Assessing short-term economic developments in times of COVID-19

Published as part of the ECB Economic Bulletin, Issue 8/2020.

The sudden and deep recession triggered by the outbreak of the coronavirus (COVID-19) has warranted adjusting the standard tools used for forecasting euro area real GDP growth in real time. The severe economic consequences of COVID-19 have played havoc with established statistical and economic relationships.[1] Hence, standard short-term forecasting models have been able to capture neither the extent of the contraction observed in the first two quarters of 2020 – with quarter-on-quarter declines of 3.7% and 11.7% in the first and the second quarters, respectively – nor the rebound in the third quarter – with an increase of 12.5%. These exceptional dynamics have required an update of the set of tools typically used to forecast euro area real GDP growth in real time. This box describes four approaches developed by ECB staff to account for the specific characteristics and implications of the COVID-19 pandemic.

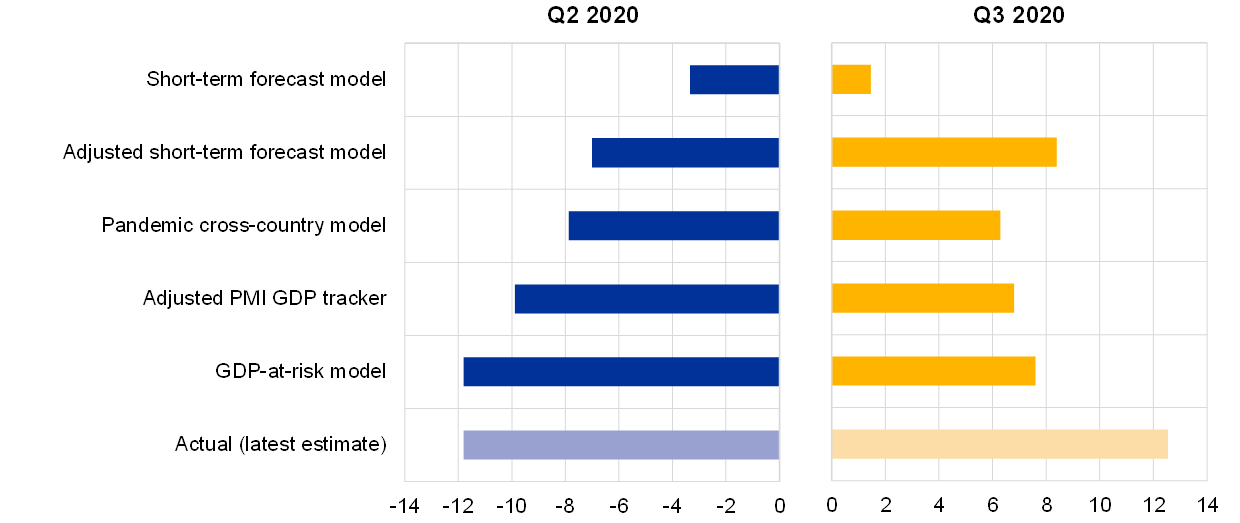

The first approach exploits the information content of the different containment measures implemented across countries. A simple methodology assesses the economic impact of the restrictions on people’s behaviour imposed in several countries to contain the pandemic.[2] A pooled panel regression, the so-called “pandemic cross-country model”, gauges the relationship between containment measures, as measured by the Oxford Stringency Index (OSI), and real GDP.[3] Based on data for the first three quarters of 2020 across all euro area countries, a linear model seems to fit reasonably well the cross-country heterogeneity in the relationship between real GDP and the OSI (see Chart A). Real-time estimates of the pandemic cross-country model indicated a quarterly contraction in euro area real GDP of 7.9% in the second quarter and a pick-up of 6.3% in the third quarter of 2020 (see Chart B).

Chart A

Real GDP and Oxford Stringency Index across euro area countries in 2020

(x-axis: index, Q4 2019 real GDP = 100; y-axis: index, max. = 100)

Sources: Eurostat, Hale et al. (2020), ECB staff calculations.

