- PRESS RELEASE

Euro area bank interest rate statistics: November 2022

4 January 2023

- Composite cost-of-borrowing indicator for new loans to corporations increased by 37 basis points to 3.09%, driven by interest rate effect; indicator for new loans to households for house purchase increased by 21 basis points to 2.88%, driven by interest rate effect

- Composite interest rate for new deposits with agreed maturity from corporations increased by 56 basis points to 1.52%, mainly driven by interest rate effect; interest rate for overnight deposits from corporations increased by 7 basis points to 0.15%, driven by interest rate effect

- Composite interest rate for new deposits with agreed maturity from households increased by 28 basis points to 1.26%, mainly driven by interest rate effect; interest rate for overnight deposits from households broadly unchanged at 0.05%

Bank interest rates for corporations

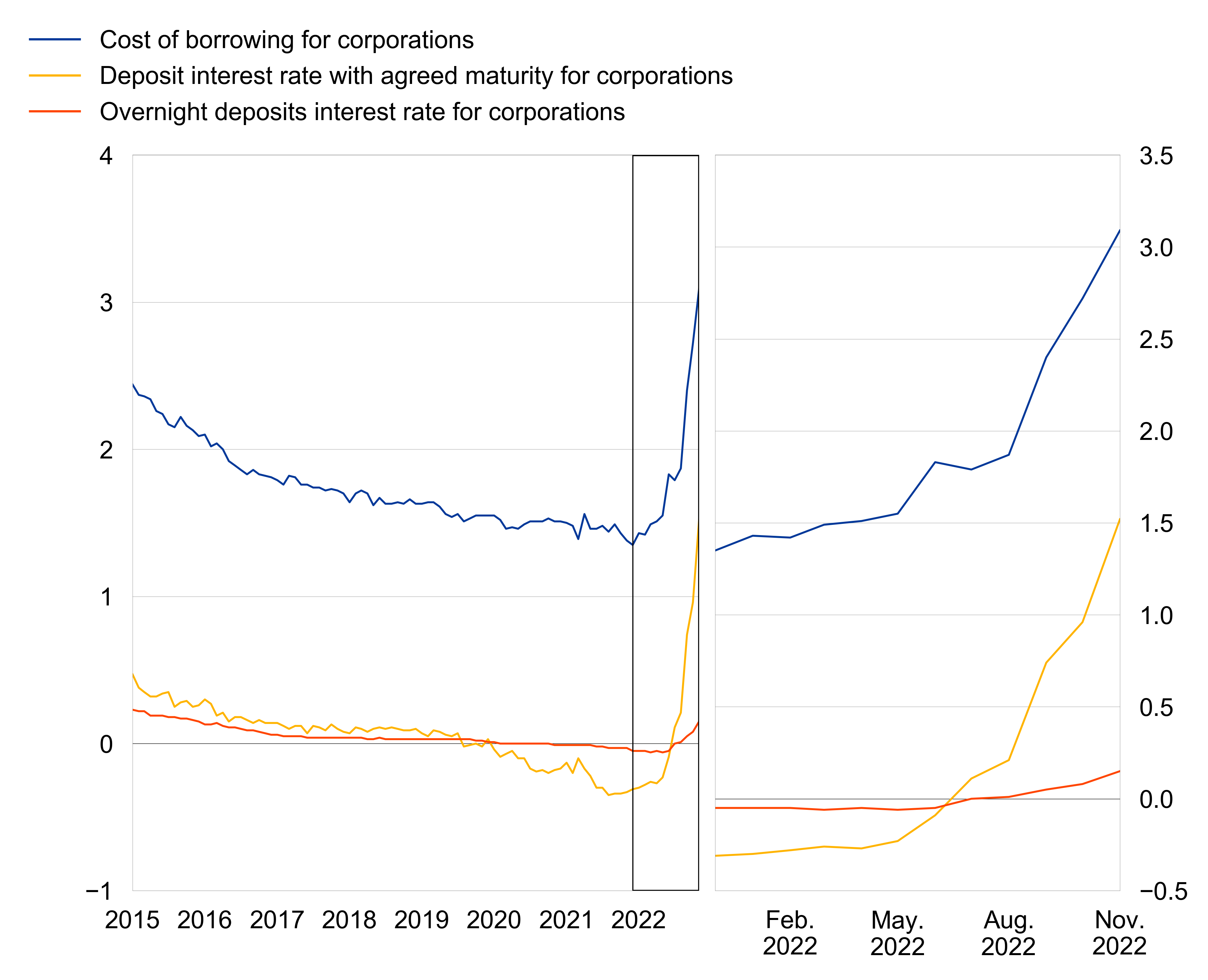

Chart 1

Bank interest rates on new loans to, and deposits from, euro area corporations

(percentages per annum)

The composite cost-of-borrowing indicator, which combines interest rates on all loans to corporations, increased in November 2022, driven by the interest rate effect. The interest rate on new loans of over €1 million with a floating rate and an initial rate fixation period of up to three months increased by 42 basis points to 2.87%, mainly driven by the interest rate effect. The rate on new loans of the same size with an initial rate fixation period of