Risk sharing in the euro area: a focus on the public channel and the COVID-19 pandemic

Risk sharing in the euro area: a focus on the public channel and the COVID-19 pandemic

Published as part of the ECB Economic Bulletin, Issue 7/2022.

1 Introduction

The reform of the architecture of Economic and Monetary Union (EMU) has been at the centre of an economic and policy debate which has, recently, also been shaped by the events related to the coronavirus (COVID-19) pandemic and Russia’s war in Ukraine. There are two fundamental dimensions in this debate. The first concerns the measures a country can take to reduce exposure to economic risks or to mitigate their effects (e.g. eliminating price and wage rigidities, building fiscal buffers or strengthening macroeconomic resilience). The second involves the notion of international risk sharing, which relates to the cross-border channels available to insure domestic disposable income and consumption against country-specific output shocks (as opposed to shocks hitting the euro area as a whole).

In this context, risk sharing is the capacity of an economy to absorb country-specific shocks by insuring against them in capital markets or by buffering through credit or fiscal transfers. When an economy is hit by a shock specific to that country or suffers more than others from a shock common to a group of countries, such as a pandemic or a war, there are three main channels through which the impact on disposable income and consumption can be smoothed out: the capital channel, the credit channel and the fiscal channel. The first two are predominantly private channels, while the last is public. The different channels can be interrelated. For example, they can reinforce each other or they can work as substitutes, e.g. one channel may become more powerful and in part replace another. They can operate at the international level, or between regions or federal states within a single country.

As regards the first channel, the effects of a shock may be dampened if the households and firms in the country hit by the shock obtain income flows from other countries (or regions) not affected by the shock. This is generally referred to as the “capital” channel and mainly operates through revenues from financial assets held abroad.[1] The strength of this channel is greater the deeper the cross-regional financial integration.

The second channel (the “credit” channel) operates when households and firms in the country hit by an adverse shock protect their consumption by resorting to savings in the domestic economy or credit from other countries. This primarily includes credit from (domestic and foreign) financial intermediaries, but also from foreign governments and/or European and international institutions (e.g. the European Union and the International Monetary Fund), which provide loans in the context of economic adjustment or other programmes.

The third channel operates if the effects of the shock are smoothed out through fiscal transfers and is typically referred to as the “fiscal” or “budgetary” channel. Such transfers are drawn from a central or federal budget. This channel may operate across countries or between states and regions in a single country. Until the Next Generation EU (NGEU) programme was launched, the budgetary channel was very small in the euro area. The resources were largely limited to EU structural and cohesion funds, which are in fact disbursed to promote convergence between national economies rather than to achieve stabilisation. In the United States, however, this channel is estimated to cushion between 10% and 20% of adverse shocks, owing to the sizeable US federal budget.

This article reviews the literature on risk sharing, puts forward some estimates of how risk sharing has operated in the euro area over the last 25 years, and finally discusses some reform proposals. The proposed reforms may help to increase fiscal risk sharing in the euro area, which is still substantially underdeveloped. The review highlights that risk-sharing mechanisms across euro area countries have been weaker than in the United States, mainly because of a lower degree of risk sharing through European capital markets.

Empirical analysis points to an improvement in risk sharing since the start of the pandemic, i.e. between 2020 and 2022, which is explained mainly by a stronger credit channel.[2] While an exact identification of the drivers of this channel is not possible, this evidence suggests that the provision of unprecedented policy support reduced the risk of cross-border financial flows coming to a sudden halt, thus preventing a severe disruption of private risk sharing.

Evaluating risk sharing is paramount for countries in a monetary union, given that these economies cannot react to a country-specific shock or impact from a common shock through autonomous monetary policy or nominal exchange rate adjustment. Building national fiscal buffers, eliminating structural rigidities and also strengthening private and public risk-sharing channels are central to enhancing the capacity of the euro area to cope with future shocks. This is the main rationale for most proposals to improve the institutional architecture of EMU, some of which are reviewed in this article.

This article is organised as follows. Section 2 reviews selected contributions from the vast body of risk-sharing literature. Section 3 presents our empirical analysis. Section 4 discusses some existing reform proposals for enhancing public risk sharing in the euro area, and Section 5 sets out the conclusions.

2 Findings from the literature

The literature on international risk sharing has grown considerably over the past three decades, especially since the seminal paper on risk sharing in the United States by Asdrubali, Sørensen and Yosha in 1996.[3] The paper finds that, between 1963 and 1990, 75% of shocks to the per capita gross product of individual US states were smoothed out, leaving a relatively small share of shocks that were not absorbed. Looking at the different channels, 39% of income shocks were smoothed out by cross-ownership of assets and 23% by borrowing or lending. Only 13% of income shocks were absorbed by federal tax transfers and grant schemes.[4] Overall, the paper shows that in the United States state-specific shocks were, for the most part, smoothed out through private risk-sharing channels, i.e. market transactions, rather than through public channels.

