Macroeconomic implications of increasing protectionism

Published as part of the ECB Economic Bulletin, Issue 6/2018.

The global trading landscape has changed rapidly in recent months. Announcements of tariffs by the US Administration and retaliation by its trading partners have raised concerns about a possible “trade war” and, potentially, a broader reversal of globalisation. On 1 March the US Administration announced tariffs of 25% on imports of steel and 10% on imports of aluminium from a wide range of countries. The first wave of tariffs relating to technology transfers on Chinese imports took effect on 6 July, followed by the announcement of retaliation in kind by the Chinese authorities. In response to the Chinese retaliation, the US Administration threatened to impose additional tariffs. In parallel, the EU and Canada implemented retaliatory measures against the US tariffs on steel and aluminium. Finally, the US Administration initiated a new investigation of imports of cars, trucks and auto parts (to determine their effects on national security) which could result in additional tariffs. Recently, however, there have also been some signs of a reduction in trade tensions resulting from a meeting between US and EU officials as well as the new NAFTA arrangements between the United States and Mexico.

This box looks at the possible impact on the global economy of a hypothetical escalation in trade tensions. In particular, channels through which protectionism might affect the economy are discussed and the potential global impact is quantified. This quantification relies on the ECB’s global model[1] and the IMF’s Global Integrated Monetary and Fiscal Model (GIMF)[2], which is a multi-country, multi-sector model. As with all models, the uncertainties involved mean that estimates from these scenarios should be treated with caution, but they can be used to provide a rough gauge of the channels at work.

In the near term, the direct effects of higher trade tariffs on economic activity in the country imposing the tariffs depend on two main channels: the expenditure switching channel – with a positive impact on GDP – and the aggregate income channel – with a negative impact. On the one hand, higher import tariffs could reduce the purchasing power of households by decreasing real disposable incomes, thereby discouraging domestic consumption and investment and reducing GDP. On the other hand, higher prices for imported goods could induce consumers and firms to switch to domestically produced goods, increasing domestic demand and reducing imports. The relative importance of the two channels, and consequently their combined impact on GDP, depends crucially on the degree of substitutability between domestically produced goods and imported goods. Greater substitutability would imply that switching consumption to domestic goods is less costly for the consumer, rendering the expenditure switching channel stronger. However, if applied to intermediate goods, higher tariffs can also increase the cost of domestic production and lead to a delay in investments. At the same time, retaliatory trade measures can reduce exports and exacerbate the negative effect of trade disputes.

Indirect negative effects arising from a deterioration in business and consumer confidence could amplify the impact on economic activity. The direct trade effect does not take into account possible additional confidence effects and financial sector stress stemming from increased uncertainty about future policies. Uncertainty and confidence effects can have a sizeable negative impact on global investment and economic activity. Firms’ investment decisions depend not only on current trade policy but also on prospective US and global trade policies. Similarly, uncertainty about future trade policies could affect the consumption behaviour of households. As concerns about the negative implications of rising protectionism increase, households may increase precautionary savings and postpone consumption. In addition, financial markets may respond to the negative real effects. A sharp change in trade policies could provide a catalyst for a reassessment of stock and bond prices, which would amplify the effects described above.

The protectionist measures taken so far will have only a marginal effect on global economic activity, as the targeted products represent only a small part of world trade. The very selective measures implemented so far, such as the tariffs on steel (25%), aluminium (10%) and USD 50 billion of US‑China trade (25%) represent only a small fraction of world trade. In addition, the response so far in financial markets and in business and consumer confidence has been contained.

