The pandemic emergency purchase programme – an initial review

Published as part of the ECB Economic Bulletin, Issue 8/2022.

1 Introduction

The ECB launched the pandemic emergency purchase programme (PEPP) in March 2020 in response to the extraordinary economic and financial shock triggered by the coronavirus (COVID-19) pandemic.[1] The pandemic erupted in full force in early 2020 and constituted a collective public health emergency unprecedented in recent history, bringing unbearable human tragedy across the world. It was also a massive economic shock that led to huge economic dislocations in production, trade, investment, employment and consumption. The economic fallout required a strong and determined policy response to support people and firms at risk, which fiscal and monetary policymakers all over the world swiftly delivered. This article provides an initial review of one cornerstone of the ECB’s monetary policy response: the announcement of the PEPP on 18 March 2020 and its subsequent implementation, which saw the ECB conduct net purchases of euro area private and public sector securities totalling around €1.7 trillion by March 2022. Since the end of net purchases in March 2022, transactions under the PEPP have only been conducted to reinvest redemptions in the portfolio. As announced in December 2021, the Governing Council intends to reinvest principal payments from maturing securities purchased under the PEPP until at least the end of 2024.

The PEPP was designed with a dual role: it supported market functioning as well as the transmission of monetary policy, and enabled a substantial easing of the monetary policy stance to counter the serious downside risks to price stability posed by the pandemic. The pandemic and associated containment measures around the world led to a sharp downward revision in the economic and financial outlook and substantially increased uncertainty, leaving the euro area with an even more subdued outlook for medium-term inflation than already prevailing when it hit. The resulting strains in the global financial system raised the risk of fire sales and adverse illiquidity spirals. In these conditions, the PEPP proved a crucial addition to the asset purchases already being conducted under the ECB’s asset purchase programme (APP) to provide market liquidity and limit the risk of self-fulfilling dynamics. The announcement of the PEPP successfully interrupted the rapid detachment of euro area sovereign bond yields from risk-free rates amid the market turmoil in early 2020, as proxied by the wedge between overnight index swap (OIS) rates and euro area GDP-weighted sovereign bond yields (Chart 1). This was essential, since sovereign bond yields serve as benchmark rates for funding conditions in the wider euro area economy and are used to price corporate and bank bonds, as well as bank loans to firms and households; they are thus pivotal in the transmission of monetary policy.[2] The market stabilisation following the announcement of the PEPP ensured that the ECB’s accommodative monetary policy stance was successfully transmitted to firms and households, and so helped counteract the pandemic shock to the inflation outlook, alongside substantial support from fiscal policy at the EU level.[3] Further monetary accommodation – in the form of more favourable financing conditions for firms and households – was required to support economic recovery and safeguard price stability. Following increases in its overall size subsequent to the initial announcement, the PEPP was therefore also instrumental in bringing about a further easing in the ECB’s monetary policy stance itself, by reducing the volume of public and private sector securities in the market and thereby further lowering their yields. Overall, the PEPP performed two critical and mutually reinforcing functions in countering an unprecedented shock: stabilising markets and easing the monetary policy stance, both of which were expected to significantly contribute to price stability.

Chart 1

Ten-year GDP-weighted sovereign bond yield and ten-year nominal OIS rate in the euro area: levels and spread

(percentages per annum, basis points)

Sources: Refinitiv and ECB calculations.

Note: The latest observations are for March 2022.

This article provides an initial review of the ECB’s experience with the PEPP and that of the wider Eurosystem, with a focus on objectives, implementation and effectiveness. Due to the exceptional, fast-evolving and uncertain circumstances created by the pandemic, the PEPP required a high degree of flexibility in its design and implementation compared with the APP. This was reflected in its design and implementation, most prominently with regard to the embedded flexibility, and these are reviewed in Sections 3 and 4. As a result, and as illustrated by empirical evidence in Section 5, the PEPP became an indispensable element of the ECB’s monetary policy response to the pandemic.

2 The PEPP’s monetary policy objectives

The PEPP was designed with two monetary policy aims in mind: supporting the proper functioning of the monetary policy transmission mechanism by stabilising financial markets and easing the monetary policy stance to offset the direct impact of the pandemic on price stability. As a result of the exceptional uncertainty caused by the acceleration of the pandemic, financial markets were suffering from serious dislocations in early March 2020. The distressed market conditions severely impeded transmission of the ECB’s monetary policy actions intended to mitigate the economic hardships caused by the pandemic. This posed significant downside risk to price stability. The first of the PEPP’s aims was to protect the monetary policy transmission mechanism against unwarranted financial market fragmentation. Over time it became apparent that the pandemic had struck the euro area economy through a combination of supply and demand shocks.[4] While the pandemic was an exogenous shock that hit the entire euro area and the world at large, its impact varied across countries depending on their initial situation and exposure to specific economic sectors that were more affected. Despite the changes in the pandemic’s economic effects over time and variation across countries, its first-order impact on the euro area inflation and growth outlook clearly called for an easing of the monetary policy stance. The first Eurosystem staff macroeconomic projections able to fully take account of the initial impact of the pandemic (published in June 2020) contained a significant downward revision of projected inflation from 1.6% to 1.3% at the end of the relevant projection horizon at the time (2019-22) and thus considerably below the Governing Council’s target. Real GDP growth projections were revised downwards dramatically in 2020 but upwards for the rest of the horizon, especially for 2021, leaving projected real GDP around 4% lower by the end of the projection horizon compared with the March 2020 staff projections. At the same time, policy rates were already at very low levels. Providing monetary accommodation by lowering longer-term interest rates to help counter the negative pandemic shock to the path of inflation in the euro area as a whole thus constituted the second, monetary policy stance objective of the PEPP (see Section 5).

The uncertainty brought about by the pandemic called for a high degree of flexibility in the PEPP’s design and implementation. Adjusting the pace and composition of purchases under the PEPP so they could quickly and effectively address impediments to the transmission mechanism in specific market segments required the ability to spread purchase volumes flexibly over time, asset classes and jurisdictions. The greater degree of flexibility is one of the key distinguishing features of the PEPP compared with the APP, beside the focus on offsetting the impact of the pandemic on the inflation outlook. The APP, by contrast, was designed to support sustained convergence of inflation rates towards the Governing Council’s target during a prolonged period of low inflation, rather than to react to an acute and fast-moving crisis.

