Corporate zombification: post-pandemic risks in the euro area

Published as part of the Financial Stability Review, May 2021.

Policy measures aimed at supporting corporates and the economy through the coronavirus pandemic may have supported not just otherwise viable firms, but also unprofitable but still operating firms – often referred to as “zombies”. This has in turn raised questions about an increased risk of zombification in the euro area economy, which could constrain the post-pandemic recovery. Firm-level, loan-level and supervisory data for euro area companies suggest that zombie firms may have temporarily benefited from loan schemes and accommodative credit conditions – but likely only to a modest degree. These firms may face tighter eligibility criteria for schemes and more recognition of credit risk in debt and loan pricing in the future. Tackling the risk of zombification more fundamentally requires the consideration of suggested reforms to insolvency frameworks, and better infrastructure for banks to manage non-performing loans.

1 Introduction

Policy responses to the pandemic have revived the debate about the presence of unprofitable but still operating firms – often referred to as “zombies” – in the euro area. Since the sovereign debt crisis, there have been concerns about the potential existence of a cohort of failing firms that continue operating on the back of cheap credit and debt forbearance. It is argued that such firms weigh on economic productivity by trapping resources and crowding out the emergence of new, more productive companies.[2] Furthermore, the incentives for some banks to repeatedly extend or alter loan terms so as to avoid writing off their loans (forbearance) can also weigh on bank balance sheets over time, dampening banks’ profitability and capacity for new lending.[3] Monetary, fiscal and prudential policy measures since the pandemic began have prevented a wave of insolvencies of otherwise viable and productive firms. They have done this through direct financial support, as well as by maintaining favourable credit conditions and introducing loan guarantee, loan moratorium and payment holiday schemes. But could these conditions have the unintended side effect of propping up unproductive and unviable firms? And, in turn, could this dampen the longer-term economic recovery and increase risks to the financial system?[4]

This special feature explores how the pandemic may have affected such firms and the impact of recent policy responses and credit conditions. The analysis focuses on considering how firms that were not viable before the pandemic may have been affected by it, rather than on the issue of whether the pandemic itself will lead to sustained changes in preferences and technologies that make some business models no longer viable. First, firm-level data are used to estimate the extent of zombie firms in the euro area ahead of the pandemic, and to construct a new measure to assess which firms are vulnerable to becoming zombies. This then allows an examination at firm level of how the pandemic may have affected these firms’ profitability and their eligibility for policy schemes, providing evidence of zombie firms benefiting from easy credit conditions.

