- THE ECB BLOG

Are banks ready to weather rising interest rates?

20 December 2022

The ECB has gauged bank resilience to interest rate shocks under different macroeconomic scenarios. ECB Vice-President Luis de Guindos and Chair of the ECB’s Supervisory Board Andrea Enria walk us through the findings.

Can banks handle changing yield curves?

The euro area is in a phase of policy normalisation. The ECB has increased policy rates by 2.5 percentage points and will raise them further to fight inflation. This will have a significant impact on bank balance sheets and profitability, and eventually on banks’ ability to provide households, small businesses and corporates with credit. So how resilient are banks when facing this changing environment? Our assessment of bank resilience under different macroeconomic scenarios shows that the banking sector is sound enough to handle the effects of rising rates on their balance sheets. However, banks must prepare for potential longer-term effects related to monetary policy normalisation. And they should pay special attention to interest rate risk in their asset and liability management.

We consider two types of instantaneous but temporary[1] shocks in the yield curve to assess the resilience of the banking sector over a three-year horizon:

- A flattening of the yield curve: an increase of 300 basis points for the short-term rate and an increase of 100 basis points for the ten-year long-term rate. Our first scenario would be consistent with the need to bring down inflation more decisively in the short term, and an expectation of success in the medium term.

- A steepening of the yield curve: an increase of 100 basis points in the short-term rate and an increase of 300 basis points in the long-term rate. Our second scenario would be consistent with a fast decrease in inflation, accompanied by medium-term concerns about the world economy.

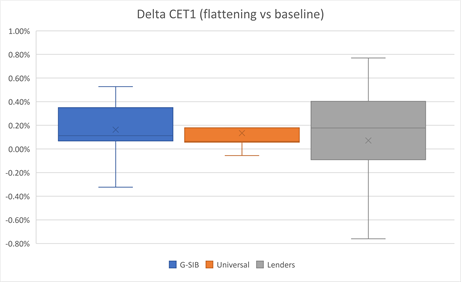

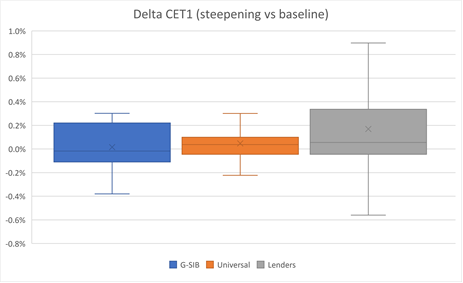

Overall, our analysis shows that the euro area banking sector would remain broadly resilient to a variety of interest rate shocks. That would hold also under a baseline scenario of an economic slowdown in 2023 with the risk of a shallow recession, such as the scenario included in the December 2022 Eurosystem staff macroeconomic projections. Profitability would increase overall, driven by net interest income. However, provisions would also increase, reflecting potential difficulties for borrowers. Results for the overall impact on solvency remain on average fairly muted with great heterogeneity across banks, within and across different business models (Chart 1; Budnik et al., 2020).[2]

Chart 1

Banking sector solvency under flattening and steepening scenarios.

Percentage points

Source: ECB staff calculation based on the Banking euro area stress test model (Budnik et al., 2020).

Notes: Distribution of changes of Common Equity Tier 1 (CET1). Capital as percentage of total risk weighted assets in deviation from the baseline scenario. Positive values represent an improvement of the solvency ratio with respect to the baseline scenario. The sample includes 89 significant banks under direct supervision of the ECB.

Each box and whisker chart shows the distribution of data into quartiles, highlighting (in descending order) the 90th, 75th, 50th, 25th and 10th percentile. The simple average is shown as an “x” and the median as a continuous line. “Lenders” includes diversified, corporate, retail and commercial lenders.

Despite their larger exposures to financial markets, the relative resilience of European global systemically important banks reflects their globally diversified balance sheets. Furthermore a few banks, representing 0.1% of the sector’s assets, would move closer to the maximum distributable amount (MDA) under the flattening scenario and might react by deleveraging their balance sheet and retracting their support to the economy. The share of banking sector assets closer to the MDA would not change under the steepening scenario.

The overall resilience of the euro area banking sector shouldn’t distract from bank specific situations that might warrant supervisory actions.

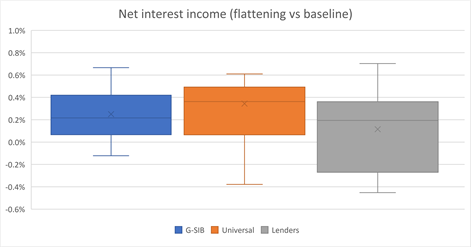

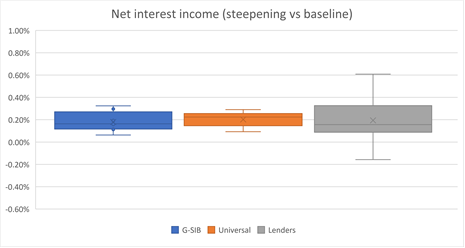

Interest rate shocks affect bank solvency via two main transmission channels. First, through net interest income and the pass-through of changes in interest rates to assets and liabilities (see Altavilla et al., 2020).[3] Our results suggest that European banks cope well with interest rate shocks as changes in net interest income are on average positive under the different scenarios. However, under the flattening scenario, few banks will face a significant increase in their funding cost that would be even larger than the projected increase in their earnings (see Chart 2). This occurs because bank liabilities have a shorter maturity relative to their assets.[4]

Chart 2

Net interest income under flattening and steepening scenarios

Percentage points

Source: ECB staff calculation based on the Banking euro area stress test model (Budnik et al., 2020).

