Enhancing the monetary analysis

Speech by Jürgen Stark, Member of the Executive Board of the ECBat the conference ‘The ECB and its Watchers IX’, Frankfurt am Main, 7 September 2007

[1]Ladies and Gentlemen,

It is a great pleasure for me to be here today at the ninth in this series of conferences entitled ‘The European Central Bank and its Watchers’. Over the past decade, this series has proved to be an important forum for constructive debate about monetary policy in Europe – a tradition that I hope will continue today.

To dwell shortly on the conference’s title, the organisers have chosen to distinguish clearly between, on the one hand, those responsible for the conduct of monetary policy and, on the other, those who observe and comment upon it. Understandably, the perspectives and priorities of these two groups might be quite different at times, as will no doubt become apparent in the course of today’s proceedings.

Let me illustrate with a short example. Drawing on the latest academic research, watchers often advise central banks pursuing price stability to ‘Just do it’. [2]

No doubt, this is sound advice. Indeed, it points to an important principle, namely that monetary policy – and thus monetary policy makers – ultimately determine the rate of inflation and, by implication, whether price stability is maintained.

But viewed from my office in the Eurotower, this advice – although sound – does not seem very relevant or useful. Like all my colleagues on the Governing Council, I am aware of the responsibilities conferred upon me by the Treaty. Collectively we act, in word and deed, to pursue our primary objective, the maintenance of price stability.

Being reminded of our responsibilities is not harmful. But neither is it very helpful. What we seek is practical guidance for taking monetary policy decisions that serve the achievement of our objective. In response to your advice to ‘just do it,’ our natural response is ‘how?’

1. Introduction

This brings me to the topic of my comments this morning – enhancing the monetary analysis. No other aspect of our monetary policy has been the subject of such intense debate over the past decade, in this and other fora. But I wonder whether this debate has generated more heat than light.

Opinions have become polarised. Some watchers argue that monetary analysis is irrelevant or even misleading. Other watchers argue for the adoption of monetary targeting, with interest rate geared to achieving a certain rate of money growth. What observers of the ECB have failed to provide is practical guidance about the conduct of monetary analysis and interpretation of monetary developments that is useful to policymakers.

The staff of the ECB and the Eurosystem have had to fill this breach. Today, I will describe the results of some of their work and how we have used it in our policy deliberations.

I will start by outlining a number of key empirical regularities relevant for monetary analysis. These empirical features have remained robust over the past two hundred years and continue to be so today. They provide a simple, yet powerful illustration of the economic principles underlying our monetary policy strategy. I will then tackle the crucial issue for applied monetary policy-making, namely the operationalisation of – and, in particular, the real time use of – monetary analysis for monetary policy purposes. After briefly reviewing the performance of monetary analysis in recent years, I will sketch the avenues that are currently being pursued to enhance the monetary analysis in the future. I hope that outlining our agenda in this way will act as a catalyst, engaging watchers and academics in a wider research effort to deepen and broaden our understanding of monetary developments and their implications.

2. A picture is worth a thousand words

Underlying the institutional framework for monetary policy in Europe is the neutrality of monetary policy in the longer run.

Monetary policy cannot affect real variables at long horizons. At these horizons, monetary policy only determines nominal variables, notably the price level and therefore the rate of inflation.

We should be cautious about using the word ‘only’ in this context. Experience has demonstrated the considerable economic and social costs incurred when inflation runs out of control. Price stability is therefore the primary objective of the ECB, and the Governing Council has been assigned the responsibility for conducting monetary policy in pursuit of this goal. This much is consensus among economists, be they academics, practitioners or central bankers.

Since monetary policy can ultimately only determine nominal variables, it is crucial that it be conducted within a nominal framework. A central bank that looked exclusively at real variables runs the risk of missing underlying nominal trends. Such trends may play little role in determining inflation one or two years ahead but – because of their persistence – can lead to a gradual, but lasting, drift of inflation away from levels consistent with price stability. Cross-checking the cyclical analysis focused on demand and cost dynamics with an assessment of longer-term nominal trends is therefore key. This is reflected in the ECB’s monetary policy strategy.

This begs the question of which nominal variables should be used to assess these longer-term nominal trends. Monetary developments are a natural candidate for a central bank that, ultimately, is the monopoly provider of base money. But, in practice, I recognize that this is an empirical question.

