Euro area monetary and financial statistics - Quality report 2022

Executive summary

This biennial data quality report is a contribution to the ECB Statistics Quality Framework[1]. It relates to statistics produced by the European System of Central Banks (ESCB) and focuses on the collection, compilation and dissemination of euro area monetary and financial statistics (MFS) in 2021 and 2022. Following the basic principles set out in the “Public commitment on European statistics by the ESCB”, this report provides both descriptive and quantitative quality indicators. The scope of this report is aligned with the responsibilities of the Working Group on Monetary and Financial Statistics (WG MFS) and is divided into eight sections: Section 1, Introduction; Section 2, Statistical developments between 2021 and 2022; Section 3, Methodological soundness and statistical procedures; Section 4, Timeliness and punctuality; Section 5, Availability of data and metadata; Section 6, Accuracy and reliability; Section 7, Internal consistency; and Section 8, External consistency/coherence.

As regards statistical processes, the collection, processing, and dissemination of the MFS went smoothly in 2021 and 2022. Overall, the data published remained at the expected very high level of quality and were fit for policy needs. The major developments that have taken place over the two-year period are set out in the relevant chapters.

In terms of changes in the euro area and in EU composition, events such as Brexit and the euro area enlargement to Croatia required significant adjustments to the compilation of euro area and EU aggregate statistics, the alignment of all ECB publications and, where appropriate, the production of the requisite back data.

Other main developments have included Regulation ECB/2021/2[2] on the balance sheet items of credit institutions and of the monetary financial institutions sector. This introduced new reporting requirements to enhance analysis of monetary and credit developments. It also made changes to some of the existing reporting requirements, definitions and reporting derogations to ensure better integration with other statistical datasets. These changes focused in particular on the areas of securitisation, notional cash pool positions and positions vis-à-vis non-bank financial corporations.

In addition, Regulation ECB/2020/59[3] on payments statistics, amending Regulation ECB/2013/43, was introduced. This significantly enhanced the scope of payments statistics collection by including new payments methods and channels, statistical requirements for fraudulent payment transactions involving non-monetary financial institutions (non-MFIs), detailed merchant category code breakdowns for card payments and enhanced geographical breakdowns. Reporting frequency was also increased, mainly from annual to semi-annual, although collection is still on a quarterly basis for some high-level payment instrument aggregates and more detailed card payment breakdowns.

Last but not least, as part of the process of updating Regulation ECB/2013/38[4] concerning investment fund (IF) statistics to ensure that data remain relevant for analytical purposes and are effectively integrated into other data sources, the ECB plans to launch a public consultation on proposed changes. These would include shifting from quarterly to monthly reporting, as well providing additional details of asset and liability items and new information on IF classifications as well as on IF income and fees. The new IF reporting framework is scheduled to apply from the June 2025 reference period.

Concerning methodological aspects, given that the Capital Requirements Regulation (CRR)[5] expanded the definition of a credit institution to also include systemic investment firms (SIFs), the definition of monetary financial institutions (MFIs) in the new Balance Sheet Items (BSI) Regulation (ECB/2021/2) also had to be adapted so that “non-MFI credit institutions” could be identified separately within the Regulation’s reporting population.

With regard to insurance corporation statistics, a compilation guide was published for the first time. This includes guidance on how to derive insurance corporation statistics from Solvency II reporting. Furthermore, the ECB took note of the changes suggested by the Solvency II 2020 review exercise undertaken by the European Insurance and Occupational Pensions Authority (EIOPA) and these are now reflected in the “ECB Add-ons”, which will come into effect from the fourth quarter of 2023 data collection reference period.

Finally, Regulation ECB/2020/59 on payment statistics expanded its definition of a “cross-border payment transaction” to align it with that of Regulation (EU) 2015/751[6].

As far as timeliness and punctuality are concerned, most of the MFS were transmitted according to the envisaged schedules with only a few infringements being observed, mainly with respect to the IF population.

With regard to the “availability of data and metadata”, no major issues in terms of completeness, accessibility and clarity were identified beyond the anticipated levels.

Turning to “accuracy and reliability”, quality measurements of revisions were performed to evaluate the reliability of first releases of euro area monetary aggregates, including the broad money aggregate M3, and of the euro area aggregates for MFI interest rate indicators.

As far as BSI statistics are concerned, the impact of revisions on the month-on-month growth rates of the euro area monetary aggregates, and in particular of M3, has continued to be limited. Overall, at time lag t+1 at least 83% of all revisions received up to December 2022 have had an impact of less than or equal to 5 basis points (0.05 percentage points) on the M3 growth rates published since August 2005

In summary, the impact of revisions is sufficiently small to ensure that the month-on-month growth rates are fit for policy needs on initial publication. The revisions received since the end of 2022 have also had a smaller impact on growth rates than those in all previous years since 2005 taken together.

Turning to MFI interest rate (MIR) statistics, in comparison with the number of observations, the number and size of revisions to these statistics at euro area level have been small, which demonstrates the reliability of the data sent in the initial releases. 83% of the revisions did not exceed 5 basis points in absolute terms and 42 % of the revisions occurred in the month after the initial release. The number of exceptional and ad hoc revisions, as opposed to ordinary revisions, shows that MIR statistics are being continuously updated and their overall high quality is therefore maintained.

Finally, internal consistency checks for all MFS showed that the levels remained mostly unchanged in 2021 and 2022. External consistency checks were used as additional “cross checks”. These consisted of comparisons between securities holdings statistics and those for insurance corporations (ICs), financial vehicle corporations (FVCs) and MFI balance sheet items.

1 Introduction

In line with the mission statement of the Eurosystem[7], the ECB is committed to adhering to values such as credibility, trust, transparency and accountability, that underpin the integrity of the statistical function provided for by the Treaty on the Functioning of the European Union (Article 5 of the Statute of the European System of Central Banks and of the European Central Bank[8]). Adherence to high-quality statistical standards is a key factor in maintaining the public’s confidence in the ESCB statistics on which monetary policy decisions and other Eurosystem tasks are based. It also ensures the comparability of euro area and national statistics at the international level. In the performance of its statistical function, the ESCB is committed to good governance and the highest ethical standards, as well as to executing its tasks in a spirit of cooperation and teamwork.

This report complies with the “Public commitment on European statistics by the ESCB”, which sets out the common set of principles that govern ESCB statistics. The main principles and elements guiding the production of ECB statistics are also contained in the Statistics Quality Framework and quality assurance procedures.

The ESCB statistical function collects all relevant data required to produce and disseminate reliable, timely, consistent and accessible statistics in the areas under the ESCB’s responsibility. The main purpose of euro area MFS is to support the monetary policy of the ECB and other tasks of the Eurosystem and the ESCB. They also support other policies of the European Union. The statistics comply with European and internationally agreed standards, guidelines and good practices.

The data collection frameworks for euro area MFS cover national central banks (NCBs), credit institutions, ICs, pension funds (PFs), money market funds (MMFs), IFs and FVCs, among others. They apply to statistics on MFI balance sheet items, as well as on ICs, PFs, FVCs and IFs. MIR statistics are also included, as are statistics on payments (PSS) made using, and involving the issuing of, electronic money in the euro area.

The scope of this report is aligned with the responsibilities of the WG MFS, the relevant ESCB reporting committee.

Statistics on MFI balance sheet items are among the core statistics used by the ECB for the conduct of monetary policy. They provide crucial information on monetary developments in the euro area (e.g. monetary aggregates) and on the business of MFIs in general (e.g. outstanding loans to and deposits by households and non-financial corporations (NFCs)). MIR statistics are likewise important for analysis of the monetary policy transmission mechanism and the pass-through of official and market interest rates to retail bank interest rates. They also provide information on the degree of integration of the retail banking markets in the euro area.

