Which sub-components are driving owner-occupied housing costs?

Published as part of the ECB Economic Bulletin, Issue 2/2022.

In January 2022, Eurostat began publishing official euro area aggregates as part of its Owner-Occupied Housing Price Index (OOHPI). This box looks at the various sub-components of that index and provides details of their correlation with other price indicators.

Owner-occupied housing costs comprise costs relating to the acquisition and ownership of dwellings.[1] Acquisition costs measure the cost of “self-build dwellings and major renovations” and “purchases of new dwellings”. The purchase of a new dwelling is considered to be part consumption and part asset, with the former reflecting the value of the services provided by the building (e.g. the shelter that it offers) and the latter reflecting the value of the building itself and the land on which it stands.[2] In contrast, land prices are not included in the “self-build dwellings and major renovations” sub-component, which mainly covers the construction costs of detached dwellings built on land already owned by the relevant self-builders. The OOHPI also gauges the cost of “other services related to the acquisition of dwellings”, such as property transfer taxes and real estate agents’ fees. In terms of ownership costs, the index mainly covers “major repairs and maintenance” and “insurance connected with dwellings”.[3]

In 2021, acquisition costs accounted for around 78% of the OOHPI at euro area level (Chart A). “Self-build dwellings and major renovations”, “purchases of new dwellings” and “other services related to the acquisition of dwellings” accounted for 45%, 21% and 12% respectively. The remaining 22% of the OOHPI related to ownership costs, with “major repairs and maintenance” accounting for 19% and “insurance connected with dwellings” accounting for 3%.

Chart A

Breakdown of the OOHPI for the euro area

(percentages)

Sources: Eurostat and ECB calculations.

Notes: Data for Greece are not available. All data relate to 2021.

When analysing the OOHPI at the level of the euro area, it is important to note that the relative importance of individual sub-components varies considerably across countries. For instance, in Germany, France and Italy, the “self-build dwellings and major renovations” sub-component is considerably more important than “purchases of new dwellings”, whereas in countries such as Spain the opposite is true.

At the level of the euro area as a whole, price dynamics differ widely across sub-components. The price index for “purchases of new dwellings” has seen the strongest average annual growth over the last decade (Chart B, panel a).[4] However, “self-build dwellings and major renovations” has made the largest contribution to the annual growth rate of the index as a whole, followed by “purchases of new dwellings”. Indeed, those two sub-components accounted, together, for 5.0 percentage points of the 6.6% annual growth that was recorded for the OOHPI as a whole in the third quarter of 2021, with most of the remainder being accounted for by “major repairs and maintenance” (Chart B, panel b). With other sub‑components accounting for less of the OOHPI and seeing more moderate price developments, their individual contributions to average annual growth have consistently been smaller, although they remain significant when grouped together (accounting for a combined total of around a third of average annual growth since 2012).

Chart B

Sub-components’ contributions to annual growth in owner-occupied housing costs

(panel a: annual percentage changes; panel b: annual percentage changes and percentage point contributions)

Sources: Eurostat and ECB calculations.

Notes: The figures in parentheses in the legend indicate the relevant sub-component’s weight in the OOHPI in 2021. The latest observations relate to the third quarter of 2021.

