Price-setting behaviour: insights from a survey of large firms

Published as part of the ECB Economic Bulletin, Issue 7/2019.

This box summarises the findings of an ad hoc ECB survey of leading euro area firms about their price-setting behaviour. Firms’ price-setting strategies are crucial pointers for understanding how prices adjust to shocks and, therefore, implicitly the effect of monetary policy on inflation. Surveys are a useful tool for collating evidence in this regard, as illustrated, in particular, in the seminal work of Blinder[1]. Survey evidence of the price-setting behaviour of firms in the euro area was collated some time ago in the context of the Eurosystem Inflation Persistence Network (see Fabiani et al., 2005[2]). Our survey draws on elements of those earlier surveys, while also gathering more qualitative evidence concerning the various dimensions of price-setting.

The main objective of the survey was to obtain an overview of how firms set prices, including the following specific dimensions. Do firms discriminate across geographical markets, by type of customer or sales platform? How often do they typically review and change their prices? What considerations do firms take into account when setting prices? Which aspects of price-setting behaviour are likely to give rise to sluggish price adjustment? Responses were received from 58 leading non-financial companies that operate across the euro area. The global sales of these firms would be the equivalent of around 2% of euro area economy-wide output. The firms are split roughly equally between industrial and services sector activities. The sample can also be split roughly equally between: (i) firms which mainly supply consumers; (ii) firms which supply businesses which mainly supply consumers; and (iii) firms which supply businesses which, in turn, mainly supply other businesses. In other words, responses were obtained from firms at various points in the supply chain.

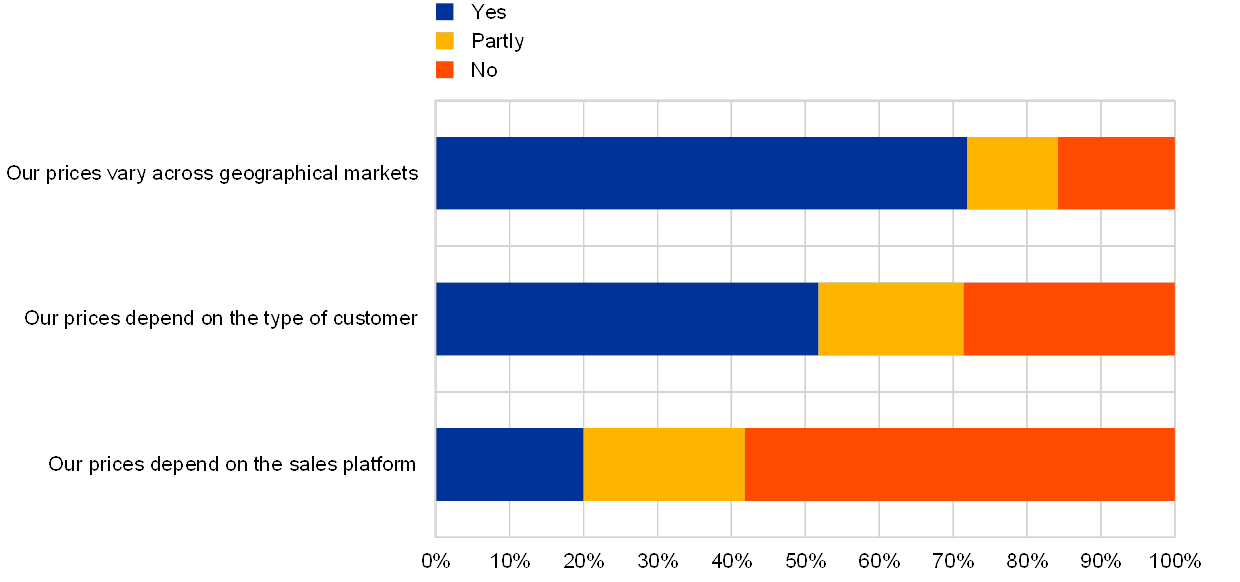

Most firms said that they vary their prices by geographical market and by type of customer (see Chart A). Varying prices by geographical market was seen to be necessary in order to adapt to local demand and supply conditions. Many firms said that they faced different local production costs, including labour, skills, tax, regulatory and logistical costs. Differences in locally-supplied inputs could also affect product quality. Customer preferences also varied across geographical regions, thus requiring different branding and/or service levels. As to varying prices by type of customer, in business-to-business sales, the volume of the contract was significant, with the imperative to attract and retain strategic customers. Respondents also cited the importance of distinguishing between wholesale and retail and/or between professional and private customers. Finally, discounts could be given to certain customers depending on how high the risk of losing them was assessed to be.

