- PRESS RELEASE

ECB report shows card fraud declined in 2019

29 October 2021

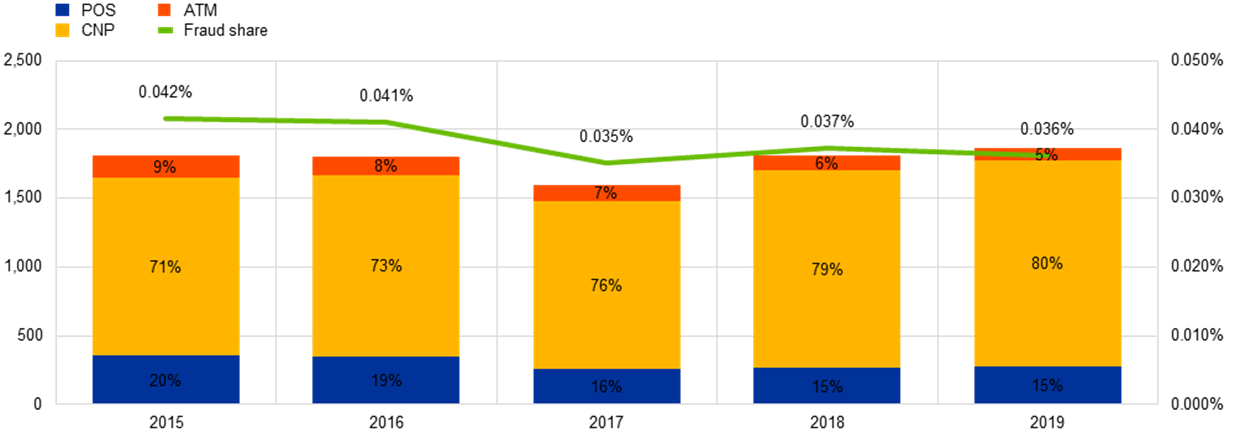

- 2019 registered the second lowest card fraud share since 2007

- 80% of card fraud took place via online and mobile payments, while 15% took place in shops and 5% at ATMs

- Cross-border transactions accounted for 65% of the total value of card fraud

In 2019 the total value of fraudulent transactions involving cards issued in the Single Euro Payments Area (SEPA) (which is made up of the EU Member States, Switzerland, Iceland, Lichtenstein and Norway) amounted to €1.87 billion out of a total value of all card transactions of €5.16 trillion. This means that 3.6 cents in every €100 spent using credit and debit cards were lost to fraud in 2019. This is the second lowest fraud share recorded since the start of data collection in 2007.

The Eurosystem’s seventh report on card fraud, which analyses statistical information on card payment transactions and fraud in the euro area, reveals that 80% of fraudulent card transactions in 2019 resulted from so-called card-not-present (CNP) payments, which are mainly carried out via online or mobile transactions. Compared with 2018, the value of CNP fraud increased by 4.3%. Fraudulent transactions at point-of-sale (POS) terminals and automated teller machines (ATMs) accounted for 15% and 5% respectively of the total value of card fraud in 2019.

Fraud committed at POS terminals was slightly higher, increasing by 2.2% in 2019, while fraud committed at ATMs decreased by 6.1%. The decline in fraud at ATMs was driven by a notable decline in fraudulent transactions involving counterfeit cards acquired outside SEPA, as the increasing global adoption of “chip and pin” technology (the EMV standard) has further reduced opportunities for committing fraud using cards with a counterfeit magnetic stripe.

Total value of card fraud using cards issued within SEPA

(left-hand scale: total value of fraud (EUR millions); right-hand scale: value of fraud as a share of the value of transactions)

Source: All reporting card payment scheme operators

The report also reveals that 65% of all fraudulent transactions conducted worldwide in 2019 using cards issued in SEPA involved cross-border payments (compared with 64% in 2018).

Looking ahead, the market-wide implementation of the Regulatory Technical Standards for strong customer authentication and common and secure open standards of communication under the revised Payment Services Directive (PSD2)[1] could further reduce card fraud in Europe. Nevertheless, raising awareness and protecting secure communication between payment service providers and end-users remain key, as criminals continue to target card holders, especially in a world that increasingly relies on contactless and online payments in the wake of the coronavirus (COVID-19) pandemic.

The Eurosystem will continue to monitor developments in payment fraud and the security of card payments and payment schemes, supported by the collection of detailed and comprehensive statistical information.

For media queries, please contact Georgina Garriga Sánchez, tel.: +39 69 1344 95368

- These enhanced security standards, drafted by the European Banking Authority and the ECB, came into force in September 2019 with an implementation deadline of 31 December 2020 for e-commerce card-based payment transactions. The initial results of their implementation by individual card payment schemes appear encouraging, although it is too early to draw market-wide conclusions.

Banco Central Europeo

Dirección General de Comunicación

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Alemania

- +49 69 1344 7455

- media@ecb.europa.eu

Se permite la reproducción, siempre que se cite la fuente.

Contactos de prensa