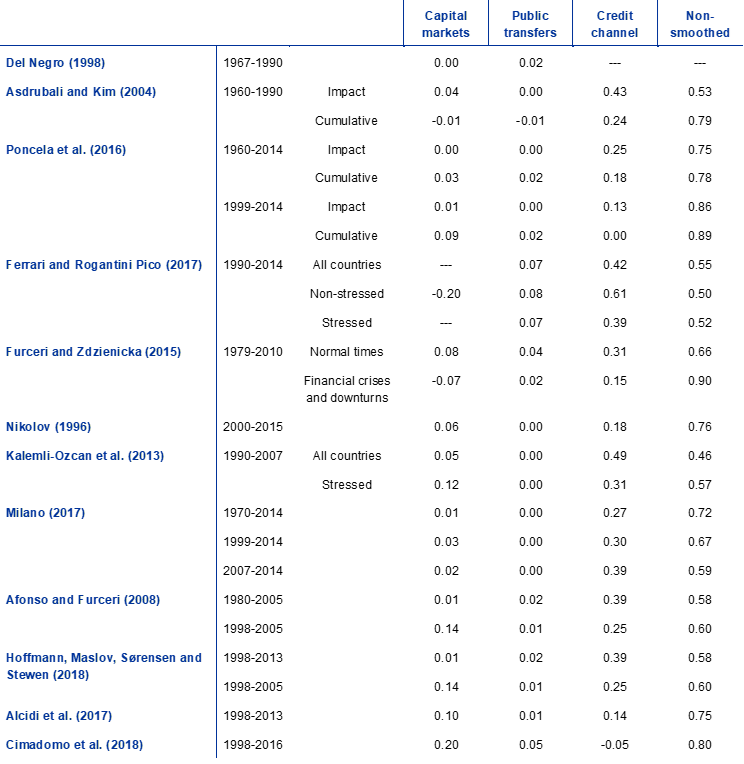

The literature suggests that the level of risk sharing among the EU countries has been significantly lower not only than in the United States but also than between regions within EU countries such as Germany, France, Italy and, to a lesser extent, Spain. This is reflected in Table 1, which presents some results from the literature. Papers are grouped according to whether they focus on EU countries, the United States or other countries. The table also shows the specific estimates for each channel. Chart 1 summarises the findings of the papers referred to in Table 1 by showing the average, for each country and the EU countries as a group, for each risk-sharing channel.

Table 1

Summary of the findings of the literature on risk sharing

EU countries

United States

Other countries

Source: Cimadomo, Gordo Mora and Palazzo, see footnote 2.

Note: The table shows the share of country-specific output shocks that were smoothed out through the capital, credit and fiscal channels in the United States, EU countries and other countries, together with the share of unsmoothed shocks, as estimated in the papers selected. The sum of the four columns is by construction equal to one. Full references for the papers shown are available in the paper cited in footnote 2.

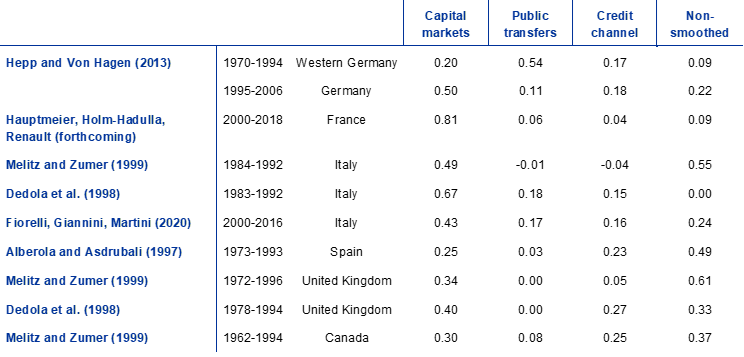

Chart 1

Strength of the risk-sharing channels in the countries covered by the literature reviewed in this article

(percentages)

Source: Cimadomo, Gordo Mora and Palazzo, see footnote 2.

Note: The chart shows the average values for the country or countries and for each channel referred to in Table 1.

The degree to which risk is shared through capital markets is the key difference between the United States and Europe, with the capital market playing a much more important role in the United States. This channel smooths out close to 40% of shocks to domestic income in the United States. In the EU, however, the role it plays is comparatively small. This may be due to the fact that equity markets are less developed in Europe, to the greater propensity to invest inter-regionally (i.e. across states) in the United States, and to the fact that cross-border investment in the EU is concentrated in just a few Member States.[5] The bulk of risk sharing in the euro area and the EU takes place through the credit channel, but this channel appears to be insufficient to compensate for the weaknesses of the other channels.

Some papers have focused on different groups of countries within the euro area and on sub-samples, distinguishing in particular between the pre- and post-global financial crisis periods. Kalemli-Ozcan et al.[6] were among the first to look at the global financial crisis of 2008-10 and to focus separately on more and less stressed euro area countries. Their findings suggest that, during that crisis, the capital channel did not provide any risk sharing for stressed countries. On the contrary, it may have acted as a shock amplifier. More recently, Cimadomo et al.[7] looked at intra-euro area financial flows on the basis of a sample of 11 euro area countries, finding that only about 40% of shocks were absorbed in the early years of EMU, while in the aftermath of the sovereign debt crisis that began in 2009 around 65% of shocks were smoothed out. This can be attributed in part to the activation of official financial assistance for countries under stress, namely the Greek Loan Facility, the European Financial Stability Facility, the European Financial Stabilisation Mechanism and the European Stability Mechanism (ESM) (see also Milano and Reichlin[8]).

As regards individual countries, the literature generally suggests that the effectiveness of risk sharing at the inter-regional level tends to be higher than at the international level. For Germany, Hepp and von Hagen found a very high level of risk sharing across western German regions in the period from 1970 to 1994 (before and immediately after unification): 91% of shocks to per capita state gross product were smoothed out.[9] In the post-unification period this level – for the unified country – decreased somewhat but remained high (at about 80%). A significant contribution in the post-unification period came from federal tax transfers and the grant system, but also from the capital channel.[10] The analysis presented in Hauptmeier et al. also points to a very high degree of inter-regional risk sharing in France, mainly owing to a strong capital channel.[11] Risk sharing appears to be of a similar order of magnitude for Italy (around 75% of shocks smoothed out), whereas it seems to have been lower, i.e. about 50%, for Spanish regions (Alberola and Asdrubali).[12] Canada and the United Kingdom exhibit a slightly lower level of risk sharing than the United States, but higher than the level across EU countries (see Chart 1).