Most firms stated that their prices did not depend on the sales platform. Hence, for example, most firms charged the same price for online sales as for sales in the store or over the phone. However, the prices of some products differed from prices of equivalent products sold on other platforms, simply because they were only available online. Compared to equivalent products available on other platforms, costs for these online products were lower, warranted by the fact that that they involved fewer services. In business-to-business segments, prices for equivalent products would often differ in bulk contracts as compared to tenders or market-based transactions.

Chart A

Price variation by geographical market, customer and sales platform

(percentage of firms)

Source: ECB staff calculations.

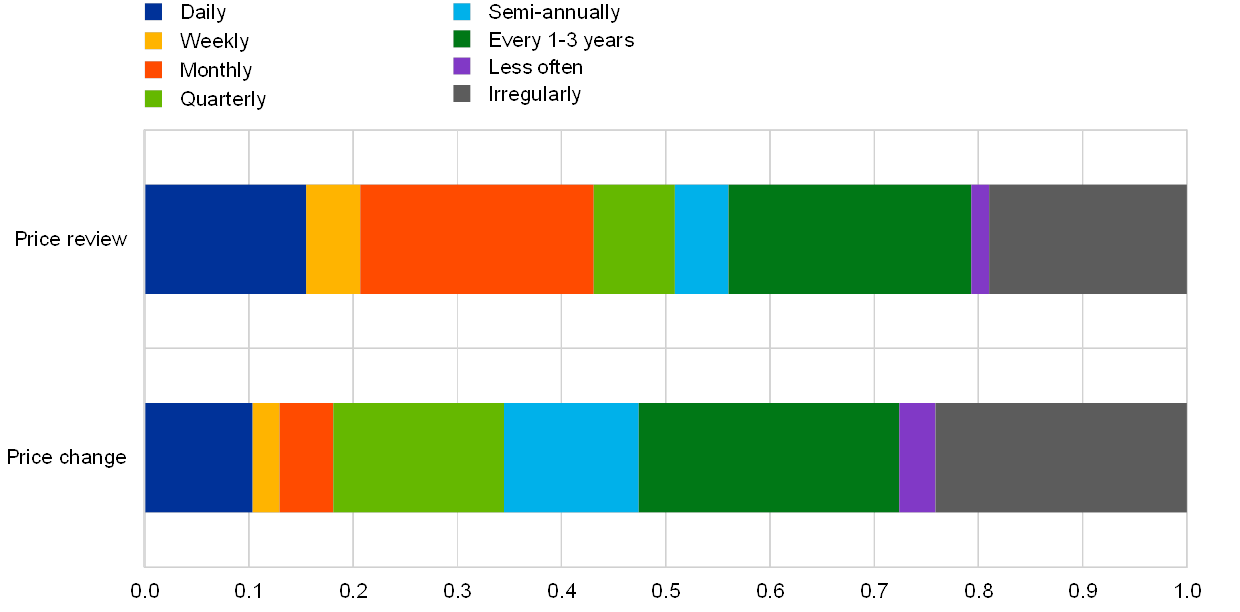

The typical frequency of price reviews and changes varies across sectors of the economy (see Chart B). Firms were asked to focus on their main (or representative) product and given a choice of frequencies at which price reviews and changes were carried out.[3] These ranged from “daily” to “less than every three years”, with firms also being able to indicate that prices were only reviewed or changed “irregularly/in response to specific events”. Some firms indicated that they reviewed prices both at a regular frequency and irregularly in response to specific events.

Chart B

Typical frequency of price reviews and price changes for a representative product

(percentage of firms)

Source: ECB staff calculations.

Note: The bars reporting the share of firms that reviewed or changed prices "irregularly or in response to events" includes only those firms which did not otherwise indicate a typical frequency of price reviews and/or changes.

The frequency of price reviews and changes tends to be highest in the retail sector and lowest in consumer and business services, with the manufacturing sector somewhere in between. Most retailers who replied to the survey said that they reviewed their prices on a monthly, weekly or even daily basis, depending on their range of products. They also tended to change prices with considerable frequency. In the manufacturing sector, price reviews were typically carried out monthly, however, prices usually only changed on a quarterly, semi-annual or annual basis. Meanwhile, if we exclude retail trade and transport (where prices are driven in part by the fuel element), the majority of respondents in other services sectors said that they typically reviewed and changed prices annually. Still, identifying a “typical” frequency of price review and/or change is clearly difficult for firms with a large range of products and different customer or contract types.

