Published as part of the ECB Economic Bulletin, Issue 2/2023.

Emerging market economies (EMEs) are facing a challenging and uncertain macroeconomic environment, with weakening global demand, high inflation amid supply shocks and a synchronised tightening of monetary policy all acting as headwinds to growth. This box studies one of those headwinds – the impact of the Federal Reserve System’s tightening of monetary policy in the United States – and analyses factors and channels shaping spillovers to large and systemically important EMEs. Overall, EMEs have tended to exhibit greater resilience to shifts in global financing conditions during the current tightening cycle relative to the past, potentially on account of a reduction of their macro-financial vulnerabilities in recent decades. However, there is some heterogeneity in the performance of countries in this regard. We find that the impact of US monetary policy shocks varies across EMEs and is shaped by macro-financial vulnerabilities and monetary policy actions at the national level.

We use a local projections empirical framework to study the ways in which macroeconomic and macro-financial variables in EMEs respond to monetary policy shocks originating in the United States.[1] Using US monetary policy shocks identified at high frequency as our key explanatory variable, we estimate the impulse responses of macro-financial variables and look at how these responses are influenced by specific characteristics of the economies concerned. The baseline results show that a surprise tightening of US monetary policy is typically associated with immediate tightening of an EME’s financial conditions, after which industrial production and inflation decline, with that effect peaking after around 18 months.[2] These responses capture the effect of the surprise component of US monetary policy, rather than the systematic component; they have the expected sign and are economically meaningful in terms of their magnitude.

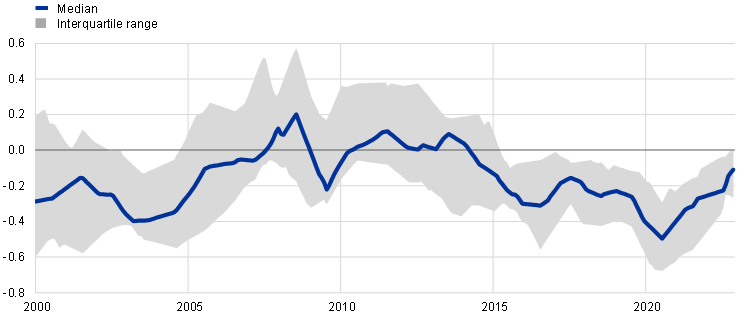

EMEs with greater vulnerabilities have stronger responses to US monetary policy shocks. The greater resilience of EMEs thus far could be associated with their lower levels of macro-financial vulnerability. A vulnerability metric suggests that EMEs have become less vulnerable overall over the last decade, albeit some of that downward trend has been reversed by the coronavirus (COVID-19) pandemic (Chart A).[3] When this vulnerability variable is included in regressions and interacted with US monetary policy shocks, we see that financial conditions, industrial production and CPI inflation all respond more strongly when a country is in a more vulnerable state (red dots in Chart B) compared with a less vulnerable state (green dots in Chart B).

Chart A

A vulnerability metric for EMEs

(index)

Sources: Haver Analytics, Refinitiv, Georgiadis and Jarociński (op. cit.) and ECB calculations.

Notes: This vulnerability index is based on principal components of four main variables, namely: (i) the real effective exchange rate gap calculated as the deviation from the linear trend (to account for the Balassa-Samuelson effect); (ii) the real effective exchange rate gap calculated as the deviation from the average for advanced economies (included because overvaluations have been shown to be predictors of crises, as in Gourinchas, P.-O. and Obstfeld, M., “Stories of the Twentieth Century for the Twenty-First”, American Economic Journal: Macroeconomics, Vol. 4, No 1, January 2012, pp. 226-265); (iii) past inflation rates (to capture weakly anchored inflation expectations, as in Ahmed, S., Akinci, O. and Queralto, A., “U.S. monetary policy spillovers to emerging markets: Both shocks and vulnerabilities matter”, International Finance Discussion Papers, No 1321, Board of Governors of the Federal Reserve System, July 2021); and (iv) US dollar-denominated portfolio debt liabilities relative to GDP (to capture external balance sheet vulnerabilities). The country sample comprises 11 EMEs (Brazil, Chile, China, India, Malaysia, Mexico, Russia, South Africa, South Korea, Thailand and Türkiye) and three EU Member States (the Czech Republic, Hungary and Poland). Higher values indicate greater vulnerability. The latest observations are for November 2022.

