- 20 August 2018

Euro area investment fund statistics: second quarter of 2018

- In the second quarter of 2018 the outstanding amount of shares/units issued by investment funds other than money market funds was €11,414 billion, €200 billion higher than in the first quarter of 2018.

- Investment funds other than money market funds increased their holdings of both equity and debt securities issued by the rest of the world. At the same time, the holdings of debt securities issued by euro area residents decreased and equity issued by euro area residents increased.

- In terms of investment funds by type, the largest transactions were recorded in mixed funds, with an inflow of €50 billion, and in equity funds, with an inflow of €19 billion in the second quarter of 2018.

- The outstanding amount of shares/units issued by money market funds was €1,135 billion, unchanged from the first quarter of 2018.

Chart 1

Investment fund shares/units issued

(EUR billions; not seasonally adjusted)

In the second quarter of 2018 the outstanding amount of shares/units issued by investment funds other than money market funds was €200 billion higher than in the first quarter of 2018. This development was accounted for by €107 billion in price and other changes and €93 billion in net issuance of shares/units. The annual growth rate of shares/units issued by investment funds other than money market funds, calculated on the basis of transactions, was 6.5% in the second quarter of 2018.

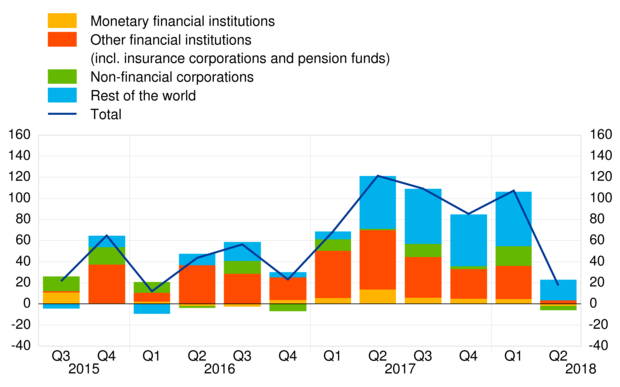

Chart 2

Debt securities - investment funds' net purchases by issuer sector

(EUR billions; not seasonally adjusted)

Chart 3

Equity and investment fund shares/units - investment funds' net purchases by issuer sector

(EUR billions; not seasonally adjusted)

Within the assets of investment funds other than money market funds, the annual growth rate of debt securities was 6.4% in the second quarter of 2018, with transactions amounting to €1 billion during this period. In the case of equity, the corresponding annual growth rate was 5.6%, with transactions totalling €14 billion. For holdings of investment fund shares/units, the annual growth rate was 6.0% and transactions amounted to €4 billion.

Chart 4

Transactions by type of investment funds

(EUR billions; not seasonally adjusted)

In terms of the type of investment fund, the annual growth rate of shares/units issued by bond funds was 4.6% in the second quarter of 2018. In the same period, transactions in shares/units issued by bond funds amounted to -€10 billion. In the case of equity funds, the corresponding annual growth rate was 6.3%, with transactions of €19 billion. For mixed funds, the corresponding figures were 7.8% and €50 billion.

In terms of holdings by issuing sector, the annual growth rate of debt securities issued by general government was -0.9% in the second quarter of 2018. In the same period, the net purchases of debt securities issued by the general government amounted to €4 billion. In the case of debt securities issued by the private sector, the annual growth rate was 5.0%, whereby the net sales amounted to €3 billion. For debt securities issued by the rest of the world, the corresponding annual growth rate was 9.5%, with net purchases of €1 billion.

The outstanding amount of shares/units issued by money market funds was unchanged from the first quarter of 2018. This position was accounted for by €14 billion in price changes and -€14 billion in net issuance of shares/units. The annual growth rate of shares/units issued by money market funds, calculated on the basis of transactions, was 0.8% in the second quarter of 2018.

Within the assets of money market funds, the annual growth rate of debt securities holdings was 0.1% in the second quarter of 2018, with transactions amounting to -€29 billion, which reflected net sales of €24 billion related to debt securities issued by euro area residents and net sales of €5 billion in debt securities issued by non-euro area residents. For deposits and loan claims, the annual growth rate was 3.7% and transactions during the second quarter of 2018 amounted to €14 billion.

Annex

Table: Annex to the press release on euro area investment fundsStatistical Data Warehouse:

All money market funds time seriesAll investment funds other than money market funds time series

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes:

- Money market funds are presented separately in this press release since they are classified in the monetary financial institutions sector within the European statistical framework.

- Hyperlinks in the main body of the press release are dynamic. The data they lead to may therefore change with subsequent data releases as a result of revisions. Figures shown in annex table are a snapshot of the data as at the time of the current release.

Banca centrale europea

Direzione Generale Comunicazione

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

La riproduzione è consentita purché venga citata la fonte.

Contatti per i media