- RESEARCH BULLETIN NO. 77

- 25 November 2020

How does monetary policy affect investment in the euro area?

We set out to analyse the monetary policy transmission mechanism by documenting how the annual investment of more than one million firms in Germany, Spain, France and Italy responded to monetary policy shocks between 2000 and 2016. We show that euro area firms react differently depending on their age and the industry they operate in: young firms and those producing durable goods react more strongly than the average firm. This confirms that monetary policy is affecting firms’ investment through two different channels. On the one hand, the “interest rate channel” affects demand for durable goods more than demand for services, which in turn affects investment demand from the producers of those goods. On the other hand, as young firms are more likely to face financing constraints, their stronger than average reaction can be explained by the “balance sheet channel” of monetary policy transmission.

Introduction

A key issue for central banks is understanding exactly how their monetary policy works. Monetary policy affects firms’ investment through both an interest rate channel and a balance sheet channel. First, through the interest rate channel, monetary policy can affect firms’ demand for capital as an input into the production process. This is because interest rates affect decisions on saving or investing and can boost aggregate demand. Second, through the balance sheet channel, monetary policy can make it less expensive for firms to borrow externally and reduce the firm‑specific user cost of capital, allowing them to invest more. The “external finance premium” is the difference between the cost of borrowing funds externally and generating them internally. Lower interest rates can reduce this premium because they increase asset values, increasing the value of firms’ balance sheets and thus their net worth.

Monetary policy affects firms differently. Not all spending is equally sensitive to interest rates. Therefore, the fluctuations in demand generated by monetary policy will vary across firms. Spending on durable goods, such as cars or household furniture, is often financed by credit and provides a stream of services over time; such spending is therefore more sensitive to the interest rate. There is ample evidence that the output of industries that produce durable goods reacts more to monetary policy shocks (see Ganley and Salmon, 1996, Dedola and Lippi, 2005, and Peersman and Smets, 2005). If the effect of monetary policy on the demand for durable goods is relatively strong, it follows that the investment demand of the firms producing these goods should also react more strongly to monetary policy shocks. Another reason why the impact on firms’ investment varies is the height of the external finance premium they face. Firms with less access to finance should face both higher and more volatile external finance premia. Unfortunately, we cannot measure firms’ external finance premia. However, a good proxy for access to finance is the age of the firm. Younger firms generally have less access to credit, are smaller and have lower earnings. Recent evidence for the United States and the United Kingdom has already shown that younger firms react more strongly to monetary policy shocks (see Cloyne et al., 2018).

This article explains how we analyse these two channels of monetary policy transmission in the euro area, i.e. by documenting the heterogeneous reaction of firms’ investment to monetary policy shocks (Durante, Ferrando and Vermeulen, 2020).

Data and estimation method

We use firm-level data from the four largest economies in the euro area (Germany, Spain, France and Italy) to construct a large and rich dataset covering more than one million firms throughout 2000-16. This provides us with around nine million observations of firm-level investment.

As a proxy for the euro area policy rate we use the high-frequency monetary policy shock series from Jarociński and Karadi (2020). The shocks are surprise movements in the three-month EONIA swap rate around policy announcements.

Since firm-level investment data are annual, we construct an annual monetary policy shock data series by aggregating the monthly shocks into twelve-month totals. The reaction of firm investment to those shocks is then estimated using local projections (see Jordà, 2005).

The next step is to identify the different channels through which monetary policy operates. We split the firms into different groups, based on what we already know about firms being affected differently by different transmission channels. In particular, we first separate financially constrained firms from unconstrained ones, in order to understand the impact of monetary policy on the external finance premium. In other words, we take a look at how well the balance sheet channel works. In line with the recent literature (see Cloyne et al., 2018), we use age as a proxy for more financially constrained firms, defining “young” firms as those less than 10 years old. Younger firms have shorter credit histories and should therefore be more vulnerable than older ones to any tightening of credit conditions.

Second, we look for evidence of the interest rate channel of monetary policy at work by breaking our sample down into different sectors such as manufacturing, construction and services. The granularity of our firm-level dataset allows us to further disaggregate the manufacturing sector into 24 two-digit NACE code industries and the services sector into 6 two-digit NACE code industries.

