Europe’s Hard Fix: The Euro Area

Speech by Otmar Issing, Member of the Executive Board of the ECBContribution to Workshop on“Regional and International Currency Arrangements”Vienna, 24 February 2006*

Monetary union as a corner solution to exchange rate regimes

The selection of exchange rate regime is one of the most fundamental policy issues in macroeconomics. The spectrum of possible choices ranges from the hard peg to a freely floating nominal exchange rate, with a variety of intermediate arrangements that are often called soft pegs. This latter group of regimes includes the conventional fixed (but adjustable) exchange rate, the crawling peg, an exchange rate band, and a crawling band. A crawling peg is given by a peg that can shift gradually over time. An exchange rate band is defined by the central bank having committed itself to a certain range for the exchange rate, while a crawling band is an exchange rate band that can shift over time. A managed float is an exchange rate regime that lies between the soft pegs and the freely floating. In this case the central bank may intervene in the exchange rate market, but it has not committed itself to a certain exchange rate or exchange rate band. The hard pegs include currency boards and situations where a country does not have a domestic currency, such as in a monetary union.

There are three main reasons why a country may want to peg its exchange rate. First, a floating exchange rate can be highly volatile and be difficult to predict not only in the short run, but also in the longer run. The costs that are linked to such exchange rate uncertainty are difficult to quantify and differ according to factors like size and degree of openness of a country. Second, pegging to a low-inflation currency may serve as a commitment device to help contain domestic inflation pressures. Third, for countries attempting to bring inflation down from excessive levels, fixed rates may help to control price developments for traded goods and provide an anchor for inflation expectations in the private sector.

Throughout modern history we have seen a number of periods when a fixed exchange rate has been the dominant regime. A common feature of such regimes seems to be the key role of the currency of a leading country (“key currency”) such as the British Pound in the 19th century and the US dollar after the second world war (see Issing, 1965). During the late 1800s and early 1900s the classical gold standard prevailed (see, for example, Eichengreen, 1996). After its political unification in 1871 Germany, adopting the British example, went on a gold standard and a large number of European as well as South and North American countries followed suit, thereby creating a system of fixed exchange rates (with small fluctuation bands reflecting the costs of gold transportation). The first negotiated system of fixed exchange rates, however, was the Bretton Woods system. In contrast with the classical gold standard, the Bretton Woods arrangement initially involved strict limits on capital mobility and the price for domestic currency was fixed relative to the U.S. Dollar (respectively to gold). This arrangement dominated the international monetary system from its introduction after World War II until its final collapse in 1973.

After the breakdown of the Bretton Woods system, a majority of countries in a series of steps have dismantled their still existing capital controls. In Europe we have seen a number of attempts to create a fixed exchange rate arrangement, such as the so called ‘Snake’ and later the Exchange Rate Mechanism (ERM) of the European Monetary System (EMS). Following the major speculative attacks on several currencies in the early 1990s, however, some European countries, like Sweden and the United Kingdom, opted for a different regime and let their exchange rate float. Other countries preferred to remain within the ERM with the goal of forming a monetary union in Europe.

To classify exchange rate regimes is not always easy in practise. What the authorities say they do (de jure) and what they actually do (de facto) sometimes differs considerably. Moreover, parallel and dual exchange rate markets sometimes existed, which further complicates a de facto classification. Fischer (2001) presents some evidence on the development of de facto exchange rate regimes for the IMF’s member countries for 1991 and 1999. Given the IMF’s evaluations of de facto regimes, 38 percent of the countries had either a hard peg or a floating exchange rate in 1991, while 62 percent had various types of soft peg arrangements. By 1999 the situation had essentially reversed when 66 percent of the countries had a hard peg or a floating exchange rate whereas only 34 percent had a soft peg arrangement. [1]

Any scheme for classifying de facto exchange rate regimes is inherently subjective and therefore open to criticism. For example, it may in some circumstances be difficult to judge whether an exchange rate is de facto a soft peg with a very broad exchange rate band or a managed float. In the case of Europe, however, it seems fair to say that since the speculative attacks on several European currencies in the early 1990s there has been a strong tendency for the countries to move towards the corners of the exchange rate regime spectrum and, in particular, in the direction towards the hard peg. By 2006 there are now 12 countries that have given up their domestic currency in favour of the euro and the 10 countries that joined the European Union in 2004 have stated their intent of adopting the single currency once they fulfil the Maastricht criteria.

At this stage we may ask what may help explain the observation that many countries, especially in the developed world, seem to move towards the two corners of the exchange rate spectrum: a hard peg or a flexible exchange rate? A well-known proposition for addressing this question is Mundell’s “impossible trinity”. It states that among the three desirable objectives:

stabilize the exchange rate;

free international capital mobility; and

an effective monetary policy oriented towards domestic goals;

only two can be mutually consistent. In this context it is interesting to note that this “impossibility theorem” was well developed before and has been “reinvented” several times.[2]

The impossible trinity has several other names, including the “uneasy triangle” and the “holy trinity”, and I will focus my attention on it in the next section. Section 3 discusses implications of the optimum currency area theory for EMU, while political aspects of monetary union are considered in section 4.

