Evaluating the impact of dividend restrictions on euro area bank valuations

This article evaluates the impact on euro area bank valuations of the March 2020 European Central Bank (ECB) recommendation not to pay dividends or buy back shares. The analysis provides evidence of a negative impact on bank valuations in the order of magnitude of 7%. That impact is not, however, homogenous across banks: institutions that pay out dividends but fail to generate returns commensurate with investor requirements are found to be more strongly affected than those generating shareholder value or banks that are too weak to pay out dividends even in the absence of dividend restrictions. Further, the analysis suggests that uncertainty over future distributions arising from the SSM recommendation, rather than the suspension of dividends per se, explains most of the negative impact on bank valuations. By construction, this analysis captures the side effects of the measure, notwithstanding its overall merit in preserving bank capital and sustaining bank intermediation capacity during the COVID-19 period.

1 Introduction

On 27 March 2020 the ECB recommended that euro area banks do not pay dividends or buy back shares until at least October 2020. The recommendation concerned dividends to be paid from profits generated in 2019 and 2020 and was issued in an environment characterised by heightened uncertainty and financial market tensions. It aimed to conserve the capital position of euro area banks, boosting their resilience and ability to provide funding to households and firms. Most banks subsequently announced that they would follow the recommendation.

Since then, the ECB has twice renewed its request that banks exercise extreme prudence with dividends and share buy-backs. The first extension, issued on 28 July, asked banks to refrain from paying dividends and buying back shares and to exercise extreme moderation with regard to variable remuneration until January 2021. The second – issued on 15 December – prolonged the request until September 2021 yet allowed profitable banks with robust capital trajectories to make distributions amounting to no more than 15% of accumulated profit for 2019-2020 or no more than 20 basis points in terms of their CET1 ratio, whichever was the lower amount. Importantly, on this occasion, the ECB signalled that in the absence of materially adverse developments, it intended to repeal the recommendation in September 2021 and return to assessing banks’ capital and distribution plans based on the outcome of the normal supervisory cycle.

This article evaluates the impact of the ECB recommendation on bank equity valuations. By construction, the impact on valuations is a side effect of the measure. As shown in the other articles of this issue of the Macroprudential Bulletin (see Dautovic et al. (2021), Belloni, Grodzicki and Jarmuzek (2021) and Katsigianni et al. (2021)), the recommendation was effective in meeting its stated objective of preserving bank capital and supporting the flow of bank credit to the real economy during the COVID-19 period. However, this analysis sheds light on the channels through which the side effects on bank equity valuations arose.

The article focuses on the negative impact of the March 2020 ECB announcement on bank share prices. Developments of euro area bank share prices relative to a broad market index around the three announcements suggest that only the March 2020 announcement was not fully anticipated by investors. Bank shares clearly underperformed the broader market following the March announcement, while the pattern was less clear-cut for the two extensions (Chart 1). Secondly, descriptive evidence shows that euro area bank share prices fell strongly following the dividend restriction and underperformed non-financial firms as well as their Swiss peers, both of which were unaffected by the announcement. Thus, only the March announcement allows for a clear identification of the overall effect on valuations.

The remainder of this article is structured as follows. The next section provides descriptive evidence of the negative impact of the initial ECB recommendation on bank valuations and is followed by a more rigorous assessment using a difference-in-difference approach. In section 3, the channels through which dividend restrictions affected bank valuations are discussed and their importance is quantified using a dividend discount model. Finally, section 4 concludes the article.

2 Quantifying the impact of dividend restrictions

Euro area bank shares declined significantly after publication of the ECB recommendation in late March while decoupling from the share prices of Swiss peers and non-financial corporates. Chart 2, left-hand panel, contrasts the trend for bank share prices with that for non-financial corporates (NFCs) over the four weeks around the announcement date (27 March). After co-moving tightly in the period leading up to the recommendation, bank share prices visibly decoupled from those of listed non-financial companies. The decoupling followed immediately after the announcement. A similar pattern was visible vis-à-vis Swiss peers not affected by the ban[1] (Chart 2, middle panel). This is indicative of a negative impact on bank valuations.