over three months and up to one year rose by 51 basis points to 3.26%, driven by the interest rate effect. The interest rate on new loans of over €1 million with an initial rate fixation period of over ten years increased by 5 basis points to 2.95%, driven by both the interest rate and the weight effects. In the case of new loans of up to €250,000 with a floating rate and an initial rate fixation period of up to three months, the average rate charged rose by 35 basis points to 3.33%, driven by the interest rate effect.

As regards new deposit agreements, the interest rate on deposits from corporations with an agreed maturity of up to one year rose by 56 basis points to 1.46% in November 2022, driven by the interest rate effect. The interest rate on overnight deposits from corporations rose by 7 basis points to 0.15%, driven by the interest rate effect.

The interest rate on new loans to sole proprietors and unincorporated partnerships with a floating rate and an initial rate fixation period of up to one year increased by 47 basis points to 3.79%, mainly driven by the interest rate effect.

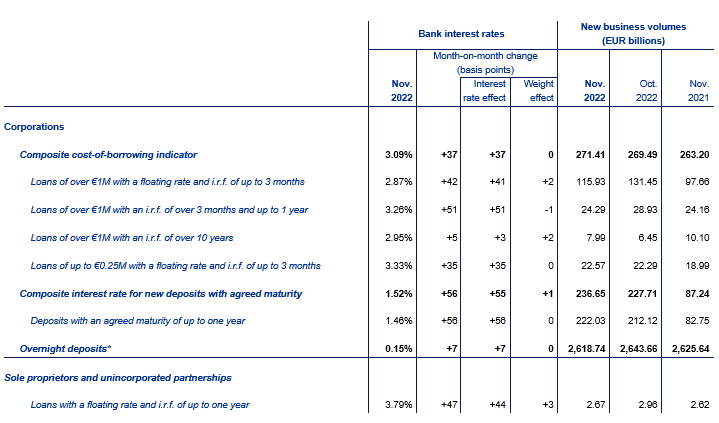

Table 1

Bank interest rates for corporations

i.r.f. = initial rate fixation

* For this instrument category, the concept of new business is extended to the whole outstanding amounts and therefore the business volumes are not comparable with those of the other categories. Outstanding amounts data are derived from the ECB's monetary financial institutions balance sheet statistics.

