The exchange rate policy of the Euro

Speech by Lorenzo Bini Smaghi, Member of the Executive Board of the ECBAnnual Meeting Association Française de Sciences EconomiquesLa Sorbonne, 21 September 2007

I would first like to thank the organisers for setting up this roundtable discussion on the exchange rate policy of the euro. I would like to clarify from the outset that the focus of my remarks will indeed be on the way the exchange rate policy is structured and organised in the euro area. Therefore, no reference to the current market situation should be derived explicitly or implicitly from these remarks. [1]

For over 40 years now, and especially since the seminal work of Mundell and Fleming, we have known that in a world with full capital mobility it is not possible for a country to have at one and the same time a fixed (or tightly managed) exchange rate regime and an independent monetary policy. If a country pegs or manages its exchange rate, it will have to run a monetary policy consistent with such a choice. In particular, its monetary policy will be determined not by its own requirements but by the requirements of the foreign country to whose currency it is pegged.

The experience is consistent with the theory. Under the Bretton Woods regime, the monetary policies of countries in Europe were determined by a need to maintain the dollar peg. It was the inconsistency with the domestic monetary policy requirements which led to a breakdown of the system in the early 1970s. In the European Monetary System, the monetary policies of France, the Netherlands, Spain or Italy were based on the monetary policy conducted by the Bundesbank. This was not sustainable either, as the 1992-93 crisis showed. And this was one of the reasons for the creation of the euro.

For monetary policy to be targeted effectively at domestic objectives, rather than at those of another country, it has to be freed from any exchange rate commitment, i.e. the country must have a flexible exchange rate system.

I will not discuss the reasons behind a country’s choice of one regime or the other. I will just note that, in today’s world, most industrial countries and a growing number of emerging market economies have adopted a flexible exchange rate regime. This is the case for large economies like the United States, the UK and Japan but also for small open economies like Switzerland, Sweden, Australia, New Zealand. This choice is consistent with the fact that in all these countries the mandate of the central bank is defined in terms of a domestic objective.

This is also the case for the euro area, whose members decided in 1998 to adopt a flexible exchange rate regime. It was the obvious decision to take. It would have made no sense at all to create the euro and then subject its monetary policy to external rather than internal requirements.

It is important to understand the implications of adopting a flexible exchange rate system.

One key aspect is that the external value of the currency is determined by the financial markets. This means that the exchange rate is not - and cannot be - an instrument of economic policy. This concept is well understood by economists and market participants, but not always in the political sphere. In fact, markets are often concerned that the exchange rate is used as instrument of economic or trade policy, or as a way to influence monetary policy. These concerns tend to discourage foreign investment. This is the reason why the US devised its “strong dollar” policy, which is not a policy aimed at achieving a certain exchange rate for the dollar. Indeed, the policy has been maintained when the dollar appreciated and when it depreciated. Rather, it’s a commitment not to manipulate the exchange rate to achieve a competitive advantage.

The fact that a country adopts a flexible exchange rate regime does not mean that the exchange rate is not an issue for discussion among the policy authorities or even, under extreme circumstances, action. There are two reasons for that.

First, market prices of financial assets, including the exchange rate, may at times deviate significantly from underlying fundamentals and develop into dynamics of their own. This point is widely accepted in the economics literature and even among financial market practitioners. Second, the exchange rate is an important variable, which affects other relevant ones in the economy, such as inflation, competitiveness, exports and imports. Therefore, even if a country adopts a flexible exchange rate regime, this does not mean that it has no exchange rate policy.

What are the main ingredients of an exchange rate policy? There are four sequential steps:

Step 1: Monitoring and assessing exchange rate markets and developments, in particular with respect to the underlying fundamentals;

Step 2: Discussing market developments with the other major partners and assess the configuration of different exchange rate developments and policies;

Step 3: Making public statements on the situation of the foreign exchange markets and on exchange rate policies;

Step 4: Intervening in the foreign exchange markets.

When considering these elements, policy-makers have to take into account a series of constraints.

First, assessing when an exchange rate which is determined in deep and competitive markets is out of line with the underlying fundamentals is not an easy task. It is also not easy to identify a more appropriate rate than the one set by the markets.

Second, influencing foreign exchange markets in one direction or another is at times a challenging task and requires substantial skills and knowledge of market dynamics. But it can be done, and has been done, as experience suggests.