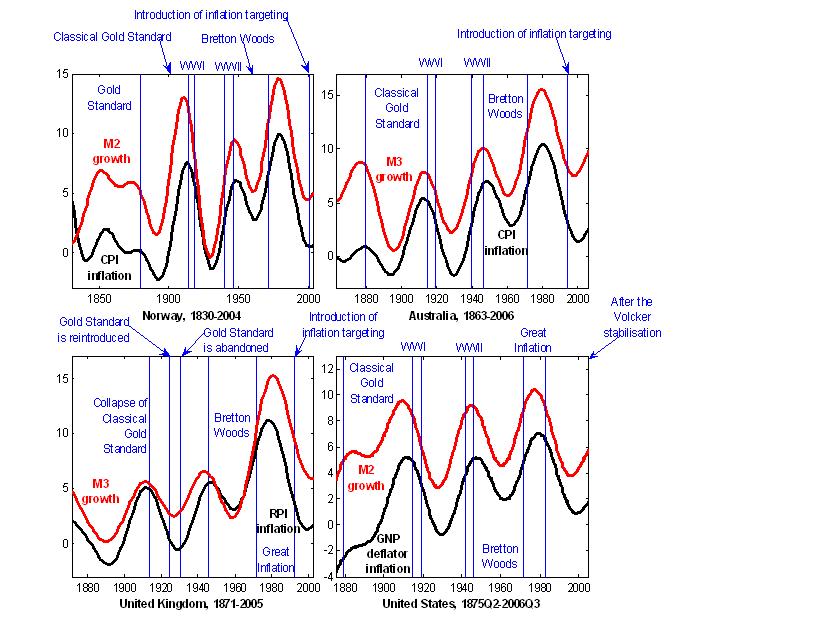

As the old adage says: ‘A picture is worth a thousand words’. Figure 1 shows the close and robust relationship between the trend components of inflation and money growth over very long periods for a selection of countries (Norway, since 1830; Australia, since 1863; the United Kingdom, since 1871; and the United States, since 1875). Over the past two centuries, upswings or downswings in trend money growth [3] have almost always been followed, a few years later, by swings in the same direction in trend inflation. [4]

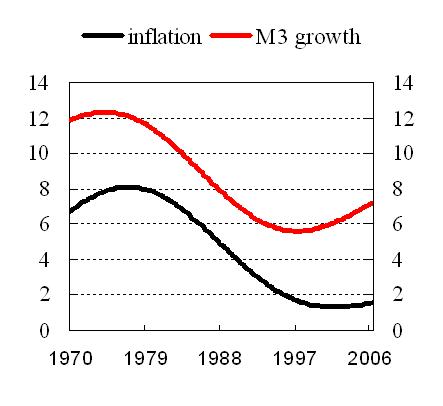

An important point to stress is that, as the figure makes clear (and as additional evidence for other countries confirms), the most recent period has not exhibited, in this respect, any difference whatsoever compared with the distant past. Indeed, if we focus on the euro area over the past thirty years, broadly the same empirical regularities emerge.

On the basis of this picture, I wish to stress three crucial points.

First, the relationship between trend money growth and trend inflation has remained intact over the past two centuries, across a variety of different monetary policy regimes. Furthermore, as I have already stressed, the data for recent years exhibit the same regularities, including for the euro area (see Figure 2). This suggests that this feature of the data is ‘hardwired’ into the deep structure of the economy. Thus, on empirical grounds, the relationship between monetary growth and inflation appears invulnerable to the well-known Lucas critique. [5] In other words, the observed empirical relationship is structural in nature and does not disappear as policy shifts from one regime to another.

Second , Figure 1 demonstrates – contrary to some recent literature [6] – that the relationship between money growth and inflation remains strong even in countries with low rates of average inflation. None of the four countries shown in Figure 1 have endured extreme events, such as hyperinflations, during the twentieth century – yet the relationship endures.

Finally – and crucially – a careful analysis of the series plotted in Figure 1 reveals that developments in trend money growth lead developments in inflation by roughly 2-3 years Therefore, by analyzing monetary developments – and, in particular, by identifying surges in trend money growth – a central bank can implement a policy that serves to contain the inflationary pressures stemming from the underlying nominal trends identified by the monetary analysis before they become manifest in inflation itself.

These three crucial and robust features of the data motivate the ECB’s monetary analysis and determine how it has been pursued in practice.

But before discussing in greater detail how these results should be operationalised and applied in a policy making context, allow me first to make a number of comments on the relationship between our framework and the so-called standard New-Keynesian model, which currently holds sway in many academic discussions of monetary policy. This model accords no meaningful role to money.

