- SPEECH

Stay safe at the intersection: the confluence of big techs and global stablecoins

Speech by Fabio Panetta, Member of the Executive Board of the ECB, at the panel on “Cross-border dimensions of non-bank financial intermediation: what are the priorities for building resilience globally?”, as part of the UK G7 Presidency Conference on “Safe Openness in Global Trade and Finance” hosted by the Bank of England

8 October 2021

In the years since the global financial crisis, non-bank financial intermediaries (NBFIs) have shown continuous growth, and now account for more than half of global financial assets.[1]

Although there are a variety of reasons for this development, one of the factors has been the stricter banking regulation adopted after the global financial crisis constraining the risk-taking of banks.[2] The regulatory reforms of the last decade have promoted financial stability, especially in the banking sector.[3] At the same time, these reforms have been accompanied by an expansion of actors outside the regulatory perimeter.

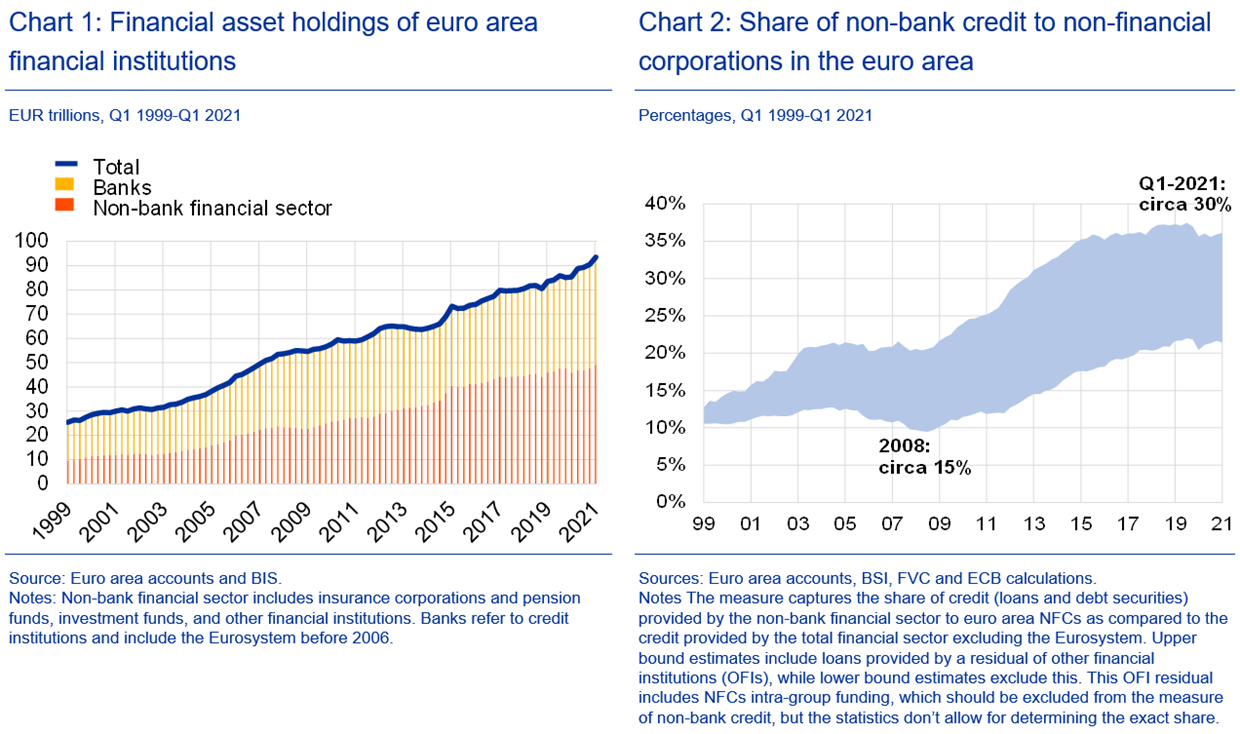

NBFIs have grown faster than banks over much of the past decade: in the euro area, their assets have almost doubled, reaching €48 trillion in December 2020 (Chart 1). In the same period, non-bank finance has become an important source of funding for the real economy: its share of credit to non-financial corporations has increased from about 15% to 30% (Chart 2).

The growth of NBFIs is not the only factor shaping the rapid change of global financial markets. Digitalisation is challenging traditional financial intermediation, for example through the emergence of decentralised finance platforms that are becoming increasingly used. But we can expect more disruptive changes if two related – but up to now parallel – trends eventually converge.

On one side, global technological companies – or “big techs”, such as Google, Amazon, Facebook and Apple (GAFA) – have started offering financial services and, given their size, their large customer base and their access to unique information, are becoming more and more relevant global players in the markets. On the other side, digital assets such as crypto-assets and stablecoins are growing rapidly, although their take-up and reach in payments has remained limited so far. If big techs start issuing global stablecoins, we could see these two trends meet and alter the functioning of global financial markets.

Today, I will argue that if we are to address the cross-border challenges stemming from the expansion of NBFIs, we not only need to strengthen the regulatory and macroprudential approach to these institutions, we also need to widen the regulatory perimeter.

