Frequently asked questions on incorporating climate change considerations into corporate bond purchases

Updated on 8 January 2025

On 4 July 2022 the ECB announced the incorporation of climate change considerations into the Eurosystem’s purchases of corporate sector securities, encompassing both the corporate sector purchase programme (CSPP) and pandemic emergency purchase programme (PEPP) corporate bond holdings. With these measures, the Eurosystem aims to gradually decarbonise its corporate bond holdings on a path aligned with the goals of the Paris Agreement. To that end, as of October 2022, the Eurosystem started to tilt its purchases towards issuers with a better climate performance. Additionally, on 2 February 2023 the Governing Council decided that the Eurosystem’s corporate bond purchases would be tilted more strongly towards issuers with a better climate performance. The overall volume of corporate bond purchases was solely determined by monetary policy considerations and the role played by such purchases in achieving the ECB’s inflation target.

The Eurosystem no longer conducts purchases of corporate sector securities under the asset purchase programme (APP) or the pandemic emergency purchase programme (PEPP). This follows the Governing Council’s decision on 15 June 2023 to discontinue reinvestments under the APP from July 2023 and the Governing Council’s decision on 12 December 2024 to fully discontinue reinvestments under the PEPP at the end of 2024.

This page provides further details on the technical aspects of the measures implemented by the Eurosystem to integrate climate change considerations into its corporate bond purchases. For more information about how the Eurosystem conducted its corporate bond purchases, please refer to the Frequently asked questions on purchases of corporate sector debt instruments. For a non-technical explanation of how climate change considerations were incorporated into corporate bond purchases, see our related explainer .

Q1 What were the key elements of the incorporation of climate change considerations into Eurosystem corporate bond purchases?

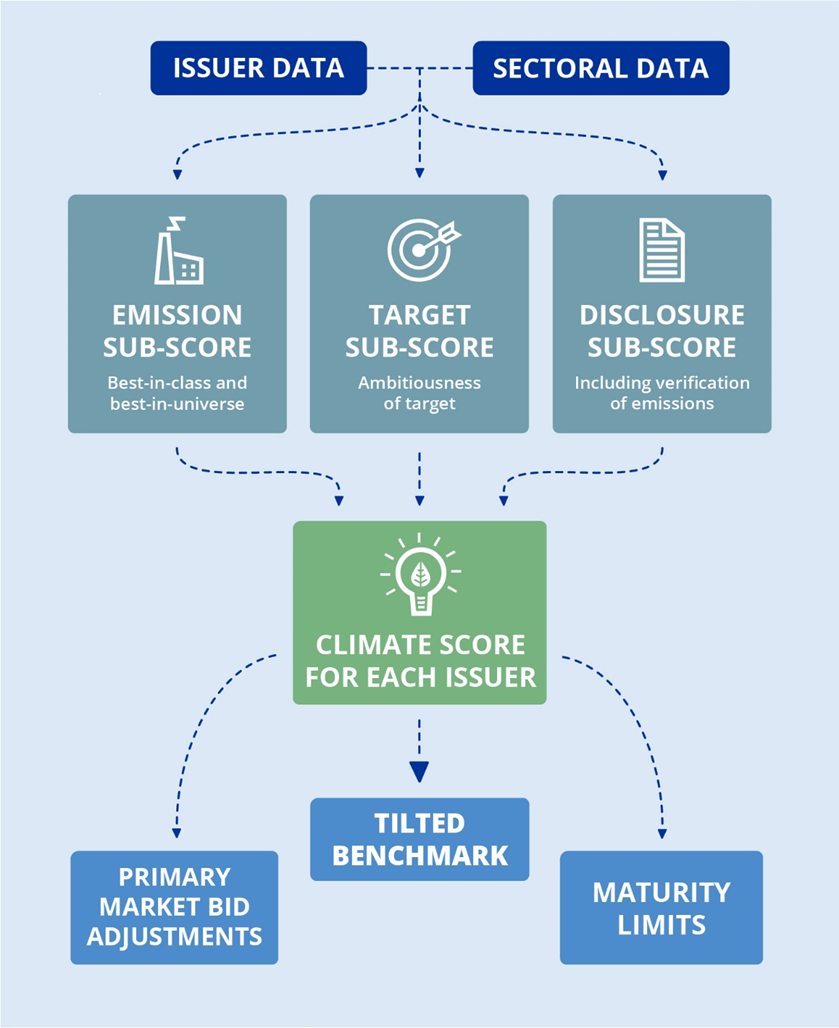

To operationalise the tilting of corporate bond purchases towards companies with a better climate performance, a specific climate score was calculated for each issuer. Purchases were then tilted towards bonds from issuers with higher (i.e. better) climate scores. The tilting of the purchases was designed to improve the weighted average climate score of the holdings over time so that it was consistent with a decarbonisation path in line with the goals of the Paris Agreement. The climate score methodology was reviewed annually and amended as warranted.

