- PRESS RELEASE

ECB publishes consolidated banking data for end-June 2020

5 November 2020

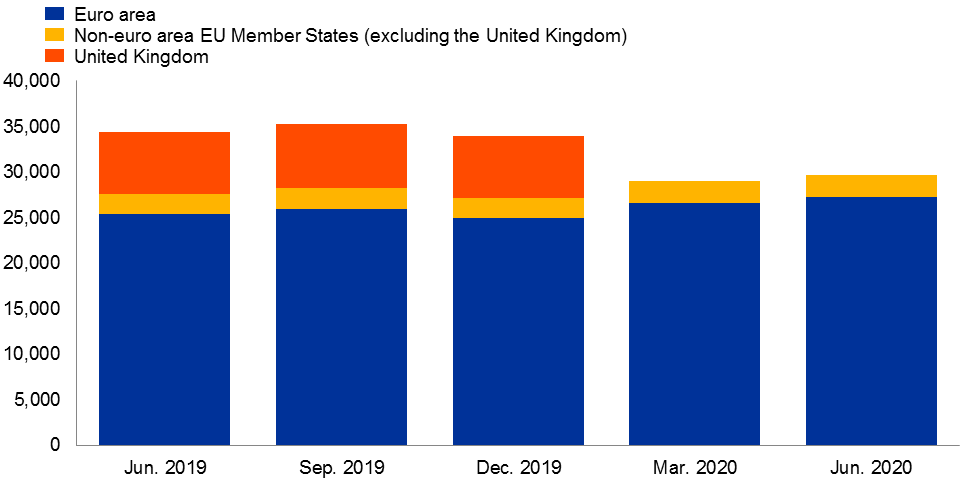

- Total assets of EU-headquartered credit institutions (excluding the United Kingdom) increased by 7.6%, from €27.6 trillion in June 2019 to €29.7 trillion in June 2020

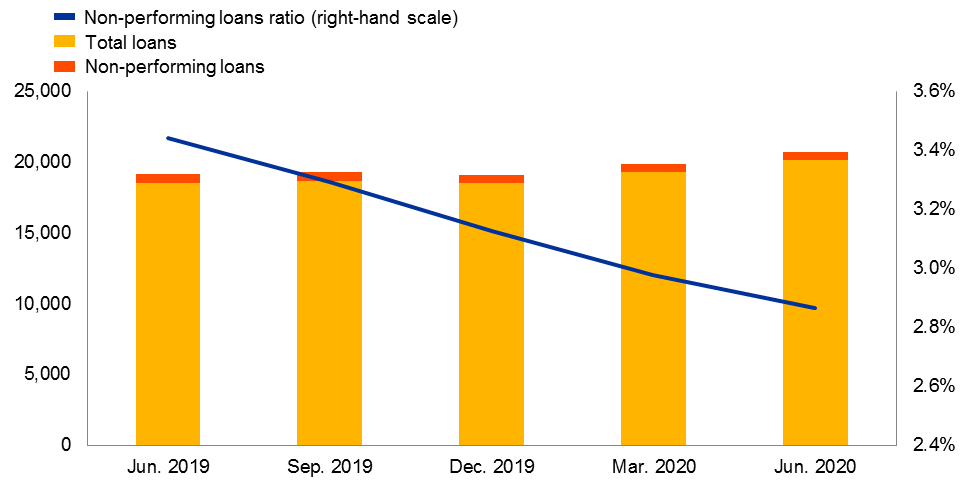

- EU non-performing loans ratio[1] (excluding the United Kingdom) dropped by 0.17 percentage points year on year to 2.87% in June 2020