As the pandemic’s impact on the economy evolved, the primary focus of the PEPP shifted over time from market stabilisation towards countering the adverse impact of the pandemic on the projected inflation path. In the first half of 2020, uncertainty about the pandemic’s economic impact led to severe tensions in global financial markets. Accordingly, the implementation of the PEPP in that period was characterised by high purchase volumes mainly geared towards stabilising markets with a view to restoring monetary policy transmission. This initial focus on the transmission objective was reflected in fluctuations in the distribution of purchases over time, across asset classes and among jurisdictions, especially in the second quarter of 2020. As the pandemic progressed and the economy adjusted, uncertainty abated. This enhanced the PEPP’s scope to operate more in the mould of a stance-oriented purchase programme. The Governing Council decided to increase the aggregate purchase volume, or envelope, of the programme in June and December 2020 in response to pandemic-related downward revisions to the inflation outlook.[5] By allowing the overall expected stock of purchases to be revised up or down, depending on the evolution of financing conditions and the projected inflation shortfall, the final recalibration in December 2020 encapsulated the Governing Council’s emphasis on two-sided flexibility. Ultimately the final envelope size was not used in full, as favourable financing conditions could be maintained with lower purchase flows. Compared with the early stages of the PEPP and the pandemic, the absence of major financial market uncertainties allowed for a steadier path of monthly net purchase volumes within the overall envelope, as well as a convergence of purchases of public sector securities towards the Eurosystem capital key (see Section 4 below for details on the evolution of overall programme size, usage and deviations from the capital key). This latter period saw increases in risk-free rates at the start of 2021, which were assessed to be in no small part the result of spillovers from rising yields in the United States. This reinforced the case for leaning against yield increases in the euro area so as to avoid a premature tightening in financing conditions that would have posed a risk to medium-term inflation. Later in 2021, as the projections for inflation approached, and ultimately exceeded, those prevailing before the pandemic, purchase volumes were reduced accordingly.

3 PEPP implementation framework

All asset categories eligible for the APP were also eligible under the PEPP, but the PEPP implementation framework complemented the APP in several ways to deliver a more tailored response to the pandemic shock. Table 1 gives a summary of the parameter differences between the APP and the PEPP. To enable the effectiveness of the PEPP, the consolidation of holdings under Article 5 of Decision (EU) 2015/774 does not apply to PEPP holdings.[6] Three other important distinctions should be mentioned. First, while generally only bonds issued by issuers with an investment-grade credit rating were eligible for purchase, a waiver of the eligibility requirements was granted for securities issued by the Hellenic Republic (which was rated below BBB-), based on a number of monetary policy and risk considerations, to ensure smooth transmission of monetary policy to all euro area countries. Second, the eligibility of private sector securities was expanded to encompass non-financial commercial paper (CP) with a remaining maturity of at least 28 days. Third, the eligible residual maturity range for the purchase of public sector securities under the PEPP was widened to include shorter-dated bonds and Treasury bills.

Table 1

APP and PEPP: key parameters

* Credit quality steps harmonise the individual rating scales and grades of different credit assessment systems on a Eurosystem harmonised rating scale. ** CP maturity lowered for the APP in March 2020. *** Combined Eurosystem holdings from monetary policy and investment portfolios. **** Subject to case-by-case verification that this would not create a situation where the Eurosystem would have blocking minority power. ***** Specific conditions may apply for non-financial corporate (NFC) commercial paper.

First, the inclusion of securities issued by the Hellenic Republic was an important element in supporting the smooth transmission of monetary policy to all euro area countries.[7] The Governing Council assessed that the eligibility of Greek government debt securities for the PEPP was warranted based on several considerations. These included (i) the need to alleviate pressures stemming from the pandemic, which had severely affected the Greek financial markets, (ii) the monitoring of the Greek economy in the context of enhanced surveillance, including the related commitments undertaken by Greece, and (iii) the fact that Greece had regained market access.[8] The eligibility waiver enhanced the effectiveness of the transmission objective of the PEPP, helping to mitigate against fragmentation risks across all euro area countries.

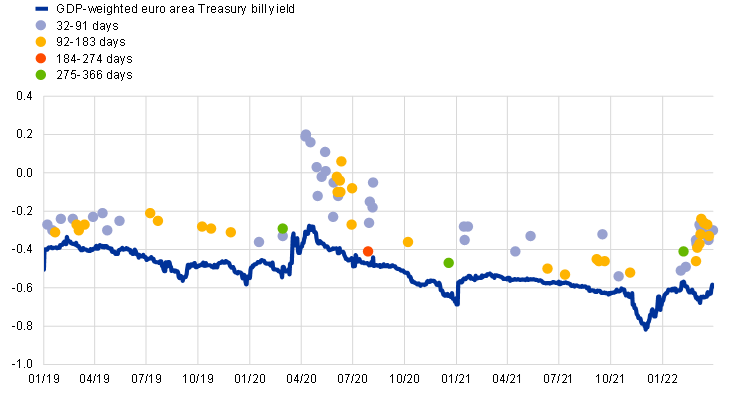

Second, in the face of significant stress in the euro area CP market, PEPP purchases were initiated to restore market functioning and maintain the transmission of monetary policy. The CP market came under significant stress in March 2020. Demand from investors evaporated at a time when corporates’ desire for short-term funding was amplified by the extremely uncertain environment. Many investors were facing large redemptions and therefore in urgent need of liquidity. Thus, they were reluctant to roll over maturing CP holdings; some even sold in the secondary market, which is rare in normal times. The collapse in investor demand at a time when issuers needed extra short-term liquidity blocked the transmission of the monetary policy stance to the real economy. This was the backdrop that led to a broadening of the eligibility rules so meaningful CP purchases could be made under the PEPP. Chart 2 shows the situation in March 2020; the market had ceased functioning, with issuance grinding to a halt. When it resumed, rates at which even short-term paper was issued rose sharply. The PEPP purchases facilitated a return to more stable market conditions and helped other investors to come back. Rates gradually declined and returned to levels in line with the monetary policy stance, supporting its transmission to financing conditions of the real economy.

Chart 2

Short-Term European Paper (STEP) interest rates and the GDP-weighted euro area Treasury bill yield

(percentages per annum)

Sources: Bloomberg and ECB.

Notes: The GDP-weighted euro area Treasury bill yield includes secondary market yields of a rolling set of outstanding Treasury bills with maturities of up to 12 months. The latest observations are for 31 March 2022.