3 Estimates of risk sharing for the euro area

New empirical analysis has been carried out for the euro area estimating the overall degree of risk sharing and the contribution of the different risk-sharing channels for the period 1997-2022.[13] The analysis covers first the full sample, then is based on 12-year windows to evaluate how risk sharing has evolved over time.

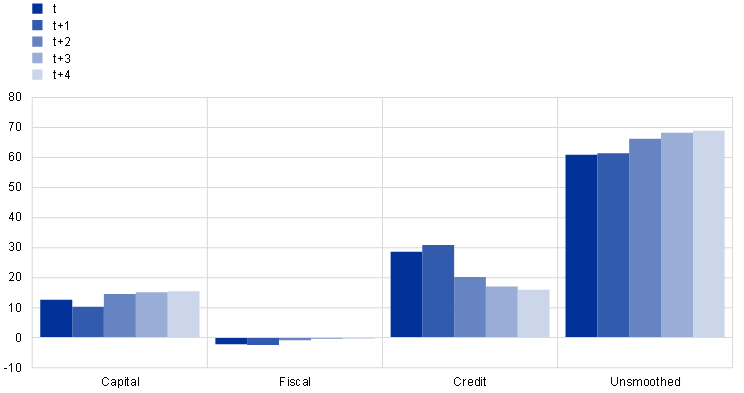

The analysis focuses on how country-specific GDP shocks affect consumption and the role played by the three risk-sharing channels in absorbing these shocks.[14] Chart 2 shows the effect of a country-specific GDP shock on consumption growth at various time horizons. The panels depict the response of each channel in the same year and then the cumulative responses after one, two, three and four years. The total impact is normalised at 100 at every horizon. For example, if a recession occurs in year t and there is no risk sharing, this will translate into a one-to-one contraction of consumption and the “unsmoothed” bar will take a value of 100, while the other bars will be at zero. In the opposite case, where there is full risk sharing, the unsmoothed bar will be at zero, and the sum of the capital, fiscal and credit channels will be 100.

Chart 2

Euro area: transmission of output shocks to consumption and the smoothing channels

(percentages)

Source: Cimadomo, Gordo Mora and Palazzo, see footnote 2.

Notes: The chart depicts the effect of a GDP shock on consumption growth at various time horizons on the basis of impulse responses generated by a panel VAR model. The first bar represents the contemporaneous response of each channel, i.e. in the same year in which the output shock occurred. The cumulative responses after one, two, three and four years are then given. The sum of all channels and the unsmoothed part is normalised at 100 at every horizon. Generally, bars are statistically significant at conventional levels when they are larger than 10%. The sample is for the period 1997-2022.

The sample used in the empirical analysis encompasses 11 euro area countries: Belgium, Germany, Greece, Spain, France, Italy, Luxembourg, the Netherlands, Austria, Portugal and Finland.[15] Data were retrieved from the European Commission’s annual macroeconomic database (AMECO), spring 2022 vintage.[16]

Chart 2 shows that risk sharing operated more effectively in the short to medium term, i.e. in the year of the shock and the following year (t and t+1). The effectiveness of risk-sharing mechanisms weakens over time, as reflected in the “unsmoothed” bars, which increase over the four-year horizon. The largest contribution was from the credit channel, which dampened about 30% of the output shock within the first two years. The contribution of the capital channel was relatively stable, at around 10% over the horizon, while the contribution of the fiscal channel was, on the whole, negligible. The share of unsmoothed shocks increased from around 60% to around 70% at the four-year horizon. This might be due to offsetting forces occurring over time: for example, if credit from abroad is received by domestic residents (credit channel) one or two years after a recession starts, there might be other developments in international credit markets at that time which blur the smoothing effect to some extent.

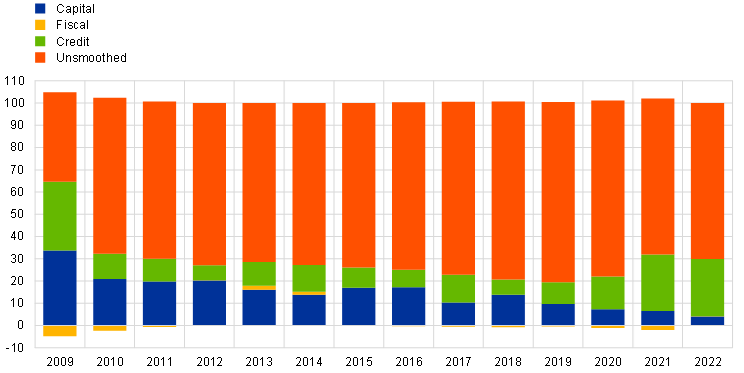

To evaluate how risk sharing has evolved over the last two decades, the effects of a GDP shock on consumption are estimated on the basis of 12-year rolling windows. The results are reported in Chart 3. In the chart, each bar represents the contributions of the three channels – together with the share of unsmoothed shocks – in a specific 12-year window (which ends in the year shown on the x-axis). For example, the 2022 bar shows estimates for the sample 2010-22.[17] Year-on-year variation in the channel shares shown reflects changes in the model parameters for each window. As in Chart 2, the remaining portion represents the share of the shock to country-specific real GDP growth that remains unsmoothed and is therefore fully reflected in country-specific consumption growth.

Chart 3

Euro area: changes in consumption risk sharing and the smoothing channels

(x-axis: end-year of the 12-year window; y-axis: percentages)

Source: Cimadomo, Gordo Mora and Palazzo, see footnote 2.

Notes: The chart shows the percentage of consumption growth that is smoothed out through the capital, fiscal and credit channels, as well as the unsmoothed component, following a shock to domestic GDP. These contributions are computed on the basis of the cumulative impact of the shock at the two-year horizon. The contributions of the channels are calculated using a panel VAR model based on parameters estimated over a 12-year rolling window of annual data. The x-axis shows the end-year for the 12-year window. The sample is for the period 1997-2022.