It took the global financial crisis to overhaul the regulation of banks and the coronavirus (COVID-19) crisis to trigger discussions on a more robust framework for money market funds, investment funds and margining practices. We should not wait for another crisis to regulate an increasingly digitalised finance with new global players.

Cross-border challenges from the growing role of non-banks in financial intermediation

Non-bank financial intermediation can bring benefits to both investors and the real economy across the globe. It allows firms to diversify their sources of funding, including across borders. This diversification can promote risk-sharing, thereby reducing the impact of country-specific or banking sector-specific shocks on the real economy and strengthening financial stability.

At the same time, if underlying risks and vulnerabilities are not kept in check, they have the potential to affect financial stability, both domestically and globally.[4] The financial shock at the onset of the coronavirus pandemic last year is a case in point: while the banking sector proved to be relatively resilient, vulnerabilities were revealed in parts of the non-bank financial system.[5]

From a cross-border perspective, three factors increase the risk of contagion through non-bank financial intermediation.

Interconnectedness

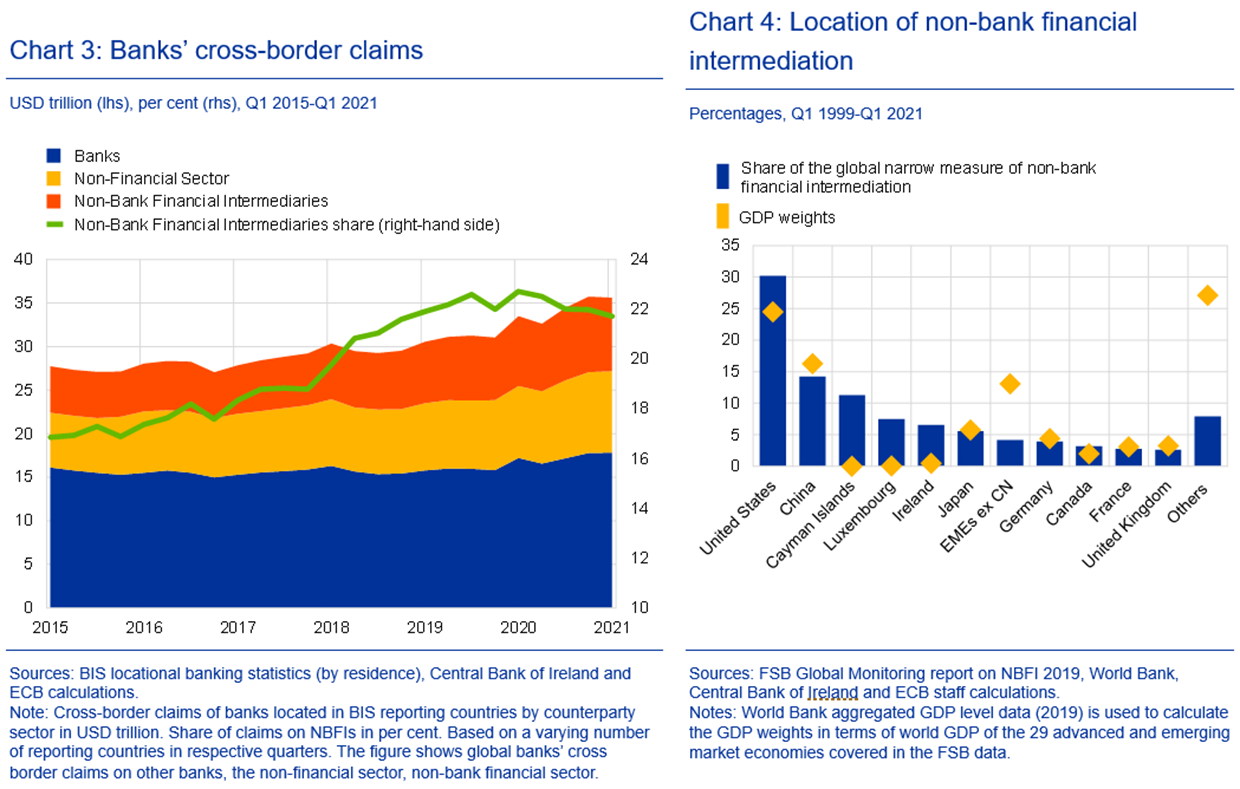

First, NBFIs are highly interconnected at the international level. This is due to their cross-border activities, but also to their interdependencies with the banking sector. Banks own asset management companies operating in multiple countries, provide liquidity to global NBFIs, or invest in their shares.[6] Globally, banks’ cross-border claims on NBFIs have been constantly growing over the past five years (Chart 3).[7]

Cross-border activity can foster international diversification and risk-sharing.[8] At the same time, it increases the risks of contagion and spillovers from a sudden loss of risk-appetite among NBFIs or a sudden loss of confidence in some NBFIs. Moreover, in a system with a higher share of fund-intermediated cross-border flows, monetary policy shocks can be propagated across borders more quickly and forcefully.[9] When economic conditions diverge, this may have adverse consequences for foreign jurisdictions, as was the case in the “taper tantrum” of 2013.[10]

Concentration in financial centres

NBFIs are often located in financial hubs, both regional and global (Chart 4). This geographical concentration is higher than for banks and it is driven by several factors such as network effects, human resources and legal systems. In certain cases, exploitation of regulatory or tax arbitrage is also likely to play a role.