Third, the lowering of the eligible maturity for public sector securities under the PEPP avoided dislocations in the shorter segments of the yield curve, which could have impeded monetary policy transmission. The onset of the pandemic led to concerns that emerging constraints on market liquidity risked severely impacting financial conditions. As is common during times of heightened market stress, investors reduced their investment horizon, as they faced a heightened risk of deposit withdrawals from their clients. Allowing for a shorter minimum eligible maturity helped to mitigate this “dash for cash” by enabling Eurosystem purchases across a broader range of the yield curve than would have been possible under the APP. At the same time, debt management offices significantly increased their issuance of Treasury bills to both address urgent funding needs and retain flexibility amid this uncertainty. Chart 2 illustrates the considerable increase in Treasury bill yields in the secondary market during the initial phase of the pandemic. PEPP purchases adjusted flexibly, ensuring an approach that remained consistent with the relative volumes of trading activity between bonds and bills observed in the secondary market.

4 Implementation in practice

The PEPP’s initial envelope of net purchases announced on 18 March 2020 amounted to €750 billion.[9] The Governing Council subsequently decided to increase the envelope by €600 billion on 4 June 2020[10] and by €500 billion on 10 December 2020[11] in response to the pandemic-related downward impact on the euro area inflation outlook (see Section 2), leading to a total programme size of €1,850 billion. During the PEPP net purchase phase, cumulative net purchases amounted to €1,718 billion, implying 93% usage of the overall envelope (Chart 3). These were conducted smoothly and flexibly by striving for a market-consistent approach,[12] mitigating unintended side effects on market functioning. The pace of purchases was calibrated regularly, taking into account market developments and the PEPP’s impact, while making full use of the flexibility mentioned.[13] Utilising a broad range of economic indicators, overlayed with expert judgement, decisions on the overall pace and the split across jurisdictions and asset classes were taken with a view to ensuring smooth policy transmission in all countries. Care was taken to prevent a tightening of financing conditions, which would have been inconsistent with countering the downward impact of the pandemic on the projected path of inflation.

Chart 3

Cumulative net purchases and the size of the programme envelope under the PEPP

(EUR billions)

Source: ECB.

Note: The latest observations are for 31 March 2022.

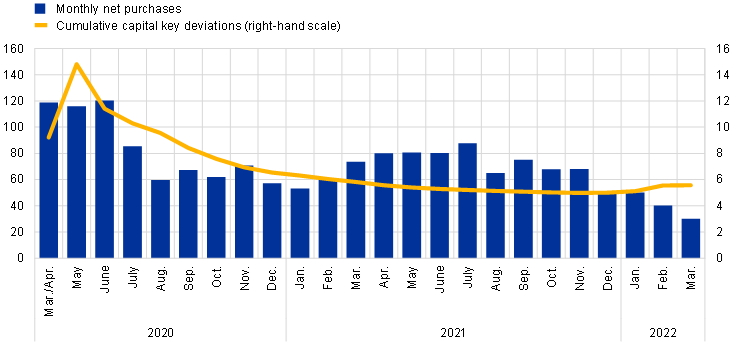

Public sector purchases accounted for 97% of overall PEPP volumes, and the benchmark allocation across jurisdictions was the Eurosystem capital key of the national central banks. Flexibility across jurisdictions was a key component of the PEPP. This allowed deviations from the Eurosystem capital key in the allocation of purchases of public sector securities, especially at the height of the market turmoil in the early phase of the pandemic when these deviations were substantial. As a result, the volume of monthly net purchases peaked between March and June 2020, as did cumulative deviations from the ECB’s capital key (Chart 4). The ability to respond to transmission risks was most evident in this period, as public sector purchases were increased in the jurisdictions most adversely affected by pandemic-related fragmentation risks. Deviations from the capital key then receded for the remainder of the net purchase phase as financial market conditions stabilised and the dual nature of the PEPP allowed the focus to evolve from the transmission phase to operating with a more stance-focused objective addressed to the euro area as a whole (see Section 2). Over most of the lifetime of the PEPP, purchases were conducted according to the capital key. However, even though there was less need to deviate from the benchmark in the later stages of the crisis, the ability to do so remained relevant as the inherent option to conduct purchases flexibly prevented pandemic-induced fragmentation risks from resurfacing.

Chart 4

Monthly net purchases and cumulative capital key deviations under the PEPP

(EUR billions, percentages)

Source: ECB.

Notes: “Cumulative capital key deviations” refers to the sum of deviations from the capital key used as the benchmark to guide the stock of public sector purchases across euro area countries. The latest observations are for 31 March 2022.

Besides avoiding fragmentation, flexibility was necessary to avoid large price movements in some asset classes, which was most clearly seen in the evolution of supranational bond purchase volumes. During the net purchase phase, supranational bonds accounted for up to 10% of public sector purchases. Chart 5 illustrates how purchase volumes were calibrated flexibly to respond to developments in the supranational market. In the first months of PEPP implementation, liquidity in outstanding supranational bonds allowed for sufficient purchase volumes. However, as purchases progressed and new issuance remained low, conducting 10% of purchases under such liquidity conditions could have led to undesired stress and risked distorting this market segment. Purchase volumes were therefore reduced to avoid this outcome. A fundamental change in the euro area supranational market came with the announcement that the Commission – on behalf of the EU – would raise significant amount of funds from the capital markets to support Europe's recovery. This led to a significant increase in issuance by the EU from late 2020 onwards. Although temporary in nature, the significant size of the issuance, equating to around 7% of euro area GDP in 2020, marked a watershed in the euro area, as fiscal policy complemented monetary stimulus. The Support to mitigate Unemployment Risks in an Emergency (SURE) and Next Generation EU (NGEU) initiatives (€100 billion and €800 billion, respectively) marked the largest issuance of supranational debt ever announced in the EU. This, along with a marginal increase in issuance from other euro area supranational entities, led to increased liquidity in the market.[14] Chart 5 shows how the increase in net purchases of supranational bonds was calibrated to take account of the improved liquidity conditions from the end of 2020 onwards.

Chart 5

Net purchases of different asset types under the PEPP

(EUR billions)

Source: ECB.

In the private sector segment too, flexible purchases were an integral part of the PEPP, with the relative proportion of the constituent sub-programmes varying significantly over time as conditions in private sector markets evolved. Purchases were conducted in corporate and covered bonds and, as mentioned above, non-financial CP.[15] Purchase volumes across all three were driven by primary market issuance dynamics and secondary market conditions, which varied markedly at times. In general, private sector purchases were larger in the early months of the programme, as issuers’ strong preference for increasing their cash holdings led to a high level of issuance in both corporate bonds and CP. This surge contrasts markedly with previous incidences of macroeconomic uncertainty, such as in the global financial crisis, when increased volatility tended to hamper market access and reduce issuance. As market conditions improved and issuance levels stabilised, the share of private sector purchases declined.

