- THE ECB BLOG

- 5 June 2020

Expanding the pandemic emergency purchase programme

Blog post by Philip R. Lane, Member of the Executive Board of the ECB

In this blog post, I will discuss the outlook for economic activity and inflation in the euro area and explain the Governing Council’s decision to expand the size of the pandemic emergency purchase programme (PEPP) at yesterday’s meeting.[1]

Macroeconomic outlook and financial conditions

The severity and duration of the pandemic macroeconomic shock will be primarily determined by the success of the public health actions to suppress the spread of COVID-19 and the impact of the associated social distancing measures on the level of economic activity. It follows that the projections are surrounded by an exceptional degree of uncertainty. In recognition of this uncertainty, Eurosystem staff have compiled two additional scenarios in addition to the baseline projections.[2]

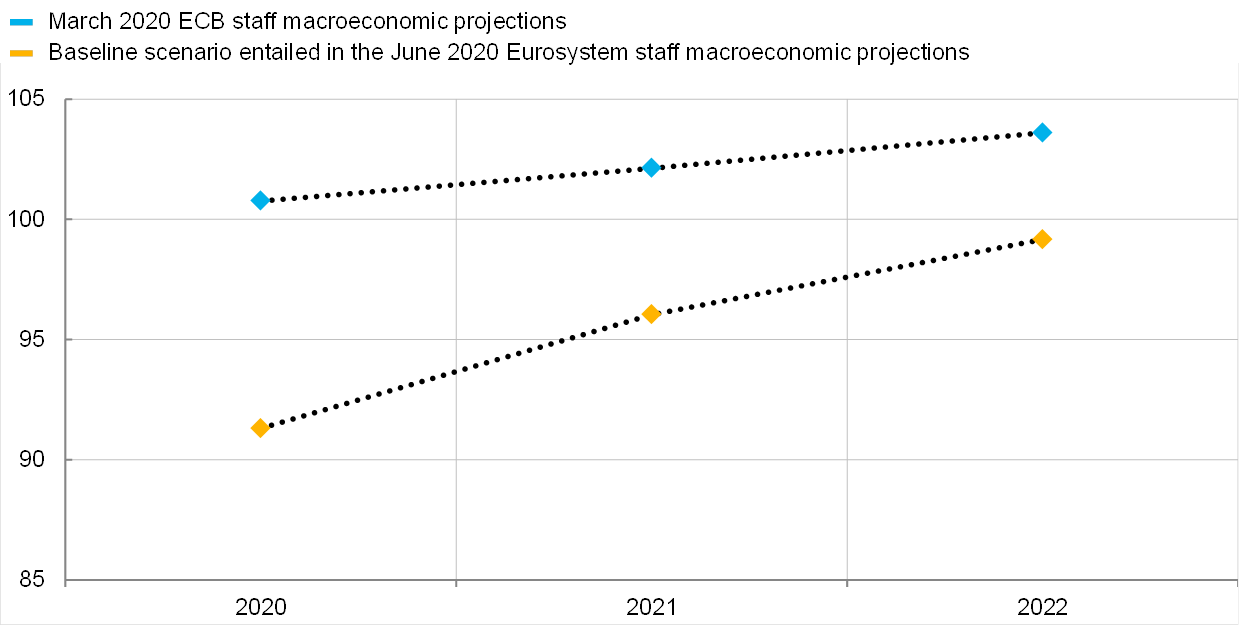

Chart 1 shows the output projections. The baseline scenario of the June Eurosystem staff projections foresees a steep decline in output of 13.0 percent in the second quarter of 2020, after a contraction of 3.8 percent in the first quarter. This is projected to be only partly reversed in the second half of the year, with quarterly growth rates of 8.3 percent and 3.2 percent in the third and fourth quarters, respectively. Annual growth is projected to average minus 8.7 percent in 2020, 5.2 percent in 2021 and 3.3 percent in 2022.

It is important to emphasise that the downward revisions to the outlook for economic activity would be far more severe in the absence of the significant fiscal response to the pandemic shock and the stabilising impact of the monetary policy and financial supervisory actions that have been taken.

Chart 2 shows the inflation projections. In the near term, headline inflation is dominated by the plunge in oil prices, while the initial reaction of underlying inflation is expected to be relatively muted. In the medium term, the net effect of the shock on inflation dynamics depends on the balance between anti-inflationary forces (such as rising slack and lower demand) on the one side and pro-inflationary forces (such as the possible near-term and medium-term adverse impact of the virus shock on supply capacity) on the other. Taken together, the scale of the increase in economic slack means that the net impact on inflation dynamics is assessed to be substantially negative in the staff projections, even when allowing for the pro-inflationary impact of some damage to supply capacity.