Notes: The line in the chart indicates the linear trend (i.e. the fitted values) of the pooled panel regression based on data for the 19 euro area countries in the first three quarters of the year. The slope coefficient provides the estimated elasticity of the OSI on real GDP.

The second approach exploits the information content of high-frequency indicators, as these indicators are able to quickly capture sudden changes in economic conditions. While monthly indicators are very informative about the current economic juncture, they are released with some delay. Non-standard daily or weekly data (e.g. credit card payments, electricity consumption and mobility indicators) have provided a timelier picture of the economic impact of the pandemic. However, as these data can be noisy, only available for a limited period of time and subject to complex seasonal patterns, they need to be viewed with caution.[4] Taking into account these measurement challenges, the standard toolkit for short-term forecasting of euro area real GDP has been expanded to include information on weekly credit card payments.[5] This additional information, partly capturing real-time developments in the two GDP components that are more severely affected by the pandemic (i.e. production in the services sector on the supply side and private consumption on the expenditure side), has improved the forecast performance of the standard short-term forecast models. Unlike the mild contraction and recovery suggested by the standard models, the adjusted short-term forecast models pointed to an average contraction in euro area real GDP of 7.0% in the second quarter of 2020 and to a swift rebound of 8.4% in the third quarter (see Chart B).

Chart B

Forecasts of euro area real GDP growth using non-standard models

(percentages; quarter-on-quarter growth rate)

Sources: Eurostat, Hale et al. (2020), IHS Markit, ECB, ECB staff calculations.

Notes: The adjusted short-term forecast model includes information from weekly credit card payments and other standard indicators which were available 15 days before the release of the preliminary flash estimate of GDP. The adjusted PMI GDP tracker refers to a non-linear PMI composite output-based rule, which takes into account both the quarterly change in this index and previous GDP growth. The GDP-at-risk model uses the 5% left tail of the conditional distribution for the second quarter of 2020 and, given the expected sharp rebound, the 1% right tail of the conditional distribution for the third quarter of 2020. All of the reported real GDP forecasts are real-time estimates.

The third approach consists of adjusting the linear relationship between GDP and the Purchasing Manager’s Index (PMI). The survey-based PMI composite output is a monthly diffusion index bounded between 0 and 100, with 50 indicating no output change over the previous month for firms in the manufacturing and services sectors. Prior to the pandemic, a PMI linear rule (i.e. a so-called “real GDP tracker”) had worked reasonably well for forecasting quarter-on-quarter euro area real GDP growth.[6] However, this relationship has become dysfunctional since the start of the COVID-19 crisis. Two types of adjustments were implemented to extract all possible information content from the PMI. The first adjustment consisted of considering only the left tail of the distribution of real GDP growth for the first two quarters of 2020. The resulting adjusted PMI-based tracker rule forecasted, in real time, a decline in euro area real GDP of 2.7% in the first quarter and of 9.8% in the second quarter. The PMI linear rule was also expected to fail in terms of estimating the expected elastic rebound in the third quarter. Therefore, the second adjustment made consisted of also extracting information from the change in the PMI and taking GDP growth from the previous quarter as the starting point.[7] This adjustment implied an estimated rebound of 6.1% in the third quarter of 2020 (see Chart B).

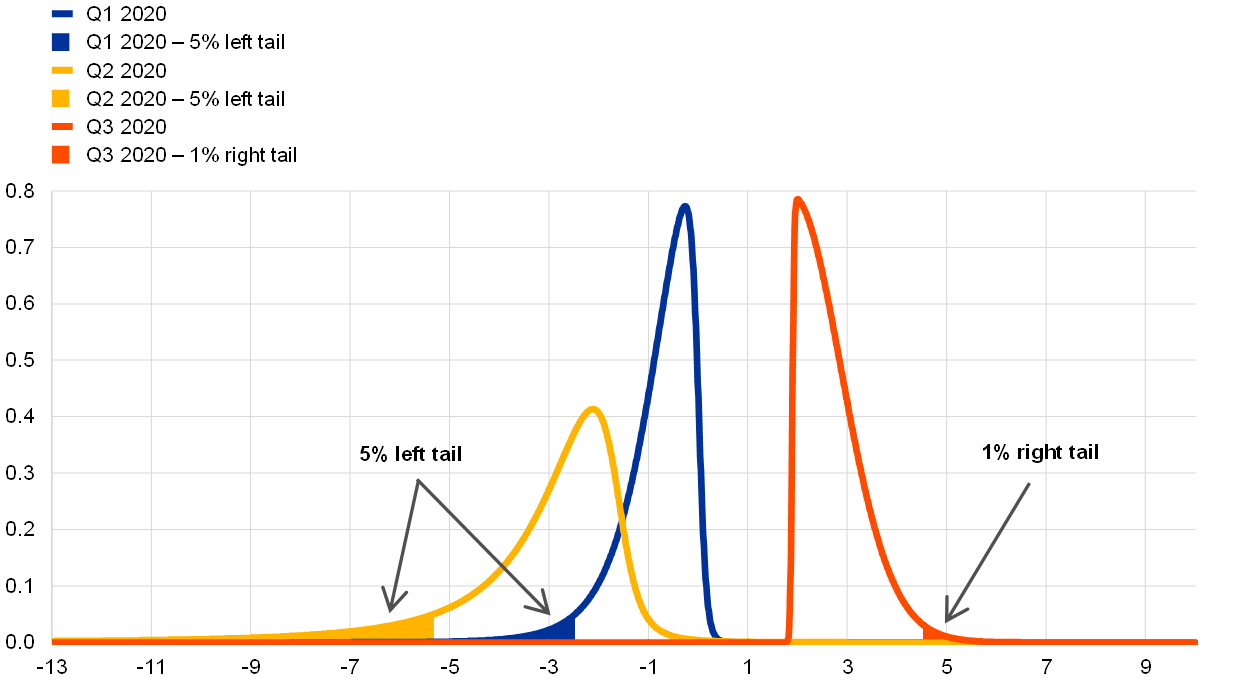

The final approach extracts information from tail events using a non-linear model. Economic variables react heterogeneously in periods of recessions and expansions. To address the non-linearity of the response, we used the GDP-at-risk model, which employs quantile regressions to link each real GDP growth quantile (e.g. the 5th percentile) to selected macro (e.g. the PMI composite output) and financial variables.[8] With regard to the latter, the Composite Indicator of Systemic Stress (CISS) and corporate spreads serve as proxy measures of financial stress and risk premia. The expected value of real GDP growth at the 5% left tail of the conditional distribution was used to forecast the exceptional contraction of activity in the first two quarters of 2020. Conversely, the expected value at the 1% right tail of the conditional distribution was employed to map the unprecedented rebound in real GDP growth in the third quarter. In line with the nature of tail events, the dynamics of economic activity in the first three quarters of 2020 were reasonably well captured in real time by the extreme quantiles of the distribution of real GDP growth (see Chart C). The expected values of these densities computed under the said tails characterise the forecasts by the GDP-at-risk model. These values indicated dramatic declines in euro area real GDP of 2.9% and 11.8% in the first and the second quarters of 2020, respectively, followed by a marked rise of 7.6% in the third quarter (see Chart B).[9]

Chart C

Euro area real GDP growth-at-risk in 2020

(y-axis: probability density; x-axis: percentages, quarter-on-quarter real GDP growth rate)

Sources: Eurostat and ECB staff calculations.

