Preserving monetary accommodation in times of normalisation

Speech by Peter Praet, Member of the Executive Board of the ECB, on “Herausforderungen für die Europäische Geldpolitik 2019” at 33. Internationales ZinsForum 2018, Frankfurt am Main, 26 November 2018

Introduction

In the aftermath of the global financial crisis, central banks have successfully fended off deflationary forces and supported economic recovery.[1] They have brought down policy rates to their effective lower bound and, importantly, have made use of a broad set of unconventional monetary policy measures in pursuit of their statutory objectives. In advanced economies, monetary policies have borne fruit, but their monetary policy cycles clearly differ substantially, reflecting different stages of recovery and degrees of progress towards achieving the central bank’s statutory objectives.

In a number of places, central banks have already tightened their monetary policy stance; unconventional monetary policy measures have been wound down and policy rates have been gradually increased. In the euro area, however, significant monetary policy stimulus is still needed to support the further build-up of inflationary pressures and headline inflation developments over the medium term. At the meeting of the ECB’s Governing Council in June, we gave an important signal of a normalisation of our policy instruments. We communicated our anticipation that, subject to incoming data confirming our medium term inflation outlook, we would end net purchases under our asset purchase programme (APP) after December 2018.

Today I would like to address our key challenge in normalising our monetary policy instruments: preserving monetary accommodation, while switching back from net asset purchases to forward guidance on policy rates as the main instrument to steer our monetary policy stance. While this rotation proceeds, we will continue to operate with multiple, complementary instruments, including our policy of reinvesting the principal payment of securities purchased under the APP.

The state of the euro area economy

Following more than five years of increasingly broad-based economic expansion in the euro area, recent developments point to some loss of growth momentum. Preliminary data show that euro area real GDP expanded by 1.7% year on year in the third quarter of 2018, down from 2.2% in the second quarter. The slowdown in euro area economic growth since the start of the year has reflected in no small part a retreat from the strong growth of 2017. One-off country-specific or sector-specific factors have also contributed to slowing production in recent months. But factors related to protectionism, financial market volatility and vulnerabilities in emerging markets are creating headwinds that are becoming increasingly noticeable. Surveys of euro area business activity and sentiment indicators have softened perceptibly relative to their earlier highs, although they remain in expansionary territory and are still above long-term averages for most sectors and countries.

Overall, domestic demand continues to be supported by favourable financing conditions, as well as by the robust labour market and steady income and profit growth that these conditions have fostered.