In addition, securities of issuers with a better climate performance and green bonds continued to be purchased in the primary market until December 2024.

Finally, the Eurosystem employed other differentiated measures, such as maturity limits for lower-scoring issuers, to further mitigate its climate-related financial risk.

A broad overview of the methodology that was used for the climate score is set out in the infographic below.

Q2 How was an issuer’s climate performance assessed?

The Eurosystem developed a climate scoring methodology to assess the climate performance of eligible issuers based on three sub-scores: (i) backward-looking climate metrics, which assessed the level of issuers’ past greenhouse gas (GHG) emissions in terms of emission intensity and the rate of decarbonisation; (ii) forward-looking climate metrics, such as whether the issuer had set and adhered to credible and ambitious decarbonisation targets; and (iii) the quality of climate disclosures, such as their completeness and verification by third parties.

These metrics were based on publicly available data as well as other relevant information and methodologies, such as science-based targets. Combining these metrics reflected prevailing market practice. Furthermore, the design of the climate scoring methodology was guided by the requirements for the EU Climate Transition Benchmarks and EU Paris-aligned Benchmarks.[1]

The Eurosystem reviewed its climate scoring methodology regularly during the purchasing phase to reflect the increasing availability and quality of climate data and models, any relevant regulatory developments, and advances in risk assessment capabilities.

Q3 How was each individual sub-score calculated?

The backward-looking emissions sub-score reflected past GHG emissions in terms of emission intensity and the rate of decarbonisation. It encompassed Scope 1 and 2 data[2] for the issuer concerned and Scope 3 data at the sector level. The sub-score combined a best-in-class with a best-in-universe approach. The best-in-class approach compared companies against their peers within specific industry sectors, while the best-in-universe approach compared companies across the entire corporate universe in terms of emission intensity and the rate of decarbonisation. If issuers did not have self-reported emissions data, they were assigned a lower backward-looking emissions sub-score. This approach incentivised issuers to decrease their carbon emissions using the best data available at the issuer level and, at the same time, to adopt a more holistic view of the carbon impact of the sector in which they operate.

The forward-looking target sub-score reflected the issuer’s expected changes in future GHG emissions. Issuers that were on an ambitious decarbonisation path towards Paris Agreement targets were given a higher score, particularly if the issuers adhered to their own GHG emissions intensity reduction targets, the targets were science-based and validated by a third party. If issuers had no self-reported emissions data, such that emissions reduction targets could not be verified, they were assigned the lowest sub-score. Similarly, if issuers did not have concrete short-term decarbonisation targets or had low adherence to their own targets, they were assigned lower values for this forward-looking sub-score. This approach incentivised all eligible issuers to plan and set up their forward-looking decarbonisation targets.

The climate disclosure sub-score reflected the quality of the emissions data provided by issuers. The sub-score considered challenges in terms of data availability and accuracy, and rewarded issuers with high-quality disclosures, thus creating incentives to improve data quality. For example, the Eurosystem looked at whether issuers disclosed their GHG emissions and whether these were verified by a reliable third party. The Eurosystem did not rely on estimated or modelled data on issuers’ emissions. If issuers had no self-reported emissions data, they were given the lowest sub-score, reflecting the fact that it was not possible to assess the transition risk to which these issuers were subject. The aim of this approach was to provide the Eurosystem with better insight into issuers’ climate-related financial risks and to incentivise all issuers to calculate and disclose their carbon footprint.

The three sub-scores were combined into a single climate score for each issuer.

Q4 Why did you use Scope 3 data at the sector level and not at the issuer level for the backward-looking emissions sub-score?

Scope 3 data provided the most comprehensive picture of companies’ total emissions, but such data were also more complicated to calculate when the programmes were in a purchasing phase. The quality of issuer-specific Scope 3 data was not deemed sufficient for the data-dependent decision-making process that was used for tilting. However, sectoral Scope 3 data were assessed as being sufficiently reliable and were therefore included in the methodology. Using these data ensured that the tilting methodology more accurately reflected the issuer’s overall carbon footprint.

Q5 How were issuers’ individual climate scores used to tilt purchases?

The Eurosystem tilted corporate bond purchases towards issuers with higher climate scores. Previously, the asset allocation for the corporate bond purchases was based mainly on issuers’ market capitalisation – meaning the Eurosystem bought more bonds from issuers that issued more bonds. After incorporating climate considerations, the Eurosystem also took into account information that was relevant for assessing companies’ climate-related risks.

First, the benchmark guiding Eurosystem purchases was tilted to give more weight to higher scoring issuers and less to those with lower scores. The higher the climate score, the larger the weight increase. Second, the tilted benchmark was incorporated into issuer group limits to ensure that purchases were guided by the climate-focused benchmark. This meant that the issuer limits were raised for higher scoring issuers, resulting in more purchases from issuers with a better climate performance.