The most pronounced use of flexibility in private sector net purchase volumes over time was seen with CP purchases. Significantly more CP was purchased early on in the programme, when the segment was under extreme stress (see Section 3). As investors were unwilling to take on longer maturities during the most acute phase of the crisis, the ability of the PEPP to buy such tenors supported issuers. This can be seen in Chart 6, which shows CP purchases by maturity. When demand from the regular investor base resumed, issuers had less need to resort to the PEPP. This mirrored the shift from transmission to stance objectives (as discussed in Section 2), with CP purchases declining in the latter phase. CP holdings then declined markedly, as most holdings were not rolled over.

Chart 6

NFC CP holdings by original maturity

(EUR billions)

Source: ECB.

The public issuance patterns of covered and corporate bond issuers during the PEPP net purchase phase contrasted starkly, as reflected in their respective purchase volumes. Chart 7 shows that in the most acute phase of the crisis corporate bond issuance spiked, as companies rushed to increase their access to cash in the face of heighted uncertainty and collapsing cash inflows. By contrast, covered bond issuance to the market from the second quarter of 2020 through to the end of 2021 was very subdued by recent standards. The most obvious difference for covered bond issuers was that banks had other sources of funding not available to corporates. First, TLTRO III was concurrently offering funding to banks at rates which, in most cases, were cheaper than issuing in the public market. Second, deposits in euro area banks rose sharply as the public reacted to the uncertainty of the pandemic by saving more. This resulted in relatively limited PEPP covered bond purchases, with purchases under the ECB’s third covered bond purchase programme (CBPP3) continuing at normal levels to support transmission of the monetary policy stance through the bank lending channel.

Chart 7

Cumulative eligible issuance of a) corporate and b) covered bonds

a) Corporate bond issuance, per year

(EUR billions)

b) Covered bond issuance, per year

(EUR billions)

Source: ECB.

The Eurosystem bought securities in a way that aimed to preserve market liquidity conditions. Securities were purchased from a broad range of counterparties. In addition, significant efforts were made to avoid buying scarce securities when they were not available.[16] At the end of the net purchase phase, public sector and private sector cumulative net purchases amounted to €1,665.7 billion and €52.4 billion respectively. PEPP purchases and holdings are disclosed on a bi-monthly basis on the ECB’s website.[17] Private sector net purchases as a percentage of overall PEPP net purchases were lower than for the APP. There are several reasons for this. First, with the exception of CP and corporate bonds, private sector issuance was otherwise subdued. Second, many of the private sector purchases were made in CP, which by their nature have short maturities and, as described above, had largely matured and were not rolled over by the end of the net purchase period. Finally, private sector APP redemptions, particularly in asset-backed securities and covered bonds, were relatively high throughout the period and absorbed a great deal of the gross purchases conducted, while new issuance was relatively low. The Eurosystem executed around 82,400 transactions under the PEPP during that time (Table 2). By the end of the net purchase phase, the weighted average maturity of PEPP holdings was 7.57 years, broadly in line with the eligible universe (7.51 years).

Table 2

Implementation of the PEPP during the net asset purchase phase

Source: ECB.

During the current PEPP reinvestment phase, flexibility has remained an integral aspect to guard against pandemic-related risks to the smooth transmission of monetary policy.[18] The Governing Council decided in June 2022 that it would apply flexibility in the reinvestment of redemptions from maturing securities coming due under the PEPP (see Box 1). This decision was confirmed in July and September 2022, with a view to countering risks to the transmission mechanism related to the pandemic.

Box 1

Flexibility of reinvestments under the pandemic emergency purchase programme

The reinvestment horizon of the pandemic emergency purchase programme (PEPP) has shifted over time in line with pandemic conditions and the programme’s dual monetary policy objectives. In June 2020 the Governing Council initially communicated that it intends to reinvest maturing securities held in the PEPP portfolio until at least the end of 2022; this was extended in December 2020 to the end of 2023, and in December 2021 to the end of 2024. In all its communications about reinvestment policy, the Governing Council has emphasised that the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

The pandemic has left lasting vulnerabilities in the euro area economy, which imply risks to the even transmission of monetary policy across jurisdictions. In December 2021 the Governing Council therefore decided that, in line with the initial design features of the PEPP, in the event of renewed market fragmentation related to the pandemic, reinvestments could be adjusted flexibly across time, asset class and jurisdiction at any time. This recognised the lesson from the pandemic, that under stressed conditions, flexibility in the design and conduct of asset purchases helped to counter impairments to the transmission of monetary policy and made the efforts to achieve the Governing Council’s goal more effective. Accordingly, the Governing Council communicated that within its mandate, under stressed conditions, flexibility would remain an element of monetary policy whenever threats to monetary policy transmission jeopardise the attainment of price stability.

By mid-2022 the euro area had experienced a complex mix of shocks that contributed to the uneven transmission of monetary policy across jurisdictions. The Governing Council therefore decided that it would apply flexibility in reinvesting redemptions of maturing securities held under the PEPP, with a view to countering pandemic-related risks to the transmission mechanism.[19] Such flexibility includes reinvesting redemptions, as deemed appropriate, in bond markets of euro area jurisdictions where orderly transmission is at risk.[20] This was evident in the relative weights of gross PEPP purchase volumes in June and July 2022. The degree to which this is applied will continue to be dependent on market conditions and forms an additional layer of the multi-faceted flexibility that characterises the PEPP. Flexibility in PEPP reinvestments represents a first line of defence against fragmentation risk.

5 The effectiveness of the PEPP

Monetary policy transmission

The launch of the PEPP arose from the need for market stabilisation in an environment in which euro area financial markets were showing increasing signs of stress and illiquidity, suggesting that financing conditions were becoming unduly detached from the ECB’s intended monetary policy stance. Central banks need to act decisively against such a detachment to ensure the transmission of their monetary policy stance. At the same time, any intervention for the purposes of market stabilisation requires that dislocations – e.g. between key yield curves – be the result of non-fundamental, self-fulfilling dynamics in securities markets. The severe financial market dislocations in the run-up to the announcement of the PEPP were indicative of such dynamics. The wedge between sovereign bond yields and risk-free rates is a case in point; this increased sizeably and rapidly (Chart 1). It also occurred amid a significant deterioration in liquidity conditions in euro area sovereign bond markets and significant systemic stress engulfing several segments of the euro area financial markets (Chart 8). This combination – together with a broad assessment of a range of further quantitative and qualitative evidence – pointed to a disorderly and potentially self-fulfilling repricing in government bond markets and a clear need for intervention to restore market stability so that monetary policy could be transmitted smoothly.[21]

The PEPP’s success is illustrated by the fact that liquidity strains in euro area sovereign bond markets and systemic stress across markets receded markedly following the announcement of the programme. After the announcement, PEPP purchases were adjusted on an ongoing basis within the overall maximum envelope, both in terms of volume and across jurisdictions, so as to guard against a non-fundamental detachment of sovereign bond yields from the ECB’s intended monetary policy stance. This approach visibly contributed to further reducing market tensions and ultimately returned them to more normal, pre-pandemic levels.