Chart 1

Euro area banks cumulative returns pre and post the dividend recommendation (extension) announcement as compared with the general market

Based on (cumulative) returns of the EuroStoxx Banks index in excess of the EuroStoxx50 index as the broad market

(percentages)

Sources: Bloomberg and ECB calculations.

By contrast, credit-risk premia embedded in bank bonds did not seem to be affected (Chart 2, right-hand panel). In general, credit default swap spreads – a measure of credit risk in senior bank bonds – could have in principle declined given that higher retain earnings bolster bank capital positions, ultimately reducing both the probability of bank default and loss given default for bond holders. The finding of no reaction by CDS on bank bonds is indicative of limited concern on the part of investors about credit risk in respect of bank bonds, while the weak earnings outlook and the associated low stream of distributions were the prime area of concern.

Chart 2

Notable decoupling of bank share prices from the general market indicating the negative impact of the SSM announcement

Cumulative returns, normalised at zero on the announcement date

(percentages)

Sources: Refinitiv and ECB calculations.

In principle, unexpected restrictions on bank dividends can affect share prices directly, by delaying investor cash flows, and indirectly, if, as a result, future dividends are perceived as becoming more uncertain. Discounted cash flow valuation methods build on the assumption that the current share price of a bank equates to the sum of its discounted expected future payouts, with the relevant discount rate being the bank’s cost of equity (COE). COE includes, in addition to the risk-free rate, the bank-specific equity risk premium (ERP) which investors demand as a compensation for the risks associated with investing in bank shares. Cash flows occurring further into the future are discounted more given that investors generally prefer to receive a risky payment sooner rather than later. Therefore, the recommendation to refrain from making distributions over a certain period – which, by construction, postpones payouts to investors and reduces their net present value – can have a negative impact on bank share prices. In addition, the recommendation could result in a perceived higher uncertainty of bank dividends in the future if investors interpret its introduction as indicating that supervisory authorities would be interfering with payout decisions more frequently in the future than had previously been the case. This perceived elevated uncertainty can be associated with an increase in the equity risk premium, which in turn results in lower valuations.

Furthermore, at least conceptually, the bank-specific impact can depend on bank’s payout plans and ability to generate shareholder value. By its very nature, the measure introduced by the recommendation directly affected banks which would have otherwise paid dividends. The direct effect on valuations of banks not paying any dividends should be negligible. Yet returns generated by institutions in which funds are temporarily “locked-in” can also be relevant. In a nutshell, shareholders would greatly prefer to receive dividends and invest them elsewhere if the respective bank is expected to generate a return below shareholders’ requirements (i.e. if the expected return on equity (ROE) is below COE). However, if, instead, a bank is able to earn its COE and therefore investors are adequately compensated for the underlying risks, a mere temporary delay in payouts should not, in principle, result in valuation losses.