Notes: Distribution of net interest income (NII) as percentage of total assets in deviation from the baseline scenario. Positive values represent an increase of banks profitability with respect to the baseline scenario. The sample includes 89 significant banks under the ECB’s direct supervision.

Each box and whisker chart shows the distribution of data into quartiles, highlighting (in descending order) the 90th, 75th, 50th, 25th and 10th percentile. The simple average is shown as an “x” and the median as a continuous line. “Lenders” includes diversified, corporate, retail and commercial lenders.

Banks could face higher credit losses

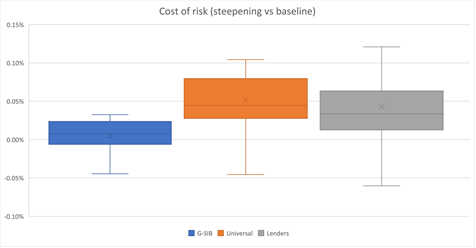

Second, banks could face higher credit losses as firms and households may struggle to service their debts in an environment of rising rates. While the banking sector recently saw a recovery in profitability, there are incipient signs of asset quality deterioration, which may require higher provisions. The increase in provisions as a share of total loans would have a mildly negative impact on banks’ capital under a scenario of sharp steepening (see Chart 3). The average cost of risk[5] remains almost unchanged under the flattening scenario, reflecting the compression of the spread between the short and long-term interest rate. Under the steepening scenario, the cost of risk increases by 4 basis points due to the difficulty for the most fragile households and firms in coping with the increase in their debt servicing cost.

Chart 3

Cost of risk under flattening and steepening scenarios

Percentage points

Source: ECB staff calculation based on the Banking euro area stress test model (Budnick et al., 2020).

Notes: Distribution of changes in provisions as percentage of total loans in deviation from the baseline scenario. Positive values represent an increase of potential credit risk over the outstanding loan exposures. The sample includes 89 banks significant institutions under the ECB’s direct supervision.

Each box and whisker chart shows the distribution of data into quartiles, highlighting (in descending order) the 90th, 75th, 50th, 25th and 10th percentile. The simple average is shown as an “x” and the median as a continuous line. “Lenders” includes diversified, corporate, retail, and commercial lenders.

ECB Banking Supervision’s action

To ensure banks are prepared for sharp changes in the interest rate configuration, ECB Banking Supervision recently concluded a targeted review of interest rate and credit spread risk management practices (see also Enria 2022). The analysis confirmed the positive impact on net interest income of an upward interest rate shock in the short term but showed that banks should not disregard the typically negative impact on the economic value of equity in the medium term.

Our results revealed that the models banks use to manage assets and liabilities were often calibrated in environments of low rates, and don’t capture the shifts in consumer preferences and behaviours that typically take place as rates rise, such as deposit withdrawals. Also, the frequency of validation, back-testing and recalibration of those models is not satisfactory.

Many banks used derivatives to change their asset and liability management profile and profit from increases in interest rates. However, detailed review on a sample of banks revealed deficiencies with respect to the monitoring of risks arising from derivative hedging transactions as well as to the governance around risk transfers between trading book and banking book, leaving room for potentially incorrect attribution of risks as well as profit and losses.

As regards credit spread risk, deficiencies were noted in the measurement and management of risks related to government bonds and other instruments in the banking book. Around 75% of the government holdings are accounted for at amortised cost; this shields the solvency position of banks, as measured by accounting and prudential metrics, from shocks and volatility. However, it does not prevent banks’ economic value of equity from falling when credit spreads rise. It is therefore not appropriate to exclude material portfolios of instruments from the monitoring and measurement of credit spread risk based on accounting classification, as this does not ultimately protect the banks from investors’ reaction, which translates into more challenging funding conditions when market stress materialises. Issues were also noted in internal stress test frameworks, for example because scenarios were too lenient compared with past episodes of market distress.

Finally, the review highlighted deficiencies in the identification of, and preparation for, potential second-round effects and structural changes related to the normalisation of interest rates, such as new pressures on refinancing needs and funding costs.

ECB Banking Supervision is following up on the weaknesses highlighted by the review, in part by taking additional initiatives on funding risk which is part of the ECB supervisory priorities for 2023-25.

Subscribe to the ECB blogAn instantaneous shock is assumed to occur in the last quarter of 2022 lasting until the end of 2023. For the remaining two years of the projection horizon a return to the baseline is assumed.

See Budnik, K., Balatti, M., Dimitrov, I., Groß, J., Kleemann, M., Reichenbachas, T., Sanna, F., Sarychev, A., Siņenko, N. and Volk, M. (2020), “Banking euro area stress test model”, Working Paper Series, No 2469, ECB, September.

Altavilla, C., Canova, F., and Ciccarelli, M. (2020), “Mending the broken link: Heterogeneous bank lending rates and monetary policy pass-through”, Journal of Monetary Economics, Vol. 110, pp. 81-98, April.

ECB (2022), “Interest rate risk exposures and hedging of euro area banks’ banking books”, Financial Stability Review, May.

The cost of risk is defined as the ratio of provisions over the year to the average volume of loans in the year.