- PRESS RELEASE

Payments statistics: 2020

23 July 2021

- Total number of non-cash payments in euro area increased by 3.7% to 101.6 billion and total value increased by 8.7% to €167.3 trillion

- Card payments accounted for 47% of total number of non-cash payments, while credit transfers accounted for 23% and direct debits accounted for 22%

- Number of payment cards issued increased by 6.5% to 609 million, representing around 1.8 payment cards per euro area inhabitant

- Around 46 billion transactions processed by retail payment systems in euro area worth €36.0 trillion

The European Central Bank (ECB) has today published the 2020 statistics on non-cash payments. The statistics comprise indicators on access to and use of payment services and terminals by the public, as well as volumes and values of transactions processed through payment systems. This press release focuses on developments in the euro area as a whole, although statistics are also published for each EU Member State, in addition to euro area and EU aggregates and comparative data.

Payment services[1]

The total number of non-cash payments in the euro area, comprising all types of payment services[2], increased in 2020 by 3.7% to 101.6 billion compared with the previous year and the total value increased by 8.7% to €167.3 trillion. Card payments accounted for 47% of all transactions, while credit transfers accounted for 23% and direct debits for 22%.

The number of credit transfers within the euro area increased in 2020 by 3.2% to 23.1 billion and the total value increased by 10.3% to €155.8 trillion. The relative importance of the number of credit transfers initiated electronically continued to increase, with the ratio of transactions initiated electronically to paper based transactions now standing at around fifteen to one. The number of direct debits within the euro area increased in 2020 by 4.4% to 22.2 billion while the total value decreased by 5.2% to €6.6 trillion. The number and value of card transactions remained broadly unchanged in 2020, at 47.8 billion and €2.0 trillion, respectively. This corresponds to an average value of around €41 per card transaction.