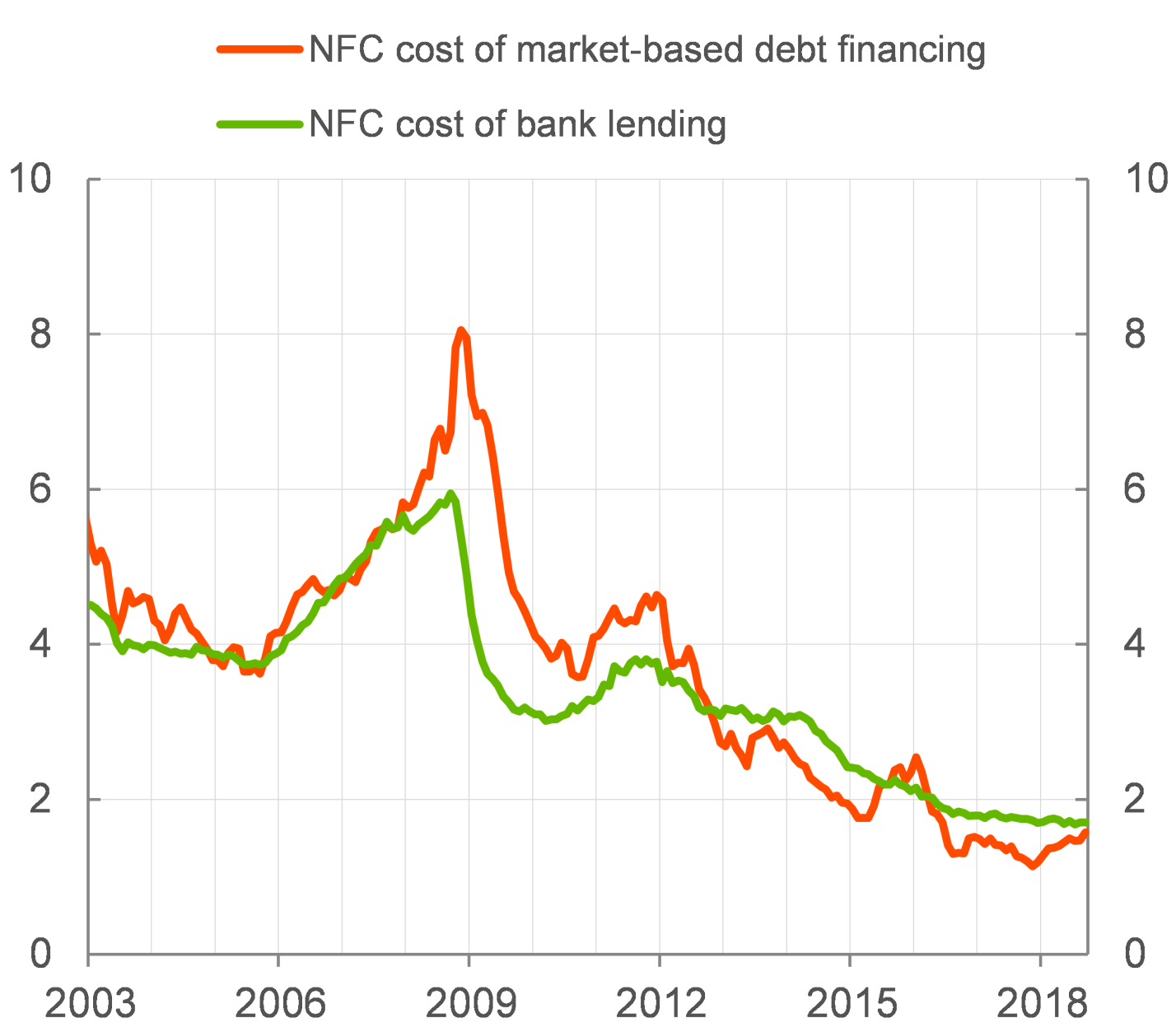

Indeed, since we announced a combination of unconventional measures to provide additional monetary policy accommodation in June 2014, financial conditions have eased considerably. Risk-free interest rates have shifted downward at all maturities (Chart 1), reducing the basis used by banks and financial markets in determining financing conditions.

Chart 1: EONIA forward curves estimated from OIS (percentages per annum)

Sources: ECB. Latest observation: 16 November 2018 for realised EONIA.

