB staff calculations.

Note: The latest observations are for November 2022.

The outlook for global trade growth has deteriorated in line with projections for global activity. World imports (excluding the euro area) expanded by 5.6% in 2022, but growth is projected to slow to 1.9% in 2023 before picking up to 3.3% in 2024 and remaining stable in 2025. Euro area foreign demand is estimated to have expanded by 6.0% in 2022. Growth in foreign demand is projected to decelerate markedly in 2023 to 1.2% owing to weaker growth prospects in some key euro area trading partners. For 2024 and 2025, it is projected to rise to around 3.0% in line with global import developments. Compared with the September 2022 ECB staff macroeconomic projections, euro area foreign demand has been revised upwards in 2022 to reflect stronger than previously expected trade dynamics in the second quarter in some advanced economies and in central and eastern European countries outside the euro area. Euro area foreign demand has been revised downwards for 2023 and 2024 in line with weaker activity growth. For 2023 this is partially compensated by a stronger trade outlook for Russia despite a sharp downward revision to the weight of Russia in euro area foreign demand.[1]

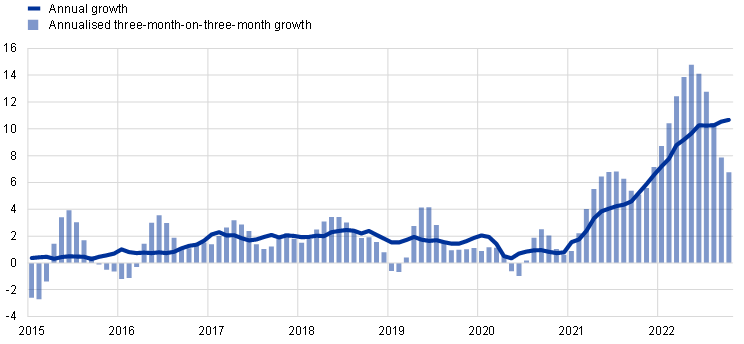

Global inflationary pressures remain high and broad-based, reflecting the still relatively robust level of demand, tight labour markets and high food prices, while energy-related inflationary pressures have started to ease as prices decline. Annual headline inflation in OECD countries (excluding Türkiye) increased to 8.3% in October from 8.2% in September driven by higher food prices.[2] Headline inflation momentum (excluding Türkiye) slowed for the fifth consecutive month to 5.9% (annualised three-month-on-three-month growth), prolonging the trend of softening price pressure (Chart 3). The projected path for euro area competitor export prices remains elevated in the near term but is set to decline thereafter as commodity prices fall and pipeline pressures ease. This path is slightly lower than the short-term outlook foreseen in the September 2022 projections due to the impact of lower commodity price assumptions and declining domestic pipeline pressures in euro area competitor countries.

Chart 3

OECD consumer price inflation

a) Headline inflation

(year-on-year percentage changes and three-month-on-three-month annualised percentage changes)

b) Core inflation

(year-on-year percentage changes and three-month-on-three-month annualised percentage changes)

Sources: OECD and ECB calculations.

Notes: The OECD aggregates reported in the panels are calculated excluding Türkiye. Annual headline and core inflation in October for OECD countries including Türkiye (not shown in the panels) were 10.7% and 7.6% respectively compared with 10.5% and 7.6% in September. Core inflation excludes energy and food. The latest observations are for October 2022.

Oil and gas prices have declined compared with the September 2022 projections. The downward pressure on oil prices was related to lower demand for oil against the backdrop of the global economic slowdown and lockdowns in China. Lower demand outweighed the reduction in OPEC+ production targets in November, while there is still considerable uncertainty regarding the effects of the EU’s embargo and the G7’s price cap on Russian oil implemented on 5 December. The drop in European gas prices reflected very mild weather conditions in October and early November, which together with lower demand for industrial gas and efforts to replace Russian gas throughout 2022 left the EU with near-full storage tanks in mid-November. However, in line with the previous futures prices, gas prices saw a partial rebound from the second half of November onwards owing to colder weather in Europe, and elevated futures prices throughout 2023 signal significant supply risks. Food commodity prices have also declined, driven mainly by lower coffee prices amid an improved supply forecast for Brazil in 2023, while wheat and corn prices have been volatile due to uncertainty about Russia’s willingness to keep the Black Sea corridor for Ukrainian grain exports open. Metal prices increased as supply concerns outweighed the effects of the global economic slowdown, while the gradual easing of some COVID-19 related containment measures in China boosted metal prices towards the end of the review period despite still high uncertainty about the Chinese growth outlook.

Global financial conditions are broadly unchanged from the previous projections and remain tight. Initially, financial conditions tightened in advanced and emerging economies. Further upside surprises to inflation led central banks to maintain a rapid pace of monetary policy tightening, leading to higher bond yields and continued declines in the price of risky assets. However, following a lower than expected headline US Consumer Price Index, market sentiment shifted as the Federal Reserve System’s more gradual path of interest rate hikes was priced in, which boosted risk sentiment globally. This caused financial conditions to loosen somewhat as long-term bond yields declined, spreads narrowed and equity prices rebounded. On the whole, financial conditions over the review period are little changed as a result but remain tight.

After two quarters of moderate contraction, the US economy saw a return to growth but underlying domestic demand remained weak. Net exports and non-residential investment were the main sources of growth in the third quarter. Looking ahead, domestic demand is projected to remain subdued as high inflation and tighter financial conditions continue to erode household real disposable income and restrain private consumption, while a steep drop in housing starts associated with lower housing affordability and rising mortgage rates is expected to weigh on residential investment. In October headline inflation eased by more than expected to 7.7%. Although still high by historical standards, headline inflation is seen to have peaked as energy and food indices continued to moderate. Annual core inflation fell to 6.3% but is expected to remain more persistent in 2023 due to upward pressure from services inflation (e.g. high rents).

