- PRESS RELEASE

January 2022 euro area bank lending survey

1 February 2022

- Credit standards tightened slightly for firms and remained unchanged for housing loans

- Banks continue to hold overall benign view of firm credit risks, owing mainly to positive assessment of economic outlook

- Strong increase in loan demand by firms, driven by higher working capital needs stemming from supply bottlenecks, as well as by financing for longer-term investment

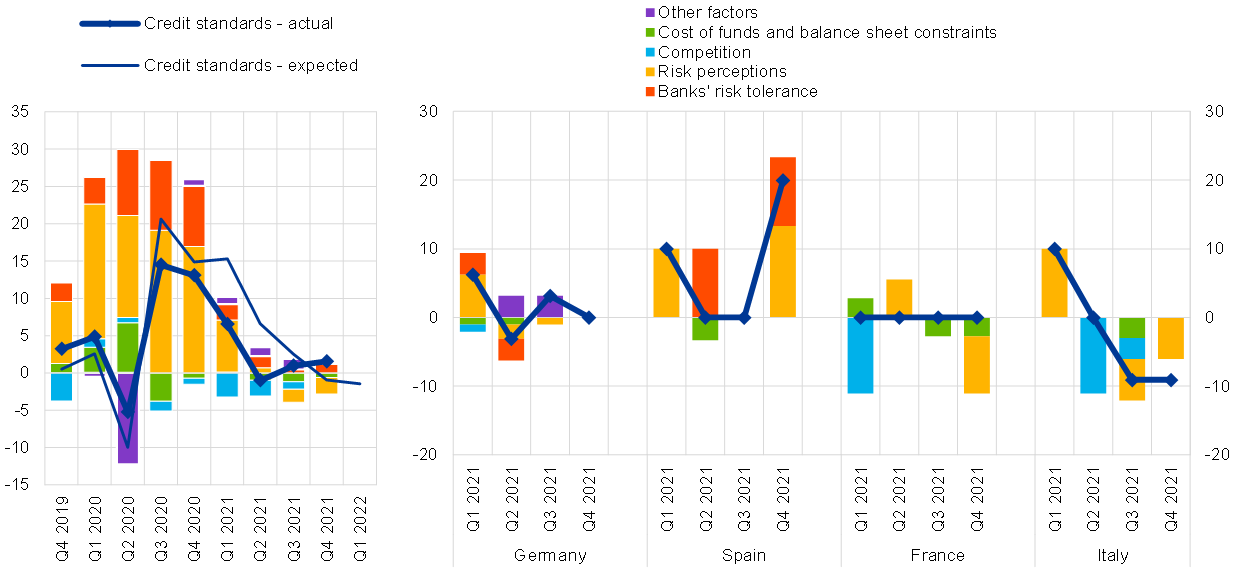

According to the January 2022 euro area bank lending survey (BLS), credit standards – i.e. banks’ internal guidelines or loan approval criteria – for loans or credit lines to enterprises tightened very slightly (net percentage of banks standing at 2%, see Chart 1) in the fourth quarter of 2021. Regarding loans to households for house purchase, euro area banks reported unchanged credit standards (net percentage of 0%), while credit standards for consumer credit and other lending to households eased moderately (net percentage of -4%). Banks had a generally benign view of firms’ and households’ credit risks based on an overall positive assessment of the economic outlook, despite the current pandemic situation and the dampening impact of supply bottlenecks. In the first quarter of 2022, banks expect credit standards to remain broadly unchanged for loans to firms, to tighten moderately for housing loans and to ease further for consumer credit.

Banks’ overall terms and conditions – i.e. the actual terms and conditions agreed in loan contracts –were broadly unchanged for loans to firms and loans to households in the fourth quarter of 2021. For margins on average loans, banks continued to report a narrowing in net terms for loans to firms and loans to households for house purchase, whereas margins on riskier loans widened for these loan categories. For consumer credit and other lending to households, both margins on average and riskier loans remained broadly unchanged.

