- THE ECB BLOG

Anonymous Eurosystem leaks – minor nuisance or major problem?

19 May 2023

At times, media reports on ECB monetary policy refer to information from unidentified Eurosystem sources. This ECB Blog post takes a closer look at such leaks. They tend to go against prevailing trends in short-term rates and can trigger major market reactions even though they are not generally informative about upcoming decisions.

Readers of ECB-related news occasionally stumble across reporting that cites unnamed Eurosystem “insiders” or “sources”. What drives such leaks and how do they impact public views? To understand this better, we have taken a systematic look at their frequency, when they typically occur, and how they affect financial markets.[1]

Eurosystem leaks are frequent, but their number has recently declined

The effects of unattributed communication about monetary policy are not well understood. They may, for instance, move markets in the run-up to policy meetings and thereby reduce policy flexibility, or more generally harm a central bank’s credibility.[2] To study their possible impact we identified and analysed 368 leaks from Eurosystem insiders from 2002 to 2021. Chart 1 shows how the number of leaks each year has evolved over time. In the second half of the sample, we observe many more leaks on average, but see a decline in 2020 and 2021. The data also reveal a change in the typical timing of leaks. In the early years of the ECB’s monetary policy, leaks occurred almost exclusively before Governing Council meetings, while there has more recently been a substantial increase in post-meeting leaks. Our analysis furthermore shows that leaks are more frequent when the policy debate is more controversial – i.e. when there may be significant disagreement among policymakers.

Chart 1

Number of leaks per year

Source: Ehrmann, Gnan and Rieder (2023). Notes: This figure plots the annual number of Eurosystem leaks for the period 2002 to 2021 (blue bars), plus the average number per year (yellow line).

Eurosystem leaks have large effects on financial markets

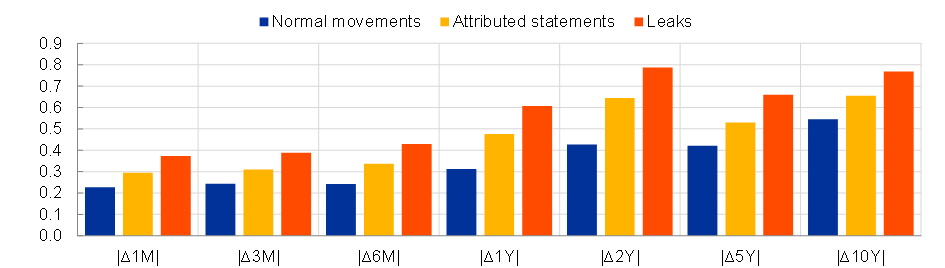

To quantify how much leaks can move markets, we looked at high-frequency movements in overnight indexed swaps (OIS), which are often used as a measure of monetary policy expectations. We broke the data down into 35-minute windows, and found that leaks trigger movements that are around 60-95% larger than normal, and around 15-30% larger than the average effect of public statements by Governing Council members (see Chart 2). Leaks about policy rates tend to move the shorter maturities (up to two years), whereas leaks about unconventional monetary policy (UMP) primarily move rates for longer maturities. This corresponds to the usual impact of monetary policy on the different maturities.

Chart 2

Market reaction to events (basis points)

Source: Ehrmann, Gnan and Rieder (2023). Notes: The figure plots the average absolute change in basis points in overnight indexed swap (OIS) rates over an event window from five minutes before attributed statements (yellow bars) or leaks (red bars) to 30 minutes afterwards, compared to the average absolute change in OIS rates during a 35-minute time window around 5,000 placebo events (i.e. normal movements) that match the distribution of leaks over time (blue bars). For each maturity and comparison, the differences in the effects are statistically significant at the 1% level.

The analysis also shows that leaks are likely to reflect minority views. They often reverse earlier market trends in short-term rates, i.e. go against the policy line perceived by the public. But looking back after the decision is made, preceding leaks usually did not move market rates closer to the actual policy outcome. In contrast, attributed statements by Governing Council members tend to do so, and can mitigate some of the market impact of leaks. This suggests that leaks do not have a substantial effect on policy decisions and usually do not reduce policy flexibility. This leads to the conclusion that many leaks just add noise to the debate and volatility to markets.

Finally, our results show that leaks after meetings can weaken the effects of official ECB policy announcements. In the aftermath of the press conference, OIS rates typically remain stable or continue the trend observed following the announcement of the monetary policy decisions. Attributed statements shortly after the press conference tend to reinforce this pattern, whereas leaks that occur shortly after the press conference tend to move rates in the opposite direction, i.e. they again go against the policy line.

Conclusion

Eurosystem leaks are frequent and have a sizable impact on financial markets, regardless of whether they occur before or after policy meetings. This is surprising, given that they generally do not provide reliable information about upcoming monetary policy decisions. While the decline in the number of leaks since 2020 implies that unattributed communication was affecting markets less often in recent times, our findings suggest that market participants would be well advised to ignore such unattributed communication in most cases.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Subscribe to the ECB blogThis blog reports results contained in CEPR Discussion Paper No. 18152 “Central Bank Communication by ??? The Economics of Public Policy Leaks” by the same authors.

These points are discussed in Vissing-Jorgensen, A. (2020). “Informal central bank communication”, Conference Proceedings ECB Forum on Central Banking, and in Assenmacher, K. et al. (2021). “Clear, consistent and engaging: ECB monetary policy communication in a changing world”, Occasional Paper Series, No 274, ECB, Revised December 2021.