Chart B

The impact of contractionary US monetary policy shocks on EMEs by level of vulnerability

(peak responses; percentage points)

Sources: Haver Analytics, Refinitiv, Jarociński and Karadi (op. cit.), Georgiadis and Jarociński (op. cit.) and ECB calculations.

Notes: This chart shows the responses of dependent variables in log terms for economies with differing levels of vulnerability. Using a monthly state-dependent local projections framework (based on Auerbach and Gorodnichenko, op. cit.), we report median estimates for the baseline specification (blue dots), a high-vulnerability state (red dots) and a low-vulnerability state (green dots). The grey bars show the interquartile ranges, indicating the heterogeneity of responses. Responses have been scaled to show the impact of a pure monetary policy shock originating in the United States that results in a 1 standard deviation change in the yield on the underlying financial instrument (five-year US Treasury bonds). In the left-hand panel, higher values indicate tighter financial conditions.

Moreover, EMEs’ domestic monetary policy stances also help to shape their responses to US monetary policy shocks. In the current global tightening cycle, many EMEs started raising interest rates considerably earlier than the United States. This may partly reflect improvements to policy frameworks, with many central banks now having greater independence and more credible mandates to target price stability. At the same time, EMEs’ central banks need to carefully calibrate their policy responses to the current macroeconomic environment, countering risks to their hard-won credibility while also taking account of the key role that supply shocks have played in the global spike in inflation.

As a result of the rapid rate increases observed so far, many EMEs’ policy rates are close to the levels implied by estimates of their monetary policy reaction functions. The monetary policy reaction function provides a basic but useful benchmark indicator of how central bank policy rates in an EME typically react to changes in expected inflation and output and the cyclical position of the economy (among other things) on the basis of coefficients estimated using regression analysis. Chart C shows how actual central bank policy rates compare with those benchmarks, with positive values indicating that monetary policy is tighter than estimates of a central bank’s reaction function would imply, and vice versa. This shows that, despite recent supply shocks and the severity of the spike in inflation, central bank policy rates in most of the EMEs in the sample are now consistent with their typical reaction functions.[4]

Chart C

Comparing EMEs’ policy rates with the levels implied by their central bank reaction functions

(index)

Sources: Haver Analytics, Refinitiv and ECB calculations.

Notes: This index is constructed as the difference between (i) the EME’s actual policy rate and (ii) the policy rate implied by an empirically estimated central bank reaction function (as in Coibion, O. and Gorodnichenko, Y., “Why Are Target Interest Rate Changes So Persistent?”, American Economic Journal: Macroeconomics, Vol. 4, No 4, October 2012, pp. 126-162). The key explanatory variables include expected inflation and output growth one year ahead, and the cyclical position of the economy as captured by contemporaneous estimates of the output gap. In addition, we control for the real effective exchange rate and oil prices. The sample comprises nine EMEs (Brazil, Chile, China, India, Malaysia, Russia, South Africa, South Korea and Thailand) and three EU Member States (the Czech Republic, Hungary and Poland). The sample is smaller than in Chart A, and the time series is shorter, owing to the availability of data required to estimate central bank reaction functions. Positive values mean that monetary policy is tighter than the estimated central bank reaction function would imply, and vice versa. The latest observations are for November 2022.

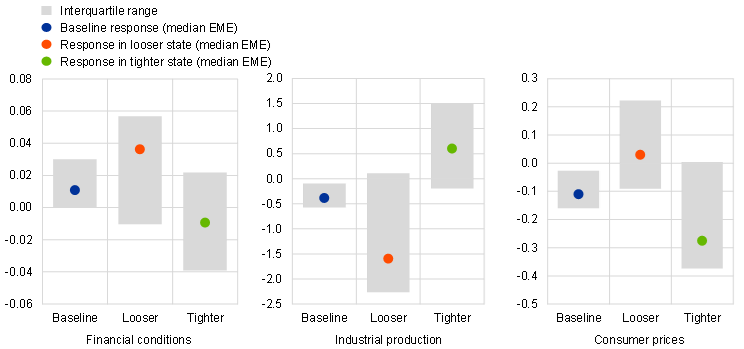

The impact of monetary policy shocks originating in the United States can be mitigated by prudent domestic monetary policy in EMEs. Our empirical results suggest that when an EME’s monetary policy is at least as tight as that implied by estimates of its central bank reaction function, spillovers from US monetary policy to financial conditions and industrial production are typically more limited (green dots in Chart D), relative to a situation where monetary policy is looser than the reaction function would suggest (red dots in Chart D).

Chart D

The impact of contractionary US monetary policy shocks on EMEs by monetary policy stance

(peak responses; percentage points)

Sources: Haver Analytics, Refinitiv, Jarociński and Karadi (op. cit.) and ECB calculations.

Notes: This chart shows the responses of dependent variables in log terms depending on economies’ monetary policy stances relative to their central bank reaction functions. Using a monthly state-dependent local projections framework (based on Auerbach and Gorodnichenko, op. cit.), we report median estimates for the baseline specification (blue dots), a state where policy rates are below the levels implied by central bank reaction functions (red dots) and a state where policy rates are above the levels implied by central bank reaction functions (green dots). The grey bars show the interquartile ranges, indicating the heterogeneity of responses. Responses have been scaled to show the impact of a pure monetary policy shock originating in the United States that results in a 1 standard deviation change in the yield on the underlying financial instrument (five-year US Treasury bonds). In the left‑hand panel, higher values denote tighter financial conditions.

Overall, our empirical analysis suggests that EMEs’ sensitivity to spillovers from US monetary policy can be amplified or attenuated by macro-financial vulnerabilities and domestic monetary policy actions. Many EMEs are currently facing the same kinds of inflationary pressures and supply shocks as advanced economies. Their central banks have participated in – and are even somewhat ahead of – the current global tightening cycle, striving to maintain their credibility and keep inflation anchored. This contrasts with the tightening cycle that occurred after the global financial crisis, when advanced economies’ central banks were the first to start tightening. Our findings suggest that maintaining a prudent policy stance helps to mitigate spillovers from US monetary policy. They also suggest that EMEs’ lower vulnerability relative to the past could be helping to shield them from stress, although there is some cross-country heterogeneity in this regard.

Our analysis builds on Jarociński, M. and Karadi, P., “Deconstructing Monetary Policy Surprises – The Role of Information Shocks”, American Economic Journal: Macroeconomics, Vol. 12, No 2, April 2020, pp. 1-43, and Georgiadis, G. and Jarociński, M., “Global implications of multi-dimensional US monetary policy normalisation”, Working Paper Series, ECB, forthcoming. Central bank announcements can reveal information about both the monetary policy stance (pure monetary policy) and the central bank’s assessment of the economic outlook (central bank information). We focus on pure monetary policy shocks, as we are interested in the effect that Federal Reserve policies have on EMEs. We employ a state‑dependent local projections framework where state-dependency is modelled using a logistic function, as in Auerbach, A.J. and Gorodnichenko, Y., “Measuring the Output Responses to Fiscal Policy”, American Economic Journal: Economic Policy, Vol. 4, No 2, May 2012, pp. 1-27.

A US monetary policy shock resulting in a 1 standard deviation increase in the yield on five-year US Treasury bonds over the estimation sample is associated with a tightening of around 1 standard deviation (0.02 percentage points (pp)) in the financial conditions index, a 1 standard deviation (0.3 pp) decline in industrial production, and a decline of one-third of a standard deviation (0.08 pp) in CPI inflation in the median EME.

The macro-financial vulnerability metric that is used here summarises EMEs’ vulnerability in terms of exchange rate misalignment, the anchoring of inflation expectations and US dollar-denominated foreign liabilities. These variables are particularly relevant at the current juncture in the presence of high inflation and a strengthening US dollar.

This follows a period of looser policy introduced in response to the COVID-19 pandemic.