The downward revision to the inflation outlook sees average headline inflation of just 0.3 percent in 2020, 0.8 percent in 2021 and 1.3 percent in 2022. The revisions to the projected outlook for core inflation foresee an even greater deterioration: core inflation is forecast to reach only 0.9 percent in 2022.

Projected real GDP in the June and March 2020 Eurosystem/ECB staff macroeconomic projection exercises

(index, 2019=100)

Source: ECB calculations.

Projected euro area headline inflation and headline inflation excluding food and energy in the June and March 2020 Eurosystem/ECB staff macroeconomic projection exercises

(year-on-year percentage changes)

Source: ECB calculations.

From a monetary policy perspective, it is essential that financial conditions are sufficiently accommodative to support the economic recovery and counter the substantial negative shock to the inflation trajectory. The ECB’s measures since mid-March have acted as a stabilising force during the initial weeks of the pandemic crisis. The announcement of the PEPP has mitigated the risk of a sharp sell-off in bond and equity markets that was threatening to undermine our monetary policy stance and its effective transmission. The highly accommodative pricing of the targeted longer-term refinancing operations (TLTRO) III programme, in conjunction with the collateral easing measures, provide strong incentives for banks to maintain credit flows to the real economy.[3] In addition, the unconditional refinancing operations (including the pandemic emergency longer-term refinancing operations (PELTRO) programme) and the enhancement of international swap lines provide important backstops for the liquidity demand of the banking system.

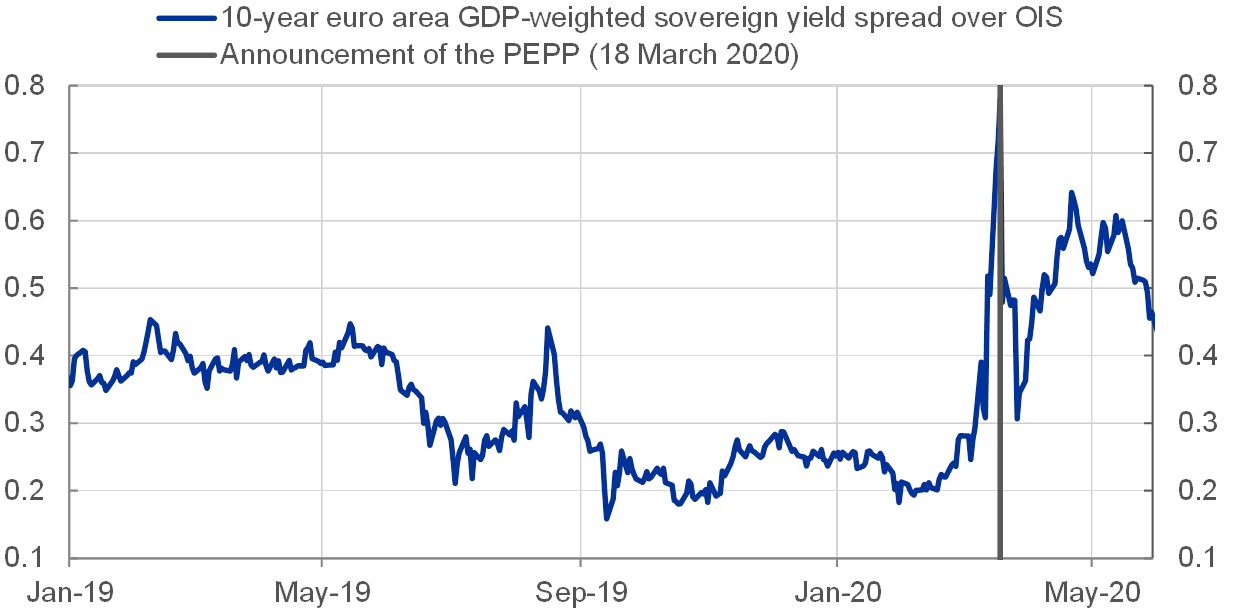

Nevertheless, financial conditions remain significantly tighter than before the escalation of the pandemic (see Chart 3). The downshift in risk-free rates has not been transmitted in full to the broader set of asset prices and yields that determine the funding costs faced by the real economy. In particular, Chart 4 shows that there has been upward pressure on average sovereign yields compared with the benchmark overnight index swap (OIS) yield curve. Given the tight links between sovereign funding conditions and private-sector funding conditions in each jurisdiction, this has contributed to higher corporate bond yields and bank bond yields and lower equity valuations, especially for bank stocks. In addition, this tightening in financial conditions puts upward pressure on the lending rates charged by banks to firms and households. This is the opposite of what is required to counter the negative shock to economic activity and the inflation path. The role of extra monetary accommodation under these conditions includes countering the risk that the upward pressure on borrowing costs associated with the high rate of public debt issuance would crowd out the expenditure plans of businesses and households at a time when the euro area economy is experiencing an extraordinary recession.