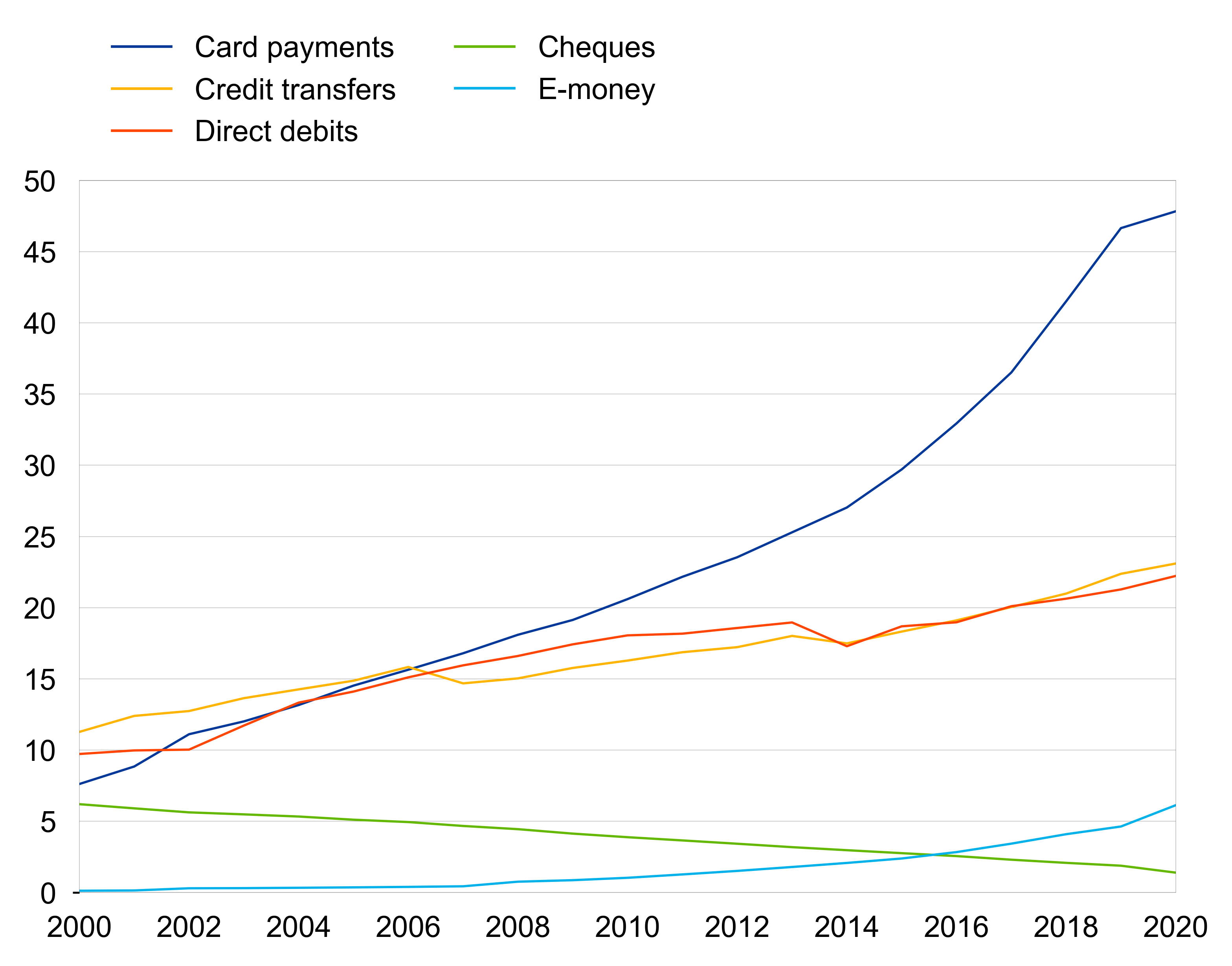

The number of cards in the euro area with a payment function increased in 2020 by 6.5% to 609.3 million. With a total euro area population of 343 million, this represented around 1.8 payment cards per euro area inhabitant. Chart 1 below shows the development in the use of the main payment services in the euro area from 2000 to 2020.

The relative importance of the main payment services continued to vary widely across euro area countries in 2020. For example, at national level, the highest share of card payments, as a percentage of total number of non-cash payments in 2020, is observed for Portugal at around 70%. The highest share for credit transfers is found in Slovakia at around 38% and Germany accounts for the highest percentage of direct debits at around 44% (see Annex).

In 2020, the total number of automated teller machines (ATMs) in the euro area decreased by 4.9% to 0.29 million, while the number of point of sale (POS) terminals increased by 4.3% to 12.2 million.

Chart 1

Use of the main payment services in the euro area

(number of transactions per year in billions)

Source: ECB.

Note: Data have been partially estimated for periods prior to 2010, as methodological changes were implemented in previous years and some corresponding data are not available. The historical estimation done by the ECB ensures comparability of figures over the entire period. Statistics are also collected on other payment services, which accounted for 1.0% of the total number of euro area transactions in 2020.

Retail payment systems

Retail payment systems in the euro area handle mainly payments that are made by individuals, with a relatively low value, high volume, and limited time-criticality.

In 2020, data have been reported for 25 retail payment systems within the euro area as a whole. During the year, around 46 billion transactions were processed with a combined value of €36.0 trillion[3].

