Published as part of the ECB Economic Bulletin, Issue 8/2022.

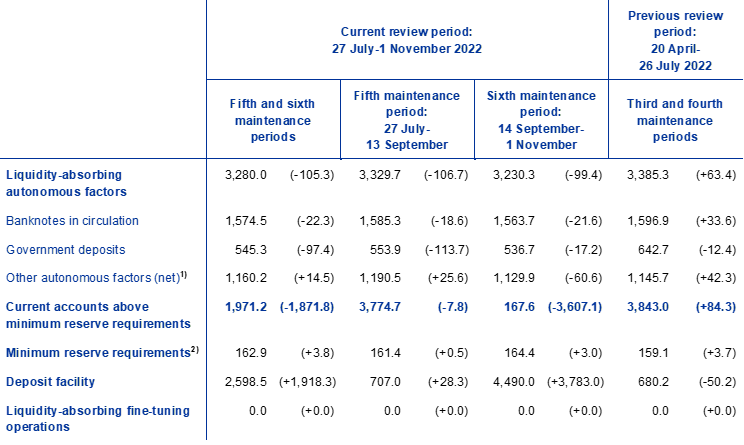

This box describes liquidity conditions and the ECB’s monetary policy operations during the fifth and sixth reserve maintenance periods of 2022. Together, these two maintenance periods ran from 27 July to 1 November 2022 (the “review period”), thus covering the period when the ECB’s policy rate hikes came into effect.

When the period of negative policy rates ended in July 2022, there were changes in various autonomous factors, notably including government deposits, which altered the composition of excess liquidity. Net autonomous factors declined and a rebalancing in the Eurosystem balance sheet occurred when the ECB raised its key policy rates by 50 basis points in the fifth maintenance period, which ended the period of negative policy rates, and increased them by a further 75 basis points in the sixth maintenance period.

Average excess liquidity in the euro area banking system rose by €46.5 billion during the fifth and sixth maintenance periods of 2022 to reach a record level of €4,569.7 billion. The overall increase was mainly driven by a decline in liquidity-absorbing autonomous factors. The increase took place primarily in the fifth maintenance period, in view of the widely anticipated increase of the deposit facility rate to positive territory as of the sixth maintenance period. At the same time, liquidity provided through monetary policy instruments declined over the review period.

Liquidity needs

The average daily liquidity needs of the banking system, defined as the sum of net autonomous factors and reserve requirements, decreased by €96.2 billion to €2,506.6 billion in the review period. The decrease compared with the two previous maintenance periods was almost entirely due to a fall of €100 billion in net autonomous factors to €2,343.7 billion, which in turn was driven by a decline in liquidity-absorbing autonomous factors (see the part of Table A entitled “Other liquidity-based information”). At the same time, there was only a marginal increase, of €3.8 billion, in minimum reserve requirements to €162.9 billion.

Liquidity-absorbing autonomous factors were affected during the review period by the raising of ECB policy rates, causing them to decline by €105.3 billion to €3,280 billion, mainly on account of lower government deposits and banknotes in circulation. Government deposits (see the part of Table A entitled “Liabilities”) fell by €97.4 billion on average over the review period to €545.3 billion, with most of the decline taking place in the fifth maintenance period. When the negative policy rate environment ended in July 2022 and in expectation of the deposit facility rate being raised to a positive level at the September meeting of the ECB’s Governing Council, debt management offices opted to reduce their liquidity buffers with the Eurosystem and sought alternative arrangements to place funds. With the further hike in September of policy rates, and of the deposit facility rate to 0.75% in particular, the Governing Council decided to temporarily remove the zero interest rate ceiling for the remuneration of government deposits and to instead remunerate these deposits at the lower of the deposit facility rate or the euro short-term rate (€STR). This measure is intended to remain in place until 30 April 2023. The decision had the intended effect of preventing an abrupt further outflow of government deposits to the market, which could have impaired policy transmission and orderly market functioning. As a consequence of this measure, the further decline in average government deposits, of €17.2 billion to €536.7 billion, was only moderate in the sixth maintenance period. Average banknotes in circulation decreased by €22.3 billion over the review period to €1,574.5 billion. The end of the negative policy rate environment has in particular led banks to reduce their banknote holdings. Previously, banks had increased the amounts of vault cash they held amid negative policy rates. With the deposit facility rate now in positive territory, these holdings have an opportunity cost, inducing banks to optimise their cash management and swiftly reduce their vault cash holdings by around €40 billion between the end of June and the end of October. The release of liquidity through lower government deposits and banknotes in circulation was only marginally offset by other autonomous factors, which increased by €14.5 billion in the review period to €1,160.2 billion.

