Confidence and investment

Published as part of the ECB Economic Bulletin, Issue 4/2019.

Economic agents’ confidence and developments in the real economy are intrinsically linked.[1] Periods of high confidence could, per se, spur activity, while currently lower confidence could reinforce the magnitude and persistence of the ongoing economic slowdown in the euro area. In terms of the expenditure components of GDP, business investment is particularly affected by changes in confidence and uncertainty, as firms may postpone their investment plans and choose to “wait and see” in times of high uncertainty.[2] This box looks at the potential propagation effects of lower confidence on investment in recent times.

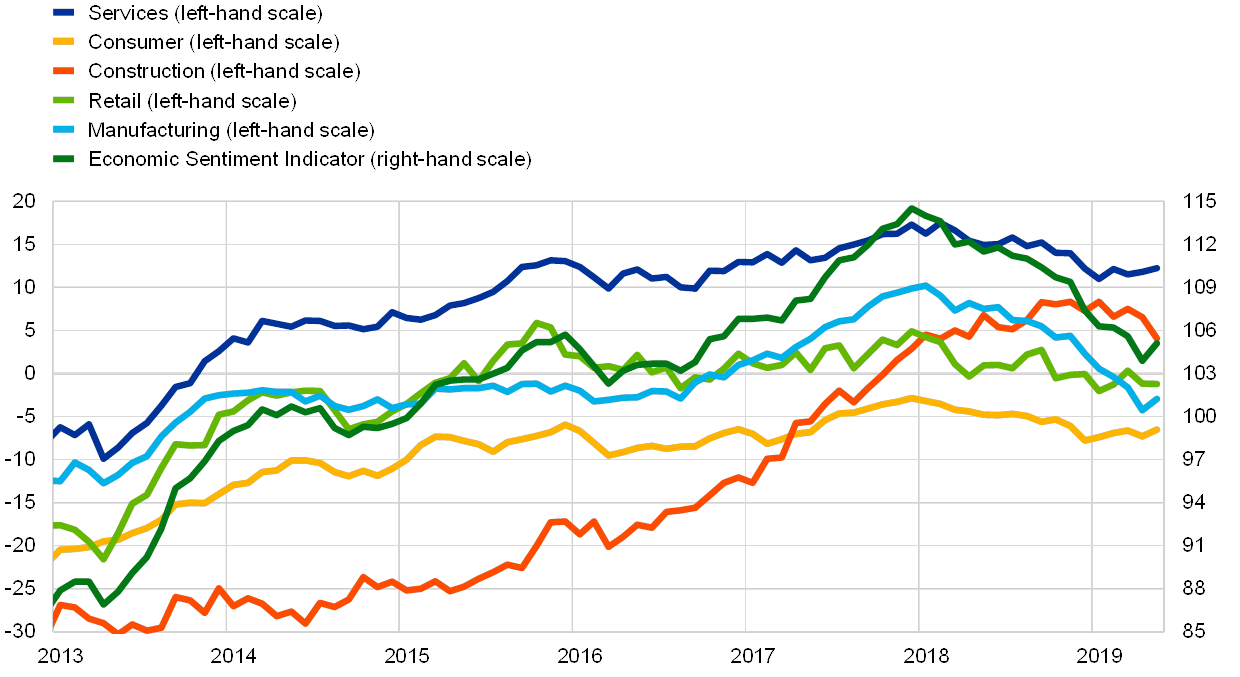

Following an extended period of improving sentiment, economic confidence in the euro area has worsened since the end of 2017. The deterioration in sentiment is not just a result of expectations of weaker economic fundamentals, but also reflects heightened uncertainty related to geopolitical factors, the threat of an escalation of protectionism, Brexit and vulnerabilities in emerging markets, including China. Confidence is illustrated, inter alia, by indicators such as the European Commission’s Economic Sentiment Indicator (ESI). The ESI is a composite indicator measuring confidence in the industrial, services, construction and retail trade sectors, and among consumers.[3] Since the end of 2017 the ESI has declined significantly in the larger euro area countries and in the euro area as a whole, although it remains above its long-term average value of 100 (see Chart A). The decline in confidence in the euro area is common across sectors (see Chart B).

