- THE ECB BLOG

What drives inflation expectations of women and men?

14 September 2022

Women and men shop differently and have different perceptions of prices and inflation. This ECB Blog post examines how inflation expectations are formed and revised across gender and why that matters for central banks.

Women tend to have higher inflation expectations than men. As these differences are well documented across the world, we have used results from the ECB’s new Consumer Expectations Survey (CES) to shed light on certain factors which can explain some of the gender inflation gap. And this gap is quite substantial: the inflation expectations of women and men participating in the CES differed by almost one percentage point.

So, what factors did we find which could explain this gender gap? First, on average, women place more emphasis on perceived food inflation. Second, men are more confident about their inflation expectations. However, when women and men receive new information regarding price changes, while that may differ depending on personal experiences, they will both adjust their inflation expectations at a similar rate and in a similar pattern to each other. As humans we absorb news the same way regardless of our gender, whereas gaps result from different information sets.

But let’s take a step back and look at how we form expectations. Our inflation perception often starts with personal experience in everyday life situations. As consumers, we observe and focus on prices we encounter in our daily routines. We extrapolate these to broader inflation perceptions and eventually shape our expectations for future inflation.[1] This is why our heterogeneous preferences and shopping habits influence the way we perceive and expect inflation to develop. And it might shape perceptions and expectations for women and men differently, also depending on their age.[2]

Food prices have biggest effect on inflation expectations

This pattern is also represented in our findings from the CES. An analysis conducted on the results of the CES shows that the inflation expectations of the average euro area consumer depend on how she or he perceives inflation in all main spending categories: food, health, clothing, transport, utilities and housing services. All of them matter, but perception of food inflation matters the most .[3]

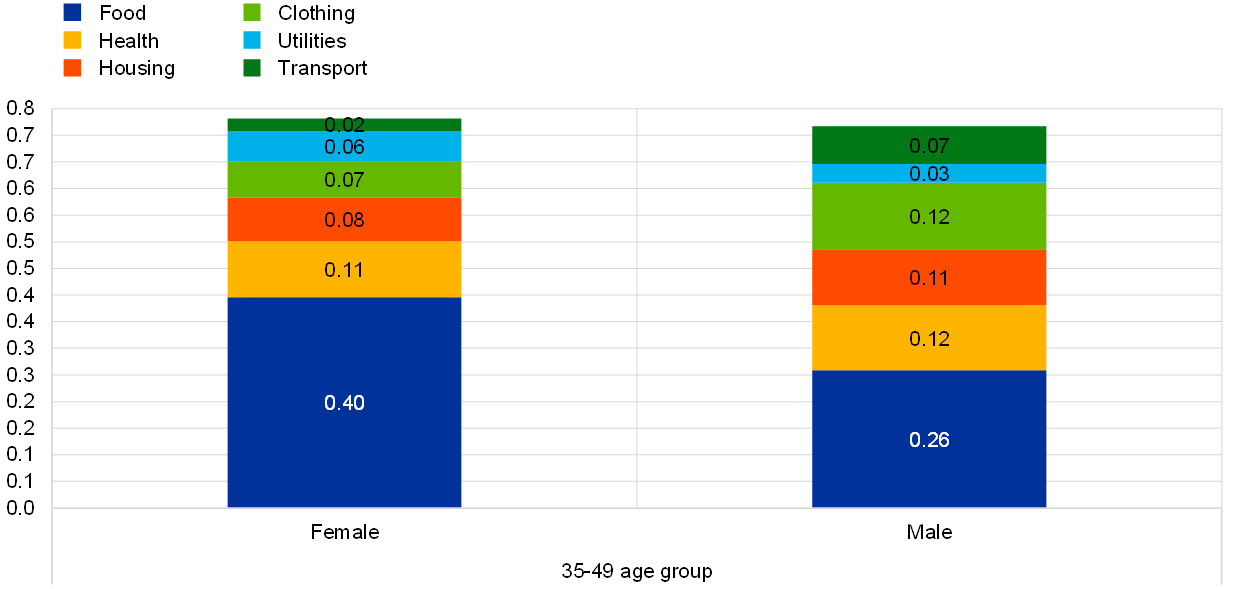

The predominant role of perceived food inflation holds for both women and men but is especially true for women.[4] Moreover, the gender gap in the influence of perceived food inflation on inflation expectations does not exist in consumers aged below 34 and is highest for women aged 35-49. It is estimated that a one-percentage-point increase in perceived food inflation will raise women’s short-term (one-year ahead) inflation expectations by 0.40 percentage points. By contrast, the impact on men’s expectations is 0.26 percentage points – see Chart 1. In reality, the share of food, beverages and tobacco in the price index is actually only 21 percent.[5] When thinking about future inflation, men seem to be more influenced by perceptions of transport, clothing and housing inflation developments. This divide could reflect the allocation of household chores between men and women. And indeed single men and single women aged 35-49 do not substantially differ in the extent to which their perceived food, transport and housing inflation carries on their inflation expectations whereas the divergence is confirmed in couples aged 35-49.[6]

Impact of perceived inflation in single spending category on inflation expectations one-year ahead

Percentage points

Sources: ECB Consumer Expectations Survey (CES).