In China, changing COVID-19 policies and ongoing weakness in the residential sector are affecting economic activity. Initially, the economy rebounded in the third quarter of 2022 as COVID-19 containment measures were gradually lifted following a wave of infections in April and May. Economic growth in the third quarter was supported by a recovery in both consumption and investment which, despite the prolonged weakness in the property sector, recovered on the back of fiscal stimulus. However, in December the Chinese Government unexpectedly reversed its zero-COVID policy and lifted most of the pandemic restrictions. As a result, infections have increased rapidly and in the near term activity is likely to have slowed. Going forward, activity is projected to remain subdued over the projection horizon amid a more prolonged contraction in residential investment and the uncertain evolution of the pandemic. Real GDP growth in 2022 is expected to miss the authorities’ target of 5.5% by a significant margin. Compared with the September 2022 projections, the growth outlook for China has been revised down markedly for 2023 and 2024. Consumer price pressures remain moderate.

In Japan, real GDP contracted unexpectedly in the third quarter of 2022 and is expected to return to growth in the fourth quarter. Real GDP contracted unexpectedly in the third quarter due to strong imports, while domestic demand remained relatively firm, supported by the lifting of pandemic-related containment measures. Real GDP is expected to grow in the final quarter of 2022 amid the continued reopening of the economy, including increased spending on services and ongoing policy support. Growth is projected to moderate slightly over the forecast period as the contribution of external demand is expected to ease significantly amid softening global demand. Annual headline inflation increased considerably over the course of 2022 amid higher food and energy prices and the end of negative base effects. While inflation is likely to stay around current levels in the near term, it is projected to decline gradually into 2023 owing to lower commodity prices and limited domestic pipeline pressures.

In the United Kingdom, the outlook for real activity has weakened further following the GDP contraction in the third quarter. High consumer price inflation, rising mortgage costs and tight financial conditions are putting a strong drag on consumption and private investment. The fiscal measures announced in November will slightly increase the budget deficit in the near term, but over the medium term they will contribute to fiscal consolidation. The economy is now expected to contract from the third quarter of 2022 until the second quarter of 2023. At the same time, the labour market remains tight and broadening wage pressures are contributing to the persistence in domestic inflation. Rising energy prices are projected to fuel consumer price inflation until the fourth quarter of 2022. Inflation is expected to peak around 11%, substantially below the level expected in the September 2022 ECB staff macroeconomic projections owing to the energy price guarantee adopted by the government.

In Russia, the economy entered a severe recession in 2022. With real GDP falling markedly in the second quarter and remaining almost 5% below the pre-invasion level in the third quarter, a severe recession is now under way in Russia. The economy has registered a more moderate fall in exports than previously expected, while imports have declined significantly especially from sanctioning countries. The economy is expected to contract further at the end of 2022 and into 2023 as sanctions have an increasingly negative impact on Russia’s production capacity, international trade and domestic demand. Following a gradual decline in recent months, inflation is expected to remain high in the near term, with only a gradual return towards the Bank of Russia’s target of 4% towards the end of the projection horizon.

2 Economic activity

GDP growth slowed to 0.3% quarter on quarter in the third quarter of 2022, following strong rates of growth in the first half of the year as the economy reopened and supply bottlenecks started to ease. Since then, elevated uncertainty about additional consequences of the war in Ukraine for the economy, ongoing concerns regarding potential energy supply disruptions and high price pressures have increasingly dampened domestic spending and production. These factors, coupled with rising financing costs and a slowdown in global growth, are expected to constrain euro area activity further in the fourth quarter and to continue to do so in the first part of 2023. Nevertheless, a contraction in activity is likely to be relatively short-lived and shallow, curbed by the ongoing resilience of labour markets, high levels of household savings accumulated during the pandemic and additional fiscal measures to cushion the impact of higher energy prices on consumers and firms in the short term. Beyond the near term, as uncertainty declines, the energy market rebalances, supply bottlenecks are resolved and real incomes start to improve, euro area economic growth is expected to gradually recover from the second half of 2023.

The December 2022 Eurosystem staff macroeconomic projections for the euro area expect annual real GDP growth to stand at 3.4% in 2022, 0.5% in 2023, 1.9% in 2024 and 1.8% in 2025. Compared with the September 2022 ECB staff macroeconomic projections for the euro area, the outlook has been revised upwards for 2022 (largely reflecting positive data surprises over the summer), downwards for 2023 and remains unchanged for 2024.

Economic activity slowed markedly in the third quarter of 2022, following strong growth in the first half of the year. Quarter-on-quarter real GDP growth slowed to 0.3% in the third quarter after averaging 0.7% in the first and second quarters of the year. The deceleration was driven mainly by a large drag from net trade, while domestic demand and output, which had benefited from changes in inventories, contributed positively to third-quarter growth (Chart 4). Consumption remained on a solid footing, owing to buoyant private consumption of services, which more than offset the negative contribution from goods consumption, and a further modest contribution from government consumption. Investment appeared to be rising strongly, reaching 3.6% quarter on quarter, although this was largely due to extraordinary growth in Irish intellectual property products (IPP). The momentum of business investment in fixed assets clearly slowed and construction investment declined further. Net exports contributed negatively to headline real GDP growth, as import growth – again driven in part by Irish dynamics – exceeded export growth. A breakdown of value added shows continued solid growth in industry excluding construction and services, while construction production declined further. Survey data and anecdotal evidence for the third quarter of 2022 suggest that, given the fall in new orders, much of the apparent strength in industry is likely due to the easing of supply bottlenecks, which has helped manufacturers to tackle the large backlogs of work (particularly in the vehicle sector) rather than a strengthening of demand. For services, the breakdown of value added shows considerable heterogeneity across subsectors, with previously constrained consumer-facing subsectors (such as retail, transport, accommodation, food and, in particular, recreational services) continuing to grow strongly in the third quarter, while the more business-oriented subsectors (such as information and communication services, finance and insurance, real estate and professional and administrative services) grew at best modestly or contracted slightly.

Chart 4

Euro area real GDP and its components

(quarter-on-quarter percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for the third quarter of 2022.