The high concentration poses a particular challenge for effective supervision and risk monitoring. The migration of financial activities to foreign financial centres could affect the complexity and transparency of such activities, making it more difficult for domestic authorities to curtail systemic risk. It will also make it more challenging for authorities to coordinate with each other in a crisis and, if necessary, intervene.

Volatility

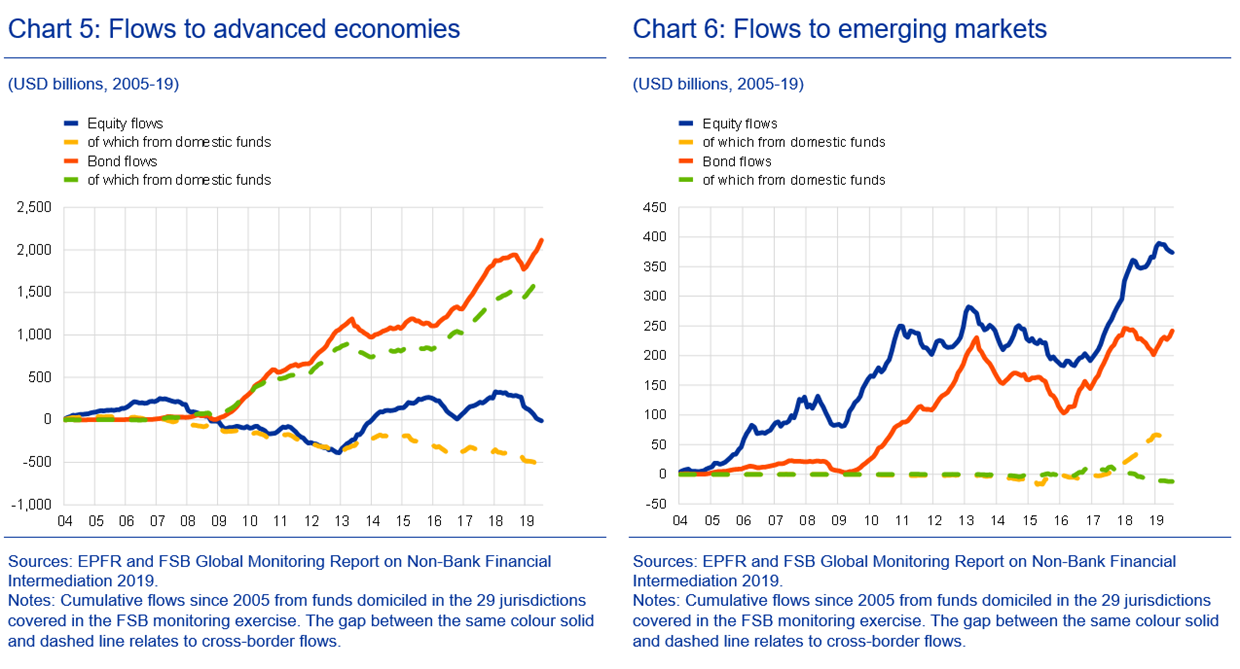

Third, NBFIs may increase the risk of contagion because fund-intermediated capital flows – especially those from and to emerging market economies – tend to be more volatile (Chart 5 and 6). As a result, the risk of sudden capital flow reversals at the global level has increased over time, also considering that the share of fund-intermediated flows is now much larger than it was 30 years ago.[11] In past episodes like the devaluation of China’s currency in 2015, NBFIs have already played a significant role in the sudden stops in capital flows.[12]

Towards a strengthened macroprudential approach for non-banks

Faced with these challenges, central banks need to look closely at the actions required to support their financial stability and monetary policy mandate.[13]

The regulatory framework for NBFIs lacks – to a large extent – a truly macroprudential perspective. This means that systemic risks might rise unchecked in good times and act as an amplifier in times of crisis.

In order to enhance the regulation and oversight of NBFIs from a systemic perspective, three principles should be followed.

First, a macroprudential approach should ensure that NBFIs provide a stable source of funding at all times in the cycle,[14] considering their aggregate behaviour during boom phases and in a crisis. Second, the framework should focus on building up resilience ex ante, for example by limiting liquidity mismatch and leverage. This would reduce the need for ex post interventions or support measures by public authorities during a crisis. And third, it should be comprehensive, with a range of measures spanning different entities and activities, in order to avoid regulatory leakages and spillovers.

Given the cross-border interconnectedness of NBFIs, the regulatory approach should be embedded in effective international policy coordination. The Financial Stability Board (FSB) is about to complete its work on international policy reforms for money market funds. Soon, the FSB’s work on investment funds and margining practices will need to switch focus from analysis to policy. And we should consider carrying out further work at the international level to assess and tackle risks arising from leverage in NBFIs.

Last but not least, central banks – together with regulatory and supervisory bodies – should continue to work on enhancing data and developing analytical capabilities so that we are better equipped to monitor risks stemming from NBFIs and devise appropriate policies.[15]

The growing challenges from big techs entry into financial services

But if we are to address the cross-border challenges from the expansion of NBFIs, strengthening the current regulatory and macroprudential approach will not be enough. We also need to widen its perimeter to keep pace with a fast-changing financial landscape.

