Mind the liquidity gap: a discussion of money market fund reform proposals

Mind the liquidity gap: a discussion of money market fund reform proposals

Published as part of the Macroprudential Bulletin 16, January 2022.

This article assesses proposed reforms to the Money Market Funds (MMF) Regulation[1] to enhance the resilience of the sector. Specifically, the article provides a rationale for requiring private debt MMFs to hold higher levels of liquid assets, of which a part should be public debt, and considers the design and calibration of such a requirement. The article also proposes that the impediments to the use of liquidity buffers should be removed and authorities should have a role in releasing these buffers. Finally, while the removal of a stable net asset value (NAV) for low-volatility MMFs would reduce cliff effects, we argue that this might not be necessary if liquidity requirements for these private debt MMFs are sufficiently strengthened.

1 Introduction

MMFs fulfil a dual economic function, namely liquidity management for investors and the provision of short-term funding for financial institutions, non-financial corporations and governments. MMFs perform a central function for the financial system by bringing together the demand for and supply of short-term funding. By investing in a portfolio of short-term debt and offering daily liquidity, MMFs enable investors to store liquidity and manage their cash needs, while at the same time they contribute to the short-term financing of banks and other companies in the wider economy.

This dual economic function can make private debt MMFs vulnerable under stressed market conditions, and the associated systemic risk was highlighted during the coronavirus (COVID‑19) market turmoil in March 2020. Following the onset of the COVID‑19 crisis in Europe in early 2020, non-public debt MMFs experienced significant outflows resulting from liquidity pressures, flight-to-safety considerations, and various other factors (see, for example, Capotă et al., 2021; ESMA, 2021).[2] These MMFs came under stress and had to reduce their holdings of private debt assets, compromising their ability to simultaneously provide cash management services to investors and short-term funding to banks and non-financial corporations (NFCs). These risks were examined and documented by the Financial Stability Board (FSB) in its recommendations on MMFs and were discussed in the Eurosystem’s response to the European Securities and Markets Authority (ESMA) consultation on the regulatory framework for MMFs in the EU.[3]

This article assesses possible MMF reform proposals to enhance the resilience of MMFs by targeting liquidity mismatch and makes the case for a mandatory public debt quota alongside other measures. The article highlights the need for private debt MMFs to strengthen their liquidity position, including through the introduction of a public debt buffer. The article also discusses the role authorities should play in the use of liquidity management tools and the release of liquidity buffers. Finally, the article considers whether the stable NAV for low-volatility net asset value (LVNAV) funds needs to be removed.

2 Liquidity requirements and the inclusion of a mandatory public debt quota

Private debt MMFs proved particularly vulnerable during the COVID-19 market turmoil in March 2020 due to the liquidity mismatch between their assets and liabilities. During the crisis, these MMFs experienced exceptionally large outflows and faced difficulties in raising cash at short notice. During normal times, MMFs can rely on maturing assets to manage liquidity and meet investor redemptions. During periods of stress, however, they may be vulnerable owing to the disparity between the relatively low market liquidity of many of their assets and the ability of investors to redeem MMF shares on a daily basis. In particular, when trying to meet large redemptions, MMFs may face severe difficulties in off-loading commercial paper (CP) and certificates of deposits (CDs), for which there is little to no secondary market trading.

MMFs’ reluctance to draw down their weekly liquid asset (WLA) holdings in March 2020 contributed to a disorderly unwinding of their positions in less liquid assets, such as bank CDs. Fund managers may have tried to avoid giving negative signals potentially associated with a reduction of liquidity buffers for fear of triggering further outflows. The resulting dislocations in money markets created risks for the smooth transmission of monetary policy and the financing of the real economy, and required exceptional central bank interventions to avert even more severe stress and contagion.[4] These central bank interventions helped to restore the functioning of key market segments, such as financial and non-financial CP, thereby preventing a procyclical tightening of financing conditions, while also helping to ease liquidity tensions for MMFs.[5]

Higher and more usable liquidity buffers, including a component of public debt holdings, would be particularly effective in reducing risks associated with liquidity mismatch in private debt MMFs. To preserve the cash management function of MMFs, it is important that MMFs can deal with large and unexpected outflows under stress. Ensuring that liquidity buffers are usable in a crisis is helpful in this respect.[6] At the same time, given the low market liquidity of most private debt assets and the relatively long lead time of weekly maturing assets, it is important to diversify liquidity sources alongside removing impediments to the use of liquidity buffers. Requiring MMFs to hold public debt is thus highly complementary to existing liquidity requirements, given that public debt typically has high market liquidity even if it is not about to mature.