The power of the uneasy triangle

To understand the working of the uneasy triangle, it is instructive to consider separately each of the mutually consistent policy pairs in a very simplified setting. If a country opts for a fixed exchange rate and wants to set the domestic interest rates, cross border capital flows need to be restricted.[3] Otherwise, sooner or later an arbitrage possibility between domestic and foreign interest rates will arise. Policies of full international capital mobility and fixed exchange rate will similarly lead to arbitrage opportunities, unless domestic and international interest rates are equal. Thus, in this case an independent monetary policy is not possible. Using the same argument, independent monetary policy and unrestricted international capital flows can coexist only if the exchange rate is allowed to fluctuate.

This leads to an important question which policymakers have too often ignored. Which one of the three objectives should be given up? In the European context the question imposed by the trilemma of the uneasy triangle can, in fact, be further narrowed down. If we are willing to take for granted the achievements of the European common market, then clearly restriction of international capital mobility is no longer a viable policy choice for the EU. The trilemma is thus reduced to a dilemma. The policymaker has to choose between mutually inconsistent policy of exchange rate stabilization and monetary policy oriented towards domestic goals.

Given the stark implications of the logic of the uneasy triangle, it is important to test if the predictions of the trilemma find empirical support. The available empirical studies generally provide a positive answer. Rose (1996) concludes that exchange rate volatility is linked to monetary policy divergence and the degree of capital mobility as predicted by the trilemma, but the connection is surprisingly weak. One potential problem of this study is the association of monetary policy independence directly with divergence in economic fundamentals. In a subsequent study Obstfeld, Shambaugh and Taylor (2004) identify monetary policy with short term nominal market interest rates rather than economic fundamentals in general and find a strong empirical support for the logic of the trilemma during the last 130 years.

In the context of the European policy trade-offs (i.e., capital movements control is not an option), two more empirical studies should be mentioned. Frankel, Schmukler and Servén (2002) explore whether the choice of exchange rate regime affects the sensitivity of local interest rates to international interest rates. In support of the dilemma faced by European policymakers, the authors find that in the short run interest rates in countries with more flexible exchange rate regimes adjust more slowly to changes in international interest rates. In the long run only large industrial countries appear to have a choice of pursuing an independent monetary policy. These long-run findings are questioned by Shambaugh (2004), who concludes that the trade-off between exchange rate stabilization and independent monetary policy finds support in the data even in the long run.

Historical evidence from Europe

In addition to considering systematic empirical evidence for economies around the world, it is instructive to examine the historical evidence for European economies. Do the recent experiences in Europe comply with the predictions of the trilemma? In fact, the 1979-1992 period of EMS in Western Europe offers a prime example of policymakers’ refusal to succumb to (or failure to acknowledge) the unpleasant logic of the trilemma. Without doubt, both exchange rate stabilization and independent monetary policy featured high on the policymakers’ agenda. Until 1987, the unavoidable consequences of the trilemma were addressed partly by occasional exchange rate realignments and partly by remaining capital controls.[4]

There is a general agreement in the literature that the power of the trilemma’s logic caught up with the EMS policy arrangements in the 1992 crisis. After 1987 remaining capital restrictions were eliminated (or further relaxed in case of some countries) and a commitment was made to avoid future realignments of the EMS currencies. However, by 1992 the interest rate levels required to maintain the exchange rate parities were not (or were perceived by the markets as being not) consistent with the needs of the domestic economies. The pressures of unification necessitated an increase in German interest rates. At the same time, a number of Germany’s partner countries were experiencing a period of economic weakness reflecting either the effects of cumulated losses of competitiveness in previous years due to high inflation or the impacts of the unwinding of earlier booms. These apparent policy dilemmas were exacerbated as markets began to doubt the credibility of the parities. This led to a wave of speculative attacks, resulting in the devaluations of a number of currencies and even exits from the exchange rate mechanism.

EMU as the only feasible solution

Less than a decade after the 1992 crisis, all the EMS members (except Denmark and the United Kingdom) joined EMU. Not only have they given up monetary policy independence, they have also altogether eliminated exchange rates by substituting national currencies with the Euro – the common currency of EMU.

One way to understand this drastic change is to revisit the mutually consistent policies of the uneasy triangle. First, as already argued above, in the context of the successful economic integration in Europe, the possibility of reinstituting even partial restrictions on capital mobility was not a viable option. It directly contradicts with integration of financial markets, which is part of the common market initiative. This leaves open the question if capital controls can be permanently implemented successfully at all.

Second, the option of monetary policy oriented towards domestic goals combined with flexible exchange rates was seriously considered in academic circles, but was never seen as a viable option by European policymakers. This is mostly because of political considerations and lessons learnt from the European history of the first half of the 20th century.

This leaves us with the option of stabilizing the exchange rates and giving up independent monetary policy. An alternative, and perhaps more insightful, way to express the same policy option under a paper money standard is to have exchange rate stability as the only goal of monetary policy for all countries but one (the n-1 regime) – the latter being the home of the currency to which the other currencies are pegged.