Chart A

Economic Sentiment Indicators for selected countries

(index: long-term average = 100)

Source: European Commission.

Note: The latest observation is for May 2019.

Chart B

Euro area Economic Sentiment Indicator across sectors

(balances; index: long-term average = 100)

Source: European Commission.

Note: The latest observation is for May 2019.

Confidence largely reflects broad economic conditions but, at times, it may also become an autonomous source of business cycle fluctuations. Confidence indicators typically co-move with other economic statistics, as they represent expectations of underlying macroeconomic fundamentals. At the same time, those indicators might provide additional information not captured by other statistics, which can be used to assess macroeconomic developments.[4] As an illustration, confidence may decline during a sharp economic downturn, but this may still correspond to a positive confidence shock if the underlying economic conditions justify an even lower confidence level. Such confidence shocks might be instrumental in supporting expert judgement in order to complement model-based projections.

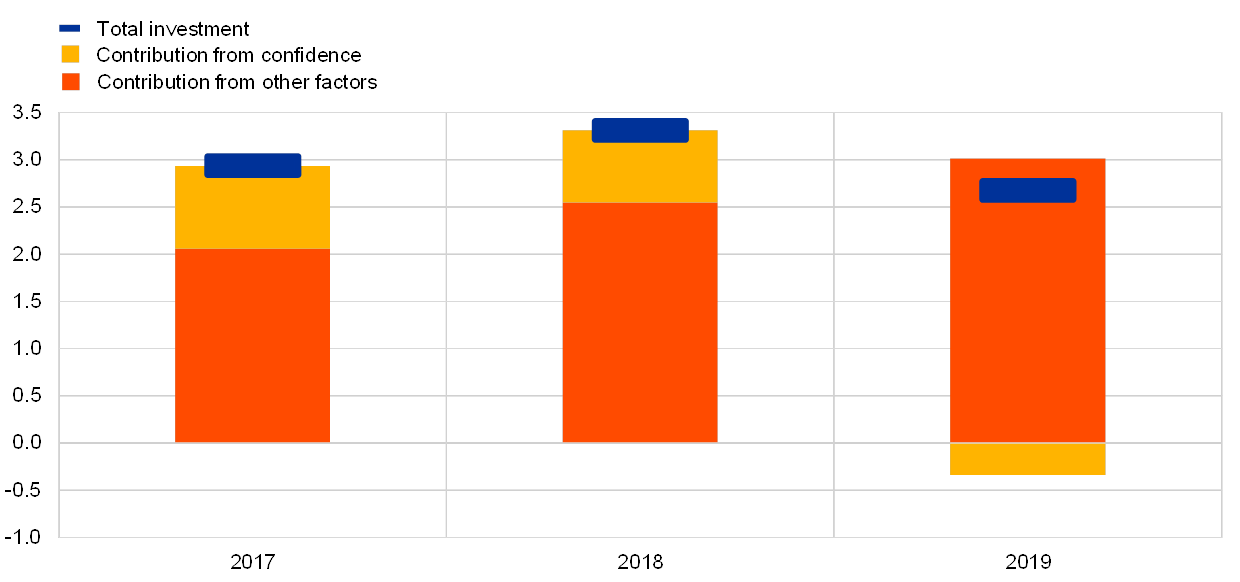

Model evidence suggests that confidence shocks have had an overall positive impact on investment growth in the past two years and a negative impact in 2019. The New Multi-Country Model (NMCM),[5] the ECB’s main model for macroeconomic projections,[6] does not explicitly feature confidence but can be augmented with a mechanism to quantify the impact of structural confidence shocks. Confidence is introduced in the model in two steps. First, confidence shocks are identified using a structural vector autoregression model that includes the variables of the NMCM’s investment equation.[7] In the second step, those confidence shocks are introduced in the NMCM. The model residuals for the investment equation, which capture the difference between the model’s output and economic outcomes, can partially be explained by the confidence shocks.[8], [9] Based on these empirical results, the model is used to decompose historical investment growth into a confidence factor and other factors, which shows that investment growth was, overall, significantly and positively impacted by confidence in 2017 and 2018 (see Chart C). This analysis can be extended to the forecast after making assumptions about future confidence indicators and interpreting the Eurosystem staff forecast data through the lens of the NMCM.[10] Assuming that the euro area ESI remains at its May 2019 level, model simulations point towards a negative but modest contribution of confidence to investment growth in 2019, partially counteracting factors that support the euro area expansion, such as favourable financing conditions, further employment gains and rising wages, and the ongoing – albeit somewhat slower – expansion in global activity.

To conclude, the quantitative exercise shows that confidence shocks could have a sizeable impact on investment.

Chart C

Total investment growth and the impact of confidence