Chart 8

Euro area indicators of systemic stress and sovereign bond market conditions

(standardised index, basis points)

Sources: Refinitiv and ECB calculations.

Notes: The euro area composite indicator of systemic stress is computed following Holló, D., Kremer, M. and Lo Duca, M., “CISS – A composite indicator of systemic stress in the financial system”, Working Paper Series, No 1426, ECB, Frankfurt, March 2012. The sovereign bond market volatility and bid-ask spread indicators are aggregated to the euro area level using GDP weights, based on ten-year sovereign benchmark yields in individual jurisdictions. The latest observations are for March 2022.

The PEPP’s success in countering pandemic-related risks to the transmission of monetary policy reflected both announcement and flow effects.[22] The announcement effect of central bank asset purchase programmes, as the name implies, refers to the impact that the announcement of key parameters such as the overall size of the programme or central implementation aspects has on financing and market conditions. The “pure” announcement effect captures the impact that materialises even before the programme is actually implemented, as market participants instantaneously readjust their expectations, especially concerning the expected stock of future bond holdings by the central bank. For pre-pandemic asset purchase programmes of major central banks, the overriding transmission channel operated by extracting duration risk,[23] i.e. the expected stock of sovereign bonds on the central bank’s balance sheet compressed the term premium component embedded in the term structure of interest rates.[24] By contrast, the set of relevant transmission channels with the PEPP is richer, owing to the flexibility in allocating net purchases over time and across asset classes and jurisdictions. Given this considerable additional flexibility, the flow effects stemming from implementation of asset purchases, i.e. the impact actual purchases have on financial asset prices, can gain additional relevance.

The most significant announcement effect arose at the inception of the programme on 18 March 2020 and reduced euro area sovereign bond yields beyond what might have been expected based on experience with non-stressed financial market environments. Of the three major announcements of the PEPP – the launch of the programme on 18 March 2020 and the two upscalings of the maximum overall envelope in June and December of the same year (Section 4, Chart 3) – the initial announcement stands out not only for being associated with the largest increase in the envelope and launching the programme to begin with; it was also largely unexpected by financial market participants at the time. Accordingly, moves in market prices within a narrow time window can be used to gauge the size of the associated announcement effect using an event-study type analysis. Chart 9 shows model-implied elasticities (i.e. changes in the yields of sovereign bonds of different maturities for a given envisaged volume of additional Eurosystem bond holdings) associated with PEPP purchases (yellow bars) and purchases under the public sector purchase programme (PSPP – blue bars). While the latter are informed by experience with the PSPP as a whole, the former reflect only bond yield reactions around the time the PEPP was announced. In addition to being significant in absolute terms, the implied PEPP elasticities are clearly higher than those implied by their PSPP counterparts. The estimated PSPP elasticities reflect the financial market conditions during its net purchase phase, which predominantly covered calm periods. This contrasts notably with the severe market stress that prevailed around, and in fact gave rise to, the announcement of the PEPP. Hence the difference between the two sets of elasticities may be interpreted as confirming that, in general, central bank policy measures which absorb risk otherwise borne by investors tend to be more effective in countering an undue build-up of risk premia under conditions of market distress.[25]

Chart 9

PSPP and PEPP yield elasticities for sovereign bond purchases, by residual maturity

(basis points per EUR 500 billion of sovereign bond purchases)

Source: ECB calculations.

Notes: PSPP elasticities are based on Eser, F., Lemke, W., Nyholm, K., Radde, S. and Vladu, A.L., “Tracing the impact of the ECB’s asset purchase programme on the yield curve”, Working Paper Series, No 2293, ECB, Frankfurt, July 2019. The model translates current and expected Eurosystem bond holdings into changes in sovereign bond yields and is estimated based on the APP/PSPP evidence. PEPP elasticities are derived from an alternative version of the same model, recalibrated such that the model-implied yield reactions to the March PEPP announcement match the two-day yield changes observed after 18 March 2020. Elasticities refer to the change in GDP-weighted yields of the four largest euro area countries in response to €500 billion of sovereign bond purchases in the euro area over the following ten months, without subsequent reinvestment.

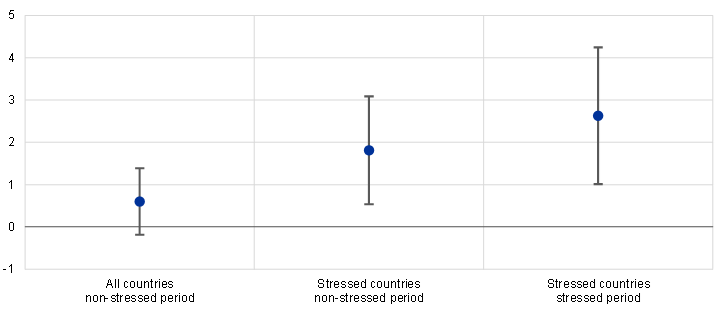

Flow effects from implementing the PEPP were also stronger during the stressed market conditions that characterised the initial phase of the programme compared with the subsequent phases. This conclusion is the result of analyses of various ECB purchase programmes, comparing the price changes of sovereign bonds that attracted positive purchase flows on a given day during the implementation phase with the price changes of those bonds that attracted no, or a lower, purchase flow. Updating and extending earlier work makes it possible to compare flow effects in sovereign bond markets according to the presence or absence of stress, both over time and across countries.[26] In this exercise, the first year of the PSPP net purchase phase serves as a benchmark for non-stressed market conditions. As shown in Chart 10, even under non-stressed conditions such as were seen during most of the PSPP net purchase phase, sovereign bond purchase flows exerted statistically significant and economically relevant effects on sovereign bond returns. These were concentrated in more stressed countries. However, in the stressed conditions prevailing from March to June 2020, the magnitude of the flow effects rose markedly. An analysis for the CBPP3, which was carried out alongside the PSPP under the umbrella of the APP, suggests that similar conclusions can be drawn for private sector purchase programmes.[27] The estimated flow effects of covered bond purchases during the CBPP3 net purchase phase were considerably larger during sub-periods of higher levels of stress, as proxied by the increase in sovereign spreads (Chart 11). This implies that central bank purchases of private sector bonds, too, are especially powerful if monetary policy transmission is at risk of being impaired. Consistent with the evidence for announcement effects, the estimates therefore suggest that actual purchases during implementation are more potent for supporting bond prices in stressed conditions.[28]

Chart 10

Flow effects on daily sovereign bond returns

(impact of a 1 percentage point increase in purchases of securities relative to the outstanding amount, percentages)

Source: ECB calculations.

