- Press release

- 20 November 2018

Euro money market statistics: sixth maintenance period 2018

- Daily average borrowing turnover in the unsecured segment increased from €113 billion in the fifth maintenance period to €115 billion in the sixth maintenance period of 2018.

- Weighted average overnight rate on borrowing transactions slightly increased from -0.42% to -0.41% for the wholesale sector and from -0.44% to -0.43% for the interbank sector.

Daily average nominal borrowing amount in the unsecured segment for the wholesale and interbank sectors, by maintenance period

(EUR billions)

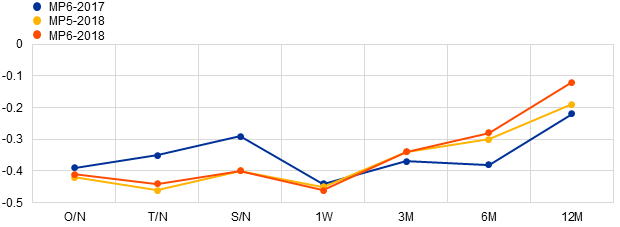

Weighted average rate for wholesale sector borrowing in the unsecured segment by tenor and maintenance period

(Percentage)

In the latest maintenance period, which started on 19 September 2018 and ended on 30 October 2018, the borrowing turnover in the unsecured segment averaged €115 billion per day. The total borrowing turnover for the period as a whole was €3,452 billion. Borrowing from credit institutions, i.e. on the interbank market, represented a turnover of €372 billion, i.e. 11% of the total borrowing turnover, and lending to other credit institutions amounted to €291 billion. Overnight borrowing transactions represented 50% of the total borrowing nominal amount. The weighted average overnight rate for borrowing transactions was -0.43% for the interbank sector and -0.41% for the wholesale sector, compared with -0.44% and -0.42% respectively in the previous maintenance period.

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes

- The money market statistics are available in the ECB’s Statistical Data Warehouse.

- The Eurosystem collects transaction-by-transaction information from the 50 largest euro area banks in terms of banks’ total main balance sheet assets, broken down by their borrowing from and lending to other counterparties. Transactions include all trades concluded via deposits, call accounts or short-term securities with financial counterparties including banks, the government sector and non-financial corporations. More information on the methodology applied, including the list of reporting agents, is available in the statistics section of the ECB’s website.

- The weighted average rate is calculated as the arithmetic mean of the rates weighted by the respective nominal amount over the maintenance period on all days on which TARGET2, the Trans-European Automated Real-time Gross settlement Express Transfer system, is open.

- Borrowing refers to transactions in which the reporting bank receives euro-denominated funds, irrespective of whether the transaction was initiated by the reporting bank or its counterpart.

- Lending refers to transactions in which the reporting bank provides euro-denominated funds, irrespective of whether the transaction was initiated by the reporting bank or its counterpart.

- The tenors O/N, T/N, S/N, 1W, 3M, 6M and 12M refer to, respectively, overnight, tomorrow/next, spot/next, one week, three months, six months and twelve months.

- The missing values for tenors in some of the reserve maintenance periods may be due to confidentiality requirements.

- In addition to the developments in the latest maintenance period, this press release incorporates minor revisions to the data for previous periods.

- The data are published every six to seven weeks, after each of the Eurosystem’s reserve maintenance periods. The indicative calendars for the Eurosystem’s reserve maintenance periods are available on the ECB’s website.

- The next press release on euro money market statistics will be published on 11 January 2019.

Banco Central Europeu

Direção-Geral de Comunicação

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Alemanha

- +49 69 1344 7455

- media@ecb.europa.eu

A reprodução é permitida, desde que a fonte esteja identificada.

Contactos de imprensa