1.1 Scope of data coverage and structure of the report

This report touches on several aspects of data quality, including: (i) methodological issues caused by national compilers diverging from statistical standards or requiring enhanced statistical procedures; (ii) NCBs’ compliance with their obligation to transmit data and metadata to the ECB in terms of timeliness and coverage; (iii) the reliability of statistical data; (iv) the internal consistency of statistics; and (v) external consistency with other statistical domains/datasets.

Accordingly, the report has been organised into eight sections: Section 1, Introduction; Section 2, Statistical developments between 2021 and 2022; Section 3, Methodological soundness and statistical procedures; Section 4, Timeliness and punctuality; Section 5, Availability of data and metadata; Section 6, Accuracy and reliability; Section 7, Internal consistency, and Section 8, External consistency/coherence.

1.2 Current legal framework

The concepts underlying the main elements of the statistical requirements applying to the statistics covered in this report are set out in both international statistical standards, namely the System of National Accounts, and the European system of national and regional accounts (i.e. ESA 2010). Adherence to these standards fosters the international comparability of national and euro area statistics and ensures a sound methodological background for the aggregation of data.

Under Article 5 of the Statute of the ESCB and of the ECB, the ESCB may collect from the competent national authorities, or directly from economic agents, the statistical information necessary for it to carry out its tasks, including those in the areas of monetary policy, financial stability and banking supervision. To carry out the functions of the Eurosystem, the ECB may adopt legal instruments that have a direct effect on certain economic agents established in the euro area, such as MFIs and other financial corporations.

The Governing Council of the ECB adopts regulations setting out statistical requirements that are binding on the euro area entities to which they are addressed. ECB regulations are “directly applicable”, meaning that they do not need to be transposed into national law. These regulations instruct reporting entities on, for example, statistical reporting requirements in terms of definitions, classifications, frequency, and timeliness. Table 1 sets out the relevant ECB regulations for collection of the statistics addressed in this report.

In addition, the NCBs may issue national instructions on the reporting data to be sent to them directly (“primary reporting”).

Table 1

Existing legal framework for ECB statistics

Existing regulations for ECB statistics

Type of statistics | Dataset | ECB Regulation |

|---|---|---|

MFI balance sheet | BSI | Regulation (EU) 2021/379 of the European Central Bank of 22 January 2021 on the balance sheet items of credit institutions and of the monetary financial institutions sector (ECB/2021/2). |

MFI interest rate | MIR | Regulation (EU) No 1072/2013 of 24 September 2013 concerning statistics on interest rates applied by monetary financial institutions (ECB/2013/34).[9] |

Investment funds | IVF | Regulation (EU) No 1073/2013 of 18 October 2013 concerning statistics on the assets and liabilities of investment funds (ECB/2013/38). |

Financial vehicle corporations | FVC | Regulation (EU) No 1075/2013 of 18 October 2013 concerning statistics on the assets and liabilities of financial vehicle corporations engaged in securitisation transactions (ECB/2013/40).[10] |

Payments | PSS[11] | Regulation (EU) No 1409/2013 of 28 November 2013 on payments statistics (ECB/2013/43)[12] – applicable up to and including reference year 2021. Regulation (EU) 2020/2011 of the European Central Bank of 1 December 2020 amending Regulation (EU) No 1409/2013 on payments statistics – applied from the 1 January 2022 reference date onwards. |

Insurance corporations | IC | Regulation (EU) No 1374/2014 of 28 November 2014 on statistical reporting requirements for insurance corporations (ECB/2014/50).[13] |

Pension funds | PF | Regulation (EU) No 231/2018 of 26 January 2018 on statistical reporting requirements for pension funds (ECB/2018/2)[14] |

The ECB also adopts guidelines that are binding on members of the Eurosystem. Statistical guidelines instruct central banks on what data must be submitted to the ECB, by when, and in which format, etc. Where the relevant statistics are not the subject of a regulation, a guideline informs euro area central banks of the ECB’s needs, often leaving NCBs some discretion as to the choice of data source, provided that certain standards are met. In addition to providing the framework for NCBs to transmit data collected under the relevant regulations to the ECB, the guideline also includes other specific requirements for which NCBs must provide data on a best-effort basis, based on the data available to them. This includes statistics relating to agents that are not subject to an ECB regulation (e.g. consolidated banking data and data for certain other financial intermediaries) and statistics that complement existing regulation requirements (e.g. undrawn credit lines provided by MFIs and separate identification of IFs that are undertakings for collective investment in transferable securities (UCITS) as defined in the UCITS Directive[15]).

2 Statistical developments between 2021 and 2022

Responding to a constantly challenging economic environment, the ECB strives to keep its statistics fit for purpose in a context of ongoing financial innovation and developing user needs. It also adjusts to changes in the euro area composition resulting from new enlargements.

This section outlines the most recent key developments over the reference period for this report.

2.1 Euro area enlargement to Croatia, and Brexit

On 1 January 2023, Croatia adopted the euro and became the 20th member of the euro area. This was the first enlargement of the euro area since Lithuania joined in 2015.

Against this background, further close and effective cooperation was established between the ECB’s statistical function and its Hrvatska narodna banka counterparts for the requisite adjustments to be made to ensure the availability of the statistics and data required under the ECB’s reporting requirements and enable the compilation and dissemination of aggregated statistics for the euro area reflecting its new enlarged composition.

This task involved work on several statistical activities identified as necessary for accession, ranging from amendment of the technical and reporting procedures, through adjustment of statistical collection, production and the dissemination environments, to configuration of the backflow delivery of historical data to be reported for the first time in euro.

Moreover, the requisite adjustments have been made to ECB publications applying the concept followed for euro area aggregates (fixed or changing composition) and national breakdowns, as the case may be.

These activities followed a well-established path, similar to that for previous enlargements of the euro area, while substantial preparatory work was also required in order to integrate data collection and reporting into the granular and micro datasets established by the ESCB since the last enlargement exercise, especially as regards the analytical credit (AnaCredit) datasets, securities holdings statistics, etc.

Most activities were accomplished by the end of June 2023, albeit full production of back data, the compilation of euro area aggregate statistics reflecting the new composition and full amendment of all ECB publications in accordance with the applicable release calendars may extend beyond that date.

On 31 January 2020, the United Kingdom left the EU. For Brexit, activities similar to as those described above took place aimed at excluding UK data contributions from EU aggregates, the relevant publications, etc., as well as definitively excluding the United Kingdom as an EU counterpart in euro area reporting.

2.2 New Regulation on monetary financial and credit institutions balance sheet items

On 22 January 2021, the ECB adopted the new Regulation on the balance sheet items of credit institutions and of the monetary financial institutions sector (ECB/2021/2), recasting Regulation ECB/2013/33[16].

The recast Regulation introduced new reporting requirements to enhance analysis of monetary and credit developments, as well as modifications to some existing reporting requirements, definitions, and reporting derogations to ensure better integration with other statistical datasets.

The key changes included new requirements applicable to data on loan transfers and cash management services (i.e. notional cash pool positions) entering into calculation of the headline figures for “adjusted loans” and in relation to the following:

- securitisations and other loan transfers, in particular with respect to loans to households broken down by loan purpose (i.e. loans for house purchase, consumer credit, and other lending);

- notional cash pool positions;

- positions vis-à-vis non-bank financial corporations, in particular, those in the European System of Accounts (ESA 2010) statistical subsectors: other financial intermediaries (S.125), financial auxiliaries (S.126), and captive financial institutions and money lenders (S.127).

The new Regulation also established new requirements relating to less detailed parts of banks’ balance sheets (e.g. capital and reserves, non-financial assets and remaining assets/liabilities). Many of these requirements had already been included in Guideline ECB/2014/15[17] (no longer in force, and, with respect to banking, replaced by Guideline ECB/2021/11[18]) relating to supplementary data to be transmitted to the ECB by the NCBs, if available. Incorporating these items into the new Regulation has enhanced both the coverage of the data and the harmonisation of concepts and definitions.