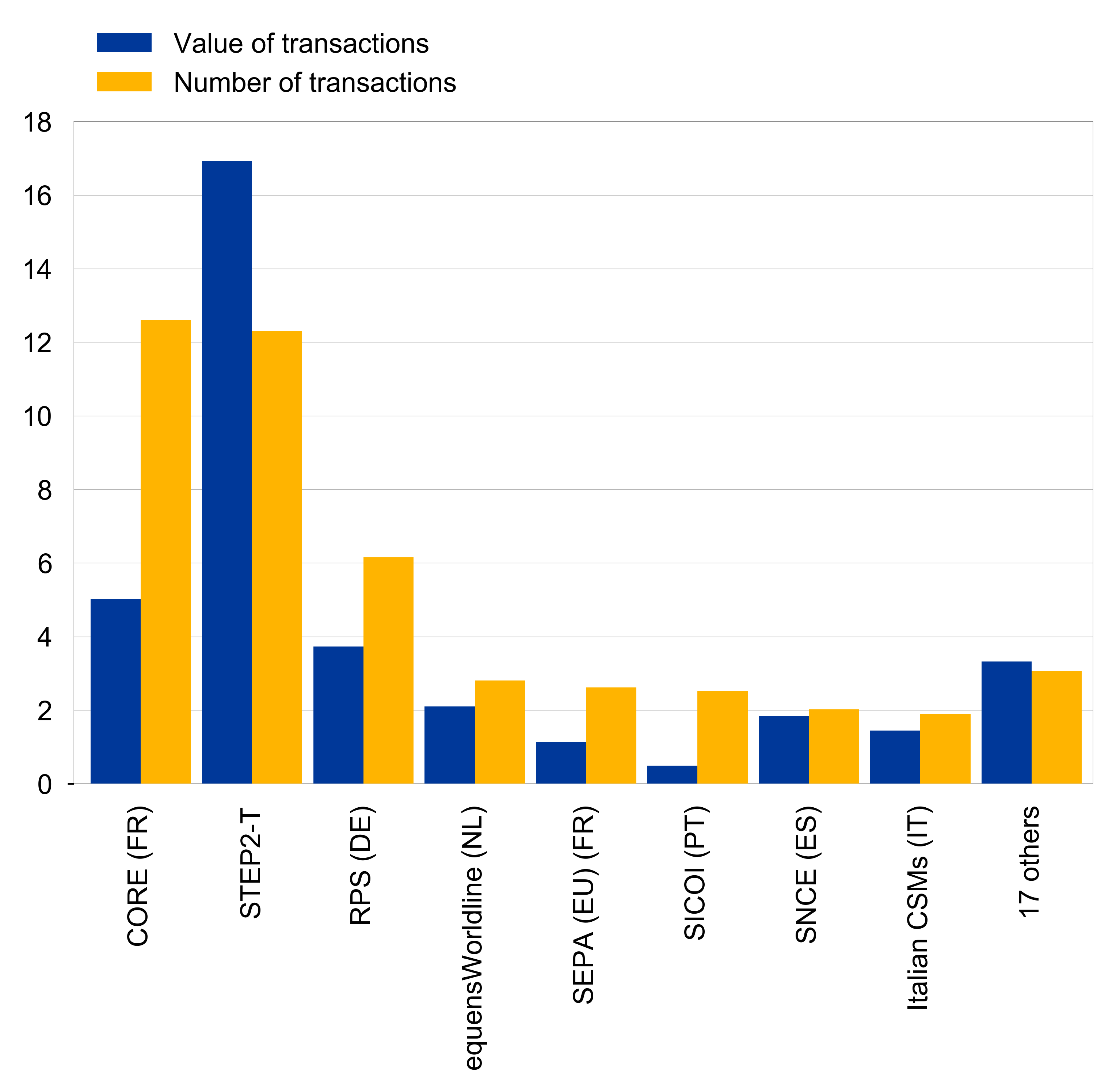

There continues to be a high degree of concentration in euro area retail payment systems in 2020. The three largest systems in terms of number of transactions (CORE in France, STEP2-T[4] and RPS in Germany) processed 68% of the volume and 71% of the value of all transactions processed by euro area retail payment systems. Chart 2 shows the number and value of transactions processed by euro area retail payment systems in 2020.

Chart 2

Retail payment systems in the euro area in 2020

(value of transactions in EUR trillions and number of transactions in billions)

Source: ECB.