Digitalisation and innovation are coming together to advance new forms of retail financial services. The provision of such services is increasingly decentralised, as more and more financial and non-financial players are looking into ways to better meet consumers’ needs. By decentralising key aspects of the financial infrastructure, technology is driving a proliferation of digital assets such as crypto-assets and stablecoins.

In parallel, big techs are entering financial services and looking into new possibilities of offering payment solutions to their users. Their payment and wallet services are now part of everyday life: they allow users to pay at point-of-sale terminals and on e-commerce platforms and apps. But big techs are not stopping there, as they are looking into ways of offering additional retail financial services.[16]

The confluence of these two dynamics means that stablecoins, which have limited take-up and use cases so far, could expand rapidly at the global level by relying on the large existing users’ base of big techs. These developments warrant careful monitoring, as the risks brought about by such structural changes may be abrupt and potentially disruptive.[17]

If we want to build a future-proof regulatory framework at the global level, we should address the three main challenges that the confluence of big techs and global stablecoins create.

Altering the structure of financial intermediation

First, big techs are beginning to offer a broad range of financial services and are increasingly competing with incumbent financial institutions. While their direct activity in this area is still limited at the global level, they may play a crucial role in the near future, especially in retail financial services.

Big techs already have group entities authorised or registered to provide financial services, including payment services, electronic money and credit provision.[18] In some markets, big techs have started lending to individuals and SMEs and also provide insurance and wealth management services.[19] The expansion of big techs in these areas has been most rapid in emerging market and developing economies[20], but their role in advanced economies is growing too. Amazon, for example, has been offering loans to its customers and sellers for over five years now[21], while other big techs are entering into partnerships with financial institutions to offer credit cards and digital current and savings accounts, among other products.[22]

Given their size, access to data from a large customer base and edge in artificial intelligence[23], big techs have a scale and information advantage over incumbent banks[24]. This could allow them to quickly expand and to challenge banks’ traditional role as the first point of contact for financial services.[25] While this may initially promote innovation and financial inclusion, it could ultimately stifle competition should big techs rise to dominance and abuse market power. This could give rise to higher costs, as well as data protection and safety issues.[26]

Influencing developments in global financial markets

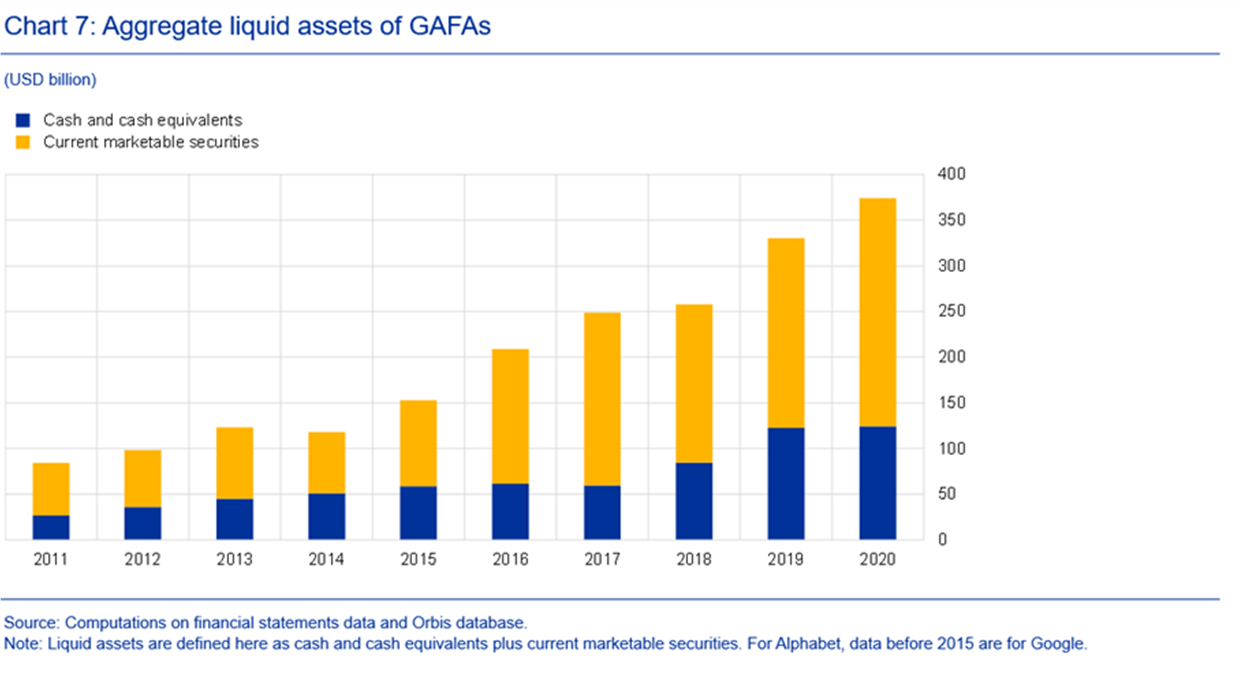

Although big techs do not yet offer financial services on a large scale, they have already become important players in global financial markets owing to their very large holdings of liquid assets, including marketable securities (Chart 7).[27]