Empirical evidence suggests that commitment to stabilize exchange rates in an environment of full capital mobility can rarely be sustained for periods longer than a few years. Only a handful of relatively small and open economies that are ready to subordinate, rather than co-ordinate, their monetary policy with respect to some base country have succeeded in maintaining fixed exchange rates (see Issing, 1965, Obstfeld and Rogoff, 1995). The few examples here include currency boards of countries such as Hong Kong and Estonia. For larger and more closed economies the commitment of monetary policy to pursue exchange rate stability as its sole objective is bound to lack credibility.

Similar insights can be gained by restricting our attention to Western Europe. It was the smaller, relatively more open and more closely integrated countries – such as Austria or the Netherlands - that managed to avoid any exchange rate realignments with the DM already from 1979 onwards (1983 in case of the Netherlands). One can also note the success of the long-standing exchange rate arrangement between Luxemburg and Belgium. Of course, being small and open does not by itself guarantee the success of a peg, as the experience of Ireland within the EMS showed.

Economists have also emphasized the self-fulfilling crisis dimension of exchange rate stabilization policies.[5] In this line of argument, the viability of a fixed exchange rate depends crucially on the markets’ perception of the credibility of the peg. If the peg is credible, then the costs involved for the country concerned in maintaining the peg should be manageable. However, if markets begin to doubt the commitment to the peg – e.g. because of political or economic developments - then the maintenance of the peg could require high levels of interest rates. In this latter case, the national authorities would have an incentive to abandon the peg, further exacerbating the speculative pressure on the currency. A number of episodes during the various currency crises of the early 1990s seem to be explicable by this type of phenomenon.

Where do these observations leave us with respect to a possibility of stable exchange rates among European economies? The options of achieving a more credible fix need to be explored and were explored following the EMS crisis in 1992. As already advocated by the Delors report in 1989, EMS countries had to proceed from formulation of (in)credible exchange rate rules to a commitment to pursue a common monetary policy under a supranational central bank.

Several possibilities were considered. The option of a DM and Bundesbank centred arrangement was neither politically acceptable, nor economically feasible. The Bundesbank as a national central bank with a national mandate could not be expected to conduct monetary policy with the view of the whole ‘DM-area’. By the same token, the Bundesbank could not have credible control over monetary policies of other countries of the ‘DM-area’.

In view of problems accompanying the ERM as well as the political constraints, EMU was the obvious option for Europe. It is a credible arrangement for achieving exchange rate stability and ensuring continuation of the integration process. By eliminating exchange rates altogether and instituting a supranational central bank with a common monetary policy, a credible commitment has been made to eliminate once and for all exchange rate fluctuations and any divergence in monetary policy between the member states.

However, outside theoretical models the credibility of commitments can always be questioned. Two potential problems need to be pointed out. First, countries still have control over a wide spectrum of policy tools that can lead to a divergence in economic policies (e.g. fiscal policy) across the EMU countries. Second, large country-specific shocks which alter the benefits and costs of EMU participation for individual countries cannot be ruled out. Both of these potential problems are discussed in more detail in the following sections.

Economic integration and EMU

The conviction underlying the Maastricht Treaty was that nominal exchange rates should be irrevocably fixed to achieve and maintain a unified single European market. Without a single currency and a single monetary policy, the achievements made regarding economic integration and the deepening of the Single Market would be in danger. Monetary Union in Europe was launched in January 1999 and the single currency eliminates, once and for all, internal nominal exchange rate fluctuations and supports the continuing process of economic integration. Monetary Union involves one supranational central bank, the ECB, and a single monetary policy. At this stage we may ask ourselves the famous question: Does one size fit all?

In view of the uneasy triangle, the main advantage of a flexible exchange rate in a world of free international capital mobility is that it allows a country to pursue an independent monetary policy. With such a tool at its disposal, the government of a country can react by, say, lowering the short-term interest rate when the domestic economy is likely to go into a recession after an adverse shock. This raises the issue what a country will loose when giving up this instrument. Alesina, Barro and Tenreyro (2002) argue that countries showing large co-movements of income and prices have the lowest costs from giving up their monetary independence. This suggests that the presence of important country-specific shocks make it particularly costly to abandon this policy instrument.

The ability of a country to achieve and maintain low inflation is also a factor that can affect the costs of loosing domestic control of the monetary policy instrument. Some governments may have an incentive to renege on a credible low inflation commitment in order to reduce unemployment (see, for instance, Barro and Gordon, 1983). The agents of the economy are likely to learn about such policy behaviour, leading to a loss of credibility and higher inflation. Countries with a history of high inflation or low credibility of its monetary policy are therefore less likely to face large costs from giving up their monetary policy independence.

A second advantage of a flexible exchange rate is the shock absorbing role that it can play. Although the protection is unlikely to be complete, movements in the nominal exchange rate can work to offset some of the effects from a temporary shock. In the case of permanent shocks, changes in the nominal exchange rate may also facilitate the transition to a new equilibrium. It should, of course, also be kept in mind that even if a country has a flexible nominal exchange rate, the economic policy response to a given adverse shock may be better addressed through another policy instrument than the short-term interest rate.