Incoming data point to a further slowdown in economic activity in the fourth quarter of 2022, against the background of high inflation and ongoing uncertainty about the war in Ukraine and the risk of disruptions to energy supplies. Survey data point to a further and broadening weakening of growth momentum, as slowing demand, which has been evident in industry for some months, has now spread to services following the strong growth linked to the reopening. The composite output Purchasing Managers’ Index (PMI) for the euro area fell to a 21-month low in October before rising slightly in November. The figures for both months are further below the theoretical no-growth threshold than in the third quarter (Chart 5, panel a). The latest dynamics indicate that manufacturing output is stabilising at a low level, as the strong contribution from vehicle production seen earlier in the year appears to be levelling off. The European Commission’s Economic Sentiment Indicator fell further in the fourth quarter, reflecting the ongoing deterioration in industrial confidence in October and November (Chart 5, panel b), as outstanding business and stocks of finished goods declined, and new orders dropped further below their third-quarter average. Responses to the Commission’s quarterly survey questions on factors limiting production suggest that labour shortages are moderating and constraints owing to a lack of materials and equipment have been easing since the summer. By contrast, financial limitations increased significantly in October, although these still played less of a role than other factors. These indicators point to a weak outlook for investment in the coming months. At the same time, consumer confidence showed some relative resilience, as it recovered from the record lows seen in September on the back of labour market and fiscal measures introduced to support households’ disposable income.

Chart 5

Survey-based indicators across sectors of the economy

a) PMI output indicators

(diffusion indicators)

b) Business and consumer confidence

(diffusion indicators)

Sources: S&P Global Market Intelligence (panel a), European Commission and ECB calculations (panel b).

Note: The latest observations are for October 2022 for vehicle output and November 2022 for all other items.

The labour market has remained robust and continued to support economic activity. Total employment rose by 0.3% quarter on quarter in the third quarter of 2022. This implies that between the fourth quarter of 2019 and the third quarter of 2022 the number of people in employment increased by 3.1 million. By contrast, hours worked decreased by 0.1% in the third quarter of 2022 but remain 0.2% above their pre-pandemic level in the fourth quarter of 2019. The difference between the growth in employment and hours worked implies a substantial decline in average hours worked since the fourth quarter of 2019, which can be attributed mainly to the public sector. The unemployment rate fell to 6.5% in October 2022, which is around 0.8 percentage points lower than the pre-pandemic level observed in February 2020 and a historical low (Chart 6). The labour force has grown significantly compared with the fourth quarter of 2019, and the number of workers on job retention schemes is estimated to have continued to decline in recent months. Similarly, labour demand has strengthened considerably since the onset of the pandemic and is showing some signs of stabilisation in recent months. Notably, in the third quarter of 2022 the job vacancy rate stood at 3.2%, 1 percentage point higher than in the fourth quarter of 2019.

Chart 6

Euro area employment, the PMI assessment of employment and the unemployment rate

(left-hand scale: quarter-on-quarter percentage changes, diffusion index; right-hand scale: percentages of the labour force)

Sources: Eurostat, S&P Global Market Intelligence and ECB calculations.

Notes: The two lines indicate monthly developments, while the bars show quarterly data. The PMI is expressed in terms of the deviation from 50 divided by 10. The latest observations are for the third quarter of 2022 for employment, November 2022 for the PMI assessment of employment and October 2022 for the unemployment rate.

Short-term labour market indicators point to a deceleration in employment growth. The monthly composite PMI employment indicator declined to 51.8 in November 2022, down from 52.5 in October, but was still above the threshold level of 50 that indicates an expansion in employment. The PMI employment indicator has been in expansionary territory since February 2021 but has fallen significantly since May 2022. Looking at developments across different sectors, this indicator points to continued, albeit weaker, employment growth in the industry and services sectors, and to a decrease in employment in the construction sector.

Private consumption continued to increase in the third quarter of 2022, but developments varied across components. Private consumption grew by 0.9% in the third quarter, after 1.0% in the second quarter. The positive dynamics were underpinned mainly by consumption of services, which rose sharply for two consecutive quarters as the economy reopened. By contrast, consumption of non-durable goods declined for the third quarter in a row, reflecting recent developments in retail sales, which fell by 0.7% in the third quarter. At the same time, durable goods consumption, which had fallen significantly over previous quarters owing to rising energy prices (see Box 3), began to improve in the third quarter of 2022, probably owing to easing supply disruptions in the vehicle sector. Accordingly, new passenger car registrations increased by 12.8% in the third quarter. Incoming economic soft data suggest some relative resilience in spending at the turn of the year, despite persistent headwinds. In October and November, the European Commission’s consumer confidence indicator rose to slightly above its level in the third quarter (when it hit a record low in September), driven mainly by an improvement in households’ economic and financial expectations. The Commission’s latest consumer and business surveys also indicate that expected demand for accommodation, food and travel services increased in November, alongside some recovery in expected major purchases by households from their record low. Against the background of continuing downbeat consumer sentiment and the squeeze on real disposable income, the latest positive signals suggest that households’ spending during the holiday season might show some resilience. Nevertheless, as inflation and uncertainty remain high, households’ real disposable income is likely to decline further at the turn of the year, dampening consumer spending. Moreover, the ongoing tightening of household loan conditions is likely to curb household borrowing. Evidence from the ECB’s Consumer Expectations Survey in October suggests that over the next three months households expect to face increasing liquidity constraints. It is therefore likely that they will need to dip into their savings to pay utility bills and meet loan repayments and, as a result, they revised downwards their perceptions and expectations regarding precautionary savings (according to the October Consumer Expectations Survey). The use of savings should help to smooth consumption to some extent in the face of weak real disposable income.

