BIS triennial survey 2007

The Triennial Central Bank Survey conducted in April 2007 by 54 central banks and monetary authorities and coordinated by the Bank for International Settlements (BIS) is the third comprehensive assessment of foreign exchange and derivatives market activity since the introduction of the euro in 1999. The BIS is today publishing preliminary global results. The final overall findings of the survey will be published by the BIS in December 2007.

For the second time now, the BIS has also collected separate data for trades conducted in the euro area as a whole. This press release concentrates on the euro area data, while the national central banks of the Eurosystem are releasing their own national results.

1. Traditional foreign exchange markets

The 2007 survey shows an unprecedented rise in global activity on traditional foreign exchange markets compared with 2004. Average daily turnover rose from USD 1,880 billion in April 2004 to USD 3,210 billion in April 2007, an increase of 71% at current exchange rates.

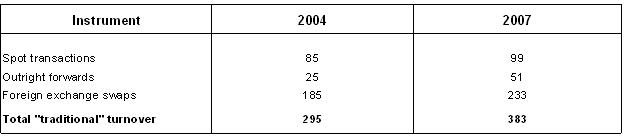

Based on provisional data, the average daily turnover for traditional foreign exchange instruments (i.e. spot transactions, outright forwards and foreign exchange swaps) traded by counterparties in the euro area was estimated at a level of USD 383 billion ( see Table 1), 30% above the level estimated for April 2004. This amount represents approximately 10% of the overall market volume in net terms (i.e. net of the double-counting of transactions with reporting dealers within the euro area). This compares with market share figures of 34% for counterparties in the United Kingdom, 17% for counterparties in the United States and 6% for counterparties in Japan. Within the euro area, most foreign exchange transactions were conducted between reporting dealers, rather than with other financial institutions or non-financial customers. Inter-dealer trading represented 65% of turnover in the euro area ( see Table 2), which was much higher than the 43% reported at the global level.

At the global level, the euro was the second most actively traded currency in April 2007, as it was on one side of 37% of all foreign exchange transactions. The most traded currency was the US dollar with an 86% share. The Japanese yen, with less than 17%, was third and the pound sterling fourth, with 15%. While the euro’s share stabilised between April 2004 and April 2007 after the sharp decline observed between 1998 and 2001 attributable to the elimination of trading in the legacy currencies of the euro following the introduction of the euro in 1999, the share of the US dollar and the other two major currencies declined further between April 2004 and April 2007.

Globally, the euro continued to be traded predominantly against the US dollar, with that currency pair representing 74% of foreign exchange turnover involving the euro. Indeed, the euro/dollar currency pair remained the most actively traded pair, accounting for 27% of global turnover. However, this was somewhat lower than the 28% share recorded in April 2004. At the same time, the combined market share of other currency pairs involving the euro remained small (accounting for 10% of global turnover), reflecting the fact that the US dollar remained the main vehicle currency in the foreign exchange markets.