Bank interest rates for households

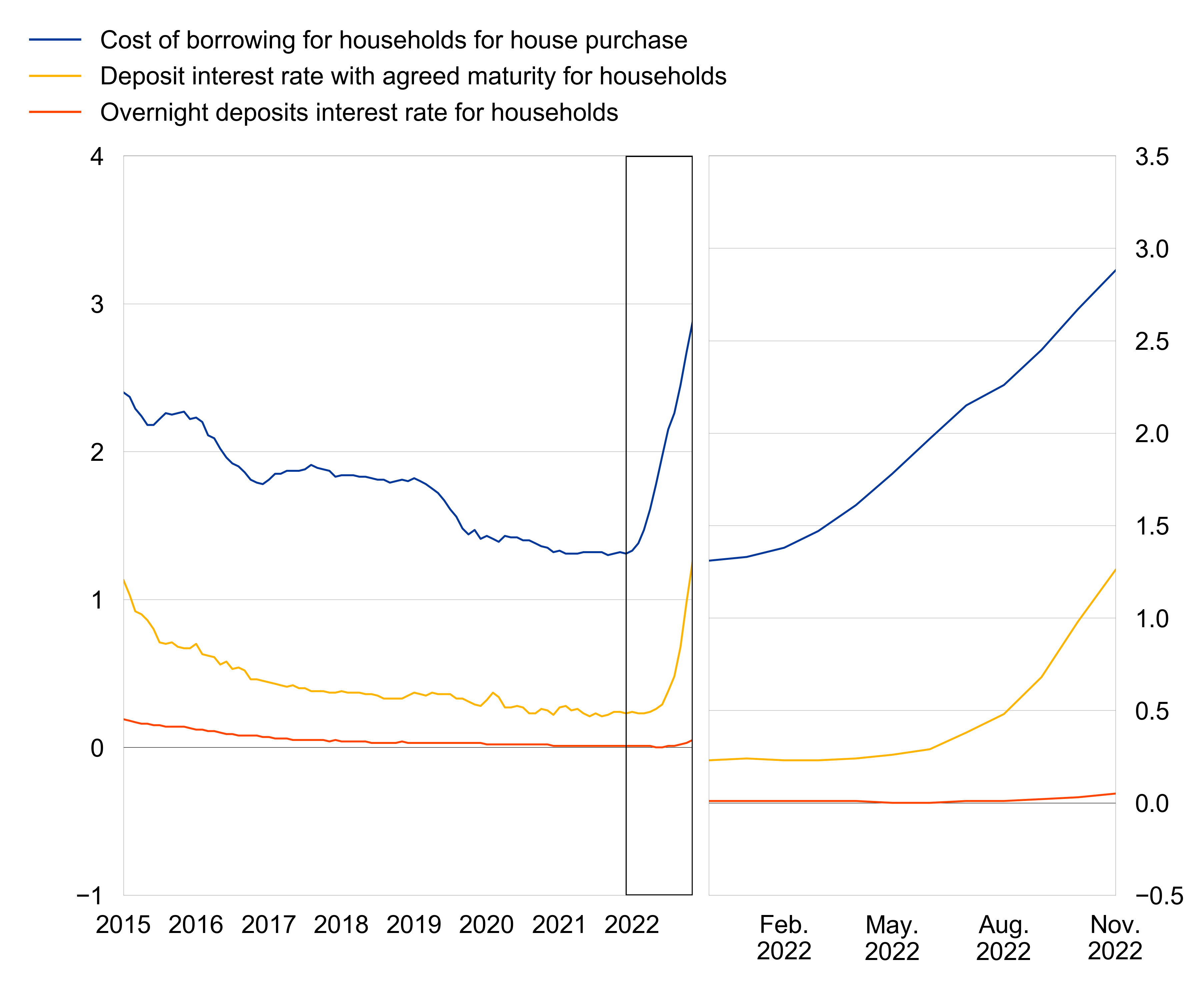

Chart 2

Bank interest rates on new loans to, and deposits from, euro area households

(percentages per annum)

The composite cost-of-borrowing indicator, which combines interest rates on all loans to households for house purchase, increased in November 2022, driven by the interest rate effect. The interest rate on loans for house purchase with a floating rate and an initial rate fixation period of up to one year increased by 28 basis points to 2.93%, driven by the interest rate effect. The rate on housing loans with an initial rate fixation period of over one and up to five years rose by 22 basis points to 3.04%, mainly driven by the interest rate effect. The interest rate on loans for house purchase with an initial rate fixation period of over five and up to ten years increased by 25 basis points to 3.30%, mainly driven by the interest rate effect. The rate on housing loans with an initial rate fixation period of over ten years rose by 14 basis points to 2.55%, driven by the interest rate effect. In the same period the interest rate on new loans to households for consumption increased by 26 basis points to 6.53%, mainly driven by the interest rate effect.