2 Pre-pandemic prevalence of zombie firms in the euro area

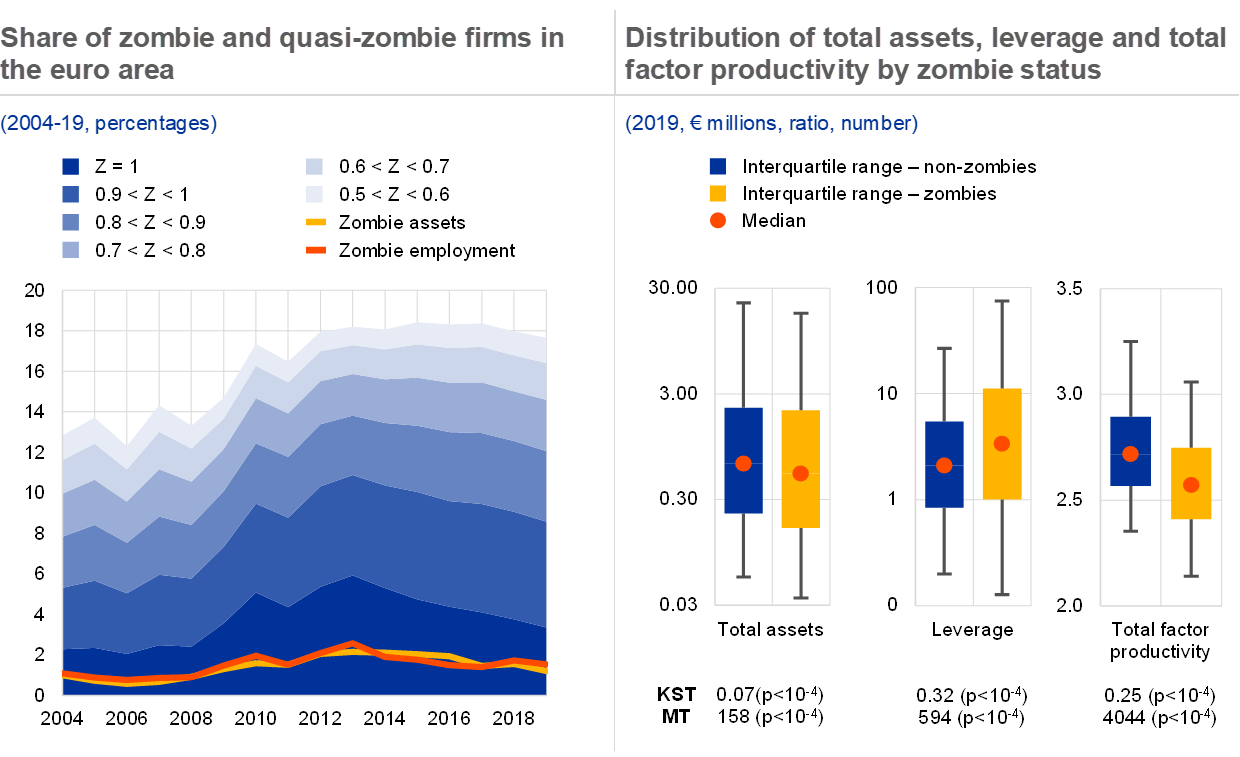

Ahead of the pandemic the estimated share of zombie firms in the euro area was modest and declining, but still above the levels of the early 2000s (see Chart A.1). In the absence of a single definition, previous studies have defined zombie firms in various ways, but they generally agree on seeking out firms that are being artificially sustained by credit. In this special feature, building on the approach of Storz et al. (2017)[5], zombie firms are defined as those firms that meet all of the following three criteria over two consecutive years: (i) negative returns on assets (net income over total assets), identifying unprofitable firms; (ii) low debt servicing capacity (earnings before interest, taxes, depreciation and amortisation (EBITDA) over financial debt of below 5%), capturing indebted firms; and (iii) negative net investment (annual change in total fixed assets), to avoid capturing young firms. Using Orbis euro area firm-level data spanning fifteen years up until 2019[6] suggests an average euro area share of zombie firms of around 3.4% before the pandemic (see Chart A.1, left panel). This is above the 2% share in the early 2000s, but below the peaks of almost 6% following the euro area sovereign debt crisis.[7]

The higher level of zombie firms following the global financial crisis partly reflects the low interest rate environment, weaker banks and inefficient insolvency frameworks. Acharya et al. (2020)[8] find evidence for 12 European countries that the share of zombie firms has significantly increased since the global financial crisis, reaching an asset-weighted share of 6.7% in 2016. Banerjee and Hofmann (2020)[9] use a sample of publicly listed firms from 14 OECD countries and find an increase in the share of zombie firms from around 4% in the mid-1980s to almost 15% in 2017.

Chart A.1

Ahead of the pandemic, the euro area share of zombie firms was still above pre-financial crisis levels, and they had lower productivity than other firms

Sources: Bureau van Dijk – Orbis and ECB calculations.

