- STATISTICAL RELEASE

Euro area investment fund statistics: second quarter of 2022

17 August 2022

- In second quarter of 2022, outstanding amount of shares/units issued by investment funds other than money market funds fell to €14,823 billion, down €1,022 billion on previous quarter

- Net redemptions in quarter amounted to €77 billion, with €1,064 billion in gross issues and €1,141 billion in gross redemptions

- Outstanding amount of shares/units issued by money market funds rose to €1,363 billion, up €22 billion on previous quarter

Chart 1

Shares/units issued by investment funds other than money market funds

(in EUR billions; not seasonally adjusted)

Data for shares/units issued by investment funds other than money market funds

In the second quarter of 2022, the outstanding amount of shares/units issued by investment funds other than money market funds stood at €14,823 billion, €1,022 billion lower than in the first quarter (see Chart 1). Net redemptions during this period were €77 billion, with gross issues amounting to €1,064 billion and gross redemptions to €1,141 billion (see Chart 2). The annual growth rate of shares/units issued by investment funds other than money market funds, calculated on the basis of transactions, was 2.8% in the second quarter of 2022.

Chart 2

Issues and redemptions of shares/units by investment funds other than money market funds

(in EUR billions; not seasonally adjusted)

Data for issues and redemptions of shares/units by investment funds other than money market funds

In terms of the type of investment fund, net redemptions of shares/units by bond funds amounted to €64 billion in the second quarter of 2022 (see Chart 3). For equity funds net redemptions amounted to €47 billion, while net issues by mixed funds amounted to €1 billion and net issues by real estate, hedge and other funds amounted to €34 billion.

Chart 3

Shares/units issued by investment fund type other than money market funds

(in EUR billions; not seasonally adjusted)

Data for shares/units issued by investment fund type other than money market funds

Exchange-traded funds (ETFs), which are a separate category within total investment funds (see annex below), recorded net issues of €17 billion in the second quarter of 2022. The outstanding amount of shares/units issued by ETFs stood at €1,221 billion.

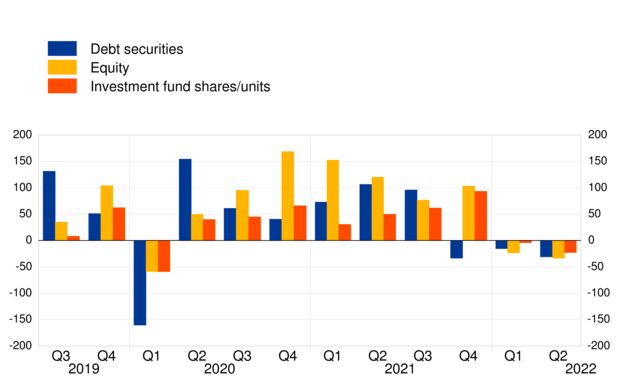

Within the assets of investment funds other than money market funds, net sales of equity amounted to €33 billion in the second quarter of 2022 (see Chart 4). Net sales of debt securities were €31 billion, while those of investment fund shares/units were €23 billion.

Chart 4

Holdings of investment funds other than money market funds, by main instrument type

(quarterly transactions in EUR billions; not seasonally adjusted)

Data for holdings of investment funds other than money market funds, by main instrument type

For shares/units issued by money market funds the outstanding amount was €22 billion higher than in the first quarter. This increase was accounted for by €26 billion in other changes (including price changes) and €4 billion in net redemptions of shares/units. The annual growth rate of shares/units issued by money market funds, calculated on the basis of transactions, was -2.8% in the second quarter of 2022.

Within the assets of money market funds, the annual growth rate of debt securities holdings was -8.1% in the second quarter of 2022, with overall net sales amounting to €33 billion, which reflected net sales of €23 billion in debt securities issued by non-euro area residents and net sales of €10 billion in debt securities issued by euro area residents. For deposits and loan claims, the annual growth rate was 13.6% and transactions during the second quarter of 2022 amounted to €23 billion.

Statistical Data Warehouse:

All money market funds (time series)

All investment funds other than money market funds (time series)

For queries, please use the Statistical information request form.

Notes:

- Money market funds are presented separately in this statistical release since they are classified in the monetary financial institutions sector within the European statistical framework.

- Hyperlinks in the main body of the statistical release and in annex tables lead to data that may change with subsequent releases as a result of revisions. Figures shown in the annex table are a snapshot of the data as at the time of the current release.

-

17 August 2022