Main findings from the ECB’s recent contacts with non-financial companies

Published as part of the ECB Economic Bulletin, Issue 3/2021.

This box summarises the results of contacts between ECB staff and representatives of 66 leading non-financial companies operating in the euro area. The exchanges took place between 23 March and 1 April 2021.[1]

Contacts reported increasing constraints and restrictions on their ability to respond to strong or growing actual or latent demand. Stricter and more prolonged coronavirus (COVID-19) containment measures continued to severely restrict activity in services dependent on social contact. Moreover, many contacts in the manufacturing sector emphasised supply constraints. As a result, many firms’ activity was stable or contracting despite strong growth in order books or indications of substantial latent demand. Overall, activity in the first quarter was seen to have contracted in most parts of the retail, consumer services and energy sectors, and was considered to be rather mixed in manufacturing, broadly stable in construction and mostly stable or growing in business services.

In the manufacturing sector, supply was increasingly failing to keep up with demand owing to shortages of inputs, which may continue for some weeks or months. The most acute shortage was of semiconductors. During the first wave of the pandemic, supply had been diverted to manufacturers of IT equipment, which then left shortages when demand from other industries recovered more quickly than expected. In recent weeks, shortages of semiconductors, as well as metals, chemicals, plastics and related components, had been exacerbated by various events, including the weather-induced power cuts in Texas. These problems were further compounded by the ongoing problems in transport logistics, especially shortages of shipping containers. This resulted in delivery times that were substantially longer than normal and crisis management of certain supply chain and production decisions. Contacts expected supply constraints to worsen in the second quarter of 2021 before gradually easing in the second half of the year.

Activity in much of the services sector continued to be strongly influenced by the prevalence of lockdowns and travel restrictions. Nearly all contacts whose businesses depended heavily on the physical presence or movement of customers reported activity that was either contracting or stable at very low levels. Within non-essential retail, developments were highly sensitive to the geographical and product focus and to the relative strength of the online offering. Consequently, retailers with businesses focused on the same or similar product lines painted starkly different pictures of business conditions. Besides lost sales, “stop-start” lockdowns added to costs in the hospitality sector. By contrast, food retailers and their suppliers continued to benefit from stronger-than-normal demand, although a lack of available drivers limited their ability to meet the increased demand for home deliveries.

Contacts anticipated growth in the second quarter, but continuing lockdowns and the slow roll-out of vaccines pushed expectations of a more substantial rebound to later in the year. Contacts in the travel industry reported negligible bookings so far for the summer. Several contacts in consumer-oriented services did, however, highlight signs that consumers were very eager to eat in restaurants, shop in physical stores and go on holiday as soon as regulations allowed. As and when those consumer services rebounded, some consumer spending was likely to be diverted away from consumer goods, which should help rebalance supply and demand in the manufacturing sector.

Most contacts described a relatively stable employment outlook in terms of permanent headcount. Firms continued to adjust to pandemic-induced fluctuations in activity by making use of the flexibility provided by government support schemes, interim staff and subcontracting. Therefore, permanent headcount tended to remain relatively stable. Permanent hiring primarily targeted highly specialised jobs, especially in IT. At the agency level, the recovery in recruitment was described as slowing overall, with new recruitment mostly related to e-commerce and logistics. For companies for which the pandemic had triggered a (greater) structural adjustment of the workforce, this adjustment had typically already been implemented in the rest of the world, but was progressing more gradually in the euro area.

Contacts in the industrial sector mostly reported increasing selling prices, while price developments in the services sector were more subdued. In much of the manufacturing sector selling prices were rising in response to higher input costs. Customers tended to focus more on securing supply than on negotiating prices, which facilitated pass-through to some extent. Many contacts thus anticipated some higher-than-usual consumer goods inflation this year. This was, however, expected to be transitory and could be mitigated by retailers pushing for stronger discounts than they had received last year. Meanwhile, selling prices across much of the services sector remained mostly stable, and in consumer-oriented services tended to be described as weak or still subject to downward pressure. There was considerable heterogeneity in the development of services prices and a highly uncertain outlook, as usual market dynamics were somewhat interrupted.

Shortages of raw materials and bottlenecks in transport and logistics were driving input prices higher, but the wage outlook remained moderate. The increase in the prices of many raw materials and related inputs had accelerated in recent months in view of global demand and supply imbalances. However, several contacts anticipated that commodity prices would peak in the coming months and could start moderating slightly later in the year. Transport costs (especially sea freight rates) remained high but seemed to have peaked. Most contacts described a normal or moderate outlook for wages. On balance, contacts expected wage agreements in 2021 to be broadly similar to those in 2020, with both years influenced by considerations surrounding the pandemic, depending on the precise timing of negotiations.

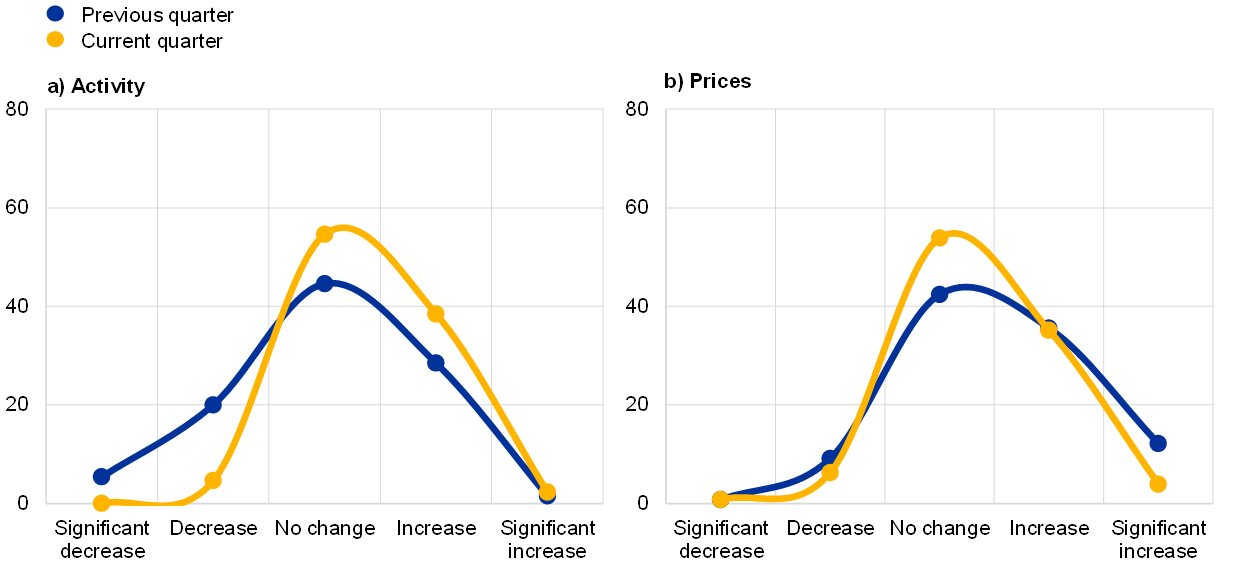

Chart A

Summary of views on developments in and the outlook for activity and prices

(percentage of respondents)

Source: ECB.

Notes: The scores for the previous quarter reflect the ECB staff assessment of what contacts said about developments in activity (sales, production and orders) and prices in the first quarter of 2021. The scores for the current quarter reflect the assessment of what contacts said about the outlook for activity and prices in the second quarter of 2021.

- For further information on the nature and purpose of these contacts, see the article entitled “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2021.