Notes: Left panel: share of zombie firms based on the number of firms, the share of total assets held by zombie firms and the share of employment in zombie firms. Due to a two-year structural reporting lag, estimates are available only until 2019. The zombie score

is a dimensionless number in the unit interval, with

corresponding to a (crisp) zombie as per the definition of Storz et al. (2017), and

corresponding to viable firms. Here only values of

are presented. Right panel: total assets and leverage are shown on log-scales. Leverage is computed as debt over equity. The whiskers indicate the 5th and 95th percentiles. Total factor productivity is computed by means of Solow residuals. KST indicates the Kolmogorov-Smirnoff statistic; here the null hypothesis (that the two distributions are the same) is rejected at level

if the statistic exceeds the critical value

. MT indicates the Mood’s median test.

Zombie firms are found to be less productive, as well as typically smaller than other firms. Supporting concerns that zombie firms may weaken overall economic productivity, euro area zombie firms have on average lower firm-level total factor productivity[10] than other firms, producing less per unit of labour and capital employed (see Chart A.1, right panel). The median zombie firm is also 20% smaller in terms of total assets, with micro-enterprises[11] five times more likely to be zombies than large firms. They also contribute less than average to employment and, as well as being (by definition) less profitable, the median zombie firm is 60% more leveraged than its non-zombie counterpart.

Furthermore, a larger cohort of firms have high debt and weak profitability. Most studies have employed a binary definition of firms being either zombie or not, typically using discrete thresholds. This is consistent with zombie firms being seen as a distinct group of firms. But it has the drawback of not capturing the possibility of a cohort of quasi zombies that may be at risk of a zombie-like condition, with for example a noticeably high degree of indebtedness and weak profitability.[12] Identifying firms which are just above the zombie threshold, but still have a high degree of indebtedness and weak profitability even if still viable, points to a larger cohort of firms (see Chart A.1, left panel). For example, around 8% of firms obtain a score higher than 0.9. While the share of zombie firms has trended down since the euro area sovereign debt crisis in 2012, the share of quasi zombies with a high degree of indebtedness and weak profitability has instead been more steady.

3 The impact of the pandemic and the policy response

The economic impact of the pandemic and the policy response may have, at least temporarily, contributed to some degree of zombification. Policy measures intended to help viable companies bridge liquidity needs arising during the pandemic and lockdowns – such as loan guarantee schemes or loan repayment breaks – may also have been accessed by zombie firms. More generally, measures seeking to ensure accommodative monetary and credit conditions may have maintained or even lowered debt servicing needs for zombie firms as well as other firms.