The new monthly requirements have applied from the January 2022 reference period and the new quarterly reporting requirements from the first quarter of 2022.

In terms of definitions, the new Regulation had to allow, inter-alia, for the expanded definition of a “credit institution” under Article 4(1)(1) of the amended CRR and adapt the definition of an MFI accordingly (see also Chapter 3.1 of this report).

2.3 New Regulation on payments statistics

On 1 December 2020, the Governing Council of the ECB adopted Regulation ECB/2020/59 on payments statistics amending Regulation ECB/2013/43. The amending Regulation sets out the statistical standards by which payments statistics are to be collected and compiled in the euro area. It is binding on payment service providers (PSPs) and payment system operators (PSOs) established in those EU Member States that have adopted the euro. PSPs and PSOs are required to report to their respective NCBs all payment transactions they have processed that involve non-MFIs.

With the amended Regulation, the scope of payment statistics’ data collection has been enhanced significantly by including new payment methods and channels, statistical requirements on fraudulent payment transactions involving non-MFIs, detailed merchant category code breakdowns for card payments and, last but not least, enhanced geographical breakdowns.

The amended payments statistics framework established by the new Regulation has been complemented by Guideline ECB/2021/13[19] on reporting requirements on payments statistics, which was adopted by the ECB on 26 March 2021, as well as by the Manual on payments statistics reporting[20]. The latter provides further clarification of the requirements laid down in the Regulation and Guideline but does not have legally binding status. Under the amended framework, the frequency of reporting payment statistics has, in principle, been increased from annual to semi-annual. However, certain high-level payment instrument aggregates and more detailed card payment breakdowns are now collected on a quarterly basis, thereby further enhancing the compilation of balance of payments statistics.

2.4 Towards an updated Regulation on IF statistics

ECB IF statistics are collected in accordance with Regulation ECB/2013/38. To ensure that the data collected under the Regulation remain relevant for analytical purposes and can be effectively integrated into other data sources, it was proposed that the Regulation be enhanced. To this end, a “merits and costs” exercise was carried out and the ECB also plans to launch a public consultation on a draft recast Regulation.

The proposed changes include:

- a shift from a quarterly to monthly reporting frequency;

- more details on assets and liabilities;

- new information on IF classifications; and,

- new information on IF income and fees.

Reporting in accordance with the new Regulation is set to begin with the data for June 2025.

3 Methodological soundness and statistical procedures

A “sound methodology” means developing and compiling statistics using a statistical methodology based on ESCB and EU legislation and standards, as well as internationally agreed standards, guidelines or best practices.

In this regard, it should be noted that the concepts underlying the main elements of the ECB’s statistical requirements for MFS are set out in international statistical standards, namely the globally used System of National Accounts, and the European system of national and regional accounts (i.e. ESA 2010). Adherence to these standards fosters the international comparability of national and euro area statistics and ensures a sound methodological background for the aggregation of data.

Moreover, methodological discussions took place within the WG MFS over the refence period of this report, as relevant with the aim of fostering the overall soundness of the methodology used.

This section describes various methodological issues that arose over the period concerned.

3.1 MFI definition: alignment with the amended credit institution definition

The definition of a credit institution in the CRR was amended, with effect from 26 June 2021, to include SIFs. This change had to be reflected in the new BSI Regulation (ECB/2021/2), which applies the definition of a credit institution given in the CRR in defining the MFI sector. The recast BSI Regulation therefore specifies that SIFs not authorised to take deposits or other repayable funds from the public nor to grant credit for their own account are not included in the MFI sector.

3.2 Reporting on SIFs

The recast BSI Regulation distinguishes, within its reporting population, between credit institutions that are not MFIs – “non-MFI credit institutions” – but are classified as security and derivative dealers in the sector and other financial intermediaries, except ICs and PFs (S.125).

The reporting requirements for non-MFIs are simplified as compared with those for MFIs. While the BSI Regulation requirements for MFIs apply for the most part, those relating to the loan securitisation and other transfers set out in Tables 5a and 5b in Part 5 of Annex I of Regulation ECB/2021/2 are excluded.

3.3 New instruments and definitions for payment statistics

With respect to new definitions, amending Regulation ECB/2020/59 expands the definition of a “cross-border payment transaction” for the purposes of card-based payment transactions, aligning it with the definition in Article 2(8) of Regulation (EU) 2015/751. A card-based payment transaction is now defined as being cross-border if either (i) the issuer and the acquirer are in different Member States, or (ii) the issuer is located in a Member State different from that of the point of sale. To ensure that all the related transactions are captured accurately, the number of data points to be reported for card-based payment transactions has been increased significantly.

3.4 Publication of the insurance corporations’ compilation guide

The “Insurance corporation statistics compilation guide” was published in May 2022. It consolidates into one document all the reporting requirements, definitions and methodological notes that are relevant for IC statistics and provides guidance on how to derive IC statistics from Solvency II reporting (including the “ECB Add-ons”). The compilation guide will be updated on a regular basis to address changes in Solvency II reporting as well as methodological developments.

3.5 Review of ECB Add-ons as part of the Solvency II 2020 review

The Solvency II 2020 update review was initiated by EIOPA to investigate whether the current reporting on ICs was fit for purpose. The updated Directive will amend the reporting requirements with effect from the fourth quarter of 2023 reference period. The ECB took note of the changes suggested by the Solvency II 2020 review and amended some of the ECB Add-ons accordingly. The ESCB also took this opportunity to review the reporting requirements currently included as ECB Add-ons in Solvency II reporting.

ECB Add-ons are collected within the Solvency II taxonomy and relate to information provided for statistical purposes over and above the supervisory requirements. The statistical reviews showed that the ECB Add-ons previously included were not sufficient to derive the high quality statistical data required under the IC Regulation (EC/2014/50). Identified gaps will now be addressed through new ECB Add-ons; the data being collected alongside that required pursuant to the Solvency II 2020 update and the reporting will come into effect from the fourth quarter of 2023 reference period.

4 Timeliness and punctuality

“Timeliness”, including “punctuality”, means that the MFS, along with other ECB statistics, must be timely and punctual. “Timeliness” refers to the time lag between the availability of the information and the event or phenomenon to which it relates, and “punctuality” refers to the time lag between the actual date of release of the data and the date by when the data should have been released.

The relevant ECB regulations and guidelines set clear timelines for statistics collected and transmitted from the NCBs to the ECB, these timelines being based on predetermined and agreed timetables that reporting agents are required to adhere to.

Table 2 sets out the relevant timelines for each type of statistic and the reporting frequency.

Table 2

Transmission dates for national contributions for each type of statistic

Statistics | Relevant regulation | Reporting frequency | Working days after the reference period |

|---|---|---|---|

MFI balance sheet items | Regulation ECB/2021/2 | Monthly | t+15 |

Quarterly | t+28 | ||

MFI interest rate | Regulation ECB/2013/34 | Monthly | t+19 |

Investment funds | Guideline ECB/2021/12 Regulation ECB/2013/38 | Monthly | t+28 |

Quarterly | t+28 | ||

Financial vehicle corporations | Regulation ECB/2013/40 | Quarterly | t+28 |

Insurance corporations | Regulation ECB/2014/50 and Guideline ECB/2021/12 | Quarterly | t+102 |

Annual | t+103 | ||

Pension funds | Regulation ECB/2018/2 and Guideline ECB/2021/12 | Quarterly | t+104 |

Annual | t+103 | ||

Payments | Regulation ECB/2013/43 and Guideline ECB/2014/15 until reference 2021 Regulation ECB/2020/59 and Guideline ECB/2021/13 as of 2022 | Annual | Annual – by close of business on the last working day of May |

Quarterly and semi-annual as of 2022 | Quarterly – by close of business on the last working day of May, August, November, and February Semi-annual – by close of business on the last working day of November and May |

Source: ECB

1) If national public holidays coincide in at least three euro area Member States on the relevant working days, the transmission date is be postponed by 1 day. A maximum of three working days may be granted, where applicable.