Third, if the authorities attempt to influence the markets, the effectiveness of their action increases if it is coordinated. The successful implementation of any policy action in the exchange markets requires close cooperation between the central bank and the finance ministry. The central bank has to be involved because it generally has a better understanding of financial market developments and sensitivities, and because it knows how and when to act. Furthermore, any interventions and related news releases have to be consistent with the underlying monetary policy stance. The finance ministry also should be involved because the accompanying statements need to be coordinated and shared with the relevant foreign authorities, and supported by domestic policy actions. Therefore, the central bank and the finance ministry must aim, through a constructive dialogue, to reach a consensus both on the underlying market developments and on the policy actions to be taken.

Fourth, the effectiveness of the policy action critically depends on it being agreed and coordinated with the authorities of the other relevant countries, in particular within the G7.

Last, but not least, the effectiveness of the policy action depends on the credibility that the authorities have acquired in using that same instrument in the past. Failure may lead to a loss of credibility, which may in turn impair the effectiveness of any future policy action. Authorities must thus be convinced that they have a high probability of success before deciding to intervene on foreign exchange markets, either verbally or directly.

To ensure effectiveness of the whole strategy, the first two steps I described above, i.e. the monitoring and assessment of exchange rate developments and the discussion of policy options, have to be conducted in an extremely confidential environment. Any action, when decided, has to be implemented swiftly and accompanied by clear messages so as to maximise the impact on markets.

A key question in discussing the exchange rate policy of the euro is whether the euro area has all the instruments it needs to implement its policy effectively. Let’s consider in turn the four steps described above.

Step 1. Exchange rate developments are regularly monitored and discussed at the technical level between the ECB and the Eurogroup. The Chair of the Euro Working Group – the group of high-level representatives of the euro area Finance Ministers which form the Eurogroup – and the member of the Executive Board of the ECB in charge of international relations have regular exchanges of views on market developments and provide input to the policy discussion between the Eurogroup and the ECB. Since the start of the euro there have been no disagreements at the technical level either on the assessment or on the policy options. Similarly, discussions have never led to differences of views between the ECB and the Eurogroup on the overall situation or on the action to be taken. Common terms of references have often sealed this agreement and have been used in international discussions.

One concern is the confidentiality of the discussions related to Step 1. Public statements on exchange rate developments have too frequently been made at the level of individual Ministers or Heads of State or Government. This is a peculiarity of the euro area. In no other country do the political authorities make frequent and un-coordinated public statements about the exchange rate, as this tends to undermine the credibility and effectiveness of the policy action. In the euro area, statements are often made before meetings or on the margins of specific events. This, indeed, undermines the credibility and effectiveness of the euro area’s exchange rate policy.

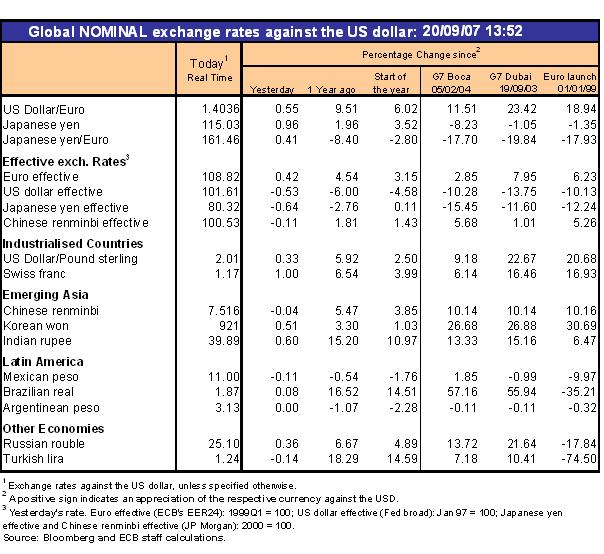

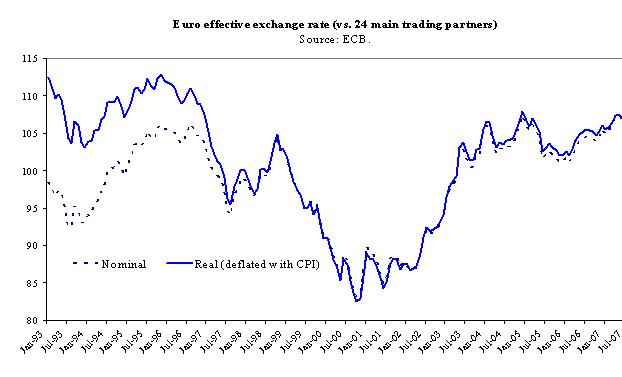

Another issue worth mentioning in this context is that the monitoring and assessment of market developments should not focus excessively on a single exchange rate, i.e. the euro-dollar rate, but consider the exchange rate of all relevant trading partners. In assessing the impact of exchange rate movements on trade and the external balance, it is the effective exchange rate, both in nominal and real terms, which matters. Effective exchange rates take into account the relative importance of the different countries in international trade. It is interesting to note, for instance, that the US dollar only has 24% of the weight for the calculation of the effective rate of the euro, and is closely followed by the pound (21%), the yen (10%), the Renmibi and the Swiss franc (7%). [2] The Pound and Swiss franc together weigh more than the US dollar. The sum of Asian currencies count for about 25%, which is higher than the US dollar. [3] This has to be taken in due consideration in assessing exchange rate developments and in drawing conclusions for the exchange rate policy.