Although such models can replicate the long-run relationship between money growth and inflation that we see in the data, they do not replicate one crucial feature of that relationship, namely the lead of trend money growth over trend inflation. In a standard New-Keynesian model – the workhorse of much recent academic investigation on monetary policy – trend money growth moves contemporaneously with trend inflation, or even lags it, rather than leading it by 2-3 years. [7] This peculiar property of the New Keynesian model standard in the academic literature is at odds with the empirical evidence from the last two hundred years (shown in Figure 1).

This point is worth emphasizing. Suppose I observe a strong upward trend in monetary growth. On the basis of the standard New Keynesian model, this would not signal any subsequent upside risk to inflation. An analysis of monetary developments based on such a model would therefore inevitably be “behind the curve”, and unhelpful from a policy makers’ perspective. However, in reality every persistent upsurge in trend money growth has been followed by an upsurge in trend inflation. This feature of the data has remained broadly unchanged across various radically different monetary policy regimes.

The in ability of the standard New Keynesian model to replicate this key feature of the data drives from its structure, which assumes that the monetary aggregates play a purely residual role. In other words, money is influenced by other variables, but it does not influence them in any way. If you accept the model’s intrinsic logic, then you ought to accept its key implication: money has no special role in monetary policy analysis.

But such logic seems flawed. As is reflected in ongoing research by ECB staff (to which I will return later), there are many reasons why monetary variables may play an active role in the transmission of monetary policy and thus serve to determine, at least in part, macroeconomic outcomes, rather than just respond to them. Moreover, such research offers reasons why monetary developments may lead inflation, as implied by the data. What is worse, the model artificially trivializes the role of monetary analysis – “artificially” in the sense that money is marginalized on the basis of an ex ante assumption, rather than on the basis of anything observed in the data.

Within the standard New-Keynesian framework, movements in inflation that persist beyond the business cycle are “explained” as the result of variations in the central bank’s inflation objective. The policy advice stemming from this framework is the admonition to ‘just do it’ that I have already mentioned. Surges in inflation like we saw globally in the 1970s are thus seen as something that was desired by the central bankers of the time.

For me, such analysis does not quite ring true. A more plausible explanation is that even well-intentioned central bankers can sometimes make mistakes. In seeking to avoid the mistakes of the past, today’s policy makers seek robust early indicators of upward trends in inflation. The empirical evidence points to money as being among the foremost of such indicators. Monetary analysis therefore remains crucial in the credible pursuit of price stability.

3. Monetary analysis in practice: The real-time dimension

Monetary policy decisions necessarily have to be taken in ‘ real time’, on the basis of the data and the models available at the moment of decision. In this context, uncertainty about data and models abounds. The stylised relations between trend money growth and trend inflation shown in Figure 1 cannot be used directly by the policy maker.

In practice, central bank monetary analysis must therefore form an assessment of the current underlying or trend rate of monetary expansion in real time, in order to draw inferences about what this implies for the future trend rate of inflation.

While such an approach embraces the robust empirical relationships I have already discussed, it has to be operationalised and employed in a pragmatic way. An apparatus needs to be developed in order to translate the robust underlying empirical regularities into practical guidance for interest rate decisions. Choices have to be made about which measures of money to follow. Assessments have to be made of how these measures may have been affected by temporary factors that cause them to deviate from the underlying trend rate of monetary expansion.

All this requires a broad-based approach , [8] which embodies three main elements:

First , rather than focusing exclusively on developments in headline M3 growth in relation to the Eurosystem’s reference value – as the ECB’s monetary analysis is sometimes erroneously characterised – the broad-based approach to monetary analysis draws on the fullest possible set of monetary, financial and economic information. The components, counterparts and sectoral composition of M3 and other monetary and credit aggregates are studied in detail, in conjunction with other financial flows deriving from the financial accounts. Financial market developments and yields are assessed for the implications they have for monetary conditions – an assessment that is likely to be central to our analysis in the coming months given recent events. Broader macroeconomic developments and data are also assessed to the extent that they are informative about the portfolio, financing and spending decisions that influence monetary and credit dynamics.

Second , the broad-based approach employs a suite of empirical models of various types, including money demand equations, time series indicator models and structural general equilibrium models. These models are used to explain developments in money and credit variables, identify unusual innovations in these variables and assess their possible implications for price developments and the broader macroeconomic and financial outlook.