Business investment slowed in the third quarter of 2022 and is expected to decline further around the turn of the year. Non-construction investment (the closest proxy for business investment in the national accounts) grew by 7.7% in the third quarter, although this was due largely to the extraordinary growth in IPP mainly as a result of developments in the Irish multinational sector.[3] Excluding this volatile component, business investment moderated to 1.2% quarter on quarter in the third quarter, down from its average quarterly growth rate of 1.7% in the first half of the year, but with considerable heterogeneity across asset classes. Within the -machinery and equipment sector, non-transport investment in fixed assets slowed markedly (down to 0.3% quarter on quarter), while the transport investment segment grew by 7.1%, as supply bottlenecks eased and facilitated completion of a still high number of back orders. Elsewhere, growth in IPP investment (excluding Ireland) remained unchanged from the second quarter, at 1.1% quarter on quarter. The first signals for the fourth quarter point to a contraction at the turn of the year. Incoming PMI survey data show that stocks of finished goods are starting to pile up in the capital goods sector, with new orders falling sharply and outstanding business and capacity utilisation declining from the high levels induced by pandemic-related disruptions. The latest ECB Survey on the Access to Finance of Enterprises in the euro area reports a marked decline in the net balances of firms seeking financing for investment purposes. In addition, the European Commission’s October biannual investment survey finds that the number of firms planning to increase investment in 2023 had declined markedly compared with 2022 levels, despite expansion plans for 2022 being reduced since the previous survey in April. For the time being, the survey suggests that financial factors are playing only a secondary role in investment decisions, but these are expected to become a greater constraint in 2023. Meanwhile, the November S&P Global Business Outlook Survey reported expectations of a sharp deterioration in profitability in 2023 amid rocketing input costs and a drop in its capital expenditure indicator to a ten-year low (leaving aside the exceptional developments in 2020).[4] Looking ahead, business investment can be expected to rebound into growth territory as energy markets rebalance, as supply bottlenecks ease further and as uncertainty declines, alongside potentially strong “crowding in” effects from further allocations of Next Generation EU funds over the coming quarters.

Housing investment declined in the third quarter of 2022 and is likely to contract further in the near term. Housing investment fell by 0.7% in the third quarter, which is slightly less than the 0.8% quarter-on-quarter decline seen in the second quarter. The Commission’s indicator of construction activity over the past three months continued to decline on average in October and November compared with the third quarter average, and the PMI for residential construction slipped further into contractionary territory. Construction order books still appear to be well filled, as indicated by data up to October from the European Commission’s quarterly business survey. This should support construction activity in the months ahead, especially against a backdrop of gradually easing supply constraints. The Commission’s monthly survey of limits to production for the construction sector in November also showed a continued decline in the share of construction firms pointing to material and/or equipment shortages, while the percentage indicating labour shortages remained at a high level. However, the share of managers specifying insufficient demand as a factor limiting their building activity rose again in November, indicating weaker demand. This is also reflected in the further decline in households’ short-term intentions to renovate, buy or build a home in the fourth quarter, as well as in the low levels of the new orders component of the construction PMI. This weakening of demand is taking place against a backdrop of a significant deterioration in financing conditions, heightened uncertainty and substantially higher construction costs, and is likely to weigh on housing investment in the future.

Foreign trade had a negative impact on GDP growth in the third quarter of 2022, and the outlook points to further weakness in euro area exports as global activity slows. In the third quarter of 2022 exports of goods and services picked up by 1.7% quarter on quarter in volume terms. Import volumes increased sharply, by 4.3% quarter on quarter, driven mainly by services imports in Ireland. As a result, net trade made a negative contribution (-1.1 percentage points) to real GDP growth. Monthly data show that in September extra-euro area goods import values fell by 2% for the first time since January 2021, while exports rose by 1.6%, resulting in a narrowing of the goods trade balance to €37.7 billion from the record high seen in August. As euro area import prices declined – driven by lower energy prices – and export prices increased, the euro area’s terms of trade index improved in September. The underlying momentum of euro area export growth remains subdued as global demand weakens. The short-term outlook points to further weakness in euro area goods trade as indicators for export orders, such as the PMI, remained in contractionary territory in November. Forward-looking travel-related indicators are also signalling a moderation in services trade in the coming months.

Beyond the near term there is still much uncertainty surrounding the outlook but euro area economic activity is expected to start to recover from the middle of 2023, as the current headwinds dissipate. Growth is expected to be subdued in 2023, before strengthening as headwinds fade. The December 2022 Eurosystem staff macroeconomic projections for the euro area foresee annual real GDP growth at 3.4% in 2022, 0.5% in 2023, 1.9% in 2024 and 1.8% in 2025, following the annual extension of the projection horizon (Chart 7). Compared with the September 2022 ECB staff macroeconomic projections, the euro area growth outlook has been revised upwards for 2022 – in part reflecting positive data surprises over the summer – and downwards for 2023, while it remains unchanged for 2024. The current projections show that the level of GDP is expected to remain below what was predicted in the (pre-war) December 2021 projections, and they anticipate a mild contraction in GDP around the turn of the year, with a rebound into positive territory expected from the middle of 2023.

Chart 7

Euro area real GDP (including projections)

(index: fourth quarter of 2019 = 100, seasonally and working day-adjusted quarterly data)

Sources: Eurostat and Eurosystem staff macroeconomic projections for the euro area, December 2022.

Note: The vertical line indicates the start of the December 2022 Eurosystem staff macroeconomic projections for the euro area.

3 Prices and costs

Inflation in the euro area declined to 10.0% in November according to the flash estimate, primarily reflecting lower energy inflation.[5] However, food price inflation rose further, with energy and food inflation continuing to explain the bulk of the high headline inflation rate. Price pressures remained strong, mainly due to the indirect effects of energy costs. Supply bottlenecks and the impact of the post-pandemic recovery eased, but still contributed to inflation, as did the previous depreciation of the exchange rate. Inflation is projected to decline gradually over the course of 2023 as the current drivers of inflation fade over time and normalisation of monetary policy works its way through the economy and price setting. Inflation is expected to average 8.4% in 2022, according to the December 2022 Eurosystem staff macroeconomic projections for the euro area, before falling back to 6.3% in 2023, 3.4% in 2024 and 2.3% in 2025. Inflation excluding energy and food is expected to amount to 4.2% in 2023, 2.8% in 2024 and 2.4% in 2025. Most measures of longer-term inflation expectations currently stand at around 2.0%, although recent above-target revisions to some indicators warrant continued monitoring.