Large-value payment systems

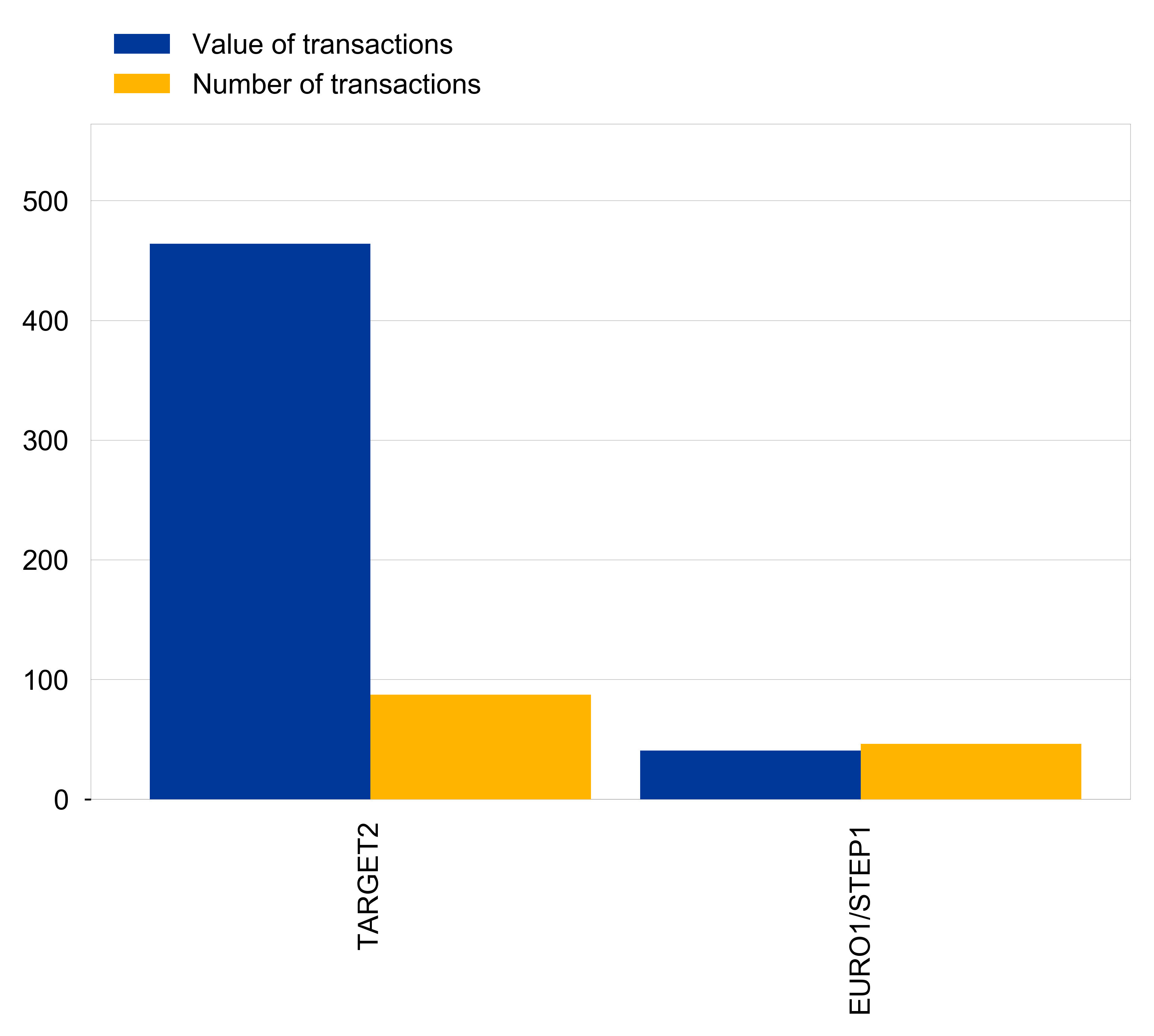

Large-value payment systems (LVPSs) are designed primarily to process large-value and/or high-priority payments made between participants in the system for their own account or on behalf of their customers. Although, as a rule, no minimum value is set for payments made in such systems, the average size of such payments is usually relatively large. During 2020, the LVPSs settled 134 million payments with a total value of €505 trillion in euro payments, with TARGET2 and EURO1/STEP1 being the two main LVPSs[5].

Chart 3 below shows the number and value of transactions processed by the main LVPSs in 2020.

Chart 3

Main large-value payment systems in 2020

(value of transactions in EUR trillions and number of transactions in millions)

Source: ECB.

Notes:

- The full set of payments statistics can be downloaded from the Statistical Data Warehouse (SDW). The "Reports" section of the SDW also contains pre-formatted tables with payments statistics for the last five years. The data are presented in the same format as in the former "Blue Book Addendum". For detailed methodological information, including a list of all data definitions, please refer to the "Statistics" section of the ECB's website.

- As a result of the progressive implementation of the Single Euro Payments Area (SEPA) and other developments in the payments market in Europe, the methodological and reporting framework for payments statistics has been enhanced as of the reference year 2014. The reporting requirements are laid down in the Regulation on payments statistics (ECB/2013/43) and in the Guideline on monetary and financial statistics (recast) (ECB/2014/15). A background note, available on the ECB's website, describes the changes in more detail.

- In addition to annual payments statistics for 2020, this press release incorporates minor revisions to data for previous periods. The hyperlinks in the press release are dynamic; thus, the data might slightly change with the next annual release due to revisions. Unless otherwise indicated, statistics referring to euro area cover the EU Member States that had adopted the euro at the time to which the data relate.

- The annual growth rate indicators for value of transactions are HICP-adjusted.

- Hyperlinks in the main body of the press release and in annex tables lead to data that may change with subsequent releases as a result of revisions. Figures shown in annex tables are a snapshot of the data as at the time of the current release.

- SEPA instruments are included in the respective categories. Information on the SEPA instruments can be found on the ECB's website (http://www.ecb.europa.eu/paym/sepa/html/index.en.html).

- Including credit transfers, direct debits, card payments with cards issued by resident payment service providers, e-money payments, cheques and other payment services.

- The figures for one Cypriot payment system are excluded from the euro area aggregates due to confidentiality.

- STEP2 is a pan-European automated clearing house for retail payments in euro operated by EBA CLEARING. The STEP2-T system is a systemically important payment system at euro area level.

- TARGET2 is the second-generation Trans-European Automated Real-time Gross settlement Express Transfer system. It is operated by the Eurosystem and settles payments in euro in central bank money.

EURO1/STEP1 is an EU-wide multilateral net large-value payment system for euro payments operated by EBA CLEARING. Payments are processed in EURO1 throughout the day and final balances are settled at the end of the day in TARGET2.

Banca centrale europea

Direzione Generale Comunicazione

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

La riproduzione è consentita purché venga citata la fonte.

Contatti per i media