Chart 3 shows that the share of unsmoothed shocks increased in the euro area when the global financial crisis of 2008-10 was included in the sample. Indeed, over that period the role of the capital and credit markets became progressively less important, possibly reflecting financial market investor flight to safety and procyclical cross-border lending. It could also reflect the limited progress in the EU on the banking union and capital markets union, which, if fully operative, could have prevented such a large decline in the capital and credit channels. However, the significant decline in risk sharing slowed in the period 2011-12. This might be in part attributable to the activation of official assistance programmes in the euro area, which are likely to have had a positive effect on risk sharing (see Cimadomo et al.[18]). Moreover, the then ECB President Mario Draghi's “whatever it takes” speech on 26 July 2012, the ECB’s announcement of the introduction of Outright Monetary Transactions on 2 August 2012 and its subsequent monetary policy measures probably further contributed to the prevention of financial fragmentation in EMU.

When the sample included the COVID-19 crisis, there was an improvement in risk sharing, mainly attributable to the credit channel. While an exact identification of the drivers of this channel is not possible in this framework, this evidence suggests that the provision of very strong policy support probably prevented a severe disruption of private risk sharing, reducing the risk of cross-border financial flows coming to a sudden halt.[19]

In particular, on top of the fiscal support provided at the national level, which helped to prevent economic fragmentation, there were significant advances in the provision of public support at the EU level. This included, initially, a safety net that made a total of €540 billion available in three distinct forms: (i) loans through the ESM to help finance pandemic-related government expenditure; (ii) credit guarantees provided to firms through the European Investment Bank; and (iii) funding of national short-time work schemes.[20] While only the latter measure – the European instrument for temporary Support to mitigate Unemployment Risks in an Emergency” (SURE) – was used to a significant extent, the announcement of these public support initiatives boosted confidence and helped to prevent sudden interruptions of cross-border financial flows.[21]

By far the most important step forward was the introduction of the EU’s Recovery and Resilience Facility (RRF), the main component of the NGEU package.[22] This facility is a temporary instrument designed to bolster the recovery and structural transformation of the EU economies through a combination of grants and loans to be financed via debt issuance by the European Commission on behalf of the EU. It amounts to almost €724 billion (in current prices 90% of the total NGEU envelope), and it is estimated that more than four-fifths will be taken up by euro area countries, in particular the countries worst hit by the crisis.[23] In addition, monetary policy measures taken by the ECB, and particularly its targeted longer-term refinancing operations (TLTROs), collateral and prudential measures and pandemic emergency purchase programme (PEPP), have reduced the risk of financial fragmentation during the COVID crisis, thus indirectly preventing a breakdown in risk sharing through the credit and capital channels in this period.[24]

The COVID-19 pandemic is providing clear and tangible evidence of the benefits of having risk-sharing mechanisms to cope with unexpected and unprecedented shocks with asymmetric effects. These effects have been shown to depend on, among other things, the stringency of the mitigation strategies applied to contain the crisis, as well as the existing productive structures.[25] In general, what emerges clearly from Chart 3 is the relative weakness of both the private risk-sharing channels (capital and credit) and the fiscal channel in the euro area, at least until the start of the pandemic, after which risk sharing improved to some extent. This suggests that further measures should be taken to help strengthen these channels.

Box 1

Risk sharing and monetary policy transmission

The literature on optimal currency areas establishes a clear division of labour in the pursuit of macroeconomic stabilisation objectives. The role of monetary policy is to achieve price stability for the currency union as a whole. It therefore aims to limit fluctuations in average macroeconomic outcomes in response to common shocks by adjusting its stance in a way that stabilises inflation at the target. Risk sharing via public and market-based mechanisms can limit the dispersion in macroeconomic outcomes across the currency union by facilitating a geographically differentiated adjustment to asymmetric shocks. Recent research suggests that a particular interaction between these macroeconomic stabilisation tools may arise if monetary policy has uneven effects on different members of a currency union.[26]

Applying the well-established framework proposed by Asdrubali et al.[27] to regionally disaggregated data shows that there is substantial variation in the overall prevalence of intra- and international risk sharing across euro area countries (Chart A, panel a).[28] The extent to which regional fluctuations in GDP were smoothed by the capital market, credit markets and the public sector varied between 32% and 97% over the period 2000-18.[29] In terms of strength, the capital channel generally emerges as the dominant channel in smoothing out contemporaneous fluctuations. While the credit market and fiscal channels are found to be weaker, the latter – operating via the public transfer and tax system – becomes more impactful over longer horizons. This cross-country variation in risk-sharing intensity and the relative strength of individual channels can be used to empirically assess the implications of inter-regional risk sharing for the real effects of monetary policy.

Chart A

The degree of risk sharing in EMU: regional heterogeneity and time profile

a) Degree of risk sharing through the capital channel

(x-axis: percentages; y-axis: density)

b) Degree of fiscal risk sharing

(x-axis: percentages; y-axis: density)

Source: Hauptmeier, Holm-Hadulla and Renault, see footnote 11.

Notes: Panels a) and b) show the cross-country density function of the estimated total degree of risk sharing via the capital and fiscal channels respectively. The solid blue line corresponds to the amount of risk sharing achieved contemporaneously; the dashed red line shows risk sharing over a five-year horizon.

