Do global investment funds have a stabilising effect on euro area government bond markets?

Published as part of the Financial Stability Review, May 2023.

This box analyses the role and behaviour of global and domestic investment funds in euro area government bond markets. Over the last year, yields have increased for many euro area sovereigns, while net debt issuance has remained positive (Chart A, panels a and b). Against this background, it is useful to assess how investors might change their holdings of sovereign bonds as central banks reduce their footprint in these markets. In addition, investment decisions are also driven by risk appetite, which can be affected by both global and euro area-specific shocks. The analysis presented in this box focuses on how investment funds react to such global and euro area risk shocks and draws implications for financial stability.

Chart A

The footprint of foreign investors in euro area government bond markets has fallen over time, but euro area yields have become more attractive over the last year

Sources: ECB, Refinitiv and ECB calculations.

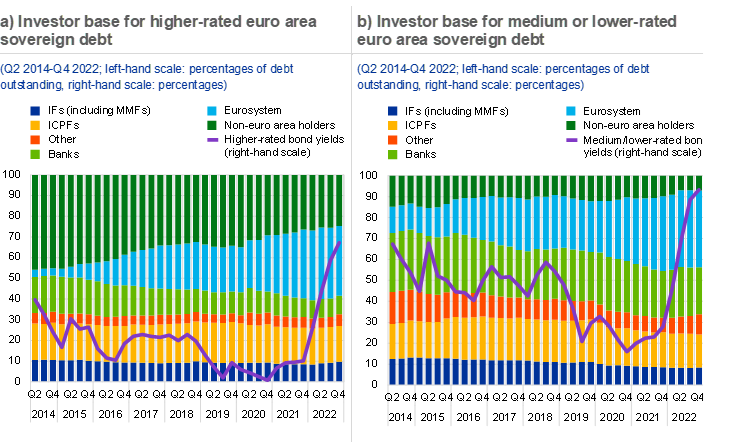

Notes: The charts show the breakdown of euro area government debt outstanding by euro area holding sector, while all non-euro area holders are aggregated in the dark green category because of missing information. Medium or lower-rated euro area sovereigns refer to countries with credit ratings below AA- over most of the sample period. IFs stands for investment funds; MMFs stands for money market funds; ICPFs stands for insurance corporations and pension funds. The purple lines depict the GDP-weighted ten-year government bond yields for higher-rated (panel a) and lower-rated (panel b) euro area sovereigns.

Foreign investors have a significant footprint in euro area government bond markets, but this has fallen since the Eurosystem launched its asset purchase programmes (Chart A, panels a and b).[1] For higher-rated euro area sovereigns, the share of foreign investors fell from almost 50% in 2014 to 25% at the end of 2022, while for medium or lower-rated countries it fell from 15% to 7%. Investment funds domiciled outside the euro area, in turn, make up a sizeable fraction of foreign sector holdings.[2] The euro area sovereign debt holdings of domestic investment funds have also fallen slightly over time and now stand at around 10% of euro area debt outstanding.[3]

Chart B

Global investment funds have tended to play a stabilising role in euro area government bond markets in the past when euro area bond spreads become elevated

Sources: Refinitiv Lipper IM, Haver Analytics, Refinitiv and ECB calculations.

Notes: Panel a: the dark blue area (light-blue line) shows the share of medium or lower-rated euro area sovereign debt holdings in US (euro area) investment funds’ portfolios. The red line shows government debt outstanding of medium or lower-rated euro area countries relative to total euro area government debt. The green line shows the spread between GDP-weighted ten-year government bond yields for higher and medium or lower-rated euro area sovereigns. Panel b: the chart shows the impulse responses of euro area medium or lower-rated and higher-rated debt holdings to a global risk shock and a euro area spread-widening shock over a six-month horizon, calculated using local projections and data at a monthly frequency. The global risk (euro area spread-widening) shock is identified by upward spikes in the daily time series of the VIX (IT-DE CDS spread) that are larger than the 90th percentile. The dots show point estimates and the lines show one-standard deviation confidence intervals. The impulse responses are estimated while also controlling for the euro area monetary policy stance and economic news. Examples of global risk shocks picked up by the methodology include the Lehman Brothers default, the stock market “flash crash” of 2010, the US sovereign downgrade of 2011 and the onset of the coronavirus (COVID-19) pandemic. Examples of euro area spread-widening shocks picked up by the methodology include the euro area sovereign debt crisis, political uncertainty in May 2018 and the onset of the COVID-19 pandemic.