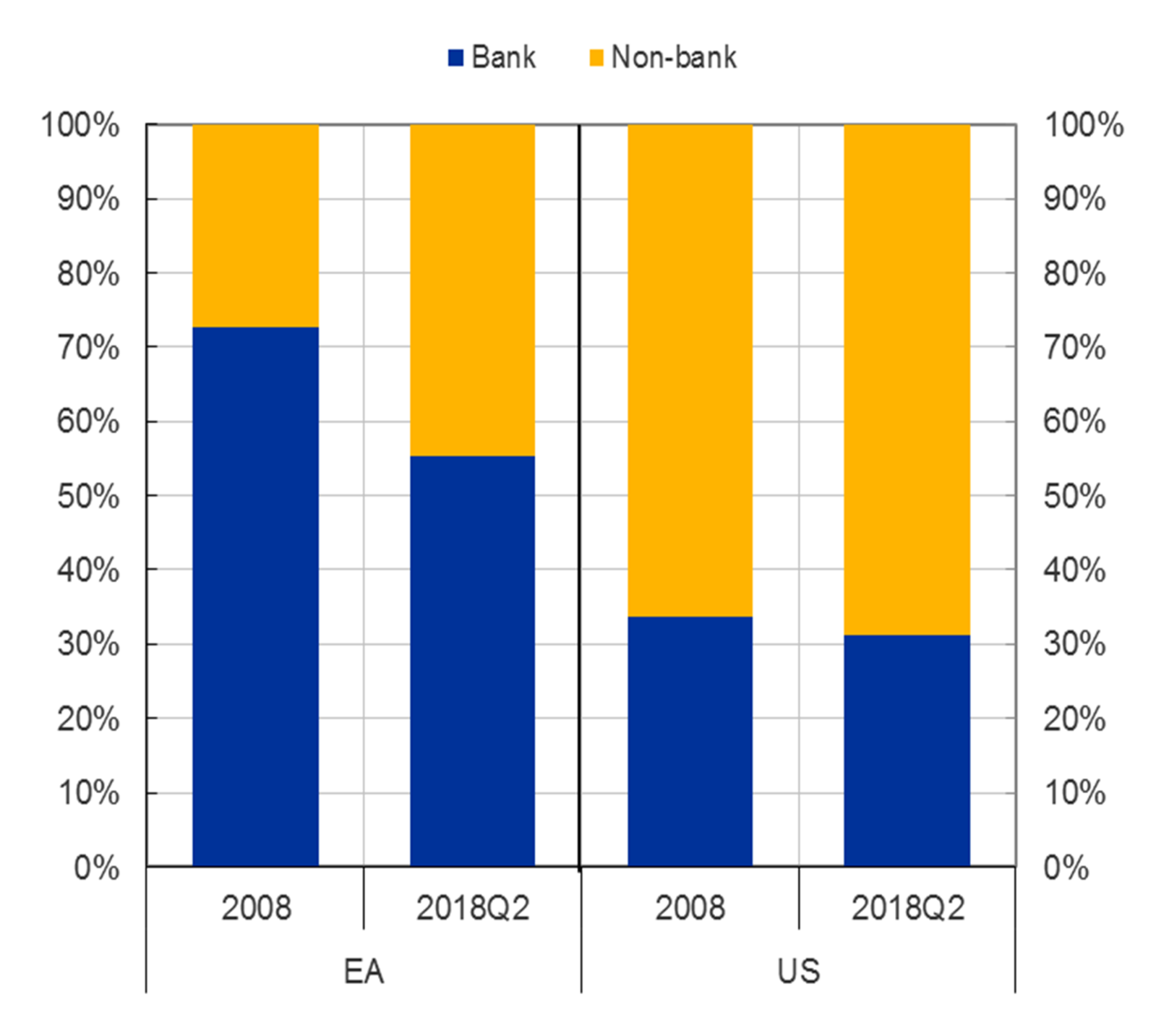

This has been reflected in the sizeable reduction in bank lending rates for euro area non-financial corporations (NFCs) and households since June 2014 – which have declined by around 130 basis points and 110 basis points, respectively – as well as in the decline of NFCs’ cost of market-based debt financing (Chart 2).

Chart 2: Nominal cost of debt financing for euro area NFCs by component (percentages per annum)

Sources: Thomson Financial DataStream, Merrill Lynch, and ECB calculations. Latest observation: September 2018.