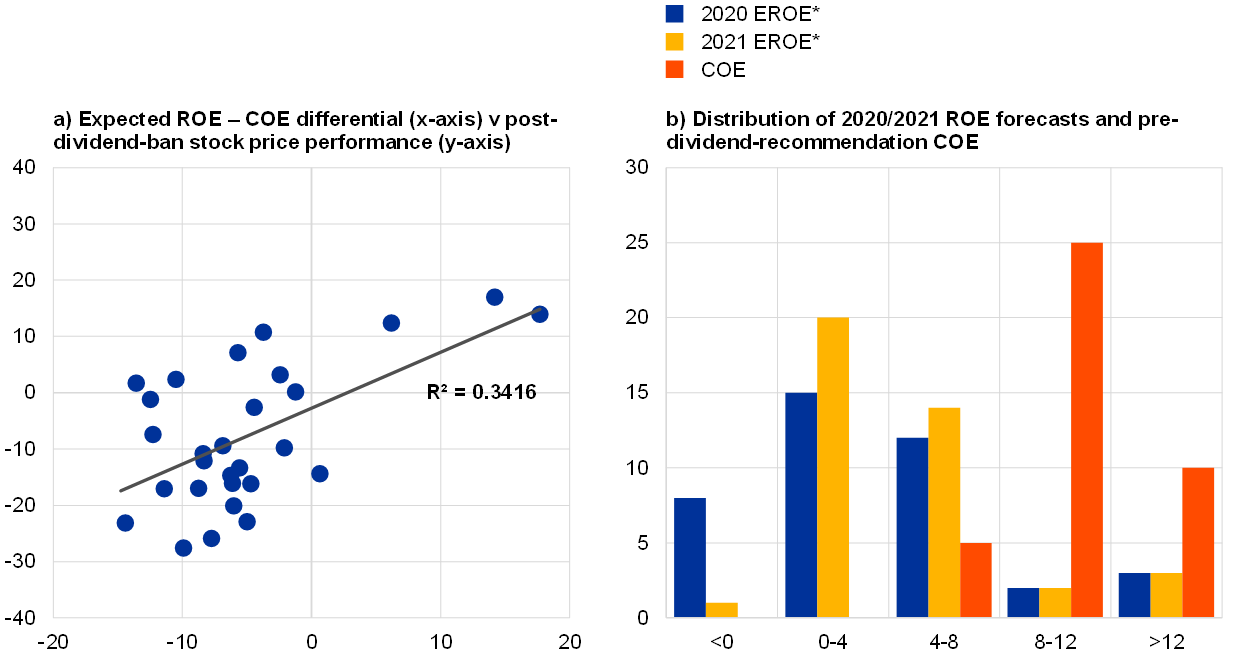

In line with this logic, dividend-paying banks that are unable to generate the returns expected by investors seem to have suffered greater share price declines. Chart 3 shows that valuation losses for dividend-paying banks correlated negatively with the differences between expected ROE and bank-level estimates of COE[2]. The small set of institutions that generate shareholder value (those with expected ROE exceeding COE) did not experience valuation losses after the SSM recommendation.

Chart 3

Shareholder value-destroying banks underperformed following the ECB announcement

(left: x-axis: percentage points, y-axis: percentages; right: x-axis: percentages, y-axis: number of banks)

Sources: Bloomberg, Refinitiv, Kenneth French’s data library, and ECB calculations.

Notes: The COE is an average across estimates from ten models (five implied cost of equity models and five factor models) and the weighted average by market capitalisation across 48 listed euro area banks. See Altavilla et al. (2021).[3] * EROE: Expected return on equity.