Findings

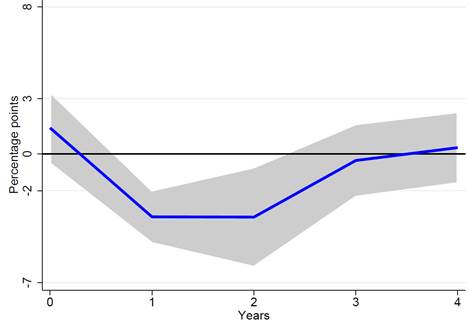

Chart 1 shows how the average firm’s investment reacts over the four years following a 10-basis-point upward surprise in the short-term interest rate, i.e. how firms’ investment reacts to a tightening of monetary policy. The investment rate of the average firm does not react initially, but drops by 3.4 percentage points in the year following the monetary policy shock. In the second year after the shock, the investment rate remains at this lower level. It then returns to its initial level in the third year.

Chart 1

Average investment reaction to a monetary policy shock

Notes: The x-axis shows the years following the shock; the y-axis is the change in percentage points from the baseline investment rate following a 10-basis-point upward surprise. The shaded areas represent 90% confidence bands.

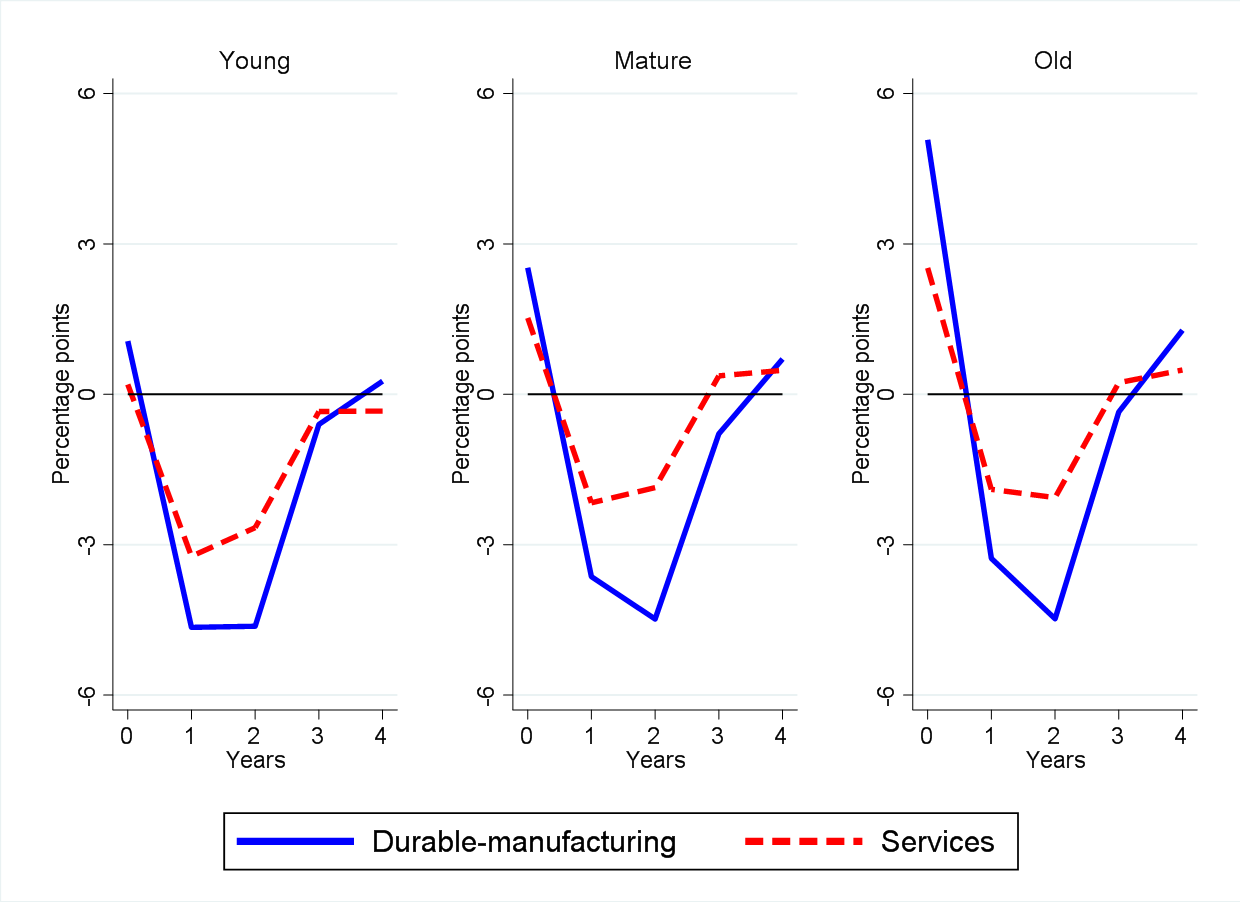

Young firms, i.e. firms below 10 years of age, react more strongly to a surprise than the average firm. Similarly, firms that produce durables react more strongly than firms providing services. Chart 2 illustrates that a combination of these characteristics leads to substantial differences in firms’ reactions to monetary policy. One year after the surprise, the investment rate of young firms in the durables sector drops by 5.0 percentage points. This compares with a drop of only 2.7 percentage points for “old” firms, defined as over 20 years of age, that provide services.[2] “Mature” firms, between 10 and 20 years of age, exhibit a reaction within those two extremes (4.4 percentage points for mature firms producing durables and 2.9 percentage points for mature firms providing services). We also run a series of statistical tests on the equality of the effect of the shock between the two sectors and in most cases the tests reject the equality. For all firms, the investment rate remains depressed for two years following a monetary policy surprise, returning to its original level only in the third year.[3]

Chart 2

Investment reaction by age of firm and durability of output

Notes: The x-axis shows the years following the shock; the y-axis shows the change in percentage points from the baseline investment rate following a 10-basis-point upward surprise.

Conclusions

The differences in the way firms’ investment reacts can be used to gauge the importance of the two different channels of monetary policy involved here. In the aftermath of a monetary policy shock, firms that produce durables cut back their investment more than firms providing services. This reflects the interest rate channel at work. Young firms also react more, indicating that the balance sheet channel of monetary policy is having an impact.

Ultimately, these findings provide a deeper understanding of the transmission of euro area monetary policy to the real economy. They point to important differences across firms – a feature that is not yet routinely embedded in the standard macroeconomic models. As central banks around the world are using such models as one of the inputs that guide their policymaking, embedding our findings into those macroeconomic models would enhance the information available to decision-makers.

References

Cloyne, J., Ferreira, C., Froemel, M. and Surico, P. (2018), “Monetary policy, corporate finance and investment”, NBER Working Paper, No 25366.

Dedola, L. and Lippi, F. (2005), “The monetary transmission mechanism: evidence from the industries of five OECD countries”, European Economic Review, 49(6), pp. 1543-1569.

Ferrando, A., Vermeulen, P., Durante, E. (2020), “Monetary policy, investment and firm heterogeneity”, ECB Working Paper, No. 2390.

Ganley, J. and Salmon, C. (1996), “The industrial impact of monetary policy”, Quarterly Bulletin, Bank of England.

Jarociński, M. and Karadi, P. (2020), “Deconstructing monetary policy surprises: the role of information shocks”, American Economic Journal: Macroeconomics, 12(2), pp. 1-43.

Jordà, O. (2005), “Estimation and Inference of Impulse Responses by Local Projections”, American Economic Review, pp. 161-182.

Peersman, G. and Smets, F. (2005), “The industry effects of monetary policy in the euro area”, Economic Journal, pp. 319-342.

- The article was written by Elena Durante (Directorate Macro Prud Policy and Financial Stability, European Central Bank), Annalisa Ferrando (Directorate Monetary Policy, European Central Bank) and Philip Vermeulen (Auckland University of Technology). It is based on their ECB Working Paper, No 2390, entitled “Monetary policy, investment and firm heterogeneity”. The authors gratefully acknowledge the comments of Alberto Martin and Giulio Nicoletti and the excellent research assistance of Valerio Di Tommaso. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank.

- These effects are relatively large. Comparisons with the existing literature are difficult to make due to differences in the period of investigation, sample characteristics, time aggregation of investment and shock definitions. In the most closely related study (Cloyne et al., 2018) the quarterly investment rate of young firms in the United States and United Kingdom falls by around 1% after a quarterly surprise increase of 25 basis points in the interest rate. The firms in that study, however, are all large and listed companies compared to the mostly smaller, unlisted companies in our study.

- Chart 2 suggests a slightly stronger effect two years after the shock in the durables sector for mature and old firms. However, the effect after two years is not statistically different from the effect after one year for any group of firms.