Optimum currency areas

Historically, currency areas have typically coincided with national territory. But this does not necessarily mean that all countries are better off when they have their own currency. The theory of optimum currency areas (OCA) is a useful framework for addressing the question about the appropriate domain of a currency area. Inspired by previous work due to Friedman (1953) and Meade (1957), the OCA theory took off with the seminal work by Mundell (1961), with essential early contributions by McKinnon (1963) and Kenen (1969). Further important contributions to this literature include Corden (1972), Mundell (1973), and more recently Tavlas (1993).

An OCA is the optimal geographic domain of a single currency or of several currencies whose exchange rates are irrevocably fixed. Optimality is regarded in terms of a set of OCA criteria that are primarily related to the economic integration of regions or countries. These criteria include price and wage flexibility, the mobility of labour and capital, economic openness, diversification in production and consumption, similarity in inflation rates, and fiscal integration. Optimality of a currency area can be defined in terms of the above criteria. When shared across countries, these criteria reduce the need for nominal exchange rate adjustments, foster internal and external balances and help to isolate individual countries from certain shocks. A “meta” criterion that has been suggested is the similarity of shocks and the responses to these. That is, the synchronisation of shocks and cycles (see, e.g., Bayoumi and Eichengreen, 1993, and Giannone and Reichlin, 2005).

The empirical literature on the status of the euro area as an OCA is too extensive for me to present in much detail in this article. Instead I will only summarize some of the evidence with the United States as a reference for comparisons. For a survey of this literature the interested reader is referred to Mongelli (2002) and references therein.

The euro area countries performed unfavourably in comparison with the United States in terms of price and wage flexibility before the start of EMU (see, e.g., OECD, 1999). Improvements in price stability had been achieved, but structural reforms overall still lacked ambition. But, one can expect that the drive to continue implementing the Single Market Programme and product market reforms is likely to have a positive impact on its future development. Furthermore, one important factor behind the relatively low price flexibility is low wage flexibility. In this respect, several labour market institutions seem to be particularly important when attempting to explain the latter.

Labour mobility could alleviate some of the problems linked to low wage flexibility. The empirical evidence, however, suggests that it is roughly 2-3 times lower in Europe than in the United States (OECD, 1999). Bertola (2000), for example, suggests that quantity and price factors of labour market rigidity are connected and that lack of employment flexibility with wage rigidity reinforce one another. For a recent study on structural reforms in labour and product markets, see Duval and Elmeskov (2005).

On the positive note, the euro area countries are highly diversified and tend to behave more as a group than the United States. For instance, Krugman (1993) provides evidence that the degree of specialisation is larger in the United States than in Europe. OECD (1999) examines the degree of similarity in the composition of consumption across euro area countries and finds evidence of very high similarities in most countries. Accordingly, the greater homogeneity among the euro area countries together with lower degree of specialisation suggests that they are less likely to suffer from asymmetric shocks than regions in the United States.

Furthermore, financial market integration is high and rising (see ECB, 2005). This OCA criterion is usually evaluated using the intensity of cross-border financial flows, the law of one price, as well as similarities in financial institutions and markets. Regarding asset price differentials, for example, yield differentials among euro area government bonds have converged significantly (see, e.g., Baele, Ferrando, Hördahl, Krylova and Monnet, 2004, and ECB, 2006).

Regarding trade integration of the euro area countries, the empirical evidence is favourable. Due to the price liberalisation process, stimulated also by the implementation of the Single Market Programme, and the deepening of industry trade, prices of tradables are becoming more aligned across the EU (see, e.g., Beck and Weber, 2001). Furthermore, differences in inflation rates across euro area countries have been declining over the past 20 years, a period during which inflation rates have converged to levels consistent with price stability (for a recent study, see Angeloni and Ehrmann, 2004). As a consequence of this convergence process, EMU began in a low inflation environment and the stability-oriented monetary policy of the ECB has succeeded in keeping inflation low. National developments and catching-up effects will continue to cause some inflation differentials, but these are self-correcting and can therefore be expected to be limited in time.

Effects of monetary union

At this stage it is worthwhile to mention some important limitations of the OCA theory. First and foremost, the theory is backward-looking and thus cannot account for the fact that a monetary union of 12 European countries already exists. The economic and institutional framework of the euro area and the EU is also changing over time and this has an impact on the status of the OCA criteria. Specifically, monetary union is a structural change and as such has an effect on the behaviour of the euro area economies at both macroeconomic and microeconomic levels. The two main sources of behavioural change that have been suggested in the academic literature are often referred to as the specialisation and the endogeneity of OCA hypotheses.

The specialisation hypothesis predicts that as countries become more integrated they will specialise in the production of those goods and services where they have a comparative advantage (see Krugman, 1993, and Krugman and Venables, 1996). A consequence of this prediction is that production becomes more specialized across countries of a monetary union and incomes across countries therefore less correlated.[6] If this specialisation force is strong enough, the OCA status of the currency area could weaken.

The endogeneity of OCA hypothesis, in contrast, predicts that there is a positive relation between trade integration and income correlation (see Frankel and Rose, 1998). The intuition behind this claim is that monetary integration reduces trading costs beyond those related to nominal exchange rate volatility. Among other things, a common currency prevents devaluations and thus removes risks linked to devaluation expectations. It also facilitates foreign direct investment, the building of stable long-term relationships, and may encourage political integration. This, in turn, further promotes reciprocal trade as well as economic and financial integration and business cycle synchronisation.

