- STATISTICAL RELEASE

Euro area securities issues statistics: March 2021

12 May 2021

- The annual growth rate of the outstanding amount of debt securities issued by euro area residents increased from 7.5% in February 2021 to 8.4% in March.

- For the outstanding amount of listed shares issued by euro area residents, the annual growth rate increased from 1.7% in February 2021 to 2.0% in March.

Debt securities

New issuances of debt securities by euro area residents totalled EUR 806.4 billion in March 2021. Redemptions amounted to EUR 630.2 billion and hence net issues to EUR 176.2 billion. The annual growth rate of outstanding debt securities issued by euro area residents increased from 7.5% in February 2021 to 8.4% in March.

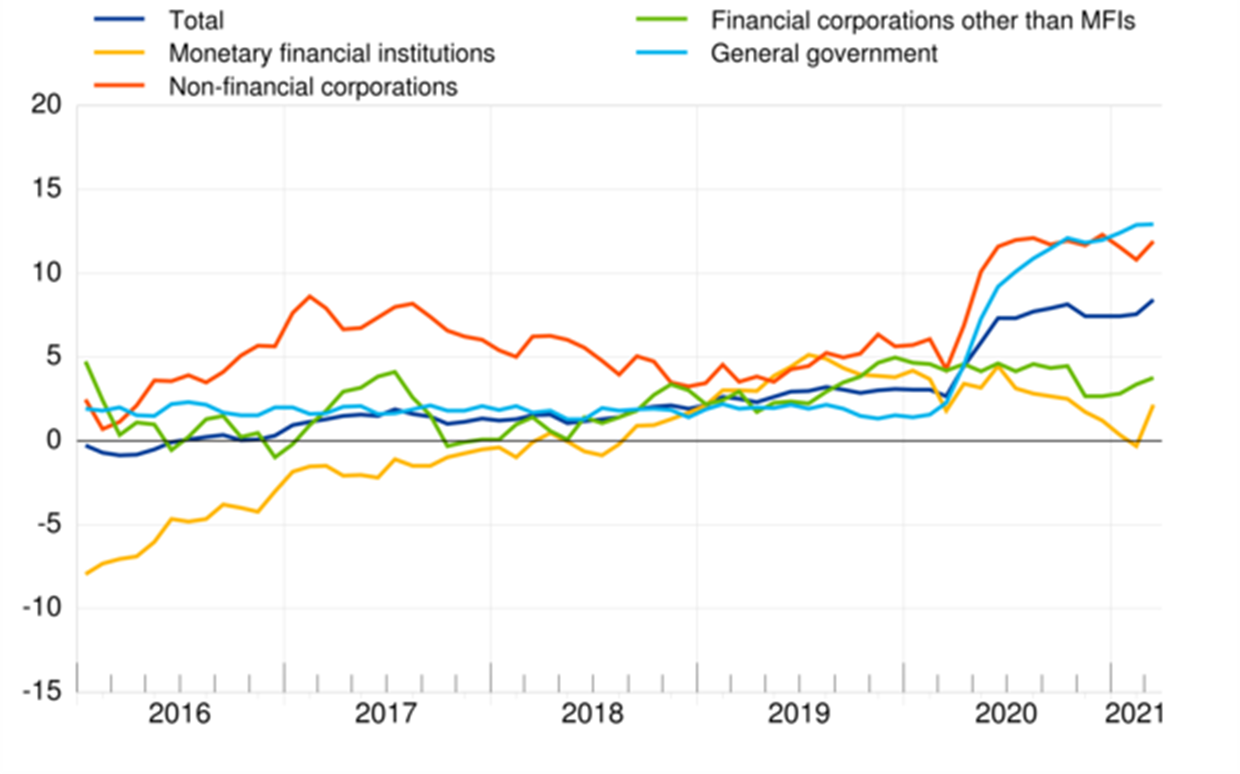

Data for debt securitiesChart 1

Debt securities issued by euro area residents

(annual growth rates)

Breakdown by maturity

The annual growth rate of outstanding short-term debt securities increased from 12.0% in February 2021 to 14.6% in March. For long-term debt securities, the annual growth rate increased from 7.2% in February 2021 to 7.9% in March. The annual growth rate of outstanding fixed rate long-term debt securities increased from 7.9% in February 2021 to 8.5% in March. The annual growth rate of outstanding variable rate long-term debt securities increased from 0.7% in February 2021 to 1.3% in March.

Data for breakdown by maturityBreakdown by sector

As regards the sectoral breakdown, the annual growth rate of outstanding debt securities issued by non-financial corporations increased from 10.8% in February 2021 to 11.9% in March. For the monetary financial institutions (MFIs) sector, this rate of change increased from -0.3% in February 2021 to 2.2% in March. The annual growth rate of outstanding debt securities issued by financial corporations other than MFIs increased from 3.4% in February 2021 to 3.8% in March. For the general government, this growth rate was 12.9% in March 2021, the same as in February.

The annual growth rate of outstanding short-term debt securities issued by MFIs was -11.0% in March 2021, compared with -19.0% in February. The annual growth rate of outstanding long-term debt securities issued by MFIs increased from 2.6% in February 2021 to 4.0% in March.

Data for breakdown by sectorBreakdown by currency

Concerning the currency breakdown, the annual growth rate of outstanding euro-denominated debt securities increased from 9.0% in February 2021 to 9.6% in March. For debt securities denominated in other currencies, this rate of change increased from -1.2% in February 2021 to 1.1% in March.

Data for breakdown by currencyListed shares

New issuances of listed shares by euro area residents totalled EUR 24.1 billion in March 2021. Redemptions amounted to EUR 3.1 billion and hence net issues to EUR 21.0 billion. The annual growth rate of the outstanding amount of listed shares issued by euro area residents (excluding valuation changes) increased from 1.7% in February 2021 to 2.0% in March. The annual growth rate of listed shares issued by non-financial corporations was 1.4% in March 2021, compared with 1.2% in February. For MFIs, the corresponding rate of change increased from -0.1% in February 2021 to 1.4% in March. For financial corporations other than MFIs, this growth rate increased from 4.7% in February 2021 to 5.0% in March.

Chart 2

Listed shares issued by euro area residents

(annual growth rates)

The market value of the outstanding amount of listed shares issued by euro area residents totalled EUR 9,238.9 billion at the end of March 2021. Compared with EUR 6,445.0 billion at the end of March 2020, this represents an annual increase of 43.3% in the value of the stock of listed shares in March 2021, up from 11.6% in February.

Data for listed shares

For queries, please use the Statistical information request form.

Notes:

- Unless otherwise indicated, data relate to non-seasonally adjusted statistics. In addition to the developments for March 2021, this statistical release incorporates minor revisions to the data for previous periods. The annual growth rates are based on financial transactions that occur when an institutional unit incurs or redeems liabilities, they are not affected by the impact of any other changes which do not arise from transactions.

- Hyperlinks in the main body of the statistical release and in annex tables lead to data that may change with subsequent releases as a result of revisions. Figures shown in annex tables are a snapshot of the data as at the time of the current release.

- The next statistical release on euro area securities issues will be published on 11 June 2021.