As regards new deposits from households, the interest rate on deposits with an agreed maturity of up to one year increased by 29 basis points to 1.12%, mainly driven by the interest rate effect. The rate on deposits redeemable at three months' notice stayed almost constant at 0.75%. The interest rate on overnight deposits from households remained broadly unchanged at 0.05%.

Table 2

Bank interest rates for households

i.r.f. = initial rate fixation

* For this instrument category, the concept of new business is extended to the whole outstanding amounts and therefore the business volumes are not comparable with those of the other categories; deposits placed by households and corporations are allocated to the household sector. Outstanding amounts data are derived from the ECB's monetary financial institutions balance sheet statistics.

** For this instrument category, the concept of new business is extended to the whole outstanding amounts and therefore the business volumes are not comparable with those of the other categories. Outstanding amounts data are derived from the ECB's monetary financial institutions balance sheet statistics.

Further information

Tables containing further breakdowns of bank interest rate statistics, including the composite cost-of-borrowing indicators for all euro area countries, are available from the ECB's Statistical Data Warehouse. A subset is visually presented on the Euro Area Statistics dedicated website. The full set of bank interest rate statistics for both the euro area and individual countries can be downloaded from SDW. More information, including the release calendar, is available under "Bank interest rates" in the statistics section of the ECB's website.

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482

Notes:

- In this press release "corporations" refers to non-financial corporations (sector S.11 in the European System of Accounts 2010, or ESA 2010), "households" refers to households and non-profit institutions serving households (ESA 2010 sectors S.14 and S.15) and "banks" refers to monetary financial institutions except central banks and money market funds (ESA 2010 sector S.122).

- The composite cost-of-borrowing indicators are described in the article entitled "Assessing the retail bank interest rate pass-through in the euro area at times of financial fragmentation" in the August 2013 issue of the ECB's Monthly Bulletin (see Box 1). For these indicators, a weighting scheme based on the 24-month moving averages of new business volumes has been applied, in order to filter out excessive monthly volatility. For this reason the developments in the composite cost of borrowing indicators in both tables cannot be explained by the month-on-month changes in the displayed subcomponents. Furthermore, the table on bank interest rates for corporations presents a subset of the series used in the calculation of the cost of borrowing indicator.

- Interest rates on new business are weighted by the size of the individual agreements. This is done both by the reporting agents and when the national and euro area averages are computed. Thus changes in average euro area interest rates for new business reflect, in addition to changes in interest rates, changes in the weights of individual countries' new business for the instrument categories concerned. The "interest rate effect" and the "weight effect" presented in this press release are derived from the Bennet index, which allows month-on-month developments in euro area aggregate rates resulting from changes in individual country rates (the "interest rate effect") to be disentangled from those caused by changes in the weights of individual countries' contributions (the "weight effect"). Owing to rounding, the combined "interest rate effect" and the "weight effect" may not add up to the month-on-month developments in euro area aggregate rates.

- In addition to monthly euro area bank interest rate statistics for November 2022, this press release incorporates revisions to data for previous periods. Hyperlinks in the main body of the press release lead to data that may change with subsequent releases as a result of revisions. Unless otherwise indicated, these euro area statistics cover the EU Member States that had adopted the euro at the time to which the data relate.

- As of reference period December 2014, the sector classification applied to bank interest rates statistics is based on the European System of Accounts 2010 (ESA 2010). In accordance with the ESA 2010 classification and as opposed to ESA 95, the non-financial corporations sector (S.11) now excludes holding companies not engaged in management and similar captive financial institutions.

Banque centrale européenne

Direction générale Communication

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Allemagne

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction autorisée en citant la source

Contacts médias