Liquidity-providing autonomous factors declined by a slight €5.4 billion to €936.6 billion. The rise of €14.6 billion in net foreign assets was more than offset by the decline in net assets denominated in euro.

Table A provides an overview of the autonomous factors[1] discussed above and their changes.

Table A

Eurosystem liquidity conditions

Liabilities

(averages; EUR billions)

Source: ECB.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in brackets denote the change from the previous review or maintenance period. With the suspension of the tier-two system, information on the exemption allowance has been removed from the table.

1) Computed as the sum of the revaluation accounts, other claims and liabilities of euro area residents, capital and reserves.

2) Memo item that does not appear on the Eurosystem balance sheet and should therefore not be included in the calculation of total liabilities.

Assets

(averages; EUR billions)

Source: ECB.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in brackets denote the change from the previous review or maintenance period.

1) With the discontinuation of net asset purchases, the individual breakdown of outright portfolios is no longer shown.

Other liquidity-based information

(averages; EUR billions)

Source: ECB.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in brackets denote the change from the previous review or maintenance period.

1) Computed as the sum of net autonomous factors and minimum reserve requirements.

2) Computed as the difference between autonomous liquidity factors on the liabilities side and autonomous liquidity factors on the assets side. For the purposes of this table, items in the course of settlement are also added to net autonomous factors.

3) Computed as the sum of current accounts above minimum reserve requirements and the recourse to the deposit facility minus the recourse to the marginal lending facility.

Interest rate developments

(averages; percentages and percentage points)

Source: ECB.

Note: Figures in brackets denote the change in percentage points from the previous review or maintenance period.

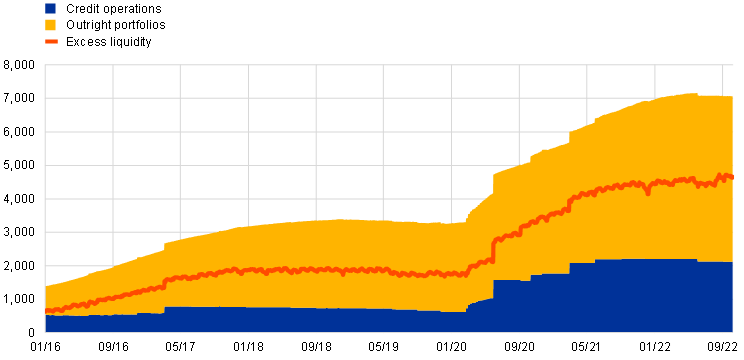

Liquidity provided through monetary policy instruments

The average amount of liquidity provided through monetary policy instruments decreased by €49.6 billion to €7,076.3 billion during the review period (Chart A). The reduction in liquidity was mainly driven by the decline in credit operations as a result of voluntary repayments of TLTRO III funds. Net asset purchases under the ECB’s pandemic emergency purchase programme (PEPP) were discontinued at the end of March and under its asset purchase programme (APP) on 1 July 2022, meaning that outright portfolios no longer provide any additional liquidity.[2]

Chart A

Changes in liquidity provided through open market operations and excess liquidity

(EUR billions)

Source: ECB.

Note: The latest observation is for 1 November 2022.