Step 2. Discussions with the other major partners take place at three main levels.

First, in the context of the G7, the euro area is represented by the President of the Eurogroup and the President of the ECB. Their deputies frequently meet with the other partners, in particular the US Deputy Secretary of the Treasury and Japan’s Deputy Finance Minister, who are in charge of their respective policies. G7 communiqués are agreed in that context.

Second, discussions on exchange rates also take place at the IMF. On the exchange rate of the euro, the representatives of euro area countries on the Executive Board of the IMF are bound by a common position, agreed in Europe by the ECB and the Eurogroup. The Article IV Consultation of the IMF on the euro area involves regular missions and discussions with the ECB, the European Commission and the Eurogroup. The IMF Head of Mission reports his findings directly to the euro area Finance Ministers at a Eurogroup meeting. But when it comes to discussing other countries’ economies, exchange rate developments and policies, like those of the US, Japan or China for instance, the euro area does not speak with one voice in the IMF. The representatives of the euro area countries – which are spread among 8 different constituencies – each have separate statements. Coordination takes place ex ante to try to achieve consistency, but has its limits. Some euro area countries, like Spain, Finland and Ireland, are members of constituencies largely dominated by non-euro area countries and thus the euro area view is unlikely to be heard in a homogeneous way. The same situation arises at the meetings of the International Monetary and Finance Committee. It is my personal conviction that a unified representation of the euro area countries at the IMF would strengthen the exchange rate policy of the euro. [4]

A third forum for discussing exchange rate issues is in the context of bilateral relations. With some emerging markets and developing countries, where the exchange rate is more of a political issue and is dealt with at times at the level of the Head of State or Government, the euro area lacks a proper format for presenting its views and exerting pressure on other countries. For instance, the US has established a Strategic Economic Dialogue with China. The Euro Area does not need to copy the same model but should develop an appropriate policy forum.

Step 3. Verbal interventions are regularly made on exchange rates in the context of the G7. The Eurogroup and ECB representatives contribute to the preparation of the communiqué. The views expressed by the two representatives have always been consistent and ensured an effective message.

It should be mentioned that on a delicate issue such as the exchange rate, frequent declarations by individual policy-makers who have not been delegated to make such statements have no impact at all on the markets; sometimes they may even backfire.

Step 4. Finally, the euro area is fully equipped to conduct foreign exchange interventions. It did so, very effectively, in the Fall of 2000. This instrument is in the hands of the ECB, which can assess when and how to use it in the light of the prevailing market conditions and its monetary policy stance. [5] The ECB will use the instrument when it will consider it appropriate.

To sum up, the euro area has all the instruments to implement an effective exchange rate policy of the euro. Contrary to what some observers have suggested, the allocation of responsibility decided in the Treaty is optimal, because it allows for all the relevant authorities to be involved. It provides for the capacity to use the necessary instruments effectively and efficiently.

Some improvements would nevertheless be desirable.

First, there is a need for greater verbal discipline when making statements on exchange rates. Only the President of the ECB and the President of the Eurogroup should comment on the exchange rate of the euro. Statements made by national Finance Ministers, especially before Eurogroup meetings, only undermine the authority and effectiveness of the Eurogroup and its President in this regard.

Second, the euro area should strive to speak with one voice, not only in public and at G7 meetings but also at international institutions, such as the IMF, on issues related to the international economy and on the euro area’s major partners.

Those who really want to strengthen the exchange rate policy of the euro area should work on these two directions.

Table

-

[1] The views expressed in this note reflect only those of the author.

-

[2] Weights calculated considering 24 major currencies.

-

[3] The weight of Asian currencies is comparatively larger in a broader basket of 44 currencies.

-

[4] L. Bini Smaghi (2006) “ Powerless Europe: Why is the Euro Area still a Political Dwarf?” International Finance, 9.2, pp 261-279.

-

[5] For an overview of the institutional aspects of exchange rate interventions in the euro area see Henning, C. R. (2007): “ Organizing Foreign Exchange Intervention in the Euro Area”, Journal of Common Market Studies, 45, 2, pp. 315-342.

Banque centrale européenne

Direction générale Communication

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Allemagne

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction autorisée en citant la source

Contacts médias