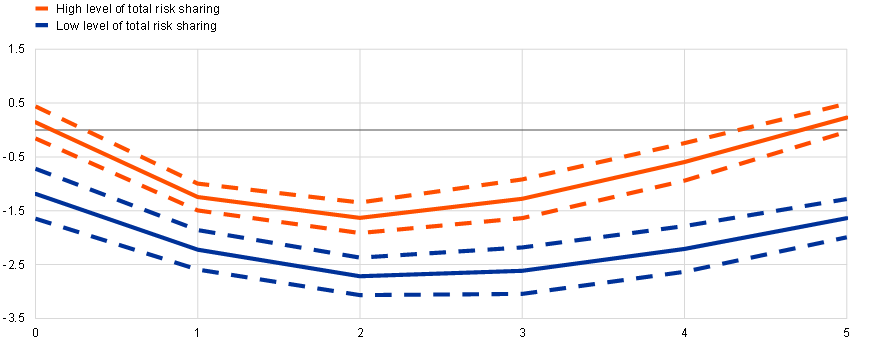

Risk sharing plays a key role in shaping the real effects of monetary policy shocks. Panel a) of Chart B shows the estimated impact of a tightening monetary shock on regional output in the euro area, conditional on the degree of inter-regional risk sharing.[30] The regional output contraction after a 100 basis point policy-rate hike is around 1 percentage point shallower for regions attaining the maximum degree of risk sharing in the sample than for those attaining the minimum degree. Moreover, regions with a high degree of risk sharing are less prone to policy-induced hysteresis, i.e. persistent economic effects of interest rate changes: while output in regions with minimum risk sharing remains around 1.5% below its initial level five years after a monetary policy tightening shock, it recovers fully over this period in regions with maximum risk sharing.

As regards individual channels, fiscal risk sharing proves particularly forceful in determining the persistence of monetary policy effects on poorer regions[31] (Chart B, panel b). For instance, with weak fiscal risk sharing, these regions experience a prolonged output contraction in response to a policy-rate hike. With strong fiscal risk sharing, poorer regions not only face a weaker output contraction but are also insulated from such hysteresis effects. For richer regions, the degree of risk sharing has a more limited differential impact on output. These results suggest that fiscal risk sharing can help prevent economic divergence stemming from regional hysteresis.

Chart B

Impact of monetary policy on regional output when risk sharing is high or low

a) Impact on regional output

(x-axis: years; y-axis: percentages)

b) Impact on output in poorer regions

(x-axis: years; y-axis: percentages)

Source: Hauptmeier, Holm-Hadulla and Renault, see footnote 11.

Notes: Panel a) shows the impact of a 100 basis point policy-rate hike on regional output for low (blue) and high (red) levels of total risk sharing for a sample consisting of 155 regions from ten euro area countries over the period 2000-18 at annual frequency. Panel b) shows the impact of a similar shock on regional output in poorer regions (lowest decile of the GDP distribution) for low (blue) and high (red) levels of fiscal risk sharing. The x-axis refers to the horizon in years of the output response. The effect of the monetary policy shock is estimated with local linear projections, see footnote 30.

4 Proposals to enhance public risk sharing

Market-based risk-sharing mechanisms alone may be not sufficient to allow an economy to withstand severe shocks.[32] As highlighted in Farhi and Werning, there is an embedded need in a monetary union for government intervention to complement market-driven risk sharing.[33] This is ultimately due to the fact that even with complete markets, market-based insurance is suboptimal in monetary unions, where private agents tend to ignore the macroeconomic stabilisation effects of portfolio choices.[34]

A central fiscal capacity (CFC) at the euro area level could increase the ability of budgetary policy to absorb common shocks, which can have asymmetric effects on different countries, and country-specific shocks. This would have the dual aim of softening the effects on individual countries and safeguarding stability in the euro area as a whole in the event of extreme shocks, such as those experienced in the past two decades.[35] A CFC could be particularly powerful when the single monetary policy is constrained by the effective lower bound and therefore has less scope to counteract common shocks. In fact, the presence of a CFC could itself reduce the incidence of episodes where the lower bound constraint becomes relevant, because an aggregate fiscal stimulus via the CFC would alleviate deflationary pressures.

Some significant institutional advances that could reinforce public risk sharing have been achieved in EMU.[36] In particular, the ESM could play a role in absorbing country-specific shocks or preventing future crises through its precautionary programmes. In addition, the RRF programme could be seen as an “embryo” of a future CFC, as it provided instruments to counteract the recession caused by the pandemic shock. Despite this progress, however, EMU is still not equipped with a fully fledged CFC aimed at business cycle stabilisation and/or the provision of European public goods.

Indeed, a CFC could be designed to provide (a) macroeconomic stabilisation and/or (b) other common public goods (e.g. common investments in the green and digital transitions, the attainment of energy autonomy, etc.).[37] While it is generally thought that only macroeconomic stabilisation can affect risk sharing, the provision of other common public goods may also indirectly influence it, especially during downturns, as this would avoid procyclical cuts in the related public expenditure items and reduce the scale of deficit financing (thus enhancing the capacity to smooth shocks). While both types of fiscal capacity have been addressed in the debate (often mixing elements of the two), the specific proposals reviewed below focus on the function of direct macroeconomic stabilisation.

Several proposals have been discussed for designing additional cross-country public insurance mechanisms within the euro area, requiring different degrees of political ambition.[38] The existing proposals focus mainly on providing macroeconomic stabilisation via direct transfers to countries in need (Beetsma et al.), through a European investment protection scheme that would shield investment in the event of a downturn (Bara et al.) or, alternatively, through a European unemployment reinsurance scheme (Balassone et al.; Bénassy-Quéré et al.; Dolls).[39] Other proposals envisage a “rainy-day” fund, with countries experiencing a boom being the net payers and countries in downturns being the net receivers (Carnot et al.; Furceri and Zdzienicka; Beetsma et al.).[40] The most ambitious proposals include the creation of an economic government for the euro area, with its own budget for macroeconomic stabilisation, which would have responsibility for a European debt agency entrusted with issuing joint debt instruments.[41]

All these instruments would reallocate resources inter-temporally, but also across countries in different positions along the economic cycle, thereby contributing to the synchronisation of business cycles in the euro area. Some papers have simulated what would have happened had such mechanisms been in place since the creation of the euro area (see, for example, Furceri and Zdzienicka; and Koester and Sondermann[42]). Their findings suggest that a CFC of a relatively moderate size would enable the euro area to achieve a stabilising power close to that of federal budget transfers in the United States.