2) Following five calendar weeks.

3) Following fourteen calendar weeks.

4) Following seven calendar weeks.

Reporting agents’ compliance with the ECB transmission dates shown in Table 2 is monitored carefully by the NCBs and if infringements occur, these must be reported to the ECB. Repeated failures to report in a timely manner may result in a sanction for the reporting agent concerned.

During the reference period of this report, i.e. from January 2021 to December 2022, most of the reporting agents transmitted their data in a timely manner and relatively few cases of non-compliance occurred in respect of timeliness, as show in Table 3. Most of these failures related to IFs subject to reporting under Regulation ECB/2013/38. Only a limited number of these cases eventually led to a sanction.

Table 3

Alleged infringements due to timeliness for the period from 2021 to 2022

Statistics | Relevant regulation | Reporting frequency | Number of NCBs involved | Number of entities involved | Number of infringements |

|---|---|---|---|---|---|

MFI balance sheet items | Regulation ECB/2021/2 | Monthly | |||

Quarterly | 1 | 1 | 3 | ||

MFI interest rate | Regulation ECB/2013/34 | Monthly | |||

Investment funds | Guideline ECB/2021/12 Regulation ECB/2013/38 | Monthly | 3 | 47 | 154 |

Quarterly | 2 | 30 | 31 | ||

Financial vehicle corporations | Regulation ECB/2013/40 | Quarterly | 2 | 7 | 12 |

Insurance corporations | Regulation ECB/2014/50 and Guideline ECB/2021/12 | Quarterly | 1 | 1 | 1 |

Annual | |||||

Pension funds | Regulation ECB/2018/2 and Guideline ECB/2021/12 | Quarterly | |||

Annual | |||||

Payments | Regulation ECB/2013/43 and Guideline ECB/2014/15 until reference 2021 Regulation ECB/2020/59 and Guideline ECB/2021/13 as of 2022 | Quarterly | |||

Annual until reference 2021 Quarterly and semi-annual as of 2022 onwards |

Source: ECB

In addition, delays in the transmission of BSI and MIR data by two NCBs were observed on two occasions.

5 Availability of data and metadata

5.1 Completeness

Completeness checks are carried out for MFS to detect missing information. If data gaps arise, the NCB colleagues involved are contacted and asked to transmit the missing data as quickly as possible.

The completeness of metadata is also of paramount importance given that it adds to the reliability and high quality of MFS. Particular effort is made to maximise the use of standardised concepts, existing data structures and international code lists, or at least code lists agreed with other international statistical institutions, and thereby lower the costs, minimise the reporting burden and better support data governance-related issues, such as data confidentiality.

Data transmissions in 2021 and 2022 were complete and carried out in accordance with the predefined deadlines, with only minor inconsistences observed, these being sorted out promptly and without any impact on the relevant data productions.

5.2 Accessibility

“Accessibility” refers to the conditions under which information on data and metadata is presented, ideally in a clear and understandable manner, and is made freely, easily and readily available to all users so that meaningful interpretations can be made. This is ultimately a measure of how straightforward it is to access data or, approaching it from the opposite angle, of the extent to which confidentiality constraints prevent certain data from being shared with the public.

The ECB primarily focuses on publishing MFS on euro area aggregates, including country level data for euro area and non-participating Member States. These data generally include:

- stock data, referring to the value of assets and liabilities on the last day of the reference period (e.g. month or quarter), this, as a rule, being the last calendar day;

- financial transactions (flows), referring to the current period, this data usually being calculated by deducting the effect of factors that do not relate to transactions from the difference in stocks over the period (e.g. reclassifications and revaluation adjustments);

- reclassifications and other adjustments, covering changes in the balance sheet stocks that arise as a result of changes in the composition and structure of the reporting population, changes in the classification of financial instruments and counterparties, changes in statistical definitions and the (partial) correction of reporting errors;

- revaluation adjustments, resulting from changes in the prices of assets and liabilities, changes in exchange rates affecting assets and liabilities denominated in foreign currencies, and write-offs or write-downs of loans;

- exchange rate adjustments, usually concerning instruments denominated in currencies other than the euro and that are reported in euro;

- new business, interest rates and volumes, referring to all new agreements on interest rates, including renegotiations of existing agreements, during the course of one month;

- pure new loans, which are calculated as the difference between total new business and renegotiations, offering a measure of the gross flow of new credit and serving to enable users to assess the MFI’s credit market stance;

- indexes of notional stocks, which are usually computed as a chain index I(t) = I(t-1)*[1+F(t)/S(t-1)], where F(t) are transactions during the period and S(t-1) are stocks at the end of the previous period;

- growth rates, which usually refer to an index of notional stocks, rather than to the stock data directly, making it possible to pinpoint the latest developments in the series free from the effects that non-transactions would have on the growth rate of stocks.

Table 4 sets out the type of data published for the different MFS.

Table 4

Type of data published for the different MFS

Statistics | Relevant regulation | Type of data |

|---|---|---|

MFI balance sheet items | Regulation ECB/2021/2 | Stocks, transactions, revaluations, reclassifications, exchange rates adjustments, indexes, growth rates |

MFI interest rate | Regulation ECB/2013/34 | interest rates (annualised agreed rates) on new business and outstanding amounts, new business volumes, renegotiations (rates and volumes), pure new loans (rates and volumes) |

Investment funds | Guideline ECB/2021/12 Regulation ECB/2013/38 | Stocks, transactions, and indexes |

Financial vehicle corporations | Regulation ECB/2013/40 | Stocks, transactions, and indexes |

Insurance corporations | Regulation ECB/2014/50 and Guideline ECB/2021/12 | Stocks, transactions, and indexes |

Pension funds | Regulation ECB/2018/2 and Guideline ECB/2021/12 | Stocks, transactions, revaluations, reclassifications, and growth rates |

Payments | Regulation ECB/2013/43 and Guideline ECB/2014/15 (until reference period 2021) Guideline ECB/2021/13 as of 2022 | Stocks, transactions |

5.3 Clarity

Clarity refers to the “information environment” surrounding the data. Efforts are made to ensure that MFS, data and explanatory material remain relevant and are presented in a clear, unambiguous way that supports and promotes their use by all types of users. Moreover, releases are accompanied by a clear description of the main statistical messages aimed at explaining the relevance and meaning of the data in a way that is not materially misleading.

Suitable data visualisations, including charts, tables and dashboards, are published either in ECB publications or through the ECB Data portal and are designed to assist the interpretation of MFS data.

A wide range of MFS is published on the ECB website on a monthly and quarterly basis. In addition, annual statistical press releases are issued in line with a pre-announced release calendar; these outline the latest data and the relevant economic developments.

In order to accommodate different user needs, MFS data are published through several avenues and in various formats, ranging from regular ECB publications, such as the Economic Bulletin, to those providing additional details, such as the newly introduced ECB Data Portal, the euro area statistics website, the ECBstatsApp, and the relevant dashboards, such as that for “Bank Interest Rates Statistics”.

6 Accuracy and reliability

This section focuses on presenting the results of the quantitative checks performed to analyse the magnitude of data revisions affecting the compilation of monetary aggregates and MIR statistics. During the period covered by this quality report (January 2021 to December 2022), quality checks were adjusted to encompass the new MFI balance sheet statistics resulting from implementation of the BSI Regulation (ECB/2021/2).

The overall quality of published data has remained very high and stable over time. This ensured that the statistical data collected contributed reliable information for the ECB’s policy needs in 2021 and 2022.