Notes: The chart shows how much impact a one percentage point higher perception of inflation in different spending categories has on one-year ahead inflation expectations for females and males aged 35-49 years old

Women are also more likely to report round numbers in their inflation expectations. Reiche and Meyler (2022) show that people who are more uncertain about the quantitative level of inflation typically report round figures as their inflation expectations.[7] Women are more likely than men to report multiples of 10 or of 5, whereas men are more likely to report either single non-rounded digits or even decimal places. There is also evidence that those who have a negative attitude about the economy tend to be more uncertain about the inflation outlook and to report rounded and higher inflation expectations.

Reassuringly for economic forecasters, the CES also provides data that indicates some interesting ways in which women and men can be predicted to behave in a similar manner. The participants in the survey were asked, on two occasions, about how they perceive inflation in the different spending categories and were also asked for the inflation rate they expected in the future. Their answers show that changes in inflation perceptions move inflation expectations when food, transport and utilities are concerned. Most interestingly, inflation expectations change to the same extent for women and men and in line with these categories’ weight in households’ consumption baskets.[8] In other words: following a similar change of perceived inflation, men and women, regardless of their age, tend to revise their inflation expectations in a similar fashion.

Why does this all matter for monetary policy? Gender indicates our inflation perceptions and perceptions influence behaviours in a myriad of different ways. Related to the different expectations of women and men, there are consequences in real life, for example, how we behave when economic circumstances or financing conditions change. Women might be less prone than men to cancelling, postponing or reducing their holiday plans when energy prices spike or be less influenced by a similar spike when planning to purchase a car. The fallout on aggregate economic activity are self-evident.

Enhancing central bankers’ understanding of how consumers form and update their inflation expectations is important in several ways. It helps identify what type of inflation matters for consumers. It enhances the analysis of the macroeconomic implications of monetary policy decisions and thus ultimately it builds up central banks’ credibility. Gender differences underscore the need for a differentiated communication strategy which can speak to specific experiences. Recently, the Eurosystem has undertaken several initiatives aimed at promoting financial literacy generally and the understanding of inflation specifically. Such initiatives could overcome the cognitive inattention of consumers by stimulating both women and men to broaden the information set upon which their beliefs and actions are grounded. Ultimately, better-informed evaluations of inflation and real interest rate would enable households to take better informed consumption and investment decisions.

Subscribe to the ECB blogThe views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Inflation perceptions and expectations are highly influenced by personal experiences, see de Bruin B., W., W. van der Klaauw and G. Topa G, 2011, “Expectations of Inflation: The Biasing Effect of Thoughts about Specific Prices.” Journal of Economic Psychology 32(5): 834-845; Cavallo, A., G. Cruces and R. Perez-Truglia. 2017, “Inflation Expectations, Learning, and Supermarket Prices: Evidence from Survey Experiments” American Economic Journal: Macroeconomics 9(3): 1-35. Conrad C., Enders Z., Glas A., 2021, “The role of information and experience for households‘ inflation expectations”, Bundesbank Discussion Paper; D’Acunto F., Malmendier U., Ospina J., Weber M., 2021 “Exposure to Grocery Prices and Inflation Expectations”, Journal of Political Economy, Vol. 129, N. 5;

For a further discussion of the gender gap in inflation perceptions and expectations see Jonung L.,1981, Perceived and Expected Rates of Inflation in Sweden”, American Economic Review (Vol. 71, Issue 5); and Arioli et al., 2016, “EU consumers’ quantitative inflation perceptions and expectations: an evaluation”, European Economy - Discussion Papers 2015 - 038, DG ECFIN European Commission.

Consumers are asked about perceived changes in the price level over the previous 12 months (perceived inflation) and those expected over the next 12 months (inflation expectations) every month. In December 2021 and March 2022, they were also asked to report perceived price changes over the same horizon in single spending categories. The empirical evidence is obtained estimating inflation expectations 12 months ahead to perceived inflation in the six main spending groupings (three years ahead inflation expectations confirm main findings) and separately revisions in inflation expectations to revisions in perceived inflation in the six spending categories. Effects due to structural factors encompassing time, country, gender, age, attained education, income are controlled for. For further information visit here.

Men and women report about the same spending allocation across categories, women perceive higher inflation in each spending category and overall. See also, D’Acunto F. Malmendier U., Weber M.,2021, “Gender roles produce divergent economic expectations”, Proceeding of National Academy of Sciences, Vol. 118, N.21.

For weights of main components of the euro area HICP inflation in 2022 see here.

See. Flagg, L., Sen, B., Kilgore, M., & Locher, J. (2014). “The influence of gender, age, education and household size on meal preparation and food shopping responsibilities”. Public Health Nutrition, 17(9), 2061-2070

The rounding to multiples of 10 or 5 by both males and females is one reason why mean inflation expectations tend to be systematically higher than actual inflation. Reiche, L. and A. Meyler (2022) “Making sense of consumer inflation expectations: the role of uncertainty”, ECB Working Paper Series No 2642, February.

See also, Armantier O., Nelson S., Topa G., van der Klaauw W., Zafar B., 2016, “The Price Is Right: Updating Inflation Expectations in a Randomized Price Information Experiment”, The Review of Economics and Statistics (2016) 98 (3): 503–523;.