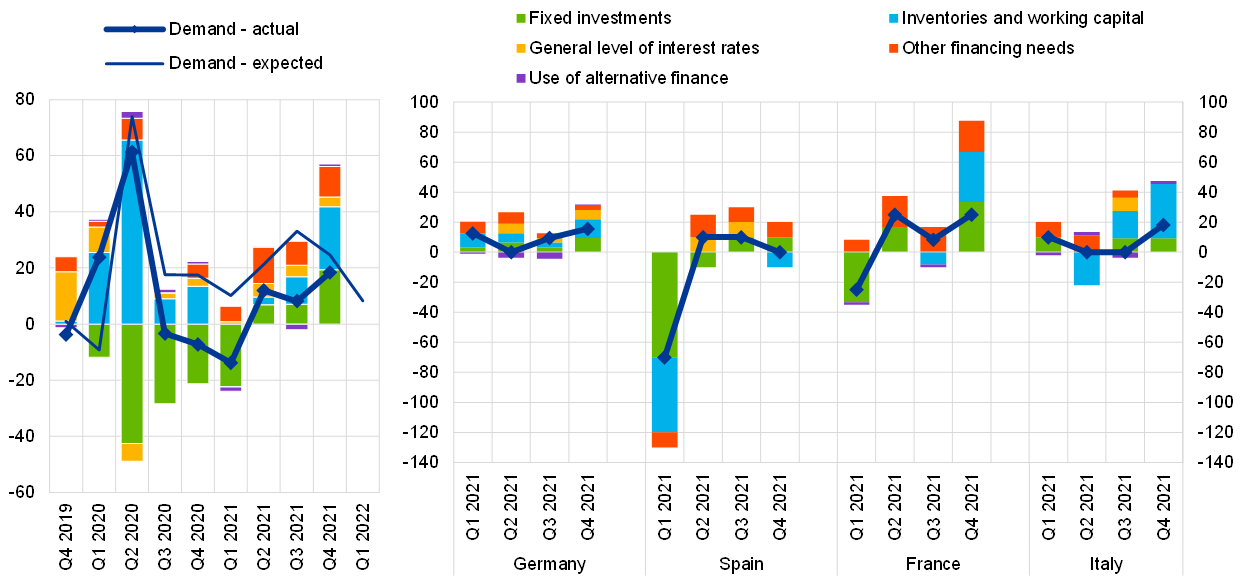

Banks reported, on balance, a considerable increase in firms’ demand for loans or drawing of credit lines in the fourth quarter of 2021 (see Chart 2), driven by a stronger positive contribution of firms’

financing needs for both working capital and fixed investment compared with the previous quarter. In addition, banks continued to report a positive impact on loan demand from other financing needs, which include M&A activity and debt refinancing and restructuring. Demand for housing loans and for consumer credit and other lending to households increased in net terms in the fourth quarter of 2021. Consumer confidence and the low general level of interest rates continued to support the demand for loans to households across loan categories. In addition, housing market prospects had a positive impact on the demand for housing loans, whereas spending on durables had a small negative impact on consumer credit. In the first quarter of 2022, banks expect net demand to continue to increase for loans to firms and households.

According to the banks surveyed, access to retail funding continued to improve in the fourth quarter of 2021. In addition, banks reported that supervisory and regulatory actions had a positive effect on their capital position in 2021. At the same time, euro area banks’ non-performing loan (NPL) ratios had a small net tightening impact on credit standards for loans to enterprises and for consumer credit, whereas the impact continued to be neutral on credit standards for loans to households for house purchase in the second half of 2021. Across the main economic sectors, euro area banks indicated moderately tightened or broadly unchanged credit standards for new loans to enterprises. Finally, euro area banks reported that COVID-19 related government guarantees continued to support banks’ credit standards for loans to firms in the second half of 2021. Demand for loans with COVID-19 related government guarantees declined on balance, while it increased for loans without such guarantees.

The euro area bank lending survey, which is conducted four times a year, was developed by the Eurosystem in order to improve its understanding of bank lending behaviour in the euro area. The results reported in the January 2022 survey relate to changes observed in the fourth quarter of 2021 and expected changes in the first quarter of 2022, unless otherwise indicated. The January 2022 survey round was conducted between 13 December 2021 and 11 January 2022. A total of 152 banks were surveyed in this round, with a response rate of 100%.

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes

- A report on this survey round is available on the ECB’s website. A copy of the questionnaire, a glossary of BLS terms and a BLS user guide with information on the BLS series keys can be found on the same web page.

- The euro area and national data series are available on the ECB’s website via the Statistical Data Warehouse. National results, as published by the respective national central banks, can be obtained via the ECB’s website.

- For more detailed information on the bank lending survey, see Köhler-Ulbrich, P., Hempell, H. and Scopel, S., “The euro area bank lending survey”, Occasional Paper Series, No 179, ECB, 2016.

Chart 1

Changes in credit standards for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards, and contributing factors)

Source: ECB (BLS).

Notes: Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. The net percentages for the “other factors” refer to further factors which were mentioned by banks as having contributed to changes in credit standards.

Chart 2

Changes in demand for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Source: ECB (BLS).

Notes: Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”.

Banca centrale europea

Direzione Generale Comunicazione

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

La riproduzione è consentita purché venga citata la fonte.

Contatti per i media