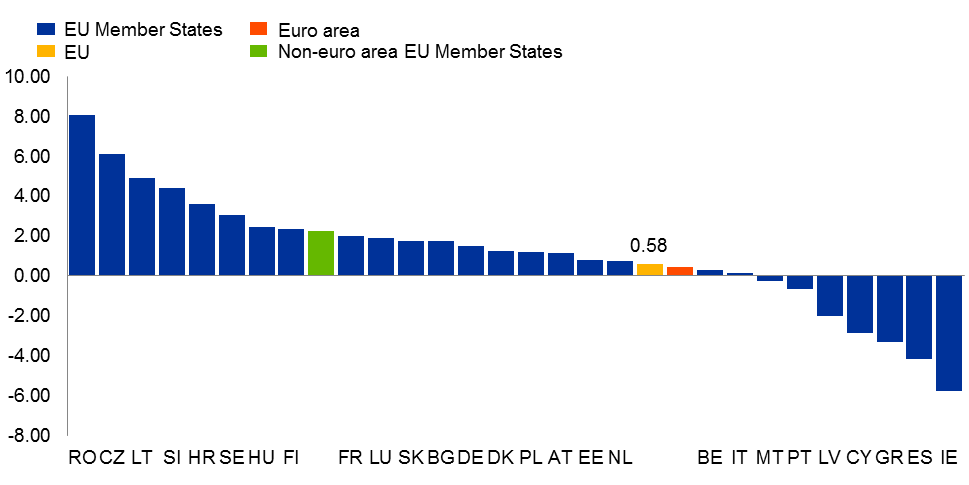

- EU average return on equity[2] was 0.58% in June 2020

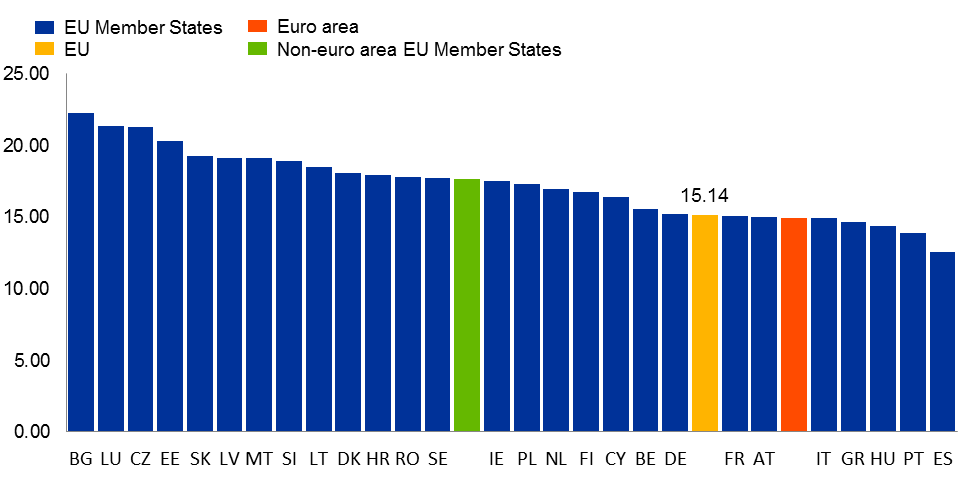

- EU average Common Equity Tier 1 ratio[3] was 15.14% in June 2020

Chart 1

Total assets of credit institutions headquartered in the EU

(EUR billions)

Chart 2

Non-performing loans ratio of credit institutions headquartered in the EU (excluding the United Kingdom)

(EUR billions; percentages) Notes: The non-performing loans ratio is defined as the ratio of non-performing loans to total loans.

Chart 3

Return on equity of credit institutions headquartered in the EU in June 2020

(percentages) Notes: Return on equity is defined as the ratio of total profit (loss) for the year to total equity. The data show the return on equity calculated on the basis for the second quarter of 2020. ISO codes have been used to indicate the country.

Chart 4

Common Equity Tier 1 ratio of credit institutions headquartered in the EU in June 2020

(percentages) Notes: The Common Equity Tier 1 ratio is defined as the ratio of Common Equity Tier 1 capital to the total risk exposure amount. ISO codes have been used to indicate the country.

The European Central Bank (ECB) has published the consolidated banking data with reference to end-June 2020, a dataset of the EU banking system compiled on a group consolidated basis.

The quarterly data cover information required for the analysis of the EU banking sector, comprising a subset of the information that is available in the year-end dataset. The end-June 2020 data refer to 326 banking groups and 2,656 stand-alone credit institutions operating in the EU (including foreign subsidiaries and branches), covering nearly 100% of the EU banking sector balance sheet. This dataset includes an extensive range of indicators on profitability and efficiency, balance sheets, liquidity and funding, asset quality, asset encumbrance, capital adequacy and solvency. Aggregates and indicators are published for the full sample of the banking industry.

Large reporters apply International Financial Reporting Standards and the Implementing Technical Standards on supervisory reporting of the European Banking Authority, while some smaller reporters may apply national accounting standards. Accordingly, aggregates and indicators may also cover data based on national accounting standards, depending on the availability of the underlying items.

A few revisions to past data are disclosed together with the end-June 2020 data.

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes

- The consolidated banking data are available in the ECB Statistical Data Warehouse.

- More information about the methodology behind the data compilation is available on the ECB's website.

- Defined as the ratio of non-performing loans to total loans.

- Defined as the ratio of total profit (loss) for the year to total equity.

- Defined as the ratio of Common Equity Tier 1 capital to the total risk exposure amount.

Banque centrale européenne

Direction générale Communication

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Allemagne

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction autorisée en citant la source

Contacts médias