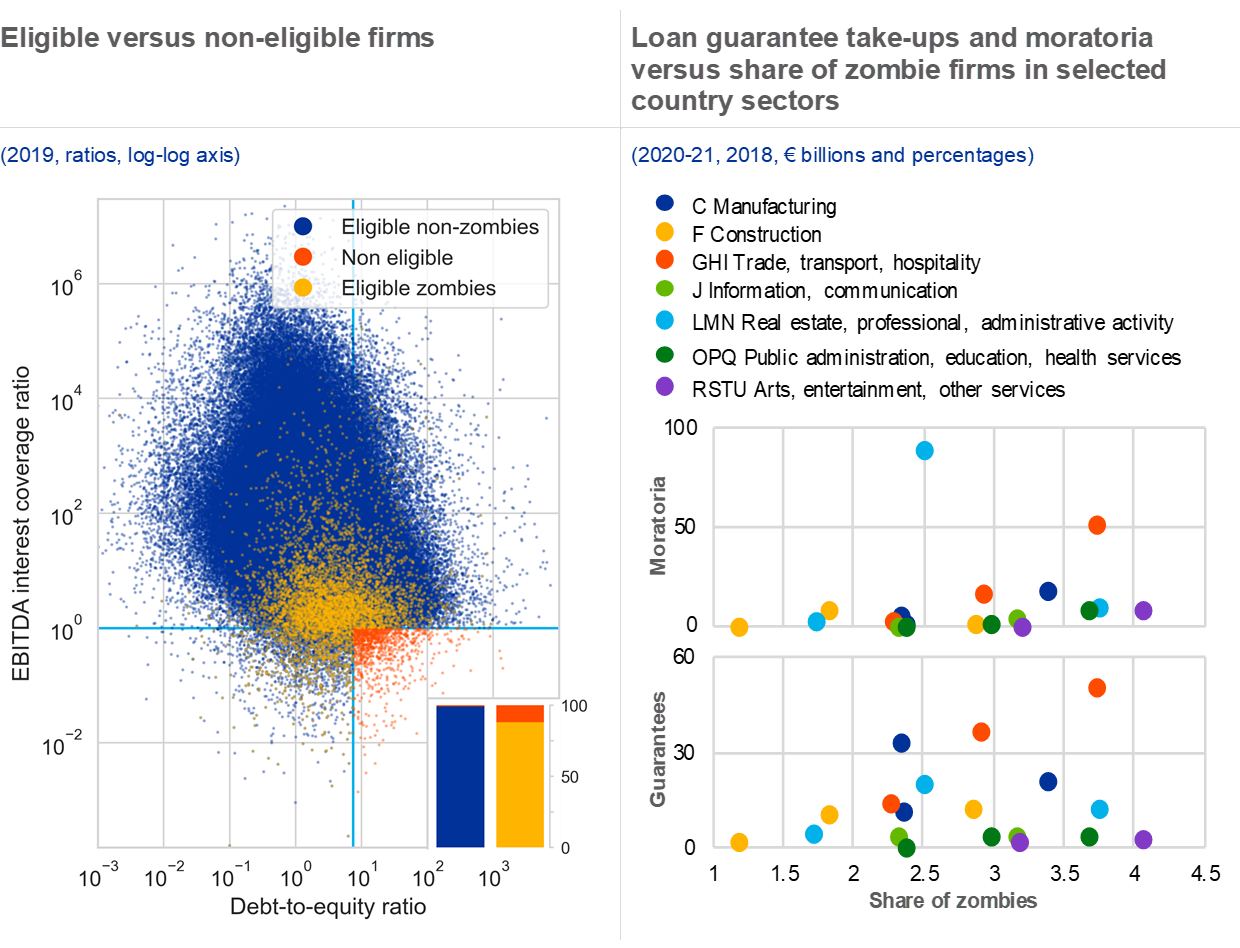

Zombie firms are likely to have accessed euro area government-guaranteed loan schemes and moratoria, given their broad eligibility criteria. Early in the pandemic, the European Commission set guidelines for access to loan guarantee schemes requiring that firms should have reported EBITDA interest coverage ratios greater than unity and debt-to-equity ratios below 7.5 for both of the last two most recent reporting years.[13] Each country eventually put in place its own eligibility criteria, although these were by and large in line with the Commission’s guidelines. Firm-level data suggest that although such criteria were successful in providing access to viable firms, with only a negligible fraction not qualifying (1%), they may have also been unable to prevent as many as 90% of firms identified as zombies from becoming eligible for public support[14],[15] (see Chart A.2, left panel). Eligibility does not mean that these firms actually borrowed from these schemes. Correlation between loan guarantee take-ups and the shares of zombie firms in selected country sectors across the euro area (see Chart A.2, right panel) may indeed suggest zombies might have accessed such schemes, although a conclusive analysis would need to rely on more granular information.

Chart A.2

Many zombie firms may have been eligible for public support and have a high share in sectors where scheme take-up has been greatest

Sources: Bureau van Dijk – Orbis, ECB supervisory data, data on guarantee take-ups from KfW, the German Federal Ministry for Economic Affairs and Energy, the French Ministry for the Economy and Finance and the Spanish Instituto de Crédito Oficial, and ECB calculations.

Notes: Left panel: only pure zombies (

) are considered. Debt-to-equity ratio refers to the minimum debt-to-equity ratio in the last two years considered; EBITDA interest coverage ratio refers to the maximum EBITDA interest coverage ratio in the last two years considered; figures refer to pre-pandemic reporting; bottom-right inset: share of eligible firms for non-zombie and zombie firms. Right panel: Markers of equal colour refer to different countries within the same sector. Moratoria and loan guarantee take-ups versus share of zombie firms in selected country sectors for the four largest European economies. Share of zombies in 2018 due to lower 2019 coverage in some country sectors. Data on loan guarantee take-ups are as at February 2021 and data on moratoria show the maximum value of loans under moratoria in the specific country sector between March 2020 and February 2021.