However purchase volumes for a specific issuer also depended on other factors, such as potential risk management considerations and the current Eurosystem holdings of that issuer.

Q6 Did the Eurosystem publish the climate scores of individual issuers?

No. The climate scores of individual issuers were not published. Publishing such information could have undermined monetary policy objectives and the effectiveness of the Eurosystem’s corporate bond purchases.

Q7 Did the Eurosystem apply any maturity limits to the securities it purchased from issuers with lower climate scores?

The Eurosystem imposed maturity limits on corporate sector securities issued by companies with lower climate scores. This helped mitigate the longer-term exposure of the Eurosystem to transition risks.

Q8 Did the Eurosystem give favourable treatment to green bonds?

Tilting was intended to mitigate climate-related financial risks on the Eurosystem’s balance sheet. It was the risk profile of the bond issuer that posed financial risks for the Eurosystem. Consequently, the Eurosystem looked at the key drivers of climate-related financial risks when tilting its corporate bond purchases based on issuer profile.

The Eurosystem acknowledged, however, the importance of green bonds in funding the green transition. It therefore gave preferential treatment to green bonds in its primary market bidding behaviour, subject to certain conditions. However, aggregate purchases of each issuer followed the tilted benchmark.

In order to mitigate risks associated with greenwashing, the Eurosystem adopted a stringent identification process for the green bonds that were given preferential treatment. The criteria included, as a starting point: (i) alignment of the issuer’s green bond framework[3] with a leading market standard, such as the International Capital Market Association Green Bond Principles or Climate Bonds Initiative; (ii) a second-party opinion indicating that adherence to that standard had been reviewed and was confirmed; and (iii) a declaration in the bond prospectus to the effect that regular verification by an independent third party on the use of proceeds was expected (for example, annual verification by an external auditor) until the funds concerned had been fully deployed.

Q9 Did the eligibility criteria for corporate bond purchases change when climate considerations were integrated? Did purchasing modalities change?

The eligibility criteria for corporate bond purchases remained unchanged. Moreover, corporate bond purchases continued to be conducted by the six purchasing national central banks[4] on behalf of the Eurosystem. Please refer to our Frequently asked questions on purchases of corporate sector debt instruments for more information.

Q10 Did the Eurosystem sell holdings because their issuer had a low climate score? Did the Eurosystem exclude specific issuers or industry sectors from its purchases?

A low climate score did not trigger sales. Rather, further purchases of low-scoring issuers were constrained, or even halted, until their climate score improved. Specific issuers and industry sectors were not excluded from the tilted benchmark. Their climate performance instead affected their benchmark share, which in turn affected the volume of further purchases from those issuers and industry sectors. This approach was expected to incentivise a wide range of issuers and sectors to improve their climate risk profile and performance.

More generally, the corporate bond portfolio remained a monetary policy portfolio, and the overall purchase volumes continued to be determined solely by monetary policy considerations and their role in delivering on the ECB’s price stability objective.

Q11 How does the Eurosystem publish climate-related information on its corporate bond holdings?

As communicated in our press release of 23 March 2023, the Eurosystem started publishing climate-related information on its corporate bond holdings on a yearly basis. The respective reports can be found on our web page about climate-related financial disclosures.

Q12 Did the Eurosystem publish the changes to its holdings of bonds from individual issuers resulting from the application of these measures?

The Eurosystem publishes the ISIN codes of its holdings, but did not and does not publish a detailed breakdown of the value of its corporate bond holdings by issuer, given that this could undermine the monetary policy objectives of the purchases. However, the Eurosystem remains committed to being as transparent as possible. It therefore continues to publish breakdowns by country, rating and sector on a yearly basis.

In accordance with Regulation (EU) 2019/2089 of the European Parliament and of the Council of 27 November 2019 amending Regulation (EU) 2016/1011 as regards EU Climate Transition Benchmarks, EU Paris-aligned Benchmarks and sustainability-related disclosures for benchmarks (OJ L 317, 9.12.2019, p. 17).

Scope 1 emissions encompass an entity’s direct emissions, and thus its exposure to rising costs from higher carbon taxes. Scope 2covers indirect emissions from electricity, heat and steam consumption, and therefore reflects an entity’s exposure to rising input prices. Scope 3 is defined in the GHG Protocol as all the indirect emissions of an entity and its products, excluding those falling under Scope 2, i.e. it includes emissions across the entire value chain.

The framework in which the issuer sets out how the proceeds raised through a green bond issuance will be used in undertaking eligible green projects.

The Nationale Bank van België/Banque Nationale de Belgique, the Deutsche Bundesbank, the Banco de España, the Banque de France, the Banca d’Italia and Suomen Pankki ‒ Finlands Bank.