There is some empirical support for both of these hypotheses. For instance, Rose (2000) uses a gravity model to assess the separate effects of exchange rate volatility and currency unions on international trade and finds evidence of a large positive effect of currency unions. This suggests that the endogeneity of OCA criteria is potentially a strong force. Other studies, such as Persson (2001), argue that this effect is lower and statistically highly uncertain.[7] Alesina et al. (2002) applies a different methodology than the gravity model and reports evidence that currency unions are likely to increase co-movements of prices and, potentially, of output.

Beck and Weber (2001), using a methodology similar to Engel and Rogers (1996), investigate the impact of the introduction of the euro on goods market integration. Based on data for 81 European cities in six euro area countries (and in Switzerland for controls), the study finds that there has been a strong decline in cross border volatility of relative prices since January 1999. In fact, border effects have been reduced to 20 percent of pre-EMU levels, although distance and border effects still matter post-EMU. Engel and Rogers (2004) study prices on a variety of comparable goods and services across a large number of cities worldwide over the period 1990 to 2003. For the euro area countries they find a decline in price dispersion over much of the 1990s but no evidence of price convergence after the introduction of the euro. Engel and Rogers suggest that their results may either be explained by the short sample after January 1999 or by other developments in the EU, such as the Single Market Programme, which contributed greatly to market integration throughout the 1990s. By 1999 the markets for consumer goods were already highly integrated. For in-depth discussions on various “endogeneities of OCA’s”, see, for example, De Grauwe and Mongelli (2005).

To summarize, the euro area may not yet be an optimum currency area to the extent that the United States is. It scores well in terms of several OCA criteria and has great potential for considerable improvements concerning, for example, price and wage flexibility. But with the specialisation and endogeneity of OCA hypotheses in mind, static thinking in terms of costs and benefits at a certain point in time can be highly misleading. It is possible that a large share of the costs of monetary union occur during the early years, while many of the benefits become important more gradually. In fact, the net benefits may not even be guaranteed, but depend on future economic developments, the policies that are carried out, and on the implementation of institutional reforms. The OCA criteria where the euro area performs poorly can be greatly affected by structural reforms. Let me therefore turn my attention to some political aspects of monetary union.

Political aspects of monetary union

The creation of a monetary union raises some interesting issues of political nature, not present in other exchange rate arrangements. In particular, monetary union requires a transfer of monetary sovereignty from national authorities to a common central bank and irrevocably fixes the nominal exchange rate. This reduces the scope for national governments to stabilise the domestic economy. In this environment, major adjustments in the national policy domain are necessary.

Need for flexible markets

The major source of external imbalances before EMU was due to different degrees of inflation across countries, which made readjustments of national exchange rates necessary. In Monetary Union this adjustment tool is no longer available and the monetary policy regime is the same for all member countries. Therefore, a straightforward consequence of monetary union is that nominal contracts in general and wages in particular have to respect this regime switch, thereby avoiding the need for adjustments which were necessary before.

Beyond this fundamental principle, need for economic adjustments between the EMU member states is likely to remain a policy concern for the national governments. In this regard, it has been argued rather convincingly in the academic literature that national policies should focus on increasing market flexibility, in particular, product market flexibility, labour market flexibility as well as financial integration.

The arguments in favour of flexibility are well known.[8] More flexible nominal prices and wages ensure that the adjustment process, induced by a negative shock, is less likely to lead to sustained adverse changes in economic fundamentals (e.g. unemployment). Similarly, labour mobility reduces the need to alter real factor prices between countries and financial integration allows for more risk sharing across the members of a monetary union.

The state of market flexibility in EMU was already discussed in the previous section. It should be stressed that in recent years we have witnessed significant improvements in market flexibility across the EMU, yet more reforms and progress are urgently required. This is particularly the case for labour markets, where the degree of flexibility remains limited. Real wages adjust much more slowly to economic shocks in the EMU than in the United States. Also labour mobility in the EMU is relatively low. Furthermore, this applies even to inter-regional and occupational mobility within the EMU countries. The existence of various barriers, institutional and administrative, makes large-scale migration in the EMU an unlikely – and considering cultural diversity probably also an unwelcome – response to economic shocks.[9]

Need for a fiscal framework

Another implication of monetary union is that the usual interplay between fiscal and monetary authorities at the national level is replaced by a potentially more complex interaction between a group of national governments and a common central bank. Should the common monetary policy be accompanied by any restrictions on the fiscal policies of the member states?

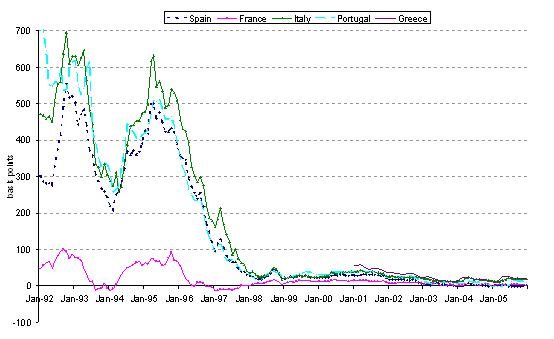

One important recent fiscal development has been the dramatic narrowing of the interest rate spreads on government debt which started already in the run up to EMU (see Figure 1). While some of the decrease can be attributed to global economic conditions during the period, there is no doubt that a dominant share of the trend is a consequence of the elimination of exchange rate risk from national debt (see ECB, 2006, and Detken, Gaspar and Winkler, 2004).