Notes: The impact estimates are derived from regressions of daily bond returns of individual central government securities on ECB purchases of these securities, scaled by their outstanding amounts, and a full set of security and day-fixed effects. Purchase volumes are instrumented via the blackout periods embedded in the PSPP and PEPP design, as detailed in De Santis, R. and Holm-Hadulla, F. (2020). The blue circles represent point estimates and the whiskers are 95% confidence intervals.

Chart 11

Yield impact of private sector purchases: the case of covered bonds

(basis points per percentage point of outstanding amount purchased)

Source: ECB calculations.

Notes: The chart shows the estimated effect of purchasing 1 percentage point of the outstanding amount of a covered bond under the CBPP3. The effects are identified using proximity to the issue share limit as an instrumental variable for the purchase decisions. The left panel shows the unconditional effect, while the right panel shows the conditional effect for a given change in the sovereign spread on the same date.

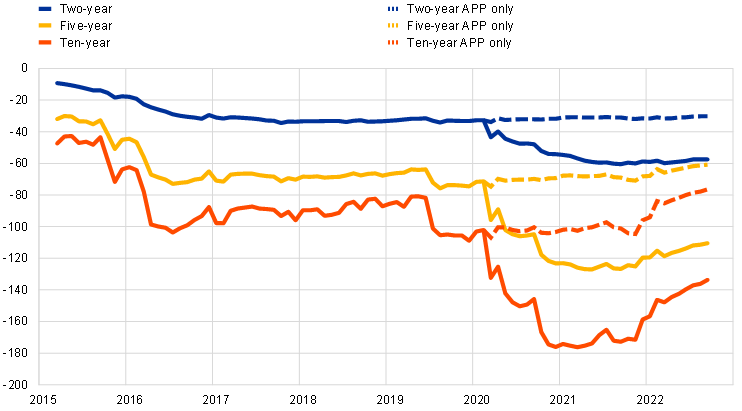

Monetary policy stance

The announcement and implementation of the PEPP effectively stabilised financial markets and contributed to countering the adverse impact of the pandemic on the projected inflation path. The accumulated stock of bond holdings under the APP had already led to an estimated compression of around 100 basis points in the aggregated ten-year bond yields of the four largest euro area jurisdictions before the announcement of the PEPP (Chart 12).[29] The additional ten-year yield compression from the PEPP added around another estimated 60 basis points by the end of the net purchase phase. The PEPP thus enabled substantial easing of financing conditions at a time when the scope for additional accommodation via the ECB’s key policy rates was limited by proximity to the effective lower bound on interest rates.

Chart 12

Time series estimates of the impact of the APP and PEPP on sovereign term premia

(basis points)

Source: ECB calculations.

Notes: APP impacts are estimated on the basis of an arbitrage-free affine model of the term structure with a quantity factor (see Eser, F. et al., 2019). PEPP impacts are derived as averages of the estimated impact using the same model and an alternative version of the model recalibrated so that the model-implied yield reactions to the March 2020 announcement of the PEPP match the two-day yield changes observed after 18 March. Estimates refer to GDP-weighted averages of the zero-coupon yields of the four largest euro area countries (Germany, Spain, France, and Italy). The latest observations are for September 2022.

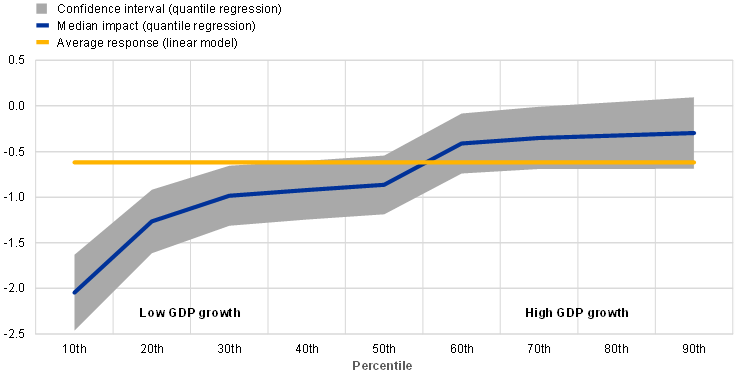

In conjunction with the ECB’s other pandemic-related measures, the PEPP successfully contributed to limiting the economic fallout from the pandemic. The inflation rates at the end of the respective horizons of the staff macroeconomic projections deteriorated sharply over the course of the pandemic, before recovering back towards (and ultimately exceeding) the Governing Council’s medium-term target of 2% (Chart 13). However, considering the evolution of the inflation outlook without a counterfactual scenario cannot establish the estimated accommodative effect of the PEPP. Compared with a model-based counterfactual scenario in which the ECB did not ease its monetary policy stance, the PEPP and other pandemic-related measures supported euro area growth by a cumulative 1.8 percentage points over the period 2020-23 (Chart 1). Inflation, which was projected to remain below the ECB’s medium-term target at the time the decisions were taken, would have been a cumulative 1.2 percentage points lower over the same period in the counterfactual scenario.[30] These numbers are likely conservative estimates of the true impact of the PEPP and other monetary policy measures during the pandemic, as the underlying models feature quantitative calibrations that largely rely on observations made in periods of calm. As discussed in Section 5.1, there is substantial evidence suggesting that the effects of monetary policy are stronger in stressed conditions like the early phase of the pandemic. Moreover, the announcement of the PEPP acted as a circuit breaker, interrupting the destabilising dynamics in the spring of 2020 and helping to reduce the risk of particularly adverse tail events. A quantile regression-based approach indicates that a tightening of financial conditions can have a considerably more negative impact on output growth during an economic downturn, suggesting that the ECB’s easing measures were particularly important to stabilise the economy during the severe recession in the first year of the pandemic (Chart 15).[31]

Chart 13

End-of-horizon projections for HICP inflation and HICP inflation excluding energy and food

(percentages per annum)

Sources: ECB/Eurosystem staff macroeconomic projections and ECB calculations.