Third , the model-based analysis is complemented by the use of informed judgement, which builds in particular on the Eurosystem’s assessment of the structural evolution of the financial and monetary sectors of the economy. On the basis of a detailed analysis of changes in the banking and financial sector, ECB staff can identify product and technical innovations that are likely to impact monetary and credit dynamics and embody their implications in the overall assessment of the monetary data.

These pragmatic tools are employed within a structured analytical framework that ensures both internal coherence of the diverse constituent elements of the comprehensive analysis and consistency over time. Specifically, all the tools are used to derive the best real time assessment of the current underlying rate of monetary expansion that – on the basis of the empirical regularities I have discussed – is robustly linked to longer-term inflationary trends.

Within such a framework, we extract the policy-relevant information contained in monetary developments that is key to ensuring that trend inflation remains consistent with price stability. This has certainly been the experience of the ECB over the past 8½ years.

To illustrate, allow me to refer briefly to two important examples from recent years that highlight how such a broad-based approach to monetary analysis has worked in practice.

If you like, one can see these episodes as the two ‘ big calls’ monetary analysis has had to make during the first years of Monetary Union: how to interpret the two surges in monetary growth that took place from mid-2001 to early 2003 and from mid-2004 to end-2005.

In the first period, we attributed the strong broad money growth observed in late 2001 to portfolio shifts into liquid monetary assets at a time of heightened economic and financial uncertainty. Such portfolio shifts were seen as temporary. The surge in M3 growth was thus viewed as unrepresentative of the underlying rate of monetary expansion and, as such, rather benign in terms of the outlook for price stability. Strong headline M3 growth was therefore not an impediment to the cuts in interest rates that took place from 2001.

In the second period , the surge in monetary growth in 2005 was attributed to strong credit growth driven by the prevailing favourable financing conditions, in turn supported by financial innovations that eased the supply of bank credit. Such dynamics were viewed as more representative of the underlying rate of monetary expansion and thus seen as of potential concern for the outlook for price stability. As has been emphasised by the President in the past, the intensification of these concerns in the course of 2005 was one of the factors underlying the Governing Council’s decision to commence withdrawing monetary policy accommodation in December 2005.

With the (considerable) benefit of hindsight, the real time judgement underlying these two “big calls” has broadly been proved correct. The implementation of the single monetary policy on the basis of the ECB’s strategy has proved very successful. Inflation rates in the euro area have been brought down to and maintained at low levels by historical standards. Crucially, the ECB has successfully managed to stabilise longer-term private inflation expectations at historically low levels.

As is illustrated by these examples, my answer to the question whether monetary analysis contributed to this success of the monetary policy of the ECB is a clear yes, albeit with a weight that varied over time.

4. The way forward for monetary analysis

But our past success means does not mean that we can afford to be complacent. To quote Winston Churchill, “ success is not final”.

For a decision maker, success in the past is not a sufficient guarantee of success in the future. Past success may even be dangerous. It might lead to the fallacious assumption that medium- to longer-term price stability can be taken for granted, freeing central banks to concentrate solely on the smoothing of inflation and output around a secure and stable steady-state.

It is thus important to stay continuously vigilant, all the more so after a period of success. Vigilance has to be exercised not only for the identification of risks to price stability, but as well for the tools we use to identify those risks, as tools are likely to change over time. For example, financial innovation may change the transmission of monetary policy or the appropriate measurement of monetary liquidity.

In the case of monetary analysis, I see the need to pursue work along four avenues, in order to stay fit for the challenges in the future.

First, further work is required on money demand models for the euro area. Standard specifications embodying the conventional determinants of money demand cannot account for monetary developments in recent years. A natural avenue for further work is therefore to refine and extend money demand models so as to improve understanding of the recent behaviour of monetary aggregates.

In this context, we must recognise that the adequate measurement of money may evolve over time to take into account a changing financial landscape. We must continually check and constructively question the statistical measurement of money and monetary liquidity in order to refine our assessment of the policy-relevant underlying monetary dynamics, which are not tied to the aggregation of a fixed money holding sector, nor tied to fixed asset classes.

A number of exercises are being pursued in this regard. Sectoral analysis of money demand is particularly promising, [9] especially given the increased importance of non-monetary financial institutions in monetary developments that has emerged in recent years, in part as a consequence of financial innovation such as loan securitisation. Given the different transmission channels of different money holding sectors, a deepening of the current analysis in this respect is likely to increase our understanding of aggregated money demand. Moreover, including wealth as a determinant of money demand – and, more generally, placing the demand for money in the context of broader private portfolio decisions – is a promising and ongoing line of work. In turn, this will require a better understanding of the opportunity costs of holding money and the impact of risk and uncertainty on portfolio choices.