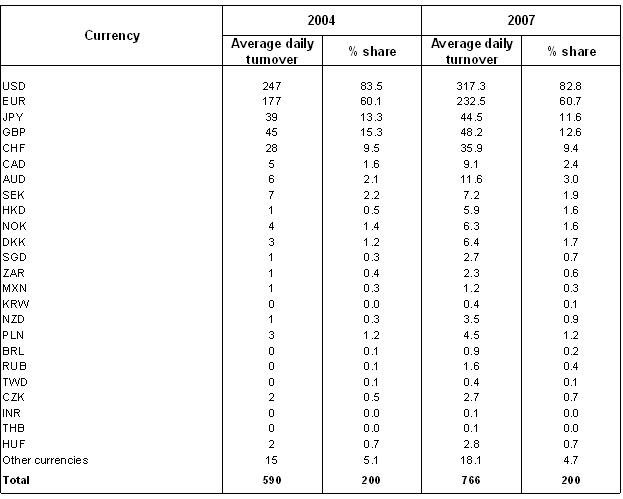

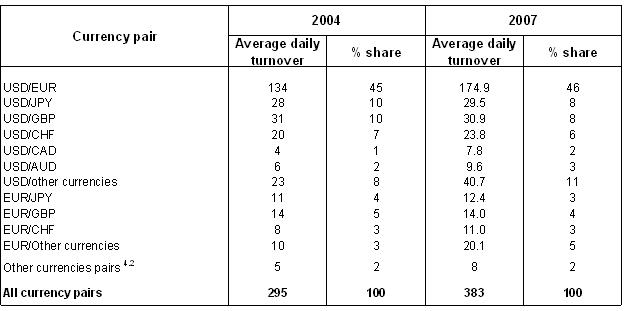

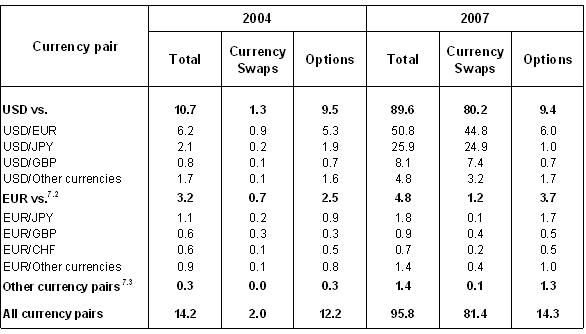

The US dollar was also the most traded currency in the euro area, being involved in 83% of foreign exchange transactions ( see Table 3). The euro was involved in 61% of foreign exchange transactions performed by euro area counterparties and was predominantly exchanged against the US dollar, that currency pair accounting for 46% of euro area foreign exchange turnover ( see Table 4).

2. OTC derivatives markets

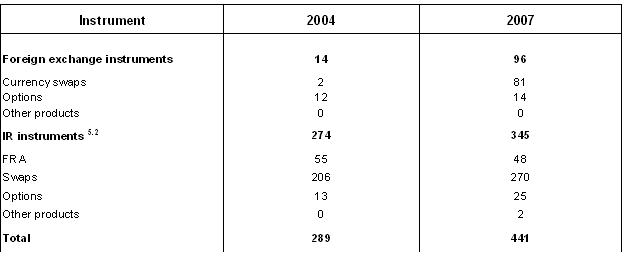

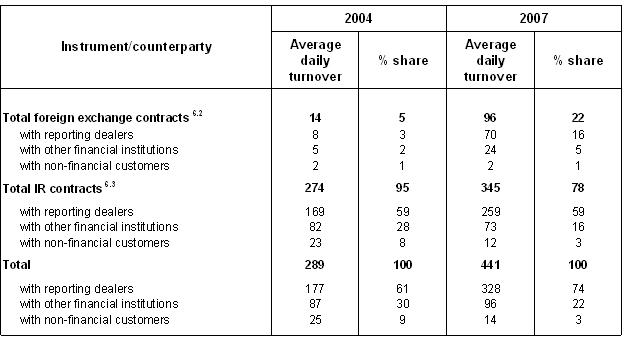

The average daily turnover for over-the-counter (OTC) derivatives, which include foreign exchange contracts, such as currency swaps and options, and interest rate instruments, was significantly higher in April 2007 than in April 2004; overall OTC derivatives turnover rose from USD 1,220 billion in 2004 to USD 2,090 billion in 2007. Based on preliminary data, deals by euro area counterparties totalled around USD 441 billion in April 2007 ( see Table 5), 53% above the level estimated for April 2004. This represented around 21% of the total reported OTC derivatives turnover in net terms (i.e. net of the double-counting of transactions with reporting dealers within the euro area). This share compared with 43% for counterparties in the United Kingdom, 24% for counterparties in the United States and 4% for counterparties in Japan. Interest rate derivative instruments were by far the most widely used instruments in the euro area ( see Table 5). Unlike in April 2004, however, they were less dominant at the euro area level than at the global level. In the euro area, foreign exchange derivatives contracts and interest rate contracts accounted for respectively 22% and 78% of overall turnover from derivatives contracts, while at the global level they made up 14% and 81% of turnover respectively (there is an estimated gap in reporting of around 5%). OTC derivatives transactions in the euro area ( see Table 6) were mostly conducted between reporting dealers (74%). The share of turnover between reporting dealers was significantly higher in the euro area than globally (46%). On the other hand, trading between reporting dealers and other financial institutions represented 22% of euro area turnover, which was lower than the 44% reported at the global level.