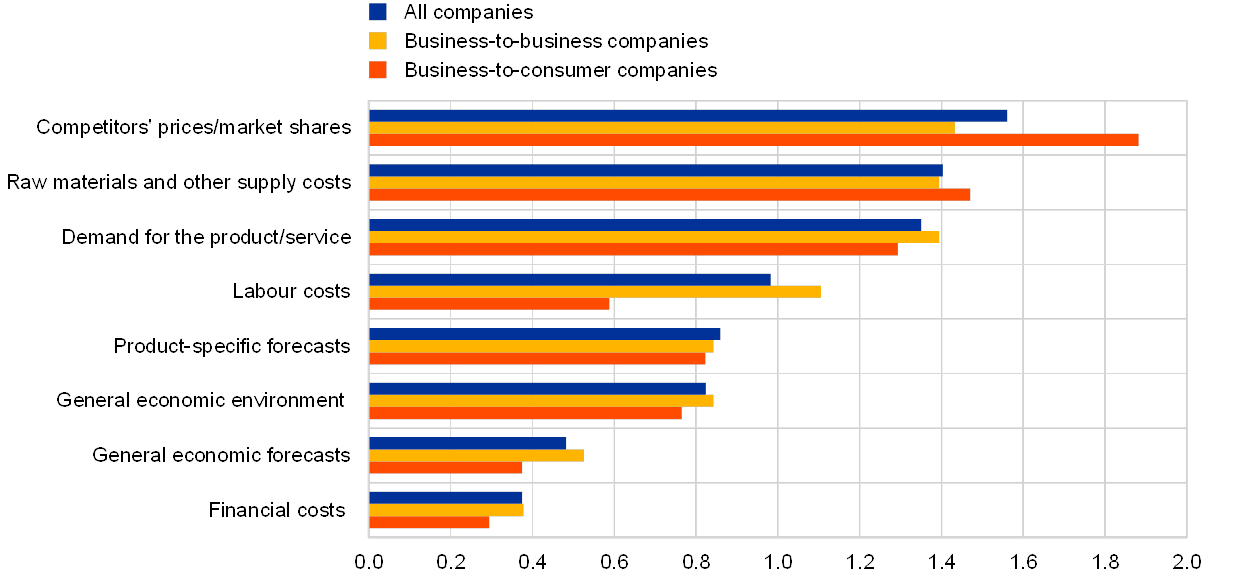

When setting prices, firms pay most attention to their competitors’ prices, closely followed by supply costs and product demand (see Chart C). In the survey, respondents were given a list of factors and asked to judge whether these were “not important”, “important” or “very important” when setting prices. When scoring their answers with “0”, “1” or “2” respectively, respondents overall considered their competitors’ prices to be the most important factor when setting prices. This was closely followed by the cost of raw materials and other supply costs and the demand for the given product or service. Labour costs were also deemed important.[4] The importance of competitors’ prices appears greater the closer the business is to the consumer, whereas further upstream, cost and demand considerations play a more significant role.

Chart C

Information that firms consider when setting prices

(average score of responses: 0 = not important; 1 = important; 2 = very important)

Source: ECB staff calculations.

Increases in average selling prices are achieved, to a large extent, by introducing new products with higher value content (see Chart D). Half of the respondents said that the introduction of new products with higher value content was “very important” and a further one-third said that this was “important” for raising average selling prices. Overall, the introduction of new products was regarded as being (slightly) more important than increasing the prices of existing products; and this was particularly the case for businesses selling directly to consumers. Rebranding or changing the specification of existing products was less important, albeit still considered important by around one-third of firms. Based on what firms said about how their price-setting behaviour had changed over the past five to ten years, the focus on adding value targeted at specific customers appears to be an increasing trend in response to increasing global competition and greater price transparency driven by the internet.

Chart D

How increases in average selling prices are achieved

(average score of responses: 0 = not important; 1 = important; 2 = very important)

Source: ECB staff calculations.