The aggregate liquid assets[28] of Alphabet (the holding company of Google), Apple, Facebook and Amazon have more than quadrupled since 2011, reaching USD 370 billion in 2020. This is larger than the high-quality liquid assets of five of the eight global systemically important banks headquartered in the euro area.[29] When using the size of the real economy as a benchmark, at the end of 2020 the aggregate liquid assets of GAFA were larger than the gross domestic product (GDP) of eleven different euro area countries, and around 10% of the GDP of the largest economy in the euro area.[30]

Given the speed at which their assets are growing, the influence of big techs on global market dynamics will increase further. This merits closer analysis and monitoring. I am thinking, in particular, of the challenges related to the global demand for liquid and safe investments. The increased shortage of safe assets that this may cause could affect financial stability.[31]

Altering the process of money and credit creation

What I have discussed so far is just the tip of the iceberg. Big techs are also developing digital alternatives to traditional forms of money, global stablecoins. This brings me to my third point.

Beyond the implications for the global payments and financial landscape,[32] these new instruments will progressively shift resources towards new investors with different asset compositions and investment strategies. This shift has the potential to change the way in which money and credit are created.[33]

To maximise the stability of their value, stablecoins are generally backed by high quality liquid assets. This would not automatically result in a reduction in credit for the domestic economy as proceeds from stablecoin sales would be recycled back to the financial system. However, as the assets managed by stablecoins increase, banks’ funding conditions could become more expensive and volatile.[34] For instance, competition for liquid resources would make these more scarce, and thus increase their price, forcing banks to turn to more expensive forms of short-term funding. And finally, the increase of deposit holdings under the control of large stablecoin issuers could make banks’ deposit base more concentrated and its developments difficult to forecast.

The issuance of private digital means of payment by large profit-maximising companies thus poses the risk of large shocks to the banking system and may alter the structure of financial intermediation. These risks are often brought up in discussions on introducing central bank digital currencies (CBDCs). CBDC sceptics who highlight such a risk should however be mindful that the counterfactual – the emergence of dominant private digital money without CBDC – may be one that has an even stronger impact on the stability of the banking sector. Conversely, CBDCs would facilitate a level playing field among financial intermediaries and be carefully introduced by central banks which – unlike stablecoin issuers – would pay adequate attention to ensure orderly adjustments in the financial sector.[35]

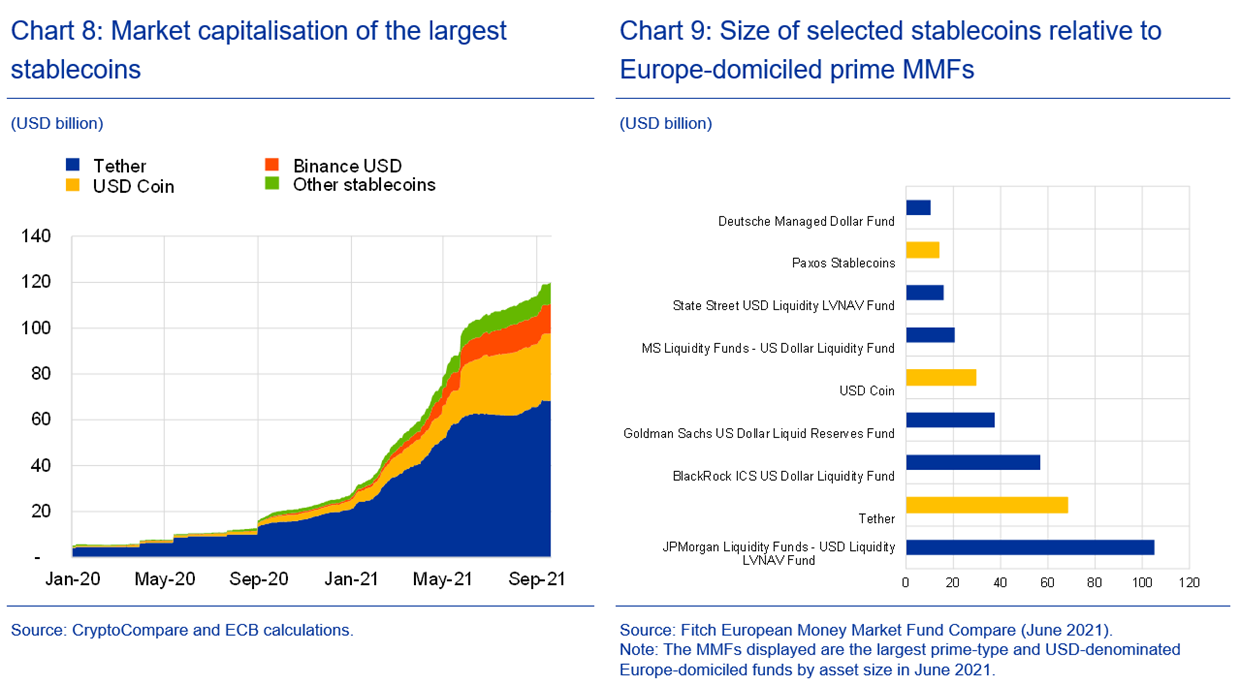

While no big techs have issued a stablecoin yet, we can look at the evolution of existing ones to get an idea of the implications of big techs’ possible role in this segment. Existing stablecoins grew from less than USD 60 billion in March of this year to USD 110 billion in August (Chart 8). The holdings of US commercial paper by Tether, the largest US dollar stablecoin, are now comparable to the holdings of large fund managers such as Vanguard and BlackRock.[36]

These numbers are just indicative. Stablecoins issued by big techs could quickly scale up globally. As a result of the network externalities associated with their large customer base[37], as well as synergies and possible bundling of payments and other services on platforms and the use of “super apps”, the role of big techs in the financial sector may rapidly and abruptly increase. They could become larger than the biggest money market funds (Chart 9),[38] and reach a higher order of magnitude of the current market value of existing stablecoins, which at USD 110 billion still represent a small fraction of the market value of crypto assets, which already stands above USD 2 trillion.[39]

Avoiding the build-up of new global systemic risks

Central banks are already familiar with some of the emerging challenges, such as the implications of large investments in safe assets by stablecoin issuers. By affecting the availability of safe assets, issuers could influence the level and volatility of real interest rates, with potentially undesirable consequences from a monetary policy perspective. Market functioning could also be negatively affected.

Central banks should also carefully monitor and address risks of self-fulfilling runs, which could intensify if stablecoin arrangements are backed by risky or opaque assets, especially in times of market turmoil.[40] To mitigate financial stability risks, we should enhance disclosure requirements and require independent audits of reserves.[41] Finally, if big techs want to manage to stablecoins, they should guarantee adequate operational and cyber resilience.

Other challenges generated by the confluence of big techs and global stablecoins are new to central banks, as they arise from the interplay between financial stability and other public policy objectives. Stablecoins can become a vehicle for money laundering and terrorism financing.[42] The interplay with antitrust and data privacy issues are even more relevant. If big techs bundle financial services with non-financial ones and exploit externalities, these companies could quickly gain excessive market power and adopt anti-competitive practices.[43]

Good progress has been made at global level thanks to the FSB.[44] The EU is leading the way,[45] but we should accelerate efforts in implementing the FSB principles in all jurisdictions to avoid regulatory arbitrage and harmful market fragmentation. We should constantly deepen our understanding of the evolving risks to ensure these frameworks are effective if big techs increase their footprint.[46]

It may be necessary to start looking at financial stability from a wider perspective and construct effective cooperation with the relevant authorities to build well-defined regulatory, oversight and supervisory frameworks that can contain the risks that big techs pose to public policy goals.

Given the global nature of the issue, stronger international cooperation is also needed. It took the global financial crisis to establish the FSB. We should be more proactive and show foresight by creating a global policy forum that brings together all the key actors needed to address the financial stability issues arising from these trends.

We will also have to carefully consider whether the regulatory paradigm of “same activity, same regulation” is still appropriate to the issue at hand. Big techs’ cross-sectoral activities create inter-linked risks where disruption in one area of activity could spill over into another. Activity-focused risk monitoring may prevent a holistic risk assessment of big techs’ internal ecosystems. An effective regulatory framework for big techs may thus warrant certain elements of entity-based requirements, starting with policy areas such as competition and operational resilience.[47]

Defining this approach will be a major challenge. The United States and the EU are increasingly recognising the benefit of this entity-based approach,[48] but we need to leverage on the ongoing work at the BIS[49] and FSB to build a broader consensus on this approach at the global level.

Conclusions

If we want to address the structural vulnerabilities exposed by the market turmoil of March 2020, we will need to strengthen the resilience of the non-bank financial sector and ensure a globally consistent approach to policy reforms.

But this may not be enough, given the potentially rapid increase in big techs’ international financial footprint and their possible role in the issuance of global stablecoins.

Without proper regulation, these developments could amplify international shocks and undermine financial resilience globally. We could see risk-biased technological change, whereby the digitalisation of finance favours business models that are riskier for the global economy.

It took a major crisis to step up the regulation of banks and another to focus more deeply on risks from money market funds, investment funds and margining practices. We should not wait for another crisis to regulate increasingly digitalised finance with new global players. In fact, this regulatory effort must be continuous in order to keep pace with technology. Regulators and supervisors will need to be empowered accordingly.

At the same time, we should acknowledge that regulation is a necessary, but insufficient, condition for tackling the concerns I outlined today. Central banks will also need to go digital. The ECB has thus started the investigation phase of a retail CBDC, the digital euro.[50] CBDCs have the potential to provide an anchor of stability for the digital finance ecosystem at both the domestic and global level. To make this happen, international cooperation will be of the essence. I thus welcome the work led by the UK’s G7 Presidency to identify principles for retail CBDCs and I truly hope they will also inform policy deliberations of countries outside the G7.[51]

- Financial Stability Board (2020), “Global Monitoring Report on Non-Bank Financial Intermediation 2020”, December

- Forbes, K.J. (2021), “The International Aspects of Macroprudential Policy”, Annual Review of Economics, Vol. 13, pp. 203-228.

- Beyond the banking sector, significant progress has been made also with respect to addressing risks in shadow banking. Financial Stability Board (2017), “FSB Assessment of shadow banking activities: risks and the adequacy of post-crisis policy tools to address financial stability concerns”, 3 July.

- In particular, liquidity mismatch between the assets and liabilities of money market funds and other open-ended funds poses a potential risk to financial stability. Moreover, although leverage tends to be relatively low among regulated mutual funds, it is concentrated in hedge funds and there can be pockets of highly leveraged entities, also outside the regulated fund sector, such as in the case of Archegos.

- See Financial Stability Board (2020), “Holistic Review of the March Market Turmoil”; and Financial Stability Board (2020), “Global Monitoring Report on Non-Bank Financial Intermediation 2020”.

- ECB (2020), “The role of bank and non-bank interconnections in amplifying recent financial contagion”, Financial Stability Review, May. See also Bagattini, G., Fecht, F. and Maddaloni, A. (2021), “Liquidity Support and Distress Resilience in Bank-Affiliated Mutual Funds”, Working Paper Series, ECB, forthcoming.

- See Bank for International Settlements (2020), “Cross-border links between banks and non-bank financial institutions”, BIS Quarterly Review, September; and Emter, L., Killeen, N. and McQuade, P. (2021), “Bank and non-bank financial institutions’ cross-border linkages: New evidence from international banking data”, Financial Stability Notes, Vol. 2021, No 3, Central Bank of Ireland.

- ECB (2020), “Is the home bias biased? New evidence from the investment fund sector”, Financial Integration and Structure in the Euro Area, March.

- Kaufmann, C. (2020), “Investment funds, monetary policy, and the global financial cycle”, Working Paper Series, No 2489, ECB, November.

- Bank for International Settlements (2021), “Changing patterns of capital flows”, CGFS Papers, No 66.

- Financial Stability Board (2020), “Global Monitoring Report on Non-Bank Financial Intermediation 2019”. See also Eguren-Martin, F., O’Neill, C., Sokol, A. and von dem Berge, L. (2020), “Capital flows-at-risk: push, pull and the role of policy”, Staff Working Papers, No 881, Bank of England..

- Bank for International Settlements (2021), “Changing patterns of capital flows”, op. cit.

- The ECB has recently concluded its strategy review in which it specifically addressed this point. See ECB (2021), “Non-bank financial intermediation in the euro area: implications for monetary policy transmission and key vulnerabilities”, Occasional Paper Series, No 270, September.

- From a global perspective, a strengthened macroprudential approach may also mean that emerging market economies with certain financial frictions manage portfolio flows more actively to mitigate the risk of boom-bust cycles which are driven by foreign portfolio flows. We therefore welcome the IMF’s efforts to review its Institutional View on capital flow management measures, which have some similarities to macroprudential measures in the cross-border context. At the same time, we have to ensure that we preserve the benefits of open financial markets and that capital flow management measures are not misused to substitute for economist adjustments. See Korinek, A. (2020), “Managing Capital Flows: Theoretical Advances and IMF Policy Frameworks”, Background Papers, No 20-02/01, Independent Evaluation Office of the IMF.

- For instance, globally consistent metrics and data on fund leverage are currently missing, while central banks do not necessarily have access to granular supervisory data on non-banks, limiting their capacity to monitor systemic risk.

- Nowadays, five big techs are already authorised in Europe as electronic money institutions, and one as a credit institution. See European Banking Authority (2021), “Report on the use of digital platforms”, September.

- See Bank for International Settlements (2019), “Big tech in finance: opportunities and risks”, BIS Annual Economic Report, June, and International Monetary Fund (2021), “Global Financial Stability Report: COVID-19, Crypto, and Climate: Navigating Challenging Transitions”, October,

- See Crisanto, J.C., Ehrentraud, J. and Fabian, M. (2021), “Big techs in finance: regulatory approaches and policy options”, FSI Briefs, No 12, Financial Stability Institute, March.

- Cornelli, G., Frost, J., Gambacorta, L., Rau, R., Wardrop, R. and Ziegler, T. (2020), “Fintech and big tech credit: a new database”, BIS Working Papers, No 887, BIS, September.

- Financial Stability Board (2020), “BigTech firms in finance in emerging market and developing economies”, October.

- At the global level, big tech credit was estimated to have reached USD 572 billion in 2019; see Cornelli, G. et al. (2020), op. cit. Also worth noting is that Alibaba and Tencent together control more than 90% of the Chinese mobile payments market and are a major reason behind China’s desire to introduce the digital renminbi, known as eCNY, as a back-up system.

- EBA (2021), op. cit.

- Chakravorti B. (2021), “Big Tech’s Stranglehold on Artificial Intelligence Must Be Regulated”, Foreign Policy, 11 August.

- See Panetta, F. (2020), “From the payments revolution to the reinvention of money”, speech at the Deutsche Bundesbank conference on the “Future of Payments in Europe”, 27 November.

- Boot, A., Hoffmann, P., Laeven, L. and Ratnovski, L. (2020), “Financial intermediation and technology: What’s old, what’s new?”, Working Paper Series, No 2438, ECB, July.

- Feyen, E., Frost, J., Gambacorta, L., Natarajan, H and Saal, M. (2021), “Fintech and the digital transformation of financial services: implications for market structure and public policy”, BIS Papers, No 117, BIS, July.

- The more than four-fold increase in liquid assets of GAFAs over the past ten years has mirrored the five-fold increase in their cumulative total assets during the same period, from USD 220 billion to USD 1,124 billion. On aggregate, as of 2020, marketable securities represent two-thirds of the total liquid assets of Google, Apple, Facebook and Amazon, and this proportion has been rather stable over the last ten years (with a low of 57% and a peak of 76%). Although there are some noticeable differences across the individual companies, US government securities and corporate debt securities are generally the largest components of their liquid asset holdings.

- Defined as cash and cash equivalents plus current marketable securities.

- This comparison for G-SIBs is based on the amount of unencumbered high-quality liquid assets (HQLA) used as numerator of the Liquidity Coverage Ratio. While the concept of high-quality liquid assets as used for the Liquidity Coverage Ratio is a narrow definition of liquid assets, it is used here for illustrative purposes. However, the amounts of liquid assets of GAFAs remain significant in the comparison even when the definition of liquid assets is broadened. For example, when considering cash, loans and advances to banks, reverse repos and financial assets measured at fair value, the aggregate liquid assets of GAFAs were larger than the liquid assets of one of the eight global systemically important banks headquartered in the euro area. Furthermore, and zooming in on some specific actors, the liquid assets of Alphabet are larger than the total balance sheet of 79 significant institutions (SIs) operating in the banking union; the liquid assets of Apple are larger than the total assets of 67 SIs, those of Amazon of 64 SIs and those of Facebook of 47 SIs.

- If we consider the liquid assets of Alphabet, they were larger than the GDP of eight different euro area countries. For Apple and Amazon, they were larger than the respective GDPs of seven euro area countries. Facebook’s liquid assets are larger than the respective GDPs of six euro area countries.

- Gourinchas, P.O. and Jeanne, O. (2012), “Global safe assets”, BIS Working Papers, No 399, December.

- See Panetta, F. (2020), “The two sides of the (stable)coin”, speech at Il Salone dei Pagamenti 2020, 4 November.

- See Panetta (2020), “From the payments revolution to the reinvention of money”, op. cit.; and Bank of England (2021), “New forms of digital money”, Discussion Paper, June.

- Adrian, T. and Mancini, T. (2019), “The Rise of Digital Money”, FinTech Notes, No 2019/001, IMF, July.

- See Panetta, F. (2021), “Evolution or revolution? The impact of a digital euro on the financial system”, speech at a Bruegel online seminar, 10 February.

- J.P. Morgan, (2021), Where crypto meets FRA/OIS, May.

- Boot, A. et al. (2020), op. cit.

- ECB (2020), “A regulatory and financial stability perspective on global stablecoins”, Macroprudential Bulletin, No 10, May.

- International Monetary Fund (2021), op. cit.

- Arner, D., Auer, R. and Frost, J. (2020), “Stablecoins: risks, potential and regulation” BIS Working Papers, No 905, BIS, November.

- International Monetary Fund (2021), op. cit.

- Financial Action Task Force (FATF), 2020, “FATF Report to the G20 Finance Ministers and Central Bank Governors on So-Called Stablecoins”, Paris.

- Feyen, E. et al. (2021), op. cit.

- See FSB (2021), “Regulation, Supervision and Oversight of “Global Stablecoin” Arrangements Progress Report on the implementation of the FSB High-Level Recommendations”, October; FSB (2020), “High-level recommendations for the regulation, supervision and oversight of global stablecoins”, October. See also CPMI-IOSCO (2021), “Consultative report on Application of the Principles for Financial Market Infrastructures to stablecoin arrangements”, October.

- The Eurosystem has published a proposal for updating its oversight framework for electronic payment instruments, schemes and arrangements (“PISA framework”) in order to include digital payment tokens (e.g. stablecoins), alongside “traditional” payment instruments and schemes. Moreover, the EU Commission has put forward several legislative initiatives The European Commission published a proposal for a regulation on Markets in Crypto-Assets (MiCA). MiCA aims to provide a harmonised framework for the issuance and provision of services related to crypto-assets and is the first such effort in major jurisdictions. The Commission also issued a “call for advice” from the European supervisory authorities to ensure that the EU financial regulation remains future proof amid the rapid transformation of the financial sector. Finally, the Commission published a legislative proposal to enhance consumer protection and prevent market abuse by large platforms.

- See the 11th BIS Research Network meeting “Regulating big tech: between financial regulation, anti-trust and data privacy”, held on 6-7 October 2021.

- Restoy, F. (2021), “Fintech regulation: how to achieve a level playing field”, Occasional Paper, No 17, Financial Stability Institute, February.

- See Subcommittee on Antitrust, Commercial and Administrative Law of the Committee of the Judiciary (2020) “Investigation of competition in digital markets: majority staff report and recommendations”, October; and the EU Digital Services and Digital Markets Act.

- See Carstens, A. Claessens, S., Restoy, F. and Shin, H.S. (2021), “Regulating big techs in finance”, BIS Bulletin, No 45, Bank for International Settlements, August.

- ECB (2021), “Eurosystem launches digital euro project”, press release, 14 July.

- See the G7 Finance Ministers and Central Bank Governors Communiqué of 5 June 2021.

Banca centrale europea

Direzione Generale Comunicazione

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

La riproduzione è consentita purché venga citata la fonte.

Contatti per i media