There are two main potential objections to CFC schemes proposed so far: first, they may create moral hazard and, second, they may lead to permanent transfers among countries. Moral hazard pertains to the risk that, if a country receives transfers from a central budget, this may weaken its incentive to pursue sound national fiscal policy and implement structural reforms to increase its ability to withstand shocks. This may imply that the country permanently underperforms other euro area countries with respect to some indicators (e.g. per capita GDP growth, green investments, digitalisation). If this is the case, and depending on how the capacity is designed, such a country could in principle become a permanent recipient of transfers from countries which perform better on the same indicators.

While some risks of moral hazard are inherently present in any transfer scheme, different mechanisms to mitigate such risks have been discussed in the literature.[43] For example, some proposals call for the introduction of safeguards in the form of strengthened surveillance and coordination mechanisms.

5 Concluding remarks

This article has surveyed the literature on consumption risk sharing, focusing on the findings for the euro area but also presenting evidence for individual countries. The literature found that risk sharing is stronger in mature federations, such as the United States, than in the euro area. The papers surveyed also suggest that state/country-specific output shocks are smoothed primarily through the capital and credit channels, whereas the fiscal channel tends to be quantitatively less important, especially in the euro area, at least until recently.

Yet, in the COVID-19 crisis, risk sharing in the euro area was somewhat stronger than in episodes such as the global financial crisis of 2008-10. This is likely to be explained not only by the fiscal support granted by national governments, but also by common EU initiatives, in particular the RRF. From a normative perspective, these findings speak in favour of some form of common public risk-sharing mechanism in the euro area. At the same time, this would call for the right balance to be found between additional, centralised euro area risk-sharing instruments and strong risk-reduction tools, such as a credible enforcement of fiscal rules that anchors market expectations of sound public finances.

All in all, the findings of this article suggest that decisive progress should be made to complete the architecture of EMU, which would also reinforce risk sharing as a by-product. Indeed, significant progress on completing the banking union and capital markets union, as well as steps towards fiscal union, would reinforce the operation of risk-sharing channels and thus create welfare gains for European citizens.

This channel also includes workers’ remittances from other countries or regions. For large advanced economies, these are typically very small (i.e. less than 1% of GDP), but for small advanced economies they can be more sizeable (i.e. up to around 3% of GDP). See World Bank data on migration and remittances.

See Cimadomo, J., Gordo Mora, E. and Palazzo, A.A., “Enhancing private and public risk sharing: Lessons from the literature and reflections on the COVID-19 crisis”, Occasional Paper Series, No 306, ECB, September 2022.

Asdrubali, P., Sørensen, B.E. and Yosha, O., “Channels of Interstate Risk Sharing: United States 1963-1990”, The Quarterly Journal of Economics, Vol. 111, No 4, November 1996, pp. 1081-1110.

Malkin, I. and Wilson, D.J., “Taxes, Transfers, and State Economic Differences”, FRBSF Economic Letter, Federal Reserve Bank of San Francisco, No 2013-36, December 2013, showed that the fiscal channel in the United States operates mainly through differences in federal tax payments across US states, rather than through transfer payments from federal programmes and services.

See Milano, V. and Reichlin, P., “Risk-sharing across the US and EMU: The role of public institutions”, Policy Brief, No 9, LUISS School of European Political Economy, January 2017; and Véron, N. and Wolff, G.B., “Capital Markets Union: A Vision for the Long Term”, Journal of Financial Regulation, Vol. 2, No 1, March 2016, pp. 130-153.

Kalemli-Ozcan, S., Luttini, E. and Sørensen, B., “Debt Crises and Risk-Sharing: The Role of Markets versus Sovereigns”, The Scandinavian Journal of Economics, Vol. 116, No 1, January 2014, pp. 253-276.

Cimadomo, J., Ciminelli, G., Furtuna, O. and Giuliodori, M., “Private and public risk sharing in the euro area”, European Economic Review, Vol. 121, January 2020.

Milano, V. and Reichlin, P., op. cit.

Hepp, R. and von Hagen, J., “Interstate risk sharing in Germany: 1970–2006”, Oxford Economic Papers, Vol. 65, No 1, January 2013, pp. 1-24. See also Buettner, T., “Fiscal federalism and interstate risk sharing: empirical evidence from Germany”, Economics Letters, Vol. 74, No 2, January 2002, pp. 195-202, for an analysis of the smoothing of state-specific shocks in western Germany through fiscal institutions over the period 1970-97.

The ECB’s 2020 Financial Integration and Structure Report looked at unlisted shares, i.e. private ownership (including cross-border) of non-listed companies, which were found to account for a larger share of financing in the EU than in the United States. This may explain why Hepp and von Hagen (see footnote 9) and Hauptmeier et al. (see footnote 11) found that risk sharing through capital markets in Germany and France is surprisingly high.

Hauptmeier, S., Holm-Hadulla, F. and Renault, T., “Risk-sharing and monetary policy transmission”, Working Paper Series, ECB, forthcoming.

Alberola, E. and Asdrubali, P., “How Do Countries Smooth Regional Disturbances? Risk sharing in Spain: 1973-1993”, Documento de Trabajo, No 9724, Servicio de Estudios, Banco de España, Madrid, January 1997. See also Burriel, P., Chronis, P., Freier, M., Hauptmeier, S., Reiss, L., Stegarescu, D. and Van Parys, S., "A fiscal capacity for the euro area: lessons from existing fiscal-federal systems", Occasional Paper Series, No 239, ECB, April 2020, for a comparative analysis of the degree of fiscal risk sharing in selected European countries.