6.1 Quality measures based on revisions to MFI balance sheet and interest rate statistics

The analysis of revisions in this section evaluates the reliability of first releases. This is an important quality feature, alongside compliance with harmonised definitions, the timely incorporation of methodological changes and consistency with other statistics. It should be noted that a small number of revisions to first data releases is not necessarily an indication of high data quality given that revisions are primarily intended to improve statistics. They also tend to mitigate the impact of trade-offs between different output quality characteristics (e.g. the timeliness and accuracy of reported data).

The revisions practice for MFI balance sheet and MIR statistics makes it possible for data releases to be revised to ensure that the statistics remain up to date and relevant. The only restriction is that revisions to monthly BSI data must be submitted by NCBs at the same time as the quarterly MFI balance sheet statistics in order to ensure the consistency of monthly and quarterly statistics. BSI data collected on a quarterly basis provide more detailed breakdowns and can thus, in principle, lead to the detection of errors in monthly BSI data and to the corresponding revisions. Exceptional revisions, owing, for example, to reclassifications and improved reporting procedures, can be done to coincide with any release.

A distinction is made between “regular” and ad hoc/exceptional revisions, which are usually accompanied by explanatory notes. Data are generally considered to be “provisional” on first release; the expectation is therefore that regular revisions will be included in the next monthly update at t+1. Ad hoc/exceptional revisions attributable, for example, to reclassifications and improved reporting procedures may be done to coincide with any release and may even go back as far as 2003, depending on the indicators concerned.

Revisions of euro area MFI balance sheet statistics

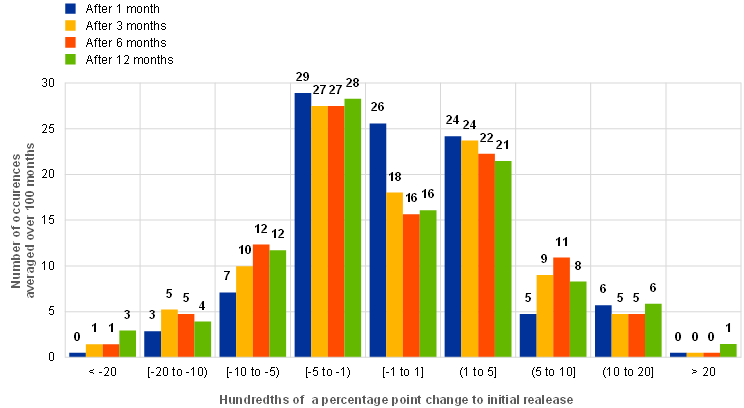

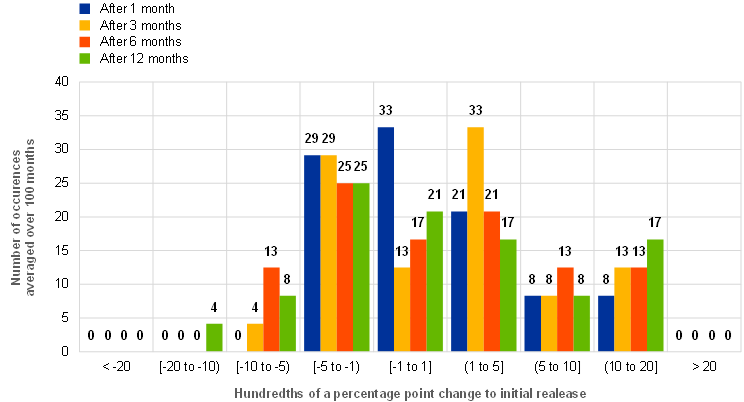

In the analysis below, vintage data in the data repositories have been used to analyse how the monthly revisions received between August 2005 and December 2022 at t+1, t+3, t+6 and t+12 months have cumulatively impacted the monetary aggregates and their components after their initial publication in press releases.[21]

Revisions impacting euro area monetary aggregates

In general, the impact of cumulative revisions on all published monetary aggregates for the broad aggregate M3 continued to be insignificant in terms of the monthly growth rates for the monetary aggregates. Moreover, the impact of the revisions received (measured by root mean square (RMS), as defined below) for the reference period of this report (January 2021 to December 2022) was relatively small for most of the monetary aggregates as compared with that for the August 2005 to December 2022 reception period.

Given that growth rates are published to one decimal place, changes of less than 0.05 percentage points do not, in practice, affect the published figures. In this regard, approximately 66% of all M3 month-on-month growth rates remained practically unchanged following the revisions received from August 2005, their cumulative impact at t+12 being less than 0.05 percentage points in absolute terms (see Table 5). Over the same reception period, 86% and 96% of the initially published growth rates saw a posteriori changes of less than 0.10 and 0.20 percentage points respectively.

Interestingly, the revisions were substantially lower for the reception period from January 2021 to December 2022, with 63%, 79% and 100% of the initially published M3 growth rates being impacted by changes of less than 0.05, 0.10 and 0.20 percentage points respectively (see Table 5).

Using the same 0.05 percentage points metric, at time lag t+1, the figure for unchanged M3 growth rates has been 79% since June 2005 (83% since January 2021). At time lag t+3, the figure has been 69% since June 2005 (75% since February 2021). At time lag t+6, the figure has stood at 65% since June 2005 (63% since July 2021).

With regard to revisions received since August 2005, the bias (simple average) vis-à-vis early estimates for month-on-month M3 growth rates has varied between -0.0002 percentage points at time lag t+1 and 0.004 percentage points at t+12 (see Table 5), which are negligible values.

The RMS of the total impact on the M3 growth rate has ranged between 0.058 percentage points at time lag t+1 and 0.089 percentage points at time lag t+12.

It is worth noting that the cumulative revisions received from January 2021 had, in general, slightly less impact on the M3 growth rate than in previous years, namely the RMS impact at t+12 was 0.07 percentage points compared with 0.09 percentage points for all revisions received from August 2005. This lower figure may partially be due to M3 growth rates being less volatile in recent years, given that the RMS of the differences between the monthly M3 growth rates is also significantly lower.

Table 5

Impact of cumulative revisions on the initially released M3 growth rates

Monthly revisions received from August 2005 to December 2022

(hundredth of percentage points)

Time lag (months) | T+1 | T+3 | T+6 | T+12 |

|---|---|---|---|---|

Number of months | 211 | 211 | 211 | 205 |

Average impact | -0.02 | -0.50 | -0.48 | -0.38 |

Standard deviation (n-1) | 5.77 | 6.91 | 7.11 | 8.92 |

RMS impact | 5.76 | 6.91 | 7.11 | 8.90 |

Maximum impact | 24.94 | 25.56 | 25.01 | 45.60 |

Minimum impact | -22.80 | -31.18 | -31.16 | -46.04 |

| Impact | <= 0.01 p.p. | 25.6% | 18.0% | 15.6% | 16.1% |

| Impact | <= 0.05 p.p. | 78.7% | 69.2% | 65.4% | 65.9% |

| Impact | <= 0.10 p.p. | 90.5% | 88.2% | 88.6% | 85.9% |

| Impact | <= 0.20 p.p. | 99.1% | 98.1% | 98.1% | 95.6% |

Monthly revisions received from January 2021 to December 2022

(hundredth of percentage points)

Time lag (months) | T+1 | T+3 | T+6 | T+12 |

|---|---|---|---|---|

Number of months | 24 | 24 | 24 | 24 |

Average impact | 1.95 | 2.29 | 2.22 | 2.03 |

Standard deviation (n-1) | 5.71 | 5.94 | 6.75 | 7.37 |

RMS impact | 5.92 | 6.25 | 6.97 | 7.49 |

Maximum impact | 19.95 | 17.98 | 18.43 | 18.21 |

Minimum impact | -4.74 | -6.12 | -8.48 | -12.98 |

| Impact | <= 0.01 p.p. | 33.3% | 12.5% | 16.7% | 20.8% |

| Impact | <= 0.05 p.p. | 83.3% | 75.0% | 62.5% | 62.5% |

| Impact | <= 0.10 p.p. | 91.7% | 87.5% | 87.5% | 79.2% |

| Impact | <= 0.20 p.p. | 100.0% | 100.0% | 100.0% | 100.0% |

Regarding the development of revisions over time, initial revisions would usually be expected take place early, mostly within the first three months of initial release, and no significant further revisions would then be received in the subsequent periods. This is generally what occurs in practice, as shown in Charts 1 and 2 below.

Chart 1

Impact on the initially released M3 growth rates of cumulative revisions received monthly from August 2005 to December 2022

(hundredths of a percentage point)

Chart 2

Impact on the initially released M3 growth rates of cumulative revisions received monthly from January 2021 to December 2022

(hundredths of a percentage point)

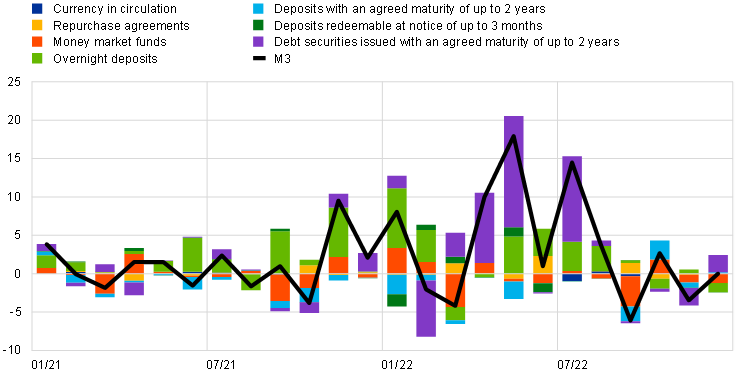

Contribution of revisions in instruments to overall M3 revisions

In assessing the contribution of individual instruments to revisions of M3, account must be taken of the share of each instrument in the aggregate figure. Chart 3 shows a breakdown of contributions to M3 revisions. The largest contributions to the overall M3 revisions primarily stem from “debt securities issued with a maturity of up to two years”, “overnight deposits” and “MMF shares/units”.

Chart 3

Breakdown of contributions to M3 revisions

(hundredths of a percentage point)

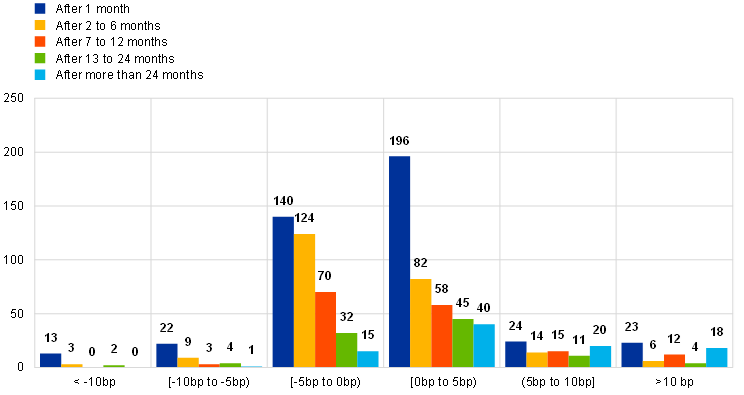

Analysis of revisions of euro area MIR statistics

In the following analysis of revisions of MIR statistics, monthly data from January 2003 to December 2022 were used to analyse revisions of euro area aggregates. Only revisions equal to or greater than 1 basis point were considered for the purpose of the analysis, given that revisions of less than 1 basis point are not visible in the published data.

As shown in Chart 4, revisions of euro area aggregates for MIR indicators are generally very small and follow the expected pattern of a higher concentration of revisions in the lower range (-5 to +5 basis points) with a short time lag (t+1)[22]. This means that after an initial revision has taken place, which generally occurs in the month following the first release (i.e. “ordinary revisions”) or shortly afterwards, there are not usually many significant revisions in subsequent periods.[23]

Chart 4

Revisions of euro area aggregates for MIR statistics

(size of the revision in basis points, x-axis; number of occurrences, y-axis)

Around 83% of all revisions were concentrated between -5 and 5 basis points (see Table 6). With respect to the time lag, a substantial number of revisions occurred in the month following the initial release (ordinary revisions). Other revisions can be divided as follows: 24% corresponded to a period preceding the current reference month by two to six months, 16% corresponded to a period preceding the current reference month by seven to 12 months, 10% of revisions referred to a period preceding the current reference month by 13 to 24 months and 9% were revisions to statistics that extended beyond their reference month by 24 months (see Table 7). In addition, several NCBs sent in a single monthly transmission of revisions by reporting agents of several time series with an impact on euro area aggregates and relating to at least 12 reference periods. This category of revision is considered to be “ad hoc” in this analysis, owing to the exceptional reasons for their occurrence and their particular characteristics.

Table 6

Range | Number of revisions | Total number of revisions (%) | Number of ad hoc revisions | Total number of revisions excluding ad hoc revisions (%) |

|---|---|---|---|---|

[-5 to 5] | 802 | 80 | 285 | 83 |

[-10 to -5 [and] +5 to +10] | 123 | 12 | 66 | 9 |

<-10 and >+10 | 81 | 8 | 35 | 7 |

Table 7

Number of revisions per time lag

Time lag | Number of revisions | Total number of revisions (%) | Number of ad hoc revisions | Total number of revisions excluding ad hoc revisions (%) |

|---|---|---|---|---|

After 1 month | 418 | 42 | 52 | 59 |

After 2 to 6 months | 238 | 24 | 111 | 20 |

After 7 to 12 months | 158 | 16 | 98 | 10 |

After 13 to 24 months | 98 | 10 | 71 | 4 |

After 24 | 94 | 9 | 54 | 6 |

The sample mean of revisions affecting euro area aggregates was 0.03 basis points, while the corresponding absolute mean was 0.06 basis points.

The number of revisions was actually very small compared with the number of indicators used for the analysis (106)[24] and the potential number of reference periods revised (from December 2022 back to January 2003, with a monthly frequency). Furthermore, it is worth noting that 13% of the indicators in the study were not revised during the period under analysis.

Overall, in comparison with the number of observations, the number and size of revisions to MIR statistics at euro area level were small, confirming the reliability of the data. The number of exceptional and ad hoc revisions, as opposed to ordinary revisions, shows that MIR statistics are being continuously updated and therefore their accuracy is continuously improving.

7 Internal consistency

“Internal consistency” refers to the set of checks conducted for MFS to verify that all linear constraints are correctly fulfilled in the data received, for instance by checking whether balance sheet balances and their sub-totals add up to the totals.

Similar consistency checks are also performed across frequencies of the same dataset, checking, for instance, whether the sum of monthly transaction values equals the quarterly values, or whether the year-end stocks equal the end-December stocks.

Overall, internal consistency checks upheld the consistency of MFS in 2021 and 2022. When issues were observed, colleagues in the NCB involved were contacted and asked either to revise or to justify the data accordingly.

Observed internal consistency check failures relating, for example, to FVC statistics may either be due to the valuation methods used, i.e. differences between the nominal and the acquisition value or reclassifications, or be due to potential reclassifications.

Plausibility checks are also conducted for MFS to detect outliers in the reported data. This is accomplished by reviewing the time series of the variable concerned; for instance, for statistics with a pronounced seasonal pattern, the most recent figure is compared with the data reported for the same period in previous years. Values which markedly deviate from the usual pattern of the series are isolated and analysed further.

In the case of MFI balance sheet statistics, data compilers use autoregressive integrated moving average (ARIMA) models to assess the plausibility of new national data received. This approach is also applied to euro area aggregates. An ARIMA-based outlier detection model is also used for MIR statistics and is applied to the raw data transmitted by the countries concerned as part of the regular data checks.

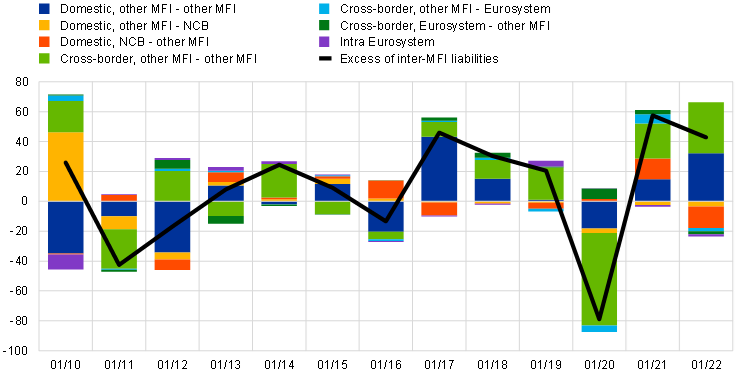

With regard to MFI balance sheet statistics, Chart 5 shows the annual flows in excess of inter-MFI liabilities between 2010 and 2022. The excess of those liabilities represents the residual figure resulting from the netting of reported inter-MFI liabilities and assets across the euro area to obtain a consolidated balance sheet of the MFI sector, and is one of the counterparts of the broad money aggregate M3[25]. While some minor discrepancies between inter-MFI assets and liabilities are to be expected on a month-to-month basis, for example due to different timings of the recording of a transaction between two MFIs, over a longer period any differences should conceptually net out.

It is apparent that, even though some discrepancies of considerable volume have been observed for certain years, these do not seem to demonstrate a clear pattern and the series has experienced a fair share of highs and lows throughout its evolution. Thus, we can conclude there is no recurrent behaviour over time, whether in terms of annual flows or in their composition. On the other hand, after examining the breakdown of flows by different combinations of reference and counterpart sectors and areas, it is clear that the main drivers of the discrepancies are the cross-border intra-euro area positions between other MFIs. This item has been the main contributor to the discrepancies in the last four years, exceeding 34 billion euro in 2022. Nonetheless, positions between domestic other MFIs have also been an important contributor since 2010, even though the magnitude of these discrepancies has been limited over the last five years, with exception of 2022. The other subcomponents are well contained and their contribution to the overall flows is minor.

Chart 5

Excess of euro area inter-MFI liabilities

(annual flows, EUR billions)

Notes: “Other MFI” refers to MFIs excluding the Eurosystem. The combination “other MFIs – NCB” represents the difference between deposits reported by other MFIs vis-à-vis the NCB and loans reported by the NCB vis-à-vis other MFIs.

8 External consistency/coherence

The MFS function carries out various checks to assess the consistency with other datasets of the data received. For instance, MFI balance sheet statistics received by the ECB statistical function on the cross-border positions of euro area banks are compared with similar data collected by the Bank for International Settlements.

Comparisons across different types of statistics, such as those set out below, are also conducted.

8.1 Comparing security holding statistics with insurance corporation statistics

The WG MFS and Working Group on Securities (WG SEC) jointly contributed to an analysis of discrepancies between the outstanding amounts of insurance corporations’ securities holdings collected via insurance corporations’ statistics (ICB dataset) and securities holdings statistics (the Eurosystem’s Securities Holdings Statistics by Sector (SHSS) dataset). The main differences, other than reporting errors, were due to variations in coverage, sources or reporting approaches. One of the most cited reasons for differences was the voluntary reporting of non-ISIN securities in SHSS. Many NCBs also highlighted the fact that inconsistencies between the two datasets were driven by different reporting approaches for branches (home versus host approaches). Another reason for discrepancies was the use of different data sources, which partly overlaps with the different reporting approaches already referred to. Derogations and the grossing-up of ICB datasets were also mentioned as a source of differences between the two datasets.

8.2 Comparing MFI balance sheet items with FVC statistics

A substantial part of the FVC balance sheet items relates to securitised loans originated by euro area MFIs. Hence, there is a connection between FVC and BSI statistics.

With regard to BSI statistics, under Part 5 of Annex I to the BSI Regulation (ECB/2021/2), MFIs are required to report a comprehensive set of information on loans, securitised or otherwise, to be communicated on a monthly and quarterly basis. This involves data on off-balance-sheet securitised loans (i.e. derecognised loans) that continue to be serviced by the MFIs concerned.

Data on securitised loans not serviced and non-securitised off-balance sheet loans are collected under the MFS Guideline (ECB/2021/11), insofar as that information is available to the NCBs. \

It is therefore possible to (approximately) compare, at an aggregated level, the FVC flows of securitised loans originated by euro area MFIs with the following BSI securitised loan flows:

- net flows transferred to euro area FVCs (BSI Regulation);

- derecognised loans serviced by MFIs (BSI Regulation);

- other available data on derecognised loans (MFS Guideline);

- non-derecognised loans on MFI balance sheets securitised using euro area FVCs (BSI Regulation).

A comparison of the two datasets relies on a number of assumptions and such checks are therefore more relevant for certain countries than for others.

8.3 MIR statistics – synthetic mean absolute error

Following entry into force of Guideline ECB/2014/15, the synthetic mean absolute error (MAE) was introduced as a measure of sample quality in MIR statistics. In particular, if an NCB applies sampling in determining the reporting population and selects the largest institutions in each stratum, the actual synthetic MAE should not exceed a time-varying MAE threshold, assuming a 10-basis-point error difference in each stratum and indicator. The maximum random error is used as a measure of the sample quality if the NCB applies random sampling in its selection of reporting institutions and should not, on average, exceed 10 basis points at a confidence level of 90%.

Under the provisions of the aforementioned Guideline, NCBs should check the representativeness of their sample at least once a year. If there are significant changes in the reference reporting population, these must be reflected in the sample. Moreover, NCBs must carry out a regular review of the sample at least once every three years. A new estimate of the sample quality must be provided after each sample maintenance round.

Annex I

Annex A: MIR statistics methods by EU country

The tables below contain a summary by EU country of the methods used for MIR statistics.

Table A

Methods for selecting the actual reporting population

Countries answers | Census | Sample |

|---|---|---|

BE | X | |

BG | X | |

CZ | X | |

DK | X | |

DE | X | |

EE | X | |

IE | X | |

GR | X | |

ES | X | |

FR | X | |

HR | X | |

IT | X | |

CY | X | |

LV | X | |

LT | X | |

LU | X | |

HU | X | |

MT | X | |

NL | X | |

AT | X | |

PL | X | |

PT | X | |

RO | X | |

SI | X | |

SK | X | |

FI | X | |

SE | X |

Table B

Specific measures performed in countries applying a sampling approach

Countries answers | Calculation of the intra-stratum variance | Calculation of the total variance of the reporting population | Calculation of expansion factors | Maximum random error | MAE measures | Other |

|---|---|---|---|---|---|---|

BE | X | |||||

BG | ||||||

CZ | ||||||

DK | X | X | ||||

DE | X | X | X | X | ||

EE | ||||||

IE | X | X | ||||

GR | X | X | X | |||

ES | X | X | ||||

FR | X | X | X | X | ||

HR | ||||||

IT | X | X | X | X | ||

CY | ||||||

LV | ||||||

LT | X | X | ||||

LU | X | |||||

HU | ||||||

MT | ||||||

NL | ||||||

AT | X | X | X | X | ||

PL | X | X | X | X | ||

PT | ||||||

RO | ||||||

SI | ||||||

SK | ||||||

FI | ||||||

SE | X | X |

Table C

Number of banks currently in the MIR sample and how often that sample is reviewed