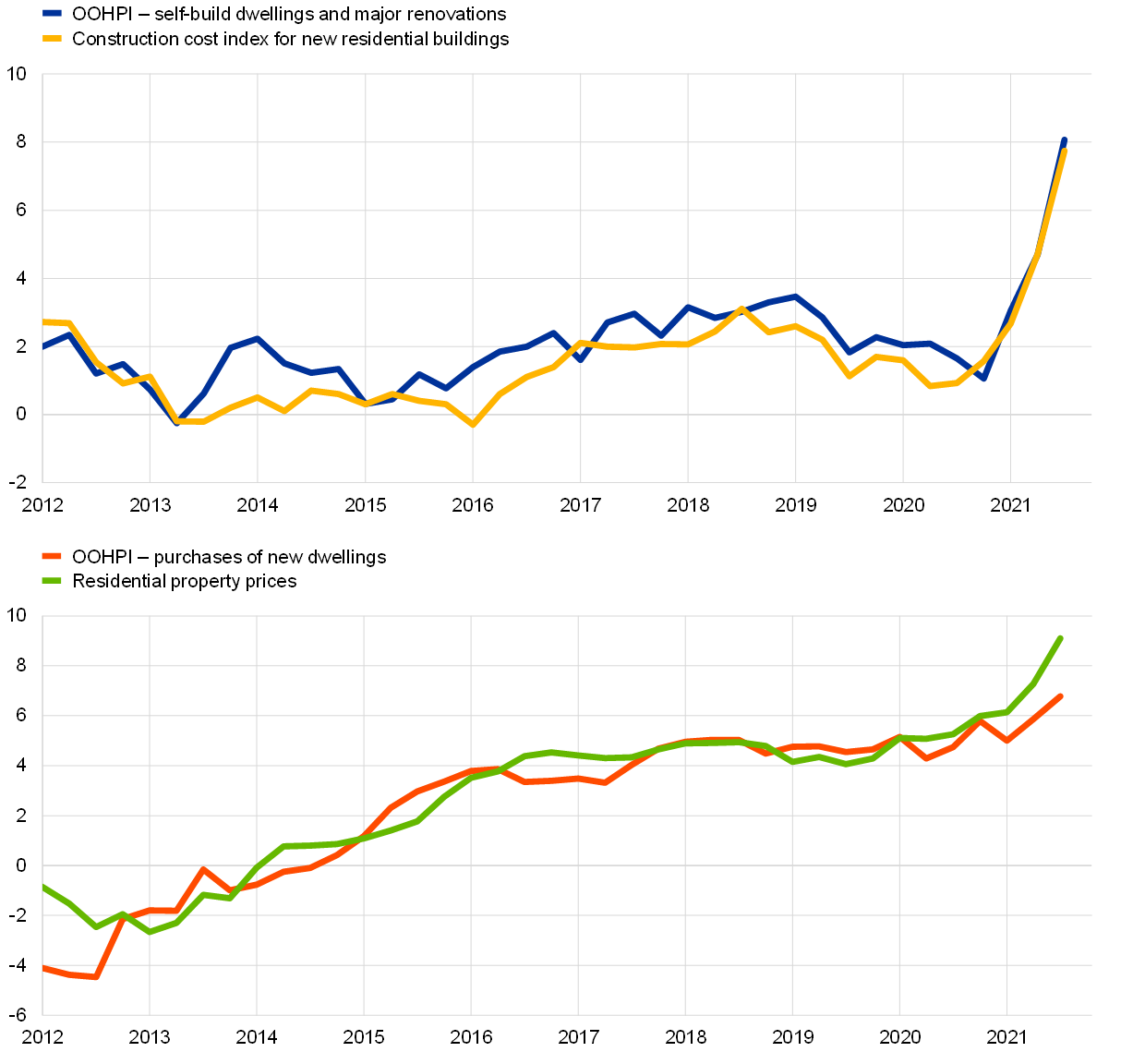

Some individual sub-components are closely correlated with construction costs and house prices. For instance, the annual growth rate for “self-build dwellings and major renovations” exhibits a strong correlation with the construction costs available in short-term business statistics (Chart C, top panel). Similarly, “major repairs and maintenance” shows strong co-movement with the HICP series “services for the maintenance and repair of the dwelling”. Meanwhile, “purchases of new dwellings” is closely correlated with residential property prices (Chart C, bottom panel).

Chart C

Correlation between OOHPI sub-components and other indices

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Note: The latest observations relate to the third quarter of 2021.

Overall, further analysis is required in order to assess the behaviour of the OOHPI and its underlying sub-components over time.[5] In particular, a better understanding of the various correlations will, among other things, help when it comes to devising ways of nowcasting (and forecasting) OOHPI developments (for instance, if data on particular correlates were to be available earlier than the 100‑working-day lag with which the OOHPI is published).

- See the article entitled “Owner-occupied housing and inflation measurement”, Economic Bulletin, Issue 1, ECB, 2022.

- See the box entitled “The treatment of land in OOHPIs” in “Inflation measurement and its assessment in the ECB’s monetary policy strategy review”, Occasional Paper Series, No 265, ECB, September 2021.

- Acquisition costs also include “existing dwellings new to households”, which accounts for around 0.5% of the total index for the euro area. However, that sub-component has, with the exception of Chart A, been excluded from the analysis in this box, as data collection is subject to quality issues owing to limited coverage and a lack of harmonisation across countries. The same applies to “other expenditure”, a sub-component of ownership costs which accounts for 0.9% of the euro area aggregate.

- Since 2012, the price index for “purchases of new dwellings” has seen average annual growth of 2.4%, compared with 2.1% for “self-build dwellings and major renovations” and 1.6% for “major repairs and maintenance”.

- See also the article entitled “The euro area housing market during the COVID-19 pandemic”, Economic Bulletin, Issue 7, ECB, 2021, and the article entitled “The state of the housing market in the euro area”, Economic Bulletin, Issue 7, ECB, 2018.