See Cimadomo, J., Gordo Mora, E. and Palazzo, A.A., op. cit. The empirical analysis is based on the methodology developed in Asdrubali, P. and Kim, S., “Dynamic risk sharing in the United States and Europe”, Journal of Monetary Economics, Vol. 51, No 4, May 2004, pp. 809-836. The same methodology was used in Financial Integration in Europe, ECB, May 2017 and in the article entitled “Risk sharing in the euro area”, Economic Bulletin, Issue 3, ECB, 2018.

The capital channel is reflected in the difference between gross domestic product (GDP) and gross national product (GNP). This difference is equal to income from financial assets held abroad and from employment abroad of citizens of the domestic country. The fiscal channel is captured by the difference between GNP and gross domestic income (GDI), which stems partly from cross-border transfers between governments (e.g. structural funds in the case of the EU). The credit channel is reflected in the difference between GDI and consumption (both private and public). This includes, for example, borrowing abroad by individuals and governments, either in credit markets or through supranational insurance mechanisms such as the ESM. Recovery and Resilience Facility loans would also fall under this channel. In the empirical model, a “panel VAR” model, a GDP shock is defined as a (positive or negative) unexpected change in a country’s GDP which does not depend on a common (euro area-wide) shock.

Ireland was excluded from the analysis owing to unusually large revisions, made in July 2016, of some of the country’s main macroeconomic statistics for 2015.

The sample also includes preliminary forecasts for 2022 which, although they might be revised to some extent in the future, help to provide initial insights into developments during the COVID-19 crisis.

The bars represent the cumulative responses two years after the shock has occurred. This is comparable to the t+2 bars in Chart 2, although the latter are estimated over the full sample.

Cimadomo, J., Ciminelli, G., Furtuna, O. and Guiliodori, M., op. cit.

Other studies also show that risk sharing was relatively resilient during the COVID-19 crisis. For example, Giovannini, A., Horn, C.-W. and Mongelli, F.P., “An early view on euro area risk-sharing during the COVID-19 crisis”, VoxEU, January 2021, suggested that lockdown measures taken to reduce the spread of COVID-19 prevented households from consuming a large share of their normal consumption basket. Consequently, it was suggested that the analysis for this period should focus on income risk sharing, i.e. the ability of a country to separate the change in its GDP from changes in its output, rather than on consumption risk sharing. The findings of these authors indicated that income risk sharing was relatively stable during the crisis. European Commission, Directorate-General for Financial Stability, Financial Services and Capital Markets Union, Alcidi, C., Postica, D., Shamsfakhr, F., et al., Study on the Analysis of Developments in EU Capital Flows in the Global Context (2021) - Rise and fall after the COVID-19 outbreak, Publications Office of the European Union, 2022, showed that, unlike in the global financial crisis of 2008-10, the COVID-19 pandemic did not reverse previous trends in global capital flows, which further underpinned income and consumption smoothing.

Other measures adopted at the EU level included the European Investment Bank’s Pan-European Guarantee Fund, and the European Commission’s Coronavirus Response Investment Initiative and REACT-EU programme.

See Bańkowski, K., Bouabdallah, O., Domingues Semeano, J., Dorrucci, E., Freier, M., Jacquinot, P., Modery, W., Rodríguez Vives, M., Valenta, V. and Zorell, N., “The economic impact of Next Generation EU: a euro area perspective”, Occasional Paper Series, No 291, ECB, April 2022, for an analysis of the potential macroeconomic impact of the NGEU programme and, in particular, the importance of the confidence effects generated by the launch of SURE and NGEU.

Even in 2020, before the finalisation of countries’ recovery and resilience plans in 2021-22, NGEU had a major effect. Together with the PEPP, NGEU was the “game changer” that restored market confidence for the most vulnerable euro area economies after the sizeable net portfolio outflows and widening spreads they recorded in March 2020 as a result of the pandemic shock.

These measures are an important milestone in public risk-sharing arrangements, but they are temporary in nature. Codogno, L. and van den Noord, P., “Assessing Next Generation EU”, LSE ‘Europe in Question’ Discussion Paper Series, LEQS Paper No 144, London School of Economics and Political Science, February 2021, applied a stylised macroeconomic model and argued that an alternative approach with ex ante risk sharing through the creation of a Eurobond and permanent central fiscal capacity would be at least as powerful, but more sustainable, automatic and timely.

The PEPP is likely to have influenced both the capital channel and the credit channel. However, the methodology used here does not make it possible to clearly isolate the contribution of monetary policy to the effectiveness of these two channels.

See the box entitled “The impact of containment measures across sectors and countries during the COVID-19 pandemic”, Economic Bulletin, Issue 2, ECB, 2021.

See Hauptmeier, S., Holm-Hadulla, F. and Renault, T., “Risk-sharing and monetary policy transmission”, op. cit.

See Asdrubali, P., Sørensen, B.E. and Yosha, O., op. cit.

The analysis relies on NUTS-2 level data, following Eurostat’s NUTS classification, which subdivides national territories into regions. The use of regional data allows the amount of risk shared within a country (intranational risk sharing) and between countries (international risk sharing) to be captured.

These estimates are not directly comparable with those in Section 3 because they refer to inter-regional risk sharing within countries, while those in Section 3 refer to risk sharing across euro area countries.