Countries answers | Number of banks | Frequency of review |

|---|---|---|

BE | 29 | Annual |

BG | ||

CZ | ||

DK | 32 | Annual |

DE | 205 | Annual |

EE | ||

IE | 12 | Annual |

GR | 15 | Annual |

ES | 76 | Annual |

FR | 208 | 5y |

HR | ||

IT | 58 | 3y |

CY | ||

LV | ||

LT | 14 | Annual |

LU | 51 | Annual |

HU | ||

MT | ||

NL | ||

AT | 111 | Annual |

PL | 18 | Annual |

PT | ||

RO | ||

SI | ||

SK | ||

FI | ||

SE | 31 | Annual |

Table D

Experience of local events (e.g. IT issues, issues with reporting agents, etc.) in the last 24 months that have had the potential to undermine data quality

Countries answers | Yes | No |

|---|---|---|

BE | X | |

BG | X | |

CZ | X | |

DK | X | |

DE | X | |

EE | X | |

IE | X | |

GR | X | |

ES | X | |

FR | X | |

HR | X | |

IT | X | |

CY | X | |

LV | X | |

LT | X | |

LU | X | |

HU | X | |

MT | X | |

NL | X | |

AT | X | |

PL | X | |

PT | X | |

RO | X | |

SI | X | |

SK | X | |

FI | X | |

SE | X |

Table E

Quality and consistency checks routinely performed

Countries answers | Internal consistency of individual MIR | Internal consistency of aggregated MIR | Comparison between MIR new business volumes and BSI flows | Comparison with AnaCredit data | Deterministic outlier detection | Model-based outlier detection | ECB outlier detection | Individual MFI outlier compared to the reporting population | Other |

|---|---|---|---|---|---|---|---|---|---|

BE | X | X | X | X | X | X | |||

BG | X | X | X | X | |||||

CZ | X | X | X | X | |||||

DK | X | X | X | X | X | ||||

DE | X | X | X | X | X | ||||

EE | X | X | X | X | X | ||||

IE | X | X | |||||||

GR | X | X | X | X | X | X | X | ||

ES | X | X | X | X | X | X | X | ||

FR | X | X | X | X | |||||

HR | X | X | X | X | X | X | |||

IT | X | X | X | X | X | X | |||

CY | X | X | X | X | |||||

LV | X | X | X | X | X | X | |||

LT | X | X | X | X | X | ||||

LU | X | X | X | X | X | X | X | ||

HU | X | X | X | X | X | X | X | ||

MT | X | X | X | X | X | X | |||

NL | X | X | X | X | X | X | X | ||

AT | X | X | X | X | X | X | X | ||

PL | X | X | X | X | X | ||||

PT | X | X | X | X | X | ||||

RO | X | X | X | X | X | ||||

SI | X | X | X | ||||||

SK | X | X | X | X | X | X | |||

FI | X | X | X | X | X | X | X | ||

SE | X | X | X | X | X |

© European Central Bank, 2023

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the ECB glossary (available in English only).

PDF ISBN 978-92-899-6315-2, ISSN 2363-0191, doi:10.2866/596038, QB-AV-23-002-EN-N

HTML ISBN 978-92-899-6314-5, ISSN 2363-0191, doi:10.2866/32904, QB-AV-23-002-EN-Q

The ECB Statistics Quality Framework (SQF) and quality assurance procedures, which were published in April 2008, build on that public commitment by the ESCB.

Regulation (EU) 2021/379 of the European Central Bank of 22 January 2021 on the balance sheet items of credit institutions and of the monetary financial institutions sector (recast) (ECB/2021/2) (OJ L 73, 3.3.2021, p. 16).

Regulation (EU) 2020/2011 of the European Central Bank of 1 December 2020 amending Regulation (EU) No 1409/2013 on payments statistics (ECB/2013/43) (ECB/2020/59) (OJ L 418 11.12.2020, p. 1).

Regulation (EU) No 1073/2013 of the European Central Bank of 18 October 2013 concerning statistics on the assets and liabilities of investment funds (recast) (ECB/2013/38) (OJ L 297, 7.11.2013, p. 73).

Regulation (EU) 2019/2033 of the European Parliament and of the Council of 27 November 2019 on the prudential requirements of investment firms and amending Regulations (EU) No 1093/2010, (EU) No 575/2013, (EU) No 600/2014 and (EU) No 806/2014 (OJ L 314, 5.12.2019, p. 1).

Regulation (EU) 2015/751 of the European Parliament and of the Council of 29 April 2015 on interchange fees for card-based payment transactions (OJ L 123, 19.5.2015, p. 1).

The Eurosystem is the central banking system of the euro area. It consists of the ECB and the NCBs of those EU Member States that have adopted the euro. See also “The Eurosystem mission” statement.

Protocol on the Statute of the European System of Central Banks and of the European Central Bank.

Regulation (EU) No 1072/2013 of 24 September 2013 concerning statistics on interest rates applied by monetary financial institutions (ECB/2013/34) (OJ L 297, 7.11.2013).

Regulation (EU) No 1075/2013 of the European Central Bank of 18 October 2013 concerning statistics on the assets and liabilities of financial vehicle corporations engaged in securitisation transactions (recast) (ECB/2013/40) (OJ L 297, 7.11.2013, p. 107).

For PSS, the last applicable reference year is 2021 and afterwards, these data are split and expanded into fourteen (14) new payments and settlement systems data structure definitions (DSD).

Regulation (EU) No 1409/2013 of the European Central Bank of 28 November 2013 on payments statistics (ECB/2013/43) (OJ L 352, 24.12.2013, p. 18).

Regulation (EU) No 1374/2014 of 28 November 2014 on statistical reporting requirements for insurance corporations (ECB/2014/50) (OJ L 366, 20.12.2014, p. 36).

Regulation (EU) 2018/231 of the European Central Bank of 26 January 2018 on statistical reporting requirements for pension funds (ECB/2018/2) (OJ L 45, 17.2.2018, p. 3).

Council Directive 85/611/EEC of 20 December 1985 on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities (UCITS) (OJ L 375, 31.12.1985, p. 3).

Regulation (EU) No 1071/2013 of the ECB of 24 September 2013 concerning the balance sheet of the monetary financial institutions sector (ECB/2013/33) (OJ L 297, 7.11.2013, p. 1).

Guideline of the European Central Bank of 4 April 2014 on monetary and financial statistics (ECB/2014/15) (OJ L 340, 26.11.2014, p.1).

Guideline (EU) 2021/830 of the European Central Bank of 26 March 2021 on balance sheet item statistics and interest rate statistics of monetary financial institutions (ECB/2021/11) (OJ L 208, 11.6.2021, p. 1).

Guideline (EU) 2021/832 of the European Central Bank of 26 March 2021 on reporting requirements on payments statistics (ECB/2021/13) (OJ L 208, 11.6.2021, p. 98).

Manual on payments statistics reporting under the Regulation ECB/2020/59 and the Guideline ECB/2021/13.

The cut-off date for the analysis was the end of February 2023. The most recent data available are therefore for the December 2022 reference period (data are received with a one-month lag).

The distribution of revisions of euro area aggregates for MIR statistics that is displayed in Chart 4 does not include ad hoc revisions.

The policy for revisions set out in Article 14 of Guideline ECB/2021/11 recognises that NCBs may need to revise the previous reference month’s data. It states, however, that revisions applied to data prior to the previous reference period, which are considered to be exceptional, should always be accompanied by explanatory notes.

The analysis covers the 117 rate indicators defined in Regulation ECB/2013/34 and Guideline ECB/2021/11. Of these, 11 indicators, which are totals or aggregates of sub-indicators, have been removed in order to avoid double-counting of revisions.

For more information on M3 derivation and counterparts of M3, please see section 7.1.3 of the Manual on MFI balance sheet statistics.