Second , to synthesise and summarise information derived from the ECB’s broad-based monetary analysis and to emphasise the use of monetary analysis as a guide to policy decisions aimed at the maintenance of price stability, it has proved useful to construct money-based inflation risk indicators. [10] These can help to summarise, in an easy-to-understand-way, the inflationary or deflationary risks identified by the broad-based, multidimensional and therefore necessarily somewhat complex monetary analysis.

Ongoing work aims at improving the transparency, clarity and robustness of such indicators. One promising approach is the employment of Bayesian techniques (which allow introducing judgmental adjustments into the indicators in a more structured manner). Attempts to embody large data sets and tools such as factor models in the analysis are also underway. In adopting these techniques, we introduce a number of methodological approaches that are commonplace in the economic analysis into the monetary analysis, thereby seeking to benefit from the experience gained.

Third , we continue to be at the forefront of introducing an active role for money and credit in structural general equilibrium models, thereby extending the standard new Keynesian framework I discussed earlier so as to address some of the specific critiques of that framework that I have raised. Such an approach allows the impact of financial frictions and factors on the cyclical behaviour of the economy – which are not embodied in the current benchmark academic models – to be assessed. [11]

By extending standard models in this way, we at least start to develop frameworks that can begin to replicate the key regularities in the data on which many of my earlier comments relied, in particular the robust and enduring lead of trend money growth over trend inflation.

Fourth , it is important to deepen further the framework for cross-checking information and analysis stemming from the monetary and economic analyses. While cross-checking is ultimately necessarily the responsibility of policy makers who have to take a single interest rate decision on the basis of several inputs, building tools and methods to enhance and deepen this process is desirable. As yet, we are far from developing a comprehensive and encompassing model of the economy that embodies all real, monetary and financial factors and the interactions among them. Consequently, adopting a diversified approach to analysing data and cross-checking among the various analyses is necessary for successful policy design.

A number of promising avenues are being pursued. The integrated sectoral accounts for the euro area provide one statistical framework for comparing economic and monetary data. More importantly, the relationship between monetary and credit dynamics, on the one hand, and asset prices, on the other, is one that is receiving increased attention. Recent research at the ECB has shown that monetary dynamics influence asset prices and thus also macroeconomic dynamics. [12]

I have confidence that pursuing such a - doubtlessly demanding – analytical and research agenda will successfully improve our work as policy makers, allowing us to continue to state with full confidence: Money matters in monetary policy making.

5. Concluding remarks

Overall, having experienced the challenges we faced in recent years, I currently do not see a single convincing theoretical framework that can replace the successful two pillar strategy of the ECB, let alone a practical apparatus that could be applied to real time policy making.

The prominent role for money provides an explicit nominal framework within which underlying or persistent nominal trends in the economy can be identified and addressed, even if the business cycles do not point to inflation pressures. Cross checking between the economic and monetary analyses provides robustness to policy decisions by ensuring that a variety of models and views of the inflation process are entertained, thereby avoiding reliance on one model-specific view of “rationality”.

This framework remains currently the best possible way to guarantee that money is accorded the appropriate relevance – recognised by most applied policy makers and practitioners – in a transparent and lasting way, avoiding the temptation to use money opportunistically when it suits.

Against this background, the question of whether or not to monitor money and credit developments strikes policy makers – and, especially in the current financial market circumstances, any analyst linked to the financial markets – as odd.

As I have demonstrated, at the ECB we are not lagging behind the latest academic work on monetary analysis and monetary policy. Rather mainstream academic work is lagging reality. As the current agenda of ongoing research to enhance the monetary analysis demonstrates, the ECB is in the vanguard of developing tools to conduct the “new and enlightened” monetary analysis that underpins our strategy.

I invite all of you here today to join us in this quest. Together we can and should be the pioneers in developing the new tools for monetary analysis that are required to address the rapidly changing economic and financial environment.

I thank you for your attention.

References

Adalid, R. and C. Detken (2007), Liquidity shocks and asset price boom/bust cycles, ECB Working Paper No. 732.

Benati, Luca (2007), ‘Money, Inflation, and New Keynesian Models’, European Central Bank Working Paper, forthcoming

Bruggeman, A., G. Camba-Méndez, B. Fischer and J. Sousa (2005), Structural filters for monetary analysis: the inflationary movements of money in the euro area, ECB Working Paper No. 470.