The analysis relies on local linear estimation techniques (see Jordà, O., “Estimation and Inference of Impulse Responses by Local Projections”, American Economic Review, Vol. 95, No 1, March 2005, pp. 161-182) and includes an interaction term between the monetary policy rate and the amount of risk sharing in the economy. This captures the extent to which the impact of a monetary policy shock varies with the degree of risk sharing (see Hauptmeier, S., Holm-Hadulla, F. and Renault, T., op. cit., for details of the empirical model and estimation techniques).

Poorer regions are defined as the lowest decile of the GDP distribution.

See also the discussion in Giovannini, A., Ioannou, D. and Stracca, L., “Public and private risk sharing: friends or foes? The interplay between different forms of risk sharing”, Occasional Paper Series, No 295, ECB, June 2022.

Farhi, E. and Werning, I., “Fiscal Unions”, American Economic Review, Vol. 107, No 12, December 2017, pp. 3788-3834.

Farhi and Werning do not reach the same conclusion for countries outside a currency union, with flexible exchange rates. As long as these countries exercise independent monetary policy, they can fully offset shocks. Farhi and Werning’s argument for government involvement in international risk sharing relies on membership in a currency union precisely because this constrains monetary policy and prevents the stabilisation of asymmetric shocks. They argue therefore that fiscal and currency unions should go hand in hand.

The Eurosystem reply to the Communication from the European Commission “the EU economy after COVID-19: implications for economic governance” of 19 October 2021, 1 December 2021, states that “a permanent central fiscal capacity, if appropriately designed, could play a role in enhancing macroeconomic stabilisation and convergence in the euro area in the longer run”. See also the Opinion of the European Central Bank of 9 November 2018 on a proposal for a regulation on the establishment of a European Investment Stabilisation Function (CON/2018/51), OJ C 444, 10.12.2018, p. 11, which mentions that a fiscal capacity “exists in all monetary unions, to better deal with economic shocks that cannot be managed at the national level. If appropriately designed, a common macroeconomic stabilisation function would increase the economic resilience of the individual participating Member States and of the euro area as a whole, thereby also supporting the single monetary policy”.

The Five Presidents’ Report (Juncker, J.-C., Tusk, D., Dijsselbloem, J., Draghi, M. and Schulz, M., Completing Europe’s Economic and Monetary Union, European Commission, 2015) describes the institutional development of EMU and provides an initial blueprint for a CFC to be introduced as a permanent euro area macroeconomic stabilisation function to enhance price stability and prevent sovereign contagion and financial fragmentation.

See also “Europe as a common shield: protecting the euro area economy from global shocks”, keynote speech by Fabio Panetta, Member of the Executive Board of the ECB, at the European Parliament’s Innovation Day “The EU in the world created by the Ukraine war”, 1 July 2022.

Surveys are included in Balassone, F., Momigliano, S., Romanelli, M. and Tommasino, P., “Just round the corner? Pros, cons, and implementation issues of a fiscal union for the euro area”, Economia Pubblica, vol. 2018(1), FrancoAngeli Editore, Milan, 2018, pp. 5-34; Arnold, N.G., Barkbu, B.B., Ture, H.E., Wang, H. and Yao, J., “A Central Fiscal Stabilization Capacity for the Euro Area”, IMF Staff Discussion Note, No SDN/18/03, International Monetary Fund, March 2018; Beetsma, R., Cima, S. and Cimadomo, J., “Fiscal Transfers without Moral Hazard?”, International Journal of Central Banking, Vol. 17, No 3, September 2021, pp. 95-153; and Beetsma, R., Cimadomo, J. and van Spronsen, J., “One scheme fits all: a central fiscal capacity for the EMU targeting eurozone, national and regional shocks”, Working Paper Series, No 2666, ECB, May 2022.

Beetsma, R. et al., “Fiscal Transfers without Moral Hazard?”, op. cit.; Bara, Y.-E., Castets, L., Ernoult, T. and Zakhartchouk, A., “A contribution to the work on the strengthening of the euro area”, Trésor-Economics, No 190, Ministère de l’Economie et des Finances, February 2017; Balassone, F. et al., op. cit.; Bénassy-Quéré, A., Brunnermeier, M., Enderlein, H., Farhi, E., Fratzcher, M., Fuest, C., Gourinchas, P.-O., Martin, P., Pisani-Ferry, J., Rey, H., Schnabel, I., Véron, N., Weder di Mauro, B. and Zettelmeyer, J., “Reconciling risk sharing with market discipline: A constructive approach to euro area reform”, CEPR Policy Insight, No 91, Centre for Economic Policy Research, London, January 2018; Dolls, M., “An Unemployment Re-Insurance Scheme for the Eurozone? Stabilizing and Redistributive Effects”, CESifo Working Paper Series, No 8219, CESifo, Munich, April 2020.

Carnot, N., Kizior, M., and Mourre, G., “Fiscal Stabilisation in the Euro-Area: A Simulation Exercise”, Working Papers CEB, No 17/025, ULB – Université Libre de Bruxelles, October 2017; Furceri, D. and Zdzienicka, A., “The Euro Area Crisis: Need for a Supranational Fiscal Risk Sharing Mechanism?”, Open Economies Review, Vol. 26, No 4, September 2015, pp. 683-710; and Beetsma, R. et al., “One scheme fits all: a central fiscal capacity for the EMU targeting eurozone, national and regional shocks”, op. cit.

See the European Commission’s 2017 roadmap for deepening EMU.

Furceri, D. and Zdzienicka, A., op. cit.; Koester, G. and Sondermann, D., “A euro area macroeconomic stabilisation function: assessing options in view of their redistribution and stabilisation properties”, Occasional Paper Series, No 216, ECB, October 2018.

See for example Beetsma, R. et al., “Fiscal transfers without moral hazard?”, op. cit. and Beetsma, R. et al., “One scheme fits all: a central fiscal capacity for the EMU targeting eurozone, national and regional shocks”, op. cit.