According to Eurostat’s flash estimate for November, headline inflation, as measured by the Harmonised Index of Consumer Prices (HICP), declined to 10.0%, down from 10.6% in October. The main HICP component driving this decrease in November was the sharp drop in the annual growth rate of energy prices (34.9% in November, down from 41.5% in October). A strong downward base effect coupled with a sharp month-on-month fall in energy prices in November accounted for the decline in the annual inflation rate for energy in November compared with October. The fall in energy prices also reflects the pass-through of the recent contraction in crude oil prices, refining and distribution margins and wholesale gas prices since August. By contrast, HICP food inflation continued to rise, to 13.6% in November from 13.1% in October, reflecting a further increase in the annual growth rate for processed food prices, which stands in contrast to the fall in the rate for unprocessed food prices. Accumulated price pressures continued to affect food prices, but the impact of the summer drought on the unprocessed component has been fading and energy producer price growth has eased (Chart 8).

Chart 8

Energy and food input cost pressure

(annual percentage changes)

Source: Eurostat.

Notes: HICP stands for Harmonised Index of Consumer Prices. The latest observations are for November 2022 for HICP food (flash estimate) and October 2022 for the remaining items.

HICP inflation excluding energy and food (HICPX) was unchanged according to the flash estimate, standing at 5.0% in November. The annual growth rate for non-energy industrial goods (NEIG) remained unchanged, while the rate for services inflation edged down in November (Chart 9). Higher input costs stemming from the surge in energy prices continued to be a key factor, despite some signs of easing. NEIG inflation stabilised in November to stand at 6.1%. The main drivers of NEIG inflation were accumulated upward pipeline price pressures from supply bottlenecks and high energy costs. Services inflation declined slightly to 4.2% (down from 4.3% in October), reflecting a month-on-month fall in services prices, albeit somewhat less pronounced than is usual for November. This change in November is likely to have been driven by the indirect effects of high energy prices and high producer food prices (a major input cost for restaurant services).

Chart 9

Headline inflation and its main components

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Notes: HICP stands for Harmonised Index of Consumer Prices. HICPX stands for HICP inflation excluding energy and food. NEIG stands for non-energy industrial goods. The latest observations are for November 2022 (flash estimate).

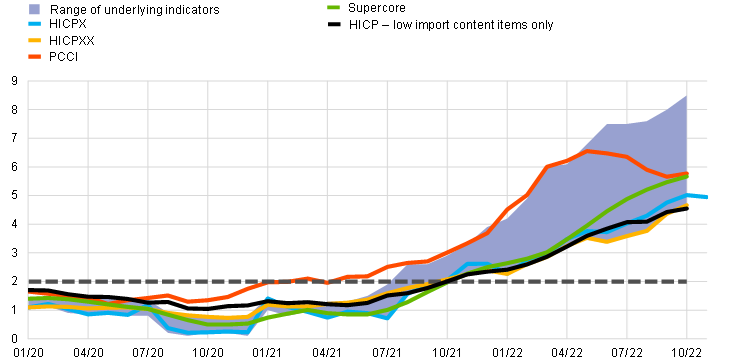

Measures of underlying inflation remained at elevated levels, although showing some signs of flattening (Chart 10).[6] This reflected widespread price pressures across more sectors and HICP items, partly as a result of the impact of high energy costs on the euro area as a whole. Looking at the wide range of indicators, most exclusion-based measures continued to rise. HICPX inflation remained unchanged at 5.0% in November. Data for other measures were only available up to October. HICP inflation excluding energy, food, travel-related items, and clothing and footwear (HICPXX) increased to 4.7% in October (up from 4.4% in the previous month). The Supercore indicator, which comprises cyclically sensitive HICP items, rose to 5.7%, up from 5.5% in September, while the model-based Persistent and Common Component of Inflation (PCCI) edged up from 5.7% in September to 5.8% in October. Month-on-month PCCI rates moved broadly sideways. Nevertheless, the persistently high month-on-month PCCI rates continued to indicate strong upward pressure on underlying inflation up to October. The indicator of domestic inflation, which represents price developments in HICP items with a lower import content, also rose further.[7] It is still unclear how persistent the high levels of these different measures and indicators will be. Much of the upward pressure on underlying inflation can be attributed to the indirect effects of the surge in energy and food prices and to exceptional supply and demand imbalances related to the pandemic and the Russian invasion of Ukraine.

Chart 10

Indicators of underlying inflation

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Notes: The range for the indicators of underlying inflation includes HICP excluding energy, HICP excluding energy and unprocessed food, HICPX, HICPXX, the 10% and 30% trimmed means and the weighted median. HICP stands for Harmonised Index of Consumer Prices. HICPX stands for HICP excluding energy and food. HICPXX stands for HIPC excluding energy, food, travel-related items, clothing and footwear. PCCI stands for Persistent and Common Component of Inflation. The latest observations are for November 2022 (flash estimate) for the HICPX and October 2022 for the remaining items.

Negotiated wage growth pointed to strengthening wage pressures, while growth in compensation per employee moderated, but was still distorted by pandemic-related measures (Chart 11). Growth in negotiated wages increased to 2.9% in the third quarter of 2022, up from 2.5% in the previous quarter. This reflects the increasing role played by compensation in inflation, whether through formal wage indexation clauses or otherwise. It also reflects the impact of one-off payments. For example, negotiated wage growth in Germany was lower in the second quarter because of base effects associated with pandemic-related one-off payments, and higher in the third quarter as a result of one-off payments to compensate for inflation. The latest available information on wage agreements since the start of 2022 points to a further strengthening of wage growth. Actual wage growth, as measured by compensation per employee, eased in the third quarter of 2022 to 3.9%, down from 4.6% in the previous quarter. This was partially the result of base effects in year-on-year growth rates; looking through such effects, quarter-on-quarter growth increased to 1.1% in the third quarter, up from 0.8% in the previous quarter. In turn, year-on-year growth in compensation per hour decreased to 2.9%, down from 3.6% in the previous quarter. The year-on-year growth rates of compensation per hour and per employee both declined in the third quarter, while that of hours worked per employee stood broadly unchanged relative to the previous quarter. Indicators of wage growth were still affected to some extent by pandemic-related distortions, albeit to a moderating degree.[8]

Chart 11

Breakdown of compensation per employee into compensation per hour and hours worked per employee

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for the third quarter of 2022.