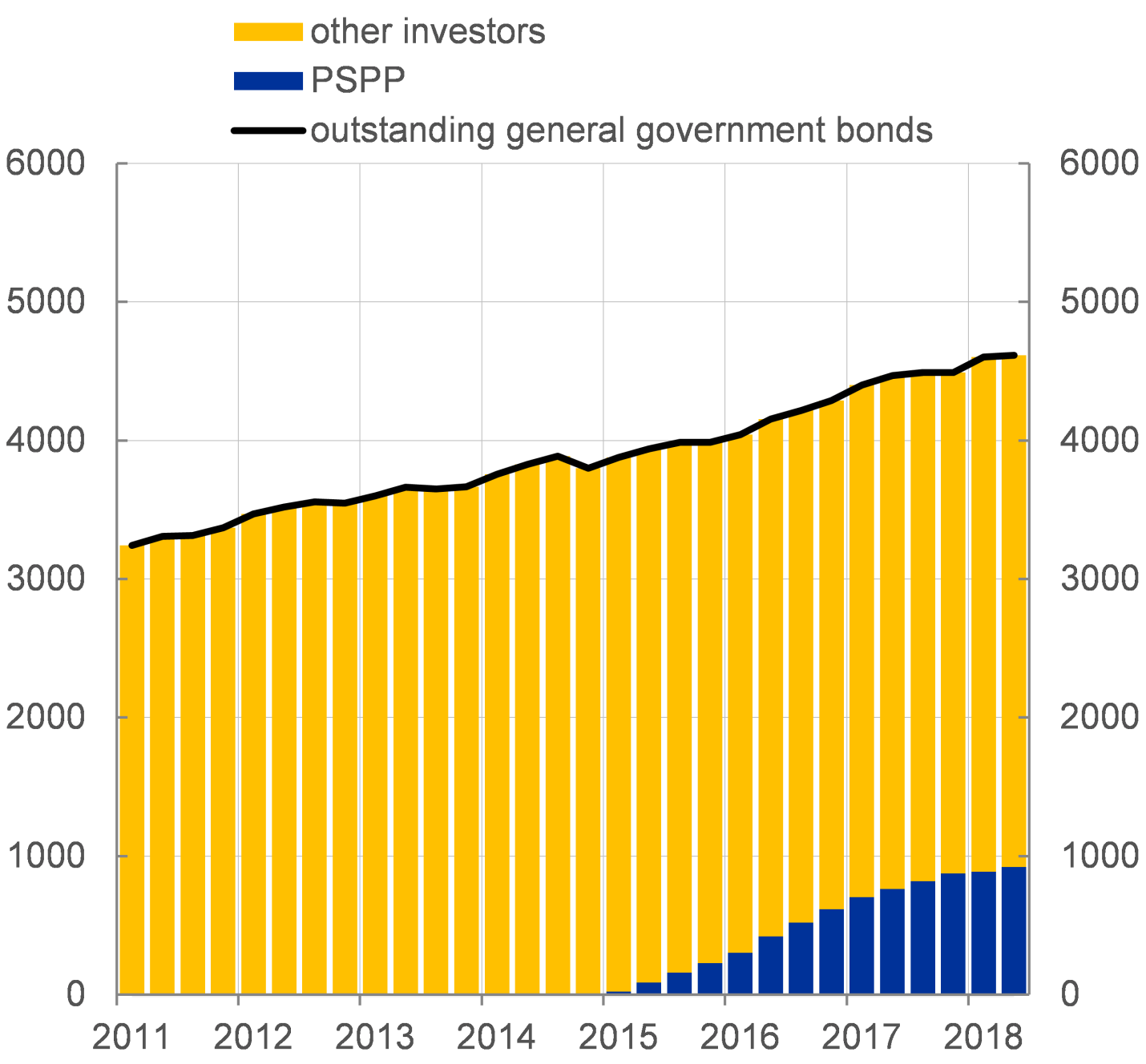

NFCs have also benefited from an increasingly diversified financing structure, with debt securities issuance and other forms of market-based financing substituting for bank-based sources of financing (Chart 3 and Chart 4).

Chart 3: Share of bank and non-bank financing in total non-financial corporation debt financing in the euro area and the United States (outstanding amounts; percentages)

Sources: ECB, Federal Reserve System. Notes: Bank financing includes only loans granted to NFCs by banks. Latest observation: Q2 2018.

Chart 4: Total debt financing of NFCs and MFI loans to NFCs in the euro area (annual changes in percent)

|

Source: ECB.Notes: MFI loans to NFCs have been adjusted for loan sales and securitisation and cash pooling. Total debt financing is based on quarterly data.Latest observation: September 2018 for loans and Q2 2018 for total debt financing.

Such diversification in financing sources is good for the economy, making business investment more resilient throughout business cycles.

The underlying strength of the euro area economy continues to support our confidence that the sustained convergence of inflation to our aim will proceed. Euro area annual HICP inflation has continued to increase and stood at 2.2% in October 2018, mainly reflecting higher energy price inflation. On the basis of current futures prices for oil, headline inflation is likely to hover around current levels in coming months. While measures of underlying inflation remain generally muted, they have been increasing from earlier lows, amid high levels of capacity utilisation and tightening labour markets. Looking ahead, underlying inflation is expected to increase further over the medium term, supported by our monetary policy measures, the ongoing economic expansion and rising wage growth.