Figure 1 : Ten-year government bond spreads against Germany

Source: ECB (2006).

As a result, we have an integrated European bond market, but at the same time an important channel for restraining unsound fiscal behaviour at the national level has been lost. The considerably smaller premium that less prudent governments have to pay on their debt presents a problem for the union. Given the muted interest rate response, each member state is exposed to incentive of running a higher level of public debt. In essence, while potential short term economic and especially political benefits of excessive government spending continue to accrue at the national level, fiscal authorities fail to fully internalize the costs of their debt policies. In equilibrium this would lead to higher public debt levels and eventually higher interest rates in the whole union.

In principle, market forces should help to constrain the less prudent governments. Indeed, numerous studies (see e.g. Codogno, Favero and Missale, 2003, Bernoth, von Hagen and Schuknecht, 2004) show that yield spreads across the EMU countries are positively correlated with fiscal vulnerability. However, the constraints imposed by financial markets tend to be either too slow and weak or too sudden and disruptive and, therefore, cannot single-handedly ensure sound public finances. As was already well recognized long before the start of EMU (see Delors Report, 1989), a common market and currency require a fiscal framework, which constrains national policies.

It is instructive to note here that similar ‘debt bias’ problems are present in a single country setting. The build-up of public debt in many industrialized countries since the 1970s has lead to an extensive literature addressing this topic. The issues involved are by now well understood. The usual arguments draw on some political distortion, resulting from short-sightedness of policy-makers, and lead to excessive levels of public debt.[10] There is a consensus among economists that such ‘debt bias’ has significant negative welfare effects. Furthermore, constraints on fiscal policy, especially in the form of institutional constraints, can help to alleviate the problem.[11] Interestingly, one of the findings in this literature is that countries with more decentralized budget processes exhibit more ‘debt bias’. The EMU without well-functioning fiscal constraints can be seen as an extreme case of such decentralization.

Another argument in favour of fiscal constrains is offered by the literature examining the complex interaction between national fiscal authorities and a supranational central bank. Dixit and Lambertini (2003) show that in a setting of a monetary union discretionary fiscal policies of the member states can undermine the monetary commitment of the common central bank. Chari and Kehoe (2003) and Beetsma and Uhlig (1999) in turn argue that without the monetary policy commitment, fiscal policy has a free-riding problem and restrictions on national fiscal policies may be desirable. Similar conclusions are reached by Uhlig (2002) after examining different potential EMU crisis scenarios, including possibilities of fiscal and systemic crises.

To be sure, there is also some concern about the costs that come with restrictions on fiscal policy. Under a common monetary policy, fiscal policy is the main domestic tool available to handle country-specific shocks. There is, however, a general scepticism in the literature about the ability of fiscal policy to handle shocks beyond the effects of automatic stabilizers. In addition to undermining soundness of budgetary positions, discretionary fiscal policies have too often proved to be pro-cyclical rather than counter-cyclical, thereby exacerbating macroeconomic fluctuations (see Issing, 2005).

Overall, despite the ongoing debate about the exact shape of the fiscal restrictions, there is an overwhelming consensus in the literature in favour of the necessity of a fiscal framework in a monetary union.

The response of the EMU to this challenge has been the Stability and Growth Pact (SGP) (see Schuknecht, 2004). Unfortunately, the implementation of SGP has proved problematic, in particular, the enforceability of its rules. The SGP, and the necessity of a fiscal framework in general, are being heavily tested by several countries, especially by those which are subject to the excessive deficit procedure.

It appears that there was no widespread and deep understanding about the implications that signing the Maastricht Treaty and joining EMU would have on the domestic policy domain. Policies pursued by the national governments, in particular fiscal and labour market policies, need to be consistent with the framework set by the monetary policy of the central bank following its mandate of maintaining price stability. To achieve this, EMU needs to continue to catalyse reforms with a steady support from all member states.

Monetary Union and Political Union

Monetary union as a corner solution raises an issue which is singular for all options of exchange rate regimes. Only monetary union implicitly and unavoidably requests reflections on the complementarily, if not precondition, of a political union.

The need for a fiscal framework is already a step in that direction. But monetary union in itself already has a clear political dimension. The transfer of national sovereignty in such an important field as the currency to a supranational institution – in the case of EMU from national central banks to the ECB – is a substantial contribution to political integration. A central bank is, after all, an element of statehood.

A common central bank conducting a single monetary policy, an efficient framework for fiscal discipline and flexible markets comprise an institutional arrangement on which monetary union can deliver the expected positive results. This leaves open the question on future steps in the direction of a fully fledged political union (see Issing, 2004).

References

* I would like to thank Rudolfs Bems and Anders Warne for their valuable contributions.