Global investment funds’ portfolio weights of medium or lower-rated euro area sovereign debt have fluctuated over time (Chart B, panel a).[4] Relative to the debt outstanding, both global and domestic investment funds underweighted medium or lower-rated euro area sovereign debt relative to higher-rated debt before and during the euro area sovereign debt crisis. During that crisis, however, US funds (the dark blue area) started to materially increase the share of medium or lower-rated euro area government bonds in their portfolios, and by much more than domestic funds (the light-blue line). But after the Eurosystem’s asset purchases began in early 2015, global funds reduced the share of medium or lower-rated debt again, while domestic funds hardly changed theirs.

After global risk shocks, domestic investment funds tend to turn to euro area government bonds, while foreign funds cut back their exposures (Chart B, panel b). Following global risk shocks, US-domiciled funds decrease their holdings of euro area government bonds irrespective of their rating and may thereby contribute to stress in euro area government bond markets. By contrast, euro area-domiciled funds increase their holdings, especially those of higher-rated bonds. These findings are consistent with a flight-to-safety after global risk shocks: US funds may retrench into dollar-denominated assets, while domestic funds may rebalance their portfolios towards higher-rated government bonds.

Overall, global investment funds have tended to play a stabilising role in euro area government bond markets in the past when spreads between sovereigns become elevated. After past events that led to spreads widening among euro area government bond markets, US investors typically increased their exposure to medium or lower-rated euro area government bonds. This could indicate that for US investors, the opportunity to profit from the higher carry on such bonds – because of higher interest rates and also, potentially, expectations of rebounding bond prices and euro appreciation – may outweigh concerns over potentially higher risks. Euro area funds, by contrast, reduce their holdings of medium or lower-rated government bonds slightly more than their holdings of higher-rated bonds after spreads start widening. As domestic investment funds have larger exposure to medium or lower-rated euro area government bonds than US funds in relative terms, a spread-widening shock could imply an overall sell-off of such bonds, thus possibly contributing to further increases in spreads after the initial event. Overall, this analysis shows that foreign and domestic investment funds have differing sensitivity to global and euro area risk events. It also shows how such financial intermediaries can affect financial stability risks in sovereign bond markets.

Foreign investors’ nominal holdings of euro area government bonds, as well as their share of total euro area government bonds issued, declined between Q2 2014 and Q4 2022.

Information on the sectoral composition of foreign debt holdings is generally limited. Kaufmann, C., “Investment funds, monetary policy, and the global financial cycle”, Journal of the European Economic Association, Vol. 21, April 2023, pp. 593-636 shows that investment funds account for around 50% of all cross-border portfolio flows globally. Arslanalp, S. and Tsuda, T., “Tracking global demand for advanced economy sovereign debt”, IMF Economic Review, Vol. 62, 2014, pp. 430-464 document significant exposures of foreign non-banks to euro area sovereign debt. For some higher-rated countries, foreign official sector holdings can also be sizeable, reflecting euro currency reserves.

Analysing data at the security level, Koijen, R., Koulisher, F., Nguyen, B. and Yogo, M., “Inspecting the mechanism of quantitative easing in the euro area”, Journal of Financial Economics, Vol. 140, 2021, pp. 1-20 find that among the sectors, foreign investors have the highest sensitivity to yield changes and that they accommodated most of the Eurosystem’s euro area government bond purchases.

Global investment funds are proxied by investment funds domiciled in the United States since these represent the bulk of investment funds domiciled outside the euro area in the dataset used in this analysis.