Overall, though, significant monetary policy stimulus is still needed to support the build-up of domestic price pressures and headline inflation developments over the medium term.

The rotation from the asset purchase programme to forward guidance on rates

At our June monetary policy meeting, we initiated a rotation of our policy instruments from the asset purchase programme towards more conventional instruments of monetary policy – the policy interest rates and forward guidance on their likely evolution. We expressed our anticipation of a gradual winding-down of net asset purchases, subject to incoming data confirming our outlook for inflation. And we updated and enhanced our forward guidance on the path for interest rates, which is now expressed in terms of the expectation that key ECB interest rates will remain at their present levels “at least through the summer of 2019 and, in any case, for as long as necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2% over the medium term”. In addition, we re-affirmed our intention to reinvest principal payments from maturing securities purchased under the APP “for an extended period of time after the end of our net asset purchases and, in any case, for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation”.

This combination of policy measures aimed to preserve the degree of monetary accommodation that is necessary to ensure sustained convergence of inflation towards our aim. Clearly, the end of net asset purchases is not tantamount to a withdrawal of monetary policy accommodation. The rotation from net asset purchases towards our conventional monetary policy instruments, together with our stock of assets and the related reinvestment policy, ensure an ample degree of monetary policy accommodation. In particular, our enhanced rate forward guidance provides a strong anchor for policy rate expectations. And the reinvestment policy will ensure that the favourable liquidity conditions and duration extraction associated with the large stock of assets on our balance sheet remain in place for a long period and thereby exert downward pressures on term premia.