Note: The latest observations are from the March 2022 ECB staff macroeconomic projections.

Chart 14

Estimated impact of the ECB’s monetary policy decisions between March and December 2020 on inflation and economic activity

a) Estimated impact per annum

(percentage points)

b) Estimated cumulative impact over the period 2020-23

(percentage points)

Source: ECB calculations.

Notes: The estimated impact across a suite of models refers to the average across a set of models used by the Eurosystem for policy simulations, namely a Bayesian vector autoregression model (see Rostagno, M. et al., cited in footnote 5), the NAWM-II model (see Coenen, G., Karadi, P., Schmidt, S. and Warne, A., “The New Area-Wide Model II: an extended version of the ECB’s micro-founded model for forecasting and policy analysis with a financial sector”, Working Paper Series, No 2200, ECB, Frankfurt, November 2018, revised December 2019) and the ECB-BASE model (see Angelini, E., Bokan, N., Christoffel, K., Ciccarelli, M. and Zimic, S., “Introducing ECB-BASE: The blueprint of the new ECB semi-structural model for the euro area”, Working Paper Series, No 2315, ECB, Frankfurt, September 2019).

Chart 15

Impact of financial tightening on real GDP growth under different distribution quantiles

(percentage points)

Source: ECB calculations.

Notes: The chart shows the impact of a one standard deviation increase in the euro area composite indicator of systemic stress (CISS) on the one-year-ahead annual growth rate of euro area GDP, by GDP decile. The estimates are based on quantile regressions of the one-year-ahead GDP growth rate on the CISS index. The estimation is carried out for the period January 1999 to December 2021, based on monthly observations. The shaded area is the 64% confidence interval for the estimates of the coefficients, while the linear model refers to the ordinary least squares estimate.

The potential side effects of the PEPP’s contribution to the macroeconomic stabilisation of the euro area during the pandemic are likely limited. Since monetary policy can affect prices only indirectly, through its impact on economic activity, all monetary policy measures have a range of direct and indirect effects on economic conditions. In its deliberations, the Governing Council therefore assesses whether the benefits of its monetary policy measures outweigh the costs.[32] With respect to the PEPP, this assessment includes careful monitoring of the potential side effects of large-scale asset purchases on the different economic sectors. First, the household sector is affected by asset purchases in several, partly opposing ways. Asset purchases tend to lower longer-term interest rates for private borrowers and savers and support household incomes and ultimately the macroeconomy through higher employment, growing wages and positive wealth effects, but asset purchase programmes can also have potential distributional implications. While they tend to reduce income inequality overall through positive employment and wage effects, their implications for wealth inequality can be mixed. Second, the favourable financing conditions for non-financial corporates, together with fiscal subsidies, might have contributed to the survival of some firms that would otherwise have been forced to shut down. However, the return to pre-pandemic GDP levels by the end of 2021 suggests that a comprehensive approach to supporting firms’ survival was broadly appropriate. Third, asset purchases have direct effects on bank profitability. However, a comprehensive assessment of the impact on banks must also consider that the supportive monetary policies during the pandemic improved the macroeconomic outlook. Fourth, while the PEPP supported market functioning especially during the outbreak of the pandemic in early 2020, purchases may at times have reduced liquidity in some smaller market segments (mitigated to some extent by precautionary measures such as securities lending). The impact of asset purchases on property markets and financial markets is also being closely monitored. The Governing Council stressed that a number of medium-term vulnerabilities had intensified when it announced in December 2021 that net purchases under the PEPP would end. In its latest assessment of the interrelation between monetary policy and financial stability in June 2022, the Governing Council concluded that the environment for financial stability had worsened. However, macroprudential policy remains the first line of defence in preserving financial stability and addressing medium-term vulnerabilities. Fifth, with regards to the impact of the PEPP on the conduct of fiscal policy, the pandemic experience demonstrated that in response to a severe shock, simultaneous and ambitious policy actions by governments and central banks working in the same direction – within their respective responsibilities and mandates – can complement each other effectively. At the same time, the ECB’s overriding price stability mandate is unambiguous. Overall, the PEPP has been found to have limited unintended side effects on households, non-financial corporates and the financial system, and is likely to have reinforced the effectiveness of the fiscal policy response to the pandemic crisis.[33]

See Lane, P.R., “Monetary policy during the pandemic: the role of the PEPP”, speech at the International Macroeconomics Chair Banque de France – Paris School of Economics, 31 March 2022 (and the references cited therein); also Lane, P.R., “The monetary policy response in the euro area”, in English, B., Forbes, K. and Ubide, A. (eds.), “Monetary Policy and Central Banking in the Covid Era”, CEPR Press, London, 2021.

See, for example, Lane, P.R., “The compass of monetary policy: favourable financing conditions”, speech at Comissão do Mercado de Valores Mobiliários, 25 February 2021.

The state-contingent forward guidance by the ECB’s Governing Council that had already been in place before the outbreak of COVID-19 ensured that the risk-free yield curve was able to adjust to the adverse economic shock from the pandemic. In response to the pandemic and before the announcement of the PEPP, the Governing Council had decided on a comprehensive package of monetary policy measures, including additional longer-term refinancing operations (LTROs) as fixed rate tenders with full allotment, easing the conditions of the third series of targeted longer-term refinancing operations (TLTRO III), pandemic emergency longer-term refinancing operations (PELTROs) and a temporary increase in the asset purchase programme (APP), which was already supporting the convergence of the pre-pandemic inflation outlook to levels close to the ECB’s inflation target.

See the articles entitled “The impact of COVID-19 on potential output in the euro area”, Economic Bulletin, Issue 7, ECB, 2020, and “The role of demand and supply factors in HICP inflation during the COVID-19 pandemic – a disaggregated perspective”, Economic Bulletin, Issue 1, ECB, 2021.

See Rostagno, M. et al., “Combining negative rates, forward guidance and asset purchases: identification and impacts of the ECB’s unconventional policies”, Working Paper Series, No 2564, ECB, Frankfurt, June 2021.

Decision (EU) 2015/774 of the European Central Bank of 4 March 2015 on a secondary markets public sector asset purchase programme (ECB/2015/10) (OJ L 121, 14.5.2015, p. 20).

See Schnabel, I., “Interview with To Vima”, 4 April 2020.