A mandatory public debt holding would help to diversify liquidity sources beyond the concept of weekly maturing assets. A minimum share of public debt as part of the broader liquidity buffer would help to ensure that MMFs have a broader range of liquidity sources at their disposal to meet elevated redemption requests. Given that public debt markets are substantially more liquid and deeper than CP and CD markets, funds would be able to sell public debt more easily and with a lower price impact in almost all circumstances, including during periods of stress.[7] This means that, depending on the type of shock and market conditions, fund managers would be able to draw on a broader range of assets to meet redemption requests, rather than relying on proceeds from maturing assets or selling other private debt assets. The weighted average maturities of funds would not be altered, as the current requirements would be maintained.[8]

The calibration of a public debt requirement needs to consider possible costs and constraints, while aiming to strengthen the resilience of MMFs. The calibration of a minimum public debt quota should be high enough to increase MMFs’ overall liquidity buffers, but not so high that it would have an excessive footprint in underlying public debt markets or unduly reduce MMF returns. It is also important that such a quota is mandatory, since MMFs’ (voluntarily held) public debt holdings currently tend to fluctuate over time, as seen after the March 2020 market turmoil when fund managers in private debt MMFs first increased their public debt holdings and then reduced them again. A mandatory quota would help ensure that private debt funds have sufficient shock-absorbing capacity to meet large and unexpected outflows under a range of different stresses, thereby significantly enhancing MMF resilience.

The emergence of a new stress channel between MMFs and sovereigns is also unlikely for several reasons. First, there is no bail-out expectation for MMFs and therefore no market perception of contingent liabilities for sovereigns. Second, there is evidence that MMFs currently hold diversified sovereign debt portfolios focused on the most liquid issuers, limiting their exposure to stress in any one country. Finally, the MMF footprint in short-term public debt markets would only increase by a small amount and remain relatively contained. Given the high liquidity of public debt in most circumstances, there should, therefore, not typically be a significant price impact when MMFs dispose of assets in an episode of stress.

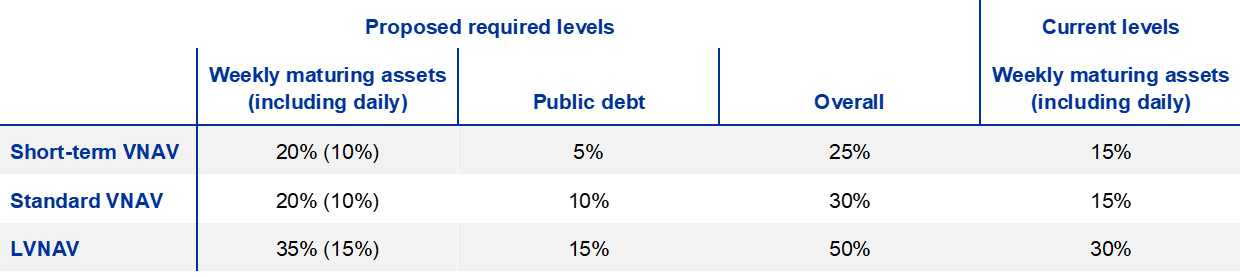

Table 1 shows a suggested calibration which would increase the liquidity requirements of both VNAV and LVNAV MMFs relative to existing requirements in the EU.[9] Under the proposed calibration, liquidity would be strengthened both by increasing WLA from current minimums and by introducing a mandatory public debt requirement.[10] Given their stable value, it is appropriate to demand higher liquidity from LVNAV funds than from other private debt MMFs. This would help support the role of LVNAV funds as a cash management vehicle and low-volatility alternative to other types of private debt MMFs. The proposed levels for LVNAV funds in Table 1 are based on the presumption that their stable value is maintained. If the stable NAV were to be removed, it would be important to assess whether a new low-volatility NAV category would be needed alongside other types of VNAV funds.