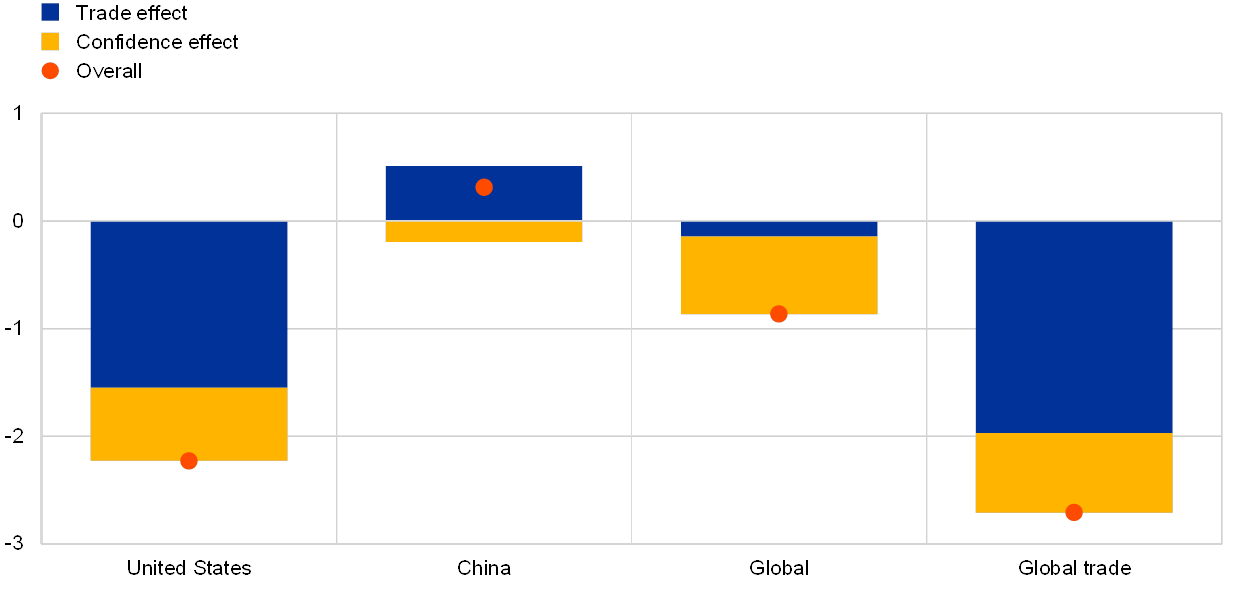

However, an escalation of trade tensions could have significant adverse global effects, as shown in a hypothetical scenario in which the United States raises tariffs on all imports by 10 percentage points and its trading partners retaliate with a 10 percentage points tariff increase on their US imports.[3] The direct channel described above is simulated in the GIMF model as an across-the-board imposition by the United States of 10% import tariffs on final and intermediate goods from all trading partners, who respond by imposing equivalent tariffs on US exports (but not vis-à-vis each other). It is very difficult to capture the indirect confidence effects of such import tariffs, so, for simplicity, it is assumed that bond premia rise by 50 basis points and stock markets decline by two standard deviations in all countries. For the United States this implies a 16% fall in the stock market. Although this implies elevated volatility in financial markets, it is still smaller than at the peak of the global financial crisis (in the fourth quarter of 2008), when the S&P 500 fell by 28% and bond premia rose by 230 basis points.

In our simulations, we also make some important modelling choices. First, we assume that the trade disputes last only two years.[4] Second, we assume that additional fiscal revenues generated by tariff increases are used to reduce budget deficits, rather than to support demand. Third, monetary policy and exchange rates are assumed to react endogenously in all countries.[5] Fourth, we model confidence effects as changes in equity and bond risk premia.

Finally, in all scenarios the assumed form of retaliation is critical to spillovers. For example, if China and the United States escalate trade disputes between themselves and no other country is involved, trade diversion effects come into play. In such a scenario, higher tariffs make US goods more expensive in China and Chinese goods more expensive in the United States. As a result, goods of third countries, which are not part of the trade dispute, gain in competitiveness vis-à-vis US goods in China and Chinese goods in the United States. The extent to which a third economy benefits from this trade diversion depends on how easily a country can substitute between imported products from different countries. Lower substitutability would imply less trade diversion. This effect also depends on whether the exchange rate moves in line with the model predictions.

The trade channel

This scenario design suggests significant negative effects on the United States. The direct trade channel lowers US economic activity by 1.5% in the first year (see the blue bars in Chart A). Lower US imports and gains in market shares by US producers within their home market are outweighed by lower exports. Estimation results suggest that the United States’ net export position would deteriorate substantially. In this model, US firms also invest less and hire fewer workers, which amplifies the negative effect on the US economy by reducing domestic demand. Gradual adjustment and substitution towards domestic production provides only limited compensation over time, and the direct trade effects of higher tariffs still imply that GDP will be 1% lower by the third year of the simulation.

By contrast, in China the trade effect on GDP is initially slightly positive, although the gains diminish over time. In the first year of the simulation, domestic consumption and investment fall in China. However, these negative effects are more than compensated by gains in China’s net export position: the United States imports fewer Chinese goods, but that is cushioned by trade diversion to third countries, where Chinese exporters gain market share at the expense of US exporters. However, over time these benefits diminish: as US production adjusts in response to higher tariffs, demand for Chinese goods falls and Chinese GDP gains diminish.[6]

The confidence channel

The deterioration in confidence has significant adverse effects on global activity. Global financial market reactions have a significant and more wide-ranging impact on output across countries, with global output around 0.75% lower in the first year (see the yellow bars in Chart A). The tightening of financial conditions dampens US GDP by about 0.7% and global trade by 0.75%. Heightened uncertainty and weakened confidence act as a drag on Chinese activity.[7]

Taken together, this implies that real economic activity in the United States could be more than 2% lower than the baseline in the first year alone, and global trade could fall by up to 3% relative to the baseline. In a nutshell, although one may argue about the relative contributions of each of the channels discussed above and about the overall effect on economic activity, qualitatively the results are unambiguous: an economy imposing a tariff which prompts retaliation by other countries is clearly worse off. Its living standards fall and jobs are lost.

Chart A

Estimated impact of an escalation in trade tensions – first year effects

(GDP response in 2018, deviation from baseline levels, percentages)

Source: ECB calculations.

Note: The results are a combination of the direct trade effects from the GIMF model and the confidence effects modelled using the ECB‑Global Model.

- See Dieppe, A., Georgiadis, G., Ricci, M., Van Robays, I. and van Roye, B., “ECB‑Global: Introducing the ECB’s global macroeconomic model for spillover analysis”, Economic Modelling, Vol. 72, June 2018, pp. 78‑98.

- See Kumhof, M., Laxton, D., Muir, D. and Mursula, S., “The Global Integrated Monetary and Fiscal Model (GIMF) – Theoretical Structure”, IMF Working Papers, No 10/34, February 2010.

- The two scenarios are independent, so the 10% import tariff also applies to steel and aluminium.

- This modelling choice is motivated by technical considerations. By assuming temporary tariffs, we proxy myopic behaviour.

- For countries in which interest rates breach the zero lower bound, negative interest rates can be interpreted as shadow rates, reflecting non-conventional monetary policy measures.

- For example, it takes some time for producers to find US suppliers for previously imported intermediate goods, or for consumers to change their habits and start buying goods produced in the United States.

- Fiscal policy in China is allowed to react according to the standard fiscal policy rule in the GIMF model.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts