Published as part of the ECB Economic Bulletin, Issue 7/2022.

This box provides an assessment of recent trends in goods trade and the tourism sector in the euro area based on the Purchasing Managers’ Indices (PMIs). Both sectors have been severely affected by the economic fallout from the coronavirus (COVID-19) pandemic. Regarding goods trade, our analysis shows that bottlenecks in the supply chain have historically preceded upward pressures on import prices, especially for intermediate goods. These pressures are now slowly easing as export demand weakens and supply chains adjust. As regards trade in services, a surge in extra and intra-euro area demand for tourism (which accounts for 19% of services exports and has been one of the sectors most affected by the pandemic) during the summer of 2022 pushed up prices in the tourism and recreation sector. Waning pent-up demand for travel, falling real incomes, rising uncertainty and higher prices may start to dampen overall demand for European tourism services in the coming months.[1]

Supply chain bottlenecks in goods trade are easing

Upward pressures on input prices associated with supply-side bottlenecks seemingly diminished in mid-2022 but remain elevated. The PMI indicators for manufacturing export orders, suppliers’ delivery times and input prices tend to be highly correlated and show a consistent lead pattern for turning points. Changes in export orders have historically preceded movements in input prices by two months with a correlation coefficient of 0.70, while changes of supplier delivery times have previously led input prices by one month with a correlation coefficient of 0.84. Turning points in export orders and suppliers’ delivery times lead input prices by one to two months on average (Chart A).[2] By mid-2022 suppliers’ delivery times started to decline, gradually falling from historically high levels but remaining elevated. Following this easing, input price pressures, as reported by the PMI, have decreased somewhat.

Chart A

Euro area manufacturing sector PMI

(diffusion index and turning points)

Sources: S&P Global and ECB staff calculations.

Notes: The data are seasonally adjusted. “Manufacturing export orders” includes intra and extra-euro area data. “Manufacturing suppliers’ delivery times” includes foreign and domestic deliveries. Note that the complement is constructed as a 100-diffusion index; a higher value of complement means tighter supply bottlenecks. “Minimum” refers to local minima and “Maximum” to local maxima in the cyclical behaviour of the series. The last observations are for September 2022.

Growth in extra-euro area import prices for intermediate goods has been slowing since mid-2022. The PMI indicator for total input prices started declining towards the end of 2021 while remaining at an elevated level, suggesting that the growth in import prices for intermediate goods may also slow somewhat, as these variables tend to be closely related (Chart B). Both variables exhibit a correlation coefficient of 0.80, with the PMI indicator leading intermediate import prices by two months. However, the high level of the PMI input price indicator for September 2022 and the continued weakness of the euro suggest that price pressures in manufacturing will remain high.

Chart B

PMI input prices and intermediate goods import prices

(left-hand scale: year-on-year percentage changes; right-hand scale: diffusion index)

Sources: S&P Global, Eurostat and ECB staff calculations.

Notes: The correlation amounts to 0.84 with two lags. The PMI input prices cover everything, including domestic and input prices.

The latest observation is for July 2022 for intermediate import prices and September 2022 for input prices.

Sector-level trade data suggest that longer delivery times were associated with weak exports in early 2022. Industries faced with longer average supplier delivery times in the first quarter of 2022 experienced larger declines in exports compared with the same quarter in the previous year (Chart C). This is illustrated by the downward-sloping line, which reflects a correlation coefficient of 0.70.

Chart C

Euro area extra-export growth and suppliers’ delivery times by sector in the first quarter of 2022

(x-axis: quarterly year-on-year percentage changes in exports; y-axis: quarterly average diffusion index)

Sources: Eurostat, S&P Global and ECB staff calculations.

Notes: R is 0.70. The diffusion index on the vertical axis indicates increasing delivery times compared with the previous month for values below 50 and decreasing delivery times for values above 50.

Among the exporting sectors most affected by supply bottlenecks were the computer and electronical equipment sector and the machinery sector.[3] The weakness in motor vehicle exports in the first quarter of 2022 is a reflection of longer delivery times for components, especially in the car subsector, while for basic metals suppliers’ delivery times eased somewhat.[4] In the second quarter of 2022 supply bottlenecks eased somewhat and became a less significant explanatory variable for the export performance of the sectors in question. Amid easing bottlenecks, quarterly extra-euro area export growth turned positive in the second quarter for the computer and electronics sector and stabilised for the machinery sector. Wood and paper exports declined further, while reported supply bottlenecks eased only slowly. The very recent easing of bottlenecks has been accompanied by weaker demand for durable goods, a moderation in demand for technological goods and an improvement in the supply of traded goods.

The recovery of the tourism sector is slowing amid high price pressures

Turning to services, the strong dynamics in the tourism and recreation sector observed over the spring and summer have started to weaken.[5] Bookings, which were proxied by PMI new orders, tend to lead prices in the tourism and recreation sector with an average lead of one to two months. The PMIs for the price series are generally quite stable in this sector compared with, for example, the more volatile manufacturing sector, despite some earlier fluctuations related to higher uncertainty surrounding international travel (Chart D). As the tourism and recreation sector in the euro area gradually re-opened after each wave of the COVID-19 pandemic, input price cost pressures and an exceptionally strong recovery of demand for tourism and recreation services increasingly pushed up output prices in this sector.[6]

Chart D

EU tourism and recreation PMI

(diffusion index weighted average and turning points)

Sources: S&P Global and ECB staff calculations.

Notes: The weighted moving averages are seasonally adjusted. The diffusion indices refer to the EU and include both domestic and foreign orders. “Minimum” refers to local minima and “Maximum” to local maxima in the cyclical behaviour of the series. The data are only available for the EU, not the euro area. The last observations are for September 2022.

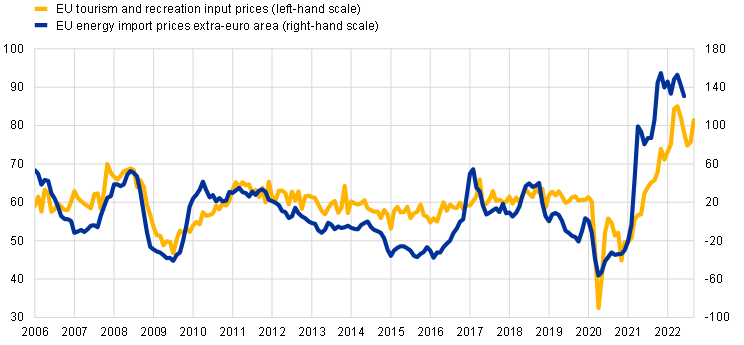

Energy is one of the factors driving movements in input prices in the tourism and recreation sector. Energy import prices are strongly correlated with the movements of the PMI indicator for input prices. The former can therefore be regarded as a major driving factor behind the increase in input prices in tourism and recreation (Chart E, panel a).[7] Labour cost developments in this sector are less synchronised with the evolution of the PMI tourism and recreation input prices.

Chart E

EU tourism and recreation PMI prices versus energy and accommodation prices

a) Tourism and recreation input prices and energy import prices

(left-hand scale: diffusion index; right-hand scale: year-on-year percentage changes)

b) Tourism output prices and accommodation services HICP

(left-hand scale: diffusion index; right-hand scale: year-on-year percentage changes)

Sources: Eurostat for EU energy import prices, HICP for accommodation services, S&P Global for the PMI series and ECB staff calculations.

Notes: Correlation coefficient amounts to 0.80 in panel a) and 0.70 with 2 months lead in panel b). The data are seasonally adjusted. The last observation is for June 2022 for EU energy import prices, August 2022 for accommodation services HICP, and September 2022 for PMI tourism and recreation input and output prices.

Tourism and recreation output prices peaked earlier this year, suggesting that consumer price dynamics for accommodation services may start to slow, although they will remain strong. The HICP for accommodation services tends to lag somewhat behind the price increases in tourism and recreation reported by purchasing managers (Chart E, panel b). At the current juncture, both measures indicate that price pressures may have reached their peak.

Waning pent-up demand for travel, falling real incomes, rising uncertainty and higher prices may start to dampen demand for tourism and recreation services in the coming months. All the indicators shown in Chart D reached a local maximum in May 2022 and have been declining in line with the lower demand expectations of travel agencies. The deterioration of the economic outlook has been accompanied by other factors, such as the waning pent-up demand for travel, falling real incomes and rising uncertainty mentioned above. Overall, this points to high but gradually stabilising price pressures in the tourism and recreation sector.

While a direct mapping of tourism activities in the balance of payments is not straightforward, its share in total services exports could be approximated to 19% in 2019. Tourism includes passenger transport services and travel-related services such as accommodation and food, with the exceptions being purchases of goods and services of seasonal and cross-border short-term workers. For additional details see the box entitled “Impact of the COVID-19 lockdown on trade in travel services”, Economic Bulletin, Issue 4, ECB, 2020.

In Chart A we inverted the reported numbers for “Manufacturing suppliers’ delivery times” to illustrate their co-movement with the other series. In this case a higher reported number implies longer delivery times. The development from 2019 to 2022 is highlighted given the focus of this box on the economic fallout from the COVID-19 pandemic.

See the box entitled “The impact of supply bottlenecks on trade”, Economic Bulletin, Issue 6, ECB, 2021, which shows the pattern of high export demand leading to tighter bottlenecks in the initial phase of the recovery.

See the box entitled “Motor vehicle sector: explaining the drop in output and rise in prices” in this Economic Bulletin issue.

In addition to tourism services, the tourism and recreation PMIs include recreation, and thus domestic, activities.

Data suggest that profit margins in this sector have also come under pressure.

For more details on the methodological background of the PMIs, see the box entitled “PMI survey data on producer input and output prices”, Monthly Bulletin March, ECB, 2005.