Euro area quarterly balance of payments and international investment position (second quarter of 2016)

- The current account of the euro area showed a surplus of €348.7 billion (3.3% of euro area GDP) in the four quarters to the second quarter of 2016.

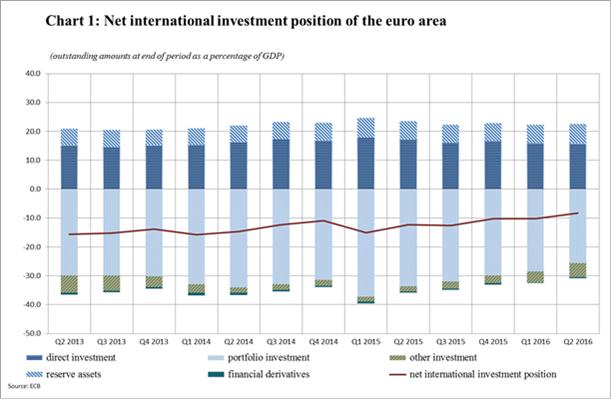

- At the end of the second quarter of 2016 the international investment position of the euro area recorded net liabilities of €0.9 trillion (approximately 8% of euro area GDP).

Current account

The current account of the euro area showed a surplus of €87.8 billion in the second quarter of 2016, compared with €67.9 billion in the same quarter of 2015 (see Table 1). The increase in the current account surplus was due to an increase in the surplus for goods (from €91.9 billion to €107.4 billion) and a decrease in the deficits for primary income (from €13.8 billion to €11.9 billion) and secondary income (from €30.2 to €22.6 billion). This was partly offset by a decrease in the surplus for services (from €20.0 billion to €14.9 billion).

The decrease in the surplus for services resulted mainly from a deterioration in the balances for the other business services (an increase in the deficit from €3.2 billion to €7.7 billion) and transport (a decrease in the surplus from €3.0 billion to €1.7 billion) components. This was partly offset by an increase in the surplus for the telecommunication, computer and information services component (from €14.6 billion to €15.6 billion).

The decrease in the primary income deficit resulted primarily from a decrease in the investment income deficit for portfolio investment (€47.8 billion to €42.9 billion).

In the four quarters to the second quarter of 2016 the current account of the euro area showed a surplus of €348.7 billion (3.3% of euro area GDP), compared with one of €296.9 billion (2.9% of euro area GDP) a year earlier. This rise resulted from an increase in the surplus for goods (from €304.0 billion to €376.1 billion) and a decrease in the deficit for secondary income (from €137.5 billion to €119.9 billion). These developments were partly offset by decreases in the surpluses for primary income (from €60.7 billion to €36.7 billion) and services (from €69.7 billion to €55.8 billion).

The geographical breakdown

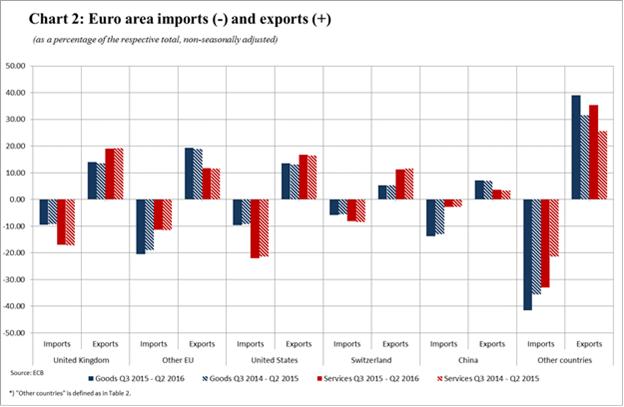

The increase in the surplus for the euro area goods account in the four quarters to the second quarter of 2016 resulted mainly from improvements in the surpluses vis-à-vis the United Kingdom (from €114.5 billion to €128.7 billion), the United States (from €106.3 billion to €120.3 billion) and “other countries” (from €12.5 billion to €68.0 billion). This was partly offset by the increase in the deficit of the goods account vis-à-vis China (from €84.4 billion to €87.9 billion) and some small decreases in surpluses vis-à-vis other trading partners (see Table 2).

The decrease in the surplus for services resulted mainly from increases in the deficits vis-à-vis “offshore financial centres” (from €34.9 billion to €45.6 billion) and the United States (from €22.6 billion to €28.2 billion), and the decrease in the surplus vis-à-vis “other countries” (from €42.0 billion to €37.3 billion).

In the four quarters to the second quarter of 2016 the non-euro area EU Member States (excluding the United Kingdom) remained the euro area’s main partners for trading in goods, accounting for approximately 20% of all euro area imports and exports, followed by the United Kingdom for exports and China for imports (see Chart 2). As regards euro area trade in services, the United Kingdom was the largest recipient of exports (accounting for 19% of the total) and the United States the largest provider, accounting for 22% of the total euro area imports of services. Trade in goods and services with “other countries” increased considerably compared with the previous year.

International investment position

At the end of the second quarter of 2016 the international investment position of the euro area recorded net liabilities of €0.9 trillion vis-à-vis the rest of the world (approximately 8% of euro area GDP; see Chart 1). This represented an improvement of around €200 billion compared with the first quarter of 2016 (see Table 3).

This decrease resulted from lower net liability positions for portfolio investment (€2,715 billion, down from €3,001 billion) and an increase in reserve assets (€722 billion, up from €675 billion). These movements were partly offset by a higher net liability position for other investment (€513 billion, up from €409 billion) and financial derivatives (€55 billion, up from €22 billion). The net asset position for direct investment remained broadly unchanged.

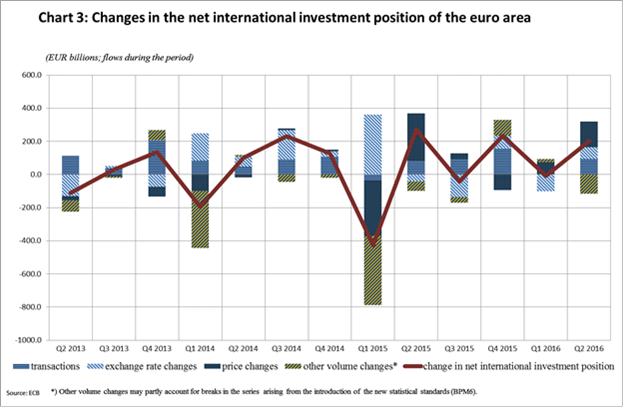

This improvement in the net international investment position of the euro area in the second quarter of 2016 can be explained by net positive revaluations – due to exchange rate and asset price changes – and transactions. These developments were partially offset by negative other volume changes, mainly related to reclassifications and changes in data coverage (see Chart 3). Positive revaluations due to exchange rate changes have been recorded for all asset and liability components. In direct investment, the net disinvestment and negative other volume changes were more than compensated by the positive exchange rate and price revaluations. The increases in portfolio investment assets and liabilities also resulted primarily from positive exchange rate and prices developments, which were reinforced by net purchases on the asset side and partially offset by net sales/amortisations on the liability side.

At the end of the second quarter of 2016 the gross external debt of the euro area amounted to €13.3 trillion (approximately 126% of euro area GDP), which represents an increase of around €100 billion compared with the previous quarter. Conversely, the net external debt decreased (by approximately €190 billion) due to a substantial increase in external debt assets.

The geographical breakdown

At the end of the second quarter of 2016 the stock of euro area direct investment abroad (assets) was €9.7 trillion, 28% of which was invested in the United States and 20% in the United Kingdom (see Table 4). The stock of foreign direct investment in the euro area (liabilities) was €8.0 trillion, with 29% coming from residents in the United States and 20% from “offshore financial centres”.

As regards portfolio investment, euro area holdings of foreign securities amounted to €7.4 trillion at the end of the second quarter of 2016, largely reflecting holdings of securities issued by residents in the United States (which accounted for 36% of the total), as well as by residents in the United Kingdom (15%). Non-residents’ holdings of securities issued by euro area residents stood at €10.1 trillion at the end of the second quarter of 2016.

As regards other investment, euro area residents’ claims on non-residents amounted to €4.7 trillion at the end of the second quarter of 2016, with 33% vis-à-vis residents in the United Kingdom and 18% vis-à-vis residents in the United States. Euro area other investment liabilities came to €5.3 trillion, with residents in the United Kingdom accounting for 34% of the total and residents in the United States for 15%.

Data revisions

This press release incorporates large revisions to the data for all the reference periods between the first quarter of 2008 and the first quarter of 2016. These revisions reflect improvements in the national contributions to the euro area aggregates following the introduction of the new statistical standards.

Additional information

- Time series data: ECB’s Statistical Data Warehouse (SDW).

- Methodological information: ECB’s website.

- Next press releases:

- Monthly balance of payments: 20 October 2016 (reference data up to August 2016).

- Quarterly balance of payments and international investment position: 13 January 2017 (reference data up to the third quarter of 2016)

Annexes

- Table 1: Current account of the euro area

- Table 2: Current and capital account of the euro area – geographical breakdown

- Table 3: International investment position of the euro area

- Table 4: International investment position of the euro area – geographical breakdown

For media queries, please contact Rocío González, Tel.: +49 69 1344 6451.

Banco Central Europeu

Direção-Geral de Comunicação

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Alemanha

- +49 69 1344 7455

- media@ecb.europa.eu

A reprodução é permitida, desde que a fonte esteja identificada.

Contactos de imprensa