Such firms may also have benefited from loan moratorium schemes (see Chart A.2, right panel). Almost €1 trillion of loans have been subject to moratoria, although these have been relatively short-lived, with 93% of them expiring by the end of the first half of 2021[16]. This suggests that, by and large, any benefit to a zombie firm’s individual financial position may have been modest at most.

4 Highly accommodative credit conditions

In an environment of highly accommodative credit conditions, zombie firms are also likely to benefit from accommodative bank lending rates. Despite the severity of the economic shock, monetary, fiscal and prudential policy actions supported the supply of bank lending and typical lending rates remained stable throughout 2020. Even though zombie firms are substantially more likely to have non-performing loans (NPLs) (see Chart A.3, left panel),[17] which is in line with their higher credit risk, the interest rates on zombie firms’ bank loans are not systematically higher than those on loans to other firms (see Chart A.3, right panel).[18]

Chart A.3

Interest rates on loans to zombie firms show little recognition of their greater tendency for non-performing loans

Sources: Bureau van Dijk – Orbis, ECB AnaCredit data and ECB calculations.

Notes: Zombie firms as identified in 2019. Left panel: NPLs and forborne loans as a percentage of total loans. Right panel: interest rates are calculated as the median interest rates of outstanding loans in February 2020 at a country-NACE4 level.

The relatively strong capital positions of banks at the onset of the pandemic might have averted some risk of excessively lenient lending to zombie firms. Several earlier studies of lending to zombie firms have emphasised the link between weak banks and greater forbearance or “subsidy” credit to failing firms.[19] With most banks having entered the crisis well capitalised and therefore being able to sustain larger losses from the pandemic, incentives for forbearance should be lower. As previously recognised however (Laeven et al., 2020)[20], going forward it will be necessary to continue ensuring that banks maintain sound capital positions, while taking a forward-looking stance on loan loss provisioning.

Chart A.4

Signs of market complacency: credit spreads show little differentiation based on leverage and rating, despite the asymmetric impact of the pandemic

Sources: Credit Market Analysis (CMA), S&P Global Market Intelligence, IHS Markit and ECB calculations.

Notes: Left panel: turns of leverage are based on annualised quarterly earnings (EBITDA). CDSs: credit default swaps. Right panel: differences in non-financial corporate spreads between pairs of adjacent rating classes, May 2021 and April 2020 versus historical range. The whiskers represent the historical 5th and 95th percentiles based on daily data since January 2010.

Pricing in capital markets shows some signs of complacency. The overall tightening of credit spreads after the March 2020 market turmoil seems to have been accompanied by decreased price differentiation with respect to fundamental credit characteristics. This could indicate that support measures may have backstopped weaker and perhaps unviable firms in particular. By the end of 2020, the spread per turn of leverage stood near all-time lows (see Chart A.4, left panel). In addition, spreads between firms with different credit ratings are also low compared with historical ranges (see Chart A.4, right panel). This relatively small differentiation between firms with different credit characteristics suggests that there may be some degree of complacency among market participants. Firms at the lower end of the credit spectrum potentially benefit from cheap funding conditions, which increase their chances of survival; but this also means that investors exposed to such debt securities may face substantial losses if such firms become unviable in the medium term.

5 Implications

It is likely that the policy response to the pandemic has also provided support to zombie firms, but in the short term this has supported aggregate demand. Zombie firms have been able to extend their indebtedness via government-guaranteed loan schemes, the use of moratoria and generally accommodative debt pricing. At the same time, the economic impact of the pandemic itself is also likely to have moved some already zombie-like firms even further away from viability, lowering their profitability and increasing their leverage. But in the short term, preventing the failure of both viable and unviable firms has limited unemployment and spillovers from insolvency during this challenging period.