Alesina, A., Barro, R.J., and S. Tenreyro (2002), “Optimal Currency Areas”, in Gertler, M. and K. Rogoff (eds), NBER Macroeconomics Annual, Cambridge, MA: MIT Press.

Angeloni, I. and M. Ehrmann (2004), “Euro Area Inflation Differentials”, ECB Working Paper Series No. 388.

Baele L., Ferrando, A., Hördahl, P., Krylova, E. and C. Monnet (2004), “Measuring Financial Integration in the Euro Area”, ECB Occasional Paper Series No. 14.

Baldwin, R.E. (2005), “The Euro’s Trade Effects”, Manuscript, Graduate Institute of International Studies, Geneva.

Barro, R.J. and D.B. Gordon (1983), “Rules, Discretion and Reputation in a Model of Monetary Policy”, Journal of Monetary Economics, 12, 101-121.

Bayoumi, T. and B. Eichengreen (1993), “Shocking Aspects of European Monetary Unification”, in Giavazzi, F. and F. Torres (eds.), Adjustment and Growth in the European Union, Cambridge: Cambridge University Press, 193-230.

Beck, G. and A.A. Weber (2001), “How Wide are European Borders? New Evidence on the Integration Effects of Monetary Policy”, CFS Working Paper No. 2001/07.

Beetsma, R. and H. Uhlig (1999), “An Analysis of the Stability and Growth Pact”, The Economic Journal, 109: 546-571.

Bernoth K., von Hagen, J., and L. Schuknecht (2004), “Sovereign Risk Premia in the European Government Bond Market,” ECB Working Paper No. 369.

Bertola, G. (2000), “Labor Markets in the European Union”, Ifo-Studien, 46, 99-122.

Chari, V.V. and P.J. Kehoe (2003), “On the Desirability for Fiscal Constraints in a Monetary Union”, Federal Reserve Bank of Minnesota, Staff Report No. 330.

Codogno L., Favero, C., and A. Missale (2003), “Yield Spreads on EMU Government Bonds,” Economic Policy, October, 503-527.

Corden, W.M. (1972), “Monetary Integration”, Essays in International Finance No. 93, International Finance Section, Princeton University.

De Grauwe, P. and F.P. Mongelli (2005), “Endogeneities of Optimum Currency Areas: What Brings Countries Sharing a Single Currency Closer Together?”, ECB Working Paper Series No. 468.

Delors Report (1989), “Report on Economic and Monetary Union in the European Community,” Committee for the Study of Economic and Monetary Union, Commission of the European Community, Brussels.

Detken C., Gaspar, V. and B. Winkler (2004), “On Prosperity and Posterity: The Need for Fiscal Discipline in a Monetary Union,” ECB Working Paper No. 420, December.

Dixit, A. and L. Lambertini (2003), “Interactions and Commitment and Discretion in Monetary and Fiscal Policies,” American Economic Review, Vol. 93, No. 5, pp 1522-1542.

Duval, R. and J. Elmeskov (2005), “The Effects of EMU on Structural Reforms in Labour and Product Markets”, OECD Economics Department Working Papers, No. 438, OECD Publishing.

ECB (2005), Indicators of Financial Integration in the Euro Area, Frankfurt.

ECB (2006), “Fiscal Policies and Financial Markets,” Monthly Bulletin, February.

Eichengreen, B. (1996), Globalizing Capital: A History of the International Monetary System, Princeton: Princeton University Press.

Eichengreen, B. and C. Wyplosz (1993), “The Unstable EMS”, Brookings Papers on Economic Activity, 1993:1, p. 51-124.

Engel, C. and J.H. Rogers (1996), “How Wide is the Border?”, American Economic Review, 86, 1113-1125.

Engel, C. and J.H. Rogers (2004), “European Product Market Integration after the Euro”, Economic Policy, 19, 347-384.

Fatas A., and I. Mihov (2003), “On Constraining Fiscal Policy Discretion in EMU,” Oxford Review of Economic Policy, Vol. 19, No. 1, pp 112-131.

Fischer, S. (2001), “Exchange Rate Regimes: Is the Bipolar View Correct?”, Journal of Economic Prespectives, 15, 3-24.

Frankel, J.A. (1999), “No Single Currency Regime is Right for all Countries or at all Times”, Essays in International Finance No 215, International Finance Section, Princeton University.

Frankel, J.A. and A.K. Rose (1998), “The Endogeneity of the Optimum Currency Area Criteria”, The Economic Journal, 108, 1009-1025.

Frankel, J., Schmukler, S., and L. Servén (2002), “Global Transmission of Interest Rates: Monetary Independence and Currency Regime,” NBER Working Paper No. 8828, March.

Friedman, M. (1953), Essays in Positive Economics, Chicago: University of Chicago Press.

Giannone, D. and L. Reichlin (2005), “Trends and Cycles in the Euro Area: How Much Heterogeneity and Should We Worry About it?”, Manuscript, Université Libre de Bruxelles, Belgium. Presented at the ECB Conference “What effect is EMU having on the euro area and its member countries?”, 16-17 June, 2005.

Issing, O. (1964), Monetäre Probleme der Konjunkturpolitik in der EWG, Berlin: Duncker & Humblot.

Issing, O. (1965), Leitwährung und internationale Währungsordnung, Berlin: Duncker & Humblot.