(annual percentage change, percentage points)

Sources: Eurostat and the June 2019 Eurosystem staff macroeconomic projections for the euro area.

Notes: The ECB analysis is based on the New Multi-Country Model. Structural confidence shocks are constructed with a structural vector autoregression (SVAR) model that includes: (i) the euro area Economic Sentiment Indicator (ESI), and (ii) the variables that appear in the NMCM’s investment equation. Data for 2017 and 2018 refer to outcomes, while data for 2019 are projected. In the analysis, the ESI is assumed to remain at its May 2019 level for the remainder of 2019.

- See, for example, “Confidence indicators and economic developments”, Monthly Bulletin, ECB, January 2013.

- To simplify, economic “confidence” captures expectations about the outlook (first moment) and economic “uncertainty” refers to the variance or dispersion of such expectations (second moment).

- The indicator is constructed to have a long-term mean of 100 and a standard deviation of 10, such that values greater than 100 indicate an above-average economic sentiment. See “The Joint Harmonised EU Programme of Business and Consumer Surveys – User Guide”, European Commission, 2016 (updated January 2019).

- See, for example, Angeletos, G.M. et al., “Quantifying Confidence”, Econometrica, Vol. 86, No 5, 2018, pp. 1689-1726.

- See Dieppe, A., González-Pandiella, A. and Willman, A., “The ECB’s New Multi-Country Model for the euro area: NMCM – Simulated with rational expectations”, Economic Modelling, Vol. 29, Issue 6, 2012, pp. 2597-2614; and Dieppe, A., González-Pandiella, A., Hall, S. and Willman, A., “Limited information minimal state variable learning in a medium-scale multi-country model”, Economic Modelling, Vol. 33, 2013, pp. 808-825.

- See “A guide to the Eurosystem/ECB staff macroeconomic projection exercises”, ECB, July 2016.

- Confidence shocks are identified using a Cholesky scheme, where the euro area ESI is last in the Cholesky ordering. This reflects the conceptual assumption that confidence reacts contemporaneously (within a quarter) to developments of other economic statistics, while confidence shocks do not contemporaneously affect other variables (e.g. user cost of capital).

- A linear regression of the residuals of the investment equation from the NMCM on lagged structural confidence shocks yields statistically significant coefficients, whereby statistical measures indicate significant explanatory power for the structural confidence shocks.

- In comparison, private consumption and employment residuals show a much weaker relationship to confidence. For the purposes here, only the investment equation is augmented to react to confidence shocks, and private consumption and employment are only affected indirectly through spillovers.

- The June 2019 staff macroeconomic projection exercise is a joint Eurosystem forecast. These forecast data are inverted using the NMCM to obtain a model-consistent decomposition of investment into a confidence factor and other factors.