Pipeline pressures on goods inflation continued to be strong, despite some early signs of easing (Chart 12). The month-on-month growth in non-energy industrial goods (NEIG) inflation was higher than is usual for November, but to a lesser extent than in previous months. This is possibly a sign that upward price pressures from supply bottlenecks and high energy costs may have started to moderate. Data for October showed that pipeline pressures were still strong, in particular at the later stages of the pricing chain. The annual growth rates for domestic producer prices for non-food consumer goods continued to rise, reaching 9.3% in October, up from 8.9% in September. For import prices and domestic producer prices for intermediate goods, annual growth fell over the same period, from 15.7% to 13.6% and from 18.9% to 17.4% respectively. Despite the easing, intermediate goods price inflation (both import and domestic) stood at over 10.0%, well above NEIG inflation. Import producer price inflation of non-food consumer goods also contracted in October, standing at 8.5%, down from 8.6% in the previous month, the first decrease seen since March 2022.

Chart 12

Indicators of pipeline pressures

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for October 2022.

Evidence from surveys and markets shows that forecasters continue to expect inflation to peak soon, with longer-term expectations remaining at around the ECB 2.0% target. However, close monitoring is warranted given the further above-target revisions of some indicators (Chart 13). In the most recent Consensus Economics survey, inflation expectations for 2023 were revised upwards by 0.3 percentage points to 6.0%. The long-term inflation expectations for 2026 set out in the December ECB Survey of Monetary Analysts remained unchanged at 2.0%, in line with the October expectations and with recent rounds of other surveys (for 2027, 2.2% in the ECB’s Survey of Professional Forecasters and 2.1% in the October Consensus Economic Survey). The market-based measures of inflation compensation (based on HICP excluding tobacco) on 6 December suggested that euro area inflation will peak at around 10.0% in 2022, falling to 5.0% during 2023 and ultimately returning to 2.0% over the course of 2024. Longer-term measures of inflation compensation increased, albeit only modestly, with the five-year forward inflation-linked swap rate five years ahead standing at 2.34% on 6 December. Importantly, however, market-based measures of inflation compensation are not a direct measure of market participants’ actual inflation expectations since they contain inflation risk premia to compensate for inflation uncertainty. By contrast, survey-based measures of long-term inflation expectations, which are free of inflation risk premia, have been relatively stable. This relative stability suggests that the current volatility in long-term market-based measures predominantly reflects variations in inflation risk premia.

Chart 13

Survey-based indicators of inflation expectations and market-based indicators of inflation compensation

(annual percentage changes)

Sources: Eurostat, Refinitiv, Consensus Economics, Survey of Professional Forecasters (Fourth quarter of 2022), Eurosystem staff macroeconomic projections for the euro area (December 2022) and ECB calculations.

Notes: HICP stands for Harmonised Index of Consumer Prices. SPF stands for Survey of Professional Forecasters. The market-based indicators of inflation compensation series are based on the one-year spot inflation rate, the one-year forward rate one year ahead, the one-year forward rate two years ahead, the one-year forward rate three years ahead and the one-year forward rate four years ahead. The latest observation for the HICP was for November 2022 (flash estimate). The cut-off date for data included in the Eurosystem staff macroeconomic projections for the euro area was 30 November 2022. The cut-off date for the Consensus Economics long-term forecasts was October 2022 for 2024, 2025, 2026 and 2027, and November 2022 for 2022 and 2023. The latest observations for market-based indicators of inflation compensation are for 6 December 2022. The SPF for the fourth quarter of 2022 was conducted in October.

The December 2022 Eurosystem staff macroeconomic projections for the euro area foresee headline inflation remaining high in the near term, averaging 8.4% in 2022, before falling back to averages of 6.3% in 2023, 3.4% in 2024 and 2.3% in 2025 (Chart 14). Headline inflation is expected to stay very high between the end of 2022 and the beginning of 2023, as pipeline prices pressures related to past increases in commodity prices, the depreciation of the euro, supply shortages and tight labour markets continue to feed through to consumer prices. Nevertheless, inflation is expected to decline from an average of 8.4% in 2022 to 6.3% in 2023, falling from 10% in the last quarter of 2022 to 3.6% in the last quarter of 2023. Inflation is then projected to ease further to an average of 3.4% in 2024 and of 2.3% in 2025. The expected decline in inflation mainly reflects strong energy-related downward base effects through the course of 2023, the gradual impact of monetary policy normalisation and the weaker growth outlook, an assumed decline in energy and food commodity prices, in line with futures prices, and the assumption that longer-term inflation expectations will remain anchored. Headline inflation is expected to remain above the ECB’s target of 2.0% until mid-2025, while HICPX inflation will remain above 2% throughout the horizon. This is due to lagged effects from high energy prices on the non-energy components of inflation, the past depreciation of the euro, robust labour markets and the effects of inflation compensation on wages, which are expected to grow at rates well above historical averages. Compared with the September 2022 projections, headline inflation has been revised up substantially for 2022 (by 0.3 percentage points), 2023 (by 0.8 percentage points) and 2024 (by 1.1 percentage points). This reflects recent data surprises, a reassessment of the strength and persistence of pipeline price pressures and their pass-through, stronger wage growth and higher food commodity prices, which more than offset the downward impact of lower oil, gas and electricity price assumptions, a faster easing of supply bottlenecks, the recent appreciation of the euro and the weaker growth outlook. Fiscal measures to compensate for high energy prices and inflation also play an important role for the inflation outlook over the projection horizon. They are estimated to have dampened headline HICP inflation by 1.1 percentage points in 2022 and should again dampen inflation by 0.5 percentage points in 2023. Thereafter, however, the withdrawal of these measures is expected to put significant upward pressure on inflation, amounting to 0.7 percentage points in 2024 and 0.4 percentage points in 2025.[9]

Chart 14

Euro area HICP and HICPX inflation

(annual percentage changes)

Sources: Eurostat and Eurosystem staff macroeconomic projections for the euro area (December 2022).