Issing, O. (2004), “Economic and Monetary Union in Europe: Political Priority versus Economic Integration”, in Barens, I., Caspari, V., and B. Schefold (eds.), Political Events and Economic Ideas, Glos: Edward Elgar.

Issing O. (2005), “Stability and Economic Growth: The Role of the Central Bank,” speech international conference, Mexico City, 14 November.

Kenen, P. (1969), “The Theory of Optimum Currency Areas: An Ecclectic View”, in Mundell, R.A. and A.K. Swoboda (eds.), Monetary Problems of the International Economy, Chicago: University of Chicago Press.

Krugman, P. (1993), “Lessons from Massachusetts”, in Giavazzi, F. and F. Torres (eds.), Adjustment and Growth in the European Union, Cambridge: Cambridge University Press, 241-261.

Krugman, P. and A.J. Venables (1996), “Integration, Specialization, and Adjustment”, European Economic Review, 40, 959-967.

McKinnon, R.I. (1963), “Optimum Currency Areas”, American Economic Review, 53, 717-724.

Meade, J.M. (1957), “The Balance of Payments Problems of a European Free Trade Area”, The Economic Journal, 67, 379-396.

Mongelli, F.P. (2002), “‘New’ Views on the Optimum Currency Area Theory: What is EMU Telling Us?”, ECB Working Paper Series No. 138.

Mundell, R.A. (1961), “A Theory of Optimum Currency Areas”, American Economic Review, 51, 657-665.

Mundell, R.A. (1973), “Uncommon Arguments for Common Currencies”, in Johnson, H.G. and A.K. Swoboda (eds.), The Economics of Common Currencies, Allen and Unwin.

Obstfeld, M. and K. Rogoff (1995), “The Mirage of Fixed Exchange Rates”, Journal of Economic Prespectives, 9, 73-96.

Obstfeld, M., Shambaugh, J.C., and A.M. Taylor (2005), “The Trilemma in History: Tradeoffs Among Exchange Rates, Monetary Policies, and Capital Mobility”, The Review of Economics and Statistics, 87, 423-438.

OECD (1999), “EMU: Facts, Challenges and Policies”, Paris: Organisation for Economic Cooperation and Development.

Persson, T. (2001), “Currency Unions and Trade: How Large is the Treatment Effect?”, Economic Policy, 16, 435-448.

Persson, T. and G. Tabellini (2000), Political Economics: Explaining Economic Policy, Cambridge, MA, MIT Press.

Reinhart, C.M. and K.S. Rogoff (2004), “The Modern History of Exchange Rate Arrangements: A Reinterpretation”, The Quarterly Journal of Economics, CXIX, 1-48.

Rose, A.K. (1996), “Explaining Exchange Rate Volatility: An Empirical Analysis of ‘The Holy Trinity’ of Monetary Independence, Fixed Exchange Rates, and Capital Mobility,” Journal of International Money and Finance 15 (6): 925–45.

Rose, A.K. (2000), “One Money, One Market: The Effect of Common Currencies on Trade”, Economic Policy, 15, 9-45.

Rose, A.K. (2001), “Currency Unions and Trade: The Effect is Large”, Economic Policy, 16, 449-461.

Schuknecht L. (2004), “EU Fiscal Rules: Issues and Lessons from Political Economy,” ECB Working Paper No. 421.

Shambaugh, J.C. (2004), “The Effects of Fixed Exchange Rates on Monetary Policy,” Quarterly Journal of Economics 119 (February): 301-52.

Tavlas, G.S. (1993), “The ‘New’ Theory of Optimum Currency Areas”, The World Economy, 1993, 663-685.

Uhlig, H. (2002), “One Money, but Many Fiscal Policies in Europe: What are the Consequences?”, in Buti, M. (ed.), Monetary and Fiscal and Coordination, Cambridge: Cambridge University Press.

-

[1] Reinhart and Rogoff (2004) develop a system for classifying exchange rate regimes that also makes use of market determined parallel exchange rates and that goes back to 1946, covering 153 countries. Their system is likely to give different percentage numbers for the three exchange rate arrangements listed by Fischer (2001).

-

[2] For reference to the literature, see Issing (1964).

-

[3] Assuming that capital controls can be applied efficiently over time, which might be questionable.

-

[4] See Eichengreen and Wyplosz (1993) for more detailed discussion and further references.

-

[5] See, for example, Eichengreen and Wyplosz (1993) for a discussion of the role of self-fulfilling expectations in the EMS 1992 crisis.

-

[6] See Frankel (1999) for a critique on this hypothesis based on the instability of such a process.

-

[7] See also Rose (2001) for a response to Persson’s results and Baldwin (2005) for a thorough discussion of this topic and further references to the literature.

-

[8] See Mongelli (2002) for a comprehensive survey of these arguments.

-

[9] See OECD (1999) for a detailed study of price and labour market flexibility in Europe.

-

[10] See Persson and Tabellini (2000) for a summary of the main theoretical arguments.

-

[11] For a survey see Fatas and Mihov (2003).

Banque centrale européenne

Direction générale Communication

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Allemagne

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction autorisée en citant la source

Contacts médias