Table 1

Possible calibration for overall liquidity

(percentages)

Notes: The proposed levels for LVNAV presume that the stable value will not be removed.

3 The role of authorities in the release of liquidity buffers and the use of liquidity management tools

Authorities should have a role in releasing liquidity buffers and provide guidance on the adequate time for rebuilding them. Such an approach may help to reduce legal uncertainty and further nudge fund managers to use their buffers if needed. Three key principles should govern the approach to a releasable buffer. First, possible impediments to the use of buffers should be minimised and asset managers should be encouraged to use the buffers if needed. Second, the release of buffers should be applied at the sector level, i.e. by fund type and currency. The release of buffers should be considered in a market-wide event with possible systemic implications, but not on a fund-by-fund basis to avoid stigma effects. Third, to limit market fragmentation, ESMA should have a strong role in coordinating the action of national competent authorities when they use their powers to release buffers.

While liquidity management tools can be useful in reducing first-mover advantage, it is important to ensure that no new cliff effects or impediments to the usability of liquidity buffers are created. The implementation of liquidity management tools, such as swing pricing and anti-dilution levies, could lead to new threshold effects in which there is uncertainty surrounding the point of implementation and whether this is initiated by the fund manager or by the competent authority.[11] If linked to the breach of certain liquidity thresholds, this could also impair the usability of liquidity buffers. Tools may also increase redemption costs in times of stress, which could incentivise investors to try to redeem MMF shares in advance of the tools being activated, effectively exacerbating rather than removing the first-mover advantage for investors.

To keep fund managers’ incentives aligned with prudent liquidity risk management, authorities should not have a role in requiring the use of liquidity management tools. However, they could have a role in providing guidance on their design and use. In particular, ESMA should be given a mandate to develop guidance on the criteria set out by the European Commission on facilitating the general use of liquidity management tools in all market conditions. The criteria should also cover the use of gates and suspensions.

4 Considerations on removing stable NAVs for LVNAV funds

Removing the stable value for LVNAV funds may complement reforms to improve funds’ liquidity risk profiles. The March 2020 market turmoil highlighted particular vulnerabilities in LVNAV funds, as these funds faced elevated outflows and investors became concerned about a breach of the collar around the stable value.[12] The removal of the stable value from LVNAV funds would have the benefit of fully eliminating unintended cliff effects related to possible transformations from LVNAV to VNAV funds in periods of stress. Furthermore, a variable share price would also reflect the underlying asset value more accurately, reducing first-mover advantages associated with a decline in asset values. However, imposing a variable NAV does not address vulnerabilities associated with liquidity mismatches in private debt MMFs more generally. The removal of the stable NAV of LVNAV funds may thus not be necessary, provided there is a substantial improvement in the liquidity risk profile of these funds.

Any removal of the stable NAV of LVNAV MMFs should be part of a comprehensive package aimed at reducing liquidity risks in private debt MMFs more broadly.[13] MMF holdings of private sector debt proved particularly vulnerable during the period of market turmoil. This posed a risk to both variable and stable NAV MMFs. Therefore, while removing the stable value pricing for LVNAV funds may reduce some risk, this measure in isolation would not be a substitute for tackling liquidity risks via enhanced liquidity requirements and greater usability of buffers.[14]

5 Conclusion

MMF vulnerabilities should be targeted through higher levels of liquid asset holdings, including a mandatory public debt requirement, and improved usability of liquidity buffers. This article has advocated the introduction of both a mandatory public debt requirement and increased WLA requirements to enhance the shock-absorbing capacity of MMFs. In addition, the article also suggests that liquidity buffers must be made more usable and that authorities should have a role in directing their use. But the deployment of liquidity management tools should remain the responsibility of fund managers in managing their liquidity position. This package of measures should substantially enhance the resilience of the MMF sector to future shocks and thereby reduce systemic risk. The upcoming review of the MMF Regulation by the Commission will present an opportunity to implement such proposals to the benefit of both the sector and financial stability.

References

Capotă, L.D., Grill, M., Molestina Vivar, L., Schmitz, N. and Weistroffer, C. (2021), “How effective is the EU Money Market Fund Regulation? Lessons from the COVID 19 turmoil”, Macroprudential Bulletin, Issue 12, ECB, April.

Cominetta, M., Lambert, C., Levels, A., Ryden, A. and Weistroffer, C. (2018), “Macroprudential liquidity tools for investment funds – A preliminary discussion”, Marcoprudential Bulletin, Issue 6, ECB, September.

de Guindos, L. and Schnabel, I. (2020a), “The ECB’s commercial paper purchases: A targeted response to the economic disturbances caused by COVID‑19”, The ECB Blog, ECB, 3 April.

de Guindos, L. and Schnabel, I. (2020b), “Improving funding conditions for the real economy during the COVID-19 crisis: the ECB’s collateral easing measures”, The ECB Blog, ECB, 22 April.

ECB (2020), “Recent stress in money market funds has exposed potential risks for the wider financial system”, Financial Stability Review, May.

ECB (2021), “Eurosystem contribution to the European Securities and Markets Authority (ESMA) consultation on the framework for EU money market funds”, 30 June.

ESMA (2021), “Vulnerabilities in money market funds”, ESMA Report on Trends, Risks and Vulnerabilities, No 1, 2021, March, pp. 60-72.

FSB (2021), “Policy proposals to enhance money market fund resilience: Final report”, October.

Grill, M., Molestina Vivar, L., Mücke, C., O’Donnell, C., Weis, M. and Weistroffer, C. (2022), “Assessing the impact of a mandatory public debt quota for private debt money market funds”, Macroprudential Bulletin, Issue 16, ECB, January.

Lane, P.R. (2020), “The market stabilisation role of the pandemic emergency purchase programme”, The ECB Blog, ECB, 22 June.

See also de Guindos and Schnabel (2020a and 2020b) and ECB (2020).

See FSB (2021) and ECB (2021).

For example, the Eurosystem increased private sector purchases and expanded the eligibility of non-financial CP to include securities with shorter remaining maturity. The Eurosystem also increased the concentration limit for unsecured bank debt in collateral pools. See also ECB (2020).

See, for example, de Guindos and Schnabel (2020a and 2020b) and Lane (2020).

Both WLA and public debt should be made usable.

While no asset is perfectly liquid, in relative terms public debt typically has a significant advantage, especially during “flight-to-liquidity” episodes. Investor feedback on FSB recommendations on MMF reforms confirmed that “flight-to-liquidity” drove some of the switching from private debt to public debt MMFs in March 2020.

Short-term variable net asset value (VNAV) funds are required to maintain a maximum of 60 days average weighted maturity and standard VNAV funds are required to maintain six months.

The MMF Regulation currently requires short-term and standard VNAV funds to hold a minimum of 15% WLA and LVNAV funds to hold a minimum of 30% WLA.

See Grill et al. (2022) for an assessment of the calibration of the public debt requirement.

See Cominetta et al. (2018) for a discussion of ex post measures.

LVNAV funds are allowed to offer a stable share price as long as the fund’s NAV at amortised cost does not deviate by more than 20 basis points from the corresponding market value. Otherwise, the fund will “break its collar” and trade at a variable price, which can result in mark-to-market losses for investors. Some LVNAV funds, mostly denominated in US dollars, were close to reaching this threshold at the end of March 2020.

The ESRB recommended that the legislation should require MMFs to have a fluctuating NAV. See Recommendation of the European Systemic Risk Board of 20 December 2012 on money market funds (ESRB/2012/1) (OJ C 146, 25.5.2013, p. 1).

See ECB (2021).