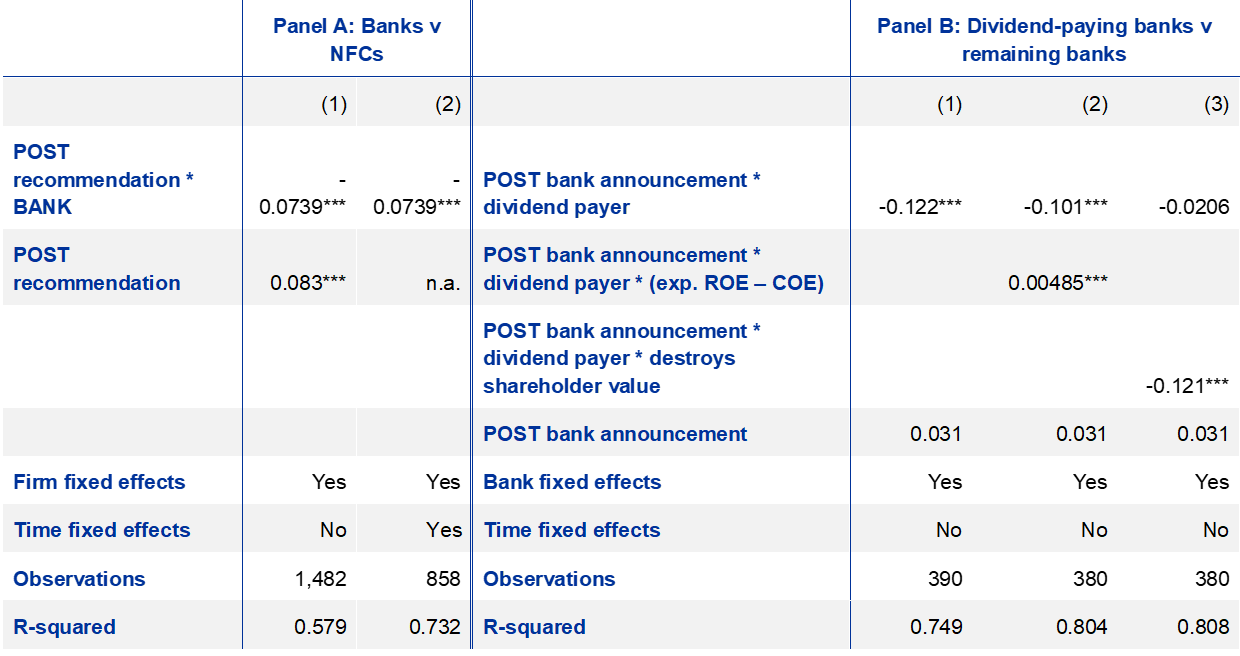

A formal impact evaluation in a difference-in-difference set-up confirms that the March 2020 dividend restrictions resulted in bank share prices falling on average by 7%. The left-hand panel (panel A) of Table 1 presents the results of a standard empirical impact evaluation. The dependent variable was the cumulative return on shares for a sample[4] of banks and NFCs over a 4-week window around the announcement of the SSM recommendation. The interaction term between a bank dummy and a post-recommendation dummy captured the decline in valuations for banks due to the announcement as compared to NFCs. NFCs served as a control group because their dividend payouts or risk premia were not affected by the ban, but at the same time their valuations did capture changes in general risk aversion, the economic outlook and risk-free rates. The difference-in-difference results imply that the dividend restrictions were associated with a share price decline of around 7%. A formal test for the parallel trend assumption confirmed that NFCs were a valid control group for our analysis, but the test is not presented for the sake of brevity.[5]

Table 1

Regression results of difference-in-difference evaluation

Sources: ECB calculations based on data from Bloomberg, Refinitiv, Kenneth French’s data library and IMF Work Economic Outlook.

Notes: The dependent variable was the cumulated stock return over a 4-week window around the announcement of the first SSM recommendation, dividend payer and destroys shareholder value are dummies taking value 1 if a bank had announced paying dividends or had an expected 2021/2021 ROE below pre-pandemic COE. Inference was based on cluster-robust standard errors with clustering at firm level. *** p<0.01, ** p<0.05, * p<0.1.

The average effect masks significant heterogeneity across banks, depending on their distribution plans and capacity to generate shareholder value, as indicated earlier. The difference-in-difference set-up was subsequently applied to banks only, distinguishing between banks which would have been expected to pay dividends (“dividend payers”) and others. As expected, the impact of the ban on dividend-paying banks was stronger: the share prices of this set of institutions declined by around 12% relative to their non-dividend-paying peers (Table 1, right-hand panel, column 1).[6]

The negative effect on share prices disappeared for banks whose expected ROE exceeded COE. Column 2 in the right-hand panel of Table 1 shows that the negative impact of the recommendation was less pronounced if expected ROE exceeded COE, and that the impact became more pronounced as the gap between ROE and COE widened. In fact, the negative effect was found to be exclusively related to banks which destroy shareholder value. Column 3 shows that when a triple interaction term with a dummy for banks with a ROE below COE was included, the post-announcement*dividend payer interaction lost its significance. This suggests that the share prices of banks that generate returns in excess of COE did not perform distinctly worse than their non-dividend-paying peers, which are, by construction, not directly affected by the ban. It should be noted that most of the banks in our sample did not belong to this category, explaining the overall negative impact of the ban in column 1.

Regression results also suggest that the dividend recommendation could have increased the cost of equity for the entire banking sector. Comparing non-dividend-paying banks to NFCs – both of which were not directly affected by the recommendation – we still found a short-lived negative impact on banks (results not presented but available on request). A tentative interpretation of this finding would suggest that the dividend recommendation increased the perceived uncertainty of future payouts. As non-dividend-paying banks are expected to resume payouts at some future point in time, the net present value of such future payouts was apparently reduced, suggesting that the cost of equity increased for all banks.

3 Disentangling the effects of the restriction

A standard dividend discount model (DDM) was used to decompose the decline in bank stock prices observed into the underlying drivers. The model linked bank share prices to developments in expected future dividend payments, changes in risk-free rates and changes in equity risk premia. More specifically, the DDM returned an estimate of bank equity risk premia given bank stock prices, risk-free rates, current and estimated future dividends observed and assumptions about the timing of associated investor cash flows. [7] It made it possible to identify factors unrelated to the dividend recommendation (e.g. changes in expected bank profitability) and can be used to decompose the residual change into that explained by delayed investor cash flows implied by the recommendation (labelled “direct effect”) and that related to the concomitant increase in the bank ERP given that the entire stream of dividends may have been perceived as more uncertain after the announcement (“indirect effect”).

Bank risk premia increased significantly in the week after the announcement of the dividend restriction. Chart 4 (left-hand panel) displays the trend for dividend expectations and the estimated equity risk premia for euro area banks as well as for non-banks. Two important observations emerge: first, expectations about future bank dividends continued their downward trend following the week of the ECB recommendation and the decline was driven by expectations of weaker earnings rather than a lower share of earnings being paid out .[8] Second, the bank equity risk premium widened distinctly, while the equity risk premium for non-banks had slightly declined during the same period. This is unusual given that these two risk premia typically show a strong positive correlation.[9]

The quantitative importance of the direct and indirect effect of the dividend recommendation on bank valuations was estimated in a series of comparative static exercises. The impact of delayed investor cash flows implied by the recommendations (the direct effect) was obtained by assuming that expected dividends in 2020 would be paid out with a one-year delay, holding their level and the bank ERP constant. The resulting decline in bank shares was then attributed to the direct effect. In a similar vein, given the strong co-movement between ERP for banks and for non-banks, the increase in ERP observed for banks was attributed to an increase in perceived uncertainty of future dividends related to the ECB announcement.[10] The resulting decline in bank shares, other model inputs remaining constant, was attributed to the indirect effect. Other factors – such as changes in risk-free rates and expected bank profitability – were quantified in a similar manner. It should be noted that the individual contributions interact: for example, the direct effect will generally be weaker if the discount rate is low.

The effect of the recommendation on bank share prices due to increased bank risk premia was estimated to be almost twice as strong as the effect due to postponed investor cash flows. Chart 4 (right-hand panel) displays a decomposition of the change in bank share prices during the week following the announcement of the ban. Of the overall decline of 13%, around 7 percentage points can be traced back to the dividend recommendation, in line with the regression results in the previous section. It should be noted that of the overall 13% decline, only around 2.7 percentage points are explained by the mechanically delayed investor cash flows. The impact of increased investor uncertainty about future dividends (reflected in higher ERP) was found to be a more important driver of share price movements. This channel is estimated to explain almost 5 percentage points of the overall decline. Exogenous factors – such as changes in market expectations about future earnings and payout ratios, as well as changes in the risk-free rate – explain around 8.5 percentage points of the overall decline. Interactions between the drivers resulted in an overestimation of the overall effect, visible in a positive corrective term.

Chart 4

Evolution of bank dividend forecasts and equity risk premia and decomposition of changes in bank share prices around the time of the ECB announcement

(left: ERP in % p.a., index-weighted average dividend per share in €; right: percentage point contributions)

Sources: Left: Refinitiv, Datastream I/B/E/S and own calculations; right: ECB calculations.

Notes: Left: bank ERP and non-bank ERP were derived from a three-stage DDM for the EuroStoxx Banks and EuroStoxx ex-Banks indices. Bank dividends were weighted average dividends per share, weighted according to each banks’ index weighting in the EuroStoxx Banks index (forecasts for 2020 and 2021 were weighted means across analyst forecasts, obtained directly from I/B/E/S). It should be noted that these referred to dividends booked, as opposed to actual payouts. Therefore, payouts of 2019 dividends by the date of the announcement were taken into account for the decomposition. Right: decomposition of the change in bank share prices during the week following the announcement of the ban. See the main text for more details about the decomposition.

4 Policy implications

The article documents the negative impact of the March 2020 ECB recommendation on bank share prices. A formal impact evaluation in a difference-in-difference set-up confirms that the dividend recommendation resulted in lower bank share prices. The impact was heterogeneous across banks, depending on their distribution plans and income generating capacity. It was found to have been stronger for dividend-paying banks and, within that group, for banks unable to generate the returns expected by shareholders.

The analysis highlights the importance of managing perceptions about dividend uncertainty to limit the unintended side effects of dividend restrictions. It suggests that uncertainty over future distributions, rather than the mechanical postponement of dividend payouts, explains a major part of the negative impact on bank valuations. Here, clear, consistent and credible communication, laying out the timeline and conditions under which normal payout policies would be resumed, could effectively counteract the surge in uncertainty and the associated declines in bank valuations, without affecting the amount of capital retained in the system. The communication of the December 2020 extension, which clarified that the recommendation would be repealed in September 2021, in the absence of materially adverse developments, already addressed such concerns to a large extent.

References

Altavilla, C., Bochmann, P., De Ryck, J., Dumitru, A., Grodzicki, M., Kick, H., Melo Fernandes, C., Mosthaf, J., O’Donnell, C. and Palligkinis, C. (2021), “Measuring the cost of equity of euro area banks”, Occasional Paper Series, No 254, European Central Bank, Frankfurt am Main, January.

Belloni, M., Grodzicki, M. and Jarmuzek, M. (2021), “What makes banks adjust dividend pay-outs?”, Macroprudential Bulletin, Issue 13, European Central Bank, Frankfurt am Main.

Dautovic, E., Ponte Marques, A., Reghezza, A., Rodriguez d’Acri, C., Vila, D. and Wildmann, N., (2021), “Evaluating the benefits of euro area dividend restrictions on lending and provisioning”, Macroprudential Bulletin, Issue 13, European Central Bank, Frankfurt am Main.

Katsigianni, E., Klupa, K., Tumino, M. and Zsámboki, B. (2021), “System-wide restrictions on distributions – policy options and challenges”, Macroprudential Bulletin, Issue 13, European Central Bank, Frankfurt am Main.

- Swiss banks served as a benchmark because the pandemic arguably affected them similarly to euro area banks, but these banks were unaffected by dividend restrictions, unlike banks in other European jurisdictions, such as Sweden and the UK, where similar measures were put in place.

- Bank-level cost of equity estimate are obtained from Altavilla et al. (2021), “Measuring the cost of equity of euro area banks”, Occasional Paper Series, No 254, ECB, Frankfurt am Main.

- Altavilla et al. (2021), “Measuring the cost of equity of euro area banks”, Occasional Paper Series, No 254, ECB, Frankfurt am Main.

- The evolution of this metric is akin to the evolution of a normalised share price.

- The validity of the parallel trends assumptions also alleviates concerns that other concurrent developments affecting the banking sector during this period, such as regulatory flexibility regarding the treatment of loans under debt moratoria or IFRS 9 application, could have had any confounding effects on the estimation.

- Notably, financial markets seem to have started differentiating across banks somewhat later, only after it became apparent that institutions would follow the recommendation. More specifically the valuations of dividend-paying and other banks decoupled only two business days after the SSM announcement. At that point in time, several large euro area banks had publicly communicated that they would abide by the recommendation, which may explain the delayed impact and could indicate that the first, immediate effect of the recommendation was through an increased bank ERP.

- It should be noted that the DDM used here to obtain the banking sector and broad market ERPs and to decompose bank share price developments differs from the modelling approach underlying the bank-specific COE estimates used above to compute the ROE-COE gap. The need for a different modelling approach in this section arose because the methodology of Altavilla et al. (2021) is not suited to modelling the postponement of individual dividend cash flows and cannot readily be applied to broad market indices.

- This observation of a downward drift in dividend expectations could imply that market participants also foresaw lower payout ratios in the future due to the ban, rendering the observed variation endogenous. We also compared the evolution of expected dividend payouts to those of expected profitability. Both series co-moved very strongly, suggesting that the decline in near-term dividends reflected low payouts due to declines in earnings (which were exogenous to the ban) rather than being a side-effect of the ban itself.

- Regressing the changes in bank risk premia on changes in the non-bank risk premia revealed a significant coefficient of around 1.36. The respective linear correlation coefficient was 0.63. In addition, the error term from this regression in the week following the announcement was positive and outside the 90% confidence interval, indicating that bank risk premia had indeed experienced a significant shock relative to what would have been suggested by historical regularities.

- This increase in risk premia was assessed as being a consequence of the dividend ban and not simply linked to a general increase in investor risk aversion; this was because non-bank risk premia had slightly decreased during the same period and changes in bank and non-bank risk premia are highly correlated in normal times.