Overall, given the exceptionally high level of uncertainty, the four approaches capture some of the specific features of the pandemic reasonably well. The first two approaches led to real-time forecasts still below the actual very steep V-shaped pattern, however, they captured more effectively the symmetry of the developments in the second and the third quarters of 2020. The second two approaches reflected the extent of the collapse in activity in the second quarter rather well, albeit they did not completely account for the robust rebound in the third quarter, likely owing to the asymmetric reaction by the PMI.

The use of non-standard approaches for the assessment of short-term economic developments in the euro area in the context of COVID-19 warrants caution. On the one hand, some of the tools share the ad hoc nature of the assessment (e.g. selection of extreme quantiles) and of the adjustments to the model specifications (e.g. PMI GDP tracker) to capture the effects of the crisis. On the other hand, some of the non-standard data (e.g. high-frequency indicators, Oxford Stringency Index) are characterised by complex seasonal patterns or very short samples. This implies that the use of each individual tool is subject to a considerable degree of judgment, particularly as to the type of adjustment needed. Some of these tools are specifically tailored to the pandemic shock and may become redundant as economic dynamics normalise. Despite their shortcomings, these tools have significantly improved upon the standard toolkit used for the assessment of euro area real GDP in real time and will continue to be employed to inform the judgment exercised and included in the ECB staff macroeconomic projections and needed to assess the impact of the second wave of the pandemic on the economy. Since a return to “normality” appears unlikely over the short term, the COVID-19-adjusted approaches described are expected to remain insightful for real GDP growth until reaching the stage of widespread immunity.

- See also Lenza, M. and Primiceri, G.E., “How to estimate a VAR after March 2020”, Working Paper Series, No 2461, ECB, August 2020.

- For further details, see also Battistini, N. and Stoevsky, G., “Alternative scenarios for the impact of the COVID-19 pandemic on economic activity in the euro area”, Economic Bulletin, Issue 3, ECB, 2020.

- See also Hale, T., Angrist, N., Cameron-Blake, E., Hallas, L., Kira, B., Majumdar, S., Petherick, A., Phillips, T., Tatlow, H., and Webster, S., “Oxford COVID-19 Government Response Tracker,” Blavatnik School of Government, 2020.

- See Hinge, D., “COVID-19 policy-making and the need for high-speed data”, centralbanking.com, August 2020.

- See Bańbura, M. and Saiz, L., “Short-term forecasting of euro area economic activity at the ECB”, Economic Bulletin, Issue 2, ECB, 2020.

- The linear PMI rule means that real GDP growth equals 10% of the (quarterly average of the) difference of the PMI from 50. For further details on this PMI-based GDP tracker rule, see de Bondt, G.J., “A PMI-based real GDP tracker for the euro area”, Journal of Business Cycle Research, Springer, Centre for International Research on Economic Tendency Surveys (CIRET), Vol. 15(2), December 2019, pp. 147-170.

- A PMI non-linear rule, applied to monthly data, adds the quadratic PMI composite output to the linear rule, with the latter adjusted from 10% to 15%, all of which based on pre-COVID-19 quantile regression estimations using the 10% lowest growth observations. A PMI non-linear rule using a ratio approach means that real GDP growth equals real GDP growth in the previous quarter multiplied by the ratio of a PMI-based measure in the current quarter to its value in the previous quarter. This PMI-based measure is equal to 15% of the (quarterly average of) the difference of the PMI from 50, less 5% of the same difference in the previous quarter.

- See Adrian, T., Boyarchenko, N. and D. Giannone, “Vulnerable Growth”, American Economic Review, 109 (4), 2019, pp.1263-89. For application to the pandemic in a panel setting, see De Santis, R.A. and W. Van der Veken, “Macroeconomic risks across the globe due to the Spanish Flu”, Working Paper Series, No 2466, ECB, November 2020. For application to the euro area, see also Figueres, J.M. and M. Jarociński, “Vulnerable growth in the euro area: Measuring the financial conditions”, Economic Letters, Vol. 191, June 2020.

- The 5% right tail of the conditional distribution forecasts real GDP growth at 5.6% in the third quarter of 2020.