Analysing drivers of residential real estate (RRE) prices and the effects of monetary policy tightening on RRE vulnerabilities

Published as part of the Macroprudential Bulletin 19, October 2022.

Understanding the nature and importance of the various drivers of RRE developments is key for the comprehensive assessment of current RRE risks. Unlike in previous periods of economic downturn or financial crisis, developments in the euro area RRE market continue to follow their pre-pandemic trends, with strong RRE price growth fuelled by robust lending for house purchases. These developments have also been underpinned by the low interest rate environment, with lending rates on new mortgage loans at historical lows. For a comprehensive RRE risk assessment and to set macroprudential measures targeting RRE, it is important to understand the main drivers of RRE developments and the implications of the various scenarios for the RRE market outlook. In this focus we propose a model framework to shed more light on these issues.

We study the dynamics of the RRE market through the lens of a Bayesian VAR model. We use a vector autoregression model which includes key variables to capture the rich dynamics and complex cross-relationships in the RRE market, in addition to the main demand and supply dynamics: (1) real RRE prices, (2) real lending for house purchases, (3) the nominal lending rate on new loans for house purchases, (4) the nominal shadow rate, (5) real residential investments, and (6) real disposable income. We use quarterly series for the euro area aggregate covering the period from the first quarter of 2000 to the third quarter of 2021. The fundamental drivers (structural shocks) are identified using a combination of zero and sign restrictions. The restrictions are based on relevant empirical literature (Jarocinski and Smets, 2008; Calza et al., 2013; Nocera and Roma, 2016).[1]

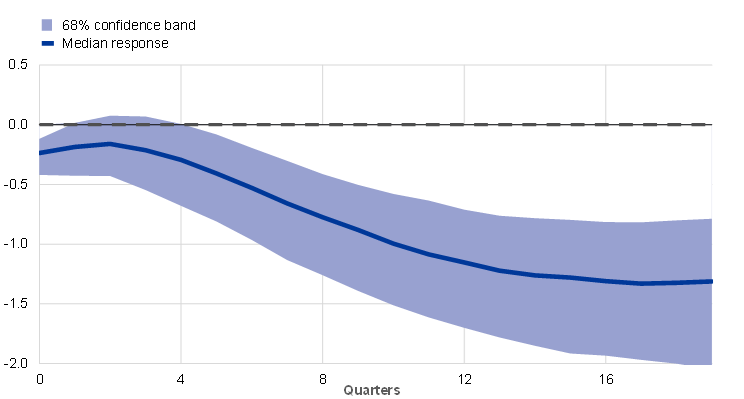

We use the model to identify the drivers of real estate prices over time and to assess the reaction of real estate prices to macro-financial developments. According to the model, accommodative monetary policy and the easing of mortgage conditions by banks (mortgage supply) have been the main contributors to the continued increase in RRE prices in recent years. Another main contributor has been demand stemming from a shift in preferences towards housing[2] following the outbreak of the pandemic, mainly due to the protracted teleworking environment. The increase in savings and greater participation of institutional investors have also played a significant role (Chart A). Furthermore, the model allows us to assess how shocks transmit to the variables of interest over time using impulse response analysis. For example, a tightening of monetary policy tends to reduce valuations in housing markets, as measured by the price-to-income ratio. Nevertheless, the response has been gradual and small in scale (Chart A, panel b). From a macroprudential policy perspective this is important as it indicates that monetary policy can mitigate some vulnerabilities that call for macroprudential policy responses. However, since the effects are expected to be gradual and modest, macroprudential policy still has a valuable role to play.

Chart A

Accommodative monetary policy has supported house prices in recent years, but the effects of a tightening monetary policy shock on valuations will be gradual and relatively modest

a) Historical decomposition of RRE price growth

(percentage, share of various shocks on total identified shocks)

b) Change in price-to-income ratio to a 1pp MP shock

(percentage)

Source: ECB calculations.

In particular, for the housing supply shock it is assumed that the residential investments and house prices move in opposing directions, while for other shocks it is assumed that residential investment does not react contemporaneously (housing preference, mortgage supply, monetary policy shocks) or is left unrestricted (income shock). Housing preference shocks and mortgage supply shocks are distinguished by the different reaction of the lending rate (increase in lending rate for the housing preference shock, decline in lending rate for the mortgage supply shock). Income shocks are identified by a contemporaneous increase in disposable income and no contemporaneous reaction of monetary policy. Finally, mortgage supply shocks and monetary policy shocks are distinguished by the reaction of the monetary policy rate (with no reaction following the supply shock as opposed to an increase following the tightening monetary policy shock).

This effect appears to fade out in the most recent period, probably due to the gradual decrease in teleworking and the recovery of household income.