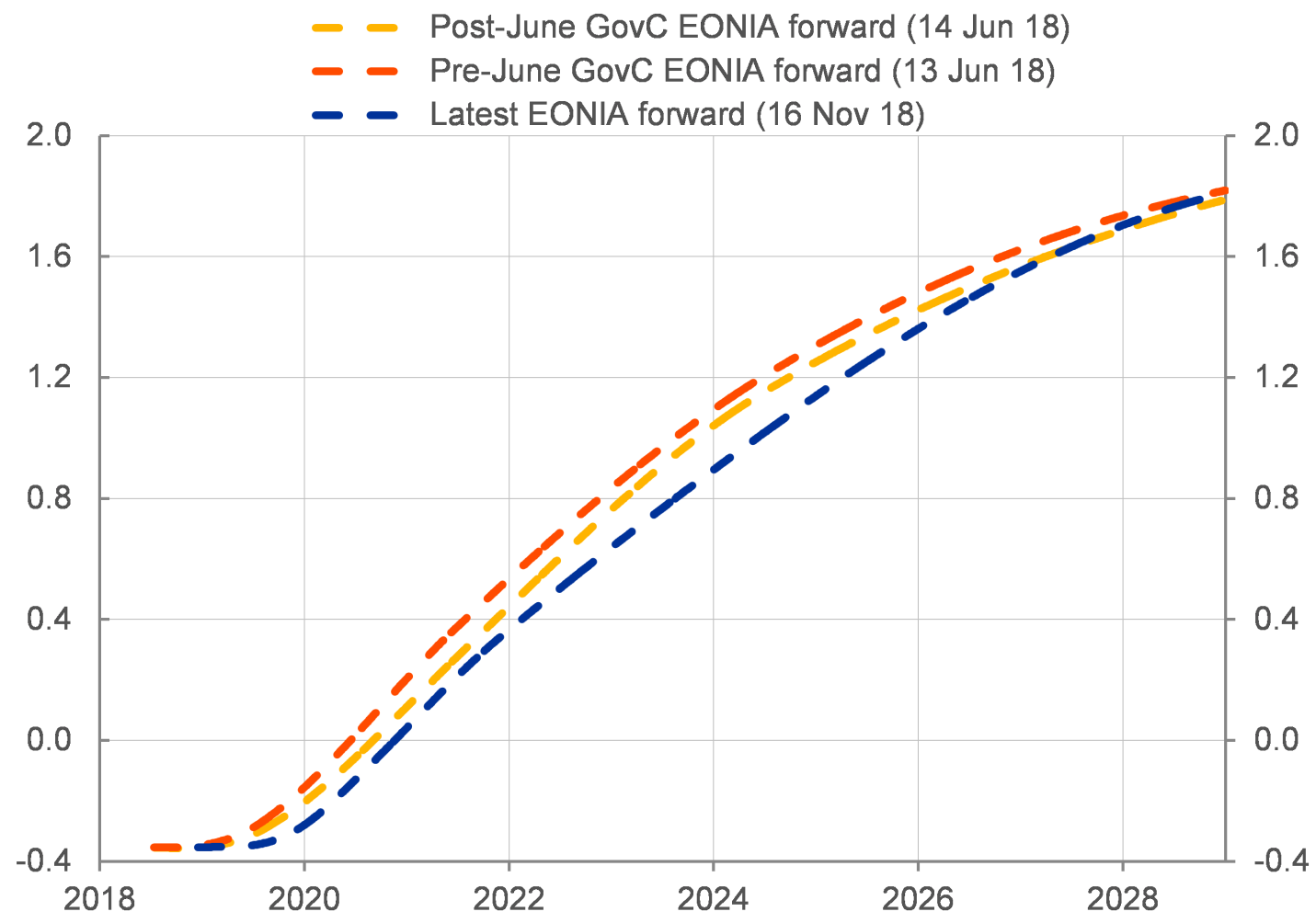

The mechanisms underlying the combination of instruments are duration extraction, liquidity creation and expectation management.

Starting with duration extraction, our reinvestment policy implies that the bonds we have purchased will remain on our balance sheet for an extended period of time after the end of net purchases. Asset purchases affect interest rates mainly through the market price of duration risk, which is the interest rate risk borne by price-sensitive investors holding long-term bonds. If the central bank wants to exert downward pressures on long-term interest rates, then it can absorb duration risk from the market by purchasing securities with a relatively longer maturity. This frees up more risk-bearing capacity for investors, which they can re-allocate towards other types of risk, including investment in productive capacity. For a central bank to set this mechanism in motion, it needs to hold a large portfolio of long-dated securities embodying duration risk. Chart 5 shows that we have built a sizeable portfolio estimated at around 20% of the duration-equivalent stock of public debt. Maintaining such a sizeable portfolio will exert lasting downward pressure on term premia.

Chart 5: Outstanding quantity of duration: PSPP portfolio and other investors (EUR billions, 10-year equivalents)

Sources: Securities Holdings Statistics, GFS, ECB calculations.Notes: The chart shows the stock of debt securities issued by the general governments of the four largest euro area jurisdictions and the Public Sector Purchase Programme (PSPP) share of that stock in terms of 10-year equivalents. “Other investors” comprise all other financial and non-financial investors. Latest observation: 2018Q2.

Turning to liquidity creation, the roll-over of the portfolio resulting from our reinvestment policy will also continue to preserve abundant liquidity over the coming years. In the absence of reinvestments, and assuming that targeted longer-term refinancing operations (TLTROs) are repaid at maturity, the level of excess liquidity would decline significantly over the coming years (Chart 6).

Chart 6: Evolution of excess liquidity under no re-investment counterfactual hypothesis (EUR billions)

Sources: ECB.Notes: The projected excess liquidity is based on a comprehensive simulation of the evolution of the Eurosystem balance sheet. For the APP it is assumed that net purchases are conducted at a monthly pace of €15 billion a month until December 2018 and then ended. In addition, the projection is constructed under the counterfactual hypothesis that there will be no reinvestments of APP maturing securities. For TLTROs it is assumed that repayments are made at the point of maturity of the respective operations. Banknotes are assumed to continue to grow in line with historical relationships. Other non-monetary policy assets and liabilities are held constant. Latest observation: September 2018.

Our reinvestment policy will contribute to maintaining favourable liquidity conditions for an extended period of time, which helps anchor expectations regarding the evolution of very short-term interest rates at the deposit facility rate. Ample volumes of excess reserves ensure that the overnight interest rate stays close to the floor of the interest rate corridor, which is provided by the deposit facility rate. This, together with forward guidance on the expected evolution of our policy interest rates, reduces rate uncertainty across maturities and thus adds to the compression of term premia brought about by the duration extraction channel.

Of course, our portfolio – even if kept constant – will tend to lose duration over time, as the securities held gradually mature. At some point, this passive loss of duration will begin to exert increasing upward pressures on the term premia. Over time, this gradual process will tend to steepen the yield curve, with our forward guidance on policy rates keeping the front end of the curve well-anchored.

Our enhanced rate forward guidance is a two-pronged statement. There is the date-based element that interest rates are expected to remain at their present levels “at least through the summer of 2019”. In addition, there is a state-contingent element that rates will remain unchanged “in any case for as long as necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2% over the medium term”. The date-based element ensures that our stimulus is not weakened by premature expectations of a rate hike. The state-contingent element, in turn, ensures that the stance will continue to evolve gradually and in a data-dependent manner.

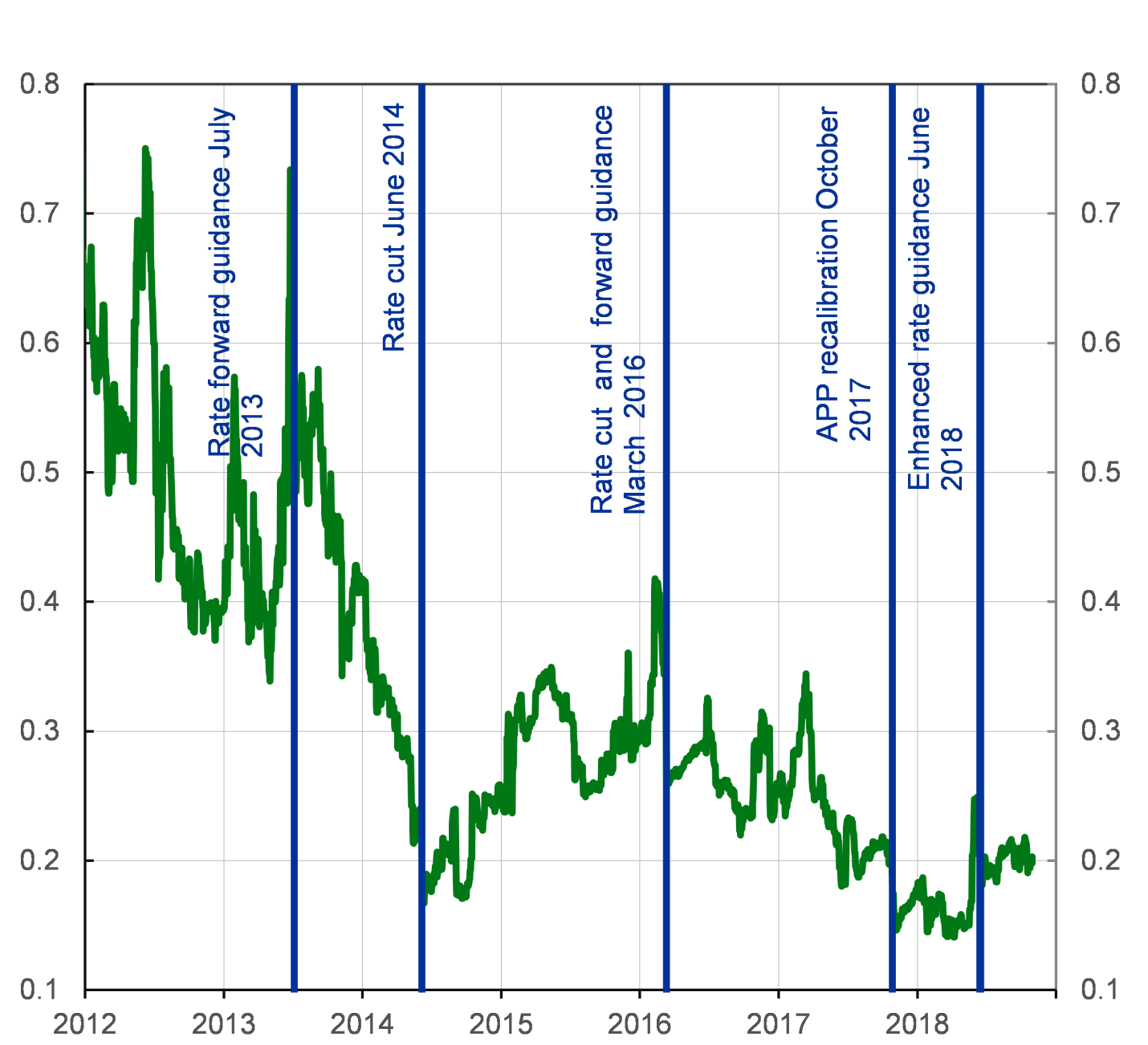

The anchoring effect of our enhanced rate guidance was highly visible in June, when the Governing Council announced that we anticipated a gradual winding-down of our net asset purchases. Our enhanced forward guidance helped reduce the uncertainty around future short-term rates (Chart 7 and Chart 8). Rate expectations aligned immediately to the Governing Council’s rate guidance; no financial market volatility ensued.

Chart 7: EONIA forward curves around June 2018 Governing Council (percentage per annum)

Sources: Thomson Reuters and ECB calculations. Latest observation: 16 November 2018.

Chart 8: Standard deviation of three-month EURIBOR option-implied density in one year’s time (percent)

Sources: LIFFE and Bloomberg, ECB calculations.Notes: Standard deviation of option-implied density of three-month EURIBOR in one year’s time.Latest observation: 30 October 2018.

But let me turn to the next steps for monetary policy in the euro area. The latest surveys of market participants’ expectations regarding the most likely date for a first rate increase indicate that the “at least through the summer of 2019” formulation has been solidly internalised by market participants.

Looking ahead, the rotation implies that our key policy rates and forward guidance about their evolution will become an anchor for monetary policy as the end of our net asset purchases is nearing. Our communication, and the rate path itself, will be calibrated to ensure that inflation remains on a sustained adjustment path. Our policy will remain predictable, and we will proceed at a gradual pace that is most appropriate for inflation convergence to consolidate. In addition, as proved in the past, our forward guidance remains an effective firewall to insulate the euro area from unwarranted tightening pressures originating elsewhere. This protection will be crucial to ensure that, as we move along the normalisation path, euro area financial conditions remain consistent with continued progress towards our policy objective. Finally, our APP portfolio and our unconstrained provision of liquidity will continue, for the time being, to provide an accommodative environment.

I would like to make a final comment on the effects of our APP portfolio on bond yields. While, overall, our APP portfolio will continue to exert downward pressure on euro area long-term interest rates, other factors such as economic fundamentals and the creditworthiness of issuers, as assessed by market participants, remain key determinants of the levels of bond yields and spreads.

Conclusion

The winding-down of net asset purchases is not tantamount to a withdrawal of monetary policy accommodation. The ongoing rotation from net asset purchases towards enhanced forward guidance on key ECB interest rates has preserved the ample degree of monetary policy accommodation that is necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2% over the medium term.

Prudence, patience and persistence will continue to inform our policy decisions. The sizeable stock of acquired assets and the associated reinvestments, as well as the strong anchor for policy rate expectations provided by our enhanced forward guidance, will continue to deliver the monetary policy stimulus necessary for inflation convergence. In any event, all our policy instruments can be adjusted to ensure that inflation moves towards our aim in a sustained manner.

- [1]This speech builds on my remarks at the UBS Conference, London, 13 November 2018.

Banco Central Europeu

Direção-Geral de Comunicação

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Alemanha

- +49 69 1344 7455

- media@ecb.europa.eu

A reprodução é permitida, desde que a fonte esteja identificada.

Contactos de imprensa