See recital (7) of Decision (EU) 2020/440 of the European Central Bank of 24 March 2020 on a temporary pandemic emergency purchase programme (ECB/2020/17) (OJ L 91, 25.3.2020, p. 1).

See ECB announces €750 billion pandemic emergency purchase programme (PEPP), press release, ECB, 18 March 2020.

See Monetary policy decisions, press release, ECB, 4 June 2020.

See Monetary policy decisions, press release, ECB, 10 December 2020.

Purchasing behaviour adjusted flexibly to ensure smooth implementation according to market conditions.

See Schnabel, I., “Asset purchases: from crisis to recovery”, speech at the Annual Conference of Latvijas Banka on “Sustainable Economy in Times of Change”, 20 September 2021.

See Bletzinger, T., Greif, W. and Schwaab, B., “Can EU bonds serve as euro denominated safe assets”, Working Paper Series, No 2712, ECB, Frankfurt, August 2022.

While asset-backed securities purchases were eligible for the PEPP, in practice, given conditions in the euro area asset-backed securities market, the purchases conducted under the ABSPP, which is part of the APP, were deemed to be sufficient. As a result, only purchases of covered bonds, corporate bonds and CP were made for the private sector element of the PEPP.

These included the use of relative value and liquidity indicators, as well as an assessment of the availability of bonds in both the cash and repo markets.

See “Pandemic emergency purchase programme (PEPP)” on the ECB’s website.

See Monetary policy decisions, press release, ECB, 16 December 2021.

See, “Statement after the ad hoc meeting of the ECB Governing Council”, press release, ECB, 15 June 2022.

Lagarde, C., “Price stability and policy transmission in the euro area”, speech at the ECB Forum on Central Banking 2022 on “Challenges for monetary policy in a rapidly changing world” in Sintra, Portugal, 28 June 2022.

See also Lane, P.R., “The market stabilisation role of the pandemic emergency purchase programme”, The ECB Blog, 22 June 2020.

See Bernanke, B.S., “The New Tools of Monetary Policy”, American Economic Association Presidential Address, 4 January 2020, for a general discussion of quantitative easing and other tools that have become a staple of major central banks since the global financial crisis. See also D’Amico, S. and King, T., “Flow and Stocks Effects of Large-Scale Treasury Purchases: Evidence on the Importance of Local Supply”, Journal of Financial Economics, Vol. 108, No 2, 2013, pp. 425-448, for a discussion of the differences between stock and flow effects and an empirical analysis of the Federal Reserve System’s large-scale asset purchases.

See Bernanke, B.S. (2020). See also Vayanos, D. and Vila, J.-L., “A Preferred-Habitat Model of the Term Structure of Interest Rates”, Econometrica, Vol. 89, No 1, 2021, pp. 77-112, for the effects of large-scale asset purchases – such as those conducted by major central banks since the global financial crisis – in a setting where various investor clienteles prefer to operate in specific segments of the yield curve (“preferred habitat”).

See also Lane, P.R., “The yield curve and monetary policy”, Public Lecture for the Centre for Finance and the Department of Economics at University College London, 25 November 2019, and Altavilla, C., Lemke, W., Linzert, T., Tapking, J. and von Landesberger, J., “Assessing the efficacy, efficiency and potential side effects of the ECB’s monetary policy instruments since 2014”, Occasional Paper Series, No 278, ECB, Frankfurt, September 2021.

See also Costain, J., Nuño, G. and Thomas, C., “The term structure of interest rates in a heterogeneous monetary union”, Documentos de Trabajo, No 2223, Banco de España, Madrid, June 2022, who find that the extraction of default risk premia is especially significant in explaining the behaviour of yields in response to the PEPP announcement, in particular for vulnerable euro area countries.

See De Santis, R. and Holm-Hadulla, F., “Flow Effects of Central Bank Asset Purchases on Sovereign Bond Prices: Evidence from a Natural Experiment”, Journal of Money, Credit and Banking, Vol. 52, No 6, 2020, pp. 1467-1491. For estimates of the effects of asset purchases in stressed conditions under the Securities Markets Programme in the context of the euro area sovereign debt crisis, see Eser, F. and Schwaab, B., “Evaluating the impact of unconventional monetary policy measures: Empirical evidence from the ECB׳s Securities Markets Programme”, Journal of Financial Economics, Vol. 119, No. 1, 2016, pp. 147-167; Ghysels, E., Idier, J., Manganelli, S. and Vergote, O., “A high frequency assessment of the ECB Securities Markets Programme”, Journal of the European Economic Association, 15, pp. 218-243; De Pooter, M., Martin, R.F. and Pruitt, S., “The Liquidity Effects of Official Bond Market Intervention”, Journal of Financial and Quantitative Analysis, Vol. 53, No. 1, 2018, pp. 243-268.

Contributions by Jasper Knyphausen to this analysis are gratefully acknowledged.

See Bernardini, M. and De Nicola, A., “The market stabilization role of central bank asset purchases: high-frequency evidence from the COVID-19 crisis”, Temi di discussione, No 1310, Banca d’Italia, Rome, December 2020, who show that, for central bank purchases made by Banca d’Italia during the pandemic crisis, outright government bond purchases compressed yields immediately and persistently over a trading day and helped to improve market liquidity, in particular under heightened market stress. For a more general discussion, see Bailey, A., Bridges, J., Harrison, R., Jones, J. and Mankodi, A., “The central bank balance sheet as a policy tool: past, present and future”, Staff Working Paper, No 899, Bank of England, London, December 2020; also Cúrdia, A. and Woodford, M., “The central-bank balance sheet as an instrument of monetary policy”, Journal of Monetary Economics, Vol. 58, No 1, January 2011, pp. 54-79.

“Term premium” in Chart 12 can be understood as the portion of the considered sovereign bond yields (the weighted average across Germany, Spain, France, and Italy) that is not related to current or expected short-term interest rate expectations. For an explicit decomposition of the effect of bond purchases on interest rate expectations, term premia (in the narrow sense of just capturing duration risk), expected default compensation and credit risk premia, see Costain, J. et al. (2022).

These estimates refer only to the monetary policy measures taken in response to the pandemic and do not account for the impact of the more recent monetary policy normalisation.

See Lane, P.R. (2022).

See, among others, Schnabel, I., “Necessary, suitable and proportionate”, The ECB Blog, 28 June 2020, and Lane, P.R. (2022) for discussions of the Governing Council’s assessment of the PEPP’s proportionality in achieving its intended objective.

For more details, see Lane, P.R. (2022).