Notes: HICP stands for Harmonised Index of Consumer Prices. HICPX stands for HICP inflation excluding energy and food. The vertical line indicates the start of the projection horizon. The latest observations are for the third quarter of 2022 for the data and the fourth quarter of 2024 for the projections. The cut-off date for data included in the projections was 30 November 2022. Historical data for HICP and HICPX inflation are at quarterly frequency. Forecast data are at quarterly frequency for HICP inflation and annual frequency for HICPX inflation.

4 Financial market developments

Over the review period (8 September to 14 December 2022) financial markets were influenced by expectations of a faster and more pronounced monetary policy tightening in the euro area. While euro area short-term risk-free rates rose markedly over the period, longer-term interest rates edged up only slightly on balance, despite high market volatility. Euro area sovereign bond yields broadly followed long-term risk-free rates, with sovereign spreads moving closer together. Despite higher risk-free interest rates and in contrast to developments in the United States, European corporate bond spreads decreased and equity prices rose, with a particularly strong performance from euro area bank stocks. In foreign exchange markets, the euro broadly strengthened in trade-weighted terms.

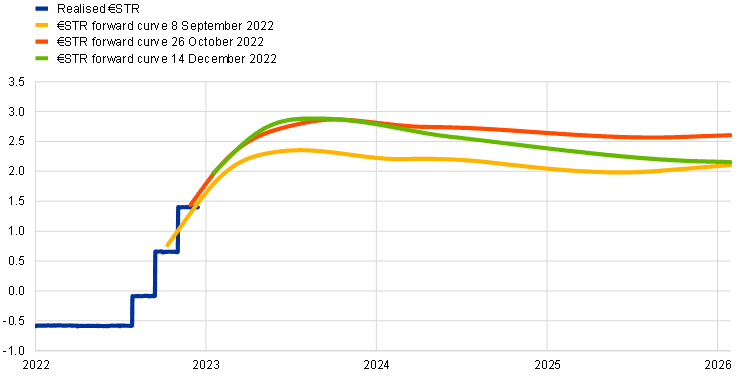

Over the review period euro area short-term risk-free rates rose on market expectations of a faster and more pronounced tightening of monetary policy, with the €STR forward curve subsequently stabilising at the very short end and becoming markedly inverted at the longer maturities. The benchmark euro short-term rate (€STR) closely followed the changes in the deposit facility rate, which the Governing Council raised from 0.00% to 0.75% at its September monetary policy meeting and then by a further 75 basis points to 1.50% at its October meeting. The €STR averaged around -8.5 basis points at the beginning of the review period in early September, and around 140 basis points from early November. The overnight index swap (OIS) forward curve, based on the €STR, increased significantly at the short end following both rate hikes and at the end of the review period priced in additional hikes of around 80 basis points for 2023, implying a peak rate of approximately 2.8% in the early part of the third quarter of that year. At the same time, it ended the review period displaying a pronounced inversion beyond the very short term, pricing in about three rate cuts during 2024 and 2025.

Chart 15

(percentages per annum)

Sources: Thomson Reuters and ECB calculations.

Note: The forward curve is estimated using spot OIS (€STR) rates.

Long-term yields initially increased in the review period as market participants reassessed their expectations for the monetary policy path, before returning towards their September levels, alongside similar developments in the United States (Chart 16). Over the review period long-term risk-free interest rates remained volatile and very sensitive to macroeconomic news. They initially continued to climb on the back of higher than expected inflation readings before falling back towards levels reached in early September. For instance, the ten-year euro area risk-free rate – as measured by the OIS rate – temporarily increased by about 80 basis points to around 3%. It then fell back to 2.3% at the end of the review period as market participants speculated that in the United States and the euro area rate hikes could slow and monetary policy could change direction sooner than expected, which was followed by yield declines globally. Overall, global sovereign bond yields increased modestly towards the end of the period, despite high volatility, with ten-year US, UK and German bond yields rising by 16, 15 and 22 basis points to reach 3.48%, 3.31% and 1.94% respectively.

Chart 16

Ten-year sovereign bond yields and the ten-year OIS rate based on the €STR

(percentages per annum)

Sources: Refinitiv and ECB calculations.

Notes: The vertical grey line denotes the start of the review period on 8 September 2022. The latest observations are for 14 December 2022.

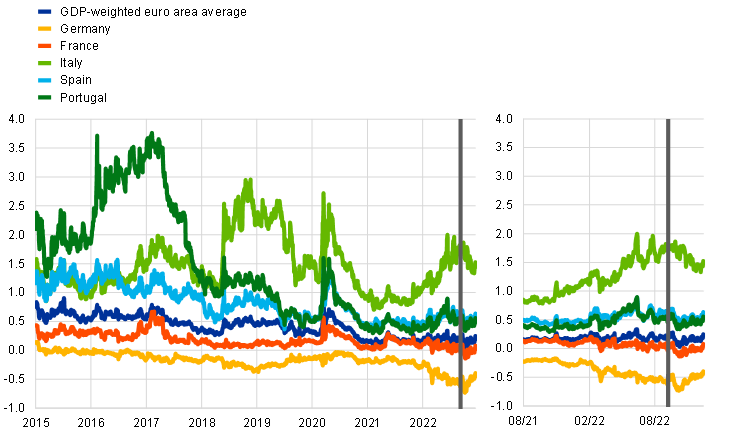

Euro area sovereign bond yields moved broadly in line with risk-free rates in the review period, with sovereign spreads moving closer together (Chart 17). While long-term risk-free rates showed sizeable fluctuations over the review period, the ten-year GDP-weighted euro area sovereign spread over the OIS rate remained overall relatively stable, ending the review period 7 basis points higher than in early September. This masked different developments across countries as individual sovereign spreads tightened. For instance, the Italian and Greek ten-year sovereign bond spreads declined by 18 and 22 basis points respectively, while the ten-year German Bund spread became less negative by 14 basis points.