Christiano, L., R. Motto and M. Rostagno (2007): “Shocks, Structures or Policies? The EA and the US after 2001”, forthcoming in the Journal of Economic Dynamics and Control.

Christiano, Lawrence J., and Fitzgerald, Terry (2003), ‘The Band-Pass Filter’, International Economic Review, 44(2), pp. 435-465

DeGrauwe, Paul, and Polan, Magdalena (2005), ‘Is Inflation Always and Everywhere a Monetary Phenomenon?’, Scandinavian Journal of Economics, 107(2), 239-259.

Detken, C. and F. Smets (2004) “Asset price booms and monetary policy”, published in: Horst Siebert (ed.), “Macroeconomic Policies in the World Economy”, Springer, Berlin, 2004.

ECB (2007) “Interpreting monetary developments since mid 2004”, ECB Monthly Bulletin, July.

ECB (2004) “Monetary analysis in real time”, ECB Monthly Bulletin, October.

Fischer, B., M. Lenza, H. Pill and L. Reichlin (2006), “Money and monetary policy: the ECB experience 1999-2006”, forthcoming in “The role of money: money and monetary policy in the 21st century”, ed. A. Beyer and L. Reichlin.

Lucas, Robert E., Jr. (1976), ‘Econometric Policy Evaluation: A Critique’, Carnegie-Rochester Conference Series on Public Policy, 1, pp. 19-46

Lucas, Robert E., Jr. (1996), ‘Nobel Lecture: Monetary Neutrality’, Journal of Political Economy, 104(4), pp. 661-82

Lucas, Robert E., Jr. (2006), ‘Remarks’ delivered at ‘Monetary Policy: A Journey from Theory to Practice - An ECB Colloquium Held in Honour of Otmar Issing’, Frankfurt am Main, 16 - 17 March 2006

McCallum, B. (1995), ‘Two fallacies concerning central bank independence’, American Economic Review, Papers and Proceedings, vol 85, 207-22.

Nelson, Edward (1998), ‘Sluggish Inflation and Optimising Models of the Business Cycle’, Journal of Monetary Economics, 42, pp. 303- 322

Uhlig, H. (2007), Discussion of the papers “Monetary policy and stock market boom-bust cycle” by L. Christiano R. Motto and M. Rostagno and “Is money important for monetary policy?” by M. Woodford, at the 4th ECB Central Banking Conference on 9/10 November 2006, see http://www.ecb.europa.eu/events/pdf/conferences/cbc4/Discussion_Uhlig.pdf

Von Landesberger, J. (2007), Sectoral money demand models for the euro area based on a common set of determinants, ECB Working Paper No. 741.

Figure 1 Trend components of inflation and money growth since the Gold Standard era for Norway, Australia,the United Kingdom, and the United States (source: Benati, 2007)

Figure 2 Trend components of inflation and money growth since 1970 in the euro are (source: Benati, 2007)

-

[1] This draft has been prepared by L. Benati and B. Fischer with substantive contributions from H. Pill and M. Rostagno. Helpful comments from J.-P. Vidal are acknowledged.

-

[2] McCallum (1995), Uhlig (2007).

-

[3] The trend components of money growth and inflation have been extracted via a standard statistical filter – see Christiano and Fitzgerald (2003) – and are defined as the very slow-moving components of the two series.

-

[4] See Benati (2007); Bruggeman et al (2005).

-

[5] See Lucas (1976).

-

[6] De Grauwe and Polan (2005), for example, have stated that ‘ [t]he relation between inflation and money growth for low-inflation countries [...] is weak, if not absent’

-

[7] This is shown in Benati (2007, Section 3) based on estimated New Keynesian models, a standard specification for the demand for real balances, and several alternative configurations of the parameters of the monetary policy rule. This problem of New Keynesian models was pointed out by Nelson (1998), but because of the academic profession’s move away from money in recent years, it has been essentially ignored.

-

[8] See ECB (2004); ECB (2006).

-

[9] See von Landesberger (2007).

-

[10] See Fischer et al. (2007).

-

[11] See Christiano et al. (2007).

-

[12] See Detken and Smets (2004); Aladid and Detken (2007).

Banco Central Europeo

Dirección General de Comunicación

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Alemania

- +49 69 1344 7455

- media@ecb.europa.eu

Se permite la reproducción, siempre que se cite la fuente.

Contactos de prensa