The average amount of liquidity provided through credit operations decreased by €53.7 billion during the review period. This decrease mainly reflects the voluntary TLTRO III repayments of €74.0 billion and €6.5 billion made at the end of June and September respectively, together with the amount of €1.9 billion from a TLTRO III tender maturing in September. Even though the settlement of €74.0 billion in TLTRO III repayments took place in the fourth maintenance period, the full effect on period averages became visible in the fifth maintenance period. The maturing PELTRO amounts of €0.5 billion and €1.3 billion at the end of June and September respectively made only a marginal contribution to the decline in the review period. With average increases of €2.1 billion and €0.9 billion respectively, the main refinancing operations (MROs) and three-month LTROs only offset a small part of the liquidity drained by TLTRO III repayments and PELTRO maturities.

Excess liquidity

Average excess liquidity increased by €46.5 billion to reach a new record high of €4,569.7 billion (Chart A). Excess liquidity is the sum of banks’ reserves above the reserve requirements and the recourse to the deposit facility net of the recourse to the marginal lending facility. It reflects the difference between the total liquidity provided to the banking system and banks’ liquidity needs.

When the ECB started raising its policy rates, banks began to shift the allocation of excess liquidity holdings between their current accounts with the Eurosystem and the deposit facility. Until the ECB lifted the deposit facility rate above zero, the remuneration of liquidity placed in the deposit facility was the same as the remuneration of liquidity placed in the current accounts in excess of the exempted excess reserves under the two-tier system. When the ECB lifted the deposit facility rate to 0.75% as of 14 September 2022, the reserves in current accounts in excess of the minimum reserve requirements continued to be remunerated at 0%.[3] To benefit from the positive deposit facility rate, banks needed to shift their excess reserves from their current accounts to the deposit facility. As a result, average current account holdings decreased by €3,607.1 billion during the sixth maintenance period, while average use of the deposit facility increased by €3,783 billion. The difference between the two figures is explained by the rise in average excess liquidity due to lower liquidity-absorbing autonomous factors. Average current account holdings in excess of minimum reserves amounted to €167.6 billion in the sixth maintenance period, representing approximately twice as much liquidity as strictly needed to fulfil the minimum reserve requirements of €164.4 billion. This may be the result of temporary operational frictions that are expected to be addressed over time to minimise excess reserves remunerated at 0%.

The ECB suspended its two-tier system for remunerating excess reserves. This system, under which average excess reserves up to six times the minimum reserve requirements were exempted from the negative deposit facility rate, had effectively become redundant when the period of negative interest rates ended in July. After raising the deposit facility rate above zero in September, the ECB decided to suspend the two-tier system by setting the multiplier to zero.

Interest rate developments

The average €STR increased by 87 basis points over the review period to 0.29% per annum. The pass-through of the ECB policy rate hikes in July and September to the unsecured money market was broadly complete and immediate. On average, the €STR traded at 8.5 and 9.3 basis points below the respective deposit facility rate during the fifth and sixth maintenance periods.

The average euro area repo rate, measured by the RepoFunds Rate Euro Index, increased by almost 79.4 basis points to 0.148% during the review period. The pass-through to the secured money market was less smooth than to the unsecured money market. This was particularly the case for the September policy rate hike. The high uncertainty around any change in behaviour by market participants during the normalisation of the interest rate environment, coupled with associated shifts in investment flows, exerted downward pressure on repo rates for transactions motivated by the need to park cash. The tensions in the repo market proved to be transitory, however, and were concentrated mostly on collateral issued by the German and French sovereigns. By 21 September, about one week after the September policy rate hike had taken effect, secured money market rates had, by and large, normalised, adjusting to the new level of policy rates, albeit with a somewhat wider spread over the €STR and the deposit facility rate compared with the previous review period.

For further details on autonomous factors, see the article entitled “The liquidity management of the ECB”, Monthly Bulletin, ECB, May 2002.

Even though net purchases ended in the previous review period, the full effect on period averages is still visible in the current review period. Furthermore, securities held in the portfolio are carried at amortised cost and revalued at the end of each quarter, which also has an impact on the total averages and the changes in the outright portfolios.

During the review period minimum reserves were remunerated at the ECB’s main refinancing operations (MRO) rate. On 27 October the ECB announced that the remuneration of minimum reserves would be lowered to the deposit facility rate which would become effective at the beginning of the reserve maintenance period starting on 21 December 2022, after the current review period.