Chart 17

Ten-year euro area sovereign bond spreads vis-à-vis the ten-year €STR OIS rate

(percentage points)

Sources: Refinitiv and ECB calculations.

Notes: The vertical grey line denotes the start of the review period on 8 September 2022. The latest observations are for 14 December 2022.

Corporate bond spreads decreased during the review period on the back of improved risk sentiment, with declines most pronounced in the high-yield segment. Notwithstanding higher short-term rates and economic headwinds, corporate bond spreads decreased over the review period on the back of improved risk sentiment, with supply side bottlenecks continuing to ease gradually and Purchasing Managers’ Indices (PMIs) showing some resilience (see Sections 1 and 2). This was particularly the case for spreads on high-yield corporate bonds, which fell 35 basis points, while spreads on investment-grade corporate bonds declined by 19 basis points.

European equity markets rebounded, with euro area banks performing particularly strongly. Despite some drag from higher risk-free rates, equity markets rebounded, with European equities outperforming their global peers, including in the United States. Overall, equities of non-financial corporations (NFCs) increased by 7.7% in the euro area, against a decline of 0.8% in the United States. The difference was even stronger for the banking sector, with euro area banks gaining as much as 14.2% against a fall of 4.0% in the United States. This rebound reflected positive earnings surprises for euro area banks in the third quarter and expectations of more robust earnings ahead, with realised and expected increases in the ECB’s key interest rates perceived as helping to bolster banks’ interest margins and hence profits.

Chart 18

Euro area and US equity price indices

(index: 1 January 2015 = 100)

Sources: Refinitiv and ECB calculations.

Notes: The vertical grey line denotes the start of the review period on 8 September 2022. The latest observations are for 14 December 2022.

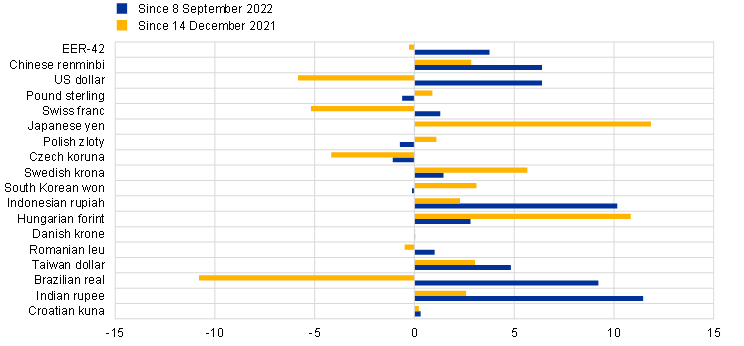

In foreign exchange markets, the euro broadly strengthened in trade-weighted terms (Chart 19). During the review period the nominal effective exchange rate of the euro – as measured against the currencies of 42 of the euro area’s most important trading partners – strengthened by 3.8%. In terms of bilateral exchange rate developments, the euro appreciated strongly against the US dollar (by 6.4%), reflecting speculation that the pace of rate hikes in the United States could slow and monetary policy could change its direction sooner than expected. It also strengthened against the currencies of most other major advanced economies, including the Swiss franc (by 1.3%), although it remained broadly unchanged vis-à-vis the Japanese yen. The euro also appreciated against most currencies of major emerging market economies, notably the Chinese renminbi (by 6.4%). It weakened slightly against some European currencies, including the pound sterling (by 0.6%), the Czech koruna (by 1.1%) and the Polish zloty (by 0.7%), while it continued to appreciate against the Hungarian forint (by 2.8%).

Chart 19

Changes in the exchange rate of the euro vis-à-vis selected currencies

(percentage changes)

Source: ECB.

Notes: EER-42 is the nominal effective exchange rate of the euro against the currencies of 42 of the euro area’s most important trading partners. A positive (negative) change corresponds to an appreciation (depreciation) of the euro. All changes have been calculated using the foreign exchange rates prevailing on 14 December 2022.

5 Financing conditions and credit developments

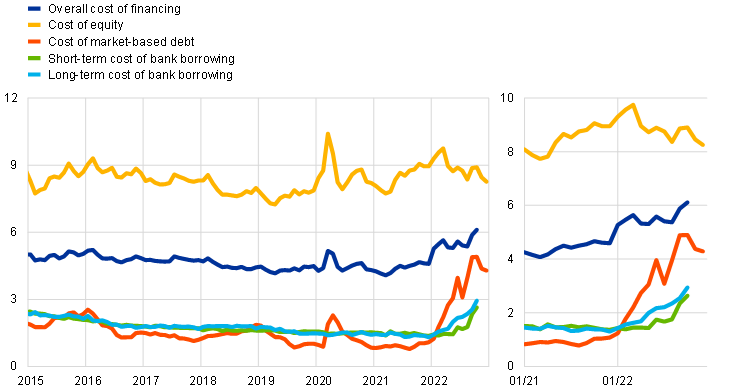

Bank lending rates have increased further, reflecting higher bank funding costs as monetary policy normalisation continues. Bank lending to firms remained robust in October, while lending to households moderated further. Over the period from 8 September to 14 December, the cost of equity financing declined significantly while the cost of market-based debt financing increased slightly. The October 2022 Survey on the Access to Finance of Enterprises (SAFE) indicates a broad-based tightening of financing conditions for firms. Meanwhile, firms were rather pessimistic about the availability of most sources of external financing. The moderation in monetary dynamics resumed in October, reflecting developments in credit to firms and households.