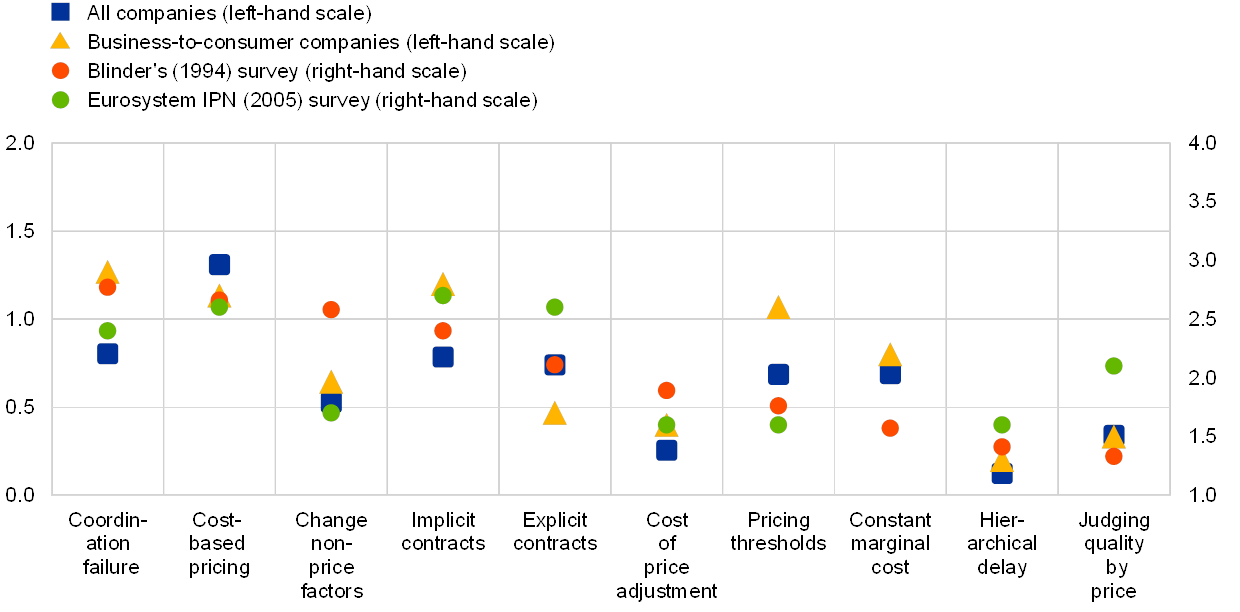

Firms’ pricing strategies are consistent with a range of theories concerning “sticky prices”. Firms were presented with a number of statements, each of which related to a different theory of sticky prices, as originally surveyed by Blinder (see the table below). Chart E plots the scores of the responses against the scores (and ranking) seen in Blinder’s survey, as well as against the results obtained in the survey undertaken by the Eurosystem Inflation Persistence Network (IPN) in 2005. For firms overall, the roles of cost-based pricing, contracts (either explicit or implicit) and coordination failure would appear to be the main causes of price stickiness. For more consumer-oriented firms, an understanding that customers expect prices to remain roughly the same (implicit contracts) and the targeting of psychological price thresholds are likely to be important causes of sluggish price adjustment.

Chart E

Price-setting behaviour and possible causes of sluggish price adjustment

(average score of responses)

Source: ECB staff calculations.

Notes: For this ECB survey: 0 = unimportant; 1 = important; 2 = very important. For Blinder’s (1994) survey and the Eurosystem IPN (2005) survey: 1 = totally unimportant; 2 = of minor importance; 3 = moderately important; 4 = very important. Theories are ordered according to their scoring (highest to lowest) in Blinder’s (1994) survey. The "constant marginal cost" theory was not tested in the Eurosystem IPN (2005) survey.

- See Blinder, A. S., “On sticky prices: academic theories meet the real world”, in Monetary Policy, Gregory Mankiw, (ed.), The University of Chicago Press, 1994.

- See Fabiani, S. et al., “The pricing behaviour of firms in the euro area – new survey evidence”, Working Paper Series, No 535, ECB, October 2005.

- A price review is understood as meaning that current prices are analysed and a decision is taken as to whether or not – and if so by how much – to change those prices. Price changes can therefore only be as frequent as, or less frequent than, the price reviews.

- Whether or not “labour costs” or “raw material costs and other supply costs” were deemed important depends, in large part, on the company’s cost base. If these two factors are considered together, then “input costs” would be the single most important consideration for these firms when setting prices.