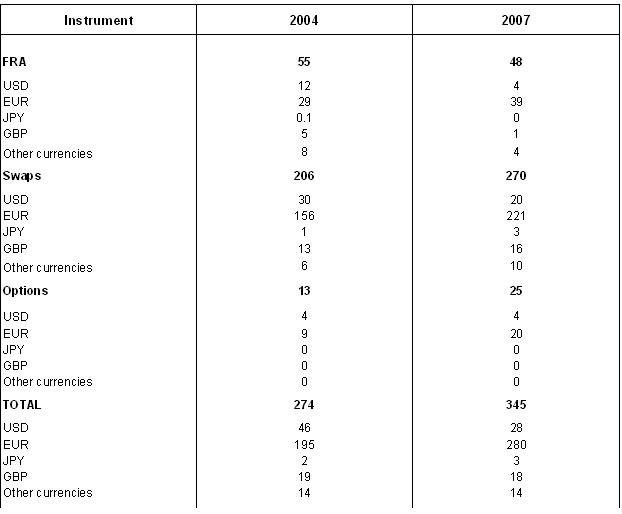

Trading in OTC interest rate derivatives continued to increase significantly compared with previous surveys. The euro again accounted for the largest share of global daily average turnover (39%), although its share was lower than in the previous survey (45%). The interest rate swap denominated in euro saw its global turnover increase by 83% between April 2004 and April 2007 and remained the most actively traded OTC derivative instrument. It accounted for 31% of global OTC derivative instrument turnover and 64% of the trades performed by euro area counterparties ( see Table 8).

Table 1: Provisional euro area foreign exchange market turnover

(daily averages in April 2004 and April 2007 in USD billions) 1

1 Adjusted for local double-counting.

Table 2: Provisional reported euro area foreign exchange market turnover by instrument and counterparty ( daily averages in April 2004 and April 2007 in USD billions) 2

2 Adjusted for local double-counting.

Table 3: Currency distribution of provisional reported euro area foreign exchange market turnover ( daily averages in April 2004 and April 2007 in USD billions and percentages) 3

3 Because two currencies are involved in each transaction, the sum of the percentage shares of individual currencies totals 200% instead of 100%. The figures relate to reported “net-gross” turnover, i.e. they are adjusted for local double-counting.

Table 4: Provisional reported euro area foreign exchange turnover by currency pair ( daily averages in April 2004 and April 2007 in USD billions and percentages) 4.1

4.1 Adjusted for local double-counting. 4.2 Excluding the US dollar and the euro

Table 5: Provisional euro area OTC derivatives market turnover by instrument ( average daily turnover in April 2004 and April 2007 in USD billions; notional amounts) 5.1

5.1 Adjusted for local double-counting. 5.2 Single-currency interest rate contracts only.

Table 6: Provisional euro area OTC derivatives turnover by counterparty ( daily averages in April 2004 and April 2007 in USD billions and percentages) 6.1

6.1 Adjusted for local double-counting. 6.2 Currency swaps and options. 6.3 Single-currency interest rate contracts only.

Table 7: Provisional reported euro area OTC foreign exchange derivatives turnover by currency pair ( daily averages in April 2004 and April 2007 in USD billions) 7.1

7.1 Adjusted for local double-counting. 7.2 Excluding the US dollar. 7.3 Excluding the US dollar and the euro

Table 8: Provisional reported euro area OTC interest rate derivatives turnover by currency ( daily averages in April 2004 and April 2007 in USD billions) 8

8 Adjusted for local double-counting. Single-currency interest rate contracts only.

Banco Central Europeo

Dirección General de Comunicación

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Alemania

- +49 69 1344 7455

- media@ecb.europa.eu

Se permite la reproducción, siempre que se cite la fuente.

Contactos de prensa