Financial conditions in the euro area

(index)

Source: ECB.

Notes: Daily data. “FCI” stands for “financial conditions index”. The FCI is constructed as a weighted average of the 1-year OIS, the 10-year OIS, the euro area nominal effective exchange rate vis-à-vis 38 trading partners and the Euro Stoxx Broad Stock Exchange Index. All variables are in deviation from their long-term average. The FCI is an average of two alternative FCIs, one in which the weights are derived from the impulse response of HICP inflation to a shock in each of the four financial variables from an estimated VAR model, and the other where the weights are derived from the elasticities drawn from a set of projection models used in the Eurosystem/ECB staff macroeconomic projections. The latest observations are for 2 June 2020.

Euro area GDP-weighted sovereign yield spread over OIS

(percentages per annum)

Sources: Bloomberg, Refinitiv and ECB calculations.

Notes: The spread is calculated as the 10-year euro area GDP-weighted sovereign yield minus the 10-year OIS rate. The vertical line marks the announcement of the PEPP on 18 March 2020. The latest observations are for 1 June 2020.

The expansion of the PEPP

In March, we decided to launch the PEPP “to counter the serious risks to the monetary policy transmission mechanism and the outlook for the euro area posed by the outbreak and escalating diffusion of the coronavirus, COVID-19”.[4] In the current environment of elevated uncertainty and associated stress in financial markets, the PEPP has already proven to be an effective monetary policy tool by supporting market stabilisation and reversing adverse dynamics in overall financial conditions.

Two factors called for further policy action yesterday. First, without a sufficient policy response, the pandemic-related negative shock to the inflation path poses a threat to medium-term price stability. As indicated above, financial conditions for the euro area as a whole are significantly tighter today compared with the pre-pandemic period, whereas the outlook for economic activity and inflation calls for easier financial conditions. Second, while conditions in financial markets have stabilised substantially since the PEPP announcement, the situation remains fragile. This fragility underlines the continued need for the central bank to be flexible and exercise a market stabilisation function to the extent necessary.

To address these concerns, we decided to boost the envelope for the PEPP by €600 billion to a total of €1,350 billion, which both contributes to market stabilisation and eases the general monetary policy stance. In turn, this protects smooth policy transmission and supports lower funding conditions for the real economy, with the aim of lifting the medium-term inflation projection closer to the pre-crisis expected trajectory.

Second, we also decided to extend the net purchase horizon of the PEPP to at least the end of June 2021. This broadly aligns the purchase horizon with the horizons of our other monetary policy measures taken in response to the pandemic, such as the TLTRO III and PELTRO programmes. In any case, we will conduct net asset purchases under the PEPP until the Governing Council judges that the coronavirus crisis phase is over.

Finally, we will reinvest maturing principal payments from securities purchased under the PEPP until at least the end of 2022 (the end of our current projection horizon) and, in any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance. This reinvestment strategy for the PEPP avoids the risk of an unwarranted tightening of financial conditions at a time when the recovery from the pandemic shock remains incomplete, while also ensuring that the management of the wind-down phase will not pose obstacles for the ongoing conduct of monetary policy. At the same time, it is appropriate that the reinvestment strategy for the PEPP reflects its temporary nature and link to the pandemic emergency.

Conclusion

In summary, the Governing Council’s decision to expand the PEPP at its June meeting is the proportionate response to the substantial downward revision of the economic and inflation outlooks and the significant deterioration in financial conditions. Looking ahead, the incoming economic and financial data and future projection rounds will provide essential guidance as to whether the pandemic-related negative shock to inflation dynamics has been sufficiently contained. In turn, once the negative pandemic shock has been successfully managed, the primary focus of monetary policy can return to its underlying strategic goal of robustly achieving our inflation aim over the medium term. Accordingly, the Governing Council stands ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner.

- [1]I am grateful to Danielle Kedan and Julian Schumacher for their contributions to this blog post.

- [2]For more details, see Box 3 “Alternative scenarios for the euro area economic outlook” in the “Eurosystem staff macroeconomic projections for the euro area, June 2020”, European Central Bank.

- [3]For further discussion on collateral easing, see the blog post by Luis de Guindos and Isabel Schnabel entitled “Improving funding conditions for the real economy during the COVID-19 crisis: the ECB’s collateral easing measures”, 22 April 2020.

- [4]See the press release announcing the PEPP, and also the legal act (ECB/2020/17): “It is also clear that this situation hampers the transmission of the monetary policy impulses and adds severe downside risks to the relevant inflation outlook. Against this background, the PEPP is a measure which is proportionate to counter the serious risks to price stability, the monetary policy transmission mechanism and the economic outlook in the euro area, which are posed by the outbreak and escalating diffusion of COVID-19.”