A more targeted approach to ongoing policy support measures and more recognition of credit risk may reduce any unintended subsidy for zombie firms. This would decrease the risk of expanding lending to zombie firms, especially when seen in conjunction with a well-designed phasing-out of policy support. Moreover, banks might find additional disincentives to recognising losses within systems with weak insolvency frameworks (Andrews and Petroulakis, 2019). In such an environment, creditors might find the risk associated with evergreening preferable to long court proceedings, especially in cases in which the exposure is expected to be recovered only partially. Measures to improve the efficiency of insolvency procedures would therefore also help in addressing the issue, with more efficient laws on bankruptcy providing additional incentives for banks to recognise losses from non-viable borrowers. These include electronic filings, virtual court hearings, as well as out-of-court or hybrid solutions.

Zombification may lead to an inefficient capital allocation, but also poses medium-term risks to the financial system if risks are not properly priced. The analysis of interest rates on bank loans (see Chart A.3, right panel) as well as credit spreads in corporate debt markets (see Chart A.4) suggests that firms’ cost of funding is relatively undifferentiated with respect to individual firms’ fundamental credit characteristics. Zombie firms may be able to access relatively cheap funding, but this leaves banks, sovereigns and investors exposed in the medium term should the viability of these firms be challenged. Such a scenario may materialise following unexpected adverse shocks, a weak recovery or an unbalanced withdrawal of policy support measures. In the face of any such adverse developments, the existence of a sizeable cohort of firms with zombie characteristics may lead to sell-offs, large-scale downgrades[21] or “catch-up defaults”. If unaddressed, these risks, in conjunction with an increase in the share of zombie firms, might result in a concrete source of losses, increasing pressure on financial institutions’ balance sheets and thus potentially jeopardising the stability of the euro area financial system. Additionally, the existence of a wider tail of overindebted corporates could be a drag on growth, as debt overhang can affect firms’ investment and employment.[22] Such macro risks could in turn feed back into the banking sector and the financial system.

- The authors are grateful to Benjamin Hartung, Paloma Lopez-Garcia, Giulio Nicoletti, Marek Rusnak, Ralph Setzer, Mika Tujula and Peter Welz for useful comments and discussions.

- See, among others, Caballero, R. J., Hoshi, T. and Kashyap, A. K., “Zombie Lending and Depressed Restructuring in Japan”, American Economic Review, Vol. 98(5), 2008, pp. 1943-1977; Adalet McGowan, M., Andrews, D. and Millot, V., “The walking dead? Zombie firms and productivity performance in OECD countries”, Economic Policy, Vol. 33(96), 2018, pp. 685-736; and Acharya, V. V., Eisert, T., Eufinger, C. and Hirsch, C., “Whatever It Takes: The Real Effects of Unconventional Monetary Policy”, The Review of Financial Studies, Vol. 32(9), 2019, pp. 3366-3411; and Nurmi, S., Vanhala, J. and Virén, M., “The life and death of zombies – evidence from government subsidies to firms”, Research Discussion Paper No 8/2020, Bank of Finland, 2020.

- See Andrews, D. and Petroulakis, F., “Breaking the shackles: Zombie firms, weak banks and depressed restructuring in Europe”, Working Paper Series, No 2240, ECB, February 2019.

- “Reviving and Restructuring the Corporate Sector Post-Covid: Designing Public Policy Interventions”, Group of 30, 2020.

- Storz, M., Koetter, M., Setzer, R. and Westphal, A., “Do we want these two to tango? On zombie firms and stressed banks in Europe”, Working Paper Series, No 2104, ECB, October 2017.

- The Bureau van Dijk’s Orbis database provides balance sheet information for millions of firms globally. Applying the filters laid out in Storz et al. (2017) (op. cit.), our sample comprises around 13 million firm-year observations for euro area non-financial firms between 2004 and 2019.

- A similar evolution of the share of zombies over time is found when looking at a very strict indicator of vulnerable firms based on the ECB Survey on the Access to Finance of Enterprises (SAFE). These are firms that have reported simultaneously lower turnover, decreasing profits, higher interest expenses, and a higher or unchanged debt-to-total assets ratio in the last six months.

- Acharya, V. V., Crosignani, M., Eisert, T. and Eufinger, C., “Zombie credit and (dis)inflation: Evidence from Europe”, NBER Working Paper No 27158, National Bureau of Economic Research, 2020.

- Banerjee, R. N. and Hofmann, B., “Corporate zombies: Anatomy and life cycle”, BIS Working Paper No 882, Bank for International Settlements, 2020.

- Total factor productivity is computed based on Solow residuals from ordinary least squares estimates of a Cobb-Douglas production function.

- As per Commission Recommendation 2003/361, micro-enterprises are defined as those meeting two of the following three criteria and not failing to do so for at least ten years: fewer than ten employees, balance sheet total below €2 million and turnover below €2 million.

- A linear membership function with boundaries between the thresholds and medians of each variable (return on assets, debt servicing capacity and net investment) is used to capture a fuzzy score in the unit interval, with zero indicating a healthy firm and unity a zombie. A geometric mean of the scores in each dimension ensures that more weight is given to firms where all variables are closer to the respective threshold and the zombie-like condition is constrained to firms for which all variables are below the median. See Mingarelli, L., Ravanetti, B., Shakir, T. and Wendelborn, J. T., “Corporate zombification risks and COVID-19 public support schemes” (2021, forthcoming) for more details.

- See Commission Regulation No 651/2014 (Article 2(18)). These eligibility criteria are those envisaged for large firms, while for small and medium-sized enterprises financial difficulty is defined as being in insolvency proceedings, having lost more than half of capital due to accumulated losses, or being subject to restructuring aid. Due to the lack of up-to-date information on corporates’ financial health during the pandemic, the former criteria are applied to the whole sample to test the eligibility of zombie firms.

- The result is dependent on the definition of zombie taken. Therefore, a more encompassing definition able to capture more strictly the non-viability of firms (as opposed to firm vulnerability), such as the one employed here, is to be preferred.

- Company size is not a relevant factor in explaining the degree of eligibility. Replicating the analysis on a sample of SMEs and on a sample of large firms, one obtains similar shares of firms accessing public schemes.

- EBA Guidelines for legislative and non-legislative moratoria on loan repayments applied in the light of the COVID-19 pandemic (EBA/GL/2020/02), European Banking Authority, 2 April 2020, amended by EBA/GL/2020/08 on 25 June 2020.

- See also Ari, A., Chen, S. and Ratnovski, L., “COVID-19 and non-performing loans: lessons from past crises”, Research Bulletin, No 71, ECB, May 2020.

- Other factors, such as different collateral requirements, which have not been considered in this analysis, could explain the divergence between the two groups.

- See, for example, Andrews, D. and Petroulakis, F., “Breaking the shackles: Zombie firms, weak banks and depressed restructuring in Europe”, Working Paper Series, No 2240, ECB, February 2019, and Keuschnigg, C. and Kogler, M., “The Schumpeterian role of banks: Credit reallocation and capital structure”, European Economic Review, Vol. 121(C), 2020.

- Laeven, L., Schepens, G. and Schnabel, I., “Zombification in Europe in times of pandemic”, VoxEU.org, 11 October 2020.

- See also “A system-wide scenario analysis of large-scale corporate bond downgrades”, ESRB technical note, European Systemic Risk Board, July 2020.

- See also Kalemli-Özcan, S., Laeven, L. and Moreno, D., “Debt overhang, rollover risk, and corporate investment: